China Property Sector Refer to Important Disclosures at the End of This Report DBS Group Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

The Annual Report on the Most Valuable and Strongest Real Estate Brands June 2020 Contents

Real Estate 25 2020The annual report on the most valuable and strongest real estate brands June 2020 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Brand Finance Real Estate 25 (USD m) 13 Sector Reputation Analysis 14 COVID-19 Global Impact Analysis 16 Definitions 20 Brand Valuation Methodology 22 Market Research Methodology 23 Stakeholder Equity Measures 23 Consulting Services 24 Brand Evaluation Services 25 Communications Services 26 Brand Finance Network 28 © 2020 All rights reserved. Brand Finance Plc, UK. Brand Finance Real Estate 25 June 2020 3 About Brand Finance. Brand Finance is the world's leading independent brand valuation consultancy. Request your own We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For more than 20 A Brand Value Report provides a years, we have helped companies and organisations of all types to connect their brands to the bottom line. complete breakdown of the assumptions, data sources, and calculations used We quantify the financial value of brands We put 5,000 of the world’s biggest brands to the test to arrive at your brand’s value. every year. Ranking brands across all sectors and countries, we publish nearly 100 reports annually. Each report includes expert recommendations for growing brand We offer a unique combination of expertise Insight Our teams have experience across a wide range of value to drive business performance disciplines from marketing and market research, to and offers a cost-effective way to brand strategy and visual identity, to tax and accounting. -

AGILE GROUP HOLDINGS LIMITED (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 3383)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities referred to herein will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States except pursuant to an exemption from, or a transaction not subject to, the registration requirements of the Securities Act. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the company making the offer and its management and financial statements. The Company does not intend to make any public offering of securities in the United States. AGILE GROUP HOLDINGS LIMITED (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3383) OVERSEAS REGULATORY ANNOUNCEMENT This overseas regulatory announcement is issued pursuant to Rule 13.10B of the Rules Governing the Listing of Securities (the “Listing Rules”) on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”). -

AGILE PROPERTY HOLDINGS LIMITED (Incorporated in the Cayman Islands with Limited Liability) Stock Code: 3383

雅居樂地產控股有限公司 AGILE PROPERTY HOLDINGS LIMITED (Incorporated in the Cayman Islands with limited liability) Stock code: 3383 Annual Report 2009 2009 Projects on Sale Corporate Profile The Group is one of leading property developers in China. It is principally engaged in the development of large-scale comprehensive property projects. The Group currently owns a diversified portfolio of 66 projects in various stages of development (including 5 developed and sold projects) in 22 different cities and districts such as Guangzhou, Zhongshan, Foshan, Heyuan, Huizhou, Shanghai, Changzhou, Nanjing, Chengdu, Xi’an, Chongqing, Shenyang and Hainan. As of 15 April 2010, the Group has a land bank with total GFA of approximately 32.15 million sq. m. (including both lands with titles and contractual interests). The shares of Agile have been listed on the Main Board of The Stock Exchange of Hong Kong Limited since 15 December 2005 under (Stock code: 3383). They are included as constituent stocks in Morgan Stanley Capital International China Index, the Hang Seng Composite Index and the Hang Seng Freefloat Composite Index. Contents 2 Financial Highlights 84 Senior Management’s Profi le 4 Business Structure 86 Corporate Governance Report 6 Milestone 2009 94 Report of the Directors 8 Honours and Awards 108 Independent Auditor’s Report 10 Chairman’s Statement 110 Consolidated Balance Sheet 18 Management Discussion and Analysis 112 Balance Sheet 26 Property Development 113 Consolidated Income Statement Land Bank of the Group 114 Consolidated Statement of Comprehensive -

Agile Property (3383 HK) Neutral (Maintained) Property - Real Estate Target Price: HKD6.30 Market Cap: USD3,051M Price: HKD6.04

