Media-Handbook How Television Went Digital In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tele2 Is Europe´S Leading Alternative Telecom Operator Offering a Wide Range of Products to Consumers Across Europe

ERG Kista 25 January 2008 Response to ERGs draft Common Position on symmetry of fixed/mobile call termination rates Tele2 is Europe´s leading alternative telecom operator offering a wide range of products to consumers across Europe. Tele2´s most important products are mobile telephony and broadband but the company also provides fixed telephony in a number of countries. Tele2 welcomes the opportunity to provide its comments on ERGs draft Common Position (CP) on symmetry of fixed/mobile call termination rates. General As a general remark on the draft CP Tele2 would like to point to the fact that before the question of symmetry regarding termination rates becomes relevant and a potential issue a NRA first must come to the conclusion that at least two operators in a specific country are considered holding SMP-position on their individual networks. This is due to the fact that price regulation of any kind can only be decided as a remedy following a finding of SMP- position according to Article 13 of the Access directive. Court judgments across Europe (e.g. in the UK, Finland and Ireland) show that an SMP assessment is not a mechanical process where the fact that an operator per definition holds a 100 percent market share on the individual market at hand can be used as a sole argument for the conclusion that the operator also holds a SMP-position in the market. The existence of customers with a strong negotiating position, which is exercised to produce a significant impact on competition, will tend to restrict the ability of providers to act independently of their customers. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Global Pay TV Fragments

Global pay TV fragments The top 503 pay TV operators will reach 853 million subscribers from the 1.02 billion global total by 2026. The top 50 operators accounted for 64% of the world’s pay TV subscribers by end-2020, with this proportion dropping to 62% by 2026. Pay TV subscribers by operator ranking (million) 1200 1000 143 165 38 45 800 74 80 102 102 600 224 215 400 200 423 412 0 2020 2026 Top 10 11-50 51-100 101-200 201+ Excluded from report The top 50 will lose 20 million subscribers over the next five years. However, operators beyond the top 100 will gain subscribers over the same period. Simon Murray, Principal Analyst at Digital TV Research, said: “Most industries consolidate as they mature. The pay TV sector is doing the opposite – fragmenting. Most of the subscriber growth will take place in developing countries where operators are not controlled by larger corporations.” By end-2020, 13 operators had more than 10 million pay TV subscribers. China and India will continue to dominate the top pay TV operator rankings, partly as their subscriber bases climb but also due to the US operators losing subscribers. Between 2020 and 2026, 307 of the 503 operators (61%) will gain subscribers, with 13 showing no change and 183 losing subscribers (36%). In 2020, 28 pay TV operators earned more than $1 billion in revenues, but this will drop to 24 operators by 2026. The Global Pay TV Operator Forecasts report covers 503 operators with 726 platforms [132 digital cable, 116 analog cable, 279 satellite, 142 IPTV and 57 DTT] across 135 countries. -

ECC REPORT 143 Electronic Communications Committee

ECC REPORT 143 Electronic Communications Committee (ECC) within the European Conference of Postal and Telecommunications Administrations (CEPT) PRACTICAL IMPROVEMENTS IN HANDLING 112 EMERGENCY CALLS: CALLER LOCATION INFORMATION Lisbon, April 2010 ECC REPORT 143 Page 2 0 EXECUTIVE SUMMARY Each year in the European Union several millions of citizens dial the emergency call number to access emergency services. Due to increasing penetration of mobile telephony in the society, the share of emergency calls emanating from mobile networks is rapidly outgrowing emergency calls for fixed networks; this causes that an emergency situation mobile callers are increasingly not able to indicate the precise location for an optimum response. Similarly, VoIP services are substituting voice calls over traditional networks, customers increasingly use VoIP for emergency calls and expecting the same reliability and completeness of the emergency calls service. Location information is normally represented by data indicating the geographic position of the terminal equipment of a user. These data vary in range, indicating in a general way where the user is or very precise, pinpointing the user’s whereabouts to within a few meters. Some location data are effectively a subset of signalling data as they are necessary for setting up a telephone connection. In the framework of Enhanced emergency call services, the availability of location information must serve three main goals: Route the calls to the right emergency call centre; Locate the caller and/or the incident site. Dispatch the most appropriate emergency response team(s); The Report identify the most relevant regulatory principles applicable to caller location requirements in the context of emergency calls and analyses the location information standards produced by ETSI as a Standard Development Organization for fixed, mobile and IP communications networks. -

