Ratings on CTBC Financial Holding Co. Ltd. and Subsidiaries Affirmed; Outlook Stable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CTBC Holding Public Resolution Plan 2013

CTBC Financial Holding Co., Ltd. 165(d) Resolution Plan Public Section December 31, 2013 US Resolution Plan – Public Section Table of Contents A. Introduction ......................................................................................................2 1. Overview of CTBC Holding ...................................................................3 2. Overview of CTBC Holding’s U.S. Presence ......................................4 B. The Names of Material Entities ....................................................................4 1. Definition ..................................................................................................4 2. Identification of Material Entity ..............................................................4 C. Description of Core Business Lines ............................................................5 1. Definition ..................................................................................................5 2. Identification of Core Business Lines ..................................................5 D. Summary of Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources ........................................................................7 1. Balance Sheet .........................................................................................7 2. Capital .......................................................................................................9 3. Major Funding Sources ..........................................................................9 -

TCS Bancs 33F.Indd

capital markets AT A GLANCE Company: CTBC Bank Headquarters: Taipei, Taiwan Business Challenge: To modernize custodian services with Bank international standards for CTBC institutional clients. Bank modernizes for Solution: TCS BaNCS Global Securities institutional clients and Investments Platform on the TCS BaNCS Global Securities Platform Kamal Khurana, Global Product Head, TCS BaNCS Global Securities Platform CTBC Bank identified several potential areas for improvement in: CTBC Bank combines strengths in institutional banking, international business, and capital l Customized reporting for The search for a solution lasted about two markets with a strong presence in Taiwan retail institutional clients years. The evaluation team considered fourteen banking for wealth management, loan and l vendors in terms of domain knowledge, payment services. Notifications and management of technology, and references, leading to the final The initial objective was to adopt global Corporate Actions To address the growing securities custody selection of the TCS BaNCS Global Securities standards and best practices with the needs of institutional customers, CTBC sought l Customer management and and Investments Platform. TCS was unmatched deployment of TCS BaNCS, which has to modernize its technology architecture. profiling in terms of analyst recognition across domains benefitted from continuous improvements Legacy systems had been built independently and presence among the top global custodians. driven by a global client base of top custodian l SWIFT integration and adoption for Taiwan and Hong Kong, leading to TCS also benefitted from strong word-of-mouth banks. The parameterized and modularized duplication and inefficiency, along with time- of international standards recommendations from peer institutions, and application enables the bank to apply the full consuming customizations for regulatory (e.g. -

Fact Sheet:State Street Defensive Emerging Markets Equity Fund

State Street Defensive Emerging Markets Equity Fund - Class K Equity 30 June 2021 Fund Objective Total Return The State Street Defensive Emerging Markets Equity Fund seeks to provide MSCI Emerging maximum total return, primarily through capital appreciation, by investing Cumulative Fund at NAV Market Index primarily in securities of foreign issuers. QTD 5.52% 5.05% Process YTD 12.79 7.45 In seeking to identify stocks offering the potential for capital growth, the Annualized Adviser employs a proprietary quantitative process. The process evaluates 1 Year 37.80 40.90 the relative attractiveness of eligible securities based on the correlation 3 Year 8.25 11.27 of certain historical economic and financial factors (such as measures of 5 Year 8.45 13.03 growth potential, valuation, quality and investor sentiment) and based on other historical quantitative metrics. 10 Year 0.96 4.28 The Adviser also uses a quantitative analysis to determine the expected volatility of a stock's market price. Volatility is a statistical measurement of up and down fluctuations in the value of a security over time. Gross Expense Ratio 1.52% Through these quantitative processes of security selection and portfolio Net Expense Ratio^ 1.00% diversification, the Adviser expects that the portfolio will be subject to a 30 Day SEC Yield 1.41% relatively low level of absolute risk (as defined by statistical measures of 30 Day SEC Yield (Unsubsidized) 1.34% volatility, such as standard deviation of returns) and should exhibit relatively Maximum Sales Charge - low volatility compared with the Index over the long term. There can be no assurance that the Fund will in fact achieve any targeted level of volatility or experience lower volatility than the Index, nor can there be any assurance Performance quoted represents past performance, which is no guarantee of that the Fund will produce returns in excess of the Index. -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

