2014 Food Processing Ingredients Taiwan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Spirits Catalog

SPIRITS CATALOG WWW.CNSIMPORTSCA.COM [email protected] PH: 626 579 9018 | FAX: 626 579 0584 TABLE OF CONTENTS Whiskey 1 Liqueurs 10 Vodka 5 Asian Beers 13 Gin 6 Baijiu 14 Tequilla 7 Terms & Conditions 16 Mezcal 8 Return Policy 17 Rum 9 WHISKEY AMERICAN DRIFTLESS GLEN DRIFTLESS GLEN STRAIGHT RYE WHISKEY STRAIGHT BOURBON WHISKEY SINGLE BARREL SINGLE BARREL (Barrel Program Available) (Barrel Program Available) Origin: Baraboo, WI Origin: Baraboo, WI Mash: 80% Rye, 10% Malted Barley, 10% Corn Mash: 60% Corn, 20% Malted Barley, 20% Rye Nose: Cinnamon, Hints of Oak Nose: Vanilla, Honey, Light Spices Tongue: Spicy Rye, Honey Tongue: Buttered Popcorn, Raw Corn Husk, Rye Spice Finish Accolades: Silver - WSWA 2017 ABV 48% Size: 750ML ABV 48% Size: 750ML DRIFTLESS GLEN DRIFTLESS GLEN RYE WHISKEY BOURBON WHISKEY Origin: Baraboo, WI Origin: Baraboo, WI Mash: 80% Rye, 10% Malted Barley, 10% Corn Mash: 60% Corn, 20% Rye, 20% Malted Barley Nose: White pepper, Burnt Oak Nose: Vanilla, Caramel Corn Tongue: Spicy Vanilla, Honey Tongue: Light Molasses, Brown Sugar Toffee ABV 48% Size: 750ML ABV 48% Size: 750ML INDIAN RAMPUR INDIAN SINGLE VINN WHISKEY MALT WHISKY DOUBLE CASK Origin: Wilsonville, OR Origin: Rampur, India Mash: 100% Long Grain Rice Mash: 100% Indian Malted Barley Nose: Toffee, Fruit Gummies Nose: Tropical Fruit, Deep Malt, Oak Tongue: Sweet, Tapioca, Spicy Cocoa Tongue: Sherry, Rich Fruit ABV 43% Size: 375ML/750ML ABV 45% Size: 750ML 1 Spirits Catalog 2019 WHISKEY JAPANESE RAMPUR INDIAN SINGLE KUJIRA MALT WHISKY RYUKYU WHISKY 20 YEAR Origin: -

World's Best Wines & Spirits

ULTIMATE BEVERAGE CHALLENGE ULTIMATE GUIDE TO THE WORLD’S BEST WINES & SPIRITS 2019 PUBLISHED JOINTLY BY BEVERAGE MEDIA GROUP & ULTIMATE BEVERAGE CHALLENGE CONGRATULATIONS TO THIS YEAR’S HIGH-SCORING WINES Chateau Malbec Chateau Ferrande Chateau Haut Surget Louis Laurent Tour Prignac Chateau Barreyres 2016 Bordeaux 2016 Graves 2015 Lalande de 2018 Rosé d’Anjou Grand Reserve 2016 Haut-Medoc 94 - FINALIST 93 - FINALIST Pomerol 93 - FINALIST 2016 Medoc 91 GREAT VALUE GREAT VALUE 93 - FINALIST GREAT VALUE 92 Aime Roquesante Chateau D’Arcins Chateau Tour Maison Castel Michel Lelu 2018 Cotes du 2015 Haut-Medoc Prignac Grande Reserve Muscadet Provence Rosé 90 2015 Medoc Cabernet Sauvignon 2018 Loire Valley 90 - TRIED & TRUE 90 2017 Pays d’Oc 90 - GREAT VALUE 90 Imported by Luneau USA Inc. Westport, CT LuneauUSA.com CONGRATULATIONS TO THIS YEAR’S HIGH-SCORING WINES ULTIMATE BEVERAGE CHALLENGE 2019 IDENTIFYING THE WORLD’S BEST WINES, SPIRITS & SAKES LIKE NO OTHER COMPETITION Ultimate Guide to the World’s Best Wines and Spirits features the At Ultimate Spirits Challenge® (USC) the quality highest-scoring results from Ultimate Beverage Challenge’s® (UBC) rankings for every category for spirits are determined two major international beverage competitions held in 2019: Ultimate with uncommon skill and precision by all-star Ultimate Spirits Challenge® (USC) and Ultimate Wine Challenge® (UWC). Spirits Challenge judging panels convened by USC So, since 2010, why has UBC become the beverage industry’s most Judging Director F. Paul Pacult, whom Forbes. trusted and respected evaluation company? Answers UBC’s Judging com called, “America’s foremost spirits authority”. Chateau Malbec Chateau Ferrande Chateau Haut Surget Louis Laurent Tour Prignac Chateau Barreyres Chairman and Co-Founder F. -

