Reemployment of Retired Members: Federal Tax Issues

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Fairtax Treatment of Housing

A FairTaxsm White Paper The FairTax treatment of housing Advocates of tax reform share a common motivation: To iron out the mangled economic incentives resulting from statutory inequities and misguided social engineering that perversely cripple the American economy and the American people. Most importantly, ironing out the statutory inequities of the federal tax code need not harm homebuyers and homebuilders. The FairTax does more than do no harm. The FairTax encourages home ownership and homebuilding by placing all Americans and all businesses on equal footing – no loopholes, no exceptions. A specific analysis of the impact of the FairTax on the homebuilding industry/the housing market shows that the new homebuilding market would greatly benefit from enactment of the FairTax. The analysis necessarily centers upon two issues: (1) Whether the FairTax’s elimination of the home mortgage interest deduction (MID) adversely impacts the housing market (new and existing) in general, and home ownership and the homebuilding industry specifically; and (2) Whether the FairTax’s superficially disparate treatment of new vs. existing housing has an adverse impact on the market for new homes and homebuilding. The response to both of the above questions is no. Visceral opposition to the repeal of a “good loophole” such as the MID is understandable, absent a more thorough and empirical analysis of the impact of the FairTax vs. the MID on home ownership and the homebuilding industry. Such an analysis demonstrates that preserving the MID is the classic instance of a situation where the business community confuses support for particular businesses with support for enterprise in general. -

Traditional Individual Retirement Arrangements (Iras)

(6-2010) TRADITIONAL INDIVIDUAL RETIREMENT ARRANGEMENTS (Traditional IRAs) List of Required Modifications and Information Package (LRMs) (For use with prototype traditional IRAs intending to satisfy the requirements of Code § 408(a) or (b).) Material added since the 3-2002 LRMs is underlined. This information package contains samples of provisions that have been found to satisfy certain specific requirements of the Internal Revenue Code as amended through the Worker, Retiree, and Employer Recovery Act of 2008 (“WRERA”), Pub. L. 110-458. Such language may or may not be acceptable in specific IRAs, depending on the context. We have prepared this package to assist sponsors who are drafting IRAs. To expedite the review process, sponsors are encouraged to use the language contained in this package. Part A, provisions 1-12, applies to individual retirement accounts under Code § 408(a). Part B, provisions 13-22, applies to individual retirement annuities under § 408(b). ________________________________________________________________ PART A: ACCOUNTS - Trust or custodial accounts under Code § 408(a). (1) Statement of Requirement: The IRA is organized and operated for the exclusive benefit of the individual, Code § 408(a). Sample Language: The account is established for the exclusive benefit of the individual or his or her beneficiaries. If this is an inherited IRA within the meaning of Code § 408(d)(3)(C) maintained for the benefit of a designated beneficiary of a deceased individual, references in this document to the “individual” are to the deceased individual. (2) Statement of Requirement: Maximum permissible annual contribution and restrictions on kinds of contributions, Code §§ 72(t)(2)(G), 219(b), 408(a)(1), 408(d)(3)(C), 408(d)(3)(G), 1 408(p)(1)(B) and 408(p)(2)(A)(iv). -

Section 501 on the Ground That All of Its Profits Are Payable to One Or More Organizations Exempt from Taxation Under Section 501

