BUDGET BACKGROUND and MEDIUM TERM FRAMEWORK 2012/13 – 2014/15 Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE UNITED REPUBLIC of TANZANIA Tanzania Airports Authority

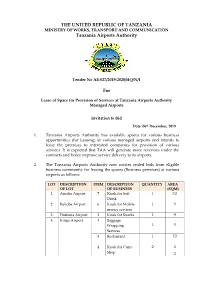

THE UNITED REPUBLIC OF TANZANIA MINISTRY OF WORKS, TRANSPORT AND COMMUNICATION Tanzania Airports Authority Tender No AE-027/2019-2020/HQ/N/1 For Lease of Space for Provision of Services at Tanzania Airports Authority Managed Airports Invitation to Bid Date: 06th December, 2019 1. Tanzania Airports Authority has available spaces for various business opportunities (for Leasing) at various managed airports and intends to lease the premises to interested companies for provision of various services. It is expected that TAA will generate more revenues under the contracts and hence improve service delivery to its airports. 2. The Tanzania Airports Authority now invites sealed bids from eligible business community for leasing the spaces (Business premises) at various airports as follows: LOT DESCRIPTION ITEM DESCRIPTION QUANTITY AREA OF LOT OF BUSINESS (SQM) 1. Arusha Airport 7 Kiosk for Soft 1 33 Drink 2. Bukoba Airport 6 Kiosk for Mobile 1 4 money services 3. Dodoma Airport 3 Kiosk for Snacks 1 4 4. Iringa Airport 1 Baggage Wrapping 1 4 Services 3 Restaurant 1 72 4 Kiosk for Curio 2 3 Shop 3 LOT DESCRIPTION ITEM DESCRIPTION QUANTITY AREA OF LOT OF BUSINESS (SQM) 5 Kiosk for Retail 1 3.5 shop 5. Kigoma Airport 1 Baggage Wrapping 1 4 Services 2 Restaurant 1 19.49 3 Kiosk for Retail 2 19.21 shop 4 Kiosk for Snacks 1 9 5 Kiosk for Curio 1 6.8 Shop 6. Kilwa Masoko 1 Restaurant 1 40 Airport 2 Kiosk for soft 1 9 drinks 7. Lake Manyara 2 Kiosk for Curio 10 84.179 Airport Shop 3 Kiosk for Soft 1 9 Drink 4 Kiosk for Ice 1 9 Cream and Beverage Outlet 5 Car Wash 1 49 6 Kiosk for Mobile 1 2 money services 8. -

Attachment a the United Republic of Tanzania

ATTACHMENT A THE UNITED REPUBLIC OF TANZANIA ANNEXES TO THE GUIDELINES FOR THE PREPARATION OF ANNUAL PLAN AND BUDGET FOR 2013/14 IN THE IMPLEMENTATION OF THE FIVE YEAR DEVELOPMENT PLAN 2011/12-2015/16 DECEMBER, 2012 TABLE OF CONTENTS LIST OF ABREVIATIONS ............................................................................................................................. IV CHAPTER I: REVIEW OF MACROECONOMIC PERFORMANCE AND 2011/12 ANNUAL DEVELOPMENT PLAN 1 INTRODUCTION ................................................................................................................................................. 1 REVIEW OF MACROECONOMIC PERFORMANCE ........................................................................................................ 1 IMPLEMENTATION OF ANNUAL DEVELOPMENT PLAN 2011/12 ................................................................. 12 REGIONAL COOPERATION ........................................................................................................................ 24 ACHIEVEMENTS: ....................................................................................................................................... 24 CHAPTER II: MACROECONOMIC OUTLOOK AND MEDIUM TERM FOCUS .................................................. 26 INTRODUCTION ............................................................................................................................................... 26 Global Economic Growth and Outlook .................................................................................................. -

