Notice of Conclusion of Fixed-Term Building Lease Renewal Agreement on AEON MALL Tsudanuma

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Third Quarter Results

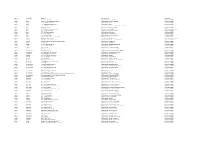

Consolidated Financial Results for the First Nine Months from April 1 to December 31, 2016 2017・1・31 Index 02 Highlights of the Third Quarter, FY2017 09 Unit Information Copyright 2017 Nomura Real Estate Holdings, Inc. 1 Highlights of the Third Quarter, FY2017 Copyright 2017 Nomura Real Estate Holdings, Inc. 2 Summary of Financial Results • The cumulative result of FY2017 3Q was as follows: Operating revenue;¥368.9 billion (down 3.1% y/y); operating income; ¥49.1 billion (down 7.4% y/y); ordinary income;¥42.9 billion (down 8.8% y/y); and profit attributable to owners of parent;¥29.1 billion (increase 2.7% y/y). • In the Residential Development Unit, the number of housing units sold decreased to 3,074 (down 711 units y/y) while gross margin ratio and housing prices increased. The contract progress rate for the planned 5,650 units of this consolidated fiscal year was 90.1% as of the end of the current third quarter. • In the leasing business, tenant leasing made a satisfactory progress, and the vacancy rate as of the end of the third quarter improved to 1.0% (down 1.2 points from the end of the previous fiscal year). • Service Management Sector which consists of 3 Units, the Investment Management Unit, the Property Brokerage & CRE Unit, and the Property & Facility Management Unit marked a smooth progress. Especially in the Property Brokerage & CRE Unit, both the number of transactions and transaction value marked the highest figure ever as the third quarter. • No change in the consolidated operating result forecast and dividend forecast which was announced in October, 2016. -

Annual Report 2013 1

Otemachi Building, 6-1, Otemachi 1-chome, Chiyoda-ku, Tokyo 100-8133, Japan http://www.mec.co.jp/index_e.html ANNUAL REPORT2013 Approx. 296m Approx. 240m Approx. Approx. 205m 180m Approx. 36m Approx. 20m Yokohama Landmark Tower Sunshine 60 McGraw-Hill Building Marunouchi Building Paternoster Square Mitsubishi Ichigokan ANNUAL REPORT This report is printed using paper that con- This report has been prepared using tains raw materials certified by the Forest 100% vegetable ink. Every effort is Stewardship Council (FSC)®. FSC ® certifi cation made to contain the incidence of vol- Fiscal Year ended ensures that materials have been harvested atile organic compounds (VOCs) and from properly managed forests. to preserve petroleum resources. Printed in Japan March 31, 2013 2013 113mec_ar表紙英文0815_初戻P.indd3mec_ar表紙英文0815_初戻P.indd 11-2-2 113/09/063/09/06 116:376:37 MITSUBISHI ESTATE CO., LTD. ANNUAL REPORT 2013 1 A Love for People A Love for the City Forever Taking on New Challenges–The Mitsubishi Estate Group Our wish is to provide people who live in, work in and visit the city with enriching and fulfi lling lives, full of stimulating opportunities to meet. The Mitsubishi Estate Group has always pursued the genuine value sought by people in the environments and services it provides. With an eye to the future, we carefully listen to each and every customer, and create the true value they seek. We wish to share with our customers the inspiration and passion we derive from our work. We will constantly take on new challenges to achieve this vision, and through it, we will continuously evolve. -

