ABS-CBN Investor Presentation Company Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Subscription Reasons...Y

INDEPENDENT COMMUNICATIONS AUTHORITY OF SOUTH AFRICA APPLICATIONS FOR COMMERCIAL SATELLITE AND CABLE SUBSCRIPTION BROADCASTING LICENCES REASONS FOR DECISIONS NOVEMBER 2007 1 TABLE OF CONTENTS SECTION A: OVERVIEW ..............................................................................................6 1. INTRODUCTION....................................................................................................6 2. BACKGROUND .....................................................................................................6 3. PROCEDURE ........................................................................................................6 4. RELEVANT CRITERIA AND CONSIDERATIONS ...............................................6 5. GENERAL FINDINGS............................................................................................6 5.5. Corporate Status ....................................................................................................6 5.6. Ownership and control restrictions ........................................................................6 5.9. Management and experience ................................................................................6 5.10. Staffing ...........................................................................................................6 5.11. Finance...........................................................................................................6 5.12. Research – demand and need .....................................................................6 -

Wolves of Paseo

Wolves of Paseo Media and Entertainment Sector Philippine Stock Exchange (PSE) ABS-CBN Corporation Date: 06/11/2019 Current Price: Recommendation: Buy Ticker: ABS:PM PHP18.6 Target Price: PHP31.8 Market Profile We issue a BUY recommendation for ABS-CBN Closing Price 18.58 Corporation (ABS) with a target price of PHP31.8, (PHP) representing a 71% upside from its closing price of 52-Week 16.80 – PHP18.6 on 06 November 2019. We arrived at our Range 25.30 Average 213.5 target price using the Discounted Free Cash Flow to Volume Equity method. (PHP’000) Shares 861.97 Strong Core Business Anchored on Growing Outstanding Consumption (Millions) Market Cap 15.07 (PHPbn) Consumer Spending is expected to pick up in the Dividend 2.96% next few years as inflation levels out and labor Yield market strengthens. Furthermore, spending will also P/E (ttm) 5.47 be supported by continuously strong inflows coming Source: MarketWatch from remittances. Figure 1. Forecasted EPS (in PHP) Outlook towards the labor market and 6 unemployment is positive, with unemployment maintaining its low level. In addition, the higher 4 minimum wage will increase disposable income which will eventually translate to consumption. ABS 4.4 4.7 4.9 2 3.8 4.1 is well positioned to reap the benefits of this trend as 0 it remains to be the leading media company in the 2020F 2021F 2022F 2023F 2024F Philippines. It consistently leads the industry based on rating agencies. Source: Team Estimates Ratios 2019F 2020F 2021F 2022F 2023F 2024F Gross Margin 41% 40% 40% 40% 40% 40% Net Profit Margin 7% 7% 7% 8% 8% 8% Current Ratio 3.0 3.1 3.2 3.4 3.5 3.6 Debt-to-Equity 0.9 0.8 0.7 0.7 0.6 0.6 Return on Asset 4% 3% 4% 4% 4% 4% Return on Equity 9% 8% 8% 8% 8% 7% Earnings per Share 3.8 3.8 4.1 4.4 4.7 4.9 Business Description ABS is the Philippines’ leading media and entertainment organization. -

