Jeju Air (089590 KS) Ready for Takeoff

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Coronavirus Forces Airlines to Suspend Flights to and from China

Coronavirus forces airlines to suspend flights to and from China In the meantime almost all airlines have discontinued or at least significantly reduced their connections to and from China. In addition, some airlines have moved their dates from and to which flights are or are not flown forward or backward. Those affected travellers should therefore in any case contact our travel agents for booked or planned trips. Below is the current overview of the affected routes: North America Airline Based in Suspended Dates of suspension Air Canada Canada Flights to Beijing and Shanghai Jan. 30 - Feb. 29 American U.S. All flights to China; and Hong Kong service from Dallas (from Feb. 1 Jan. 31 - Mar. 27 Airlines to Feb. 21) and Los Angeles (Feb. 1 to March 27) Delta U.S. All flights to China Feb. 2 - Apr. 30 United Airlines U.S. Service to Beijing, Shanghai and Chengdu; and Hong Kong service Feb. 5 - Mar. 28 from Feb. 8 until Feb. 20 Asia Airline Based in Suspended Dates of suspension Air India India Flights between Delhi and Shanghai, and between Delhi and Hong Jan. 31 - Feb. 14 Kong (from Feb. 8) Air Seoul South Korea Flights between Incheon and Zhangjiajie and Linyi in China Jan. 28* AirAsia Malaysia All flights to Wuhan and selected flights to mainland China; all Jan. 24 - Feb. 29 flights between the Philippines and mainland China, Hong Kong and Macau (until further notice) All Nippon Japan Flights to nine cities in China, including Beijing, Shanghai and Jan. 23 - Mar. 29 Airways Guangzhou, from Tokyo and Osaka; flights between Osaka and Hong Kong (Feb. -

COVID-19) on Civil Aviation: Economic Impact Analysis

Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis Montréal, Canada 11 March 2020 Contents • Introduction and Background • Scenario Analysis: Mainland China • Scenario Analysis: Hong Kong SAR of China and Macao SAR of China • Summary of Scenario Analysis and Additional Estimates: China • Scenario Analysis: Republic of Korea • Scenario Analysis: Italy • Scenario Analysis: Iran (Islamic Republic of) • Preliminary Analysis: Japan and Singapore 2 Estimated impact on 4 States with the highest number of confirmed cases* Estimated impact of COVID-19 outbreak on scheduled international passenger traffic during 1Q 2020 compared to originally-planned: • China (including Hong Kong/Macao SARs): 42 to 43% seat capacity reduction, 24.8 to 28.1 million passenger reduction, USD 6.0 to 6.9 billion loss of gross operating revenues of airlines • Republic of Korea: 27% seat capacity reduction, 6.1 to 6.6 million passenger reduction, USD 1.3 to 1.4 billion loss of gross operating revenues of airlines • Italy: 19% seat capacity reduction, 4.8 to 5.4 million passenger reduction, USD 0.6 to 0.7 billion loss of gross operating revenues of airlines • Iran (Islamic Republic of): 25% seat capacity reduction, 580,000 to 630,000 passenger reduction, USD 92 to 100 million loss of gross operating revenues of airlines * Coronavirus Disease 2019 (COVID-19) Situation Report by WHO 3 Global capacity share of 4 States dropped from 23% in January to 9% in March 2020 • Number of seats offer by airlines for scheduled international passenger traffic; -

Development of Civil Aviation in the Republic of Korea

Development of Civil Aviation in the Republic of Korea 14 July 2009 Development of Korea’s Civil Aviation Contents I Growth of civil aviation in Korea II Global Status of Korea’s civil aviation III International cooperation in aviation IV Airports of Korea V Boosting int’l cooperation & readying for future 1/21 Development of Korea’s Civil Aviation I. Growth of Civil Aviation in Korea 1. Commencement of Air Services in Korea Sept. 1913: First airplane flown in Korea’s airspace Mar. 1916: Airfield construction in Seoul at Yeoeuido Additional airfields built at Pyeongyang, Shineuiju, Ulsan, Hamheung, and Cheongjin in 1929 Dec. 1922: Changnam Ahn becomes the first Korean pilot to fly an aircraft in Korean airspace 1939: Gimpo Airport opens after completion of a runway 1945: US airlines Northwest Orient launches services between Seoul and Tokyo 1946: Northwest Orient launches domestic operations on 4 routes including between Seoul and Busan 2/21 Development of Korea’s Civil Aviation I. Growth of Civil Aviation in Korea 2. Birth of Commercial Airlines 1946: Korean National Air (KNA) established with 100% private capital Oct. 1948: Seoul-Busan operations launched Sept. 1948: Northwest Orient begins services on Seattle-Tokyo-Seoul route flying 2 times a week Sept. 1950: Services launched on Busan/Jeju and Busan/Daegu routes Dec. 1953 - Jan. 1954: Test flights begun between Seoul and Hong Kong (72 person capacity DC-4) Dissolved in 1962 due to deficits 3/21 Development of Korea’s Civil Aviation I. Growth of Civil Aviation in Korea 3. Birth of Korean Air 1962: Korea Airline Corporation founded as a government-owned public corporation 1968: Hanjin takes over Korean Airline 1971: Changed name to Korean Air 2006: Ranked 16th in int’l passenger transports and 1st in cargo transports World’s top international air cargo carrier from 2004 to 2008 June 2009: Operating to 101 cities/39 countries on 135 routes (124 aircraft) 4. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

