Jsc Avtovaz Avtovaz Group* Operating Highlights for 2003

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parimad Eelsõitude Ajad

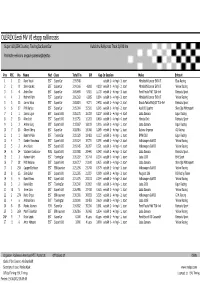

OLEREX Eesti MV VI etapp rallikrossis Super1600,ERK Juunior, TouringCar,SuperCar Kulbilohu Rallycross Track 0,930 Km Parimate eelvooru aegade paremusjärjestus Pos PIC No. Name Nat Class Total Tm Diff Gap In Session Make Entrant 1 1 12 Ruve Veski EST SuperCar 2:59.548 eelsõit 1 - 4 ringi - 3. start Mitsubishi Lancer EVO VI Elea Racing 2 2 8 Sten Karuks EST SuperCar 3:04.366 4.818 4.818 eelsõit 1 - 4 ringi - 2. start Mitsubishi Lancer EVO VI Yellow Racing 3 3 4 Andri Õun EST SuperCar 3:05.469 5.921 1.103 eelsõit 1 - 4 ringi - 3. start Ford Fiesta Mk7 T16 4x4 Reinsalu Sport 4 4 3 Helmet Palm EST SuperCar 3:06.363 6.815 0.894 eelsõit 1 - 4 ringi - 3. start Mitsubishi Lancer EVO VI Yellow Racing 5 5 15 Jarmo Võsa EST SuperCar 3:08.819 9.271 2.456 eelsõit 1 - 4 ringi - 2. start Skoda Fabia Mk1/6Y T16 4x4 Reinsalu Sport 6 6 17 Priit Karjus EST SuperCar 3:15.064 15.516 6.245 eelsõit 1 - 4 ringi - 2. start Audi 80 Quattro Sten Oja Motorsport 7 1 1 Janno Ligur EST Super1600 3:15.271 15.723 0.207 eelsõit 1 - 4 ringi - 4. start Lada Samara Ligur Racing 8 2 20 Riho Loit EST Super1600 3:15.751 16.203 0.480 eelsõit 1 - 4 ringi - 4. start Honda Civic Reinsalu Sport 9 3 3 Andre Kurg EST Super1600 3:17.667 18.119 1.916 eelsõit 1 - 4 ringi - 1. start Lada Samara Ligur Racing 10 7 13 Oliver Oberg EST SuperCar 3:18.916 19.368 1.249 eelsõit 1 - 4 ringi - 1. -

AVTOVAZ Call with Financial Analysts

AVTOVAZ Call with Financial Analysts Nicolas MAURE / Dr. Stefan MAUERER CEO / CFO 16.01.2017 Disclaimer Information contained within this document may contain forward looking statements. Although the Company considers that such information and statements are based on reasonable assumptions taken on the date of this report, due to their nature, they can be risky and uncertain and can lead to a difference between the exact figures and those given or deduced from said information and statements. PJSC AVTOVAZ does not undertake to provide updates or revisions, should any new statements and information be available, should any new specific events occur or for any other reason. PJSC AVTOVAZ makes no representation, declaration or warranty as regards the accuracy, sufficiency, adequacy, effectiveness and genuineness of any statements and information contained in this report. Further information on PJSC AVTOVAZ can be found on AVTOVAZ’s web sites (www.lada.ru/en and http://info.avtovaz.ru). AVTOVAZ Call with Financial Analysts 16.01.2017 2 AVTOVAZ Overview Moscow International Automobile Salon 2016 AVTOVAZ 50-years History 1966/1970 VAZ 2101 2016 LADA XRAY AVTOVAZ Call with Financial Analysts 16.01.2017 4 AVTOVAZ Group: Key information 408 467 Cars & KDs produced 20.1% MOSCOW AVTOVAZ 331 Representative office sales points 30 IZHEVSK LADA-Izhevsk countries TOGLIATTI plant AVTOVAZ Head-office & 2015: 176.5 B-Rub (2.6 B-Euro) Togliatti plants 2016: estimated T/O > 2015 51 527 p. AVTOVAZ Call with Financial Analysts 16.01.2017 5 LADA product portfolio -

