Avtovaz Stakes on Lada Priora

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jsc Avtovaz Avtovaz Group* Operating Highlights for 2003

ANNUAL REPORT | 2003 | JSC AVTOVAZ AVTOVAZ GROUP* OPERATING HIGHLIGHTS FOR 2003 Vehicle unit sales, JSC AVTOVAZ 2003 2002 Change 000’s units 000’s units % Domestic market 626 577 8.49 Export market 92 98 (6.12) Total 718 675 6.3 Automotive assembly kits sales 98 101 (2.97) RR mln RR mln % Net sales 130,772 119,432 9.49 Operating income 5,941 5,591 6.26 Consolidated Statement 2003 2002 Change of Income** RR mln RR mln % For the year ended 31 December Net sales 130,772 119,432 9.49 Cost of sales (110,003) (99,331) 10.74 Gross profit 20,769 20,101 3.32 Interest expense (3,416) (3,077) (11.02) Other expense, net (14,402) (15,896) (9.4) Net income for the year 2,951 1,128 161.61 Consolidated Balance Sheet** 2003 2002 Change At 31 December RR mln RR mln % Cash and cash equivalents 6,767 2,751 145.98 Other current assets 37,069 33,393 11.01 Non-current assets 108,228 102,836 5.24 Total liabilities 72,562 62,166 16.72 Minority interest 1,290 1,587 (18.71) Total shareholders’ equity 78,212 75,227 3.97 Share price and dividend 2003 2002 Change development, JSC AVTOVAZ*** Share price RR RR % For the year ended 31 December Ordinary share Closing 774.7 679.72 +13.97 Annual high 906.42 1201.31 -24.55 Annual low 582.06 558.64 +4.19 Preference share Closing 471.88 371.17 +27.13 Annual high 525.68 667.54 -21.25 Annual low 339.77 319.10 +6.48 Dividends Per ordinary share 6.00 5.00 +20.0 Per preference share 95.00 17.00 +458.82 * The AVTOVAZ Group mentioned hereinafter is the parent company (JSC AVTOVAZ or the “Company”) and all of its subsidiaries and associated companies. -

Global Monthly Is Property of John Doe Total Toyota Brand

A publication from April 2012 Volume 01 | Issue 02 global europe.autonews.com/globalmonthly monthly Your source for everything automotive. China beckons an industry answers— How foreign brands are shifting strategies to cash in on the world’s biggest auto market © 2012 Crain Communications Inc. All rights reserved. March 2012 A publication from Defeatglobal spurs monthly dAtA Toyota’s global Volume 01 | Issue 01 design boss Will Zoe spark WESTERN EUROPE SALES BY MODEL, 9 MONTHSRenault-Nissan’sbrought to you courtesy of EV push? www.jato.com February 9 months 9 months Unit Percent 9 months 9 months Unit Percent 2011 2010 change change 2011 2010 change change European sales Scenic/Grand Scenic ......... 116,475 137,093 –20,618 –15% A1 ................................. 73,394 6,307 +67,087 – Espace/Grand Espace ...... 12,656 12,340 +316 3% A3/S3/RS3 ..................... 107,684 135,284 –27,600 –20% data from JATO Koleos ........................... 11,474 9,386 +2,088 22% A4/S4/RS4 ..................... 120,301 133,366 –13,065 –10% Kangoo ......................... 24,693 27,159 –2,466 –9% A6/S6/RS6/Allroad ......... 56,012 51,950 +4,062 8% Trafic ............................. 8,142 7,057 +1,085 15% A7 ................................. 14,475 220 +14,255 – Other ............................ 592 1,075 –483 –45% A8/S8 ............................ 6,985 5,549 +1,436 26% Total Renault brand ........ 747,129 832,216 –85,087 –10% TT .................................. 14,401 13,435 +966 7% RENAULT ........................ 898,644 994,894 –96,250 –10% A5/S5/RS5 ..................... 54,387 59,925 –5,538 –9% RENAULT-NISSAN ............ 1,239,749 1,288,257 –48,508 –4% R8 ................................ -

