Study on Airport Ownership and Management and the Ground Handling Market in Selected Non-European Union (EU) Countries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Turkey Aerospace & Defense

TURKEY AEROSPACE & DEFENSE 2016 AEROSPACE TURKEY TURKEY AEROSPACE & DEFENSE 2016 Aerospace - Defense - Original Equipment Manufacturers Platforms - Clusters - Multinationals - Sub-Tier Suppliers Distinguished GBR Readers, Since the inception of the Undersecretariat for Defense Industries 30 years ago, significant steps have been taken to achieve the goals of having the Turkish armed forces equipped with modern systems and technologies and promoting the development of the Turkish defense industry. In the last decade alone, the aerospace and defense (A&D) sector's total turnover quadrupled, while exports have increased fivefold, reaching $5.1 billion and $1.65 billion in 2014, respectively. The industry's investment in research and development (R&D) reached almost $1 billion in 2014. The total workforce in the A&D industry reached 30,000 personnel, of which 30% are engineers. Even more remarkable, Turkey is now at the stage of offering its own platforms for both the local market and to international allies, and has commenced a series of follow up local programs. Although this progress has been achieved under the circumstances of a healthy and consistent political environment and in parallel with sustained growth in the Turkish economy, the proportion of expenditure for defense in the national budget and as a percentage of Turkey’s GDP has been stable. With the help of the national, multinational and joint defense industry projects that have been undertaken in Turkey by the undersecretariat, the defense industry has become a highly capable community comprising large-scale main contractors, numerous sub- system manufacturers, small- and medium-sized enterprises, R&D companies who are involved in high-tech, niche areas, research institutes, and universities. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

ERDAL KILIÇASLAN [email protected] +90 505 912 8952 +90 212 252 6339

ERDAL KILIÇASLAN [email protected] +90 505 912 8952 +90 212 252 6339 EXPERIENCE: ------------------------------------------------------------------------------------------------ TÜBİTAK BİLGEM İLTAREN -ANKARA 2013- ◊ Technical Adviser for Electronic Warfare Projects. DDI TECHNOLOGY INC -İSTANBUL 2012- ◊ Technical Adviser for Research and Development Projects RMK MARINE INC -İSTANBUL 2011-2012 ◊ Technical Adviser for the Military Ship Projects İSTANBUL OTOKAR INC -İSTANBUL/ADAPAZARI 2009-2012 ◊ Technical Adviser for the Project of Turkish National Main Battle Tank (ALTAY Project) Evaluation and Conceptual Design of Active Protection System of Turkish National Main Battle Tank Design of “Threat Evaluation Unit” of the Turkish Main Battle Tank Requirement Analysis of the Project MIKES INC. / “BAE SYSTEMS” -ANKARA/NEW YORK 2006-2008 ◊ Promoted to System Engineering Group Leader as a Design Lead System Engineer (Ankara, Facilities – NEW YORK) Participated in the Project of Modernization of F-16 Aircrafts until the preparation of System Test Procedures as System Engineering Group Leader in Ankara and New York Facilities, o Analyzed all the radars in the threat list of F-16 Aircrafts o Guided the Threat Data Package Analysis Process, o Participated in the jamming techniques definition process for the threats of F-16 Aircrafts. o Participated in the definition and analysis process of the system and software requirements, o Prepared the Test Engineering Management Process Document for the Modernization of F-16 Aircrafts Radar Warning Receivers, -

