Case M.8354 - FOX / SKY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

ABS-CBN Investor Presentation Company Overview

Investor Presentation August 2016 UBS Investor Forum HongKong & Singapore 1 ABS-CBN Investor Presentation Company Overview Financial Highlights Industry and Competitive Landscape Summary 2 ABS-CBN Investor Presentation OVERVIEW: Business Segments • Free-to-Air TV and Studio • Global Distribution Operations • Films and Music • Cable Channels / Publishing • Pay TV Pay TV • Internet broadband • Value added services • ABS-CBN mobile – MVNO New • Digital Terrestrial Television Businesses • Kidzania – franchise from Mexico • O Shopping – home TV shopping 3 ABS-CBN Investor Presentation Revenue Mix For the six months ended June 30, 2016 Advertising Revenue Consumer Sales 40% 60% 19% 13% 8% Sky Cable Global Others 4 ABS-CBN Investor Presentation Free-to-Air TV: CH2 and CH23 • Consistent leader in national audience shares and ratings among 13 FTA channels. • Power ratio of 1.3 : 1.0 • ABS-CBN Free-to-air TV advertising revenues: More than 90% of company’s total advertising revenues. 60% FTA market share. TOTAL DAY PRIMETIME AUDIENCE Total SHARE Total PH Mega Metro Mega Metro PH ABS-CBN 2 44 32 35 49 36 40 GMA 7 34 40 34 32 40 35 TV 5 7 7 6 6 7 6 Others 15 21 25 13 17 19 Source: Kantar Media TV Measurement, Total Philippines as of June 30, 2016 Primetime shows contribute 71% of total Channel 2 airtime revenues. 5 ABS-CBN Investor Presentation Digital Terrestrial TV (DTT) • Implementing Rules and Regulations COVERAGE AREA released December 17, 2014. Benguet Pangasinan • Launched February 2015. Tarlac Nueva Ecija • First-mover advantage Pampanga • More than 1.4M boxes sold to date Bulacan Metro Manila (3) • Significantly improved signal in Mega Rizal Manila and Central Luzon Cavite Incremental advertising revenues Laguna Metro Cebu expected from: Davao (new!) . -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

Subscription Reasons...Y

INDEPENDENT COMMUNICATIONS AUTHORITY OF SOUTH AFRICA APPLICATIONS FOR COMMERCIAL SATELLITE AND CABLE SUBSCRIPTION BROADCASTING LICENCES REASONS FOR DECISIONS NOVEMBER 2007 1 TABLE OF CONTENTS SECTION A: OVERVIEW ..............................................................................................6 1. INTRODUCTION....................................................................................................6 2. BACKGROUND .....................................................................................................6 3. PROCEDURE ........................................................................................................6 4. RELEVANT CRITERIA AND CONSIDERATIONS ...............................................6 5. GENERAL FINDINGS............................................................................................6 5.5. Corporate Status ....................................................................................................6 5.6. Ownership and control restrictions ........................................................................6 5.9. Management and experience ................................................................................6 5.10. Staffing ...........................................................................................................6 5.11. Finance...........................................................................................................6 5.12. Research – demand and need .....................................................................6 -

