Cash Flow Comparison

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mobile Intel® 965 Express Chipset Family

Mobile Intel® 965 Express Chipset Family Datasheet Revision 003 June 2007 INFORMATION IN THIS DOCUMENT IS PROVIDED IN CONNECTION WITH INTEL® PRODUCTS. NO LICENSE, EXPRESS OR IMPLIED, BY ESTOPPEL OR OTHERWISE, TO ANY INTELLECTUAL PROPERTY RIGHTS IS GRANTED BY THIS DOCUMENT. EXCEPT AS PROVIDED IN INTEL'S TERMS AND CONDITIONS OF SALE FOR SUCH PRODUCTS, INTEL ASSUMES NO LIABILITY WHATSOEVER, AND INTEL DISCLAIMS ANY EXPRESS OR IMPLIED WARRANTY, RELATING TO SALE AND/OR USE OF INTEL PRODUCTS INCLUDING LIABILITY OR WARRANTIES RELATING TO FITNESS FOR A PARTICULAR PURPOSE, MERCHANTABILITY, OR INFRINGEMENT OF ANY PATENT, COPYRIGHT OR OTHER INTELLECTUAL PROPERTY RIGHT. Intel products are not intended for use in medical, life saving, life sustaining, critical control or safety systems, or in nuclear facility applications. Intel may make changes to specifications and product descriptions at any time, without notice. Designers must not rely on the absence or characteristics of any features or instructions marked reserved or undefined. Intel reserves these for future definition and shall have no responsibility whatsoever for conflicts or incompatibilities arising from future changes to them. The information here is subject to change without notice. Do not finalize a design with this information. The products described in this document may contain design defects or errors known as errata which may cause the product to deviate from published specifications. Current characterized errata are available on request. Contact your local Intel sales office or your distributor to obtain the latest specifications and before placing your product order. This device is protected by U.S. patent numbers 5,315,448 and 6,516,132, and other intellectual property rights. -

Intel® Desktop Board DG41TX Product Guide

Intel® Desktop Board DG41TX Product Guide Order Number: E88309-001 Revision History Revision Revision History Date ® -001 First release of the Intel Desktop Board DG41TX Product Guide February 2010 Disclaimer INFORMATION IN THIS DOCUMENT IS PROVIDED IN CONNECTION WITH INTEL® PRODUCTS. NO LICENSE, EXPRESS OR IMPLIED, BY ESTOPPEL OR OTHERWISE, TO ANY INTELLECTUAL PROPERTY RIGHTS IS GRANTED BY THIS DOCUMENT. EXCEPT AS PROVIDED IN INTEL’S TERMS AND CONDITIONS OF SALE FOR SUCH PRODUCTS, INTEL ASSUMES NO LIABILITY WHATSOEVER, AND INTEL DISCLAIMS ANY EXPRESS OR IMPLIED WARRANTY, RELATING TO SALE AND/OR USE OF INTEL PRODUCTS INCLUDING LIABILITY OR WARRANTIES RELATING TO FITNESS FOR A PARTICULAR PURPOSE, MERCHANTABILITY, OR INFRINGEMENT OF ANY PATENT, COPYRIGHT OR OTHER INTELLECTUAL PROPERTY RIGHT. Intel products are not intended for use in medical, life saving, or life sustaining applications. Intel may make changes to specifications and product descriptions at any time, without notice. Intel Desktop Board DG41TX may contain design defects or errors known as errata which may cause the product to deviate from published specifications. Current characterized errata are available on request. Contact your local Intel sales office or your distributor to obtain the latest specifications and before placing your product order. Copies of documents which have an ordering number and are referenced in this document, or other Intel literature, may be obtained from Intel Corporation by going to the World Wide Web site at: http://intel.com/ or by calling 1-800-548-4725. Intel and the Intel logo are trademarks of Intel Corporation in the U.S. and other countries. * Other names and brands may be claimed as the property of others. -

