Value Taiwan ETF (Stock Code: 3060) ETF Distinction ● Value ● Experience

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fact Sheet:State Street Defensive Emerging Markets Equity Fund

State Street Defensive Emerging Markets Equity Fund - Class K Equity 30 June 2021 Fund Objective Total Return The State Street Defensive Emerging Markets Equity Fund seeks to provide MSCI Emerging maximum total return, primarily through capital appreciation, by investing Cumulative Fund at NAV Market Index primarily in securities of foreign issuers. QTD 5.52% 5.05% Process YTD 12.79 7.45 In seeking to identify stocks offering the potential for capital growth, the Annualized Adviser employs a proprietary quantitative process. The process evaluates 1 Year 37.80 40.90 the relative attractiveness of eligible securities based on the correlation 3 Year 8.25 11.27 of certain historical economic and financial factors (such as measures of 5 Year 8.45 13.03 growth potential, valuation, quality and investor sentiment) and based on other historical quantitative metrics. 10 Year 0.96 4.28 The Adviser also uses a quantitative analysis to determine the expected volatility of a stock's market price. Volatility is a statistical measurement of up and down fluctuations in the value of a security over time. Gross Expense Ratio 1.52% Through these quantitative processes of security selection and portfolio Net Expense Ratio^ 1.00% diversification, the Adviser expects that the portfolio will be subject to a 30 Day SEC Yield 1.41% relatively low level of absolute risk (as defined by statistical measures of 30 Day SEC Yield (Unsubsidized) 1.34% volatility, such as standard deviation of returns) and should exhibit relatively Maximum Sales Charge - low volatility compared with the Index over the long term. There can be no assurance that the Fund will in fact achieve any targeted level of volatility or experience lower volatility than the Index, nor can there be any assurance Performance quoted represents past performance, which is no guarantee of that the Fund will produce returns in excess of the Index. -

Ctbc Financial Holding Co., Ltd. and Subsidiaries

1 Stock Code:2891 CTBC FINANCIAL HOLDING CO., LTD. AND SUBSIDIARIES Consolidated Financial Statements With Independent Auditors’ Report For the Six Months Ended June 30, 2019 and 2018 Address: 27F and 29F, No.168, Jingmao 2nd Rd., Nangang Dist., Taipei City 115, Taiwan, R.O.C. Telephone: 886-2-3327-7777 The independent auditors’ report and the accompanying consolidated financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of the English and Chinese language independent auditors’ report and consolidated financial statements, the Chinese version shall prevail. 2 Table of contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Consolidated Balance Sheets 4 5. Consolidated Statements of Comprehensive Income 5 6. Consolidated Statements of Changes in Stockholder’s Equity 6 7. Consolidated Statements of Cash Flows 7 8. Notes to the Consolidated Financial Statements (1) History and Organization 8 (2) Approval Date and Procedures of the Consolidated Financial Statements 8 (3) New Standards, Amendments and Interpretations adopted 9~12 (4) Summary of Significant Accounting Policies 12~39 (5) Primary Sources of Significant Accounting Judgments, Estimates and 40 Assumptions Uncertainty (6) Summary of Major Accounts 40~202 (7) Related-Party Transactions 203~215 (8) Pledged Assets 216 (9) Significant Contingent Liabilities and Unrecognized Contract 217~226 Commitment (10) Significant Catastrophic Losses 227 (11) Significant Subsequent Events 227 (12) Other 227~282 (13) Disclosures Required (a) Related information on significant transactions 283~287 (b) Related information on reinvestment 287~289 (c) Information on investment in Mainland China 289~290 (14) Segment Information 291 KPMG 11049 5 7 68 ( 101 ) Telephone + 886 (2) 8101 6666 台北市 信義路 段 號 樓 台北 大樓 68F., TAIPEI 101 TOWER, No. -