Company Update, 5 June 2015 Agile Property (3383 HK) Neutral (Maintained) Property - Real Estate Target Price: HKD6.30 Market Cap: USD3,051m Price: HKD6.04 Macro Risks 2 Key Takeaways From Zhongshan Visit Growth . 2 0 Value . 01 0 . 02 0 We recently visited Agile’s four major projects in Zhongshan (tier-3 . Agile Property Holdings (3383 HK) 0 Price Close Relative to Hang Seng Index (RHS) city). Reiterate NEUTRAL with a higher HKD6.30 TP (4% upside), 0 7.4 110 following the sector valuation upgrade. Key takeaways: i) a preliminary 0 6.9 104 recovery in sales volume, driven by end-users and loosening mortgage approvals, and ii) ASP tends to stabilise, but upside is limited. We 6.4 98 remain concerned on Agile’s low-tier cities exposure (75% of its 5.9 91 landbank) and profit margin erosion. 5.4 85 Zhongshan the home base. Agile Property (Agile) was founded in 4.9 79 Zhongshan in 1992. It had been headquartered in the city since its establishment, until the headquarters was moved to Guangzhou in 2012. 4.4 73 Zhongshan is the highest contributing city, generating 13.7% and 18.4% 3.9 66 of landbank and contracted sales revenue, respectively, as of end-FY14. In turn, Agile is the market leader in Zhongshan, given that it achieved 3.4 60 250 the highest sales revenue among its peers in 2014. 200 150 Desirable sell-through, but likely an isolated case for Zhongshan. Benefitting from its brand reputation and track record in Zhongshan, 100 Agile’s projects are supported by end-user demand and loosening 50 mortgage approvals from banks. -

AGILE GROUP HOLDINGS LIMITED (Incorporated with Limited Liability Under the Laws of the Cayman Islands)

香 港 交 易 及 結 算 所 有 限 公 司 及 香 港 聯 合 交 易 所 有 限 公 司 對 本 公 告 的 內 容 概 不 負 責 , 對 其 準 確 性 或 完 整 性 亦 不 發 表 任 何 聲 明 , 並 明 確 表 示 概 不 就 因 本 公 告 全 部 或 任 何 部 分 內 容 而 產 生 或 因 倚 賴 該 等 內 容 而 引 致 的 任 何 損 失 承 擔 任 何 責 任 。 本 公 告 僅 供 參 考 , 並 不 構 成 收 購 、 購 買 或 認 購 證 券 的 邀 請 或 遊 說 要 約 , 或 邀 請 訂 立 協 議 進 行 上 述 任 何 事 宜 , 亦 無 意 招 攬 任 何 要 約 以 收 購 、 購 買 或 認 購 任 何 證 券 。 本 公 告 並 非 供 於 美 國 或 美 國 境 內 直 接 或 間 接 派 發 。 本 公 告 及 其 所 載 資 料 並 不 構 成 或 組 成 在 美 國 購 買 、 認 購 或 出 售 證 券 的 部 分 要 約 。 除 非 根 據 1933 年 美 國 證 券 法 ( 經 修 訂 ()「 證 券 法 」)登 記 或 獲 適 用 豁 免 登 記 規 定 , 否 則 證 券 不 得 在 美 國 提 呈 發 售 或 出 售 。 在 美 國 公 開 發 售 任 何 證 券 將 通 過 載 有 與 本 公 司 及 管 理 層 有 關 的 詳 細 資 料 以 及 財 務 報 表 的 招 股 章 程 的 方 式 進 行 。 本 公 告 所 述 證 券 並 無 及 將 不 會 根 據 證 券 法 登 記 , 且 不 會 在 美 國 公 開 發 售 任 何 證 券 。 本 公 告 所 述 證 券 將 根 據 所 有 適 用 法 律 法 規 出 售 。 本 公 告 或 其 所 載 資 料 並 非 用 以 招 攬 金 錢 、 證 券 或 其 他 代 價 , 而 倘 為 回 應 本 公 告 或 其 所 載 資 料 而 寄 出 金 錢 、 證 券 或 其 他 代 價 , 則 不 會 獲 接 納 。 本 公 告 並 非 歐 洲 經 濟 區(「 歐 洲 經 濟 區 」)成 員 國 所 實 施 歐 盟 指 令 2003 / 71 / EC( 及 其 任 何 修 訂 )所 界 定 之 招 股 章 程 。 無 PRIIPs 重 要 資 訊 文 件 - 由 於 不 可 於 歐 洲 經 濟 區 進 行 零 售 , 故 並 無 編 製 PRIIPs 重 要 資 訊 文 件 。 本 公 告 及 有 關 據 此 提 呈 發 行 證 券 之 任 何 其 他 文 件 或 資 料 並 非 由 英 國《 2000 年 金 融 服 務 與 市 場 法 》( 經 修 訂 )第 21 條 所 界 定 之 認 可 人 士 發 佈 , 而 有 關 文 件 及 ╱ 或 資 料 亦 未 經 其 批 准 。 因 此 , 有 關 文 件 及 ╱ 或 資 料 並 不 會 向 英 國 公 眾 人 士 派 發 , 亦 不 得 向 英 國 公 眾 人 士 傳 遞 。 有 關 文 件 及 ╱ 或 資 料 僅 作 為 財 務 推 廣 向 在 英 國 擁 有 相 關 專 業 投 資 經 驗 及 屬 於《 2000 年 金 融 服 務 與 市 場 法 》2005 年( 財 務 推 廣 )命 令( 經 修 訂 ) (「 財 務 推 廣 命 令 」)第 19 (5) 條 所 界 定 之 投 資 專 業 人 士 , 或 屬 於 財 務 推 廣 命 令 第 49 (2) (a) 至 (d) 條 範 圍 之 人 士 , 或 根 據 財 務 推 廣 命 令 可 以 其 他 方 式 -

