Global Pay TV Operator Forecasts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Managing Real Options in Television Broadcasting

The Television Struggle: an Assessment of Over-the-Top Television Evolutions in a Cable Dominant Market (*) Bastiaan BACCARNE, Tom EVENS & Dimitri SCHUURMAN iMinds – MICT, Ghent University, Belgium Abstract: Traditional television screens have lost their monopoly on television content. With a helping hand of digitalization, the introduction of ever more screens in our lives and increasingly faster network technologies, a wide variety of alternative screens and sources of television content are trying to conquer a piece of the audiences' viewing time. This evolution calls for new kinds of services and has the potential to change the current television market. This paper assesses the evolution of over-the-top television services in Flanders, a cable dominant market in which several OTT TV services emerged during the past two years. By presenting an analysis of the market and the results of a large scale end-user survey (n: 1,269) we provide insights on the future of OTT TV and its impact on the current television ecosystem. In the Flemish market, both traditional broadcasters, the channels themselves and new market entrants are launching OTT TV services. These market evolutions are being related to user expectations and usage patterns in order to assess the challenges for future television. This also allows to make assumptions on future scenarios regarding so-called "cord- cutting" behaviour. Because of the high adoption of triple play bundles and fierce competition between the two dominant television distributors, a large scale video cord-cutting scenario is highly unlikely for the Flemish television market. Although OTT TV might gain importance, it will be hard for 'OTT TV- only' services to replace the traditional television distributors. -

Investor Presentation

Investor Presentation Second Quarter 2016 Forward looking statements This presentation contains statements that constitute forward‐looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward‐looking statements include statements regarding the current intent, belief or expectations of our officers or management with respect to future developments, including such important matters as (1) our asset growth and financing plans, (2) trends affecting our financial condition or results of operations, (3) the impact of competition and regulations, (4) projected capital expenditures and (5) liquidity. Forward‐ looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those described in forward‐looking statements included in this presentation as a result of various factors. These factors, many of which are beyond our control, include the actions of competitors, future global economic conditions, market conditions, changes in interest rates and foreign exchange rates, changes in legislation or regulations applicable to our business, operating and financial risks, the outcome of legal proceedings and the factors discussed under “Risk Factors” in our annual report on Form 20‐F for the year ended December 31, 2015. The results in this presentation appear as they were originally reported in our financial statements. 2 Overview Content Cable Sky 3 Our Core Businesses Content and Distribution Licensing Advertising Network Subscription & Syndication Four broadcast channels in 26 pay‐tv networks and 51 Univision royalties Mexico City complemented feeds in Mexico and globally Content licensing fees through affiliated stations Exports to 70+ countries Sky* Cable Video: 7.8 million subs Video: 4.2 million RGUs(1) Data: 3.3 million RGUs A leading DTH system in Voice: 2.1 million RGUs Mexico and C. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