Pdf/Rosen Eng.Pdf Rice fields) Connnecting Otsuki to Mt.Fuji and Kawaguchiko

Iizaka Onsen Yonesaka Line Yonesaka Yamagata Shinkansen TOKYO & AROUND TOKYO Ōu Line Iizakaonsen Local area sightseeing recommendations 1 Awashima Port Sado Gold Mine Iyoboya Salmon Fukushima Ryotsu Port Museum Transportation Welcome to Fukushima Niigata Tochigi Akadomari Port Abukuma Express ❶ ❷ ❸ Murakami Takayu Onsen JAPAN Tarai-bune (tub boat) Experience Fukushima Ogi Port Iwafune Port Mt.Azumakofuji Hanamiyama Sakamachi Tuchiyu Onsen Fukushima City Fruit picking Gran Deco Snow Resort Bandai-Azuma TTOOKKYYOO information Niigata Port Skyline Itoigawa UNESCO Global Geopark Oiran Dochu Courtesan Procession Urabandai Teradomari Port Goshiki-numa Ponds Dake Onsen Marine Dream Nou Yahiko Niigata & Kitakata ramen Kasumigajo & Furumachi Geigi Airport Urabandai Highland Ibaraki Gunma ❹ ❺ Airport Limousine Bus Kitakata Park Naoetsu Port Echigo Line Hakushin Line Bandai Bunsui Yoshida Shibata Aizu-Wakamatsu Inawashiro Yahiko Line Niigata Atami Ban-etsu- Onsen Nishi-Wakamatsu West Line Nagaoka Railway Aizu Nō Naoetsu Saigata Kashiwazaki Tsukioka Lake Itoigawa Sanjo Firework Show Uetsu Line Onsen Inawashiro AARROOUUNNDD Shoun Sanso Garden Tsubamesanjō Blacksmith Niitsu Takada Takada Park Nishikigoi no sato Jōetsu Higashiyama Kamou Terraced Rice Paddies Shinkansen Dojo Ashinomaki-Onsen Takashiba Ouchi-juku Onsen Tōhoku Line Myoko Kogen Hokuhoku Line Shin-etsu Line Nagaoka Higashi- Sanjō Ban-etsu-West Line Deko Residence Tsuruga-jo Jōetsumyōkō Onsen Village Shin-etsu Yunokami-Onsen Railway Echigo TOKImeki Line Hokkaid T Kōriyama Funehiki Hokuriku -

Haneda Airport Route(*PDF File)

1 of 3 Bus stop valid for Limousine & Subway pass(Haneda Airport route) Area Bus Stop Useable Area Bus Stop Useable Century Southern Tower ○ The Capitol Hotel Tokyu ○ Hotel Sunroute Plaza Shinjuku ○ Grand Hyatt Tokyo ○ Hilton Tokyo ○ ANA InterContinental Tokyo ○ Shinjuku Washington Hotel The Okura Tokyo ○ Akasaka Roppongi, ○ Park Hyatt Tokyo ○ Toranomon Hills ○ Hyatt Regency Tokyo Andaz Tokyo ○ Toranomon ○ Shinjuku Keio Plaza Hotel ○ HOTEL THE CELESTINE TOKYO SHIBA ○ Shinjuku Station/West ○ Shiba Park Hotel ○ Shinjuku Expressway Bus Terminal ○ Tokyo Prince Hotel ○ 【Early Morning Service】Shinjuku Expressway Bus Terminal × The Prince Park Tower Tokyo ○ 【Early Morning Service】Higashi Shinjuku Station × The Westin Tokyo ○ T-CAT Tokyo City Air Terminal ○ Sheraton Miyako Hotel Tokyo ○ Ikebukuro Sunshine Bus Terminal ○ Tokyo Marriott Hotel ○ Sunshine City Prince Hotel Shinagawa Prince Hotel ○ Shinagawa Ebisu, Shiba, ○ Hotel Metropolitan ○ The Prince Sakura Tower Tokyo ○ Ikebukuro Ikebukuro Station/West ○ Grand Prince Hotel Takanawa ○ 【Early Morning Service】Ikebukuro Station/East × Grand Prince Hotel New Takanawa ○ Hotel Chinzanso Tokyo ○ Shibuya Excel Hotel Tokyu × Tokyo Dome Hotel ○ Shibuya Station/West × Akihabara Station Shibuya Station(SHIBUYA FUKURAS) ○ Shibuya × Akihabara 【Early Morning Service】Akihabara Station Cerulean Tower Tokyu Hotel Mejiro, Mejiro, Kourakuen, × × HOSHINOYA Tokyo/Otemachi Financial City Grand Cube ○ ARIAKE GARDEN × Marunouchi Tokyo Station/Marunouchi North SOTETSU GRAND FRESA TOKYO-BAY ARIAKE , ○ × Otemachi Tokyo -

Around Tokyo from Narita Airport Model Course Depart Narita Airport ➡ Nikko ➡ Chichibu ➡ Narita ➡ Arrive Narita Airport (A Model Course)

