Air Seoul Tokyo Branch

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gawc Link Classification FINAL.Xlsx

High Barcelona Beijing Sufficiency Abu Dhabi Singapore sufficiency Boston Sao Paulo Barcelona Moscow Istanbul Toronto Barcelona Tokyo Kuala Lumpur Los Angeles Beijing Taiyuan Lisbon Madrid Buenos Aires Taipei Melbourne Sao Paulo Cairo Paris Moscow San Francisco Calgary Hong Kong Nairobi New York Doha Sydney Santiago Tokyo Dublin Zurich Tokyo Vienna Frankfurt Lisbon Amsterdam Jakarta Guangzhou Milan Dallas Los Angeles Hanoi Singapore Denver New York Houston Moscow Dubai Prague Manila Moscow Hong Kong Vancouver Manila Mumbai Lisbon Milan Bangalore Tokyo Manila Tokyo Bangkok Istanbul Melbourne Mexico City Barcelona Buenos Aires Delhi Toronto Boston Mexico City Riyadh Tokyo Boston Munich Stockholm Tokyo Buenos Aires Lisbon Beijing Nanjing Frankfurt Guangzhou Beijing Santiago Kuala Lumpur Vienna Buenos Aires Toronto Lisbon Warsaw Dubai Houston London Port Louis Dubai Lisbon Madrid Prague Hong Kong Perth Manila Toronto Madrid Taipei Montreal Sao Paulo Montreal Tokyo Montreal Zurich Moscow Delhi New York Tunis Bangkok Frankfurt Rome Sao Paulo Bangkok Mumbai Santiago Zurich Barcelona Dubai Bangkok Delhi Beijing Qingdao Bangkok Warsaw Brussels Washington (DC) Cairo Sydney Dubai Guangzhou Chicago Prague Dubai Hamburg Dallas Dubai Dubai Montreal Frankfurt Rome Dublin Milan Istanbul Melbourne Johannesburg Mexico City Kuala Lumpur San Francisco Johannesburg Sao Paulo Luxembourg Madrid Karachi New York Mexico City Prague Kuwait City London Bangkok Guangzhou London Seattle Beijing Lima Luxembourg Shanghai Beijing Vancouver Madrid Melbourne Buenos Aires -

ZIPAIR's December 2020 to End of March 2021 Period Tokyo-Seoul

ZIPAIR’s December 2020 to end of March 2021 period Tokyo-Seoul and Tokyo-Bangkok routes booking is now open October 30, 2020 Tokyo, October 30, 2020 – ZIPAIR Tokyo will start to sell tickets for the Tokyo (Narita) - Seoul (Incheon) and Tokyo (Narita) - Bangkok (Suvarnabhumi) routes for travel between December 1, 2020 and March 27, 2021, from today, October 30. 1. Flight Schedule Tokyo (Narita) - Seoul (Incheon) (October 25 – March 26, 2021) Flight Route Schedule Operating day number Tokyo (Narita) = ZG 41 Narita (NRT) 8:40 a.m. Seoul (ICN) 11:15 a.m. Tue., Fri., Sun. Seoul (Incheon) ZG 42 Seoul (ICN) 12:40 p.m. Narita (NRT) 3:05 p.m. Tue., Fri., Sun. Bangkok (Suvarnabhumi) – Tokyo (Narita) “one-way” Service (October 28 – March 27, 2021) Flight Route Schedule Operating day number Bangkok This service is only available from Bangkok. (Suvarnabhumi) - ZG 52 Bangkok (BKK) 11:30 p.m. Wed., Thu., Fri., Tokyo (Narita) Narita (NRT) 7:15 a.m. (+1) Sat., Sun. 2. Sales Start Flights between December 1 and March 27, 2021. October 30, 6:00 p.m. Website:https://www.zipair.net 3. Airfares (1) Seat Fare (Tokyo - Seoul route) Fare (per seat, one-way) Fare Types Effective period Age Tokyo-Seoul Seoul-Tokyo ZIP Full-Flat JPY30,000-141,000 KRW360,000-440,000 7 years and older Standard Oct. 25, 2020 JPY8,000-30,000 KRW96,000-317,000 7 years and - Mar. 26, 2021 older U6 Standard JPY3,000 KRW36,000 Less than 7 years (2) Seat Fare (Tokyo - Bangkok route) Fare (per seat, one-way) Fare Types Effective period Age Tokyo-Bangkok Bangkok-Tokyo ZIP Full-Flat THB15,000-61,800 7 years and Value older Standard Oct. -