11. Mumbai & Thane

11. MUMBAI & THANE Service Name City BST Silver Gold Sony Mumbai & Thane N Y Y Sony SAB Mumbai & Thane N Y Y Colors Mumbai & Thane N Y Y Rishtey Mumbai & Thane N Y Y Sony PAL Mumbai & Thane N Y Y Shop CJ Mumbai & Thane N Y Y Home Shop 18 Mumbai & Thane Y Y Y I D Mumbai & Thane N Y Y Zoom Mumbai & Thane N N Y Epic Mumbai & Thane N N N ETV Bihar JH Mumbai & Thane N Y Y ETV MP CG Mumbai & Thane N Y Y ETV Rajasthan Mumbai & Thane N Y Y ETV UP UK Mumbai & Thane N Y Y DEN snapdeal tv-shop Mumbai & Thane Y Y Y Sahara One Mumbai & Thane N Y Y DD National Mumbai & Thane Y Y Y DD Rajasthan Mumbai & Thane Y Y Y DD Uttar Pradesh Mumbai & Thane Y Y Y DD Madhya Pradesh Mumbai & Thane Y Y Y DD Bihar Mumbai & Thane Y Y Y Sony MAX Mumbai & Thane N Y Y SONY MAX 2 Mumbai & Thane N Y Y B4U Movies Mumbai & Thane N Y Y Cinema TV Mumbai & Thane N Y Y Multiplex Mumbai & Thane Y Y Y DEN Cinema Mumbai & Thane Y Y Y Filmy Mumbai & Thane N N Y DEN Movies Mumbai & Thane N Y Y AXN Mumbai & Thane N Y Y Comedy Central Mumbai & Thane N Y Y Colors Infinity Mumbai & Thane N Y Y DSN INFO Mumbai & Thane Y Y Y Sony PIX Mumbai & Thane N Y Y Movies Now Mumbai & Thane N N Y Romedy Now Mumbai & Thane N N Y Discovery Turbo Mumbai & Thane N Y Y TLC Mumbai & Thane N Y Y Fashion TV Mumbai & Thane N N Y Food Food Mumbai & Thane N N Y News 18 India Mumbai & Thane N Y Y India TV Mumbai & Thane Y Y Y News 24 Mumbai & Thane N N N Aajtak Tez Mumbai & Thane N Y Y ABP News Mumbai & Thane Y Y Y Aajtak Mumbai & Thane N Y Y News Nation Mumbai & Thane Y Y Y India News Mumbai & Thane Y Y Y DD -

Hathway Cable and Datacom Limited

Date: April 20, 2021 To To The Listing Department The Corporate Relationship Department The National Stock Exchange of India Limited BSE Limited Plot No. C/1, G Block P.J. Towers, 1st Floor, Bandra Kurla Complex Dalal Street, Bandra (East) Mumbai – 400 001 Mumbai 400 051 Script Code No. 533162 Symbol: HATHWAY Ref.: Composite Scheme of Amalgamation and Arrangement between the Company, Den Networks Limited, Network18 Media & Investments Limited, TV18 Broadcast Limited, Media18 Distribution Services Limited, Web18 Digital Services Limited and Digital18 Media Limited and their respective shareholders and creditors (“Scheme”) Dear Sirs, This has reference to the captioned Composite Scheme approved by the Board of Directors on February 17, 2020. The shareholders are aware that the Scheme was filed with both BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”) for their no-objection letter. The Company had also disclosed in its quarterly financial results for the quarter ended September 30, 2020, that the stock exchanges had returned the Scheme stating that the Company may apply to the stock exchanges once the Scheme is in compliance with SEBI circulars / SEBI Regulations. This pertained to the compliance by the Company and Den Networks Limited of the Minimum Public Shareholding requirement. Considering that more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. This is for your information and records. Thanking you, FOR HATHWAY CABLE AND DATACOM LIMITED AJAY SINGH Head Corporate Legal, Company Secretary and Chief Compliance Officer FCS: 5189 Hathway Cable and Datacom Limited 805/806, “Windsor”, Off C.S.T. -

PDF SCTE Sep16

Prensario Internacional www.prensario.net www.prensario.net Prensario Internacional Prensario Internacional www.prensario.net www.prensario.net Prensario Internacional KEYNOTE REPORT Cable-Tec Expo 2016: New roads, more crossroads Latin American participation at the SCTE/ ISBE Cable-Tec Expo 2016 trade show in Philadelphia is expected to be stronger than in the past, despite the fact that the World Cup in 2014 and the Olympic Games in June, both held in Brazil, had fueled demand from 2012 to 2015 for top notch equipment and software in order to fulfill the expectations of the overseas broadcasters beaming its images to the rest of the world. Derek Caney; Miguel Fernández, CTO, Cablevisión; Vincencio Maya, CTO, Millicom; and Jorge Schwartz, CEO, There is an explanation: while Latin TVCable Ecuador American attendance swings according to the economy within the region, the strong eager customers for equipment required for ing funds to cover their production expenses, competition raised by the OTT’s and digital image capture and storage. resulting in strong attendance for the various platforms is forcing the linear television busi- Yet, Brazil keeps a huge challenge ahead: local venues designed to let them network ness to rethink its strategy and try to curb the having been the first country in the region to with the locals. audience and advertising losses caused by plan an analog television switch off in 2008 cord-cutters and migration to alternate enter- and having contributed to Japanese-designed Mexico tainment means. Therefore, the deployment system ISDB-T with some changes, it has so far Mexico, the second-largest market of telecommunications technology, products, been unable to fulfill the initial stated goals, in the region, is getting ready to see maybe because it set the emerge CadenaTres, its third private bar too high, including television network and the first mas- the notion that people sive effort to give Televisa and TV Azteca should actually use the a run for their money. -