Nikko Area Nikko Area *Please be aware that transport and the time required for a model course may vary depending on the weather and/or traffic conditions *Please note that Chichibu 2-Day Pass does not cover the Red Arrow Limited Express fare Around Tokyo from Narita Airport Model course Depart Narita Airport ➡ Nikko ➡ Chichibu ➡ Narita ➡ Arrive Narita Airport (A model course) Keisei Skyliner & Tokyo Subway Ticket NIKKO ALL AREA PASS Keisei Skyliner & Tokyo Subway Ticket Chichibu 2-Day Pass Keisei Skyliner & Tokyo Subway Ticket Narita-Kaiun Pass Keisei Tokyo Metro Tobu Limited Express Tobu Limited Express Tokyo Metro Ginza Line / Tozai Line / Red Arrow Red Arrow Tokyo Metro Marunouchi Line / Tozai Line / Keisei Skyliner Ginza Line SPACIA, Revaty SPACIA, Revaty Marunouchi Line Limited Express Limited Express Ginza Line Skyliner Keisei Main Line Keisei Main Line Narita Airport Ueno Sta. Asakusa Sta. Tobu Nikko Sta. Asakusa Sta. Ikebukuro Sta. Seibu Chichibu Sta. Ikebukuro Sta. Ueno Sta. Narita Airport Keisei Narita Sta. Narita Airport About 44 minutes About 5 minutes About 110 minutes About 110 minutes About 29 minutes About 78 minutes About 78 minutes About 16 minutes About 44 minutes About 10 minutes About 10 minutes Nikko Area Narita Area Chichibu Area Narita Area Chichibu Area Use the Use the Use the Chichibu 2-Day pass Narita-Kaiun pass Experience the mysterious charm of Nikko NIKKO ALL AREA PASS Try Sanja Meguri (visiting three shrines) to feel nature and history for sightseeing in Chichibu! Multifarious places well worth visiting near the airport! for sightseeing in Narita! for sightseeing in Nikko! Please refer to the back of the brochure for details. -

Haneda Airport Route(*PDF File)

1 of 3 Bus stop valid for Airport Limousine Bus Premium Coupon(Haneda Airport route) required required Area Bus Stop Useable Area Bus Stop Useable number number Century Southern Tower ○ 1 coupon The Capitol Hotel Tokyu ○ 1 coupon Hotel Sunroute Plaza Shinjuku ○ 1 coupon Grand Hyatt Tokyo ○ 1 coupon Hilton Tokyo ○ 1 coupon ANA InterContinental Tokyo ○ 1 coupon Shinjuku Washington Hotel 1 coupon The Okura Tokyo 1 coupon ○ Akasaka Roppongi, ○ Park Hyatt Tokyo ○ 1 coupon Toranomon Hills × × Hyatt Regency Tokyo 1 coupon Andaz Tokyo 1 coupon ○ Toranomon ○ Shinjuku Keio Plaza Hotel ○ 1 coupon HOTEL THE CELESTINE TOKYO SHIBA ○ 1 coupon Shinjuku Station/West ○ 1 coupon Shiba Park Hotel ○ 1 coupon Shinjuku Expressway Bus Terminal ○ 1 coupon Tokyo Prince Hotel ○ 1 coupon 【Early Morning Service】Shinjuku Expressway Bus Terminal ○ 2 coupons The Prince Park Tower Tokyo ○ 1 coupon 【Early Morning Service】Higashi Shinjuku Station ○ 2 coupons The Westin Tokyo ○ 1 coupon T-CAT Tokyo City Air Terminal ○ 1 coupon Sheraton Miyako Hotel Tokyo ○ 1 coupon Ikebukuro Sunshine Bus Terminal ○ 1 coupon Tokyo Marriott Hotel ○ 1 coupon Sunshine City Prince Hotel 1 coupon Shinagawa Prince Hotel 1 coupon ○ Shinagawa Ebisu, Shiba, ○ Hotel Metropolitan ○ 1 coupon The Prince Sakura Tower Tokyo ○ 1 coupon Ikebukuro Ikebukuro Station/West ○ 1 coupon Grand Prince Hotel Takanawa ○ 1 coupon 【Early Morning Service】Ikebukuro Station/East ○ 2 coupons Grand Prince Hotel New Takanawa ○ 1 coupon Hotel Chinzanso Tokyo ○ 1 coupon Shibuya Excel Hotel Tokyu × × Tokyo Dome Hotel ○ 1 coupon -

