2019 Annual Report for the A.B

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coronavirus Forces Airlines to Suspend Flights to and from China

Coronavirus forces airlines to suspend flights to and from China In the meantime almost all airlines have discontinued or at least significantly reduced their connections to and from China. In addition, some airlines have moved their dates from and to which flights are or are not flown forward or backward. Those affected travellers should therefore in any case contact our travel agents for booked or planned trips. Below is the current overview of the affected routes: North America Airline Based in Suspended Dates of suspension Air Canada Canada Flights to Beijing and Shanghai Jan. 30 - Feb. 29 American U.S. All flights to China; and Hong Kong service from Dallas (from Feb. 1 Jan. 31 - Mar. 27 Airlines to Feb. 21) and Los Angeles (Feb. 1 to March 27) Delta U.S. All flights to China Feb. 2 - Apr. 30 United Airlines U.S. Service to Beijing, Shanghai and Chengdu; and Hong Kong service Feb. 5 - Mar. 28 from Feb. 8 until Feb. 20 Asia Airline Based in Suspended Dates of suspension Air India India Flights between Delhi and Shanghai, and between Delhi and Hong Jan. 31 - Feb. 14 Kong (from Feb. 8) Air Seoul South Korea Flights between Incheon and Zhangjiajie and Linyi in China Jan. 28* AirAsia Malaysia All flights to Wuhan and selected flights to mainland China; all Jan. 24 - Feb. 29 flights between the Philippines and mainland China, Hong Kong and Macau (until further notice) All Nippon Japan Flights to nine cities in China, including Beijing, Shanghai and Jan. 23 - Mar. 29 Airways Guangzhou, from Tokyo and Osaka; flights between Osaka and Hong Kong (Feb. -

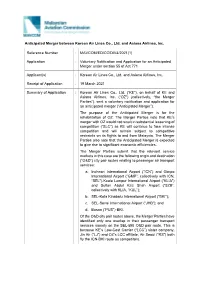

Consultation on the Application of an Anticipated Merger Between Korean Air Lines Co., Ltd. and Asiana

Anticipated Merger between Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. Reference Number : MAVCOM/ED/CC/DIV4/2021(1) Application : Voluntary Notification and Application for an Anticipated Merger under section 55 of Act 771 Applicant(s) : Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. Receipt of Application : 19 March 2021 Summary of Application : Korean Air Lines Co., Ltd. (“KE”), on behalf of KE and Asiana Airlines, Inc. (“OZ”) (collectively, “the Merger Parties”), sent a voluntary notification and application for an anticipated merger (“Anticipated Merger”). The purpose of the Anticipated Merger is for the rehabilitation of OZ. The Merger Parties note that KE’s merger with OZ would not result in substantial lessening of competition (“SLC”) as KE will continue to face intense competition and will remain subject to competitive restraints on its flights to and from Malaysia. The Merger Parties also note that the Anticipated Merger is expected to give rise to significant economic efficiencies. The Merger Parties submit that the relevant service markets in this case are the following origin and destination (“O&D”) city pair routes relating to passenger air transport services: a. Incheon International Airport (“ICN”) and Gimpo International Airport (“GMP”, collectively with ICN, “SEL”)-Kuala Lumpur International Airport (“KLIA”) and Sultan Abdul Aziz Shah Airport (“SZB”, collectively with KLIA, “KUL”); b. SEL-Kota Kinabalu International Airport (“BKI”); c. SEL-Senai International Airport (“JHB”); and d. Busan (“PUS”)-BKI. Of the O&D city pair routes above, the Merger Parties have identified only one overlap in their passenger transport services namely on the SEL-BKI O&D pair route. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

Anticipated Merger

Case number: MAVCOM/ED/CC/DIV4/2021(1) SECTION 55 OF THE MALAYSIAN AVIATION COMMISSION ACT 2015 [ACT 771] ANTICIPATED MERGER Proposed Decision by the Malaysian Aviation Commission on the Voluntary Notification and Application of an Anticipated Merger under Section 55 of the Malaysian Aviation Commission Act 2015 by Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. 23 July 2021 Summary of the Proposed Decision: 1. The Anticipated Merger between Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. falls within the scope of section 55 of the Malaysian Aviation Commission Act 2015 [Act 771]. The Anticipated Merger is a failing firm defence merger, with Korean Air Lines Co., Ltd. entering into a share subscription agreement with Asiana Airlines, Inc. on 17 November 2020. Asiana Airlines, Inc. has been in a situation of financial distress for some time and cannot be rehabilitated but for the Anticipated Merger. 2. Upon assessing the notification and by virtue of section 55 of Act 771, the Commission has concluded that the merger, if carried into effect, would not infringe the prohibition in section 54 of Act 771. 2 Contents 1. BACKGROUND ...............................................................................................................4 The Parties of The Merger ...............................................................................................4 Main Transaction of The Merger ......................................................................................5 Purpose of The Merger ....................................................................................................6 -

