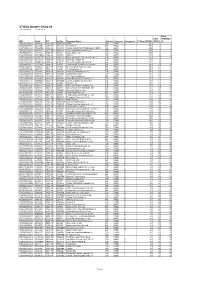

FACTSHEET - AS of 28-Sep-2021 Solactive GBS Taiwan Large & Mid Cap USD Index NTR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fact Sheet:State Street Defensive Emerging Markets Equity Fund

State Street Defensive Emerging Markets Equity Fund - Class K Equity 30 June 2021 Fund Objective Total Return The State Street Defensive Emerging Markets Equity Fund seeks to provide MSCI Emerging maximum total return, primarily through capital appreciation, by investing Cumulative Fund at NAV Market Index primarily in securities of foreign issuers. QTD 5.52% 5.05% Process YTD 12.79 7.45 In seeking to identify stocks offering the potential for capital growth, the Annualized Adviser employs a proprietary quantitative process. The process evaluates 1 Year 37.80 40.90 the relative attractiveness of eligible securities based on the correlation 3 Year 8.25 11.27 of certain historical economic and financial factors (such as measures of 5 Year 8.45 13.03 growth potential, valuation, quality and investor sentiment) and based on other historical quantitative metrics. 10 Year 0.96 4.28 The Adviser also uses a quantitative analysis to determine the expected volatility of a stock's market price. Volatility is a statistical measurement of up and down fluctuations in the value of a security over time. Gross Expense Ratio 1.52% Through these quantitative processes of security selection and portfolio Net Expense Ratio^ 1.00% diversification, the Adviser expects that the portfolio will be subject to a 30 Day SEC Yield 1.41% relatively low level of absolute risk (as defined by statistical measures of 30 Day SEC Yield (Unsubsidized) 1.34% volatility, such as standard deviation of returns) and should exhibit relatively Maximum Sales Charge - low volatility compared with the Index over the long term. There can be no assurance that the Fund will in fact achieve any targeted level of volatility or experience lower volatility than the Index, nor can there be any assurance Performance quoted represents past performance, which is no guarantee of that the Fund will produce returns in excess of the Index. -

USD XINT M EM HL Taiwan NTR USD Index

Created on 30 th April 2020 XINT M EM HL Taiwan NTR USD Index USD The XINT M EM HL Taiwan NTR USD Index covers the highly liquid and liquid segment of the Taiwanese equity market. The index membership comprises the 89 largest companies by freefloat adjusted market value and represents approximately 85% of the Taiwanese market. INDEX PERFORMANCE - PRICE RETURN USD 130 120 110 100 90 80 70 Dec 2017 Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 Jun 2019 Sep 2019 Dec 2019 Mar 2020 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -7.33 3M 36.87 From 14 Jan 2020 6M 1.07 6M 27.83 To 19 Mar 2020 1Y 11.14 1Y 22.27 Return -29.23% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Taiwan Semiconductor Man Co Ltd 37.57% 252,160 37.57% Technology Hon Hai Precision Industry Co Ltd 4.81% 32,296 4.81% Industrial Goods & Services MediaTek Inc 3.14% 21,069 3.14% Technology Chunghwa Telecom Co Ltd 2.08% 13,992 2.08% Telecommunications Largan Precision Co Ltd 2.07% 13,900 2.07% Personal & Household Goods Formosa Plastics Corp 1.96% 13,167 1.96% Chemicals CTBC Financial Holding Co Ltd 1.86% 12,453 1.86% Banks Nan Ya Plastics Corp 1.71% 11,472 1.71% Chemicals Uni-President Enterprises Corp 1.68% 11,284 1.68% Food & Beverage Mega Financial Holding Co Ltd 1.64% 11,009 1.64% Banks Total 392,803 58.52% This information has been prepared by Index Intelligence GmbH (“IIG”). -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Formosa Plastics Corporation Financial Statements December 31, 2017 and 2016

1 Stock Code:1301 (English Translation of Financial Statements and Report Originally Issued in Chinese) FORMOSA PLASTICS CORPORATION FINANCIAL STATEMENTS DECEMBER 31, 2017 AND 2016 (With Independent Auditors’ Report Thereon) Address:No.100, Shuiguan Rd., Renwu Dist., Kaohsiung City 814, Taiwan (R.O.C.) Telephone:(07)371-1411;(02)2712-2211 The independent auditors’ report and the accompanying financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of, the English and Chinese language independent auditors’ report and financial statements, the Chinese version shall prevail. 2 Table of Contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Balance Sheets 4 5. Statements of Comprehensive Income 5 6. Statements of Changes in Equity 6 7. Statements of Cash Flows 7 8. Notes to Financial Statements (1) Company history 8 (2) Approval date and procedures of the financial statements 8 (3) Application of new standards, amendments and interpretations 8~13 (4) Summary of significant accounting policies 13~25 (5) Critical accounting judgments and key sources of estimation uncertainly 26 (6) Significant account disclosures 26~55 (7) Related-party transactions 55~61 (8) Pledged properties 61 (9) Significant commitments and contingencies 61~62 (10) Losses due to major disasters 62 (11) Subsequent events 62 (12) Other 62 (13) Other disclosures (a) Information on significant transactions 63~68 (b) Information on investees 69 (c) Information on investment in mainland China 69 (14) Segment information 69 3 KPMG 〵⻍䋑11049⥌纏騟5媯7贫68垜(〵⻍101㣐垜) Telephone ꨶ鑨 + 886 (2) 8101 6666 68F., TAIPEI 101 TOWER, No. -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

