The World Is Screaming for Oil After 20 Yearsand Eroded Spare

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Energy 2012 Conference & Exhibition

GLOBAL 12 ENERGY 20 29/30/31 OCTOBER 2012 HOTEL PRESIDENT WILSON Global Energy Geneva 2012 Where the oil & gas trade meets...with key participation of Cargill, Gunvor, Lundin, Lukoil, Mercuria, Socar, Trafigura To register: www.globalenergygeneva.com GLOBAL 12 ENERGY 20 GLOBAL ENERGY 2012 CONFERENCE & EXHIBITION 29/30/31 October 2012, Hotel President Wilson, Geneva T: +41 (0) 22 321 74 80 | F: +41 (0) 22 321 74 82 | E: [email protected] | www.globalenergygeneva.com About Global Energy 2012 The oil and gas trade is critical to the global economy and the effect of energy prices and trade is more profound than for any other traded commodity. Global Energy is a trade show, conference and exhibition unique to Geneva. Global Energy 2012 is being held on October 29/30/31 at the prestigious Hotel President Wilson in the heart of Geneva. The event brings together energy traders, banks, policymakers, delivering important keynote speeches and panel debates. Global Energy 2012 takes place during an important week in the Geneva commodities trade calendar. It will be attended by a “who’s who” in oil and gas in Switzerland and abroad. Who will attend Global Energy 2012? Major international oil & gas trading firms Traders from small and medium-sized firms throughout the globe Leaders in the Swiss energy trade community Upstream oil and gas majors – interested in the global S&D of oil and gas Oil and gas investors, including family offices and private banks Trade financiers specialising in oil and gas Professional firms: lawyers, advisory/management -

Bakken Production Optimization Program Prospectus

Bakken Production Optimization Program BAKKEN PRODUCTION OPTIMIZATION PROGRAM 2.0 PROSPECTUS PROGRAM INTRODUCTION Led by the Energy & Environmental Research Center (EERC), the highly successful Bakken Production Optimization Program (BPOP), funded by its members and the North Dakota Industrial Commission, is continuing for the time frame of 2017–2020. The goal of this research program, BPOP 2.0, is to improve Bakken system oil recovery and reduce its environmental footprint. The results of the 3-year program will increase well productivity and the economic output of North Dakota’s oil and gas resources, decrease environmental impacts of wellsite operations, and reduce demand for infrastructure construction and maintenance. BPOP 1.0 PARTNERS A premier partnership program was recently completed which has been cited as an exemplary model by others nationwide. It has demonstrated that state lawmakers, state regulators, and industry can work together for positive results for shareholders and taxpayers alike. Phase I partners focused research on industry-driven challenges and opportunities. Continental Resources, Inc. ® Marathon Oil Corporation America’s Oil Champion Whiting Petroleum Corporation North Dakota Oil and Gas Research Program ConocoPhillips Company Nuverra Environmental Solutions Hitachi Hess Corporation Oasis Petroleum, Inc. SM Energy XTO Energy, Inc. BPOP 1.0 ACHIEVEMENTS (2013–2016) Continental’s Hawkinson Project Water Use and Handling Forecast Aimed at significantly increasing total production and A summary of trends in the Bakken, an estimation of production rates from North Dakota oil wells where oil future demand/disposal needs, an overview of treatment reserves of the second and third benches of the Three technologies, recycling/reuse considerations, and a Forks Formation, located just below the Bakken oil summary of implications for BPOP partners were created. -