Chinatrust (Philippines) Commercial Bank Corporation

CTBC BANK (PHILIPPINES) CORPORATION Annual Report Year 2019 Our Purpose To achieve sustainable growth and to be a trustworthy brand that provides a uniquely personal and fulfilling customer experience through differentiated products and services within our global network. Our Strategy We will provide a stable source of revenue for the Bank by being the preferred financial products provider for our customers and by optimizing the earning potential of our resources. We will innovate products and services that will delight our customers and address their needs. We will promote a culture of entrepreneurship where our employees become partners in pursuing sustainable business growth. We will remain committed to uplifting the lives of the people in our communities by sharing our resources and encouraging employee volunteerism. CTBC Bank (Philippines) Corp. CTBC Bank (Philippines) Corp. was established in 1995, when the country opened up to the entry of foreign banks. Amid an intensely competitive arena, CTBC Bank (Philippines) Corp. distinguished itself with a niche-based strategy that demonstrated its efficiency, innovativeness, and customer focus. We drew strength from the global reputation and track record of CTBC, our Parent Bank in Taiwan, and complemented these with our own unique touch of local service and innovation. In the Philippines, our brand promise "We are Family" has gained new meaning while also holding true to the tradition set by our Parent Bank. CTBC Bank (Philippines) Corp. has achieved this balance by focusing effectively on our chosen markets and developing active partnerships with customers. The results may be seen in our Bank's solid financial performance, innovative products, and responsive services enabled by technology. -

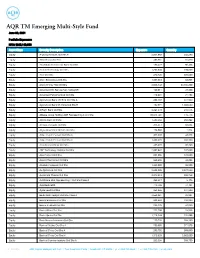

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

Value Taiwan ETF (Stock Code: 3060) ETF Distinction ● Value ● Experience

Value Taiwan ETF (stock code: 3060) ETF Distinction ● Value ● Experience HH 24 January 2017 Morningstar RatingTM1 As at 31-01-2017 • Value Taiwan ETF (the “Fund”) is an index-tracking fund listed on the Stock Exchange of Hong Kong Limited (“SEHK”) which aims to provide investment results that closely correspond to the performance of the FTSE Value-Stocks Taiwan Index (“Index”). • The Fund invests in emerging market and is subject to a greater risk of loss than investments in a developed market due to greater political, economic, taxation and regulatory uncertainty and risks linked to volatility and market liquidity. • The Index may experience periods of volatility and decline and the price of units of the Fund is likely to vary or decline accordingly. As the Fund is not actively managed, the Manager will not adopt a temporary defensive position against any market downturn. Investors may lose part or all of their investment. • There is no assurance that the Fund will pay dividends. The Manager may at its discretion pay dividends out of the capital of the Fund or pay dividend out of gross income while all or part of the fees and expenses of the Fund are charged to/paid out of the capital of the Fund. Dividends effectively paid out of capital amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Such distribution involving payment of dividends out of the capital may result in an immediate reduction of the Fund’s net asset value per unit. -

