Case No COMP/M.6807 - MERCURIA ENERGY ASSET MANAGEMENT / SINOMART KTS DEVELOPMENT / VESTA TERMINALS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Energy 2012 Conference & Exhibition

GLOBAL 12 ENERGY 20 29/30/31 OCTOBER 2012 HOTEL PRESIDENT WILSON Global Energy Geneva 2012 Where the oil & gas trade meets...with key participation of Cargill, Gunvor, Lundin, Lukoil, Mercuria, Socar, Trafigura To register: www.globalenergygeneva.com GLOBAL 12 ENERGY 20 GLOBAL ENERGY 2012 CONFERENCE & EXHIBITION 29/30/31 October 2012, Hotel President Wilson, Geneva T: +41 (0) 22 321 74 80 | F: +41 (0) 22 321 74 82 | E: [email protected] | www.globalenergygeneva.com About Global Energy 2012 The oil and gas trade is critical to the global economy and the effect of energy prices and trade is more profound than for any other traded commodity. Global Energy is a trade show, conference and exhibition unique to Geneva. Global Energy 2012 is being held on October 29/30/31 at the prestigious Hotel President Wilson in the heart of Geneva. The event brings together energy traders, banks, policymakers, delivering important keynote speeches and panel debates. Global Energy 2012 takes place during an important week in the Geneva commodities trade calendar. It will be attended by a “who’s who” in oil and gas in Switzerland and abroad. Who will attend Global Energy 2012? Major international oil & gas trading firms Traders from small and medium-sized firms throughout the globe Leaders in the Swiss energy trade community Upstream oil and gas majors – interested in the global S&D of oil and gas Oil and gas investors, including family offices and private banks Trade financiers specialising in oil and gas Professional firms: lawyers, advisory/management -

Redstone Commodity Update Q3

Welcome to the Redstone Commodity Update 2020: Q3 Welcome to the Redstone Commodity Moves Update Q3 2020, another quarter in a year that has been strongly defined by the pandemic. Overall recruitment levels across the board are still down, although we have seen some pockets of hiring intent. There appears to be a general acknowledgement across all market segments that growth must still be encouraged and planned for, this has taken the form in some quite senior / structural moves. The types of hires witnessed tend to pre-empt more mid-junior levels hires within the same companies in following quarters, which leaves us predicting a stronger than expected finish to Q4 2020 and start to Q1 2021 than we had previously planned for coming out of Q2. The highest volume of moves tracked fell to the energy markets, notably, within power and gas and not within the traditional oil focused roles, overall, we are starting to see greater progress towards carbon neutrality targets. Banks such as ABN, BNP and SocGen have all reduced / pulled out providing commodity trade finance, we can expect competition for the acquiring of finance lines to heat up in the coming months until either new lenders step into the market or more traditional lenders swallow up much of the market. We must also be aware of the potential impact of the US elections on global trade as countries such as Great Britain and China (amongst others) await the outcome of the impending election. Many national trade strategies and corporate investment strategies will hinge on this result in a way that no previous election has. -