F. IRC 502 - FEEDER ORGANIZATIONS 1. Introduction An organization described in IRC 502 does not qualify for exemption under any paragraph of IRC 501(c). The purpose of this article is to discuss some of the basic issues presented by IRC 502, to explain how it should be interpreted and applied, and to consider the amount of unrelated business activity that an exempt charitable organization may engage in. IRC 502 provides that an organization operated for the primary purpose of carrying on a trade or business for profit shall not be exempt under IRC 501 on the ground that all of its profits are payable to one or more organizations exempt under IRC 501. 2. Purpose of Feeder Provisions A brief consideration of the reasons for the enactment of IRC 502 provides some insight as to how it should be interpreted. There was growing concern, particularly after World War II, about the increasing amount of business activities carried on by exempt organizations, particularly, charitable organizations. In a series of cases involving taxable years prior to 1951, certain organizations popularly called "feeder organizations" were held exempt from federal income tax under the predecessor to IRC 501(c)(3), even though their sole activity was engaging in commercial business, and the only basis for exemption was the fact their profits were payable to specified exempt organizations. See Roche's Beach, Inc. v. Commissioner, 96 F. 2d 776 (1938); C. F. Mueller Company v. Commissioner, 190 F. 2d 120 (1951). The courts held that the exclusive purpose required by the statute was met when the only object of the organization was religious, scientific, charitable, or educational, without regard to the method of obtaining funds necessary to effectuate the objective. -

Home Workers and the Debate Over "Who's a Statutory Employee" Under the Internal Revenue Code

HOME WORKERS AND THE DEBATE OVER "WHO'S A STATUTORY EMPLOYEE" UNDER THE INTERNAL REVENUE CODE ROBERT \V VVOOD ANI) CIlIUSTOPIiER A. KARACIIALE ifferent governmental agencies use different tests for determining who is <1n D employee and who is not. The Internal Revenue Service (IRS) typically uses one test,' the Department of Labor and many employment statutes use another,2 and most state unemployment insurance authorities use another stil\.3 This creates ROBERT W. WOOD CHRISTOPHER A. /?OIlERT W WOOD I'UACT/CI,S KARACHALE a great deal of confusion about what should be a relatively simple question-is a LAW WITH WOOD & POUTEU CIIIUSTOPIIEU KAUACHALE IN SAN FUANCISCO (WWW. /S ,IN ASSOCIATE AT Woov & worker an employee or an independent contractor' WOO DPOUTFU.COM) ANI) IS POUTFU IN SAN FUANCISCO. THE AUTllOU OF TAXATION HI-"Af)VISES INDIVI DUALS AND The test for employee status generally used by the IRS looks to the employer's OF DAMAGE AWAIU)S ANI) IJUSINI;'SS ENTI'I'IESONAHROAD behavioral and financial controls over the worker, as well as the relationship between SETTLEMENT PAYMENTS (4T/-1 IIANGE OF TAX PUNNING AND ED. TAX INSTITUTE, 2009) TAX CONTROVEUSY MATTERS, the parties. This "twenty-factor test" is an uncodified,amorphous, facts and circum AND QUAIIFIFD SETTLEMENT INCI UDING TI-"'" TAXATION FUNDS AND SECTION 468/l OF I),IMAGE AI,VAIIVS AND stances test that, like many of the other tests, tends to provide uneven results. Never (TAX INSTI TUTE, 2009), DEFEUllliD COMPENS ATION, HOTH AVA/tABLE AT WWW. INIJHPFNVJ:NT C:ONTR ACTOU theless, for more than 50 years, the Internal Revenue Code has contained a narrowly TAX1NS TITUTE.COM. -

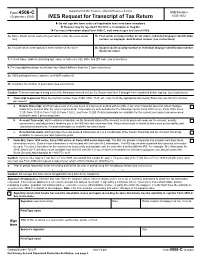

Form 4506-C, IVES Request for Transcript of Tax Return

Department of the Treasury - Internal Revenue Service Form 4506-C OMB Number (September 2020) IVES Request for Transcript of Tax Return 1545-1872 ▶ Do not sign this form unless all applicable lines have been completed. ▶ Request may be rejected if the form is incomplete or illegible. ▶ For more information about Form 4506-C, visit www.irs.gov and search IVES. 1a. Name shown on tax return (if a joint return, enter the name shown 1b. First social security number on tax return, individual taxpayer identification first) number, or employer identification number (see instructions) 2a. If a joint return, enter spouse’s name shown on tax return 2b. Second social security number or individual taxpayer identification number if joint tax return 3. Current name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions) 4. Previous address shown on the last return filed if different from line 3 (see instructions) 5a. IVES participant name, address, and SOR mailbox ID 5b. Customer file number (if applicable) (see instructions) Caution: This tax transcript is being sent to the third party entered on Line 5a. Ensure that lines 5 through 8 are completed before signing. (see instructions) 6. Transcript requested. Enter the tax form number here (1040, 1065, 1120, etc.) and check the appropriate box below. Enter only one tax form number per request a. Return Transcript, which includes most of the line items of a tax return as filed with the IRS. A tax return transcript does not reflect changes made to the account after the return is processed. -