Impact of Political Course Shift in Ukraine on Stock Returns

IMPACT OF POLITICAL COURSE SHIFT IN UKRAINE ON STOCK RETURNS by Oleksii Marchenko A thesis submitted in partial fulfillment of the requirements for the degree of MA in Economic Analysis Kyiv School of Economics 2014 Thesis Supervisor: Professor Tom Coupé Approved by ___________________________________________________ Head of the KSE Defense Committee, Professor Irwin Collier __________________________________________________ __________________________________________________ __________________________________________________ Date ___________________________________ Kyiv School of Economics Abstract IMPACT OF POLITICAL COURSE SHIFT IN UKRAINE ON STOCK RETURNS by Oleksii Marchenko Thesis Supervisor: Professor Tom Coupé Since achieving its independence from the Soviet Union, Ukraine has faced the problem which regional block to integrate in. In this paper an event study is used to investigate investors` expectations about winners and losers from two possible integration options: the Free Trade Agreement as a part of the Association Agreement with the European Union and the Custom Union of Russia, Belarus and Kazakhstan. The impact of these two sudden shifts in the political course on stock returns is analyzed to determine the companies which benefit from each integration decisions. No statistically significant impact on stock returns could be detected. However, our findings suggest a large positive reaction of companies` stock prices to the dismissal of Yanukovych regime regardless of company`s trade orientation and political affiliation. -

FACTS & FIGURES March 2019

FACTS M arch 2019 & FIGURES EDITION HIGHLIGHTS … IN 2018, GROUPE RENAULT ANNOUNCED THAT IT WOULD INVEST 1.4 BILLION EUROS IN FRANCE AND HIRE 5,000 EMPLOYEES OVER THREE YEARS. THESE INVESTMENTS WILL MAINLY GO TOWARDS THE PRODUCTION OF LIGHT COMMERCIAL AND ELECTRIC VEHICLES, OUR TWO GROWTH DRIVERS IN FRANCE. 85% CLIO OF EMPLOYEES ARE PROUD TO WORK FOR GROUPE RENAULT NO. 1 VEHICLE SOLD IN FRANCE NO. 2 IN EUROPE 15 MILLION CLIO SOLD WORLDWIDE SINCE ITS LAUNCH IN 1990 ELECTRIC VEHICLE LEADER IN EUROPE NEARLY ONE IN FOUR ELECTRIC VEHICLES SOLD IN EUROPE IS A RENAULT ONE GROUP, FIVE BRANDS 2 — KEY FIGURES 4 — INDUSTRIAL SITES 6 CONT- — MANUFACTURING 8 — GLOBAL SALES 11 — ENTS VEHICLE RANGE 21 — SERVICES 28 — RENAULT-NISSAN- MITSUBISHI 30 GROUPE RENAULT - 1 ONE GROUPE, FIVE BRANDS … GROUPE RENAULT HAS MANUFACTURED CARS SINCE 1898. TODAY IT IS AN INTERNATIONAL MULTI-BRAND GROUP. TO ADDRESS THE MAJOR TECHNOLOGICAL CHALLENGES OF THE FUTURE, WHILE CONTINUING TO PURSUE ITS PROFITABLE GROWTH STRATEGY, GROUPE RENAULT IS FOCUSING ON INTERNATIONAL EXPANSION. TO THIS END, IT IS DRAWING ON THE SYNERGIES OF ITS FIVE BRANDS (RENAULT, DACIA, RENAULT SAMSUNG MOTORS, ALPINE AND LADA), ELECTRIC VEHICLES, AND ITS UNIQUE ALLIANCE WITH NISSAN AND MITSUBISHI MOTORS. KADJAR DUSTER RENAULT 2,532,567 VEHICLES SOLD IN 2018 (PC + LCV) — Renault, the leading French brand worldwide, is present in 134 countries with nearly 12,000 points of sale. Renault has been making its customers’ lives easier for 120 years. As leader of the European electric vehicle market and committed to motorsport, the brand is driven by passion on a daily basis, with its sensual and warm design. -

