AVTOVAZ Group* Operating Highlights for 2004

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The History of Success of Central Asian Company in Automobile Industry

Review Article, ISSN 2304-2613 (Print); ISSN 2305-8730 (Online) The History of Success of Central Asian Company in Automobile Industry Kanat Zhumanov1, Anel Zhumanova2, Benjamin Chan Yin-Fah3 1,2,3Faculty of Business Management, Asia Pacific University of Technology & Innovation (APU), Kuala Lumpur, MALAYSIA 3Center of Entrepreneurship and Leadership, (APU), Technology Park Malaysia, MALAYSIA *E-mail for correspondence: [email protected] https://doi.org/10.18034/abr.v8i2.155 ABSTRACT The paper analyzes the key success factors of automobile industry in Central Asia, Kazakhstan. In particularly, strategies used, experienced challenges faced by “Bipek Auto – Asia Auto” will be presented in this paper. Key words: Success factors, Kazakhstan, Auto Company INTRODUCTION Kazakhstan in the form of tax and other payments; more than $ 24 million was directed by the company for Today Asia is a platform for a successful business. The charitable and social purposes. The staff of Bipek Auto - rapid development of innovation in Asia is facilitated by Asia Auto has over 4,500 employees in 19 cities of a large number of people, a fast temp of life, and the Kazakhstan and 13 regions of Russia. progress of the economy GDP per capita is higher than in other regions. And one-third of global companies are From 1992 to 2017 (Figure 2), Kazakhstan’s people located in Asia - Taiwan, Japan, China, and Korea. If we purchased more than 475,000 new cars at the company's look are the record provided by Ernst & Young's, Asia branches (Cursive Kazakhstan, 2018). Within 25 years accounted for 14% of world consumer spending in 2011 Bipek Auto - Asia Auto is a leader both in an automobile but been projected to 25% in 2020 and 40% in year 2030. -

Jsc Avtovaz Avtovaz Group* Operating Highlights for 2003

ANNUAL REPORT | 2003 | JSC AVTOVAZ AVTOVAZ GROUP* OPERATING HIGHLIGHTS FOR 2003 Vehicle unit sales, JSC AVTOVAZ 2003 2002 Change 000’s units 000’s units % Domestic market 626 577 8.49 Export market 92 98 (6.12) Total 718 675 6.3 Automotive assembly kits sales 98 101 (2.97) RR mln RR mln % Net sales 130,772 119,432 9.49 Operating income 5,941 5,591 6.26 Consolidated Statement 2003 2002 Change of Income** RR mln RR mln % For the year ended 31 December Net sales 130,772 119,432 9.49 Cost of sales (110,003) (99,331) 10.74 Gross profit 20,769 20,101 3.32 Interest expense (3,416) (3,077) (11.02) Other expense, net (14,402) (15,896) (9.4) Net income for the year 2,951 1,128 161.61 Consolidated Balance Sheet** 2003 2002 Change At 31 December RR mln RR mln % Cash and cash equivalents 6,767 2,751 145.98 Other current assets 37,069 33,393 11.01 Non-current assets 108,228 102,836 5.24 Total liabilities 72,562 62,166 16.72 Minority interest 1,290 1,587 (18.71) Total shareholders’ equity 78,212 75,227 3.97 Share price and dividend 2003 2002 Change development, JSC AVTOVAZ*** Share price RR RR % For the year ended 31 December Ordinary share Closing 774.7 679.72 +13.97 Annual high 906.42 1201.31 -24.55 Annual low 582.06 558.64 +4.19 Preference share Closing 471.88 371.17 +27.13 Annual high 525.68 667.54 -21.25 Annual low 339.77 319.10 +6.48 Dividends Per ordinary share 6.00 5.00 +20.0 Per preference share 95.00 17.00 +458.82 * The AVTOVAZ Group mentioned hereinafter is the parent company (JSC AVTOVAZ or the “Company”) and all of its subsidiaries and associated companies. -