World Bank Document

I-ufnu 50ar FILE-COPY RESTRICTED Report No. DB-34.1 Public Disclosure Authorized This report was prepared for use within the Bank and its affiliated organizations. They do not accept responsibility for its accuracy or completeness. The report may not be published nor may it be quoted as representing their views. INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT INTERNATIONAL FINANCE CORPORATION INTERNATIONAL DEVELOPMENT ASSOCIATION Public Disclosure Authorized APPRAI]SAL OF CHINA DEVELOPMENT CORPORATION Public Disclosure Authorized July 18, 1967 Public Disclosure Authorized Development Finance Companies CURRENCY EQUIVALENTS US$1. 00 = 40. 1 New Taiwan dollars (NT$) NT$1. 00 = US$0. 025 NT$1, 000, 000 = US$24,938 APPRAISAL OF CHINA DEVELOPMENT CORPORATION This report is based on the findings of a mission consisting of Messrs. Pollan and Hedberg of IFC which visited Taiwan in December 1966 TABLE OF CONTENTS Page Paragraph SUIM4ARY AND CONCLUSIONS 1 I. INTRODUCTION 1 1 II. THE ENVIRONIMENT Industrial Growth 1 2 Policy Setting 2 6 Financial Institutions and Capital Market 3 9 III. THE CORPORATION Objectives and Scope 6 15 Ownership 6 16 Resources 6 17 Organization and Procedures 7 20 Relations with Government and Business Community 9 28 IV. POLICIES AND OPERATIOtNS Policies 9 30 Operations 11 34 CDC's Role in Industry and the Economy 13 4 V. FINANCIAL POSITION AND RESULTS Balance Sheet 14 49 Profit and Loss 15 54 Reserves, Dividends and Share Yield 16 55 VI. PROSPECTS The Setting 16 56 CDC's Future Operations 17 58 Resources Needed 18 61 Future Financial Position 19 62 VII. CONCLUSIONIS AND RECOMI1ENDATIONS Evaluation 21 67 Recommendaitions 21 70 ANNEXES APPRAISAL OF CHINA DEVELOPMENT CORPORATION Summary and Conclusions 1. -

Yes, Chef… Hip to Be Square

CUISINE / WINE / ART LP4 [email protected] Yes, Chef… While roast goose is a traditional dish on Christmas menus around the world, Chiu Chow marinated goose has been the signature dish of Chan Kan Kee since 1948 – and it hasn’t changed since, with a unique recipe that’s a family secret passed down through the generations. Since 2010, Eliza Chan and her elder sister, Rebecca, are part of the third generation to run the restaurant. Here, they unveil some of the secrets of this delicious dish photos by Calvin Ng were a lot of hawker stalls like ours. Chiu Chow Marinated Goose Can you share any of For the lushui (stock) fry them for a bit. After that, add the water, the secrets of your 1.5kg pork belly (if making new lushui) light soy sauce and dark soy sauce. family’s recipe? 19g Sichuan pepper Bring the stock to a boil, then pour it into For one, we use galangal 10 pieces star anise a stock pot. Boil on low heat for 30 minutes to instead of regular Chinese 75g cinnamon/cassia sticks retain its quality; high heat will make the sauce ginger. In addition, Chan 300ml light soy sauce overly concentrated and it will be too salty. Kan Kee’s lushui [stock for 75ml dark soy sauce Add the meat (goose, duck, or pork) that marinating] was started in 300g crystal/rock sugar you’d like to marinate into the stock. If you’re 1948 by my grandfather. 8 slices galangal using a smaller pot at home, chop the goose Over all these 72 years, 150g leeks or duck into smaller pieces (i.e. -

