Industrial Training Report Semester 1 2016/2017 to 31 Disember 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Estudios De Mercado El Mercado De Los Automóvi- Les En Malasia

Oficina Económica y Comercial de la Embajada de España en Malasia El mercado de los Automóvi- les en Malasia 1 Estudios de Mercado El mercado de los Automóvi- les en Malasia Este estudio ha sido realizado por Joaquín Monreal bajo la supervisión de la Oficina Económica y Co- 2 Estudios de Mercado mercial de la Embajada de España en Kuala Lumpur Agosto de 2006 EL MERCADO DE LOS AUTOMOVILES EN MALASIA ÍNDICE RESUMEN Y PRINCIPALES CONCLUSIONES 4 I. INTRODUCCIÓN 5 1. Definición y características del sector y subsectores relacionados 5 2. Situación del sector en españa 8 II. ANÁLISIS DE LA OFERTA 10 1. Análisis cuantitativo 10 1.1. Tamaño de la oferta 10 2. Análisis cualitativo 12 2.1. Producción 12 2.2. Precios 14 2.3. Importaciones 16 2.4. Obstáculos comerciales: La NAP 29 2.5. El sistema de permisos para la matriculación 30 III. ANÁLISIS DEL COMERCIO 31 1. Canales de distribución 31 IV. ANÁLISIS DE LA DEMANDA 33 1. Evaluación del volumen de la demanda 33 1.1. Coyuntura económica. 33 1.2. Infraestucturas 34 1.3. Tendencias del consumo y situación del mercado nacional 34 1.4. Tendencias industriales 39 2. Estructura del mercado 39 3. Percepción del producto español 39 V. ANEXOS 41 1. Ensambladores de automóviles 41 2. Distribuidores y concesionarios 46 3. Informes de ferias 56 Oficina Económica y Comercial de la Embajada de España en Kuala Lumpur 3 EL MERCADO DE LOS AUTOMOVILES EN MALASIA RESUMEN Y PRINCIPALES CONCLUSIONES La industria de la automoción en Malasia es junto con la electrónica la industria más impor- tante en el sector manufacturero de Malasia, y de los más importantes dentro del Sudeste Asiático. -

Driving Growth Towards the Future

Head Office Jidosha Kaikan, Shiba Daimon 1-chome, Minato-ku Tokyo 105-0012 Japan Tel: +81-3-5405-6126 Fax: +81-3-5405-6136 DRIVING GROWTH http://www.jama.or.jp/ Singapore Branch North American Office 143 Cecil Street, 1050 17th Street, N.W., Suite 410 #09-03/04 GB Bldg. Washington, DC 20036-5518, USA TOWARDS THE FUTURE Singapore 069542 Tel: +1-202-296-8537 Tel: +65-6221-5057 Fax: +1-202-872-1212 Fax: +65-6221-5072 http://www.jama.org/ 2015 Beijing Representative European Office Office Avenue Louise 287 Unit 1001B, Level 10, 1050 Bruxelles, BELGIUM China World Office 2 Tel: +32-2-639-1430 No. 1 Fax: +32-2-647-5754 Jian Guo Men Wai Avenue Beijing, China 100004 Tel: +86-10-6505-0030 Fax: +86-10-6505-5856 KAWASAKI HEAVY INDUSTRIES, LTD. SUZUKI MOTOR CORPORATION DAIHATSU MOTOR CO., LTD. Kobe Head Office: Head Office: Head Office: Kobe Crystal Tower, 1-3, Higashi 300, Takatsuka-cho, Minami-ku, 1-1, Daihatsu-cho, Ikeda, Osaka 563-8651 Kawasaki-cho 1-chome Chuo-ku, Hamamatsu, Shizuoka 432-8611 Tel: +81(72)751-8811 Kobe, Hyogo 650-8680 Tel: +81(53)440-2061 Tokyo Office: Tel: +81(78)371-9530 Tokyo Branch: Shinwa Bldg, 2-10, Nihonbashi Hon-cho, Tokyo Head Office: Suzuki Bldg, Higashi-shimbashi 2F, 2-Chome, Chuo-ku, 2-2-8 Higashi-shinbashi, Tokyo 103-0023 1-14-5, Kaigan, Minato-ku, Tokyo 105-8315, Japan Minato-ku, Tokyo 105-0021 Tel: +81(3)4231-8856 Tel: +81(3)5425-2158 http://www.daihatsu.com/ Tel: +81(3)3435-2111 http://www.khi.co.jp/ http://www.globalsuzuki.com/ FUJI HEAVY INDUSTRIES LTD. -

The Product Effect: Do Designed Products Convey Their Characteristics to Their Owners?