Additional First-Year Depreciation Allowance. 40.60(1) Assets Acquired After September 10, 2001, but Before May 6, 2003

IAC Ch 40, p.1 701—40.60 (422) Additional first-year depreciation allowance. 40.60(1) Assets acquired after September 10, 2001, but before May 6, 2003. For tax periods ending after September 10, 2001, but beginning before May 6, 2003, the additional first-year depreciation allowance (“bonus depreciation”) of 30 percent authorized in Section 168(k) of the Internal Revenue Code, as enacted by Public Law No. 107-147, Section 101, does not apply for Iowa individual income tax. Taxpayers who claim the bonus depreciation on their federal income tax return must add the total amount of depreciation claimed on assets acquired after September 10, 2001, but before May 6, 2003, and subtract the amount of depreciation taken on such property using the modified accelerated cost recovery system (MACRS) depreciation method applicable under Section 168 of the Internal Revenue Code without regard to Section 168(k). If any such property was sold or disposed of during the tax year, the applicable depreciation catch-up adjustment must be made to adjust the basis of the property for Iowa tax purposes. The gain or loss reported on the sale or disposition of these assets for federal tax purposes must be adjusted for Iowa tax purposes to account for the adjusted basis of assets. The adjustment for both depreciation and the gain or loss on the sale of qualifying assets acquired after September 10, 2001, but before May 6, 2003, can be calculated on Form IA 4562A. See 701—subrule 53.22(1) for examples illustrating how this subrule is applied. -

Page 3158 TITLE 26—INTERNAL REVENUE CODE § 6101

§ 6101 TITLE 26—INTERNAL REVENUE CODE Page 3158 6107. Tax return preparer must furnish copy of re- (Aug. 16, 1954, ch. 736, 68A Stat. 753; Pub. L. turn to taxpayer and must retain a copy or 94–455, title XIX, § 1906(b)(13)(A), Oct. 4, 1976, 90 list. Stat. 1834.) 6108. Publication of statistics of income.2 6109. Identifying numbers. AMENDMENTS 6110. Public inspection of written determinations. 1976—Pub. L. 94–455 struck out ‘‘or his delegate’’ after 6111. Disclosure of reportable transactions. ‘‘Secretary’’. 6112. Material advisors of reportable transactions must keep lists of advisees, etc. § 6102. Computations on returns or other docu- 6113. Disclosure of nondeductibility of contribu- ments tions. 6114. Treaty-based return positions. (a) Amounts shown on internal revenue forms 6115. Disclosure related to quid pro quo contribu- The Secretary is authorized to provide with tions. 6116. Requirement for prisons located in United respect to any amount required to be shown on States to provide information for tax ad- a form prescribed for any internal revenue re- ministration. turn, statement, or other document, that if such 6117. Cross reference. amount of such item is other than a whole-dol- lar amount, either— AMENDMENTS (1) the fractional part of a dollar shall be 2011—Pub. L. 112–41, title V, § 502(b), Oct. 21, 2011, 125 disregarded; or Stat. 460, added items 6116 and 6117 and struck out (2) the fractional part of a dollar shall be former item 6116 ‘‘Cross reference’’. 2007—Pub. L. 110–28, title VIII, § 8246(a)(2)(C)(ii), May disregarded unless it amounts to one-half dol- 25, 2007, 121 Stat. -

The Tax Protestor Movement Legal Tax Protestors Or Illegal Tax Evaders?