Coronavirus Forces Airlines to Suspend Flights to and from China

Coronavirus forces airlines to suspend flights to and from China In the meantime almost all airlines have discontinued or at least significantly reduced their connections to and from China. In addition, some airlines have moved their dates from and to which flights are or are not flown forward or backward. Those affected travellers should therefore in any case contact our travel agents for booked or planned trips. Below is the current overview of the affected routes: North America Airline Based in Suspended Dates of suspension Air Canada Canada Flights to Beijing and Shanghai Jan. 30 - Feb. 29 American U.S. All flights to China; and Hong Kong service from Dallas (from Feb. 1 Jan. 31 - Mar. 27 Airlines to Feb. 21) and Los Angeles (Feb. 1 to March 27) Delta U.S. All flights to China Feb. 2 - Apr. 30 United Airlines U.S. Service to Beijing, Shanghai and Chengdu; and Hong Kong service Feb. 5 - Mar. 28 from Feb. 8 until Feb. 20 Asia Airline Based in Suspended Dates of suspension Air India India Flights between Delhi and Shanghai, and between Delhi and Hong Jan. 31 - Feb. 14 Kong (from Feb. 8) Air Seoul South Korea Flights between Incheon and Zhangjiajie and Linyi in China Jan. 28* AirAsia Malaysia All flights to Wuhan and selected flights to mainland China; all Jan. 24 - Feb. 29 flights between the Philippines and mainland China, Hong Kong and Macau (until further notice) All Nippon Japan Flights to nine cities in China, including Beijing, Shanghai and Jan. 23 - Mar. 29 Airways Guangzhou, from Tokyo and Osaka; flights between Osaka and Hong Kong (Feb. -

Inclusive Growth in Seoul

Inclusive Growth in Seoul Policy Highlights About the OECD About the OECD The Organisation for Economic Co-operation and Development (OECD) is a forum in which The Organisation for Economic Co-operation and Development (OECD) is a forum in which governments compare and exchange policy experiences, identify good practices in light of emerging governments compare and exchange policy experiences, identify good practices in light of emerging challenges, and promote decisions and recommendations to produce better policies for better lives. challenges, and promote decisions and recommendations to produce better policies for better lives. The OECD’s mission is to promote policies that improve economic and social well-being of people The OECD’s mission is to promote policies that improve economic and social well-being of people around the world. around the world. The OECD Champion Mayors initiative The OECD Champion Mayors initiative The OECD launched a global coalition of Champion Mayors for Inclusive Growth in March 2016, as part The OECD launched a global coalition of Champion Mayors for Inclusive Growth in March 2016, as part of the broader OECD Inclusive Growth initiative. The OECD approach to Inclusive Growth is multi- of the broader OECD Inclusive Growth initiative. The OECD approach to Inclusive Growth is multi- dimensional, going beyond income. Champion Mayors are a group of willing leaders who have dimensional, going beyond income. Champion Mayors are a group of willing leaders who have committed to tackling inequalities and promoting more inclusive economic growth in cities. For more committed to tackling inequalities and promoting more inclusive economic growth in cities. -