08-06-2021 Airline Ticket Matrix (Doc 141)

Airline Ticket Matrix 1 Supports 1 Supports Supports Supports 1 Supports 1 Supports 2 Accepts IAR IAR IAR ET IAR EMD Airline Name IAR EMD IAR EMD Automated ET ET Cancel Cancel Code Void? Refund? MCOs? Numeric Void? Refund? Refund? Refund? AccesRail 450 9B Y Y N N N N Advanced Air 360 AN N N N N N N Aegean Airlines 390 A3 Y Y Y N N N N Aer Lingus 053 EI Y Y N N N N Aeroflot Russian Airlines 555 SU Y Y Y N N N N Aerolineas Argentinas 044 AR Y Y N N N N N Aeromar 942 VW Y Y N N N N Aeromexico 139 AM Y Y N N N N Africa World Airlines 394 AW N N N N N N Air Algerie 124 AH Y Y N N N N Air Arabia Maroc 452 3O N N N N N N Air Astana 465 KC Y Y Y N N N N Air Austral 760 UU Y Y N N N N Air Baltic 657 BT Y Y Y N N N Air Belgium 142 KF Y Y N N N N Air Botswana Ltd 636 BP Y Y Y N N N Air Burkina 226 2J N N N N N N Air Canada 014 AC Y Y Y Y Y N N Air China Ltd. 999 CA Y Y N N N N Air Choice One 122 3E N N N N N N Air Côte d'Ivoire 483 HF N N N N N N Air Dolomiti 101 EN N N N N N N Air Europa 996 UX Y Y Y N N N Alaska Seaplanes 042 X4 N N N N N N Air France 057 AF Y Y Y N N N Air Greenland 631 GL Y Y Y N N N Air India 098 AI Y Y Y N N N N Air Macau 675 NX Y Y N N N N Air Madagascar 258 MD N N N N N N Air Malta 643 KM Y Y Y N N N Air Mauritius 239 MK Y Y Y N N N Air Moldova 572 9U Y Y Y N N N Air New Zealand 086 NZ Y Y N N N N Air Niugini 656 PX Y Y Y N N N Air North 287 4N Y Y N N N N Air Rarotonga 755 GZ N N N N N N Air Senegal 490 HC N N N N N N Air Serbia 115 JU Y Y Y N N N Air Seychelles 061 HM N N N N N N Air Tahiti 135 VT Y Y N N N N N Air Tahiti Nui 244 TN Y Y Y N N N Air Tanzania 197 TC N N N N N N Air Transat 649 TS Y Y N N N N N Air Vanuatu 218 NF N N N N N N Aircalin 063 SB Y Y N N N N Airlink 749 4Z Y Y Y N N N Alaska Airlines 027 AS Y Y Y N N N Alitalia 055 AZ Y Y Y N N N All Nippon Airways 205 NH Y Y Y N N N N Amaszonas S.A. -

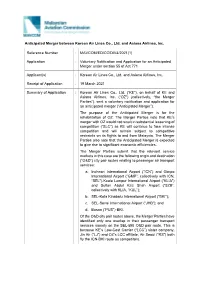

Consultation on the Application of an Anticipated Merger Between Korean Air Lines Co., Ltd. and Asiana

Anticipated Merger between Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. Reference Number : MAVCOM/ED/CC/DIV4/2021(1) Application : Voluntary Notification and Application for an Anticipated Merger under section 55 of Act 771 Applicant(s) : Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. Receipt of Application : 19 March 2021 Summary of Application : Korean Air Lines Co., Ltd. (“KE”), on behalf of KE and Asiana Airlines, Inc. (“OZ”) (collectively, “the Merger Parties”), sent a voluntary notification and application for an anticipated merger (“Anticipated Merger”). The purpose of the Anticipated Merger is for the rehabilitation of OZ. The Merger Parties note that KE’s merger with OZ would not result in substantial lessening of competition (“SLC”) as KE will continue to face intense competition and will remain subject to competitive restraints on its flights to and from Malaysia. The Merger Parties also note that the Anticipated Merger is expected to give rise to significant economic efficiencies. The Merger Parties submit that the relevant service markets in this case are the following origin and destination (“O&D”) city pair routes relating to passenger air transport services: a. Incheon International Airport (“ICN”) and Gimpo International Airport (“GMP”, collectively with ICN, “SEL”)-Kuala Lumpur International Airport (“KLIA”) and Sultan Abdul Aziz Shah Airport (“SZB”, collectively with KLIA, “KUL”); b. SEL-Kota Kinabalu International Airport (“BKI”); c. SEL-Senai International Airport (“JHB”); and d. Busan (“PUS”)-BKI. Of the O&D city pair routes above, the Merger Parties have identified only one overlap in their passenger transport services namely on the SEL-BKI O&D pair route. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

