Com Hem Reports First Quarter Results 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tele2 Is Europe´S Leading Alternative Telecom Operator Offering a Wide Range of Products to Consumers Across Europe

ERG Kista 25 January 2008 Response to ERGs draft Common Position on symmetry of fixed/mobile call termination rates Tele2 is Europe´s leading alternative telecom operator offering a wide range of products to consumers across Europe. Tele2´s most important products are mobile telephony and broadband but the company also provides fixed telephony in a number of countries. Tele2 welcomes the opportunity to provide its comments on ERGs draft Common Position (CP) on symmetry of fixed/mobile call termination rates. General As a general remark on the draft CP Tele2 would like to point to the fact that before the question of symmetry regarding termination rates becomes relevant and a potential issue a NRA first must come to the conclusion that at least two operators in a specific country are considered holding SMP-position on their individual networks. This is due to the fact that price regulation of any kind can only be decided as a remedy following a finding of SMP- position according to Article 13 of the Access directive. Court judgments across Europe (e.g. in the UK, Finland and Ireland) show that an SMP assessment is not a mechanical process where the fact that an operator per definition holds a 100 percent market share on the individual market at hand can be used as a sole argument for the conclusion that the operator also holds a SMP-position in the market. The existence of customers with a strong negotiating position, which is exercised to produce a significant impact on competition, will tend to restrict the ability of providers to act independently of their customers. -

Zero-Rating Practices in Broadband Markets

Zero-rating practices in broadband markets Report by Competition EUROPEAN COMMISSION Directorate-General for Competition E-mail: [email protected] European Commission B-1049 Brussels [Cataloguenumber] Zero-rating practices in broadband markets Final report February 2017 Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. Les informations et opinions exprimées dans ce rapport sont ceux de(s) l'auteur(s) et ne reflètent pas nécessairement l'opinion officielle de la Commission. La Commission ne garantit pas l’exactitude des informations comprises dans ce rapport. La Commission, ainsi que toute personne agissant pour le compte de celle-ci, ne saurait en aucun cas être tenue responsable de l’utilisation des informations contenues dans ce rapport. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2017 Catalogue number: KD-02-17-687-EN-N ISBN 978-92-79-69466-0 doi: 10.2763/002126 © European Union, 2017 Reproduction is authorised provided the source is acknowledged. -

Annual and Sustainability Report 2020 Content

BETTER CONNECTED LIVING ANNUAL AND SUSTAINABILITY REPORT 2020 CONTENT OUR COMPANY Telia Company at a glance ...................................................... 4 2020 in brief ............................................................................ 6 Comments from the Chair ..................................................... 10 Comments from the CEO ...................................................... 12 Trends and strategy ............................................................... 14 DIRECTORS' REPORT Group development .............................................................. 20 Country development ........................................................... 38 Sustainability ........................................................................ 48 Risks and uncertainties ......................................................... 80 CORPORATE GOVERNANCE Corporate Governance Statement ......................................... 90 Board of Directors .............................................................. 104 Group Executive Management ............................................ 106 FINANCIAL STATEMENTS Consolidated statements of comprehensive income ........... 108 Consolidated statements of financial position ..................... 109 Consolidated statements of cash flows ............................... 110 Consolidated statements of changes in equity .................... 111 Notes to consolidated financial statements ......................... 112 Parent company income statements ................................... -

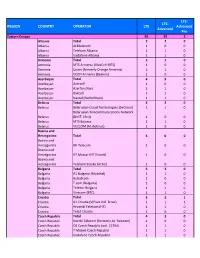

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

International Media and Communication Statistics 2010

N O R D I C M E D I A T R E N D S 1 2 A Sampler of International Media and Communication Statistics 2010 Compiled by Sara Leckner & Ulrika Facht N O R D I C O M Nordic Media Trends 12 A Sampler of International Media and Communication Statistics 2010 COMPILED BY: Sara LECKNER and Ulrika FACHT The Nordic Ministers of Culture have made globalization one of their top priorities, unified in the strategy Creativity – the Nordic Response to Globalization. The aim is to create a more prosperous Nordic Region. This publication is part of this strategy. ISSN 1401-0410 ISBN 978-91-86523-15-2 PUBLISHED BY: NORDICOM University of Gothenburg P O Box 713 SE 405 30 GÖTEBORG Sweden EDITOR NORDIC MEDIA TRENDS: Ulla CARLSSON COVER BY: Roger PALMQVIST Contents Abbrevations 6 Foreword 7 Introduction 9 List of tables & figures 11 Internet in the world 19 ICT 21 The Internet market 22 Computers 32 Internet sites & hosts 33 Languages 36 Internet access 37 Internet use 38 Fixed & mobile telephony 51 Internet by region 63 Africa 65 North & South America 75 Asia & the Pacific 85 Europe 95 Commonwealth of Independent States – CIS 110 Middle East 113 Television in the world 119 The TV market 121 TV access & distribution 127 TV viewing 139 Television by region 143 Africa 145 North & South America 149 Asia & the Pacific 157 Europe 163 Middle East 189 Radio in the world 197 Channels 199 Digital radio 202 Revenues 203 Access 206 Listening 207 Newspapers in the world 211 Top ten titles 213 Language 214 Free dailes 215 Paid-for newspapers 217 Paid-for dailies 218 Revenues & costs 230 Reading 233 References 235 5 Abbreviations General terms . -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