From Incheon Airport to Conrad Seoul Airport Bus # 6030

From Incheon Airport to Conrad Seoul Method Depart Arrival Cost Duration Remarks Hotel Incheon Conrad Seoul Hotel KRW 159,500 45 min. *most convenient* Limousine Airport Terminal 1: Gate 6B Airport bus Incheon 60 min (T1). Terminal 2: Gate 32 Conrad Seoul Hotel KRW 15,000 # 6030 Airport 1hr 15min (T2). (approximately 18 minutes from T2 to T1) KRW 60,000 (R) Incheon R: Regular taxi Taxi Conrad Seoul Hotel KRW 75,000 (D) 50 min. ~ 1hr Airport D: Deluxe taxi *Toll fee inclusive Take Airport Railroad (AREX) from Incheon airport Terminal 1 or 2(bound for Yeouido Stn. (exit #3) Gongdeok Station) then Transfer to T2: KRW 4,750 T2: 78 min is 10 min. walking Subway subway Line #5 at Gongduk Station T1: KRW 4,150 T1: 70 min distance away from (bound for Banghwa station) -> take off Hotel at Yeouido Station ※ Duration time and taxi fare can be changed depending on traffic condition Airport bus # 6030 Information Bus stop at Incheon airport Terminal 1 Bus stop is at 1st Floor Gate 6B in Incheon International Airport Terminal 1 Bus ticket purchasing is at gate 4 or 9 Bus stop at Incheon airport Terminal 2 Bus stop is at B1 Floor Gate 32 in Incheon International Airport Terminal 2 Bus ticket purchasing is available at ticket office on same B1 Floor. Conrad Seoul, 23-1, Yeouido-dong, Yeongdungpo-gu, Seoul 150-945, Korea Tel. 82-2-6137-7000 Concierge / Front office Time Table for Airport Bus #6030 How to take Airport railroad (AREX) From Incheon Airport Terminal 1: Ticketing available on B1F, take the regular Airport railroad From Incheon Airport Terminal 2: Ticketing available on B1F, take the regular Airport railroad Stations Incheon International Airport Terminal 2 ⇔ Incheon International Airport Terminal 1 ⇔ Incheon International Airport Cargo Terminal ⇔ Unseo ⇔ Yeongjong ⇔ Cheongna International City ⇔ Geomam ⇔ Gyeyang ⇔ Gimpo International Airport ⇔ Digital Media City ⇔ Hongik University ⇔ Gondeok(Transfer to Line#5) ⇔ Seoul Station From Gimpo Airport to Conrad Seoul Method Depart Arrival Cost Duration Remarks Hotel Gimpo Airport Conrad Seoul Hotel KRW 99,000 30 min. -

Shikoku Access Map Matsuyama City & Tobe Town Area

Yoshikawa Interchange Hiroshima Airport Okayama Airport Okayama Kobe Suita Sanyo Expressway Kurashiki Junction Interchange Miki Junction Junction Junction Shikoku Himeji Tarumi Junction Itami Airport Hiroshima Nishiseto-Onomichi Sanyo Shinkansen Okayama Hinase Port Shin-Kobe Shin- Okayama Interchange Himeji Port Osaka Hiroshima Port Kure Port Port Obe Kobe Shinko Pier Uno Port Shodoshima Kaido Shimanami Port Tonosho Rural Experience Content Access Let's go Seto Ohashi Fukuda Port all the way for Port an exclusive (the Great Seto Bridge) Kusakabe Port Akashi Taka Ikeda Port experience! matsu Ohashi Shikoku, the journey with in. Port Sakate Port Matsubara Takamatsu Map Tadotsu Junction Imabari Kagawa Sakaide Takamatsu Prefecture Kansai International Imabari Junction Chuo Airport Matsuyama Sightseeing Port Iyosaijyo Interchange Interchange Niihama Awajishima Beppu Beppu Port Matsuyama Takamatsu Airport 11 11 Matsuyama Kawanoe Junction Saganoseki Port Tokushima Wakayama Oita Airport Matsuyama Iyo Komatsu Kawanoe Higashi Prefecture Naruto Interchange Misaki Interchange Junction Ikawa Ikeda Interchange Usuki Yawata Junction Wakimachi Wakayama Usuki Port Interchange hama Interchange Naruto Port Port Ozu Interchange Ehime Tokushima Prefecture Awa-Ikeda Tokushima Airport Saiki Yawatahama Port 33 32 Tokushima Port Saiki Port Uwajima Kochi 195 Interchange Hiwasa What Fun! Tsushima Iwamatsu Kubokawa Kochi Gomen Interchange Kochi Prefecture 56 Wakai Kanoura ■Legend Kochi Ryoma Shimantocho-Chuo 55 Airport Sukumo Interchange JR lines Sukumo Port Nakamura -

