2015 Registration Document 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ARTICLE 6 Permis

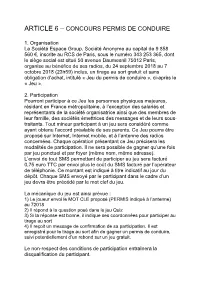

ARTICLE 6 – CONCOURS PERMIS DE CONDUIRE 1. Organisation La Société Espace Group, Société Anonyme au capital de 9 858 560 €, inscrite au RCS de Paris, sous le numéro 343 253 365, dont le siège social est situé 50 avenue Daumesnil 75012 Paris, organise au bénéfice de ses radios, du 24 septembre 2018 au 7 octobre 2018 (23h59) inclus, un tirage au sort gratuit et sans obligation d'achat, intitulé « Jeu du permis de conduire », ci-après le « Jeu ». 2. Participation Pourront participer à ce Jeu les personnes physiques majeures, résidant en France métropolitaine, à l’exception des salariés et représentants de la société organisatrice ainsi que des membres de leur famille, des sociétés émettrices des messages et de leurs sous- traitants. Tout mineur participant à un jeu sera considéré comme ayant obtenu l’accord préalable de ses parents. Ce Jeu pourra être proposé sur Internet, Internet mobile, et à l’antenne des radios concernées. Chaque opération présentant ce Jeu précisera les modalités de participation. Il ne sera possible de gagner qu’une fois par jeu ponctuel et par foyer (même nom, même adresse). L’envoi de tout SMS permettant de participer au jeu sera facturé 0,75 euro TTC par envoi plus le coût du SMS facturé par l’opérateur de téléphonie. Ce montant est indiqué à titre indicatif au jour du dépôt. Chaque SMS envoyé par le participant dans le cadre d’un jeu devra être précédé par le mot clef du jeu. La mécanique du jeu est ainsi prévue : 1) Le joueur envoi le MOT CLE proposé (PERMIS indiqué à l’antenne) au 72018 2) Il répond à la question posé dans le jeu Quiz 3) Si la réponse est bonne, il indique ses coordonnées pour participer au tirage au sort 4) Il reçoit un message de confirmation de sa participation. -

Étude D'impact De La Demande De Changement De Titulaire Et De

ÉTUDE D’IMPACT ÉTUDE Étude d’impact de la demande de changement de titulaire et de catégorie de l’autorisation de M Radio à Grenoble Version soumise à consultation publique (avant occultation des données confidentielles) Juin 2020 © Conseil supérieur de l’audiovisuel Étude d’impact de la demande de changement de titulaire et de catégorie de l’autorisation de M Radio à Grenoble Sommaire 1. L’impact sur l’offre radiophonique FM............................................................................................ 9 1.1. La diversité des opérateurs et des catégories ......................................................................... 9 1.2. La diversité des programmes et des genres musicaux .......................................................... 10 1.2.1. Une offre de programme riche et diversifiée ................................................................ 14 1.2.2. L’impact d’un changement de titulaire et de catégorie de M Radio en matière de diversité des programmes et des genres musicaux ...................................................................... 14 2. L’impact sur le nombre d’acteurs actifs sur le marché publicitaire local de Grenoble ................. 16 2.1. Les acteurs radio déjà actifs à Grenoble et l’évaluation de l’offre d’espaces publicitaires locaux en radio .................................................................................................................................. 16 2.2. Les acteurs des autres supports médias .............................................................................. -