Wet-Weather Family Bonding Levels up with Kidzania, Partners…Page 3

AUGUST 2015 www.lopezlink.ph At the Lopez Museum. See story on page 9. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Let’s gear up for the Big One THE Big One, they call it, the magnitude 7.2 earthquake generated by the West Valley Fault that could leave more than 30,000 people dead and about 148,000 injured as homes and office buildings collapse all over Metro Manila and parts of Luzon. Turn to page 6 PHOTO SOURCE: http://files.umwblogs.org/blogs.dir/3114/files/2013/04/MadsNissen_Rampen144.jpg Family bonding Jana Agoncillo levels up with is back as Wet-weather …page 12 KidZania, partners…page 3 Ningning …page 4 busters Lopezlink August 2015 Biz News Biz News Lopezlink August 2015 ABS-CBN, Asian Eye win Reader’s CSC bares secret Digest Trusted Brand awards anew ABS-CBN Corporation was of approval named most trusted Philip- v a l i d a t e s behind success of pine TV network for the fifth not only the time while Asian Eye Institute quality of received its third most trusted our services eye center award at the annual but also the ABS-CBN programs Reader’s Digest Trusted Brand confidence Awards 2015 organized by of the con- WHAT is ABS-CBN’s secret My Heart” hugely successful. SKY Cable COO Ray Montinola (4th from left) and Play Innovations Inc. president Maricel Pangilinan-Arenas Reader’s Digest Asia-Pacific. sumers in formula behind its successful Santos-Concio also said (3rd from left) do the KidZania pose with (l-r) SKY Cable Marketing head Alan Supnet, CFO Eloisa Balmoris, Play The Kapamilya network our brand. -

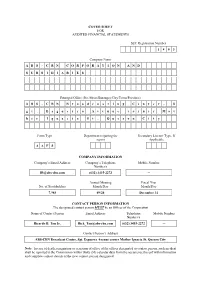

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A

COVER SHEET FOR AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A B S - C B N C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) A B S - C B N B r o a d c a s t i n g C e n t e r , S g t . E s g u e r r a A v e n u e c o r n e r M o t h e r I g n a c i a S t . Q u e z o n C i t y Form Type Department requiring the Secondary License Type, If report Applicable A A F S COMPANY INFORMATION Company’s Email Address Company’s Telephone Mobile Number Number/s [email protected] (632) 3415-2272 ─ Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 7,985 09/24 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Ricardo B. Tan Jr. [email protected] (632) 3415-2272 ─ Contact Person’s Address ABS-CBN Broadcast Center, Sgt. Esguerra Avenue corner Mother Ignacia St. Quezon City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Mapping Online Child Safety in Asia-Pacific Acknowledgments

July 2017 Mapping Online Child Safety in Asia-Pacific Acknowledgments This report is the outcome of a three-month research fellowship programme supported by Google. Research for the report, as well as the initial draft, was done by Jee Eun Choi. The report was revised by Noelle Francesca de Guzman and Rajnesh Singh, and was edited by Christine Apikul. Internet Society – APAC Bureau 9 Temasek Boulevard #09-01 Suntec Tower 2 Singapore 038989 Tel: +65 6407 1470 Fax: +65 6407 1501 Email: [email protected] www.internetsociety.org Follow us on Twitter @ISOCapac Follow us on Scoopt.it! http://www.scoop.it/t/internet-in-asia-pacific internetsociety.org @internetsociety 2 Executive Summary In today’s age, the Internet has become essential for developing and strengthening the capacities of children. But at the same time, use of the Internet can come with some risks for young Internet users. It can create new challenges with regards to their safety and protection - both in the physical and virtual worlds. However, quick-fix interventions that limit children’s online access tend to result in a loss of opportunity for them to take advantage of the benefits of the Internet. There is limited research on child online safety in Asia-Pacific --this report outlines some of the resources that are currently available. It provides an overview of initiatives, focusing on policies that are in place to tackle child online safety in selected economies in the region, and an introduction to the different actors involved in addressing the various risks that children can face online. -