The Product Effect: Do Designed Products Convey Their Characteristics To Their Owners? Raja Ahmad Azmeer Raja Ahmad Effendi Submitted in partial fulfillment of the requirements of the Degree of Doctor of Philosophy Faculty of Design Swinburne University of Technology 2011 ABSTRACT ABSTRACT Malaysia is unique within the Islamic world in developing a motor car industry that is geared towards both internal and export markets. After achieving initial success, its export performance has failed to match that of its international competitors. Factors that are suspected to contribute to this failure is in the technology and styling of its models. Moreover, with the implementation of AFTA (Asean Free Trade Area) in Malaysia, the car industry is expected to face the influx of inexpensive established brands from ASEAN countries which will gradually dominate the local market. The research was cross-cultural and tested for possible differences based on nationality and gender. It used qualitative and quantitative techniques consisting of a Car Positioning Task using Semantic Differential scales and a derivation of the Room Effect method in order to investigate the perception of cars and its effect upon the perception of its owner. The pilot and actual surveys using Room Effect method were carried out with international participants. The results indicated that it is reliable and can be used to reveal cultural and gender differences. The research also indicated that the Room Effect method is practical for application to the car industry. ii ACKNOWLEDGEMENTS ACKNOWLEDGEMENTS This thesis marks the conclusion of a three year PhD program in Design at the Faculty of Design, Swinburne University of Technology, Melbourne, Australia. -

New Proton Car out by Mid 2000 (NST 16/05/1999)

16/05/1999 New Proton car out by mid 2000 SHAH ALAM, Sat. - Perusahaan Otomobil Nasional Bhd or Proton will unveil a new passenger car in the middle of next year, chairman Tan Sri Mohd Saleh Sulong said. Work on the car is in progress, he said at the launch of the Proton Total Research and Development facility today. Without disclosing details of the new model, Mohd Saleh was confident it would be well accepted in view of the recovery in car sales. He said the new research and development facility would play a critical role in the production of the new model. "It is estimated that the R&D activity of a new model would require capital investment of about RM1 billion. This includes 35 per cent for the purchase of jigs and dies, and 28 per cent for procurement of materials for vendors." The national car manufacturer to date has produced seven models: Saga, Iswara, Wira, Satria, Putra, Tiara and Perdana. Each has two or three variants. Providing details of Proton's sales performance in the past year and to date, Mohd Saleh, who is group chairman of the DRB-Hicom group, said there had been encouraging improvement over the period. Through distributors Edaran Otomobil Nasional Bhd and Usahasama Proton- DRB Sdn Bhd, the company sold an average 5,000 units in the early months of last year. This increased to an average 9,000 units at the end of the year. "Monthly sales increased to 13,000 units in April. In line with this, Proton's market share has increased from 64 per cent to 71 per cent." Mohd Saleh said with more relaxed credit guidelines and improved performance and quality of Proton cars, he was optimistic that sales would increase to 15,000 units per month in the later part of the year. -

Chapter 1 Introduction

The development of a hybrid knowledge-based Collaborative Lean Manufacturing Management (CLMM) system for an automotive manufacturing environment: The development of a hybrid Knowledge-Based (KB)/ Analytic Hierarchy Process (AHP)/ Gauging Absences of Pre-Requisites (GAP) Approach to the design of a Collaborative Lean Manufacturing Management (CLMM) system for an automotive manufacturing environment. Item Type Thesis Authors Moud Nawawi, Mohd Kamal Rights <a rel="license" href="http://creativecommons.org/licenses/ by-nc-nd/3.0/"><img alt="Creative Commons License" style="border-width:0" src="http://i.creativecommons.org/l/by- nc-nd/3.0/88x31.png" /></a><br />The University of Bradford theses are licenced under a <a rel="license" href="http:// creativecommons.org/licenses/by-nc-nd/3.0/">Creative Commons Licence</a>. Download date 03/10/2021 11:56:12 Link to Item http://hdl.handle.net/10454/3353 CHAPTER 1 INTRODUCTION 1.0 Introduction Lean Manufacturing Management (LMM) is a management system that contains only required resources and materials, manufactures only required quantity of quality products on time that meet customers’ demands. The idea behind LMM is Manufacturing Planning and Control (MPC) system of the materials and information flow which involve both Manufacturing Resources Planning (MRP II), and Just-in-Time (JIT) techniques. In addition, Total Quality Management (TQM) is integrated to ensure the quality of the processes and products of the system. The capabilities of continuously improving the processes by identifying and eliminating manufacturing wastes are essential for effectiveness of LMM. The main benefit of effective LMM is high ratio of quality to cost of the products manufactured which finally contribute to high profitable organisation. -