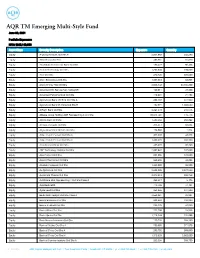

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Taiwan USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Accton Technology 0.45 TAIWAN Formosa Petrochemical 0.44 TAIWAN SinoPac Financial Holdings Co. Ltd. 0.45 TAIWAN Acer 0.29 TAIWAN Formosa Plastics Corp 1.56 TAIWAN Synnex Technology International 0.23 TAIWAN Advantech 0.49 TAIWAN Formosa Taffeta 0.13 TAIWAN Taishin Financial Holdings 0.53 TAIWAN Airtac International Group 0.42 TAIWAN Foxconn Technology 0.23 TAIWAN Taiwan Business Bank 0.19 TAIWAN ASE Technology Holding 0.87 TAIWAN Fubon Financial Holdings 1.21 TAIWAN Taiwan Cement 0.82 TAIWAN Asia Cement 0.38 TAIWAN Genius Electronic Optical 0.2 TAIWAN Taiwan Cooperative Financial Holding 0.75 TAIWAN ASMedia Technology 0.24 TAIWAN Giant Manufacturing 0.31 TAIWAN Taiwan Fertilizer 0.15 TAIWAN Asustek Computer Inc 0.7 TAIWAN GlobalWafers 0.36 TAIWAN Taiwan Glass Industrial 0.08 TAIWAN AU Optronics 0.42 TAIWAN HIWIN Technologies Corp. 0.29 TAIWAN Taiwan High Speed Rail 0.26 TAIWAN Capital Securities 0.09 TAIWAN Hon Hai Precision Industry 3.82 TAIWAN Taiwan Mobile 0.64 TAIWAN Catcher Technology 0.54 TAIWAN Hotai Motor 0.81 TAIWAN Taiwan Secom 0.1 TAIWAN Cathay Financial Holding 1.28 TAIWAN HTC Corporation 0.08 TAIWAN Taiwan Semiconductor Manufacturing 42.94 TAIWAN Chailease Holding 0.73 TAIWAN Hua Nan Financial Holdings 0.67 TAIWAN TECO Electric & Machinery 0.21 TAIWAN Chang Hwa Commercial Bank 0.45 TAIWAN Innolux 0.34 TAIWAN TPK Holding Co Ltd 0.07 TAIWAN Cheng Shin Rubber Industry 0.27 TAIWAN Inventec Co. -

Harbor Robeco Series July 31, 2020

Quarterly Schedules of Portfolio Holdings Harbor Robeco Series July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class CONSERVATIVE EQUITY Harbor Robeco Emerging Markets Conservative Equities Fund HRERX HRETX HREAX HRENX Harbor Robeco Global Conservative Equities Fund HRGTX HRGIX HRGDX HRGNX Harbor Robeco International Conservative Equities Fund HRIRX HRIEX HRIMX HRIVX Harbor Robeco US Conservative Equities Fund HRURX HRUNX HRUAX HRUVX CORE EQUITY Harbor Robeco Emerging Markets Active Equities Fund HRMEX HRMTX HRMNX HRMOX Table of Contents Portfolios of Investments HARBOR ROBECO EMERGING MARKETS CONSERVATIVE EQUITIES FUND . 1 HARBOR ROBECO GLOBAL CONSERVATIVE EQUITIES FUND. .................. 4 HARBOR ROBECO INTERNATIONAL CONSERVATIVE EQUITIES FUND . ........ 7 HARBOR ROBECO US CONSERVATIVE EQUITIES FUND. ...................... 10 HARBOR ROBECO EMERGING MARKETS ACTIVE EQUITIES FUND. ........ 12 Notes to Portfolios of Investments ..................................... 17 Harbor Robeco Emerging Markets Conservative Equities Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost and Principal Amounts in Thousands COMMON STOCKS—94.3% COMMON STOCKS—Continued Shares Value Shares Value AUTO COMPONENTS—1.2% DIVERSIFIED TELECOMMUNICATION SERVICES—Continued 5,275 Shandong Linglong Tyre Co. Ltd. (China) ................ $ 18 2,097 KT Corp. ADR (South Korea)1......................... $ 21 5,400 Weifu High Technology Group Ltd. (China) . 17 48,200 Telekomunikasi Indonesia Persero Tbk PT (Indonesia)..... 10 35 20,330 Turk Telekomunikasyon AS (Turkey) . ................. 21 118 AUTOMOBILES—2.2% 766 KIA Motors Corp. (South Korea) . ..................... 26 ELECTRIC UTILITIES—2.5% 10,785 Tofas Turk Otomobil Fabrikasi AS (Turkey) . 39 5,200 EDP - Energias do Brasil SA (Brazil) ................... 19 65 5,400 Equatorial Energia SA (Brazil) . ..................... 26 5,700 Transmissora Alianca de Energia Eletrica SA (Brazil)* ..... 32 BANKS—18.3% 77 73,000 Agricultural Bank of China Ltd. -