China Property Sector

China / Hong Kong Industry Focus China Property Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 19 Apr 2021 Spotlight on future land supply • Solid sales growth momentum sustained with strong HSI: 28,970 potential to ink another year of record-high sales • Developers poised to meet their 2021 targets ANALYST Jason LAM +852 3668 4179 [email protected] • Future land supply and new starts as keys to watch for Danielle WANG CFA, +852 3668 4176 [email protected] • Sector top picks: Vanke, COLI, CIFI and Logan Ken HE CFA, +86 21 3896 8221 [email protected] Solid performance in 1Q21; strong potential for another year of Ben Wong [email protected] record-high residential sales. Residential sales in Mar rose 63% y-o-y (or 44% vs Mar-19) on the back of a 38% (or 19% vs Mar- Recommendation & valuation 19) increment in residential GFA sold and 19% (or 21% vs Mar- 19) rise in residential ASP, marking another solid month of FY22F physical market performance. We believe the market is well- Target Price Price Rec Mkt Cap PE poised to post another record-high sales value this year – as it HK$ HK$ US$bn x will likely attain 2020’s level even if the market records a 12.5% y- o-y decline for the remaining nine months. China Overseas Developers well on track to achieve their 2021 targets. Presales 20.15 25.70 BUY 28.4 4.0 (688 HK) growth of 30 listed developers we track on a weighted-average China Vanke 'H' 28.25 45.56 BUY 49.9 5.3 basis remained strong at 47% y-o-y (or +33% vs Mar 2019) in (2202 HK) Mar (Feb-21: 144%), as compared to their c.10% weighted Logan Property 12.50 16.44 BUY 8.9 3.5 average presales target for 2021. -