指數etf (2805) 截至 31/01/2014 2805

領航富時亞洲(日本除外)指數ETF (2805) 截至 31/01/2014 2805 成分股數目 669 證券百分比 99.66% 現金及現金等類百分比 0.34% 其他 0.00% 證券名稱 證券代號 交易所 資產淨值百分比 Samsung Electronics Co. Ltd. 005930 XKRX 4.36% Taiwan Semiconductor Manufacturing Co. Ltd. 2330 XTAI 2.82% Tencent Holdings Ltd. 700 XHKG 2.20% AIA Group Ltd. 1299 XHKG 1.91% China Construction Bank Corp. 939 XHKG 1.78% China Mobile Ltd. 941 XHKG 1.69% Industrial & Commercial Bank of China Ltd. 1398 XHKG 1.59% Hyundai Motor Co. 005380 XKRX 1.14% Bank of China Ltd. 3988 XHKG 1.13% Hon Hai Precision Industry Co. Ltd. 2317 XTAI 1.13% Hutchison Whampoa Ltd. 13 XHKG 0.98% Infosys Ltd. INFY XNSE 0.97% CNOOC Ltd. 883 XHKG 0.84% Oversea-Chinese Banking Corp. Ltd. O39 XSES 0.74% Housing Development Finance Corp. HDFC XNSE 0.73% DBS Group Holdings Ltd. D05 XSES 0.72% Reliance Industries Ltd. RELIANCE XNSE 0.72% Galaxy Entertainment Group Ltd. 27 XHKG 0.72% China Life Insurance Co. Ltd. 2628 XHKG 0.71% Singapore Telecommunications Ltd. Z74 XSES 0.70% PetroChina Co. Ltd. 857 XHKG 0.70% POSCO 005490 XKRX 0.69% Shinhan Financial Group Co. Ltd. 055550 XKRX 0.69% Hong Kong Exchanges and Clearing Ltd. 388 XHKG 0.68% China Petroleum & Chemical Corp. 386 XHKG 0.68% Hyundai Mobis 012330 XKRX 0.67% Cheung Kong Holdings Ltd. 1 XHKG 0.66% Sands China Ltd. 1928 XHKG 0.62% Sun Hung Kai Properties Ltd. 16 XHKG 0.62% United Overseas Bank Ltd. U11 XSES 0.62% SK Hynix Inc. -

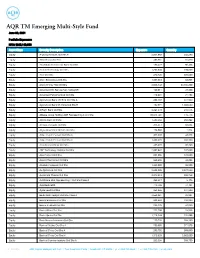

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

Formosa Chemicals & Fibre Corporation And

FORMOSA CHEMICALS & FIBRE CORPORATION AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS AND REVIEW REPORT OF INDEPENDENT ACCOUNTANTS SEPTEMBER 30, 2019 AND 2018 ------------------------------------------------------------------------------------------------------------------------------------ For the convenience of readers and for information purpose only, the auditors’ report and the accompanying financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. In the event of any discrepancy between the English version and the original Chinese version or any differences in the interpretation of the two versions, the Chinese-language auditors’ report and financial statements shall prevail. WorldReginfo - e4fed8b1-59f2-413e-8a24-3b17fd46faf1 FORMOSA CHEMICALS & FIBRE CORPORATION AND SUBSIDIARIES INDEX Items Pages Index Report of Independent Accountants 1-3 Consolidated Balance Sheets 4-5 Consolidated Statements of Comprehensive Income 6-7 Consolidated Statements of Changes in Equity 8-9 Consolidated Statements of Cash Flows 10-11 Notes to Consolidated Financial Statements 12-108 WorldReginfo - e4fed8b1-59f2-413e-8a24-3b17fd46faf1 REVIEW REPORT OF INDEPENDENT ACCOUNTANTS TRANSLATED FROM CHINESE PWCR19000124 To the Board of Directors and Shareholders of Formosa Chemicals & Fibre Corporation Introduction We have reviewed the accompanying consolidated balance sheets of Formosa Chemicals & Fibre Corporation and subsidiaries (the “Group”) as at September 30, 2019 and 2018, -