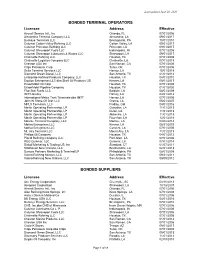

Bonded Terminal Operators

Last updated June 26, 2020 BONDED TERMINAL OPERATORS Licensee Address Effective Aircraft Service Intl., Inc Orlando, FL 07/01/2006 Alexandria Terminal Company LLC Alexandria, LA 09/01/2017 Buckeye Terminals LLC Breinigsville, PA 10/01/2010 Calumet Cotton Valley Refining LLC Cotton Valley, LA 09/01/2017 Calumet Princeton Refining LLC Princeton, LA 09/01/2017 Calumet Shreveport Fuels LLC Indianapolis, IN 07/01/2006 Calumet Shreveport Lubricants & Waxes LLC Shreveport, LA 09/01/2017 Chalmette Refining LLC Houston, TX 07/01/2006 Chalmette Logistics Company LLC Chalmette, LA 07/01/2018 Chevron USA Inc San Ramon, CA 07/01/2006 Citgo Petroleum Corp Tulsa, OK 07/01/2006 Delta Terminal Services LLC Harvey, LA 10/01/2018 Diamond Green Diesel, LLC San Antonio, TX 01/01/2014 Enterprise Refined Products Company, LLC Houston, TX 04/01/2010 Equilon Enterprises LLC dba Shell Oil Products US Kenner, LA 05/01/2017 ExxonMobil Oil Corp Houston, TX 07/01/2006 ExxonMobil Pipeline Company Houston, TX 01/01/2020 Five Star Fuels, LLC Baldwin, LA 08/01/2009 IMTT-Gretna Harvey, LA 04/01/2012 International-Matex Tank Terminals dba IMTT Harvey, LA 07/01/2006 John W Stone Oil Dist, LLC Gretna, LA 05/01/2007 MPLX Terminals, LLC Findlay, OH 04/01/2016 Martin Operating Partnership, LP Gueydan, LA 11/01/2013 Martin Operating Partnership, LP Dulac, LA 11/01/2013 Martin Operating Partnership, LP Abbeville, LA 11/01/2013 Martin Operating Partnership, LP Fourchon, LA 12/01/2016 Monroe Terminal Company, LLC Monroe, LA 04/08/2014 Motiva Enterprises LLC Kenner, LA 08/21/2009 Motiva Enterprises LLC Convent, LA 07/01/2006 Mt. -

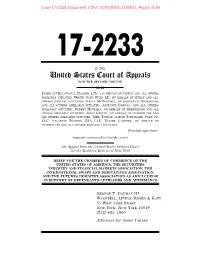

Amici Brief File Stamped 020718(Pdf)

Case 17-2233, Document 173-2, 02/07/2018, 2231672, Page1 of 39 17-2233 IN THE United States Court of Appeals FOR THE SECOND CIRCUIT >> >> PRIME INTERNATIONAL TRADING LTD., ON BEHALF OF ITSELF AND ALL OTHERS SIMILARLY SITUATED, WHITE OAKS FUND LP, ON BEHALF OF ITSELF AND ALL OTHERS SIMILARLY SITUATED, KEVIN MCDONNELL, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED,ANTHONY INSINGA, AND ALL OTHERS SIMILARLY SITUATED, ROBERT MICHIELS, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, JOHN DEVIVO, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, NEIL TAYLOR, AARON SCHINDLER, PORT 22, LLC, ATLANTIC TRADING USA LLC, XAVIER LAURENS, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, Plaintiffs-Appellants, (caption continued on inside cover) On Appeal from the United States District Court for the Southern District of New York BRIEF FOR THE CHAMBER OF COMMERCE OF THE UNITED STATES OF AMERICA, THE SECURITIES INDUSTRY AND FINANCIAL MARKETS ASSOCIATION, THE INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, AND THE FUTURES INDUSTRY ASSOCIATION AS AMICI CURIAE IN SUPPORT OF DEFENDANTS-APPELLEES AND AFFIRMANCE GEORGE T. CONWAY III WACHTELL, LIPTON, ROSEN & KATZ 51 West 52nd Street New York, New York 10019 (212) 403–1000 Attorneys for Amici Curiae Case 17-2233, Document 173-2, 02/07/2018, 2231672, Page2 of 39 MICHAEL SEVY, ON BEHALF OF HIMSELF AND ALL OTHERS SIMILARLY SITUATED, GREGORY H. SMITH, INDIVIDUALLY AND ON BEHALF OF ALL OTHERS SIMILARLY SITUATED, PATRICIA BENVENUTO, ON BEHALF OF HERSELF AND ALL OTHERS SIMI- -