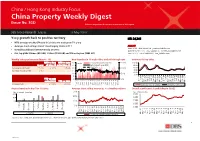

China Property Weekly Digest (Issue No

China / Hong Kong Industry Focus China Property Weekly Digest (Issue No. 302) Refer to important disclosures at the end of this report DBS Group Research . Equity 13 May 2020 Y-o-y growth back to positive territory HSI: 24,246 • MTD average weekly GFA sold in 29 cities we track grew 7% y-o-y • Average short-selling interest stood largely stable at 11% ANALYST Jason LAM +852 36684179 [email protected] • Overall southbound interest steady at 5.65% Danielle WANG CFA, +852 36684176 [email protected] • Our top picks: Shimao (813 HK), Yuzhou (1628 HK) and China Aoyuan (3883 HK) Ken HE CFA, +86 2138968221 [email protected] Weekly sales performance (May 4 – 10) New launches in 10 major cities and sell-through rate Inventory in key cities MTD vs Avg MTD vs same 30 k units Total units launched (LHS) 150% 100.0 w-o-w of May -19 period May-19 25 Sell-through rate (RHS) 80.0 Avg weekly GFA sold ↑ 1.4% ↓ 1.1% ↑ 7.0% 20 26w avg 100% 60.0 Inventory (no. of weeks) ↑ 3.7 15 40.0 20.0 10 50% 0.0 5 YTD vs same 0 0% Jul-13 Jul-18 Jan-11 Jan-16 Jun-11 Jun-16 Feb-13 Oct-14 Feb-18 Oct-19 Apr-12 Sep-12 Apr-17 Sep-17 Dec-13 Dec-18 Nov-11 Nov-16 Mar-15 Mar-20 Aug-15 May-14 period 2019 YTD vs 2019 May-19 7W17 2W18 1W19 YTD GFA sold ↓ 21.3% ↓ 35.0% 9W19 51W16 15W17 23W17 31W17 39W17 47W17 12W18 20W18 28W18 36W18 45W18 17W19 25W19 33W19 41W19 49W19 12W20 Inventory (no. -

48-R-43 a Resolution to Support the Withdrawal of OSU's Investments In

1 48-R-43 2 3 A Resolution to Support the Withdrawal of OSU’s Investments in Corporations Complicit 4 in Human Rights Violations 5 6 Sami Mubarak (for himself) introduced the following resolution to the General Assembly 7 8 * * * 9 10 Whereas the Undergraduate Student Government represents all undergraduate students at The 11 Ohio State University (OSU), and 12 13 Whereas the OSU Office of Investments manages $3.6 billion in endowment funds and $6.1 14 billion in revenue, 14.2% of which comes from student tuition and fees,1 and 15 16 Whereas the OSU Office of Investments has repeatedly denied student requests for an updated 17 list of entities in which the University is invested today, and 18 19 Whereas OSU invests in G4S, Caterpillar Inc., and Hewlett-Packard (HP),2 and 20 21 Whereas G4S, Caterpillar, and HP profit from and enable violations of the universal rights to 22 life, liberty, property, education, privacy and security of person,3 and 23 24 Whereas Caterpillar has violated these rights by providing engineering tools and bulldozers 25 used to expand settlements, construct the Separation Wall throughout the West Bank and 26 routinely demolish Palestinian homes, refugee camps, water cisterns, and agricultural fields in 27 the West Bank and Gaza Strip,4,5 and 28 29 Whereas settlements6 and the Separation Wall7 have been ruled to be in violation of 30 international law, and 31 32 Whereas HP has provided biometric identification systems used at Israeli military 33 checkpoints,8 which facilitate discrimination against Palestinians, restrict their freedom of 34 movement and limit their access to education, employment, and medical care,9 and 1 The Ohio State University - Statistical Summary 2 The Ohio State University, 2009 Equities and Fixed Income. -

Annual Report 1 FINANCIAL HIGHLIGHTS

CORPORATE PROFILE Agile Group Holdings Limited (Stock Code: 3383) and its subsidiaries are principally engaged in the development of large-scale mixed-use property projects, with extensive presence in the businesses of property management, environmental protection, construction, real estate construction management and commercial. As a renowned brand in China, the Group has established diversified businesses in various cities and districts in China and overseas. As at 31 December 2019, the Group had a land bank with a total attributable planned GFA of 39.70 million sq.m.. Shares of Agile have been listed on the Main Board of Hong Kong Stock Exchange since 2005 and are constituent stocks of Hang Seng Composite Index, Hang Seng Global Composite Index, Hang Seng Stock Connect Hong Kong Index Series, Hang Seng Mainland China Companies High Dividend Yield Index, Hang Seng Mainland Properties Index, Hang Seng High Beta Index, Hang Seng China (Hong Kong-listed) 100 Index, MSCI China Index and Lippo Select HK & Mainland Property Index. BUSINESS STRUCTURE Agile will continue to adopt the operating model of “focusing on property development, supported by a diversified range of businesses” (“1+N”), driving the solid growth of each business segment. P. 40 A-Living The GFA under management and contracted GFA were 234.0 million Property sq.m. and 356.2 million sq.m. Environmental Development respectively Protection A land bank with a total attributable Optimising its regional presence, planned GFA of 39.70 million sq.m. driving the development of its in 75 cities business segments including hazardous waste treatment, water treatment and common solid P. -