AVTOVAZ Call with Financial Analysts

AVTOVAZ Call with Financial Analysts Nicolas MAURE / Dr. Stefan MAUERER CEO / CFO 16.01.2017 Disclaimer Information contained within this document may contain forward looking statements. Although the Company considers that such information and statements are based on reasonable assumptions taken on the date of this report, due to their nature, they can be risky and uncertain and can lead to a difference between the exact figures and those given or deduced from said information and statements. PJSC AVTOVAZ does not undertake to provide updates or revisions, should any new statements and information be available, should any new specific events occur or for any other reason. PJSC AVTOVAZ makes no representation, declaration or warranty as regards the accuracy, sufficiency, adequacy, effectiveness and genuineness of any statements and information contained in this report. Further information on PJSC AVTOVAZ can be found on AVTOVAZ’s web sites (www.lada.ru/en and http://info.avtovaz.ru). AVTOVAZ Call with Financial Analysts 16.01.2017 2 AVTOVAZ Overview Moscow International Automobile Salon 2016 AVTOVAZ 50-years History 1966/1970 VAZ 2101 2016 LADA XRAY AVTOVAZ Call with Financial Analysts 16.01.2017 4 AVTOVAZ Group: Key information 408 467 Cars & KDs produced 20.1% MOSCOW AVTOVAZ 331 Representative office sales points 30 IZHEVSK LADA-Izhevsk countries TOGLIATTI plant AVTOVAZ Head-office & 2015: 176.5 B-Rub (2.6 B-Euro) Togliatti plants 2016: estimated T/O > 2015 51 527 p. AVTOVAZ Call with Financial Analysts 16.01.2017 5 LADA product portfolio -

FACTS & FIGURES March 2019

FACTS M arch 2019 & FIGURES EDITION HIGHLIGHTS … IN 2018, GROUPE RENAULT ANNOUNCED THAT IT WOULD INVEST 1.4 BILLION EUROS IN FRANCE AND HIRE 5,000 EMPLOYEES OVER THREE YEARS. THESE INVESTMENTS WILL MAINLY GO TOWARDS THE PRODUCTION OF LIGHT COMMERCIAL AND ELECTRIC VEHICLES, OUR TWO GROWTH DRIVERS IN FRANCE. 85% CLIO OF EMPLOYEES ARE PROUD TO WORK FOR GROUPE RENAULT NO. 1 VEHICLE SOLD IN FRANCE NO. 2 IN EUROPE 15 MILLION CLIO SOLD WORLDWIDE SINCE ITS LAUNCH IN 1990 ELECTRIC VEHICLE LEADER IN EUROPE NEARLY ONE IN FOUR ELECTRIC VEHICLES SOLD IN EUROPE IS A RENAULT ONE GROUP, FIVE BRANDS 2 — KEY FIGURES 4 — INDUSTRIAL SITES 6 CONT- — MANUFACTURING 8 — GLOBAL SALES 11 — ENTS VEHICLE RANGE 21 — SERVICES 28 — RENAULT-NISSAN- MITSUBISHI 30 GROUPE RENAULT - 1 ONE GROUPE, FIVE BRANDS … GROUPE RENAULT HAS MANUFACTURED CARS SINCE 1898. TODAY IT IS AN INTERNATIONAL MULTI-BRAND GROUP. TO ADDRESS THE MAJOR TECHNOLOGICAL CHALLENGES OF THE FUTURE, WHILE CONTINUING TO PURSUE ITS PROFITABLE GROWTH STRATEGY, GROUPE RENAULT IS FOCUSING ON INTERNATIONAL EXPANSION. TO THIS END, IT IS DRAWING ON THE SYNERGIES OF ITS FIVE BRANDS (RENAULT, DACIA, RENAULT SAMSUNG MOTORS, ALPINE AND LADA), ELECTRIC VEHICLES, AND ITS UNIQUE ALLIANCE WITH NISSAN AND MITSUBISHI MOTORS. KADJAR DUSTER RENAULT 2,532,567 VEHICLES SOLD IN 2018 (PC + LCV) — Renault, the leading French brand worldwide, is present in 134 countries with nearly 12,000 points of sale. Renault has been making its customers’ lives easier for 120 years. As leader of the European electric vehicle market and committed to motorsport, the brand is driven by passion on a daily basis, with its sensual and warm design. -