Corporation Limited

Corporation Limited PRESS RELEASE JACKSPEED CORPORATION SECURES NEW CONTRACT TO SUPPLY AUTOMOTIVE LEATHER TRIM TO NAZA AUTOMOTIVE MANUFACTURING SDN BHD AND EXPANDS CAPACITY TO MEET ROBUST DEMAND - Invested in additional new equipment to enhance capacity in Kluang factory - Acquired a 19,035 sq m of land in Kedah, Malaysia to build additional production facility to cater to growing domestic market in Malaysia - Surge in OEM demand and capacity constraint reduced profit margins for FY04 Singapore, March 8, 2004 Jackspeed Corporation Limited ("Jackspeed"), an SGX-Mainboard-listed manufacturer of custom-fitted automotive leather trim for car seats and leather wrapping for automotive interior products, has secured a new contract from Naza Automotive Manufacturing Sdn Bhd (“Naza Automotive”). Naza Automotive is a member of Malaysia’s Naza Group of Companies, which assembles, markets and distributes the Kia range of vehicles, Malaysia’s third national car project. Jackspeed is currently a Tier One supplier of Naza Automotive. Jackspeed will supply a total of 10,000 sets of leather trim for Naza Automotive’s special edition vehicle – the National MPV for the Malaysian market. Delivery will be done over 3 years starting from this financial year. This is the second contract Jackspeed has secured from Naza Automotive in less than a year. Jackspeed has an existing contract to supply 30,000 sets of leather trim over 3 years from July 2003. To meet increased market demand, Jackspeed has expanded its production capacity in Malaysia. It has taken delivery of 69 new sewing machines for a total of about RM$600,000 (estimated S$290,000) for its Kluang factory in January 2004 and will recruit and train new employees to run these machines. -

Journal of Advanced Vehicle System 3, Issue 1 (2016) 1-13

Journal of Advanced Vehicle System 3, Issue 1 (2016) 1-13 Penerbit Journal of Advanced Vehicle System Akademia Baru Journal homepage: www.akademiabaru.com/aravs.html ISSN: 2550-2212 Open Towards safer cars in Malaysia Access Z. Mohd Jawi 1, ∗, K.A. Abu Kassim 2, M.H. Md Isa 1,2, A. Hamzah 1, Y. Ghani 1 1 Vehicle Safety & Biomechanics Research Centre, Malaysian Institute of Road Safety Research, 43000 Kajang Selangor, Malaysia 2 ASEAN NCAP Operational Unit, Malaysian Institute of Road Safety Research, 43000 Kajang Selangor, Malaysia ARTICLE INFO ABSTRACT Article history: This article discusses the framework of safer cars in Malaysia based on the Vehicle Type Received 10 October 2016 Approval (VTA) and New Car Assessment Program (NCAP). The new era of automobile Received in revised form 16 November 2016 safety is presumably come at the right time for Malaysia after the two important Accepted 25 November 2016 milestones i.e. local assembly initiative in 1960’s and the national car project in 1980’s. Available online 5 December 2016 The maturity of VTA exercise in Malaysia and the inception of ASEAN NCAP are contributing to direct and indirect pressure to car manufacturers to progressively produce safer cars. Since car pricing is driven by market competitiveness and not affected by safety upgrades, the consumers eventually would enjoy more values for their money through safer cars. In terms of car safety, the automotive ecosystem in Malaysia could as well explain the impact of NCAP in other ASEAN countries’ automotive layout. It is expected that there will be growing demand for safer vehicles and also positive response from OEMs in Malaysia and the region. -