Taiwan Food Processing Ingredients Enter a Descriptive Report Name

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/18/2015 GAIN Report Number: TW15044 Taiwan Food Processing Ingredients Enter a Descriptive Report Name Approved By: Mark Ford Prepared By: Cindy Chang Report Highlights: extremely competitive, there are still great opportunities for U.S. exporters. U.S. exports of high value food products to Taiwan reached US$1.3 billion in 2014 and this trend is expected to continue for the next several years. Imports of premium food items from other countries has been increasing, but U.S. products continue to be well-accepted by Taiwan consumers due to competitive prices and consumer confidence in the quality and safety of U.S. food products. Taiwan is the United States’ seventh largest agricultural export market due in part to the great success in the food processing and ingredients sector. Post: Taipei ATO Executive Summary: SECTION I. MARKET SUMMARY Taiwan Food Processing and Ingredients Sector Overview and Trends Opportunities exist to expand U.S. food product sales to Taiwan’s food processing and ingredient sector. Given Taiwan’s current size and population, the country will continue the trend of looking overseas for food processing and ingredients. In 2014, Taiwan’s agricultural industry accounts for less than 2% of GDP and only 5% of employment in Taiwan. Taiwan’s food processing and ingredients industry is comprised of the following major sectors: beverage, coffee/cocoa, condiments/seasonings, dairy products, fats/oils, flour/ bakery products, fruits/vegetables, meat/poultry products, snack foods, and sugar and confectionery. -

Kaoliang and the Ganbei Culture “A Thousand Cups of Wine Do Not Suffice When True Friends Meet, but Half a Sentence Is Too Much When There Is No Meeting of Minds.”

T AIPEI UNCORKED Kaoliang and The Ganbei Culture “A thousand cups of wine do not suffice when true friends meet, but half a sentence is too much when there is no meeting of minds.” MARK L. PETERSON (Chinese Proverb) rinking for pleasure and daredevil drinking has after every course at a banquet and guests are often asked historically been part of Taiwan’s culture for to have one drink with every person who is considered who-knows-how-long. Recently, favored liquid a host. According to a Chinese proverb, “if you leave a D refreshments from abroad have included XO social meal sober you did not truly enjoy yourself,” which brandies, Scotch whiskeys, and in the past few years the is rather paradoxical considering the Chinese frown upon Taiwanese have acquired a seemingly unquenchable enthusiasm drunkenness. Even though ganbei toasts are offered for Western-style wine. Red wine in particular has become throughout the night, you only have to empty your glass once synonymous with ‘class’ and healthier drinking during on the first toast when all drain their glasses and show each weddings, restaurant dining, pub hopping, and entertaining other the traditional empty cup (ladies are supposed to take at home. Enjoying red wine has become the passion des only a sip). The Chinese generally don’t touch glasses with personnes in such a big way that France’s five largest wine each other during a toast. producers now come to Taiwan every year to promote sales. While the specific ‘tastes’ of Taiwanese may change TAIWAN FIRE-WATER with fashion, one thing never changes: the culture of ganbei On the front-line island of Kinmen, where the local specialty (literally ‘dry glass,’ requiring drinkers to consume every last is kaoliang, a unique drinking culture has taken shape. -

The Spatial Strategy of Urban Planning for an Industry-Based City in Taiwan Under Japanese Colonial Rule — the Case of Pingtung City

International Journal of Social Science and Humanity, Vol. 6, No. 11, November 2016 The Spatial Strategy of Urban Planning for an Industry-Based City in Taiwan under Japanese Colonial Rule — The Case of Pingtung City Chuan-Hsiang Hung, Ming-Hsien Ko, and Sen-I Tsai prefecture-administered cities under Japanese rule, it was the Abstract—The industrial revolution has changed our society only one that was planned and developed for a particular and living environment. In the early twentieth century, industry. It is the primary interest of the present paper to following Emperor Meiji's policy of Westernization, the explore the spatial strategy employed in planning the city and Japanese colonial government introduced primary industries to analyze the blueprints, proposals, plots, and related literature. Taiwan along with the western infrastructure and spatial planning, and Pingtung was one of the cities that received such In view of the relationship of the urban construction with the innovations. Pingtung City's rise owed much to the economic development of the Pingtung Plain, the surrounding factors policy of the Office of the Governor-General of Taiwan, and the also play a key role, evidenced in the Neighborhood Map of city's transformation from a remote village to a new Taiwan (臺灣堡圖, the 1904 edition), the Topographic Map industry-oriented city in thirty years' time was achieved 臺灣地形圖 through space planning, which involved two major phases. This of Taiwan ( ), and the Flood Control Map of the paper introduces Pingtung City's historical background and the Lower Tamsui River (下淡水溪治水計畫圖). The spatial process of its rise to economic prominence before the Second planning of this historic city is the focus of the present paper, World War. -