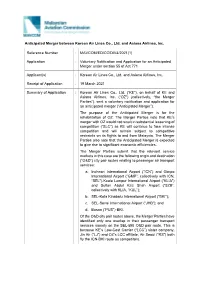

Consultation on the Application of an Anticipated Merger Between Korean Air Lines Co., Ltd. and Asiana

Anticipated Merger between Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. Reference Number : MAVCOM/ED/CC/DIV4/2021(1) Application : Voluntary Notification and Application for an Anticipated Merger under section 55 of Act 771 Applicant(s) : Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. Receipt of Application : 19 March 2021 Summary of Application : Korean Air Lines Co., Ltd. (“KE”), on behalf of KE and Asiana Airlines, Inc. (“OZ”) (collectively, “the Merger Parties”), sent a voluntary notification and application for an anticipated merger (“Anticipated Merger”). The purpose of the Anticipated Merger is for the rehabilitation of OZ. The Merger Parties note that KE’s merger with OZ would not result in substantial lessening of competition (“SLC”) as KE will continue to face intense competition and will remain subject to competitive restraints on its flights to and from Malaysia. The Merger Parties also note that the Anticipated Merger is expected to give rise to significant economic efficiencies. The Merger Parties submit that the relevant service markets in this case are the following origin and destination (“O&D”) city pair routes relating to passenger air transport services: a. Incheon International Airport (“ICN”) and Gimpo International Airport (“GMP”, collectively with ICN, “SEL”)-Kuala Lumpur International Airport (“KLIA”) and Sultan Abdul Aziz Shah Airport (“SZB”, collectively with KLIA, “KUL”); b. SEL-Kota Kinabalu International Airport (“BKI”); c. SEL-Senai International Airport (“JHB”); and d. Busan (“PUS”)-BKI. Of the O&D city pair routes above, the Merger Parties have identified only one overlap in their passenger transport services namely on the SEL-BKI O&D pair route. -

Seoul Between Beijing and Washington: South Korea's

Seoul Between Beijing and Washington: South Korea’s Strategic Dilema EIAS Briefing Seminar 23 May 2017 For thousands of years, Korea has been called “A Shrimp Among Whales”, implying the challenging situation of being land and sea- locked between Big Powers fighting for regional dominance. The 21st century is witnessing Korea being caught in the power struggle be- tween a “Rising China” and an ever more demanding “Long Time Ally”, the US. Recently, China has been strongly opposing the forgery of close security- related ties between Seoul and Washington, while the new US president Trump has initiated isolationist and protectionist economic policies. Korea is being forced to re-think its security agenda and re-evaluate its foreign policy partnership priorities. The US- initiated deployment of the Terminal High Altitude Area De- fense (THAAD) system in Korea might come as a source of solace in view of the intensified frequency and magnitude of North Korean em- anated nuclear threats, however China cannot condone the American security commitments as they come as a plight on its own state secu- rity. Arguably, Korea is now facing handicapped bilateral economic relations with China that are taking a tangible toll on Korean busi- nesses and putting pressure on the Korean institutions, particularly in this arduous governmental transition period. Thus, Seoul is faced with the challenge of balancing between security and economic interests, all the while managing its vital foreign policy relations with both great powers. Opening Remarks by Mr Frederic Carlier, Senior Associate, EIAS Mr Frederic Carlier introduced the topic of the discussion, namely the evolving strategic dilemma that South Korea is facing- the need to balance on the one hand the Korea-US alliance representing its security interests against, on the other hand, the strategic partnership with China representing its economic interests. -

Analysis of the Effects of Air Transport Liberalisation on the Domestic Market in Japan