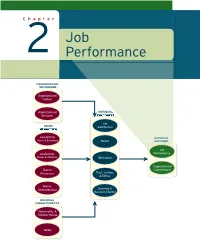

Organizational Behavior with Job Performance

Revised Pages Chapter Job 2 Performance ORGANIZATIONAL MECHANISMS Organizational Culture Organizational INDIVIDUAL Structure MECHANISMS Job GROUP Satisfaction MECHANISMS Leadership: INDIVIDUALINDIVIDUAL Styles & Behaviors Stress OUTCOMEOUTCOMESS Job Leadership: Performance Power & Influence Motivation Organizational Teams: Commitment Trust, Justice, Processes & Ethics Teams: Characteristics Learning & Decision-Making INDIVIDUAL CHARACTERISTICS Personality & Cultural Values Ability ccol30085_ch02_034-063.inddol30085_ch02_034-063.indd 3344 11/14/70/14/70 22:06:06:06:06 PPMM Revised Pages After growth made St. Jude Children’s Research Hospital the third largest health- care charity in the United States, the organization developed employee perfor- mance problems that it eventually traced to an inadequate rating and appraisal system. Hundreds of employ- ees gave input to help a consulting firm solve the problems. LEARNING GOALS After reading this chapter, you should be able to answer the following questions: 2.1 What is the defi nition of job performance? What are the three dimensions of job performance? 2.2 What is task performance? How do organizations identify the behaviors that underlie task performance? 2.3 What is citizenship behavior, and what are some specifi c examples of it? 2.4 What is counterproductive behavior, and what are some specifi c examples of it? 2.5 What workplace trends affect job performance in today’s organizations? 2.6 How can organizations use job performance information to manage employee performance? ST. JUDE CHILDREN’S RESEARCH HOSPITAL The next time you order a pizza from Domino’s, check the pizza box for a St. Jude Chil- dren’s Research Hospital logo. If you’re enjoying that pizza during a NASCAR race, look for Michael Waltrip’s #99 car, which Domino’s and St. -

Development of Civil Aviation in the Republic of Korea

Development of Civil Aviation in the Republic of Korea 14 July 2009 Development of Korea’s Civil Aviation Contents I Growth of civil aviation in Korea II Global Status of Korea’s civil aviation III International cooperation in aviation IV Airports of Korea V Boosting int’l cooperation & readying for future 1/21 Development of Korea’s Civil Aviation I. Growth of Civil Aviation in Korea 1. Commencement of Air Services in Korea Sept. 1913: First airplane flown in Korea’s airspace Mar. 1916: Airfield construction in Seoul at Yeoeuido Additional airfields built at Pyeongyang, Shineuiju, Ulsan, Hamheung, and Cheongjin in 1929 Dec. 1922: Changnam Ahn becomes the first Korean pilot to fly an aircraft in Korean airspace 1939: Gimpo Airport opens after completion of a runway 1945: US airlines Northwest Orient launches services between Seoul and Tokyo 1946: Northwest Orient launches domestic operations on 4 routes including between Seoul and Busan 2/21 Development of Korea’s Civil Aviation I. Growth of Civil Aviation in Korea 2. Birth of Commercial Airlines 1946: Korean National Air (KNA) established with 100% private capital Oct. 1948: Seoul-Busan operations launched Sept. 1948: Northwest Orient begins services on Seattle-Tokyo-Seoul route flying 2 times a week Sept. 1950: Services launched on Busan/Jeju and Busan/Daegu routes Dec. 1953 - Jan. 1954: Test flights begun between Seoul and Hong Kong (72 person capacity DC-4) Dissolved in 1962 due to deficits 3/21 Development of Korea’s Civil Aviation I. Growth of Civil Aviation in Korea 3. Birth of Korean Air 1962: Korea Airline Corporation founded as a government-owned public corporation 1968: Hanjin takes over Korean Airline 1971: Changed name to Korean Air 2006: Ranked 16th in int’l passenger transports and 1st in cargo transports World’s top international air cargo carrier from 2004 to 2008 June 2009: Operating to 101 cities/39 countries on 135 routes (124 aircraft) 4. -

ALBANY COUNTY AIRPORT AUTHORITY Albany, New York 12211-1057

ALBANY COUNTY AIRPORT AUTHORITY 2010 Operating Budget Adopted December 7, 2009 A component unit of the County of Albany, in the Town of Colonie, New York ALBANY COUNTY AIRPORT AUTHORITY Albany, New York 12211-1057 BOARD MEMBERS DAVID E. LANGDON - Chairman JOHN A. GRAZIANO, JR. ANTHONY GORMAN REV. KENNETH DOYLE ELLIOTT A. SHAW DENNIS J. FITZGERALD DORSEY M. WHITEHEAD ______________________________________________________________ ______________________________________________________________ SENIOR STAFF JOHN A. O’DONNELL WILLIAM J. O’REILLY, CPA Chief Executive Officer Chief Financial Officer MARGARET HERRMANN RIMA A. CERRONE Chief Accountant Budget & Performance Manager _____________________ www.albanyairport.com CUSIP #012123XXX ALBANY COUNTY AIRPORT AUTHORITY TABLE OF CONTENTS PAGES 1. TRANSMITTAL LETTER/BUDGET MESSAGE Status of Airline Industry----------------------------------------------------------------------------- 1-1 – 1-2 Air Trade Area served by Albany International Airport--------------------------------------- 1-2 Status of Albany International Airport------------------------------------------------------------- 1-2 – 1-3 Activity Projections for 2010------------------------------------------------------------------------- 1-4 Airline Use and Lease Agreement----------------------------------------------------------------- 1-4 Airport and Fixed Based Operations Operating Agreements------------------------------- 1-4 – 1-5 2010 Operating Budget Financial Highlights---------------------------------------------------- 1-5 – -

