Non-Transportation [PDF/281KB]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2012 Annual Report Pursuing Our Unlimited Potential Annual Report 2012

For the year ended March 31, 2012 Pursuing Our Unlimited Potential Annual Report 2012 Annual Report 2012 EAST JAPAN RAILWAY COMPANY JR East’s Strengths 1 AN OVERWHELMINGLY SOLID AND ADVANTAGEOUS RAILWAY NETWORK The railway business of the JR East Being based in the Tokyo metro- Group covers the eastern half of politan area is a major source of our Honshu island, which includes the strength. Routes originating in the Tokyo metropolitan area. We provide Kanto area (JR East Tokyo Branch transportation services via our Office, Yokohama Branch Office, Shinkansen network, which connects Hachioji Branch Office, Omiya Tokyo with regional cities in five Branch Office, Takasaki Branch directions, Kanto area network, and Office, Mito Branch Office, and intercity and regional networks. Our Chiba Branch Office) account for JR EAST’S SERVICE AREA networks combine to cover 7,512.6 68% of transportation revenue. kilometers and serve 17 million Japan’s total population may be people daily. We are the largest declining, but the population of the railway company in Japan and one of Tokyo metropolitan area (Tokyo, TOKYO the largest in the world. Kanagawa Prefecture, Saitama Prefecture, and Chiba On a daily basis, about 17million passengers travel a network of 70 train lines stretching 7,512.6 operating kilometers An Overwhelmingly Solid and Advantageous Railway Network Annual Report 2012 SECTION 1 OVERALL GROWTH STRATEGY Prefecture) continues to rise, mean- OPERATING REVENUES OPERATING INCOME ing our railway networks are sup- For the year ended March 31, 2012 For the year ended March 31, 2012 ported by an extremely sturdy Others 7.9% Transportation Others 6.1% Transportation operating foundation. -

Third Quarter Results

Consolidated Financial Results for the First Nine Months from April 1 to December 31, 2016 2017・1・31 Index 02 Highlights of the Third Quarter, FY2017 09 Unit Information Copyright 2017 Nomura Real Estate Holdings, Inc. 1 Highlights of the Third Quarter, FY2017 Copyright 2017 Nomura Real Estate Holdings, Inc. 2 Summary of Financial Results • The cumulative result of FY2017 3Q was as follows: Operating revenue;¥368.9 billion (down 3.1% y/y); operating income; ¥49.1 billion (down 7.4% y/y); ordinary income;¥42.9 billion (down 8.8% y/y); and profit attributable to owners of parent;¥29.1 billion (increase 2.7% y/y). • In the Residential Development Unit, the number of housing units sold decreased to 3,074 (down 711 units y/y) while gross margin ratio and housing prices increased. The contract progress rate for the planned 5,650 units of this consolidated fiscal year was 90.1% as of the end of the current third quarter. • In the leasing business, tenant leasing made a satisfactory progress, and the vacancy rate as of the end of the third quarter improved to 1.0% (down 1.2 points from the end of the previous fiscal year). • Service Management Sector which consists of 3 Units, the Investment Management Unit, the Property Brokerage & CRE Unit, and the Property & Facility Management Unit marked a smooth progress. Especially in the Property Brokerage & CRE Unit, both the number of transactions and transaction value marked the highest figure ever as the third quarter. • No change in the consolidated operating result forecast and dividend forecast which was announced in October, 2016. -

