Property Division

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Egn201014152134.Ps, Page 29 @ Preflight ( MA-15-6363.Indd )

G.N. 2134 ELECTORAL AFFAIRS COMMISSION (ELECTORAL PROCEDURE) (LEGISLATIVE COUNCIL) REGULATION (Section 28 of the Regulation) LEGISLATIVE COUNCIL BY-ELECTION NOTICE OF DESIGNATION OF POLLING STATIONS AND COUNTING STATIONS Date of By-election: 16 May 2010 Notice is hereby given that the following places are designated to be used as polling stations and counting stations for the Legislative Council By-election to be held on 16 May 2010 for conducting a poll and counting the votes cast in respect of the geographical constituencies named below: Code and Name of Polling Station Geographical Place designated as Polling Station and Counting Station Code Constituency LC1 A0101 Joint Professional Centre Hong Kong Island Unit 1, G/F., The Center, 99 Queen's Road Central, Hong Kong A0102 Hong Kong Park Sports Centre 29 Cotton Tree Drive, Central, Hong Kong A0201 Raimondi College 2 Robinson Road, Mid Levels, Hong Kong A0301 Ying Wa Girls' School 76 Robinson Road, Mid Levels, Hong Kong A0401 St. Joseph's College 7 Kennedy Road, Central, Hong Kong A0402 German Swiss International School 11 Guildford Road, The Peak, Hong Kong A0601 HKYWCA Western District Integrated Social Service Centre Flat A, 1/F, Block 1, Centenary Mansion, 9-15 Victoria Road, Western District, Hong Kong A0701 Smithfield Sports Centre 4/F, Smithfield Municipal Services Building, 12K Smithfield, Kennedy Town, Hong Kong Code and Name of Polling Station Geographical Place designated as Polling Station and Counting Station Code Constituency A0801 Kennedy Town Community Complex (Multi-purpose -

Restaurant List

Restaurant List (updated 1 July 2020) Island Cafeholic Shop No.23, Ground Floor, Fu Tung Plaza, Fu Tung Estate, 6 Fu Tung Street, Tung Chung First Korean Restaurant Shop 102B, 1/F, Block A, D’Deck, Discovery Bay, Lantau Island Grand Kitchen Shop G10-101, G/F, JoysMark Shopping Centre, Mung Tung Estate, Tung Chung Gyu-Kaku Jinan-Bou Shop 706, 7th Floor, Citygate Outlets, Tung Chung HANNOSUKE (Tung Chung Citygate Outlets) Shop 101A, 1st Floor, Citygate, 18-20 Tat Tung Road, Tung Chung, Lantau Hung Fook Tong Shop No. 32, Ground Floor, Yat Tung Shopping Centre, Yat Tung Estate, 8 Yat Tung Street, Tung Chung Island Café Shop 105A, 1/F, Block A, D’Deck, Discovery Bay, Lantau Island Itamomo Shop No.2, G/F, Ying Tung Shopping Centre, Ying Tung Estate, 1 Ying Tung Road, Lantau Island, Tung Chung KYO WATAMI (Tung Chung Citygate Outlets) Shop B13, B1/F, Citygate Outlets, 20 Tat Tung Road, Tung Chung, Lantau Island Moon Lok Chiu Chow Unit G22, G/F, Citygate, 20 Tat Tung Road, Tung Chung, Lantau Island Mun Tung Café Shop 11, G/F, JoysMark Shopping Centre, Mun Tung Estate, Tung Chung Paradise Dynasty Shop 326A, 3/F, Citygate, 18-20 Tat Tung Road, Tung Chung, Lantau Island Shanghai Breeze Shop 104A, 1/F, Block A, D’Deck, Discovery Bay, Lantau Island The Sixties Restaurant No. 34, Ground Floor, Commercial Centre 2, Yat Tung Estate, 8 Yat Tung Street, Tung Chung 十足風味 Shop N, G/F, Seaview Crescent, Tung Chung Waterfront Road, Tung Chung Kowloon City Yu Mai SHOP 6B G/F, Amazing World, 121 Baker Street, Site 1, Whampoa Garden, Hung Hom CAFÉ ABERDEEN Shop Nos. -