Manufacturer's Code List Liste Des Codes De Fabricant Liste Der

4-170-687-11(1) English TV Brand Code No. Brand Code No. Brand Code No. Brand Code No. Brand Code No. City 00009 Grandin 00009, 00037, 00218, 00374, 00455, 01583, 00610, Marquant 02056 Profex 00009 Tatung 00037, 00072, 00516, 01248, 01324, 01556, 01720 The following tables show brand names (Brand) Téléviseur Clarivox 00037, 00070, 00418 00451, 00668, 00714, 00715, 00865, 00880, 01037, Mascom 01556 Profi 00009 TCL 01916 Code Fernsehgerät Classic 01308 01298 Mastec 01997 Profilo 01556 TCM 00714, 00808, 01289, 01308, 20001 and their corresponding code numbers ( Clatronic 00009, 00037, 00218, 00264, 00370, 00371, 00714, Grundig 00009, 00036, 00037, 00070, 00195, 00487, 01583, Master’s 01308 Profitronic 00037 Teac 00009, 00037, 00170, 01727, 00264, 00412, 00418, Tv 01324 00411, 00672, 01223, 01248, 01308, 01376, 01149, 00455, 00587, 00451, 00668, 00698, 00712, 00714, No.). 01869, 01916, 01935, 02007, 01531, 01037, 01687, Masuda 00009, 00037, 00218, 00264, 00371 Proline 00037, 00072, 00411, 00625, 00634, 01037, 01376, Clayton 01037 Materin 00858 01545, 01727, 02135 01037, 01149, 01363, 01687, 01755, 01812, 01985, Televisor 02200, 02239 02032, 02168 To set the manufacturer’s code, refer to the CME 01308 Grunkel 01149 Matsui 00009, 00035, 00036, 00037, 00072, 00195, 00208, Prosonic 00037, 00370, 00371, 00374, 00668, 00714, 01324, Televisor 01376, 01531, 01732, 01770, 01847, 01727, 02001, Tec 00009, 00037, 00335 Concorde 00009 GVA 01363 00235, 00335, 00355, 00371, 00455, 00487, 00516, Operating Instructions. 01583, 00714, 00744, 00880, 01037, -

Annual Report 2011 On

Annual Report 2 011 Visit our Annual Report 2011 on www.tele2.com! Read more about Tele2 2011 on http://reports.tele2.com/2011/ar. On our website www.tele2.com you always find the latest information. Here we publish our interim reports, our press releases and much more. You will also find links to our European operations. Highlights Full Year 2011 ¡ NET SALES GROWTH FOR THE GROUP aMOUNTED ¡ SIGNIFICanT OPEraTIOnaL PROGRESS IN MarKET TO 7 PERCENT EXCLUDING EXCHanGE raTE AREA CENTraL EUROPE & EUraSIA DIFFERENCES During the year, Tele2 Kazakhstan carried out its successful Net sales amounted to SEK 40,750 (40,164) million corre- launch of new regions and the total customer base amounted sponding to a growth excluding exchange rate difference and to 1,371,000 (332,000) at December 31, 2011. Tele2 Croatia one-off items of 7 percent in the year. EBITDA for the year 2011 reached for the first time free cash-flow breakeven in Q3 2011. amounted to SEK 10,852 (10,284) million, equivalent to an The Baltic countries drove cost cutting throughout the year, EBITDA margin of 27 (26) percent. EBITDA growth excluding thereby maintaining a firm EBITDA margin development. exchange rate differences was 10 percent. ¡ IMPROVED MarGIN DEVELOPMENT IN FIXED ¡ RECORD EBITDA CONTRIBUTION brOADbanD IN MarKET arEA WESTErn EUROPE IN MarKET arEA RUSSIA Tele2 Netherlands expanded its fixed broadband margin further In 2011, Tele2 Russia added 2,198,000 (3,987,000) customers to 33 (31) percent during 2011 thanks to scale benefits from the leading to a total customer base of 20.6 (18.4) million. -

Case M.8842 - TELE2 / COM HEM HOLDING

EUROPEAN COMMISSION DG Competition Case M.8842 - TELE2 / COM HEM HOLDING Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 08/10/2018 In electronic form on the EUR-Lex website under document number 32018M8842 EUROPEAN COMMISSION Brussels, 8.10.2018 C(2018) 6690 final In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council PUBLIC VERSION Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures To the notifying party or a general description. Subject: Case M.8842 – Tele2 / Com Hem Holdings Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 3 September 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/20043 by which Tele2 AB (Sweden) ("Tele2" or the “Notifying Party"), controlled by Kinnevik AB (“Kinnevik”), intends to acquire sole control of Com Hem Holding AB (Sweden) ("Com Hem") by way of a statutory merger (the "Transaction")4. Tele2 and Com Hem are collectively referred to as the "Parties". 1. THE PARTIES AND THE TRANSACTION (2) Tele2 is a Swedish telecommunications provider mainly offering mobile telecommunications services (voice and data), and to a lesser extent fixed telephony services, fixed internet access services, as well as data communication services and related services, in several European countries. -

