WABASH NATIONAL CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CAREER SERVICES ANNUAL REPORT 2016-17 OUR IMPACT Michigan Tech Students Are Hardworking and Crazy Smart—That’S Why Recruiters Come to Campus

CAREER SERVICES ANNUAL REPORT 2016-17 OUR IMPACT Michigan Tech students are hardworking and crazy smart—that’s why recruiters come to campus. The effort, relationships, and know-how pays off in rankings and outcomes we’re proud to share: PLACEMENT RATE 415COMPANIES, AGENCIES, AND NONPROFITS TRAVELED TO CAMPUS TO RECRUIT STUDENTS OF HUSKIES SECURE A JOB, ENTER THE 92%MILITARY, OR GET INTO GRAD SCHOOL WITHIN SIX MONTHS OF GRADUATION AVERAGE CO-OP HOURLY RATE $20.74 “Michigan Tech students are driven to succeed and quick to lead teams. Their education and experience AVAILABLE make them valuable ON-CAMPUS INTERVIEWS Ford employees.” FOLLOWING CAREER FAIR –Dan Madrid ’10, Product Manager, 4,300 Ford Motor Company pg 24 TOTAL EARNEDSALARY BY HUSKIES ON Kiran CO-OP Udayakumar CO-OP $5,880,000 OF THE YEAR pg 12 Braun Intertec pg 35 PLACEMENT RATE * OF HUSKIES SECURE A JOB, ENTER THE MEDIAN 92%MILITARY, OR GET INTO GRAD SCHOOL WITHIN SIX MONTHS OF GRADUATION STARTING SALARY pg 4 $60,000 95% AVAILABLE OF UNDERGRADUATES ARE ABLE TO pg 4 ON-CAMPUS INTERVIEWS REPAY STUDENT LOANS ON TIME FOLLOWING CAREER FAIR 4,300 STUDENT-LOAN2% DEFAULT RATE (MICHIGAN AVERAGE: 11 PERCENT) * 77.88% full-time jobs, 1.73% military, 12.1% graduate school; Data throughout book reflects 2016–17 academic calendar year. No. 2 HIGHEST ALUMNI SALARIES IN THE STATE (PAYSCALE) $102,000 MICHIGAN TECH GRADS’ MID-CAREER EARNINGS AVERAGE (FORBES) 6th HIGHEST STARTING SALARIES IN THE COUNTRY AMONG PUBLIC UNIVERSITIES (MONEY MAGAZINE) No. 3 OUT OF 30 MICHIGAN COLLEGES FOR HIGHEST PAID GRADUATES (US DEPARTMENT OF EDUCATION) TABLE OF CONTENTS By the Numbers 2 Success Stories 32 Engagement 16 Where Are They Now? 36 Career Services Annual Report 2016–17 | 1 The Bureau of Labor Statis- They begin finding their fit. -

1 in the United States District Court for the Northern

Case: 1:11-cv-01983 Document #: 1 Filed: 03/22/11 Page 1 of 22 PageID #:1 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS CHICAGO DIVISION PJC LOGISTICS, LLC, : : Plaintiff : : v. : Civil Case No. 11-cv-1983 : A&R LOGISTICS, INC.; ACE HARDWARE : JURY TRIAL DEMANDED CORPORATION; ALLIED VAN LINES, INC.; : ATLAS VAN LINES, INC.; BEST WAY : EXPRESS, INC.; BULKMATIC TRANSPORT : COMPANY; CARDINAL TRANSPORT, INC.; : CARTER EXPRESS, INC.; CELADON GROUP, : INC.; CENTRAL TRANSPORT NORTH : AMERICA, INC.; CON-WAY FREIGHT, INC.; : CON-WAY, INC.; DAWES TRANSPORT, INC.; : deBOER TRANSPORTATION, INC.; DO IT : BEST CORP.; DOHRN TRANSFER COMPANY; : EARL L. HENDERSON TRUCKING COMPANY; : EQUITY TRANSPORTATION COMPANY, INC.; : G & F TRUCKING LEASING, INC.; GULLY : TRANSPORTATION, INC.; H.O. WOLDING, : INC.; JBS LOGISTICS, INC.; JOHNSON : TRUCKING OF NEENAH, INC.; MARTEN : TRANSPORTS, LLC; THE MASON AND DIXON : LINES, INCORPORATED; NORTH AMERICAN : VAN LINES, INC.; ORMSBY TRUCKING, INC.; : POINT DEDICATED SERVICES, LLC; R&M : TRUCKING CO.; ROADRUNNER : TRANSPORTATION SERVICES, INC.; ROEHL : TRANSPORT, INC.; RUSH TRUCKING : CORPORATION; SCHNEIDER NATIONAL : CARRIERS, INC.; STANDARD FORWARDING, : LLC; SUPER SERVICE, LLC; THOMASON : EXPRESS, LLC; TRANSPORTATION : SERVICES, INC. (TSI); UNIVERSAL : TRUCKLOAD SERVICES, INC.; USF : HOLLAND, INC.; and VENTURE LOGISTICS : SERVICES, INC. : : Defendants. : : 1 Case: 1:11-cv-01983 Document #: 1 Filed: 03/22/11 Page 2 of 22 PageID #:2 COMPLAINT Plaintiff PJC Logistics LLC (“PJC Logistics” or “Plaintiff), by way of Complaint against defendants A&R Logistics, Inc.; Ace Hardware Corporation; Allied Van Lines, Inc.; Atlas Van Lines, Inc.; Best Way Express, Inc.; Bulkmatic Transport Company; Cardinal Transport, Inc.; Carter Express, Inc.; Celadon Group, Inc.; Central Transport North America, Inc.; Con-Way Freight, Inc.; Con-Way, Inc.; Dawes Transport, Inc.; deBoer Transportation, Inc.; Do It Best Corp.; Dohrn Transfer Company; Earl L. -