Emerging Issues in Money Market Funds

Emerging Issues in Money Market Funds Peter Crane Haiwen Hsu President Treasurer Crane Data CTBC Bank (formerly Chinatrust) Emerging Issues in Money Market Funds • Current State of MMFs & Recent Trends • MF Portfolio Strategies & Holdings • MM Supply, CP & CD Update • Emerging Markets Issuance – Solving the Supply Problem? • CTBC Case Study • MMFs in Europe, Asia & Emerging Mkts. • MMF Regulatory Outlook • In the News; Q&A 2 Current State of Money Market Funds • Regulatory Overhang: SEC Regs Due 2/14? • MMF Assets $2.7 Trillion (Record was $3.9T) – Bank Savings Almost $7.0 Trillion • Still 25 Million Shareholders • $4.3 Bil. in Annual Revenue? (down from $9B) • Approx. 1/4 Share of “Cash” Markets • Zero Yields, Attrition & Consolidation • Growth & Pressures Overseas 3 History of Money Fund Assets Money Funds Are Down Almost $1.0 Trillion Over 4 Yrs (-27%), But Still at mid-’07 Levels. 4 4 Banks (Still) Taking Trillions From MMFs Money Funds Are Down $1.0T (-29.6%) Over 4 Yrs.; MMDAs Are Up $2.4T (+53.2%) 5 Rock Bottom: Ultra-Low Rate Environment 6 Fund Expenses & Fee Waivers Money Fund Revenue Estimates: $2.5 Trillion x 0.16% = $4.0 Billion (7/13); $2.4 Trillion x 0.37% = $8.8 Bil. (7/07) 7 7 Money Fund Market Share (8/31/13) Types & Number of Money Funds Minor Consolidation & Shrinking Universe Prime MMFs Still King Prime Inst 31% Prime Retail 24% Tax-Exempt 10% Share classes vs. portfolios Categorization issues 9 Taxable MMF Portfolio Composition 10 MM Supply, Commercial Paper & CD Update CD (21.13%) is #1 in Money Fund Portfolio Composition CP outstanding peak: $2.18T (2007) CP outstanding low point: $1.063T (2012) YCD was dominated by Eurozone issuers (before crisis) YCD/Non-US Financial CP new heavy-weight issuers: Japanese, Canadian, Australia YCD/Non-US Financial CP new issuers: Singapore, and emerging markets (Chinese/Taiwanese & Chilean) MM Supply, Commercial Paper & CD Update CDs Largest Money Fund Portfolio Composition Repo Volatile – Shrinking – Reg Pressure Treasury & Agency Supply CP Steady Govt vs. -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Taiwan USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Accton Technology 0.45 TAIWAN Formosa Petrochemical 0.44 TAIWAN SinoPac Financial Holdings Co. Ltd. 0.45 TAIWAN Acer 0.29 TAIWAN Formosa Plastics Corp 1.56 TAIWAN Synnex Technology International 0.23 TAIWAN Advantech 0.49 TAIWAN Formosa Taffeta 0.13 TAIWAN Taishin Financial Holdings 0.53 TAIWAN Airtac International Group 0.42 TAIWAN Foxconn Technology 0.23 TAIWAN Taiwan Business Bank 0.19 TAIWAN ASE Technology Holding 0.87 TAIWAN Fubon Financial Holdings 1.21 TAIWAN Taiwan Cement 0.82 TAIWAN Asia Cement 0.38 TAIWAN Genius Electronic Optical 0.2 TAIWAN Taiwan Cooperative Financial Holding 0.75 TAIWAN ASMedia Technology 0.24 TAIWAN Giant Manufacturing 0.31 TAIWAN Taiwan Fertilizer 0.15 TAIWAN Asustek Computer Inc 0.7 TAIWAN GlobalWafers 0.36 TAIWAN Taiwan Glass Industrial 0.08 TAIWAN AU Optronics 0.42 TAIWAN HIWIN Technologies Corp. 0.29 TAIWAN Taiwan High Speed Rail 0.26 TAIWAN Capital Securities 0.09 TAIWAN Hon Hai Precision Industry 3.82 TAIWAN Taiwan Mobile 0.64 TAIWAN Catcher Technology 0.54 TAIWAN Hotai Motor 0.81 TAIWAN Taiwan Secom 0.1 TAIWAN Cathay Financial Holding 1.28 TAIWAN HTC Corporation 0.08 TAIWAN Taiwan Semiconductor Manufacturing 42.94 TAIWAN Chailease Holding 0.73 TAIWAN Hua Nan Financial Holdings 0.67 TAIWAN TECO Electric & Machinery 0.21 TAIWAN Chang Hwa Commercial Bank 0.45 TAIWAN Innolux 0.34 TAIWAN TPK Holding Co Ltd 0.07 TAIWAN Cheng Shin Rubber Industry 0.27 TAIWAN Inventec Co. -