VIA EPIA M-Series Mini-ITX Mainboard Operation Guidelines

Operating Guidelines Version 1.20 VIA EPIA M-Series Mini-ITX Mainboard Operation Guidelines Contents • Overview • Layout • Specifications • Processor SKUs • CLE266 Chipset Overview • I/O Back Panel Layout • Layout Diagram & Mounting Holes • Noise Levels Data • DVD Playback Tests • Power Consumption Data • Compatible Chassis • Power Specifications • FliteDeck – System Management Suite • Smart5.1 – Intelligent 6 Channel Audio • Linux & Microsoft Driver Support • Contact Operating Guidelines Version 1.20 EPIA M-Series Overview Optimized for today’s killer digital media applications such as watching DVD movies and listening to music, the 17cm x 17cm VIA EPIA M-Series includes a growing range of feature rich and highly versatile solutions for building a complete range of connected multimedia entertainment devices that meet the technical, ergonomic and aesthetic requirements of this emerging but highly demanding market. In addition to an integrated VIA C3 or fanless VIA Eden processors running at speeds of up to 1GHz, the VIA EPIA M-Series features the VIA Apollo CLE266 chipset with embedded UniChrome MPEG-2 decoder and integrated 2D/3D graphics core to ensure smooth DVD playback and a rich overall entertainment experience. With the sizable memory bandwidth of DDR266 SDRAM and the high data transfer speeds of ATA/133, the VIA EPIA M-Series ensures the high performance levels required of today’s most popular digital media and productivity applications. The user’s digital media experience is further enhanced by support for 5.1 surround sound, courtesy of the onboard VIA Six-TRAC 6 Channel AC’97 codec. The latest in high-bandwidth connectivity is supported with IEEE 1394 and USB 2.0 connections provided, as well as S-Video and RCA TV-Out (NTSC & PAL) and 10/100 Ethernet for seamless broadband connectivity. -

User's Manual for Future Reference

User’s Manual EPIA Version 1.31 September 23, 2008 Copyright Copyright © 2003-2008 VIA Technologies Incorporated. All rights reserved. No part of this document may be reproduced, transmitted, transcribed, stored in a retrieval system, or translated into any language, in any form or by any means, electronic, mechanical, magnetic, optical, chemical, manual or otherwise without the prior written permission of VIA Technologies, Incorporated. Trademarks All trademarks are the property of their respective holders. PS/2 is a registered trademark of IBM Corporation. Award BIOS is a registered trademark of Phoenix Technologies Ltd. Disclaimer No license is granted, implied or otherwise, under any patent or patent rights of VIA Technologies. VIA Technologies makes no warranties, implied or otherwise, in regard to this document and to the products described in this document. The information provided in this document is believed to be accurate and reliable as of the publication date of this document. However, VIA Technologies assumes no responsibility for the use or misuse of the information in this document and for any patent infringements that may arise from the use of this document. The information and product specifications within this document are subject to change at any time, without notice and without obligation to notify any person of such change. FCC-B Radio Frequency Interference Statement This equipment has been tested and found to comply with the limits for a class B digital device, pursuant to part 15 of the FCC rules. These limits are designed to provide reasonable protection against harmful interference when the equipment is operated in a commercial environment. -

The ITRS Design Technology and System Drivers Roadmap: Process and Status

The ITRS Design Technology and System Drivers Roadmap: Process and Status Andrew B. Kahng CSE and ECE Depts., Univ. of California at San Diego [email protected] ABSTRACT progress of design technology. The Design technology working group (TWG) is one of 16 working • Understanding of contexts and needs for technology. Con- groups in the International Technology Roadmap for Semiconduc- texts ranging from process technology to market forces affect tors (ITRS) effort. It is responsible for the ITRS’ Design Chap- the need for technology. For example, the trajectory of mo- ter, which roadmaps design technology requirements and poten- bile consumer SOC products has driven rapid innovation in tial solutions for elements of the semiconductor supply chain that low-power design techniques spanning embedded memory are produced by the electronic design automation (EDA) indus- design, power and clock gating, dynamic voltage scaling, try. The Design TWG is also responsible for the ITRS’ System etc. At the same time, these low-power design techniques Drivers Chapter, which roadmaps the key product classes that drive must acknowledge process and material attributes such as the leading-edge requirements for process and design technolo- discreteness of FinFET device widths starting at the 16nm gies. Through these activities, the Design TWG sets a number foundry node, or increasingly dominant reliability and aging of fundamental parameters in the overall ITRS: layout density, die mechanisms. size, maximum on-chip clock frequency, total chip power, SOC and • Holistic selection of potential solutions. Technology roadmap- MPU architecture models, etc. This paper reviews the process by ping must holistically model and predict impacts of potential which the Design TWG evolves its roadmap content, and some of technology solutions, at many levels. -