STORM Hatchback

Ignition Leads 2013 Introduction Standard Motor Products Europe (SMPE) is one of Europe’s leading manufacturers of high quality, proprietary and private brand ignition leads and sets for the automotive aftermarket. Based in England, SMPE were one of the first specialist aftermarket ignition lead manufacturers in Europe; as such SMPE currently supply many of the major names in the European aftermarket. The extensive KERR NELSON HighVolt product offering is designed, manufactured and supplied utilising state of the art systems and processes. It is this commitment to employing the highest quality systems and processes, which has resulted in SMPE becoming one of the first specialist aftermarket ignition lead suppliers to be awarded ISO9001 ccreditation. A key requirement of ISO9001 is continuous improvement. This philosophy has been embraced in all aspects of SMPE’s business. Evidence of SMPE’s commitment to continuous improvement can be seen in the just-in-time manufacturing process and flexible production setup allowing efficient assembly for a large variety of part numbers to satisfy market requirements. SMPE are focused on new product development driven from a European vehicle parc database and industry leading applications cataloguing. The current KERR NELSON HighVolt programme of ignition leads provides the latest development of a range that has continually evolved to keep pace with the changing demands of both vehicle technology and customer requirements. By embracing the philosophy of continued product improvement SMPE is able to offer: Respected Brand Comprehensive Product Offering Premium Quality Product Outstanding Availability Excellent Technical Support Guaranteed Customer Satisfaction The Role of Ignition Leads in a Conventional Ignition System The primary function of the ignition system is to initiate the firing of the air/fuel mixture in a spark ignition engine. -

Knowing Where It's Going Before It Gets There

Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. To gain additional insight on innovation strategies for your organization and other issues important to your company or see the latest automotive innovation study The highway to growth: Strategies for automotive innovation, visit www.pwc.com/auto. © 2013 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/ structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. -

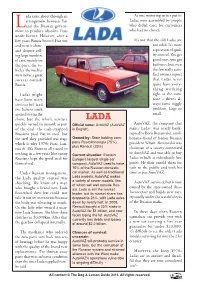

Lada Came About Through An

ada came about through an As one motoring writer put it: arrangement between Fiat Ladas were assembled by people Land the Russian govern- who didn’t care, for customers ment to produce obsolete Fiats who had no choice. under licence. However, after a few years Russia booted Fiat out It’s not that the old Ladas are and went it alone, not solid. It’s more and despite sell- a question of qual- ing large numbers ity control. You get of cars, mainly on good ones, you get the price, the ve- bad ones, but even hicles themselves the few really satis- were never a great fied owners report success outside that Ladas never Russia. quite have every- thing working Ladas might right at the same have been more time – there’s al- successful had ways some niggly the Italians stuck problem, large or around to run the small. show, but the whole venture LADA AutoVAZ, the company that quickly turned to custard; as part Official name: AvtoVAZ (AutoVAZ of the deal, the cash-strapped in English). makes Ladas, was nearly bank- Russians paid Fiat in steel, but rupted by Boris Berezovskii, a mil- the steel they provided was crap, Owned by: State holding com- lionaire friend of former Russian which is why 1970s Fiats, Lan- pany Rostekhnologia (75%), president Yeltsin. Berezovskii was cias & Alfa Romeos all rusted to plus Renault (25%) chairman of a society connected to AutoVAZ and was able to buy nothing in a few years (the canny Current situation: Eastern Russians kept the good steel for Europe’s largest single car Ladas in bulk at ridiculously low themselves). -

LISTA LADA 20-04-2021 [email protected] CALLE JOSE TORIBIO TELEFONO 226994201-226961070 PRECIOS MEDINA 11 ALAMEDA/BRASIL CON IVA