Asian Games City Commercial and Residential Project in Guangzhou Successfully Invited Two New Partners

[For Immediate Release] AGILE PROPERTY COUNTRY GARDEN SHIMAO PROPERTY HOLDINGS LIMITED HOLDINGS COMPANY GUANGZHOU R&F PROPERTIES CO., LTD HOLDINGS LIMITED (Stock Code: 3383) LIMITED (Stock Code: 813) (Stock Code:2007) (Stock Code: 2777) Asian Games City Commercial and Residential Project in Guangzhou Successfully invited two new partners * * * * * Five renowned mainland property developers joined forces to create a new Guangzhou landmark (24 June 2010, Hong Kong) Agile Property Holdings Limited (“Agile”, stock code: 3383), Country Garden Holdings Company Limited (“Country Garden”, stock code: 2007), Guangzhou R&F Properties Co., Ltd (“R&F Properties”, stock code: 2777) and Shimao Property Holdings Limited (“Shimao Property”, stock code: 813) are pleased to announce that the Asia Games City project to be jointly developed by Agile, Country Garden and R&F Properties, as announced on 23 December 2009, has today successfully invited Shimao Property and Citic Real Estate Co. Ltd. (“Citic Real Estate”) as two new partners in a move that will boost the project’s competitiveness and attractiveness. The announcement made on 23 December 2009 was followed by the incorporation of Guangzhou Lihe Property Development Company Limited (“Project Company”) in China specifically for this project. The Project Company is 33% owned by each of R&F Properties, Agile and Country Garden, and 1% by two group companies of R&F Properties. It has a registered capital of HK$750 million contributed by the five companies in accordance with their respective shareholdings. A series of equity transfer agreements have been reached today pursuant to which R&F Properties will sell a 14% shareholdings in the Project Company and each of Agile and Country Garden will sell a 13% shareholdings, while each of Shimao Property and Citic Real Estate will acquire a 20% shareholdings in the Project Company for HK$150 million in cash. -

Sustainable Quality Growth Prospect, Maintain “Buy”

股 票 研 [Table_Title] Van Liu 刘斐凡 Company Report: China Aoyuan (03883 HK) 究 (86755) 2397 6672 Equity Research 公司报告: 中国奥园 (03883 HK) [email protected] 25 January 2018 Sustainable[Table_Summary] Quality Growth Prospect, Maintain “Buy” 持续且有质量的增长预期,维持“买入” China Aoyuan (“the Company”) announced a positive profit alert. The Rating:[Table_Rank ] Buy Company’s net profit in 2017 is expected to record a significant increase of at Maintained 公 least 75% YoY. 评级: 买入 (维持) 司 Strategic layout in the Big Bay Area with proper unit land cost hints at 报 sustainable quality growth prospect. 76.1% of the Company's land bank was in tier-1/ tier-2/ international cities, and its unit land cost amounted to 6[Table_Price-18m TP 目标价] : HK$8.87 告 RMB1,897 per sq.m., representing 18.9% of ASP in 2017. Revised from 原目标价: HK$5.45 Company Report Contracted sales are likely to maintain fast growth momentum. During Share price 股价: HK$6.890 2017, the Company achieved RMB45.59 bn in contracted sales, up 78% YoY. With quality land bank exposure and a healthy financial position, sufficient saleable resources will be launched in 2018 and 2019. Stock performance 股价表现 The Company should justify a lower NAV discount. As we have revised up [Table_QuotePic] underlying net profit, we also revise up the target price from HK$5.45 to HK$8.87, representing a 37% discount to 2018E NAV of HK$14.08 per share, 9.1x 2018 underlying PER and 1.7x 2018 PBR. Therefore, we maintain "Buy". Risk factors include lower-than-expected contracted sales and possible failure in operational activities of overseas projects and 证 redevelopment projects.