User's Manual EPIA-EX

User’s Manual EPIA-EX Version 1.14 January 18, 2012 Copyright Copyright © 2010-2012 VIA Technologies Incorporated. All rights reserved. No part of this document may be reproduced, transmitted, transcribed, stored in a retrieval system, or translated into any language, in any form or by any means, electronic, mechanical, magnetic, optical, chemical, manual or otherwise without the prior written permission of VIA Technologies, Incorporated. Trademarks All trademarks are the property of their respective holders. PS/2 is a registered trademark of IBM Corporation. Award BIOS is a registered trademark of Phoenix Technologies Ltd. FCC-B Radio Frequency Interference Statement This equipment has been tested and found to comply with the limits for a class B digital device, pursuant to part 15 of the FCC rules. These limits are designed to provide reasonable protection against harmful interference when the equipment is operated in a commercial environment. This equipment generates, uses and can radiate radio frequency energy and, if not installed and used in accordance with the instruction manual, may cause harmful interference to radio communications. Operation of this equipment in a residential area is likely to cause harmful interference, in which case the user will be required to correct the interference at his personal expense. Notice 1 The changes or modifications not expressly approved by the party responsible for compliance could void the user's authority to operate the equipment. Notice 2 Shielded interface cables and A.C. power cord, if any, must be used in order to comply with the emission limits. Tested To Comply With FCC Standards FOR HOME OR OFFICE USE Safety Instructions 1. -

Atom™ All-In-One Pico ITX CPU Board User's Manual

PICO820 Series ® Intel Atom™ All-In-One Pico ITX CPU Board User’s Manual Disclaimers This manual has been carefully checked and believed to contain accurate information. AXIOMTEK Co., Ltd. assumes no responsibility for any infringements of patents or any third party’s rights, and any liability arising from such use. AXIOMTEK does not warrant or assume any legal liability or responsibility for the accuracy, completeness or usefulness of any information in this document. AXIOMTEK does not make any commitment to update the information in this manual. AXIOMTEK reserves the right to change or revise this document and/or product at any time without notice. No part of this document may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of AXIOMTEK Co., Ltd. Caution If you replace wrong batteries, it causes the danger of explosion. It is recommended by the manufacturer that you follow the manufacturer’s instructions to only replace the same or equivalent type of battery, and dispose of used ones. ©Copyright 2009 AXIOMTEK Co., Ltd. All Rights Reserved February 2009, Version A3 Printed in Taiwan ii ESD Precautions Computer boards have integrated circuits sensitive to static electricity. To prevent chipsets from electrostatic discharge damage, please take care of the following jobs with precautions: Do not remove boards or integrated circuits from their anti-static packaging until you are ready to install them. Before holding the board or integrated circuit, touch an unpainted portion of the system unit chassis for a few seconds. -