995 Final COMMISSION STAFF WORKING DOCUMENT

EUROPEAN COMMISSION Brussels,23.9.2010 SEC(2010)995final COMMISSIONSTAFFWORKINGDOCUMENT Accompanyingdocumenttothe COMMUNICATIONFROMTHECOMMISSIONTOTHE EUROPEAN PARLIAMENT,THECOUNCIL,THEEUROPEANECONOMIC ANDSOCIAL COMMITTEEANDTHECOMMITTEEOFTHEREGIONS NinthCommunication ontheapplicationofArticles4and5ofDirective89/552/EECas amendedbyDirective97/36/ECandDirective2007/65/EC,fortheperiod2007-2008 (PromotionofEuropeanandindependentaudiovisual works) COM(2010)450final EN EN COMMISSIONSTAFFWORKINGDOCUMENT Accompanyingdocumenttothe COMMUNICATIONFROMTHECOMMISSIONTOTHE EUROPEAN PARLIAMENT,THECOUNCIL,THEEUROPEANECONOMIC ANDSOCIAL COMMITTEEANDTHECOMMITTEEOFTHEREGIONS NinthCommunication ontheapplicationofArticles4and5ofDirective89/552/EECas amendedbyDirective97/36/ECandDirective2007/65/EC,fortheperiod20072008 (PromotionofEuropeanandindependentaudiovisual works) EN 2 EN TABLE OF CONTENTS ApplicationofArticles 4and5ineachMemberState ..........................................................5 Introduction ................................................................................................................................5 1. ApplicationofArticles 4and5:generalremarks ...................................................5 1.1. MonitoringmethodsintheMemberStates ..................................................................6 1.2. Reasonsfornon-compliance ........................................................................................7 1.3. Measures plannedor adoptedtoremedycasesofnoncompliance .............................8 1.4. Conclusions -

Annual and Sustainability Report Contents

2020 Annual and Sustainability Report Contents Introduction 3 Sustainability report 37 CEO word 5 Highlights from 2020 38 Tele2 at a glance 6 Introduction 39 Board of directors 7 The Tele2 approach to sustainability 40 Leadership team 9 What we did in 2020 42 Sustainability information 50 Shareholder information 11 Auditor statement 65 Administrative report 12 Critical GRI Standards indicators 66 Financial overview 12 Financial statements – Contents 67 Three-year summary 13 Financial statements – Group 68 Group summary 14 Financial statements – Parent company 119 Overview by segment 15 Enterprise risk management 22 Board of Directors’ and President’s Employees 25 certification 126 Corporate governance report 26 Auditor’s report 127 Remuneration report 34 Definitions 131 Non-IFRS measures 131 Other financial metrics 134 Audited (unless otherwise stated) Introduction Our vision “The smartest telco in the world, creating a society of unlimited possibilities.” Introduction 3 CEO word 5 Tele2 at a glance 6 Board of directors 7 Our Strategy Leadership team 9 Unique People & Culture We walk the talk, being a value driven company, based on a diverse and inclusive Shareholder information 11 organization. We always strive to attract, retain, and develop the strongest talents. Administrative report 12 Winning Customer Focus Remuneration report 34 Distinctly positioned leading brands, aiming to win the customer through FMC. We aim to be an outstanding partner to businesses and the public sector. Sustainability report 37 Financial statements 67 Radical Simplification Our mindset allows us to quickly adapt to the world around Board of Directors’ and us, and continuously modernize our operations. President’s certification 126 Auditor’s report 127 Definitions 131 The Tele2 Way The Tele2 Way defines who we are and how we do things. -

This Press Release

Important Information For the purposes of this disclaimer, “this press release” means this document, its contents or any part of them, any oral presentation, any question and answer session and any written or oral materials discussed or distributed therein. This communication does not constitute notice to an extraordinary general meeting or a merger document, nor shall it constitute an offer to sell or the solicitation or invitation of any offer to buy, acquire or subscribe for, any securities or an inducement to enter into investment activity, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any decision with respect to the proposed statutory merger of Tele2 AB (publ) (“Tele2”) and Com Hem Holding AB (publ) (“Com Hem”) in accordance with the Swedish Companies Act (the “Merger”) should be made solely on the basis of information to be contained in the actual notices to the extraordinary general meetings of Tele2 and Com Hem, as applicable, and the merger document related to the Merger as well as on an independent analysis of the information contained therein. You should consult the merger document, which will be available prior to the extraordinary general meeting of shareholders at which the matters set out herein will be subject to vote, for more complete information about the Merger. You should also perform an independent analysis of the information contained therein and the merger document when making any investment decision. This press release contains forward-looking statements.