Egn201216203328.Ps, Page 1 @ Preflight

G.N. 3328 Government Property Agency TENDERS FOR (1) A LICENCE OF THE FEE-PAYING PUBLIC CAR PARK ON PORTIONS OF THE GROUND FLOOR, LEVEL BASEMENT 1, LEVEL BASEMENT 2 AND LEVEL BASEMENT 3 OF CHEUNG SHA WAN GOVERNMENT OFFICES, 303 CHEUNG SHA WAN ROAD, KOWLOON, HONG KONG (TENDER REFERENCE NO.: GPA K1016) (2) A TENANCY OF THE GOVERNMENT CANTEEN ON A PORTION OF THE GROUND FLOOR, BLOCK R, 46 SHEK PIK RESERVOIR ROAD, SHEK PIK PRISON/SHA TSUI CORRECTIONAL INSTITUTION, SHEK PIK, LANTAU ISLAND, NEW TERRITORIES, HONG KONG (TENDER REFERENCE: GPA N949) It is hereby notified that sealed tenders (in duplicate) are invited for respective licence/tenancy of the above Government properties. The brief particulars of respective licence/tenancy are as follows:— (1) A Licence of the fee-paying public car park on portions of the Ground Floor, Level Basement 1, Level Basement 2 and Level Basement 3 of Cheung Sha Wan Government Offices, 303 Cheung Sha Wan Road, Kowloon, Hong Kong. (Tender Reference No.: GPA K1016) User : For the purpose of a fee-paying public car park for the parking of private cars and motor cycles only. (Further details are specified in the Tender Notice, Tender Form and the Form of Licence Agreement). Term : 3 years certain commencing from the date to be specified by the Chief Property Manager, Government Property Agency. Premises : 245 car parking bays, 12 motor cycle parking bays and 3 car parking bays for disabled persons on the Level Basement 1, Level Basement 2 and Level Basement 3 of Cheung Sha Wan Government Offices, 303 Cheung Sha Wan Road, Kowloon, Hong Kong. -

Property Investment 2011 Highlights

Review of Operations – Business in Hong Kong Property Investment 2011 Highlights • Including attributable contributions from associates and jointly controlled entities, the Group’s gross rental income increased by 11% year-on-year to HK$4,889 million, setting a new record • 9.2 million square feet in attributable gross floor area of completed investment properties • Quality portfolio with core properties attaining 97% occupancy at 31 December 2011 Property Investment Leasing performance was impressive innovative marketing activities, including during the year with gross rental income organizing shopping tours for mainlanders setting a new record. The Group’s and an increased adoption of multi-media At 31 December 2011, the Group held attributable gross rental incomeNote in Hong promotional channels, to draw more a total attributable gross floor area of Kong for the year ended 31 December shoppers to its shopping malls and boost approximately 9.2 million square feet in 2011 increased by 11% to HK$4,889 tenants’ business. These marketing efforts completed investment properties in Hong million, whilst pre-tax net rental incomeNote coupled with the advantageous locations Kong, comprising 4.5 million square feet was HK$3,585 million, representing a near MTR stations make these shopping of commercial or retail space, 3.4 million growth of 15% over the previous year. At malls the preferred choice for many square feet of office space, 0.9 million 31 December 2011, the leasing rate for the discerning retailers. For instance, Inditex, square feet of industrial/office space and Group’s core rental properties rose to 97%. a global fashion group, has committed to a 0.4 million square feet of residential and (Note: this figure includes that derived from the total gross floor area of 62,000 square feet at apartment space. -

RNTPC Paper No. 5/13 for Consideration by the Rural and New Town Planning Committee on 15.3.2013

RNTPC Paper No. 5/13 For Consideration by the Rural and New Town Planning Committee on 15.3.2013 PROPOSED AMENDMENTS TO THE APPROVED SOUTH LANTAU COAST OUTLINE ZONING PLAN No. S/SLC/16 1. Introduction This paper is to seek Members’ agreement that: (a) the proposed amendments to the approved South Lantau Coast Outline Zoning Plan (OZP) No. S/SLC/16 and its Notes as detailed in paragraphs 5 to 6 below are suitable for exhibition for public inspection under section 5 of the Town Planning Ordinance (the Ordinance); and (b) the revised Explanatory Statement (ES) of the OZP is an expression of the Town Planning Board (the Board)’s planning intentions and objectives for the various land use zonings of the OZP, and is suitable for exhibition together with the amendment OZP and its Notes. 2. Status of the Current OZP 2.1 On 2.11.2010, the draft South Lantau Coast OZP No. S/SLC/15 was approved by the Chief Executive in Council (CE in C) under section 9(1)(a) of the Ordinance. On 12.11.2010, the approved OZP No. S/SLC/16 (Attachment I) was exhibited for public inspection under section 9(5) of the Ordinance. 2.2 On 5.6.2012, the CE in C referred the approved South Lantau Coast OZP No. S/SLC/16 to the Board for amendment under section 12(1)(b)(ii) of the Ordinance. The reference back of the OZP was notified in the Gazette on 15.6.2012 under section 12(2) of the Ordinance. -