Global Monthly Is Property of John Doe Total Toyota Brand

A publication from April 2012 Volume 01 | Issue 02 global europe.autonews.com/globalmonthly monthly Your source for everything automotive. China beckons an industry answers— How foreign brands are shifting strategies to cash in on the world’s biggest auto market © 2012 Crain Communications Inc. All rights reserved. March 2012 A publication from Defeatglobal spurs monthly dAtA Toyota’s global Volume 01 | Issue 01 design boss Will Zoe spark WESTERN EUROPE SALES BY MODEL, 9 MONTHSRenault-Nissan’sbrought to you courtesy of EV push? www.jato.com February 9 months 9 months Unit Percent 9 months 9 months Unit Percent 2011 2010 change change 2011 2010 change change European sales Scenic/Grand Scenic ......... 116,475 137,093 –20,618 –15% A1 ................................. 73,394 6,307 +67,087 – Espace/Grand Espace ...... 12,656 12,340 +316 3% A3/S3/RS3 ..................... 107,684 135,284 –27,600 –20% data from JATO Koleos ........................... 11,474 9,386 +2,088 22% A4/S4/RS4 ..................... 120,301 133,366 –13,065 –10% Kangoo ......................... 24,693 27,159 –2,466 –9% A6/S6/RS6/Allroad ......... 56,012 51,950 +4,062 8% Trafic ............................. 8,142 7,057 +1,085 15% A7 ................................. 14,475 220 +14,255 – Other ............................ 592 1,075 –483 –45% A8/S8 ............................ 6,985 5,549 +1,436 26% Total Renault brand ........ 747,129 832,216 –85,087 –10% TT .................................. 14,401 13,435 +966 7% RENAULT ........................ 898,644 994,894 –96,250 –10% A5/S5/RS5 ..................... 54,387 59,925 –5,538 –9% RENAULT-NISSAN ............ 1,239,749 1,288,257 –48,508 –4% R8 ................................ -

Russian Automotive Market 2018 Results and Outlook

Russian automotive market www.pwc.ru/automotive 2018 results and outlook Passenger cars | Light commercial vehicles | Trucks | Buses February 2019 Contents 1 Overview of the Russian passenger car market 3 2 Overview of the Russian commercial vehicle market 11 3 Conclusions 15 4 About PwC 17 PwC 2 1 Overview of the Russian passenger car market PwC 3 Sanctions-related risks materialising in the first half of 2018 triggered year-end declines in several key macroeconomic indicators GDP growth rate and consumer price index (CPI), Average nominal RUB/USD exchange rate, Q1 2016 to Q4 2018 Q1 2016 to Q4 2018 8.4 74.9 7.4 6.8 GDP against similar quarter last year, % 5.8 65.9 CPI against similar quarter last year, % 66.5 4.6 64.6 65.6 4.2 3.9 63.0 3.4 61.9 3.0 57.1 2.5 2.2 2.6 2.2 2.4 2.2 58.6 59.0 58.4 56.8 0.4 0.9 -0.4 -0.2 0.6 1.9 1.5 -0.5 1.3 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 Sources: Ministry of Economic Development of the Russian Federation, Rosstat. Source: Central Bank of the Russian Federation Consumer confidence index, Q-end Brent oil price behaviour, USD Q1 2016 - Q4 2018 Q1 2016 - Q4 2018 82.7 79.4 70.3 -8.0% -8.0% 66.9 -11.0% -11.0% 56.8 57.5 -15.0% -14.0% -14.0% 52.8 53.8 -18.0% -17.0% -19.0% 49.7 49.1 47.9 39.6 -26.0% -30.0% 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 Source: Rosstat Source: Bloomberg PwC 4 In 2018, the passenger car market continued to recover, demonstrating 13% growth despite the slowdown in the Russian economy In 2018, sales of new Sales among Russian makers Sales of foreign brands Imports accounted for around passenger cars in Russia increased by 14%, driven by surging assembled in Russia grew by 16% of total sales in 2018. -