The Duty Free & Travel Retail Asia Pacific Summit

6 - 10 MAY 2018 - SINGAPORE The Duty Free & Travel Retail Asia Pacific Summit Introducing TFWA • Asia Pacific Market • TFWA Asia Pacific Exhibition & Conference • Programme • Why exhibit? • Why visit? • Conference & Workshops • ONE2ONE • Key tools • Networking • Contact Tax Free World Association 2 Introducing TFWA • Asia Pacific Market • TFWA Asia Pacific Exhibition & Conference • Programme • Why exhibit? • Why visit? • Conference & Workshops • ONE2ONE • Key tools • Networking • Contact 3 Introducing TFWA • Asia Pacific Market • TFWA Asia Pacific Exhibition & Conference • Programme • Why exhibit? • Why visit? • Conference & Workshops • ONE2ONE • Key tools • Networking • Contact With over 500 members, TFWA (Tax Free World Association) is the world’s biggest duty free and travel retail association. Its mission – summarised by its motto ‘by the trade, for the trade’ – is to identify trends and opportunities; build awareness; and provide a business platform for the global duty free and travel retail industry to prosper. TFWA’s key activities are organising exhibitions, delivering specialist conferences and workshops, and commissioning relevant and informative consumer research studies. 4 Introducing TFWA • Asia Pacific Market • TFWA Asia Pacific Exhibition & Conference • Programme • Why exhibit? • Why visit? • Conference & Workshops • ONE2ONE • Key tools • Networking • Contact Asia Pacific Market Asia Pacific: the engine of duty free & travel retail 5 Introducing TFWA • Asia Pacific Market • TFWA Asia Pacific Exhibition & Conference • Programme • Why exhibit? • Why visit? • Conference & Workshops • ONE2ONE • Key tools • Networking • Contact Asia Pacific is the undisputedgrowth driver of the global duty free & travel retail industry, as the region proved once again in 2016. During a year in which other regions posted flat or negative growth, sales in Asia Pacific increased by 9.1% in US$ at current rates, according to preliminary figures from Generation Research. -

A Study on the Guaranteed Sugar Price in Taiwan by Chwei-Lin Fan A

A study on the guaranteed sugar price in Taiwan by Chwei-lin Fan A THESIS Submitted to the Graduate Faculty in partial fulfillment of the requirements for the degree of Master of Science in Agricultural Economics Montana State University © Copyright by Chwei-lin Fan (1961) Abstract: This report reveals farm survey research applying to the guaranteed sugar price in Taiwan. The minimum guaranteed sugar price is determined on the basis of survey data furnished by the Taiwan Sugar Corporation and is announced by the government prior to the period of planting of each cane crop year. Since 1957 the sugar support price in Taiwan has served as a reliable method for the government's sugar-price policy making and has also been broadly welcomed by most cane growers as a guidance for their farm planning. Part I presents some basic facts about Taiwan's agriculture. Part II reviews the history of fluctuating income and rice-sugar cane competition in Taiwan. Part III describes the research problem from standpoints of the government , the Taiwan Sugar Corporation, and the cane producers. Part IV points out the objectives and procedures of the study. The aims of the guaranteed sugar price survey are to stabilize the local sugar industry. Part V shows the hypotheses used by the Taiwan Sugar Corporation in the study which was used as the basis for the government's announced guaranteed sugar price. The hypotheses are that as the result of the guaranteed sugar price are: (l) farmers will prefer to plant sugar cane, (2; the Taiwan Sugar Corporation might obtain enough raw cane material to operate the sugar factories, and (3) the government can maintain at least the past, level of foreign exchange earned by sugar export. -