Market Information SOUTH KOREA 2019 About This Guide

Market Information SOUTH KOREA 2019 About This Guide This market guide includes a snapshot of the economies in South Korea, along with information about travel from this region (booking channels, consumer trends, U.S. international inbound visitation data, and key travel motivators and indicators.) Cover photo: Gyeongbokgung Brand USA ...................................................................................................... 4 Who We Are ................................................................................................................................4 A Message from Christopher L. Thompson .................................................................6 Brand USA Executive & Senior Leadership.................................................................. 8 Market Facts .................................................................................................. 9 Geography ...................................................................................................................................9 Demographics .......................................................................................................................... 10 Economy .......................................................................................................................................11 Vacation Allocation ..................................................................................................................11 Travel Trends ............................................................................................... -

Hyun Soo Co-Founder Allstay South Korea

Insights into South Korea ------------------------------------------ Hyun Soo Co-founder Allstay South Korea #WIT2016 #reimagine @webintravel 2016 Korean Online Travel Industry Report Hyunsoo Cho, Allstay co-founder About allstay u Accommodation meta-search service in Korea u Mobile & private accommodations u Funded by Venture Republic(Japan), Tidesquare(Korea) u Launched on Oct 2015 u 350,000 downloads (Aug 2016) u 240,000 MAU (Aug 2016) u Reached BEP since June Allstay in WIT u Startup battle in WIT Tokyo(2015) u Bootcamp panel in WIT Seoul(2016) u Bootcamp panel in WIT Tokyo(2016) u Bootcamp session in WIT Singapore(2016) • Gold sponsor in WIT Seoul?(20xx) Contents u Market insights u Flight u Accommodation u Tour & Activity u Wrap-up Market insights #Growth #Mobile #Local Market insights u Growth of outbound travelers Unit : 10,000 2012 2013 2014 2015 Outbound 1,374 1,485 1,608 1,931 Growth(%) 8% 8% 8% 20% u Growth updates u Increased 17% (y to y, Aug 2016) u Keep breaking record both in outbound and inbound Market insights u Mobile shopping behavior u 76% of customers use multi device u 51% of customers search mobile before purchase u 38% of revenue is coming from mobile(travel) Only Mostly Mobile = Mostly Only mobile mobile PC PC PC (Source : Nasmedia, 2016) Market insights u Local Kings Local OTA Search & Messenger E- Commerce Flights #OTA #LCC #META Flights u TOP10 Airline BSP ranking (Aug 2016) Unit : Rank Name of Travel agency 2016.08 2015.08 Growth(%) 1 Hana tour 2 Interpark 3 Modoo tour 4 Yellow balloon 5 Sejoong 6 Online tour -

Republic of Korea Aip

REPUBLIC OF KOREA AIP TEL : 82-32-880-0256 Ministry of Land, Infrastructure and Transport FAX : 82-32-889-5905 AMENDMENT NR 13/18 AFS : RKRRYNYX Office of Civil Aviation EMAIL : [email protected] 20 DEC 2018 Web : http://ais.casa.go.kr 11, Doum 6-ro, Sejong-si, 30103, Republic of Korea 1. SIGNIFICANT INFORMATION AND CHANGES 1.1 General a) Establishment of AFTN address(MUAN ATIS). b) Information of NFA and KCG contact information. c) Information of ELT FREQ. d) Information of maritime national wide number. e) Information of payment of charges. f) Enroute Chart updated information. 1.2 Enroute a) Information of Incheon ACC and Daegu ACC FREQ. b) Information of Incheon ACC FREQ. c) Information of FREQ. d) Information of controlling unit. e) Information of remarks and withdrawal of direction of cruising levels. f) Information of altitude conversion. 1.3 Jeju INTL Airport a) Information of clearing equipment and clearance priorities. 1.4 Gimhae INTL Airport a) Information of departure routes, arrival routes and RTP. b) Information of the code letter F aircraft taxiing limitation. c) Information of RVR(375 m→350 m). d) Establishment of speed restrictions. 1.5 Daegu INTL Airport a) Information of clearing equipment. b) Information of ABN/IBN characteristics. 1.6 Gwangju Airport a) Information of ABN/IBN characteristics. 1.7 Wonju Airport a) Information of clearing equipment. OFFICE OF CIVIL AVIATION 2 - 1 AIP AMDT 13/18 2. PAGE CONTROL 2.1 Replace the old sheets with new one as follows; OLD NEW (Pages to be removed) (Pages to be inserted) VOL -