PLAINFIELD EVENING NEWSNEWS Volvol

PLAINFIELD PLAINFIELD EVENING NEWSNEWS VolVol.. B.0 No., No 90.. 9OPLAINFIELD,. PLAINFIELD N. J.. “THE. N COLORADO. J.. "THE OFCOLORAD THE EAST,”O O FTHURSDAY. THE EAST. APRIL" THURSDAY gg, 1880. APRIL 82 1886 PricePrice TwoTwo Cents. Cents . ■rnsjari^sw^tfii __n.Tu!r^u. ^ J MC8ICMVSI HALL,C HALL , P——■ yr—r~*'. -i:**.*- Tb» MlaWtani Ow CM la larnlT N» P.WiU; jzL~£rtJt£: u«J nl nulHd Mtck MHM,uJaat« |#,di ELLI0TT’S_ _ i~£^~r=H?S j^^ri£=r:ri Mcodiij ^ETCDiDg w. Apri *l 26 ELLIOTT'S 2r-ur? jrt£rD-3:ii« sari a— *W •* Graad darsr* -«aada( tba MMk a***, at iMflllntw JE I TMb>. U*orir* m-% "•J. wba dariac a pwtud «C »li>—a jsaM t±a - rfwi iu lirTiiill ttk tMZ Md ».Wi.«i;H(«410l raSS3r3^£ r AMTE^A U# *»J U4lA BA • b? Wd ad bad umo ZmbB to Calrto “xE&EHv _ BMBYTM^AMJBM^BfC-JImrju* EA>Toa, arc. HA D -T.UO a. m. and *.*) p. m_ lassgtws: - --a.rn.at.lS.SVu•..vl&rvv. n. F«(J>»OH.I7.« -. m. mmi AM | 117 10 p. b K*lnrd*yi ctaM al S p~ a> OTEBA COHPAAY. BBcjiD. rr Ha.il*—MJHL»—ArriTMAr ArrlT.t At* KITaUt 91 ».1 A. 7Ta. i_ “iWiCCira^ OSasa OBBmB fromfroaa 9.W 9 S Oa at.a. to B LMED *O W.1 a. a*.0 a. ^s."=£ra,*E=r-* Itail H«.(•|7.«» al M» n, BAm . ■ c thraa *wk«, A«U»»— iy bM MOW a> pnnaa of --“s: ggL^ivvvsaa- -sl— IB-th. -

Philippines in View Philippines Tv Industry-In-View

PHILIPPINES IN VIEW PHILIPPINES TV INDUSTRY-IN-VIEW Table of Contents PREFACE ................................................................................................................................................................ 5 1. EXECUTIVE SUMMARY ................................................................................................................................... 6 1.1. MARKET OVERVIEW .......................................................................................................................................... 6 1.2. PAY-TV MARKET ESTIMATES ............................................................................................................................... 6 1.3. PAY-TV OPERATORS .......................................................................................................................................... 6 1.4. PAY-TV AVERAGE REVENUE PER USER (ARPU) ...................................................................................................... 7 1.5. PAY-TV CONTENT AND PROGRAMMING ................................................................................................................ 7 1.6. ADOPTION OF DTT, OTT AND VIDEO-ON-DEMAND PLATFORMS ............................................................................... 7 1.7. PIRACY AND UNAUTHORIZED DISTRIBUTION ........................................................................................................... 8 1.8. REGULATORY ENVIRONMENT .............................................................................................................................. -

No. Favorite No. วาไรตี้ 193 WBTV No. การศึกษา 286 TVK CAMBODIA 0

No. Favorite No. วาไรตี้ 95 Goodfilm 144 Moradok Thai 193 WBTV No. การศึกษา 286 TVK CAMBODIA 0 Shop at Home 47 CH 3 96 GRAND TV 145 Movie MAX 194 WOW 240 DDTV 287 VTV4 1 Work Point TV 48 CH 7 97 H 146 MTV 195 You 2 Play 241 DMC 288 MRTV 2 CH 2 49 GMM O Shopping 98 HAPPY HOME 147 Music pool 196 Zaa Network 242 IBTV 289 MRTV HD 3 Thai Rath Channel 50 CH 9 99 CAT Channel 148 MV 5 197 Zabb CH 243 Mahadthai 290 MRTV 4 4 True 4U 51 AF8 100 Healty+ 149 MY TV 198 Smart Smes Channel 244 MCOT 1 291 MITV 5 Shop at Home 52 AJP 101 Lamkong Channel 150 Mystery 199 Metro Police TV 245 MCU 292 Channel 7 6 53 Aonzon TV 102 Herbs TV 151 New Vistion 200 246 MOAC 293 5 PLUS 7 TV POOL VARIETY 54 Home Channel 103 Hero TV 152 NHANG Channel 201 Man TV 247 Most Channel 294 Fashion 8 CH 8 55 Shop Thailand 104 HI Channel 153 Nice Channel 202 N Channel Thailand 248 Panyapiwat 1 295 9 Sabaidee TV 56 Beauty TV 105 HIT Globle 154 OHO CH 203 Shop & Show 249 Panyapiwat 2 296 10 You Channel 57 KorKaew 106 HIT Station 155 OK Life Asean 204 Give Siam 250 Parliament 297 No. ทีวีดิจิทัล 58 Gift CH 107 Hit TV 156 OK TV 205 251 SBB TV 298 11 TV5 HD1 59 Kaset Paruay 108 UMM TV 157 OOM TV 206 252 SBT 299 12 NBT 60 Gift Channel 109 Smart Movies 158 P&P 207 253 STOU Channel 300 13 TPBS 61 Asain Major 110 HOT TV 159 PING Channel 208 254 TGN 301 14 Future Channel 62 Giffarine 111 IN TV 160 POP Channel No. -