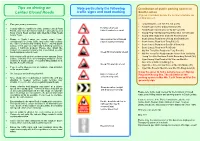

Tips on Driving on Lantau Closed Roads

Tips on driving on Note particularly the following Distribution of public parking spaces in Lantau Closed Roads traffic signs and road marking South Lantau (Figures in brackets denote the number of private car parking spaces) Plan your journey in advance. Lung Shing Street in Yim Tin, Tai O (30) Tai O Road near Tai O Bus Terminal (97) Comply with the conditions of the Lantau Closed Road Bend to left ahead Permit, and leave the closed roads (i.e. all roads south of (right if symbol reversed) Tai O Road near entrance of Tai O Town (18) Tung Chung Road junction with Shek Mun Kap Road) Ngong Ping near Ngong Ping Village Bus Terminal (22) before 7 p.m. Keung Shan Road near Shek Pik Reservoir (10) Roads in South Lantau are mainly single 2-lane Side road on the left ahead South Lantau Road near Cheung Sha Beach (28) carriageways for 2-way traffic, and some road sections (right if symbol reversed) South Lantau Road near Tong Fuk (25) are relatively narrow and winding. Before entering South South Lantau Road near San Shek Wan (19) Lantau, check your car (especially its braking system) to ensure it functions properly. Please also obtain the South Lantau Road near Pui O (24) contact of a towing company that is permitted to enter Mui Wo Ferry Pier Road near Ferry Pier (81) South Lantau in case of need. Steep Hill downwards ahead Mui Wo Ferry Pier Road near the former New Territories Fully charge or fill up the fuel tank before entering South Heung Yee Kuk Southern District Secondary School (149) Lantau. -

Research Analyst Presentation

2013 Interim Results | Analyst Briefing 15th August 2013 111219 1 Brickell CityCentre, Miami, U.S.A. Financial Summary 111219 2 EASTWOOD2011\Roadshow presentation\Eastwood Roadshow Presentation_FINAL.ppt Results Highlights Gross Rental Income Underlying Profit Equity Attri. to Shareholders HK$’M 8,557 9,015 4,390 4,711 HK$’M 6,935 2,435 2,812 HK$’M 176,043 192,434 197,542 + 3% + 7% + 15% -5% +10% +6% 2011 2012 1H 2012 1H 2013 FY12* 1H 2012* 1H 2013 Dec 11 Dec 12* Jun 13 (restated) (restated) (restated) Gross rental income up 7.3% to HK$ 4,711 M reflecting positive rental reversions at the office and retail properties in HK and at TaiKoo Hui in Guangzhou and Taikoo Li Sanlitun in Equity Attri. to Shareholders Beijing. HK$ 33.77 Per Share Underlying profit up 15.5% to HK$ 2,812 M mainly attributable to profit from property (31st Dec 2012: HK$ 32.89) trading (largely from sales of AZURA units) and positive rental reversions from investment property portfolio in HK and at TaiKoo Hui in Guangzhou and Taikoo Li Sanlitun in Beijing. Dividends Per Share Reported profit down 29.4% to HK$ 6,952 M mainly on lower valuation gains. st 1 Interim HK$ 0.20 st 1st interim dividend per share: HK$ 20 cents. (2012 1 Interim: HK$ 0.22) * Swire Properties has implemented the revised HKAS19: Employee Benefits (effective from 1st January 2013), which requires retrospective application. As a result, the 2012 comparative results have been restated. In this connection, underlying and 3 reported profit for 1H 2012 have been reduced by HK$8 million, and underlying and reported equity as at 31st Dec 2012 have been reduced by HK$180 million. -