Ali Corporation

ALi Corporation ALi Corporation (also known as Acer Laboratories Incorporated or Acer Labs Inc., and commonly known as ALi) is a major designer and manufacturer of embedded systems integrated circuits, and a former manufacturer of personal computer integrated circuits. It is based in Taiwan, and is a subsidiary of the Acer group. The company was founded in 1987, its president is Teddy Lu. Part of ALi including the personal computer integrated circuits business was spun off as ULi Electronics Inc. in June 2003. ULi was acquired by Nvidia in 2006 for $52 million. Contents 1 Products o 1.1 Chipsets . 1.1.1 80X86 Chipsets . 1.1.2 Pentium Chipsets . 1.1.3 Slot 1 and Socket 370 Chipsets . 1.1.4 Slot A and Socket A Chipsets . 1.1.5 Socket 478 Chipsets . 1.1.6 Socket 754/939/940 Chipsets . 1.1.7 Southbridge Chips o 1.2 VGA o 1.3 Video o 1.4 PC peripheral o 1.5 For embedded systems 2 See also 3 References 4 External links Products Chipsets 80X86 Chipsets Part Max. Max. Max. South Releas Processor Bus Max. FS Memor Chipset Number Memor Memor Cach PCI Bridge e Date s Type B y Types s y Bus y e Non M1209 386SX ISA FPM e Non M1217 386SX ISA FPM e 386DX M142 Non M1419 Socket 1 ISA FPM 1 e Socket 2 386DX M143 VES Non M1429 Socket 2 1 A e Socket 3 M144 M1439 Socket 3 PCI 2.0 5 FINALi 48 M148 M1489 Socket 3 PCI 50 MHz EDO 50 MHz 128MB 1MB 2.0 6 7 Pentium Chipsets Max. -

Open Source Software License Information

Open Source Software license information This document contains an open source software license information for the product VACUU·SELECT. The product VACUU·SELECT contains open source components which are licensed under the applicable open source licenses. The applicable open source licenses are listed below. The open source software licenses are granted by the respective right holders directly. The open source licenses prevail all other license information with regard to the respective open source software components contained in the product. Modifications of our programs which are linked to LGPL libraries are permitted for the customer's own use and reverse engineering for debugging such modifications. However, forwarding the information acquired during reverse engineering or debugging to third parties is prohibited. Furthermore, it is prohibited to distribute modified versions of our programs. In any case, the warranty for the product VACUU·SELECT will expire, as long as the customer cannot prove that the defect would also occur without these modification. WARRANTY DISCLAIMER THE OPEN SOURCE SOFTWARE IN THIS PRODUCT IS DISTRIBUTED IN THE HOPE THAT IT WILL BE USEFUL, BUT WITHOUT ANY WARRANTY, WITHOUT EVEN THE IMPLIED WARRANTY OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. See the applicable licenses for more details. Written offer This product VACUU·SELECT contains software components that are licensed by the holder of the rights as free software, or Open Source software, under GNU General Public License, Versions 2 and 3, or GNU Lesser General Public License, Versions 2.1, or GNU Library General Public License, Version 2, respectively. The source code for these software components can be obtained from us on a data carrier (e.g. -

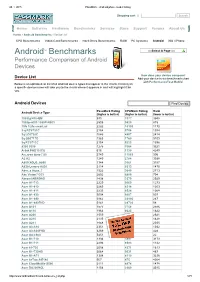

Androidtm Benchmarks

28. 1. 2015 PassMark Android phone model listing Shopping cart | Search Home Software Hardware Benchmarks Services Store Support Forums About Us Home » Android Benchmarks » Device List CPU Benchmarks Video Card Benchmarks Hard Drive Benchmarks RAM PC Systems Android iOS / iPhone TM Select A Page Android Benchmarks Performance Comparison of Android Devices How does your device compare? Device List Add your device to our benchmark chart with PerformanceTest Mobile! Below is an alphabetical list of all Android device types that appear in the charts. Clicking on a specific device name will take you to the charts where it appears in and will highlight it for you. Android Devices Find Device PassMark Rating CPUMark Rating Rank Android Device Type (higher is better) (higher is better) (lower is better) 1005tg N10QM 935 3377 3948 1080pn003 1080PN003 2505 9820 815 1life 1Life.smart.air 2282 10103 1170 3q RC9731C 2154 5756 1394 3q LC0720C 1646 4897 2414 3q QS0717D 1363 1760 3109 3q RC9712C 2154 5223 1396 9300 9300 1275 3364 3321 Alink PAD10 ICS 616 1130 4249 A.c.ryan dyno 7.85 2749 11065 596 A2 A2 1240 2784 3388 A800 XOLO_A800 1344 3661 3157 A830 Lenovo A830 2114 8313 1470 Abs_a Aqua_7 1522 3640 2713 Abc Vision7DCI 2602 6880 704 Abroad ABROAD 1438 3379 2929 Acer A1713 2229 9069 1273 Acer A1810 2265 8314 1203 Acer A1811 2233 8524 1268 Acer A1830 3004 9207 507 Acer A1840 3962 23996 267 Acer A1840FHD 5141 28720 58 Acer A101 1577 3758 2586 Acer A110 1964 8623 1822 Acer A200 1559 3822 2621 Acer A210 2135 8315 1428 Acer A211 1848 8130 2035 Acer A3A10 2351 8128 1032 Acer A3A20FHD 3269 11265 428 Acer AA3600 5451 22392 22 Acer B1710 1336 3897 3173 Acer B1711 2293 8583 1142 Acer b1720 2058 4371 1613 Acer B1730HD 3064 9031 487 Acer B1A71 1308 4119 3236 Acer beTouch E140 567 475 4264 Acer CloudMobile S500 2111 4874 1478 Acer DA220HQL 1156 2960 3545 http://www.androidbenchmark.net/device_list.php 1/71 28. -