CTBC Financial Holding Co., Ltd. Handbook for the 2021 Annual

Stock code: 2891 CTBC Financial Holding Co., Ltd. Handbook for the 2021 Annual General Meeting of Shareholders Meeting time: 9:00 am, June 11, 2021 Place: 12F., The Grand Ballroom, The Grand Hotel, No. 1, Zhongshan N. Rd., Sec. 4, Taipei, Taiwan, R.O.C. Notice to readers For the convenience of readers, “The Handbook for the 2021 Annual General Meeting of Shareholders” has been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language version shall prevail. Notice to readers For the convenience of readers, “The Handbook for the 2021 Annual General Meeting of Shareholders” has been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language shall prevail. Table of Contents I. Meeting Procedure II. Meeting Agenda A. Items to Report (Non-voting Items) 1. 2020 Business Report ............................................................................................................ 4 2. 2020 Audit Committee Report............................................................................................... 4 3. 2020 report on employee and director remuneration distribution ......................................... 4 4. Matters relating to the unsecured corporate bonds issued in 2020 ....................................... -

C Tbc Bank Co., Ltd

0424_§§�H���Ê≠^§�2018�~�‾��≠±.pdf 1 2019/4/24 下午3:33 CTBC BANK CO., LTD. 2018 ANNUAL REPORT Stock Code:5841 Printed on April 26, 2019 http://www.ctbcbank.com http://mops.twse.com.tw C M Y CM MY CY CMY K CTBC Bank Co., Ltd. Fitch Australia Pty Ltd., Taiwan Branch Address: No. 166, 168, 170, 186, 188, Jingmao 2nd Rd., Nangang Address: Suite 1306, 13F., No. 205, Tun Hwa N. Rd., Dist., Taipei City 115, Taiwan (R.O.C.) Songshan Dist., Taipei City 105, Taiwan (R.O.C.) Tel: +886-2-3327-7777 Tel: +886-2-8175-7600 Website: http://www.ctbcbank.com Website: http://fitchratings.com/site/taiwan Spokesperson Moody’s Investors Service Hong Kong Limited Name: Ya-Ling Chiu Address: 24F., One Pacific Place, 88 Queensway, Admiralty, Position: Executive vice president Hong Kong Tel: +886-2-3327-7777 Tel: +852-3758-1300 Email: [email protected] Website: http://www.moodys.com Acting Spokesperson Overseas exchange for trading of company Name: Roger Kao securities Position: Senior executive vice president (None) Tel: +886-2-3327-7777 Email: [email protected] For the contact information of our headquarters and various branches in Taiwan and overseas, please refer to page 35 Stock Transfer Agency Agency: Corporate Trust Operation and Service Department, CTBC Bank Co., Ltd. Address: 5F., No. 83, Sec. 1, Chongqing S. Rd., Zhongzheng Dist., Taipei City 100, Taiwan (R.O.C.) Tel: +886-2-6636-5566 Website: http://www.ctbcbank.com Certified Public Accountants Names: Jeff Chen, Lin Wu Business Office: KPMG Certified Public Accountants Address: 68F., No. -

Asia Ex-Japan Responding Companies 2014

Asia ex-Japan Responding Companies 2014 2014 2014 CDP would like to recognize the following Company Name Country Company Name Country Score Score 223 companies within the Asia ex-Japan CNOOC China Health Care region that used CDP’s climate change CPC Corporation, Taiwan Taiwan Divyajyoti Eye Hospital India questionnaire to manage their carbon Fortune Oil Hong Kong 27 Dr. Reddy’s Laboratories India 82 and energy impacts this year. CDP also Indian Oil Corporation India 83 GlaxoSmithKline Pharmaceuticals India SA acknowledges 21 organizations whose PETROCHINA Company China Kangmei Pharmaceutical China vital information was provided to investors PTT Thailand 86 C Shandong Dong-E E-Jiao China PTT Exploration & Production Public Thailand 97 A- Shanghai Fosun Pharmaceutical China through another company’s submission. Company Group Co To read publicly available responses in S-Oil Corporation South Korea 96 A Tasly Pharmaceutical Group Co China full, please visit www.cdp.net. Financials Industrials Alliance Financial Group Bhd Malaysia 10 Aboitiz Equity Ventures Philippines SA 2014 Company Name Country Score Ayala Land Inc Philippines 54 D Cathay Pacific Airways Hong Kong 83 B Consumer Discretionary Bangkok Bank Thailand 36 China Airlines Taiwan 73 C Astra International Indonesia 42 Bank of Beijing (A) China China Communications Construction China BYD China Bank of Communications China China Merchants Holdings China Company Crystal Group Hong Kong BOC Hong Kong Hong Kong China Shipping Container Lines China Emerging Display Technologies Corp. Taiwan Capita Commercial Trust Singapore SA China State Construction China GETRAG (Jiangxi) Transmission Co. China CapitaLand Singapore 77 B International Holdings Great Wall Motor Company (H) China CapitaMall Trust Singapore SA Cummins India India SA Hongkong & Shanghai Hotels Hong Kong Cathay Financial Holding Taiwan 85 C Far Eastern New Century Corp. -