TANZANIA TOURISM SECTOR SURVEY a TANZANIA TOURISM SECTOR SURVEY

TheThe 20142014 InternationalInternational Visitors’Visitors’ ExitExit SurveySurvey ReportReport THE TANZANIA TOURISM SECTOR SURVEY a TANZANIA TOURISM SECTOR SURVEY THE 2014 INTERNATIONAL VISITORS’ EXIT SURVEY REPORT November 2016 c TABLE OF CONTENTS LIST OF TABLES ...................................................................................... iii LIST OF CHARTS ..................................................................................... iv ACRONYMS ............................................................................................. v FOREWORD ............................................................................................. vi ACKNOWLEDGEMENT ........................................................................... vii EXECUTIVE SUMMARY .......................................................................... viii Chapter 1: Recent Developments in the Tourism Industry .................. 1 1.1 Global Perspective ........................................................................... 1 1.2 Tourism Development in East Africa ................................................. 5 1.3 Tourism Development in Tanzania ................................................... 5 1.3.1 International Tourist Arrivals ............................................... 6 1.3.2 Promotion and Marketing .................................................... 6 1.3.3 New Accommodation Establishment .................................. 7 1.3.4 Establishment of Tanzania Wildlife Management Authority .. 8 1.3.5 Tourism Trade Fair -

Register of IJS Locations V1.Xlsx

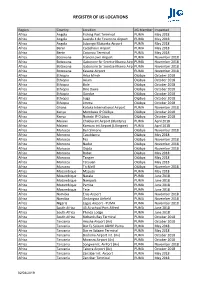

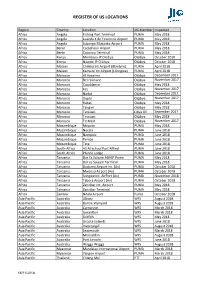

REGISTER OF IJS LOCATIONS Region Country Location JIG Member Inspected Africa Angola Fishing Port Terminal PUMA May 2018 Africa Angola Luanda 4 de Fevereiro Airport PUMA May 2018 Africa Angola Lubango Mukanka Airport PUMA May 2018 Africa Benin Cadjehoun Airport PUMA May 2018 Africa Benin Cotonou Terminal PUMA May 2018 Africa Botswana Francistown Airport PUMA November 2018 Africa Botswana Gaborone Sir Seretse Khama AirpoPUMA November 2018 Africa Botswana Gaborone Sir Seretse Khama AirpoPUMA November 2018 Africa Botswana Kasane Airport PUMA November 2018 Africa Ethiopia Arba Minch OiLibya October 2018 Africa Ethiopia Axum OiLibya October 2018 Africa Ethiopia Bole OiLibya October 2018 Africa Ethiopia Dire Dawa OiLibya October 2018 Africa Ethiopia Gondar OiLibya October 2018 Africa Ethiopia Jijiga OiLibya October 2018 Africa Ethiopia Jimma OiLibya October 2018 Africa Ghana Kotoka International Airport PUMA November 2018 Africa Kenya Mombasa IP OiLibya OiLibya October 2018 Africa Kenya Nairobi IP OiLibya OiLibya October 2018 Africa Malawi Chileka Int Airport (Blantyre) PUMA April 2018 Africa Malawi Kamuzu int.Airport (Lilongwe) PUMA April 2018 Africa Morocco Ben Slimane OiLibya November 2018 Africa Morocco Casablanca OiLibya May 2018 Africa Morocco Fez OiLibya November 2018 Africa Morocco Nador OiLibya November 2018 Africa Morocco Oujda OiLibya November 2018 Africa Morocco Rabat OiLibya May 2018 Africa Morocco Tangier OiLibya May 2018 Africa Morocco Tetouan OiLibya May 2018 Africa Morocco Tit Melil OiLibya November 2018 Africa Mozambique Maputo -