LISTA LADA 20-04-2021 [email protected] CALLE JOSE TORIBIO TELEFONO 226994201-226961070 PRECIOS MEDINA 11 ALAMEDA/BRASIL WWW.FIATALAMEDA.COM CON IVA L063610 ACTIVADOR CARBUR. PUNTA 0.97 21083-1107420 AGOTADO ACTIVADOR C/CHICLER LADA 2106 2110-1107420- L063611 3.260 PUNTA 0.50 50 L404030 ALTERNADOR LADA 2105 12V 55A 2105-3701010 63.460 ALTERNADOR LADA SAMARA L404040 2108-3701010 63.460 12V 55A AMORTIGUADOR GAS FIAT UNO 45-55- 5993542 5463540 60-70 09-1.1-1.3 cc. PORTALON A GAS 59 mm. 487670 FIAT 4.900 LARGO TOTAL AMORTIGUADOR LADA SAMARA L469090 2108-6308010 AGOTADO PORTON TRAS. A GAS FIAT PUNTO AMORTIGUADOR LADA/2105 DEL. NIVA L303064 2101-2905402 12.500 M.-1.2-1.5-1.6 cc. PAG.1 AMORTIGUADOR LADA/SAMARA DEL. L304175 2108-2905605 15.000 "CARTUCHO" AMORTIGUADOR LADA/SAMARA L304154 2108-2915004 AGOTADO TRASERO AMORTIGUADOR LADA-2105 - NIVA 1.2- L303065 2101-2915402 15.000 1.5-1.6 cc. TRASERO ANILLOS LADA 1300-1600cc STD 79MM L022876 7.200 (1.5-2.00-5/32") x 4 (OSSCA) ANILLOS LADA 2105 STD. 76 mm. L020000 AGOTADO (1.5-2.00-5/32") x 4 FIAT 147 (OSSCA) ANILLOS LADA SAMARA STD 82MM L021110 (1.5-2.00-5/32") x 4 CALIDAD 8.500 21083-1000100 ANILLOS P.C. LADA-1.2 cc.. SAMARA 1.3 L022852 cc FIAT 147 76 mm. 76*1.5*4 mm. 2.450 CROMADOS LIQUIDACION ANILLOS TW. LADA 2106 NIVA 79 m/m L022220 2.450 STD. L161210 ANILLOS SINCRONIZADOR L/2108 1.800 PAG.2 AVANCE VACIO LADA 2104-05-06-07 L064069 2101-3706600 4.750 NIVA L062121 AVANCE VACIO LADA SAMARA 4.750 BALANCIN VALVULA LADA /2105 (T) L043142 3.300 ROCKER ORIG. -

Worldwide Equipment Guide

WORLDWIDE EQUIPMENT GUIDE TRADOC DCSINT Threat Support Directorate DISTRIBUTION RESTRICTION: Approved for public release; distribution unlimited. Worldwide Equipment Guide Sep 2001 TABLE OF CONTENTS Page Page Memorandum, 24 Sep 2001 ...................................... *i V-150................................................................. 2-12 Introduction ............................................................ *vii VTT-323 ......................................................... 2-12.1 Table: Units of Measure........................................... ix WZ 551........................................................... 2-12.2 Errata Notes................................................................ x YW 531A/531C/Type 63 Vehicle Series........... 2-13 Supplement Page Changes.................................... *xiii YW 531H/Type 85 Vehicle Series ................... 2-14 1. INFANTRY WEAPONS ................................... 1-1 Infantry Fighting Vehicles AMX-10P IFV................................................... 2-15 Small Arms BMD-1 Airborne Fighting Vehicle.................... 2-17 AK-74 5.45-mm Assault Rifle ............................. 1-3 BMD-3 Airborne Fighting Vehicle.................... 2-19 RPK-74 5.45-mm Light Machinegun................... 1-4 BMP-1 IFV..................................................... 2-20.1 AK-47 7.62-mm Assault Rifle .......................... 1-4.1 BMP-1P IFV...................................................... 2-21 Sniper Rifles..................................................... -

WTO Documents Online

WORLD TRADE RESTRICTED WT/ACC/SPEC/UKR/5/Rev.3 24 August 2005 ORGANIZATION (05-3737) Working Party on the Accession of Ukraine DRAFT REPORT OF THE WORKING PARTY ON THE ACCESSION OF UKRAINE TO THE WORLD TRADE ORGANIZATION Revision WT/ACC/SPEC/UKR/5/Rev.3 Page i TABLE OF CONTENTS I. INTRODUCTION ....................................................................................................................1 DOCUMENTATION PROVIDED ......................................................................................................1 INTRODUCTORY STATEMENTS....................................................................................................2 II. ECONOMIC POLICIES..........................................................................................................3 - Monetary and Fiscal Policy......................................................................................................3 - Foreign Exchange and Payments ............................................................................................5 - Investment Regime....................................................................................................................8 - State Ownership and Privatization .......................................................................................10 - Pricing Policies ........................................................................................................................14 - Competition Policy..................................................................................................................21 -