Peak Oil, Peak Energy Mother Nature Bats Last

Peak Oil, Peak Energy Mother Nature Bats Last Martin Sereno 1 Feb 2011 (orig. talk: Nov 2004) Oil is the Lifeblood of Industrial Civilization • 80 million barrels/day, 1000 barrels/sec, 1 cubic mile/year • highly energy-dense • easy to transport, store • moves goods and people • allows us to fly (there will never be a battery-operated jet plane) • digs huge holes and puts up huge buildings • ballooned our food supply (fertilize, cultivate, irrigate, transport) • our 'stuff' is made from it (iPods to the roads themselves) • we're not "addicted to oil" -- that's like saying a person has an "addiction to blood" Where Oil Comes From • raw organic material for oil (e.g., from plankton) is present in low concentrations in ‘all’ sedimentary rocks, but esp. from two warm periods 90 million and 140 million years ago • temperature rises with depth (radioactivity, Kelvin’s mistake) • oil is generated in rocks heated to 60-120 deg Celsius • rocks at this temp. occur at different depths in different places (N.B.: water depth doesn't count) • oil is ‘cracked’ to natural gas at higher temps (deeper) • abiotic oil from “crystalline basement” is negligible, if it exists • exhausted oil fields do not refill Recoverable Oil • oil must collect in a “trap” to be practically recoverable • a trap is a permeable layer capped by an impermeable one • obvious traps: anticlines, domes (“oil in those hills”) • less obvious traps found by seismic imaging: turned up edges of salt domes, near buried meteorite crater (Mexico) • harder-to-get-at traps: shallow continental shelf (GOM) • even-harder-to-get-at traps: edge continental slope (Macondo, resevoir pressure: 12,000 pounds [6 tons] per sq inch) • essentially no oil in basaltic ocean floor or granitic basement (Used to be!) Second Largest Oilfield Cantarell used to supply 2% of world oil (water) Guzman, A.E. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Oil & Gas, and Mining Associations, Organizations, and Company

2021 OIL & GAS, AND MINING ASSOCIATIONS, ORGANIZATIONS, AND COMPANY INFORMATION UNIVERSITY OF COLORADO DENVER ASSOCIATIONS AND ORGANIZATIONS Colorado Cleantech Industry Association – https://coloradocleantech.com/ Colorado Energy Coalition – http://www.metrodenver.org/news/news-center/2017/02/colorado-energy-coalition- takes-energy-%E2%80%98asks-to-congressional-delegation-in-washington,-dc/ Colorado Mining Association (CMA) – https://www.coloradomining.org/default.aspx Colorado Oil and Gas Association (COGA) – http://www.coga.org/ Colorado Petroleum Association – http://www.coloradopetroleumassociation.org/ Colorado Renewable Energy Society (CRES) – https://www.cres-energy.org/ Society of Petroleum Engineers – https://www.spe.org/en/ United States Energy Association – https://www.usea.org/ OIL AND GAS Antero Resources – http://www.anteroresources.com/ Antero Resources is an independent exploration and production (E&P) company engaged in the exploitation, development, and acquisition of natural gas, NGLs and oil properties located in the Appalachia Basin. Headquartered in Denver, Colorado, we are focused on creating value through the development of our large portfolio of repeatable, low cost, liquids-rich drilling opportunities in two of the premier North American shale plays. Battalion Oil – https://battalionoil.com/ http://www.forestoil.com/ Battalion Oil (Formerly Halcón Resources Corporation) is an independent energy company focused on the acquisition, production, exploration and development of onshore liquids-rich assets in the United States. While Battalion is a new venture, we operate on a proven strategy used in prior, successful ventures. We have experienced staff and use the most advanced technology, enabling us to make informed and effective business decisions. Spanish for hawk, Halcón embraces the vision and agility to become a resource powerhouse in the oil and gas industry. -