Flight Calibration of Landing and Navigation Aids

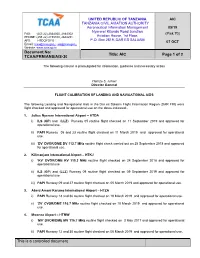

UNITED REPUBLIC OF TANZANIA AIC TANZANIA CIVIL AVIATION AUTHORITY Aeronautical Information Management 05/19 Nyerere/ Kitunda Road Junction FAX: (255 22) 2844300, 2844302 (Pink 70) Aviation House, 1st Floor, PHONE: (255 22) 2198100, 2844291. P.O. Box 2819, DAR ES SALAAM AFS: HTDQYOYO 07 OCT Email: [email protected], [email protected] Website: www.tcaa.go.tz Document No: Title: AIC Page 1 of 2 TCAA/FRM/ANS/AIS-30 The following circular is promulgated for information, guidance and necessary action Hamza S. Johari Director General FLIGHT CALIBRATION OF LANDING AND NAVIGATIONAL AIDS The following Landing and Navigational Aids in the Dar es Salaam Flight Information Region (DAR FIR) were flight checked and approved for operational use on the dates indicated:- 1. Julius Nyerere International Airport – HTDA i) ILS (GP) and (LLZ) Runway 05 routine flight checked on 11 September 2019 and approved for operational use. ii) PAPI Runway 05 and 23 routine flight checked on 11 March 2019 and approved for operational use. iii) ‘DV’ DVOR/DME DV 112.7 MHz routine flight check carried out on 25 September 2018 and approved for operational use. 2. Kilimanjaro International Airport – HTKJ i) ‘KV’ DVOR/DME KV 115.3 MHz routine flight checked on 24 September 2018 and approved for operational use. ii) ILS (GP) and (LLZ) Runway 09 routine flight checked on 09 September 2019 and approved for operational use. iii) PAPI Runway 09 and 27 routine flight checked on 05 March 2019 and approved for operational use. 3. Abeid Amani Karume International Airport – HTZA i) PAPI Runway 18 and 36 routine flight checked on 10 March 2019 and approved for operational use. -

The United Republic of Tanzania Ministry of Works, Transport and Communication Tanzania Airports Authority Proposed Projects

THE UNITED REPUBLIC OF TANZANIA MINISTRY OF WORKS, TRANSPORT AND COMMUNICATION TANZANIA AIRPORTS AUTHORITY PROPOSED PROJECTS WRITE UP FOR THE BELGIAN TRADE MISSION TO TANZANIA NOVEMBER, 2 0 1 6 , S No. REMARKS I. PROJECT NAME Upgrading of MWANZA AIRPORT PROJECT CODE 4209 PROJECT LOCATION IATA:MWZ; ICA0:1-1.TMW; with elevation above mean sea level (AMSL) 3763ft/1147m FEASIBILITY STUDY Feasibility Study for construction of new terminal building REMARKS and landside pavements, parallel taxiway, widening of runway 45wide to 60m including relocation of AGL System and improvement of storm water drainage was completed in June, 2016 STATUS Contractor for extension of runway, rehabilitation of taxiway to bitumen standard, extension of existing apron and cargo apron, construction of control tower, cargo building, power house and water supply system has resumed to site. ncti, ahold03-)3 ConSkiNclp4) N_ Teicyrri2 WORKS REQUIRING and landside paveThents, parallel taxiway, widening of runway FUNDING 45wide to 60m including relocation of AGL System and improvement of storm water drainage PROJECT COST ESTIMATES/ USD.113 Million FINANCING GAP1 • Improved efficiency and comfort upon construction of new terminal building. • Improved efficiency upon installation of AGL and NAVAIDS • Improved safety upon Construction of Fire Station and PROJECT BENEFITS associated equipment • Improved safety and security upon construction of Control Tower • Improved security upon implementation of security programs. FINANCING MODE PPP, EPC, Bilateral and Multilateral Financing -