Converged Markets

Converged Markets - Converged Power? Regulation and Case Law A publication series of the Market power becomes an issue for European and media services and enabling services, platforms and European Audiovisual Observatory national law makers whenever market players acquire a converged services, and fi nally distribution services. degree of power which severely disturbs the market balance. In this sense, the audiovisual sector is no The eleven countries were selected for this study because exception. But this sector is different in that too much they either represented major markets for audiovisual market power may not only endanger the competitive media services in Europe, or because they developed out- parameters of the sector but may also become a threat side the constraints of the internal market, or because they had some interesting unique feature, for example to the freedom of information. It is this latter aspect the ability to attract major market players despite lacking which turns market power into a particularly sensitive an adequately sized market. issue for the audiovisual sector. National legislators and regulators backed by national courts seek solutions The third part brings in the economic background in the adapted to this problem. form of different overviews concerning audience market shares for television and video online. This data puts the This IRIS Special issue is deals with the regulation of legal information into an everyday context. market power in the audiovisual sector in Europe. The fourth and fi nal part seeks to tie together the common The fi rst part of this IRIS Special explores the European threads in state regulation of media power, to work Union’s approach to limiting media power, an approach out the main differences and to hint to some unusual still dominated by the application of competition law. -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

Monthly Industry Overview

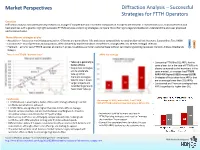

Market Perspectives Diffraction Analysis – Successful Strategies for FTTH Operators Overview Diffraction Analysis conducted primary research on a range of competitive and incumbent companies in Europe to benchmark FTTH/B services so as to analyse trends and best practices with a goal to: highlight successful FTTH/B services and pricing strategies; compare fibre offerings to legacy broadband; understand the end-user proposed and perceived value. Three different strategies at play ARPU • Acquisition – focuses on maximising penetration. Offerings are generally no frills and priced competitively to existing alternatives: Networx; Superonline; Teo; HKBN TAKE • Constrained – mix of premium and acquisition, often dictated by market condition: Rostelecom; Orange; KPN; Izzi; M-Net; Portugal Telecom - UP • Premium – aims for sexy FTTH/B services at premium prices, to address a smaller customer base without cannibalising existing revenues: Verizon; Altibox; Bredbands Bolaget There is no FTTH/B “demand issue” ARPU by strategy • Take-up is generally a • Comparing FTTH/B to DSL ARPU for the factor of time same player (or in the case of FTTH/B only • Acquisition strategies players compared to the incumbent in the aim to accelerate same market), on average has FTTH/B take-up while ARPU 46% higher (US$55 versus US$38) Premium strategies • Strategies of Acquisition have ARPUs that tend to slow it down are on average lower than DSL ARPUs • Larger projects and • Constrained and Premium strategies have incumbents generally ARPUs significantly higher than DSL -

EAA, 1000–2–1422 Stadts-Zulage-Journæle Der Kayserl. Stadt Pernau Von Denen Von 1Mo Octobr. 1776 Bis Den 30Ten Septembr. 17