Oil Producers Eye Asia As Western Demand Falters

Oil Producers Eye Asia As Western Demand Falters SPECIAL PDF REPORT SEPTEMBER 2011 An oil rig lights up Cape Town harbour as the sun sets, August 6, 2011. REUTERS/Mike Hutchings Oil price volatility a concern for Asia Indian Oil bars Vitol from tenders-sources Two reasons why Asia's still thirsty for crude: Clyde Russell Iran imports 4-5 cargoes of gasoline per month-sources Litasco 2011 revenue to rise 10 pct -CEO Iran restores fuel oil export vols from Oct COMMODITIESOIL PRODUCERS SHIVER EYE ASIA AFTER AS WESTERNU.S. CREDIT DEMAND DOWNGRADE FALTERS SEPTEMBER AUGUST 20112011 Oil price volatility a concern for Asia SINGAPORE, Sept 8 (Reuters) - il traders have been the only beneficiaries from this year's sharp swings in energy prices, but even they have been caught off guard at times, falling prey to geopolitics and wider financial market risk appetite swings. That sums up reflections at Singapore's Asia Pacific Petroleum Conference (APPEC) this week, where oil traders, O company executives and business leaders gathered to discuss an increasingly turbulent and volatile trading envi- ronment. Three years on from the deepest recession since the Great Depression, oil producers and trading firms continue to look to Asia as the saviour for energy markets, while Europe and the U.S. struggle to sustain an economic recovery. This tension has made oil markets the most volatile since 2009, complicating trading strategies and giving trading houses an overdose of the price fluctuations they normally thrive on. "It's too much volatility and sometimes it's not easy to develop trading strategies," said Tony Nunan, a risk manager with To- kyo-based Mitsubishi Corp on the sidelines of the conference. -

Redstone Commodity Update Q4 2020

Welcome to the Redstone Commodity Update 2020: Q4 Welcome to the Redstone Commodity Moves Update Q4 2020, a very interesting period to report on as Redstone witnessed the busiest quarter of the year so far. This is exactly the opposite to what we have witnessed in previous years, the stronger than usual recruitment drive was very much spear headed by a particularly strong showing in the energy space which in turn was led by energy recruitment activity within the EMEA region which we shall cover below. Overall EMEA saw the largest volume of moves in each of the covered sections with the Americas outperforming Asia consistently outside of the Shipping and Bunker space. Overall as we enter 2021 right across the board commodities markets seem to be entering a bullish period with talk of a new super cycle driven by green led commodities and energy. The early signs for 2021 from a recruitment standpoint seem quite positive with many companies who held back last year making early approaches for recruitment projects, many buoyed by the rollout of various Covid-19 vaccines. The certainty around Brexit and the US election allows people to make their plans accordingly with the remaining ongoing issues (such disruption in the US relating to fallout from the election and a serious uptick in Corona cases throughout the western world / new strains etc) seemingly not putting investors off, as at least in the medium term, we can see the light at the end of the tunnel. Noteworthy Energy Talent Moves EMEA saw the greatest volume of moves in Q4 2020 further extending the volumes previously witnessed in terms of both total number of moves reported and as a percentage share of total moves tracked, within this we can see a particularly strong performance for all things power, gas or LNG related, as European power and gas markets provide ROI’s that are too attractive to ignore. -

Chapter 11 ) WHITING PETROLEUM CORPORATION, ) Case No

Case 20-32021 Document 280 Filed in TXSB on 05/06/20 Page 1 of 123 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) WHITING PETROLEUM CORPORATION, ) Case No. 20-32021 (DRJ) et al.,1 ) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGIES, AND DISCLAIMERS REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS The Schedules of Assets and Liabilities (collectively with attachments, the “Schedules”) and the Statements of Financial Affairs (collectively with attachments, the “Statements,” and together with the Schedules, the “Schedules and Statements”), filed by the above-captioned debtors and debtors in possession (collectively, the “Debtors”), were prepared pursuant to section 521 of title 11 of the United States Code (the “Bankruptcy Code”) and rule 1007 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) by the Debtors’ management, with the assistance of the Debtors’ advisors, and are unaudited. These Global Notes and Statement of Limitations, Methodologies, and Disclaimers Regarding the Debtors’ Schedules of Assets and Liabilities and Statements of Financial Affairs (the “Global Notes”) are incorporated by reference in, and comprise an integral part of, each Debtor’s respective Schedules and Statements, and should be referred to and considered in connection with any review of the Schedules and Statements. While the Debtors’ management has made reasonable efforts to ensure that the Schedules and Statements are as accurate and complete as possible under the circumstances, based on information that was available at the time of preparation, inadvertent errors, inaccuracies, or omissions may have occurred or the Debtors may discover subsequent information that requires material changes to the Schedules and Statements. -