The Tax Protestor Movement Legal Tax Protestors or Illegal Tax Evaders? By David Mason and Daren Lanter TAXPRO Quarterly Journal Spring 2002 The IRS differentiates between legal tax protestors and illegal tax evaders. Tax evasion, not filing and not paying federal income tax, is subject to both civil and criminal sanctions. Under the banner of “the tax protestor movement,” naive and uninformed individuals are being persuaded that not filing tax returns and not paying federal income tax is legal and wise tax planning. In reality there is nothing legal or wise in what is being promoted; rather, it is an illegal and foolish action by promoters using cleverly worded sophisms to capture an unsuspecting audience. These Promoters of the tax protest movement also take advantage of the average person’s natural aversion to paying taxes. Those who buy into their arguments usually discover that they end up paying twice- first to the “tax protestor” who sells them the tax protestor materials, seminars, associate degrees, etc. (all at exorbitant prices), and then once again to the IRS or the Courts when they are required to pay their taxes and interest that they legally owe. In addition, those who willingly follow these tax protest schemes often find themselves subject to levies of huge penalties, fines, and even jail time (not to mention the emotional and mental traumas IRS audits and tax court proceedings exact on participants). These protestors of the federal income tax have been present for numerous years. However, in recent years, these schemes are being spread to Internet usage. Unfortunately, this has led to an escalation in the number of uninformed taxpayers being seduced by their arguments. -

Grown-Up Income Shifting: Yesterday's Kiddie Tax Is Not Enough

Loyola University Chicago, School of Law LAW eCommons Faculty Publications & Other Works 2011 Grown-Up Income Shifting: Yesterday's Kiddie Tax Is Not Enough. Samuel Brunson Loyola University Chicago, [email protected] Follow this and additional works at: http://lawecommons.luc.edu/facpubs Part of the Tax Law Commons Recommended Citation Brunson, Samuel, Grown-Up Income Shifting: Yesterday's Kiddie Tax Is Not Enough, 59 U. Kan. L. Rev. 457 (2011). This Article is brought to you for free and open access by LAW eCommons. It has been accepted for inclusion in Faculty Publications & Other Works by an authorized administrator of LAW eCommons. For more information, please contact [email protected]. Grown-Up Income Shifting: Yesterday's Kiddie Tax Is Not Enough Samuel D. Brunson I. INTRODUCTION As part of its ongoing war against tax evasion, Congress changed the tax law in 1986 to make income shifting' less viable and less attractive.2 Congress assaulted income shifting on two fronts. First, it passed provisions that closed perceived loopholes in the tax law that permitted income shifting. Second, it passed provisions that, while not aimed directly at income shifting, resulted in its being less attractive. In the latter category were the changes to tax brackets made by the Tax Reform Act of 1986 (the Act).3 The Act reduced both the number of tax brackets and their rates. Before the Act, there were fourteen tax brackets; after the Act, there were just two.4 At the same time, the Act reduced the highest marginal rate from fifty percent to twenty-eight percent.5 This compression of tax brackets, combined with the reduction in marginal rates, significantly decreased the amount by which income shifting could reduce a taxpayer's tax liability. -

INFORMATION BULLETIN #119 INCOME TAX MAY 2021 (Replaces Information Bulletin #119 Dated May 2021) Effective Date: Upon Publication