Wolves of Paseo

Wolves of Paseo Media and Entertainment Sector Philippine Stock Exchange (PSE) ABS-CBN Corporation Date: 06/11/2019 Current Price: Recommendation: Buy Ticker: ABS:PM PHP18.6 Target Price: PHP31.8 Market Profile We issue a BUY recommendation for ABS-CBN Closing Price 18.58 Corporation (ABS) with a target price of PHP31.8, (PHP) representing a 71% upside from its closing price of 52-Week 16.80 – PHP18.6 on 06 November 2019. We arrived at our Range 25.30 Average 213.5 target price using the Discounted Free Cash Flow to Volume Equity method. (PHP’000) Shares 861.97 Strong Core Business Anchored on Growing Outstanding Consumption (Millions) Market Cap 15.07 (PHPbn) Consumer Spending is expected to pick up in the Dividend 2.96% next few years as inflation levels out and labor Yield market strengthens. Furthermore, spending will also P/E (ttm) 5.47 be supported by continuously strong inflows coming Source: MarketWatch from remittances. Figure 1. Forecasted EPS (in PHP) Outlook towards the labor market and 6 unemployment is positive, with unemployment maintaining its low level. In addition, the higher 4 minimum wage will increase disposable income which will eventually translate to consumption. ABS 4.4 4.7 4.9 2 3.8 4.1 is well positioned to reap the benefits of this trend as 0 it remains to be the leading media company in the 2020F 2021F 2022F 2023F 2024F Philippines. It consistently leads the industry based on rating agencies. Source: Team Estimates Ratios 2019F 2020F 2021F 2022F 2023F 2024F Gross Margin 41% 40% 40% 40% 40% 40% Net Profit Margin 7% 7% 7% 8% 8% 8% Current Ratio 3.0 3.1 3.2 3.4 3.5 3.6 Debt-to-Equity 0.9 0.8 0.7 0.7 0.6 0.6 Return on Asset 4% 3% 4% 4% 4% 4% Return on Equity 9% 8% 8% 8% 8% 7% Earnings per Share 3.8 3.8 4.1 4.4 4.7 4.9 Business Description ABS is the Philippines’ leading media and entertainment organization. -

Resolution No. 118 Authorizing an Agreement with Insite Wireless Group for Distributed Antenna System for the Times Union Center

RESOLUTION NO. 118 AUTHORIZING AN AGREEMENT WITH INSITE WIRELESS GROUP FOR DISTRIBUTED ANTENNA SYSTEM FOR THE TIMES UNION CENTER Introduced: 4/12/17 By Civic Center Committee: WHEREAS, The Department of General Services through the Purchasing Agent issued a Request for Proposals regarding a Distributed Antenna System (DAS) for the Times Union Center, and WHEREAS, Four Proposals were received and representatives of the Department of General Services reviewed said Proposals and recommended awarding the contract to InSite Wireless Group as the lowest responsible bidder, and WHEREAS, The Commissioner of the Department of General Services indicated that the Times Union Center and Albany Capital Center will split the projected revenues of $500,000 over a ten year period, guaranteed by InSite Wireless Group with the Times Union Center will retain seventy-five percent of revenues and the Albany Capital Center will retain twenty-five percent of revenues collected and paid by InSite Wireless Group, and WHEREAS, The Commissioner of the Department of General Services has proposed to enter into an agreement with InSite Wireless Group for the DAS project to combine services at the Times Union Center and the Albany Capital Center with InSite Wireless Group is responsible for funding of the project, now, therefore be it RESOLVED, By the Albany County Legislature that the County Executive is authorized to enter into an agreement with InSite Wireless Group regarding a Distributed Antenna System, in collaboration with the Times Union Center and Albany Capital Center for a term commencing May 1, 2017 and ending April 30, 2027, and, be it further RESOLVED, That the County Attorney is authorized to approve said agreement as to form and content, and, be it further RESOLVED, That the Clerk of the County Legislature is directed to forward certified copies of this resolution to the appropriate County Officials. -

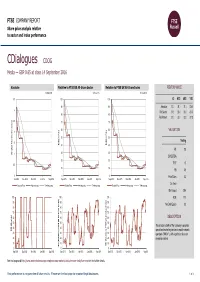

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

TVNZ, Mediaworks TV Spotlist: Chorus WC: 6 September 30-Sec Estimated Spotfall - TX Time Indicative Only (Use Programme As Guide)