Chiba Travel

ChibaMeguri_sideB Leisure Shopping Nature History&Festival Tobu Noda Line Travel All Around Chiba ChibaExpressway Joban Travel Map MAP-H MAP-H Noda City Tateyama Family Park Narita Dream Farm MITSUI OUTLET PARK KISARAZU SHISUI PREMIUM OUTLET® MAP-15 MAP-24 Express Tsukuba Isumi Railway Naritasan Shinshoji Temple Noda-shi 18 MAP-1 MAP-2 Kashiwa IC 7 M22 Just within a stone’s throw from Tokyo by the Aqua Line, Nagareyama City Kozaki IC M24 Sawara Nagareyama IC Narita Line 25 Abiko Kozaki Town why don’t you visit and enjoy Chiba. Kashiwa 26 Sawara-katori IC Nagareyama M1 Abiko City Shimosa IC Whether it is for having fun, soak in our rich hot springs, RyutetsuNagareyamaline H 13 Kashiwa City Sakae Town Tobu Noda Line Minami Nagareyama Joban Line satiate your taste bud with superior products from the seas 6 F Narita City Taiei IC Tobu Toll Road Katori City Narita Line Shin-Matsudo Inzai City Taiei JCT Shiroi City Tonosho Town and mountains, Chiba New Town M20 Shin-Yahashira Tokyo Outer Ring Road Higashikanto Expressway Hokuso Line Shibayama Railway Matsudo City Inba-Nichi-idai Narita Sky Access Shin-Kamagaya 24 you can enjoy all in Chiba. Narita Narita Airport Tako Town Tone Kamome Ohashi Toll Road 28 34 Narita IC Musashino Line I Shibayama-Chiyoda Activities such as milking cows or making KamagayaShin Keisei City Line M2 All these conveniences can only be found in Chiba. Naritasan Shinshoji Temple is the main temple Narita International Airport Asahi City butter can be experienced on a daily basis. Narita Line Tomisato IC Ichikawa City Yachiyo City of the Shingon Sect of Chizan-ha Buddhism, Funabashi City Keisei-Sakura Shisui IC You can enjoy gathering poppy , gerbera, Additionally, there are various amusement DATA 398, Nakajima, Kisarazu-City DATA 689 Iizumi, Shisui-Town Sobu LineKeisei-Yawata Shibayama Town M21 Choshi City Isumi and Kominato railroad lines consecutively run across Boso Peninsula, through a historical Choshi 32 and antirrhinum all the year round in the TEL:0438-38-6100 TEL:043-481-6160 which was established in 940. -

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho -

ASP-DAC 2017 Advance Program

ASP-DAC 2017 Advance Program 22nd Asia and South Pacific Design Automation Conference Date: January, 16-19, 2017 Place: Chiba/Tokyo, Japan Highlights Special Sessions Tutorial-2: Towards Energy-Efficient Intelligence in Power- /Area-Constrained Hardware Opening and Keynote I 1S: (Presentation + Poster Discussion) University Design Contest Monday, January 16, 2017, 9:30-11:30, 12:45-14:45 Tuesday, January 17, 2017, 11:05-13:50 Tuesday, January 17, 2017, 8:30-10:35 Organizer: 2S: (Invited Talks) Neuromorphic Computing and Low-Power Im- Jae-sun Seo (Arizona State Univ.) Keynote I: In Memory of Edward J. McCluskey: The Next age Recognition Speakers: Wave of Pioneering Innovations Tuesday, January 17, 2017, 13:50-15:30 Zhengya Zhang (U. Michigan, Ann Arbor) Organizers/Chairs: Mingoo Seok (Columbia Univ.) Subhasish Mitra (Stanford University) 3S: (Invited Talks) Let’s Secure the Physics of Cyber-Physical Sys- Jae-sun Seo (Arizona State Univ.) Deming Chen (University of Illinois at Urbana-Champaign) tems Tuesday, January 17, 2017, 15:50-17:30 Tutorial-3: Post-Silicon Validation and Emulation-Based Val- This special plenary session will celebrate Prof. McCluskey idation Using Exercisers (who passed away in 2016) through three keynote speeches by 4S: (Invited Talks) Emerging Technologies for Biomedical Appli- Monday, January 16, 2017, 9:30-11:30, 15:15-17:15 world-renowned scholars on the next wave of pioneering innova- cations: Artificial Vision Systems and Brain Machine Interface Organizers: tions, starting with a memorial speech by Prof. Jacob Abraham Wednesday, January 18, 2017, 10:15-12:20 Ronny Morad (IBM Research - Haifa) of University of Texas at Austin. -