Nombre Ciudad/Municipio Estado Canal TV Ojocaliente Cosío

Nombre Ciudad/Municipio Estado Canal TV Ojocaliente Cosío Aguascalientes 83 Total Play Aguascalientes Aguascalientes 393/Practico Total Play Tijuana Baja California Norte 393 Varivisión de Baja California Ensenada Baja California Norte 69 Megacable Santa Rosalía Baja California Sur 80 Kblex Escarcega Francisco Escárcega Campeche 78 Telecable de Campeche/Cablecom Cd. Del Carmen Campeche 81 Cable Atenas Calkiní Campeche 83 Cable Atenas Calkiní Campeche 83 Cable Atenas Calkiní Campeche 83 Cable Atenas Calkiní Campeche 83 Cable Atenas Calkiní Campeche 83 Cable Atenas Hecelchakán Campeche 83 Cable Atenas Hecelchakán Campeche 83 Cable Atenas Hecelchakán Campeche 83 Cable Atenas Tenabo Campeche 83 Telecable de Campeche Campeche Campeche 112 Telecable de Campeche Chiná Campeche 112 Cablevisión Nunkiní S.A. de C.V. Calkiní Campeche 36 Sistema de Cable HKAN Hecelchakán Campeche 75 Cablevisión de Pomuch Hecelchakán Campeche 75 Econo Cable Matamoros Coahuila 99 Econo Cable Francisco I. Madero Coahuila 96 Televisión Monclova Monclova Coahuila 90 Televisión Monclova Castaños Coahuila 90 Televisión Monclova San Buenaventura Coahuila 90 Televisión Monclova Frontera Coahuila 90 Cable del Bravo Sabinas Coahuila 68 Megacable Francisco I Madero Coahuila 83 Megacable San Pedro Coahuila 83 Cable Laguna Torreón Coahuila 212 Cable Red Cd. Acuña Coahuila 444 Telecable Quesería Quesería Colima 53 Megacable Huixtla Chiapas 44/Básico Plus Megacable Tonalá Chiapas 193 Megacable Arriaga Chiapas 49/Básico Plus Megacable Comitán de Domínguez Chiapas 81/Básico Plus Megacable -

February 17, 2020

February 17, 2020 The Manager, Listing Department The General Manager The National Stock Exchange of India Ltd. The Bombay Stock Exchange Limited Exchange Plaza Listing Department Bandra Kurla Complex 15th Floor, P J Towers Bandra (E) Mumbai-400 051 Dalal Street, Mumbai-400 001 NSE Trading Symbol- DEN BSE Scrip Code- 533137 Dear Sirs, Sub.: Media Release titled “Scheme of Amalgamation and Arrangement amongst Network18, TV18, Den & Hathway” Dear Sirs, Attached is the Media Release being issued by the Company titled “Scheme of amalgamation and Arrangement amongst Network18, TV18, Den & Hathway”. You are requested to take the above on record. Thanking You, FCS No. :6887 MEDIA RELEASE Scheme of Amalgamation and Arrangement amongst Network18, TV18, Den & Hathway Consolidates media and distribution businesses of Reliance Creates Media & Distribution platform comparable with global standards of reach, scale and integration News Broadcasting business of TV18 to be housed in Network18 Cable and Broadband businesses of Den and Hathway to be housed in two separate wholly-owned subsidiaries of Network18 February 17, 2020: Reliance Industries (NSE: RELIANCE) announced a consolidation of its media and distribution businesses spread across multiple entities into Network18. Under the Scheme of Arrangement, TV18 Broadcast (NSE: TV18), Hathway Cable & Datacom (NSE: HATHWAY) and Den Networks (NSE: DEN) will merge into Network18 Media & Investments (NSE: NETWORK18). The Appointed Date for the merger shall be February 1, 2020. The Board of Directors of the respective companies approved the Scheme of Amalgamation and Arrangement at their meetings held today. The broadcasting business will be housed in Network18 and the cable and ISP businesses in two separate wholly owned subsidiaries of Network18. -

