Nomura-Greentech-Gen

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vallejo News Issue #236

Vallejo News May 27, 2016 | Issue #236 City to Consider Negotiations on 157 Acres of North Mare Island Sign-Up for other City On May 24, the City announced that on May 31 at 6:30 p.m. the Communications City Council will consider entering into an ERN (exclusive right to negotiate) agreement with Faraday Future. This represents the first formal step to potentially allow the electric vehicle startup on Mare Island. In This Issue Formed two years ago, Faraday Future is a private California- City to Consider Negotiations incorporated company based in Los Angeles and currently on 157 Acres of North Mare Island employs more than 760 people in the United States and 200 more worldwide. Faraday Future recently introduced a first concept Joker Roller Coaster Opens vehicle and broke ground at its first U.S. manufacturing facility in Vallejo Graduation Rate North Las Vegas, Nevada. Increases The waterfront property is located on North Mare Island, which City Presents at International Conference on PB offers 157 acres with entitlements for over a million square feet of light industrial, office, and commercial use. With the shipyard closing in 1997, the City Council meeting is an important turning point for Mare Island as well as the City. The ERN agreement sets the timeline and terms for negotiations between the City and Faraday Future toward the sale and project approval of the 157 acres. The ERN will also set a six-month negotiation period with two potential 90-day extensions. Click here to view the press release. Click here to view the Vallejo City Council Agenda packet. -

Nevada's Workforce Investment System July 2015 – June 2016

Nevada’s Workforce Investment System July 2015 – June 2016 Nevada’s Workforce Development Boards Nevada Department of Employment, Training and Rehabilitation October 03, 2016 1 Table of Contents Preface 3 Governance of the Nevada Workforce System 4-7 Governor’s Workforce Development Board 8-11 Nevada JobConnect 12-26 Workforce Connections 27-79 Southern Nevada’s Local Workforce Development Board NevadaWorks 80-117 Northern Nevada’s Local Workforce Development Board Self-Appraisal System (SAS) 118 Performance 119-120 Research and Analysis 121-125 Waivers 126 Cost of Program 127 State Evaluation Activities 128-129 2 Preface Through the Workforce Innovation and Opportunity Act (WIOA) funding the Department of Employment, Training and Rehabilitation (DETR) and the state’s two local Workforce Development Boards (Nevadaworks, Workforce Connections) provided an array of quality programs and services during Program Year 2015 (PY15). Individuals and employers benefited from well-established offerings. Opportunities around the state included unique approaches to engage youth, projects to assist veterans, and promising programs designed to further economic growth. WIOA funding, as well as funds from other sources, played a role in providing a level of services to meet workforce needs for businesses and workers. Successful outcomes were attained and WIOA performance levels were met, and often exceeded, through exceptional efforts by the state and the two local Workforce Development Boards (LWDB). The focus of State and LWDB activity included service to long term unemployed persons, veterans and cooperation with State initiatives in job growth and economic development. The positive results of these endeavors are reflected in each of the summaries of Nevada’s annual report. -

Stock Market Reaction to Election Results: an Event Study Analysis

Facultat d’Economia i Empresa Memòria del Treball de Fi de Grau Stock Market reaction to Election Results: an Event Study Analysis Liliana Rebeca Dutra Duffy Grau de Administració d’Empreses Any acadèmic 2019-20 DNI de l’alumne: 41624155C Treball tutelat per Pau Balart Castro Departament d’Economia de l’empresa S'autoritza la Universitat a incloure aquest treball en el Repositori Autor Tutor Institucional per a la seva consulta en accés obert i difusió en línia, Sí No Sí No amb finalitats exclusivament acadèmiques i d'investigació Paraules clau del treball: Event study, shares, dummy variables, survey, regressions, abnormal returns... ABSTRACT The aim of this paper is to find the possible effect that estimation vote surveys have over the share prices of public companies listed in the Spanish stock market. To test this effect, we used the event study methodology. For the event study, daily data from 6 firms listed on the IBEX35 index are analyzed over the period of 1st January 2000 to 31st December 2015. Alongside the event study, another analysis has been conducted to test the economic literature that finds a positive relation between right-wing parties and the stock market. The results of this paper have not shown significant changes for the days surrounding the publication of estimation vote, known as event day. Although it can be observed a positive reaction to PP vote increases, confirming what the literature suggests. This indicates that the event indeed does affect the stock market depending on which party outcomes the other. The results also indicate that certain companies were more exposed to the political results than others. -