M / SP / 14 / 178 ɤ 9 `ÁW³º¹Î² PRIMARY PLANNING UNIT NUMBER PLAN No

500 8 8 200 8 23 '¤D¿ 20012 100 Wang Tong 100 Pui O 203 13 12 Hei Ling Chau Typhoon Shelter 9.4.4 14 KEUNG SHAN Lo Wai Tsuen 700 400 9.6.3 f› 7 600 400 17 15 ‹n 200 ©¨D¿s Fan Kwai Tong j øª 384 ¹ÃÎ 100 122 D 6 Lo Uk 16 Pui O D Cheung Ting 500 D San Wai Tsuen A 300 Tsuen O 13 10 1 |§ ´s 400 R 100 100 300 300 AU Q⁄æ Hang Pui TUNG 300 SOUTH LAN T Shap Long ú¤N TAI O ÐÄÐ¥ Nga Ying Kok 200 n«j⁄‹¥ CH San Tsuen 644 443 Ham Tin San Tsuen 339 200 200 RO 434 UN 9.3.1 CHI MA WAN AD [˘ G RO y¦p 100 4 KWUN YAM SHAN 400 AD ÐÄÐ¥ TSIM FUNG SHAN LANTAU SOUTH COUNTRY PARK 19 Ham Tin Kau Tsuen Q⁄æ 100 300 FªF 300 û¤L 400 200 7 Shap Long ·‰ D 5 20 100 Ferry Pier Ngau Kwo Tin 100 Kau Tsuen CHI 200 s 4 ¯ªú 9.3 ˘ PUI O BEACH ROAD 52 MA W A N 11  KAU NGA LING o´ San Shek Wan D Q⁄æ Water 539 W 9 Shap Long Treatment PUI O WAN  R˜ Chung Hau 500 Works 18 CHEUNG SHA “wW˘ 374 361 Leyburn Villas 200 øªF¨ Chi Ma Wan ú¤N 2 Cheung Sha Correctional Institution C«L Sheung Tsuen Tsing Lam Kok NGA YING SHAN 9.4.1 21 sJ¥ ROAD øªF¨ 300 100 Lung Tsai Ng Yuen 400 Cheung Sha Ha Tsuen 3 2 100 188 ¶Æ 300 Wong Fa Pai 329 SHAP LONG IRRIGATION 428 SHAN 9.3.1 RESERVOIR 77 100 10 137 G¤D YI O 400 300 LOWER CHEUNG 200 øªF Yi O Hau SHUI LO CHO 5 ´ SHA BEACH 100 Cheung Sha Wan 459 F¨ 300 KEUNG SHAN 9.3.2 SHEK PIK RESERVOIR UPPER CHEUNG Sha Tsui KEUNG 4 9 357 300 SHA BEACH û½ C H I M A W A N 100 1 301 9.3 5 60 KAI KUNG SHAN G¤D¿ MAN CHEUNG PO P E N I N S U L A Yi O San Tsuen 200 ‹n 194 9.4.2 ¶ 116 3 Tong Fuk ƒH LO YAN 1 SHAN ¶”g 164 Tong Fuk 303 9.4 162 Correctional Institution TONG -

Recreation Tourism

RECREATION & TOURISM DEVELOPMENT STRATEGY FOR LANTAU - FEASIBILITY STUDY EXCECUTIVE SUMMARY OCT 2018 Civil Engineering and Development Development Department Bureau 2 | Recreation & Tourism Development Strategy for Lantau - Feasibility Study TABLE OF CONTENT Recreation & Tourism Development Strategy for Lantau - Feasibility Study | 3 1 Introduction 1 1.1 Background 1 1.2 Scope of the Study 1 1.3 Study Area 1 1.4 Study Process 1 2 Market Trend of Recreation and Tourism Development 3 2.1 Overview 3 2.2 Market Trend 3 2.3 Recreation and Tourism Trend in Hong Kong 4 2.4 Regional Benchmarking 5 3 Identification of Attractions 6 3.1 Attractions 6 3.2 Innovative Attractions 12 4 Preliminary Recreation and Tourism Development Strategy 17 4.1 Overview 17 4.2 Vision, Mission and Guiding Principles 17 4.3 Vision 17 4.4 Mission 17 4.5 Guiding Principles 18 4.6 Planning Framework 18 4.7 Public Engagement 20 5 General Receiving Capacity Assessment 21 5.1 Purpose 21 5.2 Methodology 21 5.3 Overall Findings 21 6 Strategic Traffic and Transport Assessment 23 6.1 Purpose 23 6.2 Methodology 23 6.3 Overall Findings 23 7 Shortlisted Proposals and the associated Broad Technical Assessments 25 7.1 Purpose of Shortlisting Proposals 25 7.2 Methodology of the Broad Technical Assessments 26 7.3 Overall Findings 26 7.4 Conclusion 32 4 | Recreation & Tourism Development Strategy for Lantau - Feasibility Study 8 Lantau Development Public Engagement Exercise 33 8.1 Public Engagement Exercise 33 8.2 Major Comments from Public Engagement Exercise 33 9 Recreation and Tourism -