Conseil Supérieur De L'audiovisuel

RAPPORTD’ACTIVITÉ 2007 Conseil supérieur de l’audiovisuel RAPPORT D’ACTIVITÉ 2007 Conseil supérieur de l’audiovisuel Service de l’information et de la documentation Ce document aété élaboré en application des deux premiers alinéas de l’article 18 de la loi n° 86-1067 du 30 septembre 1986 C relative àlaliberté de communication. Aux termes de ces dispositions : «LeConseil supérieur de l’audiovisuel établit chaque année un rapport public qui rend compte de son activité, de l’application de la pré- sente loi, du respect de leurs obligations par les sociétés et l’établissement public mentionnés aux articles 44 et 49 de la présente loi. Ce rapport est adressé au Président de la République, au Gouver- nement et au Parlement [...]. Dans ce rapport, le Conseil supérieur de l’audiovisuel peut suggérer les modifications de nature législative et régle- mentaire que lui paraît appeler l’évolution technologique, économique, sociale et culturelle des activités du secteur de l’audiovisuel. Il peut également formuler des observations sur la répartition du produit de la redevance et de la publicité entre les organismes du secteur public. » Le présent rapport porte sur l’année 2007. Il aété approuvé par l’assemblée plénière du Conseil supérieur de l’audiovisuel dans sa séance du 29 avril 2008. CSA -RAPPORT D’ACTIVITÉ 2007 3 SOMMAIRE 07 Avant-propos 7 LES CHIFFRES CLÉS DU CSA ET DU SECTEUR AUDIOVISUEL EN 2007 9 LES DATES CLÉS DU CSA EN 2007 16 SYNTHÈSE 23 2007, CONSTRUIRE LA TÉLÉVISION ET LA RADIO DE DEMAIN AU SERVICE DE TOUS :BILAN ET PERSPECTIVES 29 I– -

COMMUNIQUE DE PRESSE L'assemblée Générale Des Indés

COMMUNIQUE DE PRESSE 17/03/2017 L’Assemblée Générale des Indés Radios élit 11 membres au Conseil d’Administration L'Assemblée Générale des Indés Radios, réunie en plénière le jeudi 16 mars, a procédé à l'élection des 11 membres de son Conseil d'administration pour la période 2017-2019. 10 administrateurs ont été réélus et 1 nouvel administrateur a été élu : Christophe MAHE, Président d’Espace Group. Le Conseil d’Administration élu se compose donc de : • Président : Jean-Eric VALLI, Président Groupe 1981 (Ado, Blackbox, Forum, Latina, Vibration, Voltage et Wit FM) • Vice-président : Daniel PEREZ, Président du Conseil de Surveillance de Radio Scoop • Vice-président : Bertrand de VILLIERS, Président d'Alouette • Vice-président : Antoine BADUEL, Président de Radio FG • Vice-président : Hervé du PLESSIX, Président du Groupe HPI (Chante France, Evasion et MBS) • Administrateur : Anthony EUSTACHE, Président de Fréquence Plus • Administrateur : Jacques HARDOIN, Président de Contact FM, Gérant de Champagne FM et de Happy FM • Administrateur : Jacques IRIBARREN, Gérant de 100% • Administrateur : Christophe MAHE, Président d’Espace Group (Alpes 1, Durance FM, Générations, Jazz Radio, La Radio Plus, MFM Radio, ODS Radio, Radio Espace, RVA et Virage Radio) • Administrateur : Agnain MARTIN, Président de Radio Dreyeckland et Gérant de Cannes Radio • Administrateur : Yann OGER, Directeur de Hit West, d’Oceane FM et de Radio Cristal, trois stations liées à Ouest France Dans la foulée de son élection, le Conseil d’Administration a procédé à la nomination des membres du Bureau : • Jean-Eric VALLI – Président du Conseil d’Administration • Bertrand de VILLIERS – Vice-président du Conseil d’Administration • Antoine BADUEL – Vice-président du Conseil d’Administration • Membre du Bureau délégué : Yann OGER – Administrateur du Conseil d’Administration Pour Jean-Eric Valli, Président des Indés Radios : « à 25 ans, les Indés Radios ont atteint l’âge de la maturité et de la stabilité. -