Acs, Servicios, Comunicaciones Y Energía, S.L

PROSPECTUS DATED 17 APRIL 2018 ACS, SERVICIOS, COMUNICACIONES Y ENERGÍA, S.L. (incorporated with limited liability in the Kingdom of Spain) €750,000,000 1.875 per cent. Green Notes due 2026 The issue price of the €750,000,000 1.875 per cent. Green Notes due 20 April 2026 (the Notes or the Green Notes) of ACS, Servicios, Comunicaciones y Energía, S.L. (the Issuer) is 99.435 per cent of their principal amount. Unless previously redeemed or cancelled, the Notes will be redeemed at their principal amount on 20 April 2026 (the Maturity Date). The Notes are subject to redemption in whole at their principal amount at the option of the Issuer at any time in the event of certain changes affecting taxation in the Kingdom of Spain. See “Terms and Conditions of the Notes—Redemption and Purchase”. In addition, if a Change of Control occurs and, during the Change of Control Period, a Rating Downgrade occurs, then each Noteholder may require the Issuer to redeem or, at the Issuer's option, purchase in whole or in part its Notes at their principal amount plus accrued and unpaid interest up to (but excluding) the date for such redemption or purchase, all as more fully set out under “Terms and Conditions of the Notes—Redemption and Purchase – Change of Control”. The Notes are subject to redemption in whole at their principal amount together with any accrued and unpaid interest up to (but excluding) the date fixed for such redemption which shall be no earlier than three months before the Maturity Date, as more fully set out under “Terms and Conditions of the Notes— Redemption and Purchase – Residual Maturity Call Option”. -

Business Voice January 2017

YOUR COMPLETE GUIDE TO + The complete speaker line-up + What to see on the exhibit floor + How to make the most of your Preview experience They Happen. Be Ready. The Metro Chamber's new workers' compensation plan through First Choice Casualty Insurance Company gives you peace of mind that your business is covered and you're receiving member-exclusive competitive rates. - Five percent discount on First Choice base rate for Metro Chamber members - Most industries eligible for coverage - Safety planning and loss control oriented services - Online bill payment - Online access to claims information For more information or to get a quote today, visit ChamberIB.com or call 702.586.3889. A Message From the Chairman BILL NOONAN s I step into the role of chairman of the Las Vegas Metro with our Congressional delegation Chamber, I am inspired by a quote from Henry Ford, to make sure our state’s interests "Coming together is a beginning; keeping together is are being heard, and that lawmakers A progress; working together is success." understand the significant role our state plays in growing the regional These words capture what the Chamber is all about. The Chamber has and national economy. always been the place where local businesses, large and small, come together to envision our collective future. As we enter 2017, the Chamber’s And that’s why the Chamber will advocacy efforts are more important than ever. The Chamber will be, as it be elevating our Washington, always is, engaged with a full-time presence at local government, in Carson D.C. -

Multistate Tax Report®

Tax Management Multistate Tax Report® VOL. 23, NO. 2 FEBRUARY 26, 2016 HIGHLIGHTS ALSO IN THE NEWS Amazon to Start Collecting Colorado Sales Tax February 1 ELECTRONIC COMMERCE: Appeals Amazon.com LLC said it will start collecting Colorado sales tax for the first court tosses Wisconsin sales tax time. A spokesman told Bloomberg BNA that the online retailer ‘‘will be re- assessment against Orbitz quired to collect sales tax in Colorado’’ beginning Feb. 1. Page 116 Page 115 What Will the Future of State Tax Law Look Like Without Scalia? EXEMPTIONS: Challenge to Princ- With the sudden passing of Justice Antonin Scalia, the empty seat on the U.S. eton’s tax-exempt status will Supreme Court is a reminder of a three-decade era marked by an originalist proceed, New Jersey tax judge jurist whose ‘‘bigger than life’’ presence reshaped the highest court’s dis- rules Page 131 course, but whose absence may have a material impact on future state tax cases. Page 158 PROPERTY TAX: Wind turbine Airbnb Agrees to Collect Alabama Lodging Tax ruled exempt from property tax in Rhode Island Page 135 Airbnb Inc. will begin collecting Alabama lodging taxes for its room rental list- ings in the state March 1, under an agreement reached with the Alabama De- PROCEDURE: Legally sound path- partment of Revenue. ‘‘This agreement will increase compliance in this area, way exists to exempt state’s hos- and I commend Airbnb’s willingness to take the steps necessary to ensure that pital fee from revenue limits the appropriate taxes are being remitted,’’ Alabama Revenue Commissioner Page 154 Julie P. -