Doc 20210909024413 NOTAM CURRENT 09 SEPT 2021.Pdf

UNITED REPUBLIC OF TANZANIA DAILY NOTAM TANZANIA CIVIL AVIATION AUTHORITY Aeronautical Information Management LIST TEL: 255 22 2110223/224 International NOTAM Office FAX: 255 22 2110264 AFTN: HTDAYNYX P. O. Box 18001, E-mail: [email protected] 09 SEP 2021 [email protected] DAR ES SALAAM Website: www.tcaa.go.tz TANZANIA Document No: Page 1 of 10 Title: Daily List of Valid NOTAM TCAA/FRM/ANS/AIM-33 THE FOLLOWING NOTAM SERIES (A, B & C) WERE STILL VALID AT 0001 UTC. 2021: 0278, 0276, 0274, 0273, 0272, 0271, 0269, 0258, 0253, 0251, 0249, SERIES:A 0248, 0243, 0242, 0239, 0238, 0237, 0236, 0234, 0229, 0220, 0219, 0216, 0215, 0206, 0204, 0199 AND 0197 210908 DAR ES SALAAM FIR HTDC 2109160400/2109190900 EST 0400 - 0900 PARAGLIDING FLT WILL TAKE PLACE FM THE PEAK OF MT KILIMANJARO A0278/21 COORD 3445.39S 372141.90E TOWARD MOSHI TOWN COORD 32017.78S 372013.53E, DUE WX CONDITION THE ALTERNATIVE LDG WILL BE AT FIELD IN RONGAI GATE AREA COORD 2581.37S 37282.91E. FM GND TO 20000FT AMSL 210907 DAR ES SALAAM FIR HTDC 2109110300/2109211500 EST 0300 - 1530 PARAGLIDING FLT WILL TAKE PLACE WITHIN A RADIUS OF 11NM FM PARE A0276/21 MOUNTAINS COORD 338204S 3739409E AND WITHIN A RADIUS OF 17NM FM USAMBARA MOUNTAINS COORD 437591S 3818016E. GND TO 2000FT AMSL 210903 DAR ES SALAAM FIR HTDC 2109030400/2112031300 EST 0400 – 1300 MIL TRAINING FLT WILL TAKE PLACE FM TANGA WI AN AREA ENCLOSED WITH THE FOLLOWING COORD:- A0274/21 05 02 24.705S 038 59 05.881E 04 56 35.986S 038 48 33.782E 05 22 27.105S 038 58 33.955E 05 11 02.295S 039 02 26.620E, PILOTS TO AVOID THE AREA AND STRICTLY ADHERE TO ATC INSTRUCTIONS. -

Guidelines for the Preparation of Plans and Budget for 2017/18

GUIDELINES FOR THE PREPARATION OF PLANS AND BUDGET FOR 2017/18 MINISTRY OF FINANCE AND PLANNING NOVEMBER, 2016 ISBN 978 - 9987 - 829 - 03 - 3 TABLE OF CONTENTS 1.0 INTRODUCTION ....................................................................... 1 2.0 CURRENT BUDGETARY REFORMS ............................................. 2 2.1 Budget Act No. 11 of 2015 .............................................................. 2 2.2 Programme Based Budget ............................................................... 2 2.3 Public Investment Management – Operational Manual .............................. 3 3.0 PREPARATION OF INSTITUTIONS’ PLANS AND BUDGETS ............. 3 3.1 Budget Committees ....................................................................... 3 3.2 Roadmap for Plans and Budgets Preparation .......................................... 3 3.3 Shifting Operations of the Government Headquarters to Dodoma .................. 4 3.4 Budget Dialogue and Scrutinization Process .......................................... 4 3.5 Data Entry into the Integrated Financial Management System ...................... 5 4.0 INSTRUCTIONS FOR PREPARATION OF PLANS AND BUDGET........................................................................................... 6 4.1 Medium Term Expenditure Framework and Resource Envelope ................... 6 4.2 The Medium Term Indicative Budget Ceilings........................................ 6 4.3 Strategies to Enhance Revenue Collection ............................................. 6 4.4 Criteria for Resource -

