Biocryst Pharmaceuticals Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Biotech Investing 2020

BIOTECH INVESTING 2020 Bill Cara www.billcara.com [email protected] 647-868-6013 JULY 20, 2020 A. Report Overview This Greenfield Capital (billcara.com) report on the Biotechnology industry is written by a registered investment consultant & portfolio manager, not by a scientist. Our objective is to provide education and information to investors who lack the tools to trade successfully in an industry made vitally important to the world by the coronavirus pandemic of 2020. If we want to live through this pandemic -- and future ones -- where it is possible that hundreds of millions of us could perish because of the lack of diagnostics, vaccines, and therapeutics, then as investors we should be keenly interested in the Biotech industry. News reports state that in just six and a half months, COVID-19, initially called SARS- CoV-2, has killed more people than the number of Americans who die each year from opioid overdose (46,000), traffic accidents (36,500), and gun violence (40,000) combined. But, currently, there is no vaccine for COVID-19, and the treatment options for patients with severe or life-threatening symptoms are limited. As the world struggles to contain the deadly virus, there are, fortunately, over 140 coronavirus vaccines in development. News is breaking every day. At the same time, however, many individuals who are trading in Biotech stocks remain woefully uninformed and are speculating wildly. Some Biotech stocks that have appreciated 100% or more in a few months on hopefulness may have trouble sustaining gains beyond the news peak. Still, for investors who study this industry, there are opportunities right now to buy Biotech stocks that will grow in price well into the future. -

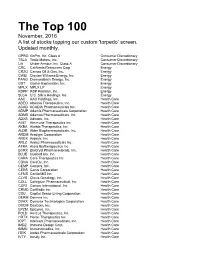

The Top 100 November, 2016 a List of Stocks Topping Our Custom 'Torpedo’ Screen

The Top 100 November, 2016 A list of stocks topping our custom 'torpedo’ screen. Updated monthly. GPRO GoPro, Inc. Class A Consumer Discretionary TSLA Tesla Motors, Inc. Consumer Discretionary UA Under Armour, Inc. Class A Consumer Discretionary CRC California Resources Corp Energy CRZO Carrizo Oil & Gas, Inc. Energy CWEI Clayton Williams Energy, Inc. Energy FANG Diamondback Energy, Inc. Energy GST Gastar Exploration, Inc. Energy MPLX MPLX LP Energy RSPP RSP Permian, Inc. Energy SLCA U.S. Silica Holdings, Inc. Energy AAC AAC Holdings, Inc. Health Care ABEO Abeona Therapeutics, Inc. Health Care ACAD ACADIA Pharmaceuticals Inc. Health Care ADMP Adamis Pharmaceuticals Corporation Health Care ADMS Adamas Pharmaceuticals, Inc. Health Care ADXS Advaxis, Inc. Health Care AIMT Aimmune Therapeutics Inc Health Care AKBA Akebia Therapeutics, Inc. Health Care ALDR Alder Biopharmaceuticals, Inc. Health Care ARDM Aradigm Corporation Health Care ARDX Ardelyx, Inc. Health Care ARLZ Aralez Pharmaceuticals Inc. Health Care ATRA Atara Biotherapeutics Inc Health Care BCRX BioCryst Pharmaceuticals, Inc. Health Care BLUE bluebird bio, Inc. Health Care CARA Cara Therapeutics Inc Health Care CDNA CareDx, Inc. Health Care CEMP Cempra, Inc. Health Care CERS Cerus Corporation Health Care CFMS ConforMIS Inc Health Care CLVS Clovis Oncology, Inc. Health Care COLL Collegium Pharmaceutical, Inc. Health Care CORI Corium International, Inc. Health Care CRMD CorMedix Inc. Health Care CSU Capital Senior Living Corporation Health Care DERM Dermira Inc Health Care DVAX Dynavax Technologies Corporation Health Care DXCM DexCom, Inc. Health Care EPZM Epizyme, Inc. Health Care FOLD Amicus Therapeutics, Inc. Health Care HRTX Heron Therapeutics Inc Health Care ICPT Intercept Pharmaceuticals, Inc. -