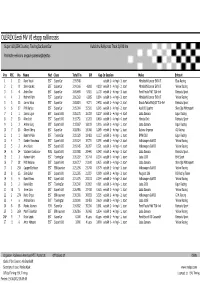

Parimad Eelsõitude Ajad

OLEREX Eesti MV VI etapp rallikrossis Super1600,ERK Juunior, TouringCar,SuperCar Kulbilohu Rallycross Track 0,930 Km Parimate eelvooru aegade paremusjärjestus Pos PIC No. Name Nat Class Total Tm Diff Gap In Session Make Entrant 1 1 12 Ruve Veski EST SuperCar 2:59.548 eelsõit 1 - 4 ringi - 3. start Mitsubishi Lancer EVO VI Elea Racing 2 2 8 Sten Karuks EST SuperCar 3:04.366 4.818 4.818 eelsõit 1 - 4 ringi - 2. start Mitsubishi Lancer EVO VI Yellow Racing 3 3 4 Andri Õun EST SuperCar 3:05.469 5.921 1.103 eelsõit 1 - 4 ringi - 3. start Ford Fiesta Mk7 T16 4x4 Reinsalu Sport 4 4 3 Helmet Palm EST SuperCar 3:06.363 6.815 0.894 eelsõit 1 - 4 ringi - 3. start Mitsubishi Lancer EVO VI Yellow Racing 5 5 15 Jarmo Võsa EST SuperCar 3:08.819 9.271 2.456 eelsõit 1 - 4 ringi - 2. start Skoda Fabia Mk1/6Y T16 4x4 Reinsalu Sport 6 6 17 Priit Karjus EST SuperCar 3:15.064 15.516 6.245 eelsõit 1 - 4 ringi - 2. start Audi 80 Quattro Sten Oja Motorsport 7 1 1 Janno Ligur EST Super1600 3:15.271 15.723 0.207 eelsõit 1 - 4 ringi - 4. start Lada Samara Ligur Racing 8 2 20 Riho Loit EST Super1600 3:15.751 16.203 0.480 eelsõit 1 - 4 ringi - 4. start Honda Civic Reinsalu Sport 9 3 3 Andre Kurg EST Super1600 3:17.667 18.119 1.916 eelsõit 1 - 4 ringi - 1. start Lada Samara Ligur Racing 10 7 13 Oliver Oberg EST SuperCar 3:18.916 19.368 1.249 eelsõit 1 - 4 ringi - 1. -

AVTOVAZ Call with Financial Analysts

AVTOVAZ Call with Financial Analysts Nicolas MAURE / Dr. Stefan MAUERER CEO / CFO 16.01.2017 Disclaimer Information contained within this document may contain forward looking statements. Although the Company considers that such information and statements are based on reasonable assumptions taken on the date of this report, due to their nature, they can be risky and uncertain and can lead to a difference between the exact figures and those given or deduced from said information and statements. PJSC AVTOVAZ does not undertake to provide updates or revisions, should any new statements and information be available, should any new specific events occur or for any other reason. PJSC AVTOVAZ makes no representation, declaration or warranty as regards the accuracy, sufficiency, adequacy, effectiveness and genuineness of any statements and information contained in this report. Further information on PJSC AVTOVAZ can be found on AVTOVAZ’s web sites (www.lada.ru/en and http://info.avtovaz.ru). AVTOVAZ Call with Financial Analysts 16.01.2017 2 AVTOVAZ Overview Moscow International Automobile Salon 2016 AVTOVAZ 50-years History 1966/1970 VAZ 2101 2016 LADA XRAY AVTOVAZ Call with Financial Analysts 16.01.2017 4 AVTOVAZ Group: Key information 408 467 Cars & KDs produced 20.1% MOSCOW AVTOVAZ 331 Representative office sales points 30 IZHEVSK LADA-Izhevsk countries TOGLIATTI plant AVTOVAZ Head-office & 2015: 176.5 B-Rub (2.6 B-Euro) Togliatti plants 2016: estimated T/O > 2015 51 527 p. AVTOVAZ Call with Financial Analysts 16.01.2017 5 LADA product portfolio -

Europe Swings Toward Suvs, Minivans Fragmenting Market Sedans and Station Wagons – Fell Automakers Did Slightly Better Than Cent