National Oil Companies: Business Models, Challenges, and Emerging Trends

Corporate Ownership & Control / Volume 11, Issue 1, 2013, Continued - 8 NATIONAL OIL COMPANIES: BUSINESS MODELS, CHALLENGES, AND EMERGING TRENDS Saud M. Al-Fattah* Abstract This paper provides an assessment and a review of the national oil companies' (NOCs) business models, challenges and opportunities, their strategies and emerging trends. The role of the national oil company (NOC) continues to evolve as the global energy landscape changes to reflect variations in demand, discovery of new ultra-deep water oil deposits, and national and geopolitical developments. NOCs, traditionally viewed as the custodians of their country's natural resources, have generally owned and managed the complete national oil and gas supply chain from upstream to downstream activities. In recent years, NOCs have emerged not only as joint venture partners globally with the major oil companies, but increasingly as competitors to the International Oil Companies (IOCs). Many NOCs are now more active in mergers and acquisitions (M&A), thereby increasing the number of NOCs seeking international upstream and downstream acquisition and asset targets. Keywords: National Oil Companies, Petroleum, Business and Operating Models * Saudi Aramco, and King Abdullah Petroleum Studies and Research Center (KAPSARC) E-mail: [email protected] Introduction historically have mainly operated in their home countries, although the evolving trend is that they are National oil companies (NOCs) are defined as those going international. Examples of NOCs include Saudi oil companies that have significant shares owned by Aramco (the largest integrated oil and gas company in their parent government, and whose missions are to the world), Kuwait Petroleum Corporation (KPC), work toward the interest of their country. -

Statoil ASA Statoil Petroleum AS

Offering Circular A9.4.1.1 Statoil ASA (incorporated with limited liability in the Kingdom of Norway) Notes issued under the programme may be unconditionally and irrevocably guaranteed by Statoil Petroleum AS (incorporated with limited liability in the Kingdom of Norway) €20,000,000,000 Euro Medium Term Note Programme On 21 March 1997, Statoil ASA (the Issuer) entered into a Euro Medium Term Note Programme (the Programme) and issued an Offering Circular on that date describing the Programme. The Programme has been subsequently amended and updated. This Offering Circular supersedes any previous dated offering circulars. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes issued prior to the date hereof. Under this Programme, Statoil ASA may from time to time issue notes (the Notes) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). The Notes may be issued in bearer form or in uncertificated book entry form (VPS Notes) settled through the Norwegian Central Securities Depositary, Verdipapirsentralen ASA (the VPS). The maximum aggregate nominal amount of all Notes from time to time outstanding will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described herein). The payments of all amounts due in respect of the Notes issued by the Issuer may be unconditionally and irrevocably guaranteed by Statoil A6.1 Petroleum AS (the Guarantor). The Notes may be issued on a continuing basis to one or more of the Dealers specified on page 6 and any additional Dealer appointed under the Programme from time to time, which appointment may be for a specific issue or on an ongoing basis (each a Dealer and together the Dealers). -

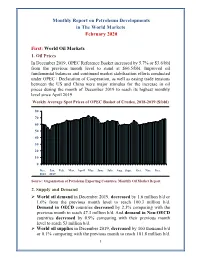

Monthly Report on Petroleum Developments in the World Markets February 2020

Monthly Report on Petroleum Developments in The World Markets February 2020 First: World Oil Markets 1. Oil Prices In December 2019, OPEC Reference Basket increased by 5.7% or $3.6/bbl from the previous month level to stand at $66.5/bbl. Improved oil fundamental balances and continued market stabilization efforts conducted under OPEC+ Declaration of Cooperation, as well as easing trade tensions between the US and China were major stimulus for the increase in oil prices during the month of December 2019 to reach its highest monthly level since April 2019. Weekly Average Spot Prices of OPEC Basket of Crudes, 2018-2019 ($/bbl) 80 70 60 50 40 30 20 10 0 Dec. Jan. Feb. Mar. April May June July Aug. Sept. Oct. Nov. Dec. 2018 2019 Source: Organization of Petroleum Exporting Countries, Monthly Oil Market Report. 2. Supply and Demand World oil demand in December 2019, decreased by 1.6 million b/d or 1.6% from the previous month level to reach 100.3 million b/d. Demand in OECD countries decreased by 2.3% comparing with the previous month to reach 47.3 million b/d. And demand in Non-OECD countries decreased by 0.9% comparing with their previous month level to reach 53 million b/d. World oil supplies in December 2019, decreased by 100 thousand b/d or 0.1% comparing with the previous month to reach 101.8 million b/d. 1 Non-OPEC supplies remained stable at the same previous month level of 67.2 million b/d. Whereas preliminary estimates show that OPEC crude oil and NGLs/condensates total supplies decreased by 0.6% comparing with the previous month to reach 34.5 million b/d. -