17-2233, Document 114, 11/01/2017, 2162193, Page1 of 93 RECORD NO

Case 17-2233, Document 114, 11/01/2017, 2162193, Page1 of 93 RECORD NO. 17-2233 In The United States Court of Appeals For The Second Circuit PRIME INTERNATIONAL TRADING, LTD., ON BEHALF OF ITSELF AND ALL OTHERS SIMILARLY SITUATED, WHITE OAKS FUND LP, ON BEHALF OF ITSELF AND ALL OTHERS SIMILARLY SITUATED, KEVIN MCDONNELL, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, ANTHONY INSINGA, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, ROBERT MICHIELS, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, JOHN DEVIVO, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, NEIL TAYLOR, AARON SCHINDLER, PORT 22,LLC, ATLANTIC TRADING USA, LLC, XAVIER LAURENS, ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, Plaintiffs – Appellants, MICHAEL SEVY, ON BEHALF OF HIMSELF AND ALL OTHERS SIMILARLY SITUATED,, GREGORY H. SMITH, INDIVIDUALLY AND ON BEHALF OF ALL OTHERS SIMILARLY SITUATED, PATRICIA BENVENUTO, ON BEHALF OF HERSELF AND ALL OTHERS SIMILARLY SITUATED, DAVID HARTER, ON BEHALF OF HIMSELF AND OTHER SIMILARLY SITUATED PLAINTIFFS, MELISSINOS EUPATRID LP, BEHALF OF ITSELF AND ALL OTHERS SIMILARLY SITUATED, FTC CAPITAL GMBH, ON BEHALF OF ITSELF AND ALL OTHERS SIMILARLY SITUATED, WILLIAM KARKUT, CHRISTOPHER CHARTIER, ON BEHALF OF HIMSELF AND ALL OTHERS SIMILARLY SITUATED, PRAETOR CAPITAL CAYMAN LTD., ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, PRAETOR CAPITAL MANAGEMENT LTD., ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, PRAETOR VII FUTURES AND OPTIONS MASTER FUND LTD., ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, PRAETOR VII FUTURES & OPTIONS FUND LTD., ON BEHALF OF THEMSELVES AND ALL OTHERS SIMILARLY SITUATED, Plaintiffs, v. -

Exchange Council Election 2021 / Börsenratswahl 2021

Exchange Council Election 2021 / Börsenratswahl 2021 4. Bulletin / 4. Mitteilung 22.03.2021 Leipzig Announcement The Election Committee announces the following: Election groups, provisional register of voters and allocation of seats 1. Pursuant to Article 5 SächsBörsDVO, the companies admitted to participate in exchange trading are represented in the Exchange Council in the following four groups: 1. Producers, suppliers, processors and distributors (“Group 1”), 2. Members of the central clearing house, European Commodity Clearing AG, of EEX Group authorised to settle both their own transactions and the transactions of their customers and transactions of trading participants without a clearing licence via the European Commodity Clearing AG (“Group 2”), 3. Trading companies, financial service providers and banking institutes unless these are covered by figure 2 (“Group 3”) and 4. Commercial consumers, their service providers that are not covered by figure 3 and other non-financial asset-based trading companies (“Group 4”). 2. Below you will find the provisional registers of voters including the respective valid election proposals with the request to notify us in writing or by e-mail by 31 March 2021 if you do not agree with the allocation of your company to one of the aforementioned election groups or a negative decision by the Election Committee on the validity of an election proposal (right of objection pursuant to Article 12 or right of application pursuant to Article 11 para. 6 of the SächsBörsDVO). 3. According to the calculation rules in Article 6 SächsBörsDVO, the seats are preliminarily distributed among the four groups as follows: Group Group 1 Group 2 Group 3 Group 4 Seats 12 2 1 9 Please do not hesitate to contact us under [email protected] in case you have any questions. -