TVNZ, Mediaworks TV Spotlist: Chorus WC: 6 September 30-sec Estimated Spotfall - TX time indicative only (use programme as guide). Peak spots highlighted. Date Day Channel Time Dur Programme Est. Ratings Campaign 6-Sep-20 Sun TVNZ 1* 18:10 30 1 News At 6pm 10.8 Fibre it's how we internet now 7-Sep-20 Mon TVNZ 2* 10:10 30 Neighbours 0.1 Fibre it's how we internet now 7-Sep-20 Mon TVNZ 2* 11:10 30 Grey's Anatomy 0.1 Fibre it's how we internet now 7-Sep-20 Mon TVNZ 2* 19:40 30 MasterChef Australia: Back To 6.5 Fibre it's how we internet now 7-Sep-20 Mon TVNZ 1* 21:20 30 Drama 3.9 Fibre it's how we internet now 8-Sep-20 Tue TVNZ 1* 08:40 30 Breakfast 3 2.1 Fibre it's how we internet now 8-Sep-20 Tue TVNZ 1* 11:10 30 The Chase 1.3 Fibre it's how we internet now 8-Sep-20 Tue TVNZ 2* 16:50 30 Friends 1.1 Fibre it's how we internet now 8-Sep-20 Tue Three* 18:20 30 Newshub Live At 6pm 4.8 Fibre it's how we internet now 8-Sep-20 Tue TVNZ 2* 19:10 30 Shortland Street 7.6 Fibre it's how we internet now 8-Sep-20 Tue TVNZ 1* 23:20 30 Sunday 1.3 Fibre it's how we internet now 9-Sep-20 Wed TVNZ 1* 15:50 30 Tipping Point 1.5 Fibre it's how we internet now 9-Sep-20 Wed Three* 16:20 30 ITM Fishing Show Classics, The 1 Fibre it's how we internet now 9-Sep-20 Wed TVNZ 2* 23:20 30 2 Broke Girls 0.9 Fibre it's how we internet now 10-Sep-20 Thu TVNZ 1* 09:20 30 Ellen 1.3 Fibre it's how we internet now 10-Sep-20 Thu TVNZ 1* 17:10 30 The Chase 5 Fibre it's how we internet now 10-Sep-20 Thu TVNZ 2* 17:40 30 The Big Bang Theory 2.1 Fibre it's how we internet now -

Philippines in View Philippines Tv Industry-In-View

PHILIPPINES IN VIEW PHILIPPINES TV INDUSTRY-IN-VIEW Table of Contents PREFACE ................................................................................................................................................................ 5 1. EXECUTIVE SUMMARY ................................................................................................................................... 6 1.1. MARKET OVERVIEW .......................................................................................................................................... 6 1.2. PAY-TV MARKET ESTIMATES ............................................................................................................................... 6 1.3. PAY-TV OPERATORS .......................................................................................................................................... 6 1.4. PAY-TV AVERAGE REVENUE PER USER (ARPU) ...................................................................................................... 7 1.5. PAY-TV CONTENT AND PROGRAMMING ................................................................................................................ 7 1.6. ADOPTION OF DTT, OTT AND VIDEO-ON-DEMAND PLATFORMS ............................................................................... 7 1.7. PIRACY AND UNAUTHORIZED DISTRIBUTION ........................................................................................................... 8 1.8. REGULATORY ENVIRONMENT .............................................................................................................................. -

WHERE ARE the AUDIENCES? August 2021 Introduction

WHERE ARE THE AUDIENCES? August 2021 Introduction • New Zealand On Air (NZ On Air) supports and funds public media content for New Zealand audiences, focussing on authentic NZ stories and songs that reflect New Zealand’s cultural identity and help build social cohesion, inclusion and connection. • It is therefore essential NZ On Air has an accurate understanding of the evolving media behaviour of NZ audiences. • The Where Are The Audiences? study delivers an objective measure of NZ audience behaviour at a time when continuous single source audience measurement is still in development. • This document presents the findings of the 2021 study. This is the fifth wave of the study since the benchmark in 2014 and provides not only a snapshot of current audience behaviour but also how behaviour is evolving over time. • NZ On Air aims to hold a mirror up to New Zealand and its people. The 2021 Where Are The Audiences? study will contribute to this goal by: – Informing NZ On Air’s content and platform strategy as well as the assessment of specific content proposals – Positioning NZ On Air as a knowledge leader with stakeholders. – Maintaining NZ On Air’s platform neutral approach to funding and support, and ensuring decisions are based on objective, single source, multi-media audience information. Glasshouse Consulting July 21 2 Potential impact of Covid 19 on the 2020 study • The Where Are The Audiences? study has always been conducted in April and May to ensure results are not influenced by seasonal audience patterns. • However in 2020 the study was delayed to May-June due to levels 3 and 4 Covid 19 lockdown prior to this period. -