Whiting Petroleum Corporation and Our Ability to Grow MMBOE: One Million BOE

Whiting Petroleum Corporation ANNUAL REPORT 8 0 0 2 NATU RAL HUM+AN Resources ABOUT THE COVER Having assembled a solid foundation of quality assets through acquisition, we are now more focused on organic drilling activity and on the development of previously acquired properties. We believe that our experienced team of management, engineering and geoscience professionals is generating superior results as evidenced by our reserves and production growth in the Bakken formation in North CONTENTS Dakota and our two CO 2 enhanced oil recovery projects. Corporate Profile 1 From our Bakken play in North Dakota, our average net daily production jumped 516% to 14,165 BOE in December 2008 Financial and Operations Summary 2 from 2,300 BOE in December 2007. We also completed Letter to the Shareholders 4 our first two infill wells in the Sanish field, which we believe Drilling and Operations Overview 7 adds a total of 78 potential infill well locations. Also of note was our first Three Forks horizontal well completion in the Northern Rockies 8 Sanish field. Production and pressure data from this well are Central Rockies 10 being analyzed to determine the viability of developing the Three Forks in the Sanish field. EOR Projects 12 Board of Directors 14 At our two EOR projects, our average net daily production Annual Report on Form 10-K 15 from the Postle and North Ward Estes fields increased 26% to 13,700 BOE in December 2008 from 10,900 BOE in Corporate Investor Information Inside back cover December 2007. We expect production from both EOR projects to continue to increase as 2009 progresses. -

Future Supply of Oil and Gas from the Gulf of Mexico

Future Supply of Oil and Gas From the Gulf of Mexico U.S. GEOLOGICAL SUltyEY PROFESSIONAL PAPER 1294 Future Supply of Oil and Gas From the Gulf of Mexico By E. D. Attanasi and]. L. Haynes U.S. GEOLOGICAL SURVEY PROFESSIONAL PAPER 1294 An engineering-economic costing algorithm combined with a discovery process model to forecast long-run incremental costs of undiscovered oil and gas UNITED STATES GOVERNMENT PRINTING OFFICE, WASHINGTON : 1983 UNITED STATES DEPARTMENT OF THE INTERIOR JAMES G. WATT, Secretary GEOLOGICAL SURVEY Dallas L. Peck, Director Library of Congress Cataloging in Publication Data Attanasi, E. D. Future supply of oil and gas from the Gulf of Mexico. (U.S. Geological Survey professional paper ; 1294) Bibliography: p. 1. Petroleum in submerged lands Mexico, Gulf of. 2. Gas, Natural, in submerged lands Mexico, Gulf of. I. Haynes, J. (John), 1954- . II. Title. III. Series: Geological Survey professional paper ; 1294. TN872.A5A87 1983 553.2'8'0916364 83-600030 ____ ____________ For sale by the Superintendent of Documents, U.S. Government Printing Office Washington, D.C. 20402 CONTENTS Page Abstract 1 Introduction 1 Engineering-economic model 3 Methodology 3 Engineering data and assumptions 5 Field classification 5 Field design 6 Production schedules of oil and nonassociated gas wells 7 Economic assumptions and variables 8 Field development costs 8 Production costs and production related taxes 9 Assumptions for after-tax net present value calculations 10 Exploration costs 10 Industry behavior and market conditions 10 Forecasting future discoveries 11 Discovery process model 11 Estimated marginal cost functions for undiscovered recoverable oil and gas resources in the Gulf of Mexico 12 Conclusions and implications 16 References cited 16 Appendix A 17 Appendix B 20 ILLUSTRATIONS FIGURE 1. -