La Lettre.Pro

RADIO_LLP_4_Mise en page 1 18/10/11 02:46 Page1 Actu La Lettre.Pro 1982 Georges Fillioud 20/10 N°4 RADIO archives Joëlle Girard 1981/2011 - n°4 & médias novembre ◗ Bientôt X 9 novembre 1981 1981 Loi de la tolérance et dérogations pour les radio locales privées et associatives. 1981 – 2011 : les radios libres ont 30 ans Préserver la magie qui caractérise la radio En 1981, le monopole d’Etat de la radiodiffusion prenait fin entrainant avec lui la création De sources sûres de dizaines de stations aux quatre coins de France. Trente ans après cette libéralisation ◗ des ondes, le paysage radiophonique français fait figure d’exception et demeure encore Jeudi 28 juin 1979 en perpétuelle évolution. Un signe de bonne santé. ☞p.2 Selon nos sources, un affrontement vient d’opposer des policiers et des élus socialistes à Paris cité Males- herbes. Des élus socialistes dont 1981 Laurent Fabius et Paul Quilès au- Radio Alsthom Belfort raient été expulsés du siège du parti. Les policiers auraient d’abord archives Joëlle Girard fait passer des gaz lacrymogènes puis enfoncé la porte à coups de masse. Les forces de l’ordre vou- laient saisir la radio pirate du PS, Radio Riposte mais n’ont rien pu trouver. De sources douteuses ◗ Vendredi 9 septembre 1977 Radio Verte de Fessenheim menace de faire sauter l’émetteur radio TV de Mulhouse si le brouillage de la répression policière se poursuit. C’est du moins ce que le pouvoir tente de faire croire à la population dans le but de provoquer et discré- diter R.V.F. -

Rapport CSA Sur La Concentration Radio 15-05-14

La concentration du média radiophonique Rapport au Parlement Avril 2014 Conseil supérieur de l’audiovisuel Direction des études et de la prospective Service de l’information et de la documentation Avril 2014 La concentration du média radiophonique Rapport au Parlement Avril 2014 Synthèse Chaque jour, plus de huit Français sur dix écoutent la radio pour s’informer, au niveau national aussi bien qu’au niveau local, pour débattre mais aussi pour se divertir. L’influence considérable du média radiophonique réclame, en complément du contrôle prévu par le droit commun de la concurrence, des mesures permettant de préserver le pluralisme des courants socio-culturels qui s’y expriment. La régulation de la concentration est une tâche centrale et délicate. Elle doit préserver le pluralisme des services de radio auxquels ont accès les citoyens sans pour autant compromettre le dynamisme économique du secteur, qui est la condition effective de l’existence d’une pluralité d’opérateurs. Aujourd’hui, le secteur radiophonique français fait preuve de solidité dans un contexte publicitaire difficile, notamment grâce à la capacité d’innovation de ses opérateurs. Cependant, il fait face à la concurrence de nouveaux services numériques alors qu’il se déploie lui-même vers les nouveaux réseaux de distribution numériques, sur lesquels il doit s’insérer dans de nouveaux schémas et de nouvelles relations économiques. Le paysage radiophonique français se caractérise par la coexistence de nombreux opérateurs de types très différents, de petites structures locales aussi bien que des groupes régionaux et nationaux. Cependant, au niveau local, il existe d’importantes disparités dans l’offre de services de radio, à la fois en termes de nombre et de diversité. -

Quel Rôle Pour La Radio Numérique Terrestre ?

Evolution des modes de diffusion de la radio : quel rôle pour la radio numérique terrestre ? Janvier 2015 www.csa.fr EVOLUTION DES MODES DE DIFFUSION DE LA RADIO : QUEL ROLE POUR LA RADIO NUMERIQUE TERRESTRE ? Plan Introduction .......................................................................................................................................... 4 1 L’état des lieux des modes de diffusion de la radio ........................................................................ 6 1.1 Les ondes moyennes et les ondes longues, modes de diffusion historiques de la radio ............ 6 1.2 La FM, socle du paysage radiophonique français ................................................................... 8 1.2.1 Un nombre de fréquences allouées permettant de délivrer une offre radiophonique riche et diversifiée ................................................................................................................................. 9 1.2.2 Des disparités de l’offre en FM sur le territoire............................................................... 9 1.2.3 L’état du marché publicitaire ........................................................................................ 10 1.3 Une part croissante de l’offre provenant des services sur internet ......................................... 11 1.3.1 L’internet permet aux acteurs diffusés par voie hertzienne de développer leur visibilité, et d’enrichir et diversifier leur offre ................................................................................................ -