Chikage Miyoshi Analysis Of The Effects Of Air Transport Liberalisation On The Domestic Market In Japan COLLEGE OF AERONAUTICS PhD Thesis COLLEGE OF AERONAUTICS PhD Thesis Academic year 2006-2007 Chikage Miyoshi Analysis of the effects of air transport liberalisation on the domestic market in Japan Supervisor: Dr. G. Williams May 2007 This thesis is submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy © Cranfield University 2007. All rights reserved. No part of this publication may be reproduced without the written permission of the copyright owner Abstract This study aims to demonstrate the different experiences in the Japanese domestic air transport market compared to those of the intra-EU market as a result of liberalisation along with the Slot allocations from 1997 to 2005 at Haneda (Tokyo international) airport and to identify the constraints for air transport liberalisation in Japan. The main contribution of this study is the identification of the structure of deregulated air transport market during the process of liberalisation using qualitative and quantitative techniques and the provision of an analytical approach to explain the constraints for liberalisation. Moreover, this research is considered original because the results of air transport liberalisation in Japan are verified and confirmed by Structural Equation Modelling, demonstrating the importance of each factor which affects the market. The Tokyo domestic routes were investigated as a major market in Japan in order to analyse the effects of liberalisation of air transport. The Tokyo routes market has seven prominent characteristics as follows: (1) high volume of demand, (2) influence of slots, (3) different features of each market category, (4) relatively low load factors, (5) significant market seasonality, (6) competition with high speed rail, and (7) high fares in the market. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

Anticipated Merger

Case number: MAVCOM/ED/CC/DIV4/2021(1) SECTION 55 OF THE MALAYSIAN AVIATION COMMISSION ACT 2015 [ACT 771] ANTICIPATED MERGER Proposed Decision by the Malaysian Aviation Commission on the Voluntary Notification and Application of an Anticipated Merger under Section 55 of the Malaysian Aviation Commission Act 2015 by Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. 23 July 2021 Summary of the Proposed Decision: 1. The Anticipated Merger between Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. falls within the scope of section 55 of the Malaysian Aviation Commission Act 2015 [Act 771]. The Anticipated Merger is a failing firm defence merger, with Korean Air Lines Co., Ltd. entering into a share subscription agreement with Asiana Airlines, Inc. on 17 November 2020. Asiana Airlines, Inc. has been in a situation of financial distress for some time and cannot be rehabilitated but for the Anticipated Merger. 2. Upon assessing the notification and by virtue of section 55 of Act 771, the Commission has concluded that the merger, if carried into effect, would not infringe the prohibition in section 54 of Act 771. 2 Contents 1. BACKGROUND ...............................................................................................................4 The Parties of The Merger ...............................................................................................4 Main Transaction of The Merger ......................................................................................5 Purpose of The Merger ....................................................................................................6 -

Flight Path to New Horizons Annual Report 2012 for the Year Ended March 31, 2012

Flight Path to New Horizons Annual Report 2012 For the Year Ended March 31, 2012 Web Edition Shinichiro Ito President and Chief Executive Officer Editorial Policy The ANA Group aims to establish security and reliability through communication with its stakeholders, thus increasing corporate value. Annual Report 2012 covers management strategies, a business overview and our management struc- ture, along with a wide-ranging overview of the ANA Group’s corporate social responsibility (CSR) activities. We have published information on CSR activities that we have selected as being of particular importance to the ANA Group and society in general. Please see our website for more details. ANA’s CSR Website: http://www.ana.co.jp/eng/aboutana/corporate/csr/ Welcome aboard Annual Report 2012 The ANA Group targets growth with a global business perspective. Based on our desire to deliver ANA value to customers worldwide, our corporate vision is to be one of the leading corporate groups in Asia, providing passenger and cargo transportation around the world. The ANA Group will achieve this vision by responding quickly to its rapidly changing operating environment and continuing to innovate in each of its businesses. We are working toward our renaissance as a stronger ANA Group in order to make further meaningful progress. Annual Report 2012 follows the ANA Group on its journey through the skies as it vigorously takes on new challenges to get on track for further growth. Annual Report Flight 2012 is now departing. Enjoy your flight! Targeted Form of the ANA Group ANA Group Corporate Philosophy ANA Group Corporate Vision Our Commitments On a foundation of security and reliability, With passenger and cargo the ANA Group will transportation around the world • Create attractive surroundings for customers as its core field of business, • Continue to be a familiar presence the ANA Group aims to be one of the • Offer dreams and experiences to people leading corporate groups in Asia.