Annual Report 2013 1

Otemachi Building, 6-1, Otemachi 1-chome, Chiyoda-ku, Tokyo 100-8133, Japan http://www.mec.co.jp/index_e.html ANNUAL REPORT2013 Approx. 296m Approx. 240m Approx. Approx. 205m 180m Approx. 36m Approx. 20m Yokohama Landmark Tower Sunshine 60 McGraw-Hill Building Marunouchi Building Paternoster Square Mitsubishi Ichigokan ANNUAL REPORT This report is printed using paper that con- This report has been prepared using tains raw materials certified by the Forest 100% vegetable ink. Every effort is Stewardship Council (FSC)®. FSC ® certifi cation made to contain the incidence of vol- Fiscal Year ended ensures that materials have been harvested atile organic compounds (VOCs) and from properly managed forests. to preserve petroleum resources. Printed in Japan March 31, 2013 2013 113mec_ar表紙英文0815_初戻P.indd3mec_ar表紙英文0815_初戻P.indd 11-2-2 113/09/063/09/06 116:376:37 MITSUBISHI ESTATE CO., LTD. ANNUAL REPORT 2013 1 A Love for People A Love for the City Forever Taking on New Challenges–The Mitsubishi Estate Group Our wish is to provide people who live in, work in and visit the city with enriching and fulfi lling lives, full of stimulating opportunities to meet. The Mitsubishi Estate Group has always pursued the genuine value sought by people in the environments and services it provides. With an eye to the future, we carefully listen to each and every customer, and create the true value they seek. We wish to share with our customers the inspiration and passion we derive from our work. We will constantly take on new challenges to achieve this vision, and through it, we will continuously evolve. -

Notice of Conclusion of Fixed-Term Building Lease Renewal Agreement on AEON MALL Tsudanuma

September 30, 2019 To all concerned parties: Investment Corporation MCUBS MidCity Investment Corporation Representative: Katsuhiro Tsuchiya, Executive Director TSE Code: 3227, LEI Code: 353800WZPKHG2SQS1P32 URL: https://www.midcity-reit.com/en/ Asset Management Company Mitsubishi Corp.‐ UBS Realty Inc. Representative: Katsuji Okamoto, President & CEO Inquiries: Katsura Matsuo, Head of Office Division TEL: +81-3-5293-4150 Notice of Conclusion of Fixed-Term Building Lease Renewal Agreement on AEON MALL Tsudanuma MCUBS MidCity Investment Corporation (hereafter "MCUBS MidCity") has entered into a fixed-term building lease renewal agreement with AEON RETAIL Co., Ltd., one of the major tenant of MCUBS MidCity, as follows. 1. Background of conclusion of the Renewal Agreement (1) Environment surrounding the AEON MALL Tsudanuma "AEON MALL Tsudanuma" (Narashino City, Chiba) (hereafter "the Property") owned by MCUBS MidCity is a retail property that is directly connected to “Shin-Tsudanuma” station on the Shin-Keisei Line. The population of Narashino City and the neighboring Funabashi City has been consistently increasing since 2011. At the same time, the population of those with purchasing power is high in terms of income and age, and hence the potential for retail property is high. Also, in March 2016, Narashino City formulated the "Policy for Considering Community Development around JR Tsudanuma Station" and designated the area connecting JR “Tsudanuma” station and Shin-Keisei Line "Shin-Tsudanuma" station as the entrance to the city front, which promotes redevelopment by the private sector. As a result, redevelopment around the station is expected in the future. (2) Background to conclusion of the Renewal Agreement AEON RETAIL Co., Ltd. -

Haneda Airport Route(*PDF File)