2 General Description of the Russian-Made Vehicle Fleet

;-.. ; : s -- 0--21297 .4 { Public Disclosure Authorized VehicleFle'et Public Disclosure Authorized Characterizationin CentralAsia and, the Caucasus Public Disclosure Authorized Reportfor the RegionalStudy on: CleanerTransportation FuelIs for UrbanAir QualityImprovement Public Disclosure Authorized inCentralAsia -and the Caucasus Vehicle Fleet Characterization in Central Asia and the Caucasus Report for the Regional Study on: Cleaner Transportation Fuels for Urban Air Quality Improvement in Central Asia and the Caucasus Canadian International Development Agency Joint UNDPlWorld Bank Energy Sector ManagementAssistance Programme (ESMAP) Contents Acknowledgments ............................................... vii Abbreviations and Acronyms ............................................... ix Executive Summary ............................................... xi Vehicle Technology in Central Asia and the Caucasus........................................ xii Fleet Octane Requirements ........................................ xiii Inspection and Maintenance Programs ........................................ xiv Uzbekistan's Natural Gas Conversion Program ........................................ xvi Conclusions and Recommendations ....................................... xvii 1 Introduction ................................................ 1 1.1 Objectives .1 1.2 Background .2 Impact of Fuel on Vehicle Emissions .2 Long Range Effects of Emissions .2 Climate Change and Greenhouse Gases .2 Impact of Fuel on Vehicle Technology. 3 1.3 Study Methodology.3 -

Bo Andersson CEO Avtovaz AVTOVAZ

Bo Andersson CEO AvtoVAZ AVTOVAZ The Russian Automotive Industry Today & Tomorrow Bo Inge Andersson President & CEO of AVTOVAZ ТВОЙ ГОД ТВОЕ БУДУЩЕЕ 10 June 2015 Current Macroeconomic Situation •1 Global Oil Prices have fallen by over 50 % • In Q1 2015 Russian Income from oil export reduced by 43.5% •2 Imposed Sanctions on Russia from the West • In 2015 estimated affect can reach 75 B-EURO or 4.8% of GDP •3 RUB Rate has plunged vs. EUR and USD • In Q1 2015 EUR/RUB and USD/RUB grew up to 90-100% •4 Cost of Borrowing has increased substantially • In 2014 key interest rate was increased by Russian central bank from 5.5% to 17.0%. Current rate is 12.5% •5 Increasing Inflation and Russian Recession • Annual Inflation in May was 15.8% • GDP decrease in Q1 2015 is 2.2%, annual forecast is -2.5 to -5.0% 3 Passenger Vehicles Market Outlook • AVTOVAZ forecast the Market to drop by 32-36% in 2015 vs. 2014 M-units 3.10 3.00 3.0 2.90 2.8 2.77 2.7 2.68 2.90 2.6 2.60 2.80 2.55 2.5 2.70 2.5 2.4 2.58 2.4 2.52 2.46 2.20 2.40 2.0 2.10 1.85 1.8 1.8 1.59 1.70 1.5 1.4 1.4 1.3 1.50 1.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 4 Actual Optimistic Forecast Pessimistic Forecast Who we are 2015 Leading Manufacturer 585,000 of vehicles in Russia Cars & CKD Own Brand Name LADA Market Share in Russia (4M 2015) 18.7% Market Share in <600 k-RUB segment 51% Dealer Network in 336 Russia dealers Export 29 countries Controlling Alliance Rostec Auto B.V., a part of Shareholder Alliance Renault-Nissan Togliatti, Russia 5 Headquarters The Russian Automotive Industry Majority of Russian plants have problems being cost competitive due to low production capacities k-units / year Production Capacities of Russian Plants 1000 910 900 800 700 600 500 400 300 Typical plant in other Markets 300 200 190 175 200 – 400 k-units / year 200 150 150 120 110 100 100 75 75 75 100 50 0 UAZ Renault GAZ Moscow Ford Izhevsk GM Togliatti Kaluga AVTOVAZ AVTOVAZ Elabuga Ulyanovsk Nissan Toyota Togliatti Kaluga Nizhny Nov.