1 EAA, 1000–2–1422 Stadts-Zulage-Journæle der Kayserl. Stadt Pernau von denen von 1mo Octobr. 1776 bis den 30ten Septembr. 1777 expedirten und clarirten Schiffen mit angehängter Loots- und Brücken-Zoll-Berechnung geführt von Jochim Israel Victor Petermann, Groß-Fürstlen Secretaire und p. t. Pernauischen Stadts-Zulage-Administrator. Stadts-Zulage-Journal von eingekommenen Schiffen und zwar vom 1sten Octobr. 1776 bis den 30ten Sept. 1777 nemlich de No 58 bis No 72 incl. in Ao 1776 und No 73 item de No 1 bis No 53 in Ao 1777. Datum Jahr, Eintragsnummer, Schiffer, Ausgangsort, Wert Zoll Zoll auf Bestimmungsort, Besitzer der Waren, Waren rthl. Rub/ allen Kop. Waaren Rub/Kop. Stadts-Zulage von eingekommenen Schiffen und zwar de No 58 bis No 68 inclusive pro Mense Ocrobris 1776 Octobr. No 58 5. Sept. Sr Sytze Piebes de Jonge von Amsterdam1 Hr Ober Kämmerer Jacob Jacke 24 Lasten 16 Tonnen St. Ybes Saltz, à Last werth rtl. 20 7. – 25 Thee de bou, à werth [rtl.] ¾ –. 62½ 54 Bouteillen rothen Bourgogne Wein 20 –. 37½ 80/8tel } 12½ Tonnen Hollandsche 40/16tel } Heeringe2 –. 93¾ 80 feigen, à 100 werth [rtl.] 6 –. 6½ 90 Bünde alte gebrauchte Matten enthaltende 200 Stück, welche in diesem früh-Jahr mit selbigen Schiffer zur Garnirung ausgesandt, und nunmehro wieder retour gebracht sind 9. ¼ der Schiffer tel 15 16/8 } 2 /16 Tonnen Hollandsche 15/16tel } Heeringe3 –. 22½ 50 Coffee-Bohnen, à 100 werth [rtl.] 12 –. 62½ –. 85 1 (EAA 1000–2–1423, Bl. 1) Ich Schiffer Sietze Piebes d’Jong gebürtig in Wouzend kommende von Amsterdam mit mein drey Mast Pink Schiff het Zeepaart genannt, ist groß 150 Lasten, gehet tief 8 Fuß, fahre stark 10 Mann, bin unter weges gewesen 23 Tage, geaddressiret an dem Herrn Jacob Jacke junior und habe gelahden in stelle Ballast [...]. -

EAA, 1000–2–1426 Stadts-Zulage-Journäle Der Kayserl. Stadt Pernau Von Denen Bey Derselben Einge- Kommenen Und Abgegangenen Schiffen De 1Mo Octobris 1778 Bis Ult

1 EAA, 1000–2–1426 Stadts-Zulage-Journäle der Kayserl. Stadt Pernau von denen bey derselben einge- kommenen und abgegangenen Schiffen de 1mo Octobris 1778 bis ult. Septbris 1779 mit angehängter Loots- und Brücken-Gelder Rechnung geführet von dem Groß-Fürst. Secretaire und Stadts-Zulage-Administrator Joachim Israel Victor Petermann. Datum Jahr, Eintragsnummer, Schiffer, Ausgangsort, Wert Zoll Zoll auf Bestimmungsort, Besitzer der Waren, Waren rthl. Rub./ allen Kop. Waaren Rub./Kop. Stadts-Zulage-Journal von denen bey der Kayserlichen Stadt Pernau eingekommenen Schiffen und zwar de No 50 bis No 59 incl. de 1mo Octobris 1778 bis Ausgang deßelben Jahrs nach beyfolgender balance werden hieselbst aufgenommen1 1. 4 No 50 15. Sept. Mailo Johann von Riga2 Sr Excellence Hr General en chef und Ritter de Bousquet3 1 faß Engl. Bier enthielt ½ Oxhoft 5 –. 9½ 2 Ancker rothen franz Wein 8 –. 25 1 dito Muscat-Wein 4 –. 15¾ 1 Kistel mit 30 Bout. dito 3 –. 11½ 61¾ Kop. 1 Pudel mit 6 Töpfe Saft } 1 fäßel Gurcken } Einheimisch 1 leeres Kästgen } Hr Ober Kämmerer Jacob Jacke & Comp. 6 Stück metallene Gewichte wägen zusammen 41 , in Riga verfertiget, frey Hr Aeltester Georg Gotts. von Essen 50 Kullen russ. Haber, à Kull [rubel] 1¼ } 16 S Rußisch Eisen, à S wehrt rubel 10 } alles 40 Stk. Engl. Bier-Tonnen, à [rubel 1¼] } frey 1 (EAA 1000–2–1427, Bl. 2) No 45 bey Sr Hans Sietam eingekommend außgelassen 9 Kisten Stahl gewogen 1062 –.66½ Kop. bey H. Gottlieb Hinr. Frantzen bei 10 Stk. klar und gewürffelt Lein in werth von 32½ rtl. zu wenig berechnet –. -