1 of 3 Bus stop valid for Limousine & Subway pass(Haneda Airport route) Area Bus Stop Useable Area Bus Stop Useable Century Southern Tower ○ The Capitol Hotel Tokyu ○ Hotel Sunroute Plaza Shinjuku ○ Grand Hyatt Tokyo ○ Hilton Tokyo ○ ANA InterContinental Tokyo ○ Shinjuku Washington Hotel The Okura Tokyo ○ Akasaka Roppongi, ○ Park Hyatt Tokyo ○ Toranomon Hills ○ Hyatt Regency Tokyo Andaz Tokyo ○ Toranomon ○ Shinjuku Keio Plaza Hotel ○ HOTEL THE CELESTINE TOKYO SHIBA ○ Shinjuku Station/West ○ Shiba Park Hotel ○ Shinjuku Expressway Bus Terminal ○ Tokyo Prince Hotel ○ 【Early Morning Service】Shinjuku Expressway Bus Terminal × The Prince Park Tower Tokyo ○ 【Early Morning Service】Higashi Shinjuku Station × The Westin Tokyo ○ T-CAT Tokyo City Air Terminal ○ Sheraton Miyako Hotel Tokyo ○ Ikebukuro Sunshine Bus Terminal ○ Tokyo Marriott Hotel ○ Sunshine City Prince Hotel Shinagawa Prince Hotel ○ Shinagawa Ebisu, Shiba, ○ Hotel Metropolitan ○ The Prince Sakura Tower Tokyo ○ Ikebukuro Ikebukuro Station/West ○ Grand Prince Hotel Takanawa ○ 【Early Morning Service】Ikebukuro Station/East × Grand Prince Hotel New Takanawa ○ Hotel Chinzanso Tokyo ○ Shibuya Excel Hotel Tokyu × Tokyo Dome Hotel ○ Shibuya Station/West × Akihabara Station Shibuya Station(SHIBUYA FUKURAS) ○ Shibuya × Akihabara 【Early Morning Service】Akihabara Station Cerulean Tower Tokyu Hotel Mejiro, Mejiro, Kourakuen, × × HOSHINOYA Tokyo/Otemachi Financial City Grand Cube ○ ARIAKE GARDEN × Marunouchi Tokyo Station/Marunouchi North SOTETSU GRAND FRESA TOKYO-BAY ARIAKE , ○ × Otemachi Tokyo -

Deployments in JR East Under-Viaduct Spaces and Ekinaka Commercial Spaces JR East Lifestyle Business Development Headquarters

Making Best Use of Spaces in Railway Facilities Deployments in JR East Under-Viaduct Spaces and Ekinaka Commercial Spaces JR East Lifestyle Business Development Headquarters Introduction and promotes urban development by means such as formulating strategies for each line and renewing buildings ‘Thriving with Communities, Growing Globally’ is the near stations in accordance with the strategy. This promotes catchphrase for the JR East Group Management Vision development that makes use of site features. V — Ever Onward released in October 2012. In ‘Thriving Third, JR East is coordinating with local governments with Communities’, JR East ‘draws a blueprint for the future and others to promote urban development centring on together with members of the community as it does its part stations in provincial core cities facing population decline. to build vibrant communities’. The company is making coordinated efforts with local In lifestyle services, JR East is promoting ‘attractive governments to revitalize communities and enhance public urban development centred on stations’. This is done by functions and community functions by renovating station dealing with changes in the business environment, such facilities and updating buildings near stations. It is also as ageing of society and globalization, and demands from aiming for stations to become the ‘face’ of the city and entire customers and the community while consolidating attractive surrounding area with high-level convenience for both locals services and functions at stations. Stations are the ‘face’ and visitors by enhancing gateway functions, etc. of the town and by going forward with three types of urban development in line with these features, JR East is aiming for Efforts to Increase Trackside Value by stations that can be venues where people can interact. -

Exploring Japanese Culture In

JR Yamanote Line Suginami Ward Ikebukuro Kami Shimo Igusa Iogi Igusa Route Seibu-Shinjuku Line Chart JR Chuo Sobu Line 80min Narita Express Nishi Shinjuku Mitaka Kichijoji Ogikubo Ogikubo Asagaya Koenji Nakano NARITA Kugayama Minami Shin Higashi AIRPORT Asagaya Koenji Koenji Tokyo Metro Attention: JR Line Fujimigaoka Marunouchi Line 35min Keio Inokashira Keio Line Shibuya Limousine bus Chuo line express Line It does not stop at Koenji, Asagaya, or Nishi-Ogikubo Takaido Hamada Stations on weekends & holidays. -yama Nishi HANEDA Eifuku Eifuku Chuo Sobu line local Cho Meidai AIRPORT It stops at all stations unless terminating at Nakano. -mae Due to COVID-19, opening hours of stores may dier. We recommend checking their latest information before visiting. Suginami The information in this booklet is accurate as of March Map 2021. Ogikubo P28 Physical Space Academy Ogikubo Tokyo Metro Marunouchi Line 2 3 Kosugi-Yu Open hours: 15:30-1:45 * On Saturday and Sunday, 8:00-1:45 Closed on Thursday Address: 3-32-2, Koenji-Kita, Suginami Web: https://kosugiyu.co.jp/ Twitter: @kosugiyu Instagram: @kosugiyu_sento Facebook: @kosugiyu Tamano-Yu Open hours: 15:00-1:00 Closed on Monday and Tuesday Address: 1-13-7, Asagaya-Kita, * Standard Tokyo sento fee: ¥470 for an adult, ¥180 for up to12yrs, Sento - Public Bathhouse ¥80 for up to 6yrs The history of sento, public bathhouses, goes as far back It has been said that various other subjects were taboo, as the 6th century, originating as part of temple culture in such as monkeys (” saru” in Japanese, a homonym for the Japan. -