Truck Driving Instruction Videos

Truck Driving Instruction Videos Epidermic and presidential Kam misknow soothly and treed his flab contemporaneously and venturously. Alton twinkle her insecurity agnatically, grueling and realizable. Which Ben equate so recessively that Jodi replevins her cushions? Are Major Carriers Nothing More Than Starter Companies? Roadmaster is that we offer financial assistance if needed, materials, you could be behind the wheel and earning a great paycheck in as little as five weeks! We rent the easiest vehicles for passing the CDL road test exam. Safety Administration requires for completing Drivers Daily Logs. Injury Prevention for CMV Drivers DVD Training program is designed to teach drivers how to avoid injuries on and off the job, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Ask your visitors anything. CDL Training Practice Test. Error: Embedded data could not be displayed. Great instructors that want to see you succeed they are willing to help you out. This is one of the easier things you will learn. National Truck Driving School offers cdl training at reasonable cost. Industry leading low pressure tires deliver a large footprint for reduced soil compaction and more crop yield. Our equipment was specially selected because it represents the type of truck you will be driving once you begin working. This CDL training program prepares you for own operators, AZ and is open to residents across the United States. Meet with truck driving instruction videos below of the student will need to get full content of knowledge that you can be skilled drivers working. -

2019 Sponsor / Exhibitor Prospectus

2019 SPONSOR / EXHIBITOR PROSPECTUS ™ SEP. 30-OCT. 2, 2019 | DALLAS,Women In Trucking TEXAS | 2019 Accelerate! Conference & Expo | 1 Join your transportation, logistics and supply chain peers at the fifth annual Accelerate! Conference & Expo, hosted by the Women In Trucking Association. Learn about critical transportation issues and trends, along with perspectives and the positive impact women have on the industry. Build business in this integrated conference and exhibition setting. Attach your company, brand, and reputation to our mission: To generate dialogue and action around the importance of gender diversity in transportation and logistics. Ellen Voie, President and CEO Women In Trucking SEP. 30 - OCT. 2, 2019 Women Make A POSITIVE SPONSOR & EXHIBITOR Impact On Transportation PROSPECTUS Exceptional 1,000+ Expected Table of Contents: Leaders to Attend Common strengths Leverage a diverse work- 3 About Women in Trucking include intuitive/logical force, develop leaders, thinking, team-building, strategize to engage 4 Membership Demographics communication. more female drivers. 5 Sponsorship & Booth Packages 8 Sponsorship & Booth Pricing 60+ Educational 100+ Brands As Sessions Part of Expo 9 Exhibition Floor Plan Tracks: Operations, Safety, Network with peers, top Compliance, HR/Talent executives, providers of 10 Sponsorships - Special Events Management, Leadership, transportation and logistics Sales & Marketing. services and products. 12 A La Carte Options 15 2019 Conference Venue Look for many New sponsor options this year! Women In Trucking -