Breakdown of the ATP Group's Corporate Bonds, Year-End 2019

Breakdown of the ATP Group's corporate bonds, year-end 2019 Market value Companies DKKm 1011778 BC ULC / New Red Finance Inc 20.8 24 Hour Fitness Worldwide Inc 6.3 ABH Financial Ltd Via Alfa Holding Issuance PLC 19.9 Adient Global Holdings Ltd 6.1 ADT Security Corp/The 18.5 Advanced Disposal Services Inc 10.5 Aeropuerto Internacional de Tocumen SA 7.5 Air Medical Group Holdings Inc 13.5 Albertsons Cos Inc / Safeway Inc / New Albertsons 10.3 Aleris International Inc 5.4 Alfa Bank AO Via Alfa Bond Issuance PLC 9.6 Alliant Holdings Intermediate LLC / Alliant Holdin 5.4 Ally Financial Inc 26.8 AMC Networks Inc 15.4 American Builders & Contractors Supply Co Inc 7.1 Antero Midstream Partners LP / Antero Midstream Fi 3.0 Antero Resources Corp 6.0 Aramark Services Inc 15.8 Arconic Inc 21.3 Ardagh Packaging Finance PLC / Ardagh Holdings USA 10.5 Ascend Learning LLC 23.4 Ashland LLC 3.6 ASP AMC Merger Sub Inc 3.4 Associated Materials LLC / AMH New Finance Inc 13.9 Atotech Alpha 2 BV 8.6 Atotech Alpha 3 BV / Alpha US Bidco Inc 10.6 Autoridad del Canal de Panama 3.2 Avantor Inc 24.0 Avon International Operations Inc 7.1 Banco BTG Pactual SA/Cayman Islands 5.4 Banco do Brasil SA/Cayman 64.4 Banco Mercantil del Norte SA/Grand Cayman 7.8 Banco Votorantim SA 2.1 Barclays PLC 7.3 Bausch Health Cos Inc 59.5 BCD Acquisition Inc 7.0 BCPE Cycle Merger Sub II Inc 12.6 Beacon Roofing Supply Inc 20.2 Berry Global Inc 12.1 Bioceanico Sovereign Certificate Ltd 15.4 Blue Racer Midstream LLC / Blue Racer Finance Corp 13.2 Further information 2019 1 Breakdown of -

A Comparative History of Oil and Gas Markets and Prices: Is 2020 Just an Extreme Cyclical Event Or an Acceleration of the Energy Transition?

April 2020 A Comparative History of Oil and Gas Markets and Prices: is 2020 just an extreme cyclical event or an acceleration of the energy transition? Introduction Natural gas markets have gone through an unprecedented transformation. Demand growth for this relatively clean, plentiful, versatile and now relatively cheap fuel has been increasing faster than for other fossil fuels.1 Historically a `poor relation’ of oil, gas is now taking centre stage. New markets, pricing mechanisms and benchmarks are being developed, and it is only natural to be curious about the direction these developments are taking. The oil industry has had a particularly rich and well recorded history, making it potentially useful for comparison. However, oil and gas are very different fuels and compete in different markets. Their paths of evolution will very much depend on what happens in the markets for energy sources with which they compete. Their history is rich with dominant companies, government intervention and cycles of boom and bust. A common denominator of virtually all energy industries is a tendency towards natural monopoly because they have characteristics that make such monopolies common. 2 Energy projects tend to require multibillion – often tens of billions of - investments with long gestation periods, with assets that can only be used for very specific purposes and usually, for very long-time periods. Natural monopolies are generally resolved either by new entrants breaking their integrated market structures or by government regulation. Historically, both have occurred in oil and gas markets.3 As we shall show, new entrants into the oil market in the 1960s led to increased supply at lower prices, and higher royalties, resulting in the collapse of control by the major oil companies.