Haneda Airport Route(*PDF File)

1 of 3 Bus stop valid for Airport Limousine Bus Premium Coupon(Haneda Airport route) required required Area Bus Stop Useable Area Bus Stop Useable number number Century Southern Tower ○ 1 coupon The Capitol Hotel Tokyu ○ 1 coupon Hotel Sunroute Plaza Shinjuku ○ 1 coupon Grand Hyatt Tokyo ○ 1 coupon Hilton Tokyo ○ 1 coupon ANA InterContinental Tokyo ○ 1 coupon Shinjuku Washington Hotel 1 coupon The Okura Tokyo 1 coupon ○ Akasaka Roppongi, ○ Park Hyatt Tokyo ○ 1 coupon Toranomon Hills × × Hyatt Regency Tokyo 1 coupon Andaz Tokyo 1 coupon ○ Toranomon ○ Shinjuku Keio Plaza Hotel ○ 1 coupon HOTEL THE CELESTINE TOKYO SHIBA ○ 1 coupon Shinjuku Station/West ○ 1 coupon Shiba Park Hotel ○ 1 coupon Shinjuku Expressway Bus Terminal ○ 1 coupon Tokyo Prince Hotel ○ 1 coupon 【Early Morning Service】Shinjuku Expressway Bus Terminal ○ 2 coupons The Prince Park Tower Tokyo ○ 1 coupon 【Early Morning Service】Higashi Shinjuku Station ○ 2 coupons The Westin Tokyo ○ 1 coupon T-CAT Tokyo City Air Terminal ○ 1 coupon Sheraton Miyako Hotel Tokyo ○ 1 coupon Ikebukuro Sunshine Bus Terminal ○ 1 coupon Tokyo Marriott Hotel ○ 1 coupon Sunshine City Prince Hotel 1 coupon Shinagawa Prince Hotel 1 coupon ○ Shinagawa Ebisu, Shiba, ○ Hotel Metropolitan ○ 1 coupon The Prince Sakura Tower Tokyo ○ 1 coupon Ikebukuro Ikebukuro Station/West ○ 1 coupon Grand Prince Hotel Takanawa ○ 1 coupon 【Early Morning Service】Ikebukuro Station/East ○ 2 coupons Grand Prince Hotel New Takanawa ○ 1 coupon Hotel Chinzanso Tokyo ○ 1 coupon Shibuya Excel Hotel Tokyu × × Tokyo Dome Hotel ○ 1 coupon -