The New ACS Group Construction 1H/03 Revenues

Global Construction Conference November,November, 20032003 Index Highlights The new ACS Group Outlook for 2003 Conclusions 2 Highlights Strategic rationale of the merger Creation of a European leader • #1 in the most profitable market: Spain • Market leader in all businesses related to the development and management of infrastructures Excellent growth opportunities • Diversified portfolio of activities • Government Investment Plans Potential synergies from the merger Financial strength Industry’s reference stock • Market Capitalization > € 4.3 bn • Liquidity > € 20 mn daily 3 Highlights Creation of a market leader … # 1 in Spanish Construction # 1 in Industrial Services in Spain, Portugal & Latam # 1 in Waste Management in Spain # 1 in Ports and Logistics Services in Spain Core shareholder in the # 1 transport infrastructure concessions company worldwide (by # of concessions) 4 Highlights … of European size … Comp. EBIT 03e* € million 650 Margin on sales 6,0% 525 425 4,3% 3,3% 285 3,0% 250 1,9% 200 1,6% Sales 03e (€ bn) ACS Vinci Bouygues Skanska Ferrovial** Hochtieff Total Sales 10.8 17.5 21.5 14.9 7.0 12.3 Comp. Sales* 10.8 15.7 14.2 12.3 5.8 12.3 * Comparable data are estimated figures in those activities carried out by all companies:Construction, Services & Industrial. It does not include data from Concessions, Real Estate and other businesses. ** Ferrovial figures include CESPA & Amey full year data Source: Analysts’ Reports and Companies data 5 Highlights … and invested in Concessions Equity Investments in Concessions* € billion 3.0 1.7 1.0 Vinci Ferrovial ACS Main Cofiroute(85%), carparks, Cintra (60%), including Abertis (12%), highways, Assets airports & ASF (17%) ETR 407, carparks & airports airports & railroads Accounting Global consolidation Global consolidation Equity accounted method (except ASF: Equity acc.) * Source: Companies’ Reports. -

Forty Years of Democratic Spain: Political, Economic, Foreign Policy

Working Paper Documento de Trabajo Forty years of democratic Spain Political, economic, foreign policy and social change, 1978-2018 William Chislett Working Paper 01/2018 | October 2018 Sponsored by Bussiness Advisory Council With the collaboration of Forty years of democratic Spain Political, economic, foreign policy and social change, 1978-2018 William Chislett - Real Instituto Elcano - October 2018 Real Instituto Elcano - Madrid - España www.realinstitutoelcano.org © 2018 Real Instituto Elcano C/ Príncipe de Vergara, 51 28006 Madrid www.realinstitutoelcano.org ISSN: 1699-3504 Depósito Legal: M-26708-2005 Working Paper Forty years of democratic Spain Political, economic, foreign policy and social change, 1978-2018 William Chislett Summary 1. Background 2. Political scene: a new mould 3. Autonomous communities: unfinished business 4. The discord in Catalonia: no end in sight 5. Economy: transformed but vulnerable 6. Labour market: haves and have-nots 7. Exports: surprising success 8. Direct investment abroad: the forging of multinationals 9. Banks: from a cosy club to tough competition 10. Foreign policy: from isolation to full integration 11. Migration: from a net exporter to a net importer of people 12. Social change: a new world 13. Conclusion: the next 40 years Appendix Bibliography Working Paper Forty years of democratic Spain Spain: Autonomous Communities Real Instituto Elcano - 2018 page | 5 Working Paper Forty years of democratic Spain Summary1 Whichever way one looks at it, Spain has been profoundly transformed since the 1978 -