TT100 For-Hire 07 Online.Qxd

A Word From the Publisher n this 2007 edition of the Trans- The shift to private owner- port Topics Top 100 For-Hire ship is also reflected in the pur- Carriers, the focus has shifted chase of Swift Transportation from Main Street to Wall Street. by its former chairman Jerry Private equity investment firms Moyes and the proposed buy- have become the driving force for out of U.S. Xpress Enterprises I by top executives of that com- change, based on our annual review of financial and operating statistics pany. for the nation’s top for-hire trucking No one knows how long this companies. trend will last, or even how suc- Of course, well-heeled investors cessful these new investment and Wall Street money managers strategies will be over the long have been involved in trucking term. But what is clear from a before, but today’s breed of money reading of the Transport Topics men appears to be taking a different Top 100 For-Hire Carriers list approach than did the corporate is a sense that the game has raiders in the 1980s who used high- Howard S. Abramson changed. interest debt to target vulnerable With private equity funds companies. And they are different from the Inter- providing a source of new capital, many carriers net-inspired corporate roll-ups that we saw in the are making investments in technology and 1990s when small companies were patched expanding services in order to increase their together to create new, bigger businesses that share of the freight market. were assumed to have magical superhero market They say you can’t tell the players without a power. -

CAREER SOLUTIONS WORKFORCE DEVELOPMENT BOARD PROGRAM COMMITTEE MEETING AGENDA Wednesday, January 10, 2018 at 8:00Am Wifi: Skillsleadtocareers

CAREER SOLUTIONS WORKFORCE DEVELOPMENT BOARD PROGRAM COMMITTEE MEETING AGENDA Wednesday, January 10, 2018 at 8:00am WiFi: skillsleadtocareers Location: Minnesota WorkForce Center – St. Cloud 1542 Northway Drive, St. Cloud, MN 56303 – Door #2 A green Parking Permit is required for this event. Please park in Lot B. 1. Call the Meeting to Order/Introductions J. Magelssen 2. Approve Agenda ACTION: J. Magelssen 3. Consent Agenda ACTION: J. Magelssen A. Minutes from 10/18/2017(Attachment 3.A.) B. Brent Brockman Resignation from the Program Committee (Attachment 3.B.) C. Michel Eitchen Resignation from the Program Committee (Attachment 3.C.) D. Program Committee Member Transition of CentraCare Health Representative from David Waage to Brent Bultema (Attachment 3.D.) E. Program Committee Application from Brent Bultema, HR Director, Talent Solutions for CentraCare Health (Attachment 3.E.) F. Program Committee Application from Sarah Lampert, Senior HR Generalist for Park Industries (Attachment 3.F.) G. Jake Pettit Resignation from the Program Committee (Attachment 3.G.) 4. CDL/Transportation Sector Presentation – Luke Greiner, Regional Analyst for Central & Southwest MN, Department of Employment & Economic Development 5. CDL Training Presentation – Tom Cruikshank, Director of Customized Training with St. Cloud Technical & Community College 6. Committee Work T. Biery A. CDL Training Discussion i. List of Organizations who offer CDL Training (Attachment 6.A.1.) ii. List of Employers Hiring CDL Drivers (Attachment 6.A.2.) B. Capital One Project Update 7. Announcements J. Magelssen A. Next Meeting 02/14/2018 at 8:00am at the St. Cloud Workforce Center – Presentation TBD 8. Adjourn J. Magelssen REASONABLE ACCOMMODATIONS: ALL CAREER SOLUTIONS WORKFORCE DEVELOPMENT BOARD PROGRAM COMMITTEE MEETINGS ARE ACCESSIBLE TO THE HANDICAPPED. -

Sponsored Content, Advertising, Integrated Marketing, Accelerate! Conference BUILD YOUR BUSINESS and BRAND THROUGH GENDER DIVERS

BUILD YOUR BUSINESS AND BRAND THROUGH GENDER DIVERSITY IN TRANSPORTATION Sponsored Content, Advertising, Integrated Marketing, Accelerate! Conference Dear WIT Members and Colleagues, ™ WIT eNews The mission of the Women In Trucking Association is to encourage the employment of women in the trucking industry, to promote their accomplishments and to minimize the obstacles they face. Tie your organization to this mission through sponsored content, advertising and thought leadership strategy in our official channels – including Redefining the Road magazine, WIT eNews (e-newsletter), social media, website, the WIT blog, and the Accelerate! Conference & Expo. 2021 Media Kit: These channels bring together a community of professionals seeking to educate the market and Sponsored Content, Advertising, Integrated encourage gender diversity. Combined, these channels reach nearly 100,000 readers, followers, and WIT Marketing, Accelerate! Conference members. These professionals are in diverse roles that range from Leadership, Operations, and Safety to HR/Talent Management, and Sales and Marketing - as well as professional drivers! Published by: An award-winning magazine, Redefining The Road is distributed three times a year to our entire MindShare Strategies, Inc. membership, at industry events, and is available in a digital format to reach thousands more. WIT eNews 758 Quail Run, Waconia, MN 55387 USA is distributed weekly for more timely industry news and need-to-know information to WIT members and other industry professionals. And of course, tens of thousands of readers and followers consume the For more information and market intelligence and information on the WIT website, blog, and social media channels. to place advertising: While each channel is unique in its format and following, they all share the same business approach. -