INFORMATION BULLETIN #119 INCOME TAX MAY 2021 (Replaces Information Bulletin #119 dated May 2021) Effective Date: Upon Publication SUBJECT: Internal Revenue Code Provisions Not Followed by Indiana and Clarification of Related Issues REFERENCE: IC 6-3-1-11; IC 6-3.1-21-6. DISCLAIMER: Information bulletins are intended to provide nontechnical assistance to the general public. Every attempt is made to provide the information that is consistent with the appropriate statutes, rules, and court decisions. Any information that is not consistent with the law, rules, or court decisions is not binding on either the department or the taxpayer. Therefore, the information provided herein should serve only as a foundation for further investigation and study of the current law and procedures related to the subject matter covered herein. SUMMARY OF CHANGES Other than nonsubstantive edits, this bulletin has been updated to clarify that the effective date of the bulletin does not impact the effective date of the various provisions contained in the bulletin. In addition, this bulletin has been updated to reflect several changes enacted by the American Rescue Plan Act. Also, this bulletin has been updated to provide for how the Indiana General Assembly treated various items during the 2021 legislative session. Finally, this bulletin has been updated to provide updated reporting requirements and a worksheet for calculating the Indiana unemployment deduction. I. INTRODUCTION Under IC 6-3-1-11, the definition of “Internal Revenue Code” is established as of a specific date. Prior to the 2021 session of the Indiana General Assembly, IC 6-3-1-11 defined “Internal Revenue Code” as the version in effect on January 1, 2020. -

2020 Instructions for Form 8615

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 8.5 Draft Ok to Print AH XSL/XML Fileid: … ions/I8615/2020/A/XML/Cycle05/source (Init. & Date) _______ Page 1 of 6 14:29 - 8-Feb-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury 2020 Internal Revenue Service Instructions for Form 8615 Tax for Certain Children Who Have Unearned Income Section references are to the Internal Revenue Code unless 3. The child either: otherwise noted. a. Was under age 18 at the end of 2020, b. Was age 18 at the end of 2020 and didn’t have earned Future Developments income that was more than half of the child's support, or c. Was a full-time student at least age 19 and under age 24 at For the latest information about developments related to Form 8615 the end of 2020 and didn’t have earned income that was more than and its instructions, such as legislation enacted after they were half of the child's support. published, go to IRS.gov/Form8615. (Earned income is defined later. Support is defined below.) What’s New 4. At least one of the child's parents was alive at the end of Change in tax rates. Recent legislation modified the tax rates and 2020. brackets used to figure the tax on 2020 unearned income for certain 5. The child doesn’t file a joint return for 2020. children. For tax year 2020, dependent children with unearned income above a certain amount are taxed at the parents' individual For these rules, the term “child” includes a legally adopted child tax rate. -

AGENCY: Internal Revenue Service (IRS), Treasury ACTION: Final and Temporary Regulations. SUMMARY: This Document Contains

AGENCY: Internal Revenue Service (IRS), Treasury ACTION: Final and temporary regulations. SUMMARY: This document contains regulations relating to the depreciation of property subject to section 168 of the Internal Revenue Code (MACRS property) and the depreciation of computer software subject to section 167. Specifically, these regulations provide guidance regarding the additional first year depreciation allowance provided by sections 168(k) and 1400L(b) for certain MACRS property and computer software. The regulations reflect changes to the law made by the Job Creation and Worker Assistance Act of 2002 and the Jobs and Growth Tax Relief Reconciliation Act of 2003. The text of these temporary regulations also serves as the text of the proposed regulations set forth in the notice of proposed rulemaking on this subject in the Proposed Rules section in this issue of the . DATES: Effective Dates: These regulations are effective September 8, 2003. Applicability Dates: For dates of applicability, see §§1.167(a)-14T(e), 1.168(d)- 1T(d), 1.168(k)-1T(g), 1.169-3T(g), and 1.1400L(b)-1T(g). FOR FURTHER INFORMATION CONTACT: Douglas Kim, (202) 622-3110 (not a toll- free number). SUPPLEMENTARY INFORMATION: This document contains amendments to 26 CFR part 1 to provide regulations under sections 168(k) and 1400L(b) of the Internal Revenue Code (Code). Sections 168(k) and 1400L(b) were added to the Code by, respectively, sections 101 and 301(a) of the Job Creation and Worker Assistance Act of 2002, Public Law 107-147 (116 Stat. 21), and were modified by section 201 of the Jobs and Growth Tax Relief Reconciliation Act of 2003, Public Law 108-27 (117 Stat.