Annual Report 2008 Annual Report the Leadingeuropeanentertainment Network

THE LEADING EUROPEAN ENTERTAINMENT NETWORK FIVE-YEAR SUMMARY 2008 2007 2006 2005 2004 €m €m €m €m €m Revenue 5,774 5,707 5,640 5,115 4,878 RTL Group – of which net advertising sales 3,656 3,615 3,418 3,149 3,016 Corporate Communications Other operating income 37 71 86 103 118 45, boulevard Pierre Frieden Consumption of current programme rights (2,053) (2,048) (1,968) (1,788) (1,607) L-1543 Luxembourg Depreciation, amortisation and impairment (203) (213) (217) (219) (233) T: +352 2486 5201 F: +352 2486 5139 Other operating expense (2,685) (2,689) (2,764) (2,518) (2,495) www.RTLGroup.com Amortisation and impairment of goodwill ANNUAL REPORT and fair value adjustments on acquisitions of subsidiaries and joint ventures (395) (142) (14) (16) (13) Gain/(Loss) from sale of subsidiaries, joint ventures and other investments (9) 76 207 1 (18) Profit from operating activities 466 762 970 678 630 Share of results of associates 34 60 72 63 42 Earnings before interest and taxes (“EBIT”) 500 822 1,042 741 672 Net interest income/(expense) 21 (4) 2 (11) (25) Financial results other than interest 7 26 33 2 (19) Profit before taxes 528 844 1,077 732 628 Income tax income/(expense) (232) (170) 34 (116) (196) Profit for the year 296 674 1,111 616 432 Attributable to: RTL Group shareholders 194 563 890 537 366 Minority interest 102 111 221 79 66 Profit for the year 296 674 1,111 616 432 EBITA 916 898 851 758 709 Amortisation and impairment of goodwill (including disposal group) and fair value adjustments on acquisitions of subsidiaries and joint ventures -

Zero-Rating Practices in Broadband Markets

Zero-rating practices in broadband markets Report by Competition EUROPEAN COMMISSION Directorate-General for Competition E-mail: [email protected] European Commission B-1049 Brussels [Cataloguenumber] Zero-rating practices in broadband markets Final report February 2017 Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. Les informations et opinions exprimées dans ce rapport sont ceux de(s) l'auteur(s) et ne reflètent pas nécessairement l'opinion officielle de la Commission. La Commission ne garantit pas l’exactitude des informations comprises dans ce rapport. La Commission, ainsi que toute personne agissant pour le compte de celle-ci, ne saurait en aucun cas être tenue responsable de l’utilisation des informations contenues dans ce rapport. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2017 Catalogue number: KD-02-17-687-EN-N ISBN 978-92-79-69466-0 doi: 10.2763/002126 © European Union, 2017 Reproduction is authorised provided the source is acknowledged. -

Annual and Sustainability Report 2020 Content

BETTER CONNECTED LIVING ANNUAL AND SUSTAINABILITY REPORT 2020 CONTENT OUR COMPANY Telia Company at a glance ...................................................... 4 2020 in brief ............................................................................ 6 Comments from the Chair ..................................................... 10 Comments from the CEO ...................................................... 12 Trends and strategy ............................................................... 14 DIRECTORS' REPORT Group development .............................................................. 20 Country development ........................................................... 38 Sustainability ........................................................................ 48 Risks and uncertainties ......................................................... 80 CORPORATE GOVERNANCE Corporate Governance Statement ......................................... 90 Board of Directors .............................................................. 104 Group Executive Management ............................................ 106 FINANCIAL STATEMENTS Consolidated statements of comprehensive income ........... 108 Consolidated statements of financial position ..................... 109 Consolidated statements of cash flows ............................... 110 Consolidated statements of changes in equity .................... 111 Notes to consolidated financial statements ......................... 112 Parent company income statements ...................................