FTSE TWSE Taiwan 50

2 FTSE Russell Publications 19 August 2021 FTSE TWSE Taiwan 50 Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Advantech 0.47 TAIWAN First Financial Holding 0.76 TAIWAN Realtek Semiconductor 0.8 TAIWAN Airtac International Group 0.53 TAIWAN Formosa Chemicals & Fibre 0.97 TAIWAN Shanghai Commercial & Savings Bank 0.49 TAIWAN ASE Technology Holding 1.28 TAIWAN Formosa Petrochemical 0.48 TAIWAN Silergy 0.78 TAIWAN Asia Cement 0.39 TAIWAN Formosa Plastics Corp 1.67 TAIWAN Taishin Financial Holdings 0.53 TAIWAN Asustek Computer Inc 0.87 TAIWAN Fubon Financial Holdings 1.81 TAIWAN Taiwan Cement 0.88 TAIWAN AU Optronics 0.66 TAIWAN Hon Hai Precision Industry 4.45 TAIWAN Taiwan Cooperative Financial Holding 0.68 TAIWAN Cathay Financial Holding 1.48 TAIWAN Hotai Motor 0.65 TAIWAN Taiwan Mobile 0.56 TAIWAN Chailease Holding 0.85 TAIWAN Hua Nan Financial Holdings 0.59 TAIWAN Taiwan Semiconductor Manufacturing 47.57 TAIWAN Chang Hwa Commercial Bank 0.35 TAIWAN Largan Precision 1.06 TAIWAN Uni-president Enterprises 1.17 TAIWAN China Steel 1.63 TAIWAN MediaTek 4.74 TAIWAN United Microelectronics 2.06 TAIWAN Chunghwa Telecom 1.44 TAIWAN Mega Financial Holding 1.19 TAIWAN Wan Hai Lines 1.19 TAIWAN CTBC Financial Holding 1.37 TAIWAN Nan Ya Plastics 1.56 TAIWAN Yageo 0.85 TAIWAN Delta Electronics 2.18 TAIWAN Nan Ya Printed Circuit Board 0.27 TAIWAN Yang Ming Marine Transport 0.91 TAIWAN E.Sun Financial Holding 1.05 TAIWAN Nanya Technology 0.22 TAIWAN Yuanta Financial Holding 1.04 TAIWAN Evergreen Marine 1.71 TAIWAN Novatek Microelectronics 0.95 TAIWAN Far Eastern New Century Corporation 0.42 TAIWAN Pegatron 0.47 TAIWAN Far EasTone Telecommunications 0.34 TAIWAN President Chain Store 0.49 TAIWAN Feng TAY Enterprise 0.36 TAIWAN Quanta Computer 0.78 TAIWAN Source: FTSE Russell 1 of 2 19 August 2021 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. -