Lettre Pro De La Radio

é t i c i l b u Ceci est une lettre pilote P Actu La Lettre.Pro 0 ° N 6 0 / 5 1 RADIO 15 Juin 2011 - n°0 & médias NRJ Group confie sa diffusion De sources sûres Q Goom Radio endettée ! Internet et mobile à SmartJog En réponse à une question d’un jour - naliste sur la 3G et internet lors du (TDF) lancement de la RNT à Lyon le 18 mai 2011 Rachid Arhab à indiqué : On rentre les griffes «Les mêmes gens qui ont annoncé la NRJ Group a confié l'ensemble de sa diffusion Internet et mobile mort de la RNT on fait un nombre d’ar - à SmartJog, filiale multimédia du groupe TDF. Le plateforme de ticle incroyable sur l’exemple que vous streaming de SmartJog assurera la diffusion de plus de 70 we - avez cité (ndlr : Goom Radio) en annon - çant que c’était l’alpha et l’Oméga de la bradios et plusieurs flux TV de NRJ Group. Il s'agit de "l'offre mul - numérisation de la radio et personne timédia la plus riche du marché", a indiqué Alain Reyes, directeur n’a réussi à l’écouter suffisamment pour technique de NRJ Group. Q que le modèle économique fonctionne et que je sache, ce groupe là me sem - Humeur Et de 4 ! ble assez endetté d’après ce que j’en sais. Peut-être que la radio par internet Onde Numérique - Un modèle Un nouvel opérateur de diffusion sera un secteur économique qui fonc - tionnera, je le souhaite parce qu’il sera pour la RNP (radio payante) ? pour les radios françaises complémentaire de la RNT». -

Rossignol Le Leader Mondial Du Ski Alpin Courtise Les Femmes

13.11.2013 n° 1229 + d’infos sur www.intermedia.fr ISSN : 0249-1575 Marketing / coMMunication / Médias en rhône-alpes L’hebdo JEUNES PROS p.2 panoramA 2 annonceurs 4 AgENces 6 servIcES 8 médias 9 Emploi 10 débloque-notes 12 IrIna TrenTea La fibre L’Auvergne ratisse les jeunes Insign Une réorganisation Les régies nationales se replient féminine couples sur internet menée tambour battant sur Paris p.4 p.6 p.9 Casting à 2 300 mètres d’altitude. Les égéries de cette campagne ont été recrutées sur les pistes de Val Thorens. Cinquante skieuses ont participé au casting, seule une dizaine a été retenue. Les heureuses élues s’appellent Ingrid, Solène, Sepha, Hermine ou encore Dana. L’une est Parisienne, l’autre travaille dans une station de ski, il y a une chanteuse, une Londonienne, mais aussi une Slovaque. Groupe Rossignol. Création : 1907 - Marques : Rossignol, Dynastar, Lange (chaussures), Look (fixations) - Implantations en France : Saint- Jean-de-Moirans (siège), Saint-Étienne-de-Saint- Geoirs, Sallanches, Nevers - CA : 207 M€ - 1 120 salariés - 35 % de PDM en France. Rossignol Le leader mondial du ski alpin courtise les femmes ais que veulent les femmes ? Pour tos d’action ou lifetsyle », martèle Yann pas associer notre image à la performance le savoir, Rossignol a confié à Laphin. Sous l’objectif de l’ancien publi- et à la gagne », précise Yann Laphin. Ml’agence américaine JDK une vaste citaire Sacha Goldberger, connu pour ses étude marketing auprès de 7 000 skieuses séries de mode, les visuels mettent en Tournée européenne. Toujours peu por- issues de sept pays (France, États-Unis, scène des jeunes femmes en mode avant/ tée sur l’achat d’espaces, la marque réac- Suisse, Autriche...). -

Etude D'impact Annecy

Étude d’impact de la demande de changement de titulaire et de catégorie de l’autorisation de Jazz R adio à Annecy MAI 2016 Les éléments relevant du secret des affaires figurent entre crochets. Version publique soumise à débat contradictoire Sommaire 1. L’impact sur l’offre radiophonique FM............................................................................................ 7 1.1. La diversité des opérateurs et des catégories ......................................................................... 7 1.2. La diversité des programmes et des genres musicaux ............................................................ 7 1.2.1. Une offre de programme riche et diversifiée ................................................................ 10 1.2.2. L’impact d’un changement de titulaire et de catégorie de Jazz Radio en matière de diversité des programmes et des genres musicaux ...................................................................... 10 2. L’impact sur le nombre d’acteurs actifs sur le marché publicitaire local d’Annecy ...................... 12 2.1. Les acteurs radio déjà actifs à Annecy et l’évaluation de l’offre d’espaces publicitaires locaux en radio .................................................................................................................................. 12 2.2. Les acteurs des autres supports médias ............................................................................... 14 3. L’impact sur l’audience ................................................................................................................. -