Harbor Robeco Series July 31, 2020

Quarterly Schedules of Portfolio Holdings Harbor Robeco Series July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class CONSERVATIVE EQUITY Harbor Robeco Emerging Markets Conservative Equities Fund HRERX HRETX HREAX HRENX Harbor Robeco Global Conservative Equities Fund HRGTX HRGIX HRGDX HRGNX Harbor Robeco International Conservative Equities Fund HRIRX HRIEX HRIMX HRIVX Harbor Robeco US Conservative Equities Fund HRURX HRUNX HRUAX HRUVX CORE EQUITY Harbor Robeco Emerging Markets Active Equities Fund HRMEX HRMTX HRMNX HRMOX Table of Contents Portfolios of Investments HARBOR ROBECO EMERGING MARKETS CONSERVATIVE EQUITIES FUND . 1 HARBOR ROBECO GLOBAL CONSERVATIVE EQUITIES FUND. .................. 4 HARBOR ROBECO INTERNATIONAL CONSERVATIVE EQUITIES FUND . ........ 7 HARBOR ROBECO US CONSERVATIVE EQUITIES FUND. ...................... 10 HARBOR ROBECO EMERGING MARKETS ACTIVE EQUITIES FUND. ........ 12 Notes to Portfolios of Investments ..................................... 17 Harbor Robeco Emerging Markets Conservative Equities Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost and Principal Amounts in Thousands COMMON STOCKS—94.3% COMMON STOCKS—Continued Shares Value Shares Value AUTO COMPONENTS—1.2% DIVERSIFIED TELECOMMUNICATION SERVICES—Continued 5,275 Shandong Linglong Tyre Co. Ltd. (China) ................ $ 18 2,097 KT Corp. ADR (South Korea)1......................... $ 21 5,400 Weifu High Technology Group Ltd. (China) . 17 48,200 Telekomunikasi Indonesia Persero Tbk PT (Indonesia)..... 10 35 20,330 Turk Telekomunikasyon AS (Turkey) . ................. 21 118 AUTOMOBILES—2.2% 766 KIA Motors Corp. (South Korea) . ..................... 26 ELECTRIC UTILITIES—2.5% 10,785 Tofas Turk Otomobil Fabrikasi AS (Turkey) . 39 5,200 EDP - Energias do Brasil SA (Brazil) ................... 19 65 5,400 Equatorial Energia SA (Brazil) . ..................... 26 5,700 Transmissora Alianca de Energia Eletrica SA (Brazil)* ..... 32 BANKS—18.3% 77 73,000 Agricultural Bank of China Ltd. -

Ctbc Bank Co., Ltd. and Subsidiaries

1 Stock Code: 5841 CTBC BANK CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Review Report For the Three Months Ended March 31, 2021 and 2020 Address: No. 166, 168, 170, 186, 188, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ review report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ review report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Review Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) Company history 8~10 (2) Approval date and procedures of the consolidated financial statements 10 (3) New standards, amendments and interpretations adopted 10~14 (4) Summary of significant accounting policies 14~32 (5) Significant accounting assumptions and judgments, and major sources 32 of estimation uncertainty (6) Explanation of significant accounts 33~139 (7) Related-party transactions 140~152 (8) Pledged assets 152~153 (9) Commitments and contingencies 153~159 (10) Losses Due to Major Disasters 159 (11) Subsequent Events 159 (12) Other 159~169 (13) Other disclosures (a) Information on significant transactions 170~171 (b) Information on investment in mainland China 171~172 (14) Segment information 173 3 Independent Auditors’ Review Report To the Board of Directors of CTBC Bank Co., Ltd.: Introduction We have reviewed the consolidated financial statements of CTBC Bank Co., Ltd. -

CTBC Financial Holding Co., Ltd. Handbook for the 2021 Annual

Stock code: 2891 CTBC Financial Holding Co., Ltd. Handbook for the 2021 Annual General Meeting of Shareholders Meeting time: 9:00 am, June 11, 2021 Place: 12F., The Grand Ballroom, The Grand Hotel, No. 1, Zhongshan N. Rd., Sec. 4, Taipei, Taiwan, R.O.C. Notice to readers For the convenience of readers, “The Handbook for the 2021 Annual General Meeting of Shareholders” has been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language version shall prevail. Notice to readers For the convenience of readers, “The Handbook for the 2021 Annual General Meeting of Shareholders” has been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language shall prevail. Table of Contents I. Meeting Procedure II. Meeting Agenda A. Items to Report (Non-voting Items) 1. 2020 Business Report ............................................................................................................ 4 2. 2020 Audit Committee Report............................................................................................... 4 3. 2020 report on employee and director remuneration distribution ......................................... 4 4. Matters relating to the unsecured corporate bonds issued in 2020 .......................................