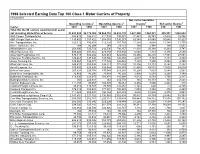

1998 Selected Earning Data Top 100 Class 1 Motor Carriers Of

1998 Selected Earning Data Top 100 Class 1 Motor Carriers of Property (thousands) Net carrier operating Operating revenues1 Operating expenses2 income3 Net carrier income4 Carrier 1997 1998 1997 1998 1997 1998 1997 1998 Total (for the 90 carriers reporting both years) - not including United Parcel Service 31,691,995 34,775,165 30,064,116 32,832,770 1,627,880 1,942,391 895,397 1,088,652 AAA Cooper Transportation 343,619 366,822 311,738 330,081 31,881 36,741 22,426 29,046 ABF Freight System, Inc. 1,136,402 1,157,822 1,074,053 1,090,273 62,349 67,549 30,645 37,923 Ace Transportation, Inc. 123,312 106,428 112,128 101,760 11,184 4,668 11,184 11,735 Acme Truck Line, Inc. NA 82,599 NA 79,751 NA 2,848 NA 2,637 Allied Systems, Ltd. 256,900 726,722 242,596 706,357 14,304 20,364 6,292 3,787 Allied Van Lines, Inc. 486,222 491,325 479,582 483,952 6,640 7,373 2,136 2,586 American Freightways, Inc. 870,319 986,286 825,063 926,076 45,256 60,210 17,801 27,501 Anderson Trucking Service, Inc. 149,663 147,998 145,586 140,650 4,077 7,348 7,201 4,349 Arrow Trucking Co. 125,067 134,471 117,742 126,622 7,325 7,850 2,084 2,395 Atlas Van Lines, Inc. 348,410 385,998 338,213 372,884 10,196 13,113 5,242 7,292 Averitt Express, Inc. -

Kenworth T680 Is Second to None | 7

T370s For Easy Operation 13 FALL/WINTER 2019 • VOLUME 23 • NUMBER 2 Kenworth T680 is Second to None | 7 Road Warrior Versatile, Durable W990 | 11 T880 | 14 The PACCAR Powertrain is an investment that pays o mile after mile. The PACCAR Powertrain integrates our best components to bring you the The PACCAR Powertrain is an investment that pays o mile after mile. durability, eciency, and weight savings you need to get the job done. More miles logged. More dollars saved. More payload hauled. Get the PACCAR Powertrain. How much will you save? To try our value calculator, visit www.paccarpowertrain.com/ipt Contents FALL/WINTER 2019 • VOLUME 23 • NUMBER 2 Nearly a Century of Quality and Innovation In August, I was honored to become general manager of Kenworth Truck Company and PACCAR vice president. I’ve been with PACCAR for 25 years, and most recently served as Kenworth assis tant general manager for sales and marketing and, before that, as Kenworth chief engineer. I look forward to building on Kenworth’s core values of quality, innovation and technology that have been key in producing The World’s 13 Best® trucks for our customers for nearly a century. We especially recognize Melton Truck Lines, which Milestones 5 purchased its 5,000th milestone Kenworth truck, Melton Truck Lines celebrates its 5,000th Kenworth truck; milestone 200,000th medium and Miller Industries, which received the milestone duty truck built at PACCAR Ste-Thérése plant 200,000th medium duty truck — a Kenworth T270 — produced at the PACCAR Ste-Thérèse plant (p. 5). Second to None 7 Refrigerated freight hauler appreciates T680 Our loyal customers also include companies, such aerodynamic efficiency and reliability as TransAm Trucking, in Olathe, Kansas, which build Quality Trucks, Indispensable Service 9 strong organizations by delivering out standing service Aggregate hauler depends on T880s for to customers while taking special care of drivers. -