Klotz AIS Gmbh, Today a Leading Company in the Cable and Accessory Market Branded Enterprises Are Part of the Same Culture and Philosophy

klotz — issue #01 decades klotz —issue #01: years weeks days 35 1,825 12,775 hours minutes 306,600 18,396,000 seconds 1,103,760,000 the three klotz brothers, thomas, dieter and peter have been in the forefront of the audio broadcasting and event technology industry for 35 years. from the foundation through periods of innovation and growth, and last but not least due to the refocus on the two market segments interfaces and communications, the klotz companies have mastered periods of turbulent developments and changes successfully. by exploiting their strengths, including dynamic innovation, reliability, desire and ability to ensure the satisfaction of individual customer needs, the companies have established themselves as leaders in quality and performance. until today this has been appreciated by musicians, rental operators, theatres, operas, stadiums, airports and worldwide broadcast stations. the times 88—95 they are a- changin’ growth The late 1980s and early 1990s saw the world in a state of upheaval. As the Cold War standards to the studio rack. In 1988 Klotz established it´s cable production in the ended, borders were dissolved. The sound-track for the era was provided by the Franconian town of Vilchband. In the late 80ies Klotz was pioneering the fibre optic Scorpions with their worldwide megahit “Wind of Change”. The band’s guitarist, technology within the pro audio market. The development of OAK_link, the world’s first Matthias Jabs, would later collaborate with Klotz to develop his signature cable, the optical fiber cable designed specifically for professional audio technology, proved its “Rockmaster”. It’s a small world! In the meantime, Klotz was also continuing to put worth in numerous settings including Wembley Stadium, where it made an impressive every effort into improving and expanding its range of standard music products, launching debut by delivering superb sound for the Rolling Stones and Madonna. -

Classement ACPM/OJD Des Radios Digitales Février 2020

Classement ACPM/OJD des Radios Digitales février 2020 L'ACPM publie les chiffres de la diffusion globale des Radios digitales diffusées et contrôlées sur le mois de février 2020. Voici les 3 tableaux comportant respectivement les chiffres de diffusion classés, dans le premier regroupé par Marques, dans le deuxième par Groupes et réseaux et enfin par Radios. Ce mois-ci près de 119 millions d’heures d’écoute de la Radio via les terminaux connectés, soit près de 186 millions de Sessions d’écoutes actives Monde dont 142 millions réalisés en France. 1 - Les Marques* de Radios adhérentes, les plus diffusées en ligne (février 2020) : Durée d'Ecoute Ecoutes actives Ecoutes Durée d'Ecoute Nbr. de Rang Marques moyenne France actives Monde Monde (en h.) Radios Monde 1 France Inter 21 739 996 25 483 641 15 062 769 35m 28s 1 2 RMC 18 676 483 21 393 993 11 373 629 31m 54s 1 3 NRJ 14 584 590 24 583 259 14 861 186 36m 16s 618 4 France Info 10 110 106 13 564 978 6 604 414 29m 13s 1 5 Nostalgie 7 230 386 9 597 124 7 864 650 49m 10s 74 6 Skyrock 6 972 253 8 069 715 3 310 637 24m 37s 12 7 FIP 6 687 127 9 346 917 9 588 729 1h 01m 33s 12 8 Chérie FM 6 252 506 8 463 457 8 003 830 56m 44s 72 9 France Culture 5 669 526 7 133 939 2 888 906 24m 18s 1 10 Rire et Chansons 4 703 545 5 734 103 3 163 857 33m 06s 33 11 France Bleu 4 105 802 4 753 209 3 443 113 43m 28s 46 12 Radio Public Sante 2 526 144 2 529 557 199 053 04m 43s 8 13 Radio Classique 2 079 230 2 571 725 2 438 170 56m 53s 1 14 M Radio 1 759 522 2 060 696 1 333 237 38m 49s 31 15 Jazz Radio 1 641 982 3 001