Asia Pacific to Add 45 Million Pay TV Subscribers

Asia Pacific to add 45 million pay TV subscribers The Asia Pacific pay TV sector is the most vibrant in the world, with subscribers up by 45 million and revenues up by $1.40 billion over the next five years. Pay TV penetration will stay at around 69%. Asia Pacific pay TV subscribers by country (mil) 800.0 700.0 600.0 500.0 400.0 300.0 200.0 100.0 0.0 2019 2020 2025 Others 70.5 72.3 80.9 Japan 17.4 17.6 17.7 Indonesia 11.2 13.5 18.5 S Korea 20.4 20.3 20.2 India 158.8 161.1 183.1 China 353.4 357.2 356.0 Source: Digital TV Research Ltd China and India together will account for 80% of the region’s 676 million pay TV subscribers by 2025. India will add 24 million pay TV subscribers over the next five years. However, China will peak in 2021 with a slow decline thereafter. OTT penetration and competition will remain much higher in China than in India. Simon Murray, Principal Analyst at Digital TV Research, said: “Much of this subscriber growth is down to the number of TV households increasing by 65 million between 2019 and 2025 to 978 million as populations rise and disposable income climbs. The region’s population is 4 billion – more than half of the world’s total.” For more information on the Asia Pacific OTT TV and Video Forecasts report, please contact: Simon Murray, [email protected], Tel: +44 20 8248 5051 Asia Pacific Pay TV Forecasts Table of Contents Published in March 2020, this 198-page PDF, PowerPoint and excel report comes in three parts: • Outlook: Forecasts for 22 countries in a 52-page PowerPoint document full of charts, graphs and bullet points; • Excel workbook covering each year from 2010 to 2025 for 22 countries by household penetration, by pay TV subscribers, by pay TV revenues and by major operator. -

Maybank Annual Report 2013 – Corporate Annual Report 2013

Maybank Annual Report 2013 – Corporate ANNUAL REPOrt 2013 ANNUAL REPOrt Shareholder Returns 15.1% Regionalisation Dividend per share 53.5 sen Return on Equity Higher loans growth and PBT growth in overseas markets Earnings per share 75.8 sen BRIDGING WORLDS IN ASIA CTAP URING THE FLOW OF BUSINess AROUND THE WORLD INTO ASIA THROUGH OUR NETWORK Reach Opportunity Market Community People 2 MAYBANK • ANNUAL REPORT 2013 CONTENTS Page 6 CHAIRMAN’S STATEMENT “Your Company has performed strongly once again with record Profit After Tax and Minority Interest (PATAMI), growing at double digits, reaching RM6.55 billion at end of 2013.” This annual report Page 8 is available on the web at GRU O P PresIDENT & CEO’S STATEMENT www.maybank.com/ar2013 “A strategic imperative in managing the Maybank Group is ensuring the strength of our balance sheet. Our clients who have chosen our institution to place their funds, have to be assured that their savings are secure, not just for today but for generations to come.” To contact us, please refer to page 181 for Corporate Information and page 182 for AT A GRUS O P TRATEGY & Group Directory. GLANCE ACHIEVEMENts 4 Highlights of 2013 28 Our Strategy & Achievements 32 Key Performance Indicators 34 Five-Year Group Financial Summary M ESSAGE TO 36 Simplified Group Statements of ANNUAL REPOrt 2013 Financial Position FINANCIAL STATEMENts SHAREHOLDERS 6 Chairman’s Statement 37 Group Quarterly Financial Performance 8 Group President & CEO’s Statement 37 Key Interest Bearing Assets and Liabilities 38 Statement of Value Added -