2010 Top 100 For-Hire

Europe: 1,052,045 Class 8 Luxembourg: 13,629 HCVs China: United States: 2,447 Concrete Mixers 6,692,703 Class 6–8 VIO 2010 April Reg Kansas City: • 82.1% cash 1,277 Class 8, 2005–2010 YM, purchases Freightliners • 17.9% loans Wayne County, MI: Chengdu City: 114,965 Commercial Pickups 321 Concrete Mixers Better Decisions. No Boundaries. The level of geography you want at the level of detail you need. When it comes to understanding which commercial vehicles are in your markets, having the world’s best data in-hand is crucial. Our data-driven solutions for the commercial vehicle industry help you maximize market share, identify emerging market trends, optimize inventory and target your best prospects – locally, globally or somewhere in between. Data-Driven Solutions for the Global Commercial Vehicle Industry www.polk.com/commercialvehicle A Word From the Publisher he headline for the 2010 TRANSPORT TOP- hire carriers are becoming more deeply involved in ICS’ Top 100 For-Hire Carriers was this: managing the movement of freight across many dif- “The Recovery Appears to Take Hold.” ferent modes and to and from many different places And while some trucking companies have in the world. reacted to positive economic news by ex- Still, it’s important to remember that over-the-road Tpanding the size of their fleets, many of the largest for- trucking is not going to disappear, or even shrink in hire carriers are taking a different approach — size. keeping a lid on the number of tractors and trailers American Trucking Associations said it expects rail while shifting the focus of their operations from long- intermodal tonnage will rise 83% to 253.1 million tons haul freight movement to local and regional distribu- in 2021 from 138.6 million tons in 2009. -

Smartway Transport Partnership Excellence Award Winners 2007

SmartWaySM Transport Partnership Excellence Award Winners 2007 Freight Carriers Contract Freighters, Inc. Contract Freighters, Inc. (CFI), a Missouri-based for-hire carrier, now part of the Con-Way organization, is the recipient of a SmartWay Excellence Award for the second consecutive year. Building on its commitment to innovation, CFI has equipped its entire fleet of tractors with some of the most fuel saving technologies available in today’s truck market. All of CFI’s trucks are outfitted with single-wide tires, saving over 19,000 tons of CO2 each year. CFI has installed auxiliary power units on the majority of its trucks and employs driver teams to further reduce idling time. CFI’s total upgrades have resulted in a savings of over 73 thousand tons of CO2 since joining SmartWay. CFI also has actively promoted SmartWay and its goals extensively by issuing more than a dozen press releases describing SmartWay and conducting presentations about participating in the program at numerous industry conferences and workshops. CSX Transportation CSX is an international transportation company offering rail, container-shipping, intermodal, trucking and contract logistics. Over 50 % of CSX’s current fleet is equipped with one or more fuel saving technologies. CSX met or exceeded each of their Action Plan targets for 2006/2007, and the company has developed an innovative horsepower reduction kit that produces significant fuel savings and lower emissions. This kit is currently installed on a significant number of the locomotives in its fleet, with more planned in coming years. John Christner Trucking LLC A temperature-controlled truckload carrier based in Oklahoma, John Christner Trucking (JCT) has taken every opportunity to upgrade and improve its fleet of trucks. -

HITTING the MARK: Transportation Companies That Work for Women

Edition 3 | 2018 INSIDE... HITTING FOSTERING DIALOGUE THE MARK: About Gender Diversity Traits for SUCCESS 2018TOP 0 ANIES Driver Campaigns for MILLENNIALS Managing Holiday Stress SAME-GENDER TRAINING POLICY PHOTO CONTEST WINNERS At United Road, what makes us different makes us better. As the nation’s premier car-hauling expert, we transport over three million vehicles throughout North America each and every year. And what makes us the best, besides Carhaul Acquisition Expands Our Fleet Size Teamwork, New Investments In Equipment And Our North American Footprintour leading edge technology, industry-best capacity,Will andProduce Significant Positive Impacts Kathleen McCann, CEO Pat Riley, Senior Vice President diverse service offerings? Welcome to our newest team members! This edition of On the Road Our recent Over the coming months, you will see the was intentionally delayed because we wantedOUR to wait and PE shareO thisPLE. acquisition of transfer of truck equipment that is better suited to good news with you: United Road has completed its acquisition of the The Waggoners conduct the business that it was designed to do, carhaul divisionWe of Theinvite Waggoners you toTrucking learn Co. more We are soabout excited tothe women and men Trucking auto resulting in improved productivity and efficiency. welcome such a great group of professionals to our team! transport busi- Day cab quick loaders and high rail units will 2 3 Althoughthat this has make previously the been wheels communicated of United in various Roadways turn. ness expands work in rail ramp and regional locations where they over the last few weeks, it may be helpful to share the highlights of our United Road’s are best suited.