Mn Services Aandelenfonds Emerging Markets 1

MN Services Aandelenfonds Emerging Markets 31-12-2020 Naam 3SBio Inc 51job Inc AAC Technologies Holdings Inc Agricultural Bank of China Ltd Abdullah Al Othaim Markets Co Aboitiz Equity Ventures Inc Aboitiz Power Corp Absa Group Ltd Abu Dhabi Commercial Bank PJSC ACC Ltd Accton Technology Corp Ace Hardware Indonesia Tbk PT Acer Inc Adani Green Energy Ltd Adani Ports & Special Economic Zone Ltd Adaro Energy Tbk PT Aditya Birla Capital Ltd Advanced Info Service PCL Advanced Petrochemical Co Advantech Co Ltd AECC Aviation Power Co Ltd Grupo Aeroportuario del Pacifico SAB de CV Grupo Aeroportuario del Sureste SAB de CV Agile Group Holdings Ltd Agility Public Warehousing Co KSC Aier Eye Hospital Group Co Ltd Air China Ltd Airports of Thailand PCL Airtac International Group AK Medical Holdings Ltd Akbank T.A.S. Al Hammadi Co for Development and Investment Al Rajhi Bank Aldar Properties PJSC Alfa SAB de CV Alibaba Pictures Group Ltd Alibaba Group Holding Ltd Alibaba Health Information Technology Ltd Alinma Bank A-Living Services Co Ltd MN SERVICES AANDELENFONDS EMERGING MARKETS 1 Allegro.eu SA Almarai Co JSC Alpargatas SA Alrosa PJSC Alsea SAB de CV Alteogen Inc Aluminum Corp of China Ltd Amara Raja Batteries Ltd AMMB Holdings Bhd Ambev SA Ambuja Cements Ltd America Movil SAB de CV Amorepacific Corp AMOREPACIFIC Group Anadolu Efes Biracilik Ve Malt Sanayii AS Embotelladora Andina SA Angang Steel Co Ltd Anglo American Platinum Ltd AngloGold Ashanti Ltd Anhui Conch Cement Co Ltd Anhui Gujing Distillery Co Ltd ANTA Sports Products Ltd Apollo Hospitals -

FACTSHEET - AS of 28-Sep-2021 Solactive GBS Taiwan Large & Mid Cap USD Index NTR

FACTSHEET - AS OF 28-Sep-2021 Solactive GBS Taiwan Large & Mid Cap USD Index NTR DESCRIPTION The Solactive GBS Taiwan Large & Mid Cap USD Index NTR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Taiwanese market. It is calculated as a net total return index in USD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 2,500 2,000 1,500 1,000 500 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Taiwan Large & Mid Cap USD Index NTR CHARACTERISTICS ISIN / WKN DE000SLA80G3 / SLA80G Base Value / Base Date 578.49 Points / 08.05.2006 Bloomberg / Reuters / .STWLMCUN Last Price 2325.45 Index Calculator Solactive AG Dividends Reinvested Index Type Net Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency USD History Available daily back to 08.05.2006 Index Members 109 FACTSHEET - AS OF 28-Sep-2021 Solactive GBS Taiwan Large & Mid Cap USD Index NTR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance 0.77% 0.24% 6.37% 46.87% 19.41% 301.99% Performance (p.a.) - - - - - 9.46% Volatility (p.a.) 15.97% 16.77% 19.83% 19.51% 20.76% 21.18% High 2403.15 2403.15 2403.15 2403.15 2403.15 2403.15 Low 2291.02 2169.05 2055.25 1588.20 1947.44 283.71 Sharpe Ratio 0.60 0.05 0.67 2.43 1.29 0.44 Max. -

Ratings on CTBC Financial Holding Co. Ltd. and Subsidiaries Affirmed; Outlook Stable

信用評等資料庫 Ratings On CTBC Financial Holding Co. Ltd. And Subsidiaries Affirmed; Outlook Stable May 6, 2020 Overview PRIMARY CREDIT ANALYST Yuhan Lan − We believe CTBC FHC and its subsidiaries have sufficient capital buffer on a Taipei consolidated basis to manage the impact of increased volatility in global financial +886-2-8722-5810 markets. yuhan.lan − However, we anticipate the group's life insurance subsidiary, Taiwan Life Insurance, @spglobal.com could face increasing challenges to preserve its capital and earnings on a stand- yuhan.lan alone basis if it encounters unexpected financial market volatility. @taiwanratings.com.tw − We are affirming the ratings on CTBC FHC and its key subsidiaries. − The outlook on all the long-term ratings is stable to reflect our view that CTBC FHC SECONDARY CONTACT group will maintain most of its key risk characteristics including its adequate risk management and stable earnings over the next one to two years. Patty Wang Taipei +886-2-8722-5823 Rating Action patty.wang Taiwan Ratings Corp. today affirmed its ratings on CTBC Financial Holding Co. Ltd. (CTBC @spglobal.com FHC), CTBC Bank Co. Ltd., Taiwan Life Insurance Co. Ltd., and CTBC Securities Co. Ltd. patty.wang @taiwanratings.com.tw (see ratings list). The outlook on the long-term ratings remains stable. Eunice Fan Rationale Taipei +886-2-8722-5818 We believe CTBC FHC group has maintained its overall credit profile remains despite the eunice.fan recent rise in global financial market volatility triggered by the COVID-19 pandemic. We @spglobal.com expect CTBC FHC group to maintain its satisfactory capitalization at the consolidated eunice.fan level.