Corporation Limited

Corporation Limited PRESS RELEASE Jackspeed Corporation Limited Wins RM55 million Contract from Naza Automotive Manufacturing Sdn Bhd • Jackspeed's Malaysian subsidiary will supply leather trims for Naza’s New MPV project for three years Singapore, September 13, 2004 – SGX Mainboard-listed Jackspeed Corporation Limited (“Jackspeed””), a manufacturer of custom-fitted automotive leather trim for car seats and leather wrapping for automotive interior products, has secured a RM 55 million contract from Naza Automotive Manufacturing Sdn Bhd (“Naza Automotive”). This is its third and also single largest contract that Naza Automotive has awarded to Jackspeed. The contract is for the company’s Malaysian subsidiary to supply leather trims for Naza’s new MPV project for three years, starting on November 2004. Naza Automotive assembles, markets and distributes the Naza range of vehicles for its third national car project. Jackspeed is currently a Tier One supplier of Naza Automotive. Commenting on the new contract win, Mr Jackson Liew, Jackspeed’s Group Chairman and CEO said, "This latest contract with Naza Automotive is a strong testament to their trust and confidence in our high standards of quality and delivery. We see tremendous potential in the automotive industry in Malaysia. With the implementation of AFTA and reduction of tariffs, the region’s automotive industry is expected to enjoy robust growth. This will also drive further growth in the automotive manufacturing sector in Malaysia. Jackspeed, which already has an established presence in Malaysia, is well-poised to take advantage of new opportunities in the auto sector and ride on its vibrant growth. Mr Liew said that this major contract win will further reinforce its relationship with Naza Automotive and strengthen its stronghold in the Malaysian automotive industry. -

Annualreport2004 Annual Report 2004

Edaran Otomobil Nasional Berhad (119767-X) Edaran Otomobil Nasional Berhad (119767-X) AnnualReport2004 Annual Edaran Otomobil Nasional Berhad (119767-X) Report EON Head Office Complex No. 2, Persiaran Kerjaya Taman Perindustrian Glenmarie Seksyen U1 2004 40150 Shah Alam Selangor Darul Ehsan Tel: 03-7711 2211 Fax : 03-7803 0009 COVER RATIONALE The cover illustrates a metaphor exemplified by the abundant opportunities waiting to be realised and the new energy symbolised by the spirited gold fish, an icon of wealth and vigour. The electrifying surge into the next level portrays EON’s determination, dedication and aspiration to re-define and strategically position itself in the local automotive industry. In excelling to a new level, EON is poised to realise all possibilities and exceed expectations. “A Paradigm Shift” is our beginning in achieving a new and dynamic business culture as well as a wider range of exciting marques. It is a reflection of our commitment to always be at the forefront of our business. At A Glance EDARAN OTOMOBIL NASIONAL BERHAD (EON) IS ONE OF MALAYSIA’S LEADING COMPANIES IN MOTOR VEHICLES DISTRIBUTION AND RETAILING. FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2004, THE GROUP RECORDED A REVENUE OF RM3.9 BILLION WITH A PRE-TAX PROFIT OF RM300.5 MILLION. FINANCIAL CALENDAR FOR FINANCIAL YEAR ended 31 December 2004 QUARTERLY ANNOUNCEMENT OF RESULTS 20 MAY 2004 29 NOV 2004 1st Quarter for the 3rd Quarter for the three months ended nine months ended 31 March 2004 30 September 2004 27 AUG 2004 24 FEB 2005 2nd Quarter for the 4th Quarter for six months ended the year ended 30 June 2004 31 December 2004 DIVIDENDS 14 JUNE 2004 31 MAY 2005 Payment of final dividend of 22 sen Book closure for determining the per share less income tax at 28% in entitlement for the proposed final respect of the year ended dividend of 18 sen per share less 31 December 2003. -