STORM Hatchback

Ignition Leads 2013 Introduction Standard Motor Products Europe (SMPE) is one of Europe’s leading manufacturers of high quality, proprietary and private brand ignition leads and sets for the automotive aftermarket. Based in England, SMPE were one of the first specialist aftermarket ignition lead manufacturers in Europe; as such SMPE currently supply many of the major names in the European aftermarket. The extensive KERR NELSON HighVolt product offering is designed, manufactured and supplied utilising state of the art systems and processes. It is this commitment to employing the highest quality systems and processes, which has resulted in SMPE becoming one of the first specialist aftermarket ignition lead suppliers to be awarded ISO9001 ccreditation. A key requirement of ISO9001 is continuous improvement. This philosophy has been embraced in all aspects of SMPE’s business. Evidence of SMPE’s commitment to continuous improvement can be seen in the just-in-time manufacturing process and flexible production setup allowing efficient assembly for a large variety of part numbers to satisfy market requirements. SMPE are focused on new product development driven from a European vehicle parc database and industry leading applications cataloguing. The current KERR NELSON HighVolt programme of ignition leads provides the latest development of a range that has continually evolved to keep pace with the changing demands of both vehicle technology and customer requirements. By embracing the philosophy of continued product improvement SMPE is able to offer: Respected Brand Comprehensive Product Offering Premium Quality Product Outstanding Availability Excellent Technical Support Guaranteed Customer Satisfaction The Role of Ignition Leads in a Conventional Ignition System The primary function of the ignition system is to initiate the firing of the air/fuel mixture in a spark ignition engine. -

Knowing Where It's Going Before It Gets There

Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. To gain additional insight on innovation strategies for your organization and other issues important to your company or see the latest automotive innovation study The highway to growth: Strategies for automotive innovation, visit www.pwc.com/auto. © 2013 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/ structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. -

Bo Andersson CEO Avtovaz AVTOVAZ

Bo Andersson CEO AvtoVAZ AVTOVAZ The Russian Automotive Industry Today & Tomorrow Bo Inge Andersson President & CEO of AVTOVAZ ТВОЙ ГОД ТВОЕ БУДУЩЕЕ 10 June 2015 Current Macroeconomic Situation •1 Global Oil Prices have fallen by over 50 % • In Q1 2015 Russian Income from oil export reduced by 43.5% •2 Imposed Sanctions on Russia from the West • In 2015 estimated affect can reach 75 B-EURO or 4.8% of GDP •3 RUB Rate has plunged vs. EUR and USD • In Q1 2015 EUR/RUB and USD/RUB grew up to 90-100% •4 Cost of Borrowing has increased substantially • In 2014 key interest rate was increased by Russian central bank from 5.5% to 17.0%. Current rate is 12.5% •5 Increasing Inflation and Russian Recession • Annual Inflation in May was 15.8% • GDP decrease in Q1 2015 is 2.2%, annual forecast is -2.5 to -5.0% 3 Passenger Vehicles Market Outlook • AVTOVAZ forecast the Market to drop by 32-36% in 2015 vs. 2014 M-units 3.10 3.00 3.0 2.90 2.8 2.77 2.7 2.68 2.90 2.6 2.60 2.80 2.55 2.5 2.70 2.5 2.4 2.58 2.4 2.52 2.46 2.20 2.40 2.0 2.10 1.85 1.8 1.8 1.59 1.70 1.5 1.4 1.4 1.3 1.50 1.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 4 Actual Optimistic Forecast Pessimistic Forecast Who we are 2015 Leading Manufacturer 585,000 of vehicles in Russia Cars & CKD Own Brand Name LADA Market Share in Russia (4M 2015) 18.7% Market Share in <600 k-RUB segment 51% Dealer Network in 336 Russia dealers Export 29 countries Controlling Alliance Rostec Auto B.V., a part of Shareholder Alliance Renault-Nissan Togliatti, Russia 5 Headquarters The Russian Automotive Industry Majority of Russian plants have problems being cost competitive due to low production capacities k-units / year Production Capacities of Russian Plants 1000 910 900 800 700 600 500 400 300 Typical plant in other Markets 300 200 190 175 200 – 400 k-units / year 200 150 150 120 110 100 100 75 75 75 100 50 0 UAZ Renault GAZ Moscow Ford Izhevsk GM Togliatti Kaluga AVTOVAZ AVTOVAZ Elabuga Ulyanovsk Nissan Toyota Togliatti Kaluga Nizhny Nov. -