Asia Pacific to Add 45 Million Pay TV Subscribers

Asia Pacific to add 45 million pay TV subscribers The Asia Pacific pay TV sector is the most vibrant in the world, with subscribers up by 45 million and revenues up by $1.40 billion over the next five years. Pay TV penetration will stay at around 69%. Asia Pacific pay TV subscribers by country (mil) 800.0 700.0 600.0 500.0 400.0 300.0 200.0 100.0 0.0 2019 2020 2025 Others 70.5 72.3 80.9 Japan 17.4 17.6 17.7 Indonesia 11.2 13.5 18.5 S Korea 20.4 20.3 20.2 India 158.8 161.1 183.1 China 353.4 357.2 356.0 Source: Digital TV Research Ltd China and India together will account for 80% of the region’s 676 million pay TV subscribers by 2025. India will add 24 million pay TV subscribers over the next five years. However, China will peak in 2021 with a slow decline thereafter. OTT penetration and competition will remain much higher in China than in India. Simon Murray, Principal Analyst at Digital TV Research, said: “Much of this subscriber growth is down to the number of TV households increasing by 65 million between 2019 and 2025 to 978 million as populations rise and disposable income climbs. The region’s population is 4 billion – more than half of the world’s total.” For more information on the Asia Pacific OTT TV and Video Forecasts report, please contact: Simon Murray, [email protected], Tel: +44 20 8248 5051 Asia Pacific Pay TV Forecasts Table of Contents Published in March 2020, this 198-page PDF, PowerPoint and excel report comes in three parts: • Outlook: Forecasts for 22 countries in a 52-page PowerPoint document full of charts, graphs and bullet points; • Excel workbook covering each year from 2010 to 2025 for 22 countries by household penetration, by pay TV subscribers, by pay TV revenues and by major operator. -

Sky Advertising

Sky Sport 1 Sky Advertising Sky Sport 2 4 TELEVISION BOOKING/ Sky Sport 3 MOVEMENT POLICY Sky Sport 4 4.1 Bookings moved within 14 days TLC before transmission incur a 100% Advertising Terms Vibe cancellation fee. Bookings moved within the period of 15 to 28 days and Conditions BBC Earth from transmission, so that they are BBC UKTV more than 28 days from Cartoon Network 1 AGREEMENT transmission, incur a 100% E! Entertainment cancellation fee. 1.1 Sky agrees to allocate advertising Food Network 4.2 Bookings may be moved only once time, and the Advertiser and/or HISTORY within a 28 day period or will incur a Agency agrees to advertise products Living Channel 100% cancellation fee. or services on Sky’s television Sky Movies Action 4.3 Moving or amending bookings within channels, or in SKYWATCH on the Sky Movies Pop-ups (SD & HD) a Special Event or Pack will be at the terms and conditions set out below National Geographic sole discretion of Sky (subject to the ("Terms"). These Terms are part of Nickelodeon Special Terms, if any). If the booking all contracts between Sky and any Sky BOX SETS is moved or amended, it will be Advertiser and between Sky and any Sky News rebooked at the current rate as Agency. Any terms or conditions Sky Sport 5 applied to the new placement and inconsistent with these Terms will Sky Sport 6 new discounts applied (and if moved not apply to any such contracts Sky Sport 8 or amended after the booking unless expressly agreed to by Sky.