Curriculum Vitae: Daniel J

CURRICULUM VITAE: DANIEL J. WALLACE, M.D., F.A.C.P., M.A.C.R. Up to date as of January 1, 2019 Personal: Address: 8750 Wilshire Blvd, Suite 350 Beverly Hills, CA 90211 Phone: (310) 652-0010 FAX: (310) 360-6219 E mail: [email protected] Education: University of Southern California, 2/67-6/70, BA Medicine, 1971. University of Southern California, 9/70-6/74, M.D, 1974. Postgraduate Training: 7/74-6/75 Medical Intern, Rhode Island (Brown University) Hospital, Providence, RI. 7/75-6/77 Medical Resident, Cedars-Sinai Medical Center, Los Angeles, CA. 7/77-6/79 Rheumatology Fellow, UCLA School of Medicine, Los Angeles, CA. Medical Boards and Licensure: Diplomate, National Board of Medical Examiners, 1975. Board Certified, American Board of Internal Medicine, 1978. Board Certified, Rheumatology subspecialty, 1982. California License: #G-30533. Present Appointments: Medical Director, Wallace Rheumatic Study Center Attune Health Affiliate, Beverly Hills, CA 90211 Attending Physician, Cedars-Sinai Medical Center, Los Angeles, 1979- Clinical Professor of Medicine, David Geffen School of Medicine at UCLA, 1995- Professor of Medicine, Cedars-Sinai Medical Center, 2012- Expert Reviewer, Medical Board of California, 2007- Associate Director, Rheumatology Fellowship Program, Cedars-Sinai Medical Center, 2010- Board of Governors, Cedars-Sinai Medical Center, 2016- Member, Medical Policy Committee, United Rheumatology, 2017- Honorary Appointments: Fellow, American College of Physicians (FACP) Fellow, American College of Rheumatology (FACR) -

RESI Boston Program Guide 09-26-2017 Digital

SEPTEMBER 26 , 2017 BOSTON, MA Early stage investors, fundraising CEOs, scientist-entrepreneurs, strategic partners, and service providers now have an opportunity to Make a Compelling Connection ONSITE GUIDE LIFE SCIENCE NATION Connecting Products, Services & Capital #RESIBOS17 | RESIConference.com | Boston Marriott Copley Place FLOOR PLAN Therapeutics Track 2 Investor Track 3 & track4 Track 1 Device, Panels Workshops & Diagnostic & HCIT Asia Investor Panels Panels Ad-Hoc Meeting Area Breakfast & Lunch DINING 29 25 30 26 31 27 32 28 33 29 34 30 35 Breakfast / LunchBreakfast BUFFETS 37 28 24 27 23 26 22 25 21 24 20 23 19 22 exhibit hall 40 15 13 16 14 17 15 18 16 19 17 20 18 21 39 INNOVATION 14 12 13 11 12 10 11 9 10 8 9 7 8 EXHIBITORS CHALLENGE 36 38 FINALISTS 1 1 2 2 3 3 4 4 5 5 6 6 7 Partnering Check-in PARTNERING Forum Lunch BUFFETS Breakfast / Breakfast RESTROOM cocktail reception REGISTRATION content Welcome to RESI - - - - - - - - - - - - - - - 2 RESI Agenda - - - - - - - - - - - - - - - - - - 3 BOSTON RESI Innovation Challenge - - - - - - - 5 Exhibiting Companies - - - - - - - - - - 12 Track 1: Therapeutics Investor Panels - - - - - - - - - - - - - - - 19 Track 2: Device, Diagnostic, & HCIT Investor Panels - - - - 29 Track 3: Entrepreneur Workshops - - - - - - - - - - - - - - - - - - 38 Track 4: Asia-North America Workshop & Panels - - - - - - 41 Track 5: Partnering Forum - - - - - - - - - - - - - - - - - - - - - - - - 45 Sponsors & Media Partners - - - - - - - - - - - - - - - - - - - - - - - 46 1 welcome to resi On behalf of Life Science Nation (LSN) and our title sponsors WuXi AppTec and Johnson & Johnson Innovation JLABS, I would like to thank you for joining us at RESI Boston. LSN is very happy to welcome you all to Boston, the city where it all began, for our 14th RESI event. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Management Team