4.5 Tanzania Airport Company Contact List

4.5 Tanzania Airport Company Contact List Airport Company Street / Physical Address Name Title Email Phone Phone Fax Website Number Number Number (office) (mobile) Julius Nyerere Tanzania Airport Ilala jnia@airport +255 22 http://www. International Airport Authority s.go.tz 2844324 jnia.go.tz (JNIA) Dar es Salaam +255 22 P. O. Box 18032 2844373 Tanzania Songwe International Tanzania Airport P. O Box 249, Hamisi Airport +255 25 http://www. Airport Authority Amiri Manager 250 4274 taa.go.tz/# Songwe-Mbeya Abeid Amani Karume Zanzibar Airport Abeid Amani Karume Zaina. +255 24 http://www. International Airport - Authorities International Airport, PO Box commandent 2233979 zaa.go.tz Zanzibar 1254, Zanzibar @zaa.go.tz /#tab-id-4 Kilimanjaro International Tanzania Airport KADCO, info@kadco. +255 (27) +255 (27) Airport Authority and co.tz 255 4252, 255 4312 P.O. BOX 10 KIA, Kilimanjaro Airports Development Company Kilimanjaro,Tanzania (KADCO) Kigoma Airport Tanzania Airport P.O Box 764, Kigoma. +255 28 +255 767 36 Authority 280 2857/8 3386/ +255 713 363 384 Dodoma Airport Tanzania Airport P.O. Box 1025, +255 26 Authority 235 4833/ Dodoma. +255 26 235 2179 Manyara Airport Tanzania Airport P.O Box 06, Authority Mto wa Mbu - ARUSHA Mafia Tanzania Airport P. O Box 21, +255 23 Authority 2011309 Airport Mafia Shinyanga Airport Tanzania Airport P.O Box 837, Authority Shinyanga Tabora Airport Tanzania Airport P.O Box 11, +255 26 Authority 2604133 Tabora. Tanga Airport Tanzania Airport P.O Box 851, +255 27 Authority 2644175 Tabora. Morogoro Airport Tanzania Airport P.O Box 89, Authority Morogoro. -

Aeronautical Information Promulgation Advice Form

UNITED REPUBLIC OF TANZANIA MONTLY TANZANIA CIVIL AVIATION AUTHORITY Aeronautical Information Management NOTAM LIST TEL: 255 22 2110223/224 International NOTAM Office FAX: 255 22 2110264 AFTN: HTDAYNYX P. O. Box 18001, SERIES B E-mail: [email protected] [email protected] DAR ES SALAAM Website: www.tcaa.go.tz TANZANIA 01 SEPT 2020 Document No: Page 1 of 10 Title: Monthly List of Valid NOTAM TCAA/FRM/ANS/AIM-33 THE FOLLOWING NOTAM SERIES B WERE STILL VALID ON 01 SEPTEMBER 2020 NOTAM NOT INCLUDED HAVE EITHER BEEN CANCELLED, TIME EXPIRED, SUPERSEDED BY AIP SUPPLEMENT OR INCORPORATED IN THE AIP. 2020: 0064, 0063, 0062, 0061, 0059, 0057, 0054, 0047, 0041, 0039, 0029, SERIES:B 0010 AND 0009 2016: 0097 AND 0095 200901 DAR ES SALAAM FIR HTDC B0064/20 2009010000/2009302359 EST NOTAM CHECKLIST. 200829 DODOMA AIRPORT HTDO 2008290705/2009301530 EST B0063/20 EXTD APRON WIP. PILOTS ADVISED ADHERE TO ATC AND MARSHERLLER INSTRUCTIONS. 200829 DODOMA AIRPORT HTDO 2008290700/2009301530 EST RWY 27 DISPLACED BY 250M DUE CONSTRUCTION WIP. DECLARED DIST AVBL NOW ARE AS FLW: B0062/20 RWY TORA TODA LDA ASDA 09 2250M 2250M 2250M 2450M 27 2250M 2250M 2250M 2250M. 200829 DODOMA AIRPORT HTDO 2008290654/2009301530 EST CONSTRUCTION WIP 50M BEYOND THR RWY 27 B0061/20 PILOTS TO EXER CTN AND STRICTLY ADHERE TO ATC INSTRUCTION DRG LDG/TKOF. 200812 SONGWE AIRPORT HTGW B0059/20 2008150001/2009132359 EST THR RWY 27 DISPLACED BY 1000M DUE WIP, DECLARED DIST AVBL ARE AS FLW:- RWY TORA TODA ASDA LDA 09 2330 2330 2330 2330 This is a controlled Document 9Document No: TCAA/FRM/ANS/AIM-33 Title: Daily List of Valid NOTAM Page 2 of 10 27 2330 2330 2330 2330 (REF: AIP SUP 25/20). -