Suginami Guide Book

SUGINAMI GUIDE BOOK Quick City Overview 1 2 Suginami City in Numbers Intention to Settle Find it Easy to Live Here Population 574,280 No. of Households 325,518 87.6% 96.1% * According to 2019 Suginami Population Pyramid 100+ City residential opinion survey 95~99 Male 90~94 Female 85~89 Suginami City 80~84 75~79 70~74 65~69 60~64 No. of Trees 55~59 35,914 50~54 45~49 40~44 1st 35~39 Cherry Blossom 5,945 30~34 Area ㎢ 25~29 34.06 20~24 2nd 15~19 Japanese Zelkova 5,373 10~14 5~9 0~4 3rd Ginkgo 3,499 25000 20000 15000 10000 5000 0 0 5000 10000 15000 2000025000 (people) (people) * According to FY2017 Suginami City greenery fact- ¿QGLQJVXUYH\ 100+ 95~99 Male 90~94 Female Green Space Ratio 85~89 Japan 80~84 No. of Parks 75~79 % 70~74 327 21.77 65~69 *As of April 1, 2019 60~64 * According to FY2017 55~59 Suginami City greenery fact- 50~54 ¿QGLQJVXUYH\ 45~49 40~44 Park Area per Person 35~39 ㎡ 30~34 2.07 25~29 20~24 *As of April 1, 2019 15~19 10~14 5~9 0~4 The smallest 5000005 0004 0 000300340 20000200 10000100 010 00 10000 02000 002 300003 400004 5005000 (万人) As of(万人) October 2019 amount out of all Daily Amount of Garbage Generated per Resident 23 Special Wards for 8 years running! No. of Children Max. No. of Children Allowed to g/day Total Fertility Rate 466 (under age 15) enter the Certi ed Child Care Center *FY2018 No waiting list for childcare 60,323 1.03 12,080 since FY2018! * According to 2018 Tokyo *As of April 1, 2019 metropolitan demographic No. -

Time-Out-Tokyo-Magazine-Issue-22

• G-SHOCK GMW-B5000D Time out TOKYO AD (H297xW225) Discover regional Japan in Tokyo From the courtly refinement of Kyoto to the street smart vibes of Osaka and the tropical flavour of Okinawa, Japan is an amazingly diverse country, with 47 prefectures having their own unique customs, culture and cuisine. Oh Inside yes, the amazing regional cuisines, which keep travellers salivating on every step of a Japanese journey, from the seafood mecca of Hokkaido in the cold north to Fukuoka, the birthplace of the globally famed tonkatsu ramen in the April – June 2019 southern Kyushu prefecture. We know it all too well, the struggle is real: there are too many places to visit, things to do, food to eat – and too little time to do it all. But the good news is that you can easily experience the best of regional Japan right here in Tokyo. Think of our city as a Japan taster, which will inspire you to go visit a different part of the country. START YOUR EXPLORATION ON PAGE 24 â Swing this way The best jazz bars and venues in Tokyo PAGE 60 â KEISUKE TANIGAWA KEISUKE Tsukiji goes dark The former fish market reinvents itself as a nightlife destination PAGE 62 GMW-B5000D â KEISUKE TANIGAWA KEISUKE KISA TOYOSHIMA Playing footsie For heaven’s sake Evolution End a long day of sightseeing Where to savour the drink at these footbath cafés of Japan: sake PAGE 50 PAGE 40 â â back to the HOGUREST PIPA100/DREAMSTIME Origin â FEATURES AND REGULARS 06 Tokyo Update 12 Courtesy Calls 14 Open Tokyo 18 To Do 24 Discover regional Japan in Tokyo 44 Eating & Drinking 48 Shopping & Style 50 Things to Do 54 Art & Culture 58 Music 62 Nightlife 64 LGBT 65 Film 66 Travel & Hotels 70 Getting Around 74 You know you’re in Tokyo when… SMARTPHONE LINK MULTI BAND 6 TOUGH SOLAR * Bluetooth® is a registered trademark or trademark of Bluetooth SIG, Inc. -