Management Team Bruce C. Cozadd Executive Chairman Bruce Cozadd joined Jazz Pharmaceuticals at its inception. From 2001 until he joined Jazz Pharmaceuticals, Mr. Cozadd served as a consultant to companies in the biopharmaceutical industry. From 1991 until 2001, he held various positions with ALZA Corporation, a pharmaceutical company now owned by Johnson & Johnson, most recently as its Executive Vice President and Chief Operating Officer, with responsibility for research and development, manufacturing and sales and marketing. Previously at ALZA Corporation he held the roles of Chief Financial Officer and Vice President, Corporate Planning and Analysis. Mr. Cozadd received a B.S. from Yale University and an M.B.A. from the Stanford Graduate School of Business. Mr. Cozadd serves on the boards of Cerus Corporation, a biopharmaceutical company; Threshold Pharmaceuticals, a biotechnology company; and The Nueva School and Stanford Hospital and Clinics, both non-profit organizations. Samuel R. Saks, MD Chief Executive Officer Samuel Saks, M.D., joined Jazz Pharmaceuticals at its inception. From 2001 until he joined Jazz Pharmaceuticals, Dr. Saks was Company Group Chairman of ALZA Corporation and served as a member of the Johnson & Johnson Pharmaceutical Group Operating Committee. From 1992 until 2001, he held various positions with ALZA Corporation, most recently as its Chief Medical Officer and Group Vice President, where he was responsible for clinical and commercial activities. Dr. Saks received a B.S. and an M.D. from the University of Illinois. Dr. Saks serves on the board of Trubion Pharmaceuticals and Cougar Biotechnology. Robert M. Myers President Robert Myers joined Jazz Pharmaceuticals at its inception and was appointed as Jazz Pharmaceuticals’ President in March 2007. -

CDER – Redi: Focus on CGMP & FDA Inspections – Participant List

FDA – CDER – RedI: Focus on CGMP & FDA Inspections – Participant List These participants granted permission to share their contact information Eileen Zhou Michael Channing A B M Mahfuz ul Alam Research Associate Group Chief - Positron Emission General Manager, Quality Operations Neuralstem Tomography Department ACI HealthCare Limited Germantown, MD, United States NIH Dhaka, Non-US, Bangladesh [email protected] Bethesda, MD, United States [email protected] [email protected] Abe Wong ABHIJEET GUJAR Adam Ebbinghouse CCO Chief Operating Officer QC Associate Gmpsigma SETHU KP Pharmaceutical Technology, Inc. Seattle, WA, United States Porvorim Goa, Non-US, India Bloomington, IN, United States [email protected] [email protected] [email protected] Adil Gatrad Adiseshu Modugula Aditiben Patel Director, Quality Systems RA Regulatory Specialist Actavis MSN USAMMDA Parsippany, NJ, United States Hyderabad, Non-US, India Frederick, MD, United States [email protected] [email protected] [email protected] Adriana de la Cruz ahsanul haque Aimee Gogarty Manager CSO Quality Coordinator Laboratorios Pisa SA de CV FDA Mallinckrodt Jalisco, Non-US, Mexico silver spring, MD, United States Port Allen, LA, United States [email protected] [email protected] [email protected] Aislyn Fronzak Ajay Deshmukh Ajay Khedkar QC Manager QA manager Regulatory Affair PL Developments Ingenus Pharmaceutical Umedica Laboratories Pvt Ltd Clinton, SC, United States Navi mumbai, Non-US, India Mumbai, Non-US, India [email protected] -

Acquisition De Wyeth Par Pfizer : Quels Impacts En MatiÈ

Acquisition de Wyeth par Pfizer : quels impacts en matière de R&D ? (suite) Suite de l’article paru dans la précédente étidion du BE Etats-Unis (10/03/2009) : https://www.bulletins-electroniques.com/actualites/58135.htm Des stratégies de recherche différenciées et une acquisition aux conséquences lourdes Il faut s’attendre à ce que la consolidation des équipes de recherches ait lieu dans le domaine des petites molécules, en particulier en ce qui concerne l’oncologie et les maladies inflammatoires où Pfizer va s’imposer aux dépends de Wyeth. Il est en revanche probable que le reste des équipes de recherche de Wyeth soit conservé, ce qui conduirait également à la liquidation de certaines unités de recherche de Pfizer. Le couperet tombera après la réunion du prochain conseil d’administration, au début de l’été 2009. A cette date, et si la fusion devient pleinement opérationnelle, le français Poussot pourra alors actionner son parachute doré de… 18,3 millions de dollars[1]. Personne ne doute de sa motivation d’aboutir surtout que les pourparlers entre Wyeth et Pfizer ont débuté il y a plus de deux ans ! Cette acquisition a un gros impact en matière de recherche pharmaceutique. Elle a aussi des répercussions importantes dans le domaine de la santé publique et dans l’économie du système de recherche aux Etats-Unis et dans le monde. La nouvelle société Pfizer va en effet consacrer moins d’argent à sa recherche alors que l’effort cumulé des deux sociétés en matière de R&D se monte actuellement à environ 10,36 milliards (respectivement 7,5 et 2,86 milliards). -