Autobusiness N 138 Eng.Pdf

content Content Car Marke……………………………………………………………..……………………………………...………….. 3 Commercial Vehicles………………………………………...….……………………………………………………. 21 Foreign Investors: Business Organization in Russia ……………………………………………..…….……… 27 Auto component sector – no way out?………………………….……….………………………………………… 31 DMS: Auto Dealers’ Experience …………………………………………………………………………………….. 34 A Car on Demand …………………………………………………………………………………………………..…. 38 Power Plant ……………………………………………………………………....………………………...………….. 43 Model Highway Initiative ……………..…………………………………………………………………...………….. 43 Autobusiness [138] June 2013 | 2 first quarter results Car Market The car segment of the first quarter of 2013 is characterized by a pronounced stability of its indices. The production and sales growth was insignificant, in comparison with the first quarter of 2012. The increase in the share of foreign cars in the car production and sales structure also slowed down. Car Production Over the first three months of 2013, in Russia, 452.5 thousand cars were manufactured, which is only a 0.62% increase on the production result for the same period of 2012. Shares of Russian and foreign cars in the production structure also remained almost unchanged. In January-March 2013, 140.6 thousand cars of Russian brands were produced, which amounted to 31.07% of the total production volume. For comparison, In January-March 2012, their share was equal to 31.11%. Despite the total production volume stability, in the first quarter of 2013, the dynamics of cars, produced by various manufacturers, differed significantly. So, most enterprises, producing cars of Russian brands, showed the negative production dynamics. AVTOVAZ’s car production decreased by 4.63%, in particular, due to the assembly termination of Lada Kalina cars of the previous generation and preparation for the production of a new model of Kalina cars. The car production of Ulyanovsk Automobile Plant also decreased, by 14.1%. -

AVTOVAZ Overview

AVTOVAZ Overview 05.07.2017 AVTOVAZ 50-years History 1966/1970 VAZ 2101 2016 LADA XRAY AVTOVAZ Overview 05.07.2017 2 AVTOVAZ Group: Key information 408 467 Cars & KDs produced 20.1% MOSCOW AVTOVAZ 331 Representative office sales points 30 IZHEVSK countries LADA-Izhevsk TOGLIATTI plant AVTOVAZ Head-office & 184.9 B-Rub (2.5 B-Euro) Togliatti plants 51 527 p. AVTOVAZ Overview 05.07.2017 3 AVTOVAZ footprint Local Producer of Renault / Nissan / Component Supply Develop / Build / Sell / Service LADA cars globally Datsun cars & Components on Russian market Design Engineering Purchasing (ARNPO) Production incl. components Sales Service + Finance Spare parts AVTOVAZ Overview 05.07.2017 4 LADA product portfolio LADA Granta LADA Kalina LADA Priora LADA Vesta LADA XRAY LADA Largus LADA 4x4 Granta Sedan Kalina Hatchback Priora Sedan Vesta Sedan XRAY Largus 5- or 7-seats 4x4 3-doors Launched Launched Nov, 2015 Feb, 2016 Granta Liftback Kalina Wagon Largus Cross 4x4 Urban 3-doors 5- or 7-seats Vesta SW Granta Pick Up Kalina Cross Largus Fourgon 4x4 5-doors LADA Sport Launch H2 2017 Granta Sport Kalina Sport 4x4 Urban 5-doors Kalina NFR 4x4 Pick Up AVTOVAZ Overview Confidential 05.07.2017 5 Russian TIV Achievements 5m’2017 – LADA Market Share Top-10 brands, К units / MS % Top-10 PC models, К units MS 2017 vs. 2016, % LADA 19.5% 112.8 Kia Rio Kia Rio 38.1 Kia LADA +1,0% Kia 11.9% 68.4 LADA Granta LADA Granta 33.4 Renault VW Hyundai 9.7% 56.0 LADA Vesta LADA Vesta 28.0 Datsun Mazda Renault 8.4% 48.6 Hyundai SolarisHyundai Solaris 25.3 Hyundai GAZ LCV Toyota -