SMBIOS) Reference 6 Specification

1 2 Document Identifier: DSP0134 3 Date: 2018-04-26 4 Version: 3.2.0 5 System Management BIOS (SMBIOS) Reference 6 Specification 7 Supersedes: 3.1.1 8 Document Class: Normative 9 Document Status: Published 10 Document Language: en-US 11 System Management BIOS (SMBIOS) Reference Specification DSP0134 12 Copyright Notice 13 Copyright © 2000, 2002, 2004–2016 Distributed Management Task Force, Inc. (DMTF). All rights 14 reserved. 15 DMTF is a not-for-profit association of industry members dedicated to promoting enterprise and systems 16 management and interoperability. Members and non-members may reproduce DMTF specifications and 17 documents, provided that correct attribution is given. As DMTF specifications may be revised from time to 18 time, the particular version and release date should always be noted. 19 Implementation of certain elements of this standard or proposed standard may be subject to third party 20 patent rights, including provisional patent rights (herein "patent rights"). DMTF makes no representations 21 to users of the standard as to the existence of such rights, and is not responsible to recognize, disclose, 22 or identify any or all such third party patent right, owners or claimants, nor for any incomplete or 23 inaccurate identification or disclosure of such rights, owners or claimants. DMTF shall have no liability to 24 any party, in any manner or circumstance, under any legal theory whatsoever, for failure to recognize, 25 disclose, or identify any such third party patent rights, or for such party’s reliance on the standard or 26 incorporation thereof in its product, protocols or testing procedures. -

Wifi to HDMI® Wireless Video Extender with Audio

WiFi to HDMI® Wireless Video Extender with Audio WIFI2HD2 *actual product may vary from photos DE: Bedienungsanleitung - de.startech.com FR: Guide de l'utilisateur - fr.startech.com ES: Guía del usuario - es.startech.com IT: Guida per l'uso - it.startech.com NL: Gebruiksaanwijzing - nl.startech.com PT: Guia do usuário - pt.startech.com For the most up-to-date information, please visit: www.startech.com Manual Revision: 05/08/2013 FCC Compliance Statement This equipment has been tested and found to comply with the limits for a Class B digital device, pursuant to part 15 of the FCC Rules. These limits are designed to provide reasonable protection against harmful interference in a residential installation. This equipment generates, uses and can radiate radio frequency energy and, if not installed and used in accordance with the instructions, may cause harmful interference to radio communications. However, there is no guarantee that interference will not occur in a particular installation. If this equipment does cause harmful interference to radio or television reception, which can be determined by turning the equipment off and on, the user is encouraged to try to correct the interference by one or more of the following measures: • Reorient or relocate the receiving antenna. • Increase the separation between the equipment and receiver. • Connect the equipment into an outlet on a circuit different from that to which the receiver is connected. • Consult the dealer or an experienced radio/TV technician for help. Use of Trademarks, Registered Trademarks, and other Protected Names and Symbols This manual may make reference to trademarks, registered trademarks, and other protected names and/or symbols of third-party companies not related in any way to StarTech.com.