AN.040209.18&19.qxd 06.02.2004 13:25 Uhr Page 18 ◆ 18 AUTOMOTIVE NEWS EUROPE FEBRUARY 9, 2004 ◆ MARKET ANALYSIS BY SEGMENT Europe swings toward SUVs, minivans Fragmenting market sedans and station wagons – fell automakers did slightly better than cent. The only new product in an cent because of declining sales for 656,000 units or 5.5 percent. mass-market automakers. Volume otherwise aging arena, the Fiat the Honda HR-V and Mitsubishi favors the non-typical But automakers boosted sales of brands lost close to 2 percent of vol- Panda, was on sale for only four Pajero Pinin. over familiar sedans unconventional vehicles – coupes, ume last year, compared to 0.9 per- months of the year. In terms of brands leading the roadsters, minivans, sport-utility cent for luxury marques. European buyers seem to pro- most segments, Renault is the win- LUCA CIFERRI vehicles exotic cars and multi- Traditional European-brand gressively walk away from large ner with four. Its Twingo leads the spaces such as the Citroen Berlingo automakers dominate the tradi- sedans, down 20.3 percent for the minicar segment, but Renault also AUTOMOTIVE NEWS EUROPE – by 16.8 percent last year to nearly tional car, minivan and premium volume makers and off 11.1 percent leads three other segments that it 3 million units. segments, but Asian brands control in the upper-premium segment. created: compact minivan, Scenic; TURIN – Automakers sold 428,000 These non-traditional vehicle cat- virtually all the top spots in small, large minivan, Espace; and multi- more specialty vehicles last year in egories, some of which barely compact and large SUV segments. -

Lada Niva 1600

Lada Niva 1600 Maintenance Manual For VAZ 2121 21212 cars This manual comprises pages 27 to 64 of the official car manual which is not copyright. The manual is intended for owners of Lada Nivas who were not provided with a manual for their car. This manual may not be sold for profit. This is the first version of this manual to be placed on the web. It probably contains minor spelling errors. Names of oils and grease types will shortly be printed in Russian characters. Appendixes are not yet included. Currently underway is the Operations manual for the Lada Niva which contains driving instructions for the car and how to use things such as heaters, windows, seats, mirrors and so on. It has been delayed due to the demand for maintenance information. Important note: This manual has been designed to print on a HP-600 printer. Due to differences in printer types page alignments may vary. Print-Preview the document before printing and adjust margins as necessary to avoid blank pages. Please send corrections or comments to [email protected] Lada Niva Manual - Maintenance Page 1 Table of Contents MAINTENANCE.........................................................................................................................................................................3 ENGINE LUBRICATION......................................................................................................................................................3 Oil Sump............................................................................................................................................................................3 -

FACTS & FIGURES March 2019

FACTS M arch 2019 & FIGURES EDITION HIGHLIGHTS … IN 2018, GROUPE RENAULT ANNOUNCED THAT IT WOULD INVEST 1.4 BILLION EUROS IN FRANCE AND HIRE 5,000 EMPLOYEES OVER THREE YEARS. THESE INVESTMENTS WILL MAINLY GO TOWARDS THE PRODUCTION OF LIGHT COMMERCIAL AND ELECTRIC VEHICLES, OUR TWO GROWTH DRIVERS IN FRANCE. 85% CLIO OF EMPLOYEES ARE PROUD TO WORK FOR GROUPE RENAULT NO. 1 VEHICLE SOLD IN FRANCE NO. 2 IN EUROPE 15 MILLION CLIO SOLD WORLDWIDE SINCE ITS LAUNCH IN 1990 ELECTRIC VEHICLE LEADER IN EUROPE NEARLY ONE IN FOUR ELECTRIC VEHICLES SOLD IN EUROPE IS A RENAULT ONE GROUP, FIVE BRANDS 2 — KEY FIGURES 4 — INDUSTRIAL SITES 6 CONT- — MANUFACTURING 8 — GLOBAL SALES 11 — ENTS VEHICLE RANGE 21 — SERVICES 28 — RENAULT-NISSAN- MITSUBISHI 30 GROUPE RENAULT - 1 ONE GROUPE, FIVE BRANDS … GROUPE RENAULT HAS MANUFACTURED CARS SINCE 1898. TODAY IT IS AN INTERNATIONAL MULTI-BRAND GROUP. TO ADDRESS THE MAJOR TECHNOLOGICAL CHALLENGES OF THE FUTURE, WHILE CONTINUING TO PURSUE ITS PROFITABLE GROWTH STRATEGY, GROUPE RENAULT IS FOCUSING ON INTERNATIONAL EXPANSION. TO THIS END, IT IS DRAWING ON THE SYNERGIES OF ITS FIVE BRANDS (RENAULT, DACIA, RENAULT SAMSUNG MOTORS, ALPINE AND LADA), ELECTRIC VEHICLES, AND ITS UNIQUE ALLIANCE WITH NISSAN AND MITSUBISHI MOTORS. KADJAR DUSTER RENAULT 2,532,567 VEHICLES SOLD IN 2018 (PC + LCV) — Renault, the leading French brand worldwide, is present in 134 countries with nearly 12,000 points of sale. Renault has been making its customers’ lives easier for 120 years. As leader of the European electric vehicle market and committed to motorsport, the brand is driven by passion on a daily basis, with its sensual and warm design. -