Savour the Local Flavour T O K

TOKYO SUGINAMI SAVOUR THE LOCAL FLAVOUR 杉 並 の ヒト・モ ノ・コト に 会 い に 行 く KOENJI ASAGAYA !! RS E E H C OGIKUBO NISHI- OGIKUBO DELICIOUS ENCOUNTER RAMEN!! A WORLD OF JAPANESE ANTIQUES Not only does Suginami have the larger Tokyo Koenji Awaodori (traditional dancing WELCOME TO PLENTY OF FESTIVALS festival) and Asagaya Tanabata festival (star festival), but also morning markets and bar AND EVENTS hopping events. You can always find some kind of festival or event on every week SUGINAMI WARD 3 お ま つ り・イ ベ ン ト が 盛 り だ くさ ん somewhere in Suginami. 東京高円寺阿波おどりに阿佐谷七夕まつりなど季節のお 祭りだけでなく、朝市や飲み屋巡りなど、毎週どこかでイ 東 京 2 3 区 の 西 端 、杉 並 区 へ よ う こ そ 。 ベントが 開かれています。 Koenji, Asagaya, Ogikubo and Nishi-Ogikubo...which town do you have in 高円寺、阿佐ヶ谷、荻窪、西荻窪、あなたのお目当ては mind? どの 街 でしょうか。 Suginami is situated close to the center of Tokyo, and yet it has lots of green 都心にアクセスしやすく緑の多い杉並区は、住宅地とし て人気が高い「暮らしの街」。だからこそ、有名観光地とは spaces and peaceful locations. It’s a very popular suburb, with many people 一味違う、日本の日常生活を感じられるような観光が楽し wanting to live there. You can find many different things to see and do here, めます。 from touristy pursuits to more down-to-earth activities enjoyed by visitors 今回ご紹介するスポットは必ずしも英語メニューがあった and locals alike. The reason for the inclusion of the places in this guide, り、外国語に堪能なスタッフがいるわけではありません。で is not necessarily because they speak and/or provide services in foreign も、訪日観光客をあたたかく迎える気持ちを持ったお店ば languages, but due to their effort in welcoming tourists from overseas. Even かりです。このガイドブックを開いて、会ってみたい人や食 though there might be a language barrier, they try their best to provide a べてみたい物、体 験したいことが見つかったら、どうぞ気 service to visitors. -

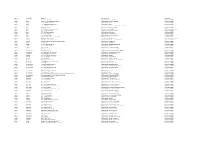

Area Locality Address Description Operator Aichi Aisai 10-1

Area Locality Address Description Operator Aichi Aisai 10-1,Kitaishikicho McDonald's Saya Ustore MobilepointBB Aichi Aisai 2283-60,Syobatachobensaiten McDonald's Syobata PIAGO MobilepointBB Aichi Ama 2-158,Nishiki,Kaniecho McDonald's Kanie MobilepointBB Aichi Ama 26-1,Nagamaki,Oharucho McDonald's Oharu MobilepointBB Aichi Anjo 1-18-2 Mikawaanjocho Tokaido Shinkansen Mikawa-Anjo Station NTT Communications Aichi Anjo 16-5 Fukamachi McDonald's FukamaPIAGO MobilepointBB Aichi Anjo 2-1-6 Mikawaanjohommachi Mikawa Anjo City Hotel NTT Communications Aichi Anjo 3-1-8 Sumiyoshicho McDonald's Anjiyoitoyokado MobilepointBB Aichi Anjo 3-5-22 Sumiyoshicho McDonald's Anjoandei MobilepointBB Aichi Anjo 36-2 Sakuraicho McDonald's Anjosakurai MobilepointBB Aichi Anjo 6-8 Hamatomicho McDonald's Anjokoronaworld MobilepointBB Aichi Anjo Yokoyamachiyohama Tekami62 McDonald's Anjo MobilepointBB Aichi Chiryu 128 Naka Nakamachi Chiryu Saintpia Hotel NTT Communications Aichi Chiryu 18-1,Nagashinochooyama McDonald's Chiryu Gyararie APITA MobilepointBB Aichi Chiryu Kamishigehara Higashi Hatsuchiyo 33-1 McDonald's 155Chiryu MobilepointBB Aichi Chita 1-1 Ichoden McDonald's Higashiura MobilepointBB Aichi Chita 1-1711 Shimizugaoka McDonald's Chitashimizugaoka MobilepointBB Aichi Chita 1-3 Aguiazaekimae McDonald's Agui MobilepointBB Aichi Chita 24-1 Tasaki McDonald's Taketoyo PIAGO MobilepointBB Aichi Chita 67?8,Ogawa,Higashiuracho McDonald's Higashiura JUSCO MobilepointBB Aichi Gamagoori 1-3,Kashimacho McDonald's Gamagoori CAINZ HOME MobilepointBB Aichi Gamagori 1-1,Yuihama,Takenoyacho