Anticipated Merger

Case number: MAVCOM/ED/CC/DIV4/2021(1) SECTION 55 OF THE MALAYSIAN AVIATION COMMISSION ACT 2015 [ACT 771] ANTICIPATED MERGER Proposed Decision by the Malaysian Aviation Commission on the Voluntary Notification and Application of an Anticipated Merger under Section 55 of the Malaysian Aviation Commission Act 2015 by Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. 23 July 2021 Summary of the Proposed Decision: 1. The Anticipated Merger between Korean Air Lines Co., Ltd. and Asiana Airlines, Inc. falls within the scope of section 55 of the Malaysian Aviation Commission Act 2015 [Act 771]. The Anticipated Merger is a failing firm defence merger, with Korean Air Lines Co., Ltd. entering into a share subscription agreement with Asiana Airlines, Inc. on 17 November 2020. Asiana Airlines, Inc. has been in a situation of financial distress for some time and cannot be rehabilitated but for the Anticipated Merger. 2. Upon assessing the notification and by virtue of section 55 of Act 771, the Commission has concluded that the merger, if carried into effect, would not infringe the prohibition in section 54 of Act 771. 2 Contents 1. BACKGROUND ...............................................................................................................4 The Parties of The Merger ...............................................................................................4 Main Transaction of The Merger ......................................................................................5 Purpose of The Merger ....................................................................................................6 -

Airports of Thailand Plc. for 6 Months of Fiscal Year 2018 (October 2017 – March 2018)

Airports of Thailand Plc. For 6 Months of Fiscal Year 2018 (October 2017 – March 2018) Investor Relations Department, E-mail: [email protected], Tel: (662) 535-5900, Fax (662) 535-5909 Disclaimer This presentation is intended to assist investors to better understand the company’s business and financial status. This presentation may contain forward looking statements relate to analysis and other information which are based on forecast of future results and estimates of amounts not yet determinable. These statements reflect our current views with respect to future events which relate to our future prospects, developments and business strategies and are not guarantee of future performance. Such forward looking statements involve known and unknown risks and uncertainties. The actual result may differ materially from information contained in these statements. 2 Airports in Thailand MAE FAH LUANG-CHIANG RAI Total of 39 airports INTERNATIONAL AIRPORT CHIANG MAI INTERNATIONAL Airports of Thailand Public Company Limited AIRPORT ▪ 2 in Bangkok and perimeter Pai Mae Hong Son o Suvarnabhumi Airport (BKK) Nan Lampang o Don Mueang International Airport (DMK) Phrae Udon Thani ▪ 4 international airports at regional sites Sukhothai Nakhon Phanom Tak Loei Mae Sot Sakon Nakhorn o Chiang Mai International Airport (CNX) Phitsanulok Khon Kaen Phetchabun o Phuket International Airport (HKT) Roi Ed DON MUEANG o Hat Yai International Airport (HDY) INTERNATIONAL Surin * AIRPORT Buri Ram Ubon Ratchathani o Mae Fah Luang-Chiang Rai International Airport (CEI) -

Jeju Air (089590 KS ) Fears of Rights Issue Come to Pass

Jeju Air (089590 KS ) Fears of rights issue come to pass Airlines W170bn rights offering to cause 32% share dilution Company Report Yesterday, Jeju Air announced its decision to issue 12.14mn new shares, representing May 22, 2020 46% of its current shares outstanding. The new shares will be offered to e xisting shareholders (20% to the employee stock ownership association) on a basis of 0.37 th th shares for each share held. The subscription period will run from July 14 to July 15 , and any shares unsubscribed by existing shareholders will be offered to the public. The record date for the rights offering will be June 10th , 2020 , and the new shares will be (Downgrade) Sell listed on August 4, 2020. Target Price (12M, W) 17,000 The offering is expected to raise roughly W170bn, of which W67.8bn will be used on debt repayment and W102.2bn on working capital. The expected offering price is Share Price (05/21/20, W) 19,600 W14,000 per share, but the final price will be determined based on the first reference price (June 5 th ) and the second reference price (July 9 th ). Expected Return -13% More fundraising may be needed by year-end if current conditions continue As of end-1Q20, Jeju Air held cash and cash equivalents of W68bn (W99bn when OP (20F, Wbn) -174 including short-term financial assets). We believe the carrier has reduced its monthly Consensus OP (20F, Wbn) -181 cash outflow from over W50bn to W30-40bn currently by deferring some payments (leases, etc.) and furloughing its employees. -

356 Partners Found. Check If Available in Your Market

367 partners found. Check if available in your market. Please always use Quick Check on www.hahnair.com/quickcheck prior to ticketing P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon GA Garuda Indonesia XL LATAM Airlines