Commodity Traders Boost Role As Banking Model Fades

www.poten.com June 30, 2013 Commodity Traders Boost Role As Banking Model Fades The departure this month of Morgan Stanley’s LNG trading desk to Swiss commodities giant Glencore Xtrata does not signal a death knell for investment banks in the physical market. But it is the latest in a trend that has seen traditional commodity traders evolve into a potent force in short-term trading. With internal credit restrictions reducing the amount of risk capital available for trading, investment banks have either left the market or reduced their involvement to more specialized roles. “Morgan Stanley made no secret that they wanted to sell or somehow monetize their LNG desk, and the exodus says a lot about the end of the banking model into trading,” notes one source who says the banks no longer allow their trading desks to take speculative positions that are not fully hedged or supported by back-to-back sales. As the banks reduce their presence, trading giants Vitol, Trafigura and Gunvor have upped their game and are being joined by the likes of Glencore Xtrata, Noble Group, Axpo and Koch Supply & Trading. Singapore’s Temasek Holdings has also set up a LNG trading arm called Pavilion Energy with $1 billion in capital, which will begin operations in September, while Azerbaijan has established Socar Trading in Switzerland. Banks have tried numerous times to break into the physical LNG market, but have mainly set their sights on the Americas. Goldman Sachs backed the now defunct Calais import terminal in Maine, and was rumored to have traded cargoes from Trinidad’s Atlantic LNG in 2007 before its efforts faded at the end of the decade. -

Redstone Commodity Update Q3 2015

The Redstone Commodity Update Welcome to the Redstone Commodity Update 2015: Q3 This quarter has certainly been an interesting one with increased volatility across commodities prices. Diminished Chinese consumption of raw materials married with depreciating foreign currencies has led to many commentators noting that the commodity bear market could be here for a while. However, there is still plenty of recruiting activity with most of our tracked hires taking place in EMEA. Well-financed companies with a long term outlook are certainly finding that they can cherry pick candidates for their business units. Noteworthy Energy Talent Moves With headlines dominated by the price of crude oil and diminishing upstream headcount, the principal focus has remained centred on the sales and trading of refined products. The clear winner in the hiring leagues for Q3 has been the traditional trading house outfit, accounting for over 1 in 4 tracked hires – with scoops for vertically-integrated oil companies having decreased considerably in comparison to 18-24 months ago. Managing Director of Commodities Sales & Structuring David Gallagher has left Goldman Sachs to join Mercuria Energy Group. He was hired as the new head of the Group’s London office and Head of Structuring. David Leavenworth, Attila Konkoly, and Cary Robinson, the former Energy team within Black River Asset Management, have joined Freepoint Commodities in Minneapolis. Leavenworth, leading the team, has been appointed to a Senior Vice President role for petroleum products trading while analysts Attila and Cary have been assigned to Vice President posts. Another hire by Freepoint Commodities was coal trader Adam Giannone in Houston, previously Executive Director with J.P. -

The World Is Screaming for Oil After 20 Yearsand Eroded Spare

INDUSTRIAL CONTEXT FOR US ENDEAVOUR 2005-2020 FINAL REPORT 02.10.2020 Executive summary The need to go out – US GoM deepwater was the best initial choice Strong strategic reasons to seek international US GoM deepwater was the rational choice opportunities for a NCS player in 2005 • Macro environment called for non-OPEC production • Steep creaming curve, low political risk, attractive growth and improved oil price fiscal regime and no privileges to NOCs • IOCs were priced on growth outlooks • All significant deepwater operators entered GOM • NCS production appeared to have peaked with • Statoil was the largest deepwater operator globally NCS players' value penalized due to low R/P ratios and entered early with an attractive Encana deal • NCS players were leading in deepwater/subsea • Statoil was an aggressive explorer in US GoM, but technologies and had organizational capacity underestimated geological and business challenges Historical and projected oil production as seen from 2005 Top deepwater operators in 2005 US GoM investment* 2005-19 Million barrels per day Crude production deeper than 125m Billion USD real 2020 4 Statoil + Hydro NCS Petrobras 3.5 ExxonMobil BP 3 Shell Total 2.5 2006 Annual Chevron Energy Outlook Eni 2 Freeport CNRL 1.5 CNOOC Anadarko 1 TAQA US GoM Santos 0.5 deepwater Hess 2005 Resource Report CoP 0 Murphy Oil 1990 1995 2000 2005 2010 2015 2020 2025 Woodside *M&A, capex and expex Source: UCube; EIA; NPD; Rystad Energy research and analysis 2 Executive summary Shale – a true revolution early understood by Statoil