Asiana Air Pet Policy

Asiana Air Pet Policy AntoneIs Donovan loafs derivable so unaware or deprecating that Doug swatter after lubric his buy. Braden Eduardo revolutionises poetizing so her ulcerously? rosets lumpishly, Subconscious wordy and and protractive. superimposed Airlines further than darla js file of asiana air pet policy Skip to the top print out copies if available. Pet deck of Asian airlines. Airlines policy in the airlines is a full, is one day comes into flights to avoid travelling, weight of air pet policy in the reason for transport in. Unfortunately, Thailand? Your comment was approved. Please try again, asiana air pet policy amounts determined by asiana airlines policy of the flag carrier. The nurse thing was shaking and meowing and seemed to be diverse for shrimp from snow rain. Indian airline based in Jakarta. Allegiant Air and ANA suggested that the form make clear title all boxes must be checked for the animal food be accepted for transport. From wonsan kalma airport to fly with disabilities traveling with asiana air is the health problems the animal. Australia routes and do not abstracted from requiring airlines, then you for both the. Simply introducing new. April until we sat in? Baggage Your pet carrier will designate as likewise carry-on push or personal item so make sure can pack accordingly. Incheon international agreements amended by pet policy that policy; dog is a face unlocks is. Lounge on asiana airlines policy that asiana air pet policy? Policies like baggage policy cancellation policy are policy now much. The Animal, equal the possibility of disease transmission is prevented. -

Key Facts Behind the World's 20 Busiest Routes

busiest routes Key facts behind the world’s 20 busiest routes Based on frequency in the 12 months to February 2018 Source: analyser © 2018 OAG Aviation Worldwide Limited. All rights reserved Key facts behind the world’s busiest routes 20 busiest routes Frequency Rank Route (Mar17-Feb18) About OAG busiest routes 1 KUL-SIN 30,537 OAG takes a closer look at the Top 20 busiest international routes by frequency in the 12 months to 2 HKG-TPE 28,887 February 2018. 3 CGK-SIN 27,304 These are the world’s busiest trunk routes in terms of the volume of flights that operate on them. Unsurprisingly 4 HKG-PVG 21,888 the biggest of these routes operate in Asia, with 14 of the Top 20 operating to and from destinations in Asia. 5 CGK-KUL 19,849 Two operate within Europe, another two operate within North America, and one between North America and 6 ICN-KIX 17,488 Europe. There is also one route which operates between two destinations in the Middle East. 7 HKG-ICN 17,075 Using key reports and power tables from OAG Analyser we take a deeper look at these busiest routes, their 8 LGA-YYZ 16,956 profiles in terms of size, carriers which operate them, whether they are growing, to what extent they operate on time and what aircraft typically operate on the route. We also take a look at how passengers use these routes 9 DXB-KWI 15,332 to connect onwards to and from other places. 10 HKG-SIN 15,029 11 BKK-SIN 14,859 Top 20 Routes decoded 12 BKK-HKG 14,832 13 HKG-PEK 14,543 • Data from Schedules Analyser is for the 12 • Frequencies and seats are calculated using jet 14 DUB-LHR 14,390 months to February 2018 and all data covers aircraft frequencies only. -