The Agb Newsletter

THE AGB NEWSLETTER An electronic publication dedicated to Asymptotic Giant Branch stars and related phenomena Official publication of the IAU Working Group on Red Giants and Supergiants No. 260 — 1 March 2019 http://www.astro.keele.ac.uk/AGBnews Editors: Jacco van Loon, Ambra Nanni and Albert Zijlstra Figure 1: Planetary nebula Fr2-25 (David Frew, 2008) or Alv–Kn1 (Filipe Alves & Matthias Kronberger, 2012) is a large (20′), old nebula in Monoceros, interacting with the surrounding interstellar medium. For more details see http://www.chart32.de/index.php/component/k2/item/155. 1 Editorial Dear Colleagues, It is a pleasure to present you the 260th issue of the AGB Newsletter. There are some very interesting papers on the effect of mass loss on planetary system architecture and on the origin of interstellar asteroids. Gaia data are also being put to good use. If you like dust or other stuff in space, take your pick from three conferences (or go to them all). If you don’t yet have a Ph.D. then why not consider working towards one in Leuven? Efrat Sabach and Noam Soker responded to the Food for Thought statements of the previous two issues (”How large will the Sun really become?” and ”What fraction of stars evolve as single stars all the way to the PN phase?”): ”We start by what we find to be the relevant term: A Jsolated star. We think that the important question is whether a companion enhances the mass loss rate during the very late giant phases of the star (upper RGB or upper AGB phase). -

Notice Regarding Closure of Tsudanuma PARCO and Shin-Tokorozawa PARCO of PARCO Co., Ltd

[Translation] February 24, 2021 To whom it may concern Company name: J. FRONT RETAILING Co., Ltd. Representative: YOSHIMOTO Tatsuya President and Representative Executive Officer (Securities code: 3086, First Section of the Tokyo Stock Exchange and Nagoya Stock Exchange) Inquiries: INAGAMI Hajime Senior General Manager of Investor Relations Promotion Division, Financial Strategy Unit [TEL: +81-3-6895-0178 (from overseas)] Notice Regarding Closure of Tsudanuma PARCO and Shin-Tokorozawa PARCO of PARCO Co., Ltd. J. FRONT RETAILING Co., Ltd. (the “Company”) hereby announces that PARCO Co., Ltd., a consolidated subsidiary of the Company, has decided to close the Tsudanuma PARCO and Shin-Tokorozawa PARCO stores as follows. Details 1. Reform of group management structure The Group has been moving forward with formulating its Medium-Term Business Plan, which is starting in fiscal 2021, in order to ensure corporate survival and sustainable growth amid the dramatic changes occurring in the environment affecting the Group’s business. Beginning from the current fiscal year, the Group has first proceeded with taking on the core elements of those measures, namely “Management structure reform,” “Digital transformation,” and “Full creation of synergy with Parco.” In order to achieve reform of the management structure, the Group will work on improving revenue by accelerating the transformation of business models and streamlining business operations by restructuring the Group’s business to quickly build a future growth platform, while taking a serious look at the future survivability and growth potential of each of the Group’s businesses and stores. As part of these efforts, PARCO Co., Ltd. has decided to close Tsudanuma PARCO and Shin-Tokorozawa PARCO in order to redistribute its limited management resources to growth fields, which it believes will contribute to the realization of sustainable growth. -

Integration of the Lalaport Financial Center and the Tsudanuma Consulting Spot

May 2011 Dear customers with accounts opened at the LaLaport Financial Center or the Tsudanuma Consulting Spot, Integration of the LaLaport Financial Center and the Tsudanuma Consulting Spot We would like to inform customers that the LaLaport Financial Center and the Tsudanuma Consult- ing Spot will be integrated. As a result, the LaLaport Financial Center will close as of Sunday, July 31, 2011, and the existing Tsudanuma Consulting Spot will be renamed the Tsudanuma Financial Center effective Monday, August 1, 2011. We thank you for your long patronage of these branches. Any of the Shinsei Financial Centers including the Tsudanuma Financial Center, which is the current Tsudanuma Consulting Spot, will welcome your future business. No changes will occur to the cash card, branch code, and account number customers use. However, the branch name will become “Tsudanuma” effective Monday, August 1, 2011 instead of “LaLaport”. Please note that the branch name of “Tsudanuma” is specified for salary transfers and fund trans- fers from Monday, August 1, 2011. For more detailed information and specific requests that need to be carried out for the branch name change, please read the reverse of this letter. We apologize for any inconvenience it may cause you. Your understanding is appreciated, and we look forward to continuing to serve you. Yours faithfully, A List of Branches in the Vicinity of LaLaport Financial Center Tsudanuma Financial Center To Funabashi To Yotsukaido Toyoko Inn LAWSON The existing Tsudanuma Consulting Spot will be To Ichikawa renamed the Tsudanuma Financial Center effective FamilyMart To Matsudo August 1, 2011. PARCO B Tsudanuma Address: 2-21-1, Maebara-nishi, Funabashi-shi, Chiba, Tsudanuma Sta.