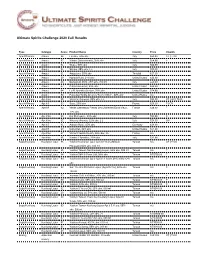

Ultimate Spirits Challenge 2020 Full Results

Ultimate Spirits Challenge 2020 Full Results Type Subtype Score Product Name Country Price Awards Aperitif/Amaro Amaro 94 Lucano, 28% abv Italy $30.00 CT | T100 Aperitif/Amaro Amaro 92 Nonino Quintessentia, 35% abv Italy $54.99 F Aperitif/Amaro Amaro 91 Silano, 30% abv Italy $24.99 Aperitif/Amaro Amaro 91 Sibona, 28% abv, 1 L Italy $30.00 Aperitif/Amaro Amaro 91 Angostura, 35% abv Trinidad $27.99 Aperitif/Amaro Amaro 89 Hypatia Rubi, 24% abv United States $39.00 Aperitif/Amaro Amaro 88 Bertagnolli 1870, 27% abv, 700 ml Italy €20.00 Aperitif/Amaro Amaro 87 California Fernet, 40% abv United States $39.99 Aperitif/Amaro Amaro 84 Lo-Fi Aperitifs Gentian, 20% abv United States $24.99 Aperitif/Amaro Amaro 84 Founding Spirits Arroyo's "Never Bitter" , 22% abv United States n/a Aperitif/Amaro Aperitivo 95 Vincenzi Capasso, 22% abv, 1 L Italy $24.99 CT | GV | T100 Aperitif/Amaro Aperitif 93 Suze, 20% abv France $24.99 F | GV Aperitif/Amaro Aperitif 93 Merlet Chevessac Pineau des Charentes Extra Vieux, France $36.00 F 17% abv Aperitif/Amaro Aperitivo 93 Del Professore, 15% abv Italy $30.99 F Aperitif/Amaro Aperitivo 92 Vincenzi Arancia, 11% abv, 1 L Italy $24.99 GV Aperitif/Amaro Aperitif 91 Asbach Rose, 15% abv Germany $24.99 Aperitif/Amaro Aperitif 90 Dubonnet, 19% abv United States $17.99 Aperitif/Amaro Aperitivo 87 Vincenzi Bellini Peach, 18% abv, 1 L France n/a Aperitif/Amaro Aperitivo 86 Nonino L'Aperitivo, 21% abv Italy $31.99 Baijiu/Kaoliang Kaoliang Liquor 96 Yushan Kaoliang Liquor Aged 8 Years (Mikado Taiwan n/a CT | T100 Pheasant) 56% -

Durham Research Online

Durham Research Online Deposited in DRO: 02 August 2010 Version of attached le: Accepted Version Peer-review status of attached le: Peer-reviewed Citation for published item: Zhang, J. J. (2010) 'Brand(ing) kinmen : a tourism perspective.', International journal of entrepreneurship and small business., 9 (4). pp. 407-433. Further information on publisher's website: http://dx.doi.org/10.1504/IJESB.2010.032402 Publisher's copyright statement: Copyright c 2010 Inderscience Enterprises Limited. Additional information: Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in DRO • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full DRO policy for further details. Durham University Library, Stockton Road, Durham DH1 3LY, United Kingdom Tel : +44 (0)191 334 3042 | Fax : +44 (0)191 334 2971 https://dro.dur.ac.uk Brand(ing) Kinmen: A Tourism Perspective 1 J.J. Zhang Abstract The recent proliferation of academic works on ‘place branding’ has led to a burgeoning interest in ‘island branding’. This paper posits that islands are geographical features that possess unique characteristics and experience distinctive circumstances, and thus deserve to be analysed on their own terms. In particular, it explores the intricacies in the branding of Kinmen Island, Taiwan, as a battlefield tourism destination. -

Chinese Working-Class Lives: Getting by in Taiwan by H Ill Gates Praying for Justice: Faith, Order; and Community in an American Town B Y C a R O L J

Anthropology of Contemporary Issues A SERIES EDITED BY ROGER SANJEK Farm Work and Fieldwork: American Agriculture in Anthropological Perspective E d i t e d b y M i c h a e l C h i b n i k The Varieties of Ethnic Experience: Kinship, Class, and Gender among California Italian-Americans by M icaela di Leonardo Chinese Working-Class Lives: Getting By in Taiwan by H ill Gates Praying for Justice: Faith, Order; and Community in an American Town b y C a r o l J. G r e e n h o u s e American Odyssey: Haitians in New York b y M i c h e l S. L a g u e r r e From Working Daughters to Working Mothers: Immigrant Women in a New England Industrial Community by Louise Lamphere City of Green Benches: Growing Old in a New Downtown by Maria D. Vesperi Renunciation and Reformulation: A Study of Conversion in an American Sect by H arriet W hitehead Womens Work and Chicano Families: Cannery Workers of the Santa Clara Valley by Patricia Zavella Chinese Working- Class Lives GETTING BY IN TAIWAN Hill Gates Cornell University Press Ithaca and London Open access edition funded by the National Endowment for the Humanities/ Andrew W. Mellon Foundation Humanities Open Book Program. Copyright © 1987 by Cornell University All rights reserved. Except for brief quotations in a review, this book, or parts thereof, must not be reproduced in any form without permission in writing from the publisher. For information, address Cornell University Press, Sage House, 512 East State Street, Ithaca, New York 14850, or visit our website at cornellpress.cornell.edu.