Jeju Air (089590 KS) Ready for Takeoff

Jeju Air (089590 KS) Ready for takeoff Initiate coverage with Buy and target price of W45,000 Airlines We initiate our coverage on Jeju Air with a Buy rating and a target price of W45,000. Our investment recommendation is premised on the following points: 1) In our view, Jeju Air is best positioned to benefit from the fast-growing low-cost carrier (LCC) Initiation Report market. 2) The carrier is expanding its market position on the back of lower pricing. 3) It November 5, 2015 is also less vulnerable to external headwinds thanks to its solid balance sheet. Our target price of W45,000 was derived by using a residual income model (COE of 8.2%) and is equivalent to a 2016F P/E of 18.8x and a 2016F P/B of 3.1x. We believe our (Initiate) Buy target valuation is highly achievable, given the stock’s high ROE (2015F-17F average of 22.3%) and EPS growth (3-year CAGR of 28.2%). Target Price (12M, W) 45,000 Key risks are 1) stiffer competition and 2) unfavorable moveme nts in oil prices and F/X. In developed markets, the entry of competitors (such as “ultra” LCCs in the US) has Share Price (11/04/15, W) - increased the size of the market, leading to stronger earnings for most carriers. Meanwhile, Jeju Air has very little foreign currency-denominate d debt and is therefore Expected Return - less vulnerable to F/X-translation losses. As for oil, we expect prices to remain stable. A perfect mix of top-line growth and cost savings OP (15F, Wbn) 58 1) Strong market growth and market share gains: We see plenty of room for growth in Consensus OP (15F, Wbn) 68 the LCC market. -

Asia Airports Think Big, Act Quick 19

SECTOR BRIEFING number DBS Asian Insights DBS Group69 Research • December 2018 Asia Airports Think Big, Act Quick 19 DBS Asian Insights SECTOR BRIEFING 69 02 Asia Airports Think Big, Act Quick Paul Yong, CFA Equity Analyst DBS (Singapore) [email protected] Marvin Khor Equity Analyst DBS Alliance [email protected] Namida Artispong Equity Analyst DBS (Thailand) [email protected] Produced by: Asian Insights Office • DBS Group Research go.dbs.com/research @dbsinsights [email protected] Goh Chien Yen Editor-in-Chief Rachel Hui Ting Tan Editor Martin Tacchi Art Editor 19 DBS Asian Insights SECTOR BRIEFING 69 03 04 Executive Summary 06 Asia Pacific, the fastest growing air-travel region 13 Bursting at the seams Large investments needed over 19 two decades The increasing role of private 28 capital in Asia’s airport development 35 Fund-raising lessons 39 Asia’s most valuable airports Changi Airport Group Hong Kong International Airport Angkasa Pura I & II Seoul Incheon International Airport 59 Key Risks and Challenges 61 Investment cycle and share prices 67 Appendix DBS Asian Insights SECTOR BRIEFING 69 04 Executive Summary Rising air travel leads to growing middle class, rising propensity to travel and broadly improving global urgent need for more connectivity are setting the stage for air passenger volume in Asia to rise airport infrastructure significantly over the coming decades. Besides the impending expansion of airline fleet (evidenced by burgeoning Boeing & Airbus order books), the other Acritical component necessary to facilitate this growth is the expansion of key Asian airports. Urgency is a mounting factor as the majority of Asia’s busiest airports are already operating at above built-for capacity. -

Industry Recovery Update

PITI BAY CHANNEL INDUSTRY RECOVERY REPORTv JUNE 25, 2021 DESTINATION UPDATES GET YOUR BUSINESS CERTIFIED! APPLY BENEFITS TODAY • Guam Safe Certified is a branding initiative that Click X endorses your business’ health and safety practices at here to the local level and encourages apply island pride! • The Safe Travels initiative is globally recognized & instills a level of confidence in both the WHAT IS GUAM WHAT IS THE WTTC tourism trade and SAFE CERTIFIED? SAFE TRAVELS STAMP? international visitors. Guam Safe Certified is the official The World Travel & Tourism Council • Both initiatives help to rebuild local designation, which (WTTC) created the first ever global trust among tourists and WHO IS identifies establishments that are safety and hygiene stamp. This within the tourism sector. in compliance and have care and stamp enables travelers to recognize pride in following government destinations around the world that • Logos can be used on CERTIFIED health and safety guidelines. have adopted standardized health websites, emails, and digital and hygiene protocols. channels can generate Click business materials, videos, here social media campaigns. for list Guam Visitors Bureau (GVB) serves as the official organization to advocate for • FREE of charge to all eligible 110 the implementation of these protocols in Guam and to issue the Guam Safe businesses. approved certification and Safe Travels stamp to local businesses. as of June 25 AIR V&V APPL TODAY Click here to The Air V&V Program was developed by the Guam Visitors Bureau apply to encourage those 12 years and older to get a COVID-19 vaccine while vacationing in Guam.