Albany International Annual Report 2021

Albany International Annual Report 2021 Form 10-K (NYSE:AIN) Published: February 25th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ______________________________________________________________ FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended: December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________. Commission file number: 1-10026 ______________________________________________________________ ALBANY INTERNATIONAL CORP. ____________________________________________________________________ (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 216 Airport Drive, Rochester, New Hampshire (Address of principal executive offices) 14-0462060 (IRS Employer Identification No.) 03867 (Zip Code) Registrant’s telephone number, including area code 603-330-5850 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Class A Common Stock, $0.001 par value per AIN The New York Stock Exchange (NYSE) share Class B Common Stock, $0.001 par value per AIN The New York Stock Exchange (NYSE) share Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Y es ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Crash Survivability and the Emergency Brace Position

航空宇宙政策․法學會誌 第 33 卷 第 2 號 논문접수일 2018. 11. 30 2018년 12월 30일 발행, pp. 199~224 논문심사일 2018. 12. 14 http://dx.doi.org/10.31691/KASL33.2.6. 게재확정일 2018. 12. 30 Regulatory Aspects of Passenger and Crew Safety: Crash Survivability and the Emergency Brace Position Jan M. Davies* 46) CONTENTS Ⅰ. Introduction Ⅱ. Passenger and Crew Crash Survivability and the Emergency Brace Position Ⅲ. Regulations, and their Gaps, Relating to the Emergency Brace Position Ⅳ. Conclusions * Professor Jan M Davies MSc MD FRCPC FRAeS is a Professor of Anesthesiology, Perioperative and Pain Medicine in the Cumming School of Medicine and an Adjunct Professor of Psychology in the Faculty of Arts, University of Calgary. She is the chair of IBRACE, the International Board for Research into Aircraft Crash Events. (https://en. wikipedia.org/wiki/International_Board_for_Research_into_Aircraft_Crash_Events) Amongst other publications, she is the co-author, with Linda Campbell, of An Investigation into Serial Deaths During Oral Surgery. In: Selby H (Ed) The Inquest Handbook, Leichardt, NSW, Australia: The Federation Press; 1998;150-169 and co-author with Drs. Keith Anderson, Christopher Pysyk and JN Armstrong of Anaesthesia. In: Freckelton I and Selby H (Eds). Expert Evidence. Thomson Reuters, Australia, 2017. E-Mail : [email protected] 200 航空宇宙政策․法學會誌 第 33 卷 第 2 號 Ⅰ. Introduction Barely more than a century has passed since the first passenger was carried by an aircraft. That individual was Henri Farman, an Anglo-French painter turned aviator. He was a passenger on a flight piloted by Léon Delagrange, a French sculptor turned aviator, and aircraft designer and manufacturer. -

India: Airport Security Screening for Passengers Departing on International Flights Research Directorate, Immigration and Refugee Board of Canada, Ottawa

Home > Research > Responses to Information Requests RESPONSES TO INFORMATION REQUESTS (RIRs) New Search | About RIR's | Help 14 April 2009 IND103120.E India: Airport security screening for passengers departing on international flights Research Directorate, Immigration and Refugee Board of Canada, Ottawa In 27 April 2009 correspondence, the Security Manager of Air India in Toronto stated the following in regard to airport security screening for passengers departing on international flights: … when the passenger approaches the check-in counter, his/her travel documents, such as passport, visa, ticket, etc. are checked by an airline check-in agent to verify the genuineness of the [documents] prior to the issuance of a boarding card. After obtaining the boarding card, the passenger goes through immigration checks where his/her passport/visa is thoroughly screened and their biographical data are stored into the computer by the government immigration officials. And, at this stage the passenger's data is matched with the suspected criminal databank. The Security Manager also stated that these screening procedures are generally similar at all airports (27 April 2009). The Bengaluru International Airport [Bangalore] website has a "security and passport control" section for international flight passengers that states that passengers, after acquiring their boarding pass, must proceed to the emigration check area where they are to complete "Visa formalities," after which they can proceed to the "international security control area," and then to the departure area (n.d.). Specific information on the security screening procedures within the emigration check area or the international security control area is not available on this airport website. -