Autonomous Vehicles Future: Driverless Cars

Executive Insights Volume XIX, Issue 58 Mapping the Road to Autonomous Vehicles There’s no doubt that over the long term, 3. Industrial: Discovering and organizing the right business autonomous vehicles (better known as self-driving model to produce a commercially viable product cars), combined with electrification and shared While these challenges are significant, they will eventually be overcome. The path forward on No. 3 in particular (creating mobility, will have a massive impact on society. a business model to produce a sellable product) is just becoming clear. Many pundits debate the extent and speed of the expected effects. Will autonomy act as a “lighter fluid” for the spread of shared mobility services? How soon will urban real estate Figure 1 developers be freed from the need to provide space for parking? SAE International’s definitions of automation levels for on-road vehicles What will the impact on logistics do to retail? We like to say that these potential long-term effects depend on • Level 0: No automation (full driver control) how we get “from 1 to 100” — that is, from the launch of self- • Level 1: Driver assistance (vehicle controls either driving cars to a day when autonomous mobility is ubiquitous. steering or speed under certain conditions) But while prognostication is fun, the map to that destination is still far from clear. • Level 2: Partial automation (vehicle controls both steering and speed under certain conditions) What is becoming clearer, however, is the first leg of the journey, • Level 3: Conditional automation (total vehicle control or how we get “from 0 to 1” — from where we are today to the with expected human intervention) successful commercialization of the first fully self-driving vehicle. -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

Savvy and Sophisticated: Meet China's New Car Buyers

Savvy and sophisticated: Meet China’s new car buyers September 2017 Wouter Baan Paul Gao Arthur Wang Daniel Zipser 2 Savvy and sophisticated: Meet China’s new car buyers September 2017 China auto consumer survey 2017 Savvy and sophisticated: Meet China’s new car buyers Wouter Baan Paul Gao Arthur Wang Daniel Zipser Introduction After registering its lowest growth since 2011, China’s automotive market rebounded strongly in 2016 (Exhibit 1). Car sales jumped 20 percent, nearly twice the rate of increase in 2015. Much of this vigorous expansion resulted from the country’s temporary suspension of sales taxes for cars with small engines. Volatility continued in 2017: A large drop early in the year reflected Exhibit 1 China’s auto market rebounded to a 20% sales volume growth Passenger car1 sales volume YoY growth Million cars % 22 23 20 19 17 16 16 15 13 13 11 11 11 6 2010 11 12 13 14 15 2016 1 Including sedan, MPV, SUV SOURCE: McKinsey M-view the impact of strong “pull ahead” sales in December 2016, as many consumers sought to take advantage of a lower sales tax rate before an increase took effect on January 1, 2017. However, sales growth eventually picked up again over the course of the year. While the recent resurgence in sales represents one of the most dramatic shifts in China’s automotive market, a variety of other factors are at play that will drive even more profound changes in the industry over the coming years. Perhaps the biggest of these changes involves the transformation taking place among car buyers. -

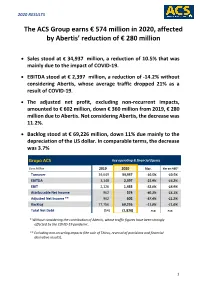

The ACS Group Earns € 574 Million in 2020, Affected by Abertis' Reduction

2020 RESULTS The ACS Group earns € 574 million in 2020, affected by Abertis’ reduction of € 280 million Sales stood at € 34,937 million, a reduction of 10.5% that was mainly due to the impact of COVID-19. EBITDA stood at € 2,397 million, a reduction of -14.2% without considering Abertis, whose average traffic dropped 21% as a result of COVID-19. The adjusted net profit, excluding non-recurrent impacts, amounted to € 602 million, down € 360 million from 2019, € 280 million due to Abertis. Not considering Abertis, the decrease was 11.2%. Backlog stood at € 69,226 million, down 11% due mainly to the depreciation of the US dollar. In comparable terms, the decrease was 3.7% Grupo ACS Key operating & financial figures Euro Million 2019 2020 Var. Var ex-ABE* Turnover 39,049 34,937 -10.5% -10.5% EBITDA 3,148 2,397 -23.9% -14.2% EBIT 2,126 1,433 -32.6% -18.9% Attributable Net Income 962 574 -40.3% -15.1% Adjusted Net Income ** 962 602 -37.4% -11.2% Backlog 77,756 69,226 -11.0% -11.0% Total Net Debt (54) (1,820) n.a. n.a. * Without considering the contribution of Abertis, whose traffic figures have been strongly affected by the COVID-19 pandemic. ** Excluding non-recurring impacts (the sale of Thiess, reversal of provisions and financial derivative results). 1 2020 RESULTS 1. Consolidated Results The Group’s 2020 ordinary net profit accounted for € 602 million, € 360 million less than the previous year. This decline is mainly due to the evolution of Abertis, whose traffic was heavily affected by the lockdown measures related to COVID- 19, reducing its contribution by € 280 million.