STORM Hatchback

Ignition Leads 2013 Introduction Standard Motor Products Europe (SMPE) is one of Europe’s leading manufacturers of high quality, proprietary and private brand ignition leads and sets for the automotive aftermarket. Based in England, SMPE were one of the first specialist aftermarket ignition lead manufacturers in Europe; as such SMPE currently supply many of the major names in the European aftermarket. The extensive KERR NELSON HighVolt product offering is designed, manufactured and supplied utilising state of the art systems and processes. It is this commitment to employing the highest quality systems and processes, which has resulted in SMPE becoming one of the first specialist aftermarket ignition lead suppliers to be awarded ISO9001 ccreditation. A key requirement of ISO9001 is continuous improvement. This philosophy has been embraced in all aspects of SMPE’s business. Evidence of SMPE’s commitment to continuous improvement can be seen in the just-in-time manufacturing process and flexible production setup allowing efficient assembly for a large variety of part numbers to satisfy market requirements. SMPE are focused on new product development driven from a European vehicle parc database and industry leading applications cataloguing. The current KERR NELSON HighVolt programme of ignition leads provides the latest development of a range that has continually evolved to keep pace with the changing demands of both vehicle technology and customer requirements. By embracing the philosophy of continued product improvement SMPE is able to offer: Respected Brand Comprehensive Product Offering Premium Quality Product Outstanding Availability Excellent Technical Support Guaranteed Customer Satisfaction The Role of Ignition Leads in a Conventional Ignition System The primary function of the ignition system is to initiate the firing of the air/fuel mixture in a spark ignition engine. -

Knowing Where It's Going Before It Gets There

Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. To gain additional insight on innovation strategies for your organization and other issues important to your company or see the latest automotive innovation study The highway to growth: Strategies for automotive innovation, visit www.pwc.com/auto. © 2013 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/ structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. -

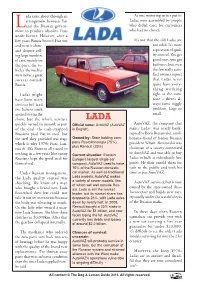

Lada Came About Through An

ada came about through an As one motoring writer put it: arrangement between Fiat Ladas were assembled by people Land the Russian govern- who didn’t care, for customers ment to produce obsolete Fiats who had no choice. under licence. However, after a few years Russia booted Fiat out It’s not that the old Ladas are and went it alone, not solid. It’s more and despite sell- a question of qual- ing large numbers ity control. You get of cars, mainly on good ones, you get the price, the ve- bad ones, but even hicles themselves the few really satis- were never a great fied owners report success outside that Ladas never Russia. quite have every- thing working Ladas might right at the same have been more time – there’s al- successful had ways some niggly the Italians stuck problem, large or around to run the small. show, but the whole venture LADA AutoVAZ, the company that quickly turned to custard; as part Official name: AvtoVAZ (AutoVAZ of the deal, the cash-strapped in English). makes Ladas, was nearly bank- Russians paid Fiat in steel, but rupted by Boris Berezovskii, a mil- the steel they provided was crap, Owned by: State holding com- lionaire friend of former Russian which is why 1970s Fiats, Lan- pany Rostekhnologia (75%), president Yeltsin. Berezovskii was cias & Alfa Romeos all rusted to plus Renault (25%) chairman of a society connected to AutoVAZ and was able to buy nothing in a few years (the canny Current situation: Eastern Russians kept the good steel for Europe’s largest single car Ladas in bulk at ridiculously low themselves).