First-Term Work Report

Lantau Development Advisory Committee First-term Work Report Synopsis This work report summarises the work of the first term of the Lantau Development Advisory Committee (LanDAC), and its major proposals in the areas of spatial planning and land use, conservation, strategic transport infrastructure, social development, and recreation and tourism for Lantau. It also outlines the direction of the Committee's next step of work. Background LanDAC was formed in January 2014 to advise the Government, through the Secretary for Development, on: 1) the social and economic development opportunities on Lantau to capitalise on its advantages as the confluence of major transport infrastructure linking Hong Kong, Macao and the western Pearl River Delta, so as to meet the long-term development needs of Hong Kong; and 2) the policies, measures and specific proposals conducive to the sustainable development and conservation of Lantau. Information on LanDAC and its subcommittees, including meeting minutes and discussion papers, has been uploaded to the LanDAC website (www.LanDAC.hk). Work of LanDAC LanDAC and its subcommittees held a total of 7 and 19 meetings respectively and conducted site visits to Lantau and cities in the western Pearl River Delta (PRD). Moreover, a number of promotional events had been organized to brief key stakeholders on Lantau development and site visits to Lantau had also been conducted for the 18 District Councils. Three topical strategic studies were commissioned in 2015 to facilitate LanDAC on formulation of the proposed development strategies, namely, the Study on Consolidated Economic Development Strategy for Lantau and Market Positioning for Commercial Land Uses in Major Developments of Lantau; the Study on Recreation 1 and Tourism Development Strategy for Lantau; and the Preliminary Feasibility Study on the Cable Car System from Ngong Ping to Tai O, and Spa and Resort Development at Cheung Sha and Soko Islands. -

Submission from Green Lantau Association on the Concept Plan For

Green Lantau Association House B12, Leyburn Villas Cheung Sha, Lantau 24 February 2005 The Lantau Development Task Force c/o Planning Department 15/F Sha Tin Government Offices Sha Tin, NT Dear Sirs, Lantau Concept Plan – Response to Consultation Document The submission of the Green Lantau Association (GLA) is attached. GLA is a voluntary organisation which has been established since 1989. We are committed to working toward the environmental protection of Lantau. We believe that Lantau is a uniquely valuable island, a natural and national treasure which should be conserved for this and future generations. The original remit of the Lantau Development Task Force was to ‘provide a high level policy steer on the economic and infra-structural development of Lantau and to ensure the timely delivery of the planned projects”. We were therefore initially pleasantly surprised that the outcome of 10 months of closed door meetings was the Consultation Digest. This went far further, it first appeared, than mere development, and actually articulated a number of conservation philosophies with which we fully agree.. It did indeed appear that mounting public concern over the development- oriented thrust of the Task Force had been heard. We have studied the Digest carefully, and have attended three consultation sessions. We have also spoken informally with officials from the Housing Planning and Lands Bureau, and the Planning Department. However despite the initial impressions and the rounds of meetings, we are generally disappointed with the Concept Plan, which in detail falls far short, we feel, of its purported aims. From comparison with the 2001 SWNT DSR we are aware that the plan is incomplete. -

Key Species/Habitats of Conservation Concern in Different Areas of Lantau

Appendix 1 - Key species/habitats of conservation concern in different areas of Lantau Locations Key species/habitats of conservation concern# 1 Yam O and Sunny Consisting of various coastal wetlands, including mangroves and Bay mudflats Two species of pipefish and seagrass recorded 2 Tai Ho and Pak Consisting of various wetland habitats, including natural streams, Mong mangrove, seagrass bed, freshwater and brackish marshes and estuaries Streams are habitats for Ayu Sweetfish Important breeding and nursery grounds for Horseshoe Crab Woodland and wetland habitats are suitable foraging and roosting grounds for Brown Fish Owl and Romer’s Tree Frog Tai Ho River is recognised as EIS and SSSI 3 Wong Lung Hang, Over 200 species of native plants with more than 13 protected Pok To Yan and Por plant species recorded, including rare orchids and the globally Kai Shan vulnerable and regionally restricted Rhododendron hongkongensis. A butterfly hotspot as recognised by AFCD Presence of an EIS at Wong Lung Hang 4 Tung Chung Valley Tung Chung River is one of the few large streams in Hong Kong and Tung Chung Bay remaining largely intact; recognised by AFCD as EIS. The stream system provides habitats for many rare species such as the South China Cascade Frog and eels. Wetlands habitats, such as mangroves, mudflats and estuaries, are breeding and nursery grounds for two Horseshoe Crab species Proposed Marine Protection Area by local scholars. Fung shui woodland and lowland secondary woodland are habitats for Tokay Gecko and Eurasian Eagle Owl. Tung Chung Valley is also a butterfly hotspot which nurtures 148 species which comprises about 60% of Hong Kong’s total.