Value Taiwan ETF (Stock Code: 3060) ETF Distinction ● Value ● Experience

Value Taiwan ETF (stock code: 3060) ETF Distinction ● Value ● Experience HH 24 January 2017 Morningstar RatingTM1 As at 31-01-2017 • Value Taiwan ETF (the “Fund”) is an index-tracking fund listed on the Stock Exchange of Hong Kong Limited (“SEHK”) which aims to provide investment results that closely correspond to the performance of the FTSE Value-Stocks Taiwan Index (“Index”). • The Fund invests in emerging market and is subject to a greater risk of loss than investments in a developed market due to greater political, economic, taxation and regulatory uncertainty and risks linked to volatility and market liquidity. • The Index may experience periods of volatility and decline and the price of units of the Fund is likely to vary or decline accordingly. As the Fund is not actively managed, the Manager will not adopt a temporary defensive position against any market downturn. Investors may lose part or all of their investment. • There is no assurance that the Fund will pay dividends. The Manager may at its discretion pay dividends out of the capital of the Fund or pay dividend out of gross income while all or part of the fees and expenses of the Fund are charged to/paid out of the capital of the Fund. Dividends effectively paid out of capital amount to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Such distribution involving payment of dividends out of the capital may result in an immediate reduction of the Fund’s net asset value per unit. -

FORMOSA PLASTICS GROUP 2018Annual Report

FORMOSA PLASTICS GROUP 2018Annual Report The Mailiao Harbor Chinese white dolphins (Sousa chinensis) can be seen taking a leisurely swim, reflecting the balance that has been achieved between economy and ecology. CONTENTS 2018 Financial Highlights (In Thousands of US Dollars, persons) 1 2018 Financial Highlights Income Before Number of Company Capital Assets Equity Sales Income Tax Employees 2 Preface Formosa Plastics Corp. 2,071,305 15,533,289 11,569,583 6,157,759 1,856,186 6,132 10 Formosa Plastics Corporation Nan Ya Plastics Corp. 2,580,556 17,522,129 12,223,740 6,146,812 1,881,388 12,599 20 Nan Ya Plastics Corporation Formosa Chemicals & Fibre Corp. 1,907,131 15,460,496 12,032,957 8,902,227 1,768,420 5,049 Formosa Petrochemical Corp. 3,099,587 13,039,347 10,989,432 24,907,859 2,424,408 5,285 26 Formosa Chemicals & Fibre Corporation Nan Ya Technology Corp. 1,009,742 6,610,680 5,365,805 2,742,002 1,352,505 3,157 32 Formosa Petrochemical Corporation Nan Ya PCB Corp. 210,251 1,172,577 967,390 763,415 -18,961 5,629 38 Formosa Plastics Group-US. Operations Formosa Sumco Technology Corp. 126,199 806,590 708,461 532,266 207,963 1,339 Formosa Ta eta Co., Ltd. 548,161 2,619,318 2,242,319 897,845 171,014 4,706 41 Other Investments Formosa Advanced Technologies Corp. 143,892 412,409 369,521 285,866 56,973 2,406 Non-Prot Organization—Medical Care Mai-Liao Power Corp. -

Formosa Plastics Corp

Formosa Plastics Corp. Primary Credit Analyst: Ronald Cheng, Hong Kong + 852 2532 8015; [email protected] Secondary Contact: David L Hsu, Taipei + 88688609334488; [email protected] Table Of Contents Credit Highlights Outlook Our Base-Case Scenario Company Description Peer comparison Business Risk Financial Risk Liquidity Environmental, Social, And Governance Group Influence Issue Ratings - Subordination Risk Analysis Ratings Score Snapshot Related Criteria WWW.STANDARDANDPOORS.COM/RATINGSDIRECT NOVEMBER 26, 2020 1 Formosa Plastics Corp. Business Risk: SATISFACTORY Issuer Credit Rating Vulnerable Excellent bbb+ bbb+ bbb BBB+/Stable/-- Financial Risk: INTERMEDIATE Highly leveraged Minimal Anchor Modifiers Group/Gov't Taiwan National Scale twAA-/Stable/twA-1+ Credit Highlights Key strengths Key risks Good market position for various petrochemical products Extended oversupply and weak demand constrains recovery in profitability throughout the Greater China region. and cash flow generation in 2021-2022. Good operating efficiency and product diversity underpinned by a High capital expenditure (capex) in U.S. and China prevents deleveraging high degree of vertical integration. over the next three to five years. Good financial flexibility with sizable liquid non-core assets. The group's performance remains sensitive to oil price volatility and uncertain market recovery from oversupply. Adequate liquidity but with sound banking relationships. Asset concentration risk from its largest single-site complex in Mai-Liao, Taiwan. Deteriorating oversupply conditions could constrain the pace of recovery in the group's performance. We forecast the group's sales to recover by 20%-25% in 2021, supported by an expected rebound in oil price, as well as the group's capacity addition in the U.S.