Auto Industry in Russia

Auto industry in Russia The automotive industry is one of the most socially important sectors of the Russian economy. All world car brands are presented in Russia. The largest companies are light vehicle producers AvtoVAZ and GAZ, while KAMAZ is the leading heavy vehicle producer. Foreign carmakers have production and construction plants in Russia. Table: TOP-10 CAR MANUFACTURERS IN RUSSIA Turnover, mlnRUB, № Name Region 2014 1 LLC Volkswagen Group Rus Kaluga Oblast 230 583 INN 5042059767 OJC AutoVAZ 2 Samara Oblast 189 370 INN 6320002223 LLC Nissan Manufacturing Rus 3 Saint-Petersburg 152 033 INN 7842337791 CJC Renault Russia 4 Moscow 110 592 INN 7709259743 PAO KamAZ Republic of 5 104 389 INN 1650032058 Tatarstan LLC Ellada Intertrade 6 Kaliningrad Oblast 91 640 INN 3906072056 LLC Hyundai Motor Manufacturing Rus 7 Saint-Petersburg 85 392 INN 7801463902 LLC Automobile Plant Gaz Nizhny Novgorod 8 59 278 INN 5250018433 Oblast LLC Ford Sollers Holding Republic of 9 54 888 INN 1646021952 Tatarstan CJC Autotor 10 Kaliningrad Oblast 40 967 INN 3905011678 Thai Trade Center-Moscow, Department of International Trade Promotion LIGHT VEHICLE The light vehicle market shows the leading positions of passenger cars from Japan. There are 6.69 million of these vehicles. They occupy about a half (45.7%) of the foreign car park. Then go European cars with 3.92 million units. Currently, over a quarter (26.8%) of the foreign car park belongs to them, but they are losing their share every year, mostly due to the increment of the American (13.7%) and Korean (12.5%) cars, whose aggregate number is comparable to the “Europeans” (3.83 million units). -

Guide to Assembly Plants in Europe

AN_071112_16_17.qxd 3/13/08 4:11 PM Page 16 PAGE 16 · www.autonew seurope.com November 12, 2007 Guide to assembly plants in Europe BMW GROUP A San Benedetto Val di Sangro, Italy (Sevel Sud: Fiat 50%, (2008). Note: GM has temporary plant on site until 4 Flins, France – Renault Clio III, Clio II (See also 3 , 25 ) PSA 50%) – Citroen Jumper/Relay; Fiat Ducato; permanent plant opens in 2008. 5 Maubeuge, France – Passenger cars: Kangoo, new 1 Dingolfing, Germany – BMW 5-series sedan, station Peugeot Boxer 11 Asaka, Uzbekistan (UzDaewoo: joint venture of GM, Kangoo; LCV: new Kangoo Express, new Kangoo Express wagon, 6-series coupe, convertible, 7-series sedan, B Lieu Saint-Amand, France (Sevel Nord: Fiat 50%, PSA GM Daewoo and Uzautosanoat) – Daewoo Tico, Matiz, Compact; Nissan Kubistar M5 sedan, station wagon, M6 coupe, convertible 50%) – Citroen Atlante/C8, Dispatch/Jumpy; Fiat Scudo, Damas, Nexia, Lacetti; (from kits** starting in 2008) 6 Sandouville, France – Renault Laguna III Sport Tourer and 2 Leipzig, Germany – BMW 1-series 3 door, coupe, Scudo Panorama, Ulysse; Lancia Phedra; Peugeot 807, Chevrolet Epica, Tacuma, Captiva hatchback, Espace IV, Vel Satis convertible, 3-series sedan Expert, TePee A Togliatti, Russia (joint venture of GM and AvtoVAZ) – 7 Palencia, Spain – Renault Megane II hatchback, sport 3 Munich, Germany – BMW 3-series sedan, station wagon Chevrolet Niva, Viva; Opel car (2008) hatch, sport station wagon 4 Regensburg, Germany – BMW 1-series 5 door, 3-series FORD B Warsaw, Poland (FSO: UkrAvto 60%, GM Daewoo 40%) – 8 Valladolid, -