Vea Un Ejemplo

3 To search aircraft in the registration index, go to page 178 Operator Page Operator Page Operator Page Operator Page 10 Tanker Air Carrier 8 Air Georgian 20 Amapola Flyg 32 Belavia 45 21 Air 8 Air Ghana 20 Amaszonas 32 Bering Air 45 2Excel Aviation 8 Air Greenland 20 Amaszonas Uruguay 32 Berjaya Air 45 748 Air Services 8 Air Guilin 20 AMC 32 Berkut Air 45 9 Air 8 Air Hamburg 21 Amelia 33 Berry Aviation 45 Abu Dhabi Aviation 8 Air Hong Kong 21 American Airlines 33 Bestfly 45 ABX Air 8 Air Horizont 21 American Jet 35 BH Air - Balkan Holidays 46 ACE Belgium Freighters 8 Air Iceland Connect 21 Ameriflight 35 Bhutan Airlines 46 Acropolis Aviation 8 Air India 21 Amerijet International 35 Bid Air Cargo 46 ACT Airlines 8 Air India Express 21 AMS Airlines 35 Biman Bangladesh 46 ADI Aerodynamics 9 Air India Regional 22 ANA Wings 35 Binter Canarias 46 Aegean Airlines 9 Air Inuit 22 AnadoluJet 36 Blue Air 46 Aer Lingus 9 Air KBZ 22 Anda Air 36 Blue Bird Airways 46 AerCaribe 9 Air Kenya 22 Andes Lineas Aereas 36 Blue Bird Aviation 46 Aereo Calafia 9 Air Kiribati 22 Angkasa Pura Logistics 36 Blue Dart Aviation 46 Aero Caribbean 9 Air Leap 22 Animawings 36 Blue Islands 47 Aero Flite 9 Air Libya 22 Apex Air 36 Blue Panorama Airlines 47 Aero K 9 Air Macau 22 Arab Wings 36 Blue Ridge Aero Services 47 Aero Mongolia 10 Air Madagascar 22 ARAMCO 36 Bluebird Nordic 47 Aero Transporte 10 Air Malta 23 Ariana Afghan Airlines 36 Boliviana de Aviacion 47 AeroContractors 10 Air Mandalay 23 Arik Air 36 BRA Braathens Regional 47 Aeroflot 10 Air Marshall Islands 23 -

RASG-PA ESC/29 — WP/04 14/11/17 Twenty

RASG‐PA ESC/29 — WP/04 14/11/17 Twenty ‐ Ninth Regional Aviation Safety Group — Pan America Executive Steering Committee Meeting (RASG‐PA ESC/29) ICAO NACC Regional Office, Mexico City, Mexico, 29‐30 November 2017 Agenda Item 3: Items/Briefings of interest to the RASG‐PA ESC PROPOSAL TO AMEND ICAO FLIGHT DATA ANALYSIS PROGRAMME (FDAP) RECOMMENDATION AND STANDARD TO EXPAND AEROPLANES´ WEIGHT THRESHOLD (Presented by Flight Safety Foundation and supported by Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP) EXECUTIVE SUMMARY The Flight Data Analysis Program (FDAP) working group comprised by representatives of Airbus, ATR, Embraer, IATA, Brazil ANAC, ICAO SAM Office, and SRVSOP, is in the process of preparing a proposal to expand the number of functional flight data analysis programs. It is anticipated that a greater number of Flight Data Analysis Programs will lead to significantly greater safety levels through analysis of critical event sets and incidents. Action: The FDAP working group is requesting support for greater implementation of FDAP/FDMP throughout the Pan American Regions and consideration of new ICAO standards through the actions outlined in Section 4 of this working paper. Strategic Safety Objectives: References: Annex 6 ‐ Operation of Aircraft, Part 1 sections as mentioned in this working paper RASG‐PA ESC/28 ‐ WP/09 presented at the ICAO SAM Regional Office, 4 to 5 May 2017. 1. Introduction 1.1 Flight Data Recorders have long been used as one of the most important tools for accident investigations such that the term “black box” and its recovery is well known beyond the aviation industry. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L.