Oncological Therapy 2013 Q2

Quarterly Industry Update As of August 31, 2013 Industry: Oncological Therapy Industry Summary Cogent Valuation identified publicly traded companies, IPOs, and recent M&A transactions within the Oncological Therapy industry, which provides a basis for market and transaction pricing that can be used by your firm in estimating market sentiment and its impact on your firm's value. Since August 31, 2012, the median 52-week share price return of the Oncological Therapy industry has decreased by -0.7%. Comparable Public Company Key Statistics Median 52-Week Return -0.7% Median EV/Revenue Multiple 2.7x Median Price/Earnings Multiple 32.6x Median 3-Year CAGR Return 24.7% Median EV/EBITDA Multiple 9.9x Median EV/Gross CF Multiple 22.6x Comparable Public Company Market Price Returns (As of August 31, 2013) YTD 3 Month 1 Year 2 Year 3 Year 5 Year 2012 2011 2010 2009 2008 Agenus Inc. -11.0% -9.4% -20.5% 8.2% -7.6% -19.0% 105.0% -67.0% 57.8% 33.3% -76.5% Sunesis Pharmaceuticals, Inc. 14.5% -10.8% 51.7% 76.2% 24.7% -12.7% 259.0% -62.5% -51.4% 234.4% -83.9% Infinity Pharmaceuticals, Inc. -47.1% -31.3% 1.9% 64.3% 57.7% 20.2% 295.9% 49.1% -4.0% -22.7% -16.3% Oncolytics Biotech Inc. -32.4% 1.5% -0.7% -16.4% -3.9% 8.4% 0.5% -41.8% 156.7% 115.7% -29.6% ArQule Inc. 0.0% 3.0% -46.8% -20.0% -18.8% -4.5% -50.5% -3.9% 59.1% -12.6% -27.2% OncoGenex Pharmaceuticals, Inc. -

11/09/2016 Provider Subsystem Healthcare and Family Services Run Time: 20:25:21 Report Id 2794D051 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 11/09/2016 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 20:25:21 REPORT ID 2794D051 PAGE: 01 NUMERIC COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 01/01/2017 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 00002 ELI LILLY AND COMPANY 00145 STIEFEL LABORATORIES, INC, 00003 E.R. SQUIBB & SONS, LLC. 00149 WARNER CHILCOTT PHARMACEUTICALS INC. 00004 HOFFMANN-LA ROCHE 00168 E FOUGERA AND CO. 00006 MERCK & CO., INC. 00169 NOVO NORDISK, INC. 00007 GLAXOSMITHKLINE 00172 IVAX PHARMACEUTICALS, INC. 00008 WYETH LABORATORIES 00173 GLAXOSMITHKLINE 00009 PFIZER, INC 00178 MISSION PHARMACAL COMPANY 00013 PFIZER, INC. 00182 GOLDLINE LABORATORIES, INC. 00015 MEAD JOHNSON AND COMPANY 00185 EON LABS, INC. 00023 ALLERGAN INC 00186 ASTRAZENECA LP 00024 SANOFI-AVENTIS, US LLC 00187 VALEANT PHARMACEUTICALS NORTH AMERICA 00025 PFIZER, INC. 00206 LEDERLE PIPERACILLIN 00026 BAYER HEALTHCARE LLC 00224 KONSYL PHARMACEUTICALS, INC. 00029 GLAXOSMITHKLINE 00225 B. F. ASCHER AND COMPANY, INC. 00032 SOLVAY PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 00037 MEDA PHARMACEUTICALS, INC. 00245 UPSHER-SMITH LABORATORIES, INC. 00039 SANOFI-AVENTIS, US LLC 00258 FOREST LABORATORIES INC 00046 AYERST LABORATORIES 00259 MERZ PHARMACEUTICALS 00049 PFIZER, INC 00264 B. BRAUN MEDICAL INC. 00051 UNIMED PHARMACEUTICALS, INC 00281 SAVAGE LABORATORIES 00052 ORGANON USA INC. 00299 GALDERMA LABORATORIES, L.P. 00053 CSL BEHRING 00300 TAP PHARMACEUTICALS INC 00054 ROXANE LABORATORIES, INC. 00310 ASTRAZENECA LP 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00327 GUARDIAN LABS DIV UNITED-GUARDIAN INC 00062 ORTHO MCNEIL PHARMACEUTICALS 00338 BAXTER HEALTHCARE CORPORATION 00064 HEALTHPOINT, LTD. 00378 MYLAN PHARMACEUTICALS, INC. -