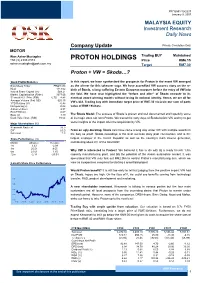

PROTON HOLDINGS Price RM6.15 [email protected] Target RM7.30

PP/10551/10/2007 January 9, 2007 MALAYSIA EQUITY Investment Research Daily News Private Circulation Only Company Update MOTOR Wan Azhar Mustapha Trading BUY Maintained +60 (3) 2333 8373 PROTON HOLDINGS Price RM6.15 [email protected] Target RM7.30 Proton + VW = Skoda…? Stock Profile/Statistics In this report, we have synthesized the prospects for Proton in the event VW emerged Bloomberg Ticker PROH MK as the winner for this takeover saga. We have accredited VW success story on the re- KLCI 1113.02 birth of Škoda, a long suffering Eastern European marques before the entry of VW into Issued Share Capital (m) 549.21 Market Capitalisation (RMm) 3377.66 the fold. We have also highlighted the “before and after” of Škoda en-route to its 52 week H | L Price (RM) 6.75 4.48 eventual award winning models without losing its national identity. Hence, we are all for Average Volume (3m) ‘000 625.15 VW’s bid. Trading buy with immediate target price of RM7.30 vis-à-vis our sum of parts YTD Returns (%) -0.45 Net gearing (x) -0.02 value of RM9.19/share. Altman Z-Score 2.97 ROCE/WACC -0.07 Beta (x) 1.49 The Škoda Model. The success of Škoda is proven and well documented and hopefully some Book Value/share (RM) 10.64 of its magic does rub onto Proton. We traced the early days of Škoda before VW and try to get some insights of the impact after the acquisition by VW. Major Shareholders (%) Khazanah Nasional 38.3 EPF 10.5 From an ugly duckling. -

The Mediating Effects of Organisational Culture on Job Performance of Automotive Salespersons in a Large Automotive Sales Company in Malaysia

International Journal of Recent Technology and Engineering (IJRTE) ISSN: 2277-3878, Volume-9 Issue-1, May 2020 The Mediating Effects of Organisational Culture on Job Performance of Automotive salespersons in a Large Automotive Sales Company in Malaysia Muhammad Iqbal Shaharom, K. Kuperan Viswanathan, Nor Azman Ali Abstract: The purpose of this paper was to examine the This translates to a rather high employment of employees mediating effects that organisational culture would have, on the within the country’s automotive industry, where statistics has work performance of those automotive sales persons, specifically shown that the total employment numbers stand at 550,000 in within a case study of a large automotive sales organisation within the year 2014 (Statistics Employment, 2014). With such a the country of Malaysia. The findings were then detailed from the high number of employees within the automotive sector, it is perceptions of the studies automotive salespersons, along with the correlating implications that could affect the automotive retaining vital that their job performances are sustained in order to also industry in Malaysia. It was known that the work and job sustain the growth of the overall automotive manufacturing performance of automotive salespersons were greatly influenced sector in the country. Having a high number of employed by the kind of organisational culture that they were residing staff but with low productivity will negatively affect the within. The organisational culture theories were used to overall performance and growth of the automotive industry. investigate the social cognitive theory, via literature reviews This will then involve the role of organisation culture in conducted. -

UMW ACHIEVES PRETAX PROFIT of RM312 M in 2Q11 Investor Update RM Million 2Q11 1Q11 Qoq 2Q11 Profit Before Taxation 312.0 339.5 -8.1%

Quarterly UMW ACHIEVES PRETAX PROFIT OF RM312 M IN 2Q11 Investor Update RM million 2Q11 1Q11 QoQ 2Q11 Profit Before Taxation 312.0 339.5 -8.1% EXECUTIVE SUMMARY 2Q11 financial highlights • Group PBT decreased by 8.1% QoQ to RM312 million Dear fund managers and analysts, • 2Q results largely affected by disruptions in Toyota and Perodua vehicle production following the earthquake and tsunami in The recent earthquake and tsunami in Japan had a negative impact on Malaysia’s automotive industry. Japan Although UMW Toyota registered a slight drop in sales • Operating results of Oil & Gas Division improved compared with 1Q11, I am pleased to inform you that we • Consolidated cash and deposits stand at RM2.4billion have ramped up our production for the second half of the year and we expect to meet our sales targets. Perodua’s 2Q11 highlights sales was also affected by the Japan disaster and the • Automotive Division’s overall market share as at 30th June 2011 run-out of the old Myvi. The brand new Myvi was was 42.3% launched on 16th June and the response has been very • Perodua launched the new Myvi on 16 June 2011. good. As such the performance of both Toyota and nd • All three of our offshore rigs have been contracted out. Perodua is expected to the better in the 2 half. • NAGA 1 achieved 11 years with no Lost-Time-Incident (LTI) on Operating results of our Oil & Gas Division have 6 June 2011. improved. All our rigs are now generating income, and we expect our Oil & Gas Division to return to profitability Prospects for 2H11 again this year.