PDF, 102 KB, Datei Ist Nicht

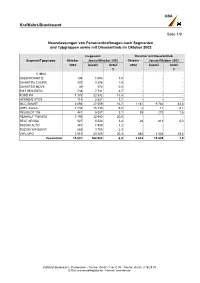

KBA Kraftfahrt-Bundesamt Seite 1/9 Neuzulassungen von Personenkraftwagen nach Segmenten und Typgruppen sowie mit Dieselantrieb im Oktober 2002 Insgesamt Darunter mit Dieselantrieb Segment/Typgruppe Oktober Januar/Oktober 2002 Oktober Januar/Oktober 2002 2002 Anzahl Anteil 2002 Anzahl Anteil % % 1. Mini DAEWOO MATIZ 138 1 693 1,0 - - - DAIHATSU CUORE 307 3 206 1,9 - - - DAIHATSU MOVE 49 574 0,3 - - - FIAT SEICENTO 738 7 731 4,7 - - - FORD KA 1 370 22 832 13,8 - - - HYUNDAI ATOS 114 2 827 1,7 - - - MCC SMART 3 094 27 559 16,7 1 181 9 782 63,5 OPEL AGILA 1 734 15 735 9,5 2 11 0,1 PEUGEOT 106 441 5 087 3,1 39 272 1,8 RENAULT TWINGO 3 193 32 980 20,0 - - - SEAT AROSA 527 5 526 3,3 28 812 5,3 SUZUKI ALTO 347 1 949 1,2 - - - SUZUKI WAGON R 269 3 755 2,3 - - - VW LUPO 3 510 33 529 20,3 384 4 528 29,4 Zusammen 15 831 164 983 6,0 1 634 15 405 1,5 Kraftfahrt-Bundesamt • Pressestelle • Telefon: (04 61) 3 16-12 93 • Telefax: (04 61) 3 16-29 07 E-Mail: [email protected] • Internet: www.kba.de KBA Kraftfahrt-Bundesamt Seite 2/9 Insgesamt Darunter mit Dieselantrieb Segment/Typgruppe Oktober Januar/Oktober 2002 Oktober Januar/Oktober 2002 2002 Anzahl Anteil 2002 Anzahl Anteil % % 2. Kleinwagen AUDI A2 1 956 17 559 3,5 795 7 864 9,4 BMW MINI 2 373 20 908 4,1 - 5 0,0 CITROEN BERLINGO 1 283 13 611 2,7 574 6 567 7,9 CITROEN C3 1 240 4 789 0,9 252 1 232 1,5 CITROEN SAXO 645 7 803 1,5 38 403 0,5 DAEWOO KALOS 306 524 0,1 - - - DAEWOO LANOS, NEXIA 66 838 0,2 - - - DAIHATSU SIRION 122 1 297 0,3 - - - DAIHATSU YRV 82 1 082 0,2 - - - FIAT DOBLO 568 4 393 0,9 342