Fidelity® Select Portfolio® Biotechnology Portfolio

Quarterly Holdings Report for Fidelity® Select Portfolio® Biotechnology Portfolio May 31, 2021 BIO-QTLY-0721 1.802156.117 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 97.4% Shares Value Shares Value Biotechnology – 89.4% CareDx, Inc. (a) 178,500 $ 14,351,400 Biotechnology – 89.4% Celldex Therapeutics, Inc. (a) 337,900 9,444,305 4D Molecular Therapeutics, Inc. 214,868 $ 5,706,894 Cellectis SA sponsored ADR (a) (b) 157,465 2,467,477 AbbVie, Inc. 9,829,284 1,112,674,949 Cerevel Therapeutics Holdings (a) 201,800 2,647,616 ACADIA Pharmaceuticals, Inc. (a) 199,594 4,458,930 ChemoCentryx, Inc. (a) 2,062,222 20,931,553 Acceleron Pharma, Inc. (a) 924,453 121,001,653 Chinook Therapeutics, Inc. (a) 840,646 13,870,659 ADC Therapeutics SA (a) (b) 755,238 16,350,903 Chinook Therapeutics, Inc. rights (a) (d) 115,821 5,791 Agios Pharmaceuticals, Inc. (a) 1,075,059 59,966,791 Codiak Biosciences, Inc. (b) 436,539 9,874,512 Akouos, Inc. (a) (b) 716,626 9,359,136 Coherus BioSciences, Inc. (a) 58,387 768,373 Albireo Pharma, Inc. (a) (b) 320,350 10,715,708 Connect Biopharma Holdings Ltd. ADR (a) 1,079,600 16,064,448 Aldeyra Therapeutics, Inc. (a) 1,201,911 15,047,926 Constellation Pharmaceuticals, Inc. (a) (b) 90,259 1,788,031 Alector, Inc. (a) (b) 998,482 17,772,980 ContraFect Corp. (a) (b) 456,309 1,843,488 Allakos, Inc. (a) 207,631 21,062,089 Cortexyme, Inc. -

The Weekly Shot Biotech Issue a Weekly Summary of Healthcare Industry Valuation and Near-Term Catalysts June 17, 2010

Small Cap The Weekly Shot Biotech Issue June 17, 2010 A weekly summary of healthcare industry valuation and near-term catalysts The Weekly Shot: Overview and Comment - Small Cap Biotechnology Next week's sector highlights include LGND’s Thursday analyst event at the Eventi - Pharmaceuticals and Large Cap Biotech Hotel in NYC. The company on 6/15 announced updated 2010 revenue guidance of approx $25M, op ex of approx $30M, and expects to finish the year with $30M - Generics and Specialty Pharmaceuticals in cash (vs approx $43M as of 1Q10). Management will likely focus on partner GSK’s progress with add’l trials of Promacta (for ITP), which could potentially expand the drug’s label to Hep C, AML, and MDS (LGND receives <10% royalty from GSK). Investors should focus on pipeline plans following LGND’s opportunistic 2008/09 M&A activity. Key pipeline programs include LGD-4033 (ph.I, SARM candidate from PCOP) and RG7348, partnered with Roche (ph.I, Hep C candidate from MBRX). We do not expect major data announcements at the event. FDA’s Pediatric Drugs Advisory Committee will meet Monday to discuss pediatric safety reviews of multiple approved drugs, including Kogenate, Casodex, Apidra, NovoLog, Arimidex, Desmopressin, Prevacid, Nexium, Aciphex, Priolex, OraVerse, Zemuron, and Suprane . While important from a public safety perspective, we do not anticipate regulatory activity to be announced. Brian Lian, Ph.D. Small caps biotechs rebounded mid-week as elevated volatility continued across 212.500.6646 [email protected] the broader market. Investors are struggling to balance economic data supporting a modest recovery against concerns on EU debt loads, financial reform legislation, and aggressive govt rhetoric on BP’s oil spill.