Encuentro Latinoamericano Vs Terrorismo Mediático

Encuentro Latinoamericano vs Terrorismo Mediático Ministerio del Poder Popular para la Comunicación y la Información Encuentro Latinoamericano vs Terrorismo Mediático Ministerio para el Poder Popular para la Comunicación y la Información; Av. Universidad, Esq. El Chorro, Torre Ministerial, pisos 9 y 10. Caracas-Venezuela. www.minci.gob.ve / [email protected] Directorio Ministro del Poder Popular para la Comunicación y la Información Andrés Izarra Viceministro de Gestión Comunicacional Mauricio Rodríguez Viceministro de Estrategia Comunicacional Freddy Fernández Directora General de Difusión y Publicidad Mayberth Graterol Director de Publicaciones Gabriel González Diseño y diagramación Ingrid Rodríguez M. Edición Sylvia Sabogal Ilustraciones Ares Depósito legal: lf8712008384365 Mayo, 2008. Segunda Edición República Bolivariana de Venezuela l Encuentro Latinoamericano vs el Terrorismo Mediático se realizó en- Etre el 27 y el 30 de marzo de 2008, en los espacios del Centro de Estudios Latinoa- mericanos Rómulo Gallegos (Celarg) y coin- cidió con una reunión de la Sociedad Intera- mericana de Prensa (SIP), efectuada a pocas cuadras. Así, mientras los dueños de la gran prensa emitían un informe sin sorpresas en un hotel que llegó a ser símbolo del golpismo venezolano, periodistas e investigadores de nuestra América debatían sobre el papel de los medios y denunciaban la infausta historia de la SIP. Este libro reúne las ponencias hechas duran- te ese Encuentro, presentadas casi estricta- mente en el mismo orden de exposición que tuvieron durante las jornadas de debate. Algunos periodistas que manifestaron su interés en participar en el evento, pero no pudieron viajar a Caracas, aportaron sus reflexiones para el Encuentro, las cuales son incluidas en esta publicación, por conside- rarlas una contribución valiosa para la dis- cusión sobre el tema. -

PHL State of the TV and Video Industry-V2

State of the TV and Video Industry in the Philippines Leo Jaymar G. Uy Head of Research, BusinessWorld Economic Snapshots (Philippines) Indicator 2020 2019 GDP (% growth/decline) -9.6% 6.1% Household Final Consumption -7.9% 5.9% Expenditure (% growth/decline) Unemployment Rate (%) 10.3% 5.1% Labor Force Participation Rate (%) 59.5% 61.3% GDP per capita (2018 prices) P164,919 P181,920 HFCE per capita (2018 prices) P123,915 P133,177 Timeline January 12 March 17 May 5 June 13 June 30 October 10 Taal Volcano Start of PHL Launch of Sky Direct and “A2Z”starts airing Eruption lockdown Congress Kapamilya ABS-CBN TV in Mega Manila measures votes to not Channel Plus is ordered renew ABS- by NTC to shut CBN down franchise Philippine TV industry has gone through a rollercoaster ride in 2020 TV viewership has not recovered since. TV Ad and Number of Spots (Kapamilya Channel and A2Z Channel) In spite of gloomy picture in TV viewing, pay TV viewership has been observed to have increased significantly during primetime. However, Pay TV Subscription has increased at the same time… However, Pay TV Subscription has increased at the same time… Both for cable subscription… Both for cable subscription… …and satellite subscription. The rollout of digital terrestrial television or DTT continues to progress as the appreciation for DTT has improved over the years with the increased use of affordable set-top boxes: ABS-CBN’s TVplus GMA Affordabox Other trends worth watching: • Continuing presence of ABS-CBN on digital (e.g., iWantTFC), on pay TV (e.g., ANC, Kapamilya