Issued by the Britain-Tanzania Society No 116 January 2017

Tanzanian Affairs Issued by the Britain-Tanzania Society No 116 January 2017 A new editor after 30 years One year into Magufuli’s Presidency Earthquake in Kagera Tanzania & Morocco ASANTE DAVID ! As the incoming editor of Tanzanian Affairs, I feel very lucky – and a little daunted – to be able to follow in the footsteps of David Brewin, who has done a fantastic job editing the journal for more than 30 years. Over that time, Tanzanian Affairs has evolved and grown under his stewardship into the engaging, informative and highly respected publication that it is today. I am sure you will all join me in thanking him for his remarkable work. David has now decided it is time to step back from the editorship, though I am delighted to say that he will continue to be involved as a contributor. I promise to do my best to protect David’s wonderful legacy and to maintain the high regard in which TA is held by its readers. Ben Taylor Incoming Editor, Tanzanian Affairs Left is the cover of Issue 19 (1984), the first issue edited by David, covering the death of Edward Sokoine in a car crash. To the right is the familiar green cover David introduced a year later which many readers will remember. cover photo: PM Majaliwa views earthquake damage in Kagera (State House) Ben Taylor: ONE YEAR INTO MAGUFULI’S PRESIDENCY Since coming to office, the pace of President Magufuli’s activity has surprised many observers. In government, the phrase – HapaKaziTu! (Work and nothing else!) – rapidly evolved from a campaign slogan into a philosophy for governance. -

Register of Ijs Locations

REGISTER OF IJS LOCATIONS Region Country Location JIG Member Inspected Africa Angola Fishing Port Terminal PUMA May 2018 Africa Angola Luanda 4 de Fevereiro Airport PUMA May 2018 Africa Angola Lubango Mukanka Airport PUMA May 2018 Africa Benin Cadjehoun Airport PUMA May 2018 Africa Benin Cotonou Terminal PUMA May 2018 Africa Kenya Mombasa IP OiLibya OiLibya October 2018 Africa Kenya Nairobi IP OiLibya OiLibya October 2018 Africa Malawi Chileka Int Airport (Blantyre) PUMA April 2018 Africa Malawi Kamuzu int.Airport (Lilongwe) PUMA April 2018 Africa Morocco Al Hoceima OiLibya December 2017 Africa Morocco Ben Slimane OiLibya November 2017 Africa Morocco Casablanca OiLibya May 2018 Africa Morocco Fez OiLibya November 2017 Africa Morocco Nador OiLibya December 2017 Africa Morocco Oujda OiLibya November 2017 Africa Morocco Rabat OiLibya May 2018 Africa Morocco Tangier OiLibya May 2018 Africa Morocco Tetouan Libya Oil Sepember 2017 Africa Morocco Tetouan OiLibya May 2018 Africa Morocco Tit Melil OiLibya November 2017 Africa Mozambique Maputo PUMA May 2018 Africa Mozambique Nacala PUMA June 2018 Africa Mozambique Nampula PUMA June 2018 Africa Mozambique Pemba PUMA June 2018 Africa Mozambique Tete PUMA June 2018 Africa South Africa 43 Airschool Port Alfred PUMA June 2018 Africa South Africa Phinda Lodge PUMA June 2018 Africa Tanzania Dar Es Salaam ADHIP Puma PUMA May 2018 Africa Tanzania Dar es Salaam Terminal PUMA May 2018 Africa Tanzania Dodoma Airport Int. (Av) PUMA October 2018 Africa Tanzania Mwanza Airport (Av) PUMA October 2018 Africa Tanzania