Mediaconcentratie in Vlaanderen

MMediaconcentratieediaconcentratie iinn VVlaanderenlaanderen rapport 2009 VLAAMSE REGULATOR VOOR DE MEDIA Koning Albert II-laan 20,bus 21 1000 Brussel COLOFON Samenstelling, redactie en eindredactie: Stijn Bruyneel, Ingrid Kools en Francis Soulliaert Verantwoordelijke uitgever: Joris Sels, gedelegeerd bestuurder Koning Albert II-laan 20, bus 21 1000 Brussel Tel.: 02/553 45 04 Fax: 02/553 45 06 e-mail:[email protected] website: www.vlaamseregulatormedia.be Lay-out en druk: Digitale drukkerij Facilitair Management Vlaamse Overheid Depotnummer: D/2009/3241/429 Mediaconcentratie in Vlaanderen INHOUDSTAFEL Samenvatting ......................................................................................................................... 10 1 DE VLAAMSE MEDIASECTOR ............................................................................................... 13 1.1 RADIO ......................................................................................................................... 17 1.1.1 Contentleveranciers ........................................................................................................................ 17 1.1.2 Radio-omroeporganisaties ............................................................................................................. 18 1.1.2.1 Landelijke publieke radio-omroeporganisaties ........................................................ 18 1.1.2.2 Regionale publieke radio-omroeporganisaties ......................................................... 19 1.1.2.3 Wereldomroep .............................................................................................................. -

UHD Content on Live TV

Channel Overview Presentation UHD Content on Live TV We are covering the world with SPI is a leader in content distribution, movie channels, thematic channels entertainment and online media business. All you wanted to know about SPI and you were afraid to ask 21 FILM CHANNELS 11 WORLDWIDE THEMATIC CHANNELS 63 FEEDS 14 LANGUAGES 35+ CUMULATIVE mln SUBSCRIBERS For more than 20 years, SPI International has been a leading distributor of theatrical movies and television programming on the international market. SPI has strong alliances with producers such as Miramax, NBC Universal, Studio Canal, Pathé, Summit, Lakeshore and many others. These alliances have resulted in SPI establishing its leading position on the video and VOD segments of the market. SPI’s current catalogue consists of over 3000 movies and series. Over the last 8 years, in order to become a fully vertically integrated media company, SPI has developed local film channels. SPI has also invested in channel acquisition, film production, internet build up and hardware sales. SPI channels are delivered via cable and satellite (Astra, Thor and Eutelsat) and are available through all major platforms: Skylink, Digi, Blizoo, Total TV, Hello HD, UPC Direct, nc+, Cyfrowy Polsat, Freebox, Orange TV and many others. SPI INTERNATIONAL CHANNELS SPI all around the world USA TURKEY ISRAEL POLAND czech/sk ROMANIA HUNGARY germany France Switzerland PORTUGAl SPI all around the world Bosnia Lithuania Ukraine BULGARIA Serbia Croatia SLOVENIA Montenegro Macedonia albania and Herzegovina SPI all around the world Scandinavia UK LATAM brasil west africa east africa south africa Australia SPI’s high quality approach to 4k SPI is guaranteeing the highest picture quality and a clear focus on native 4K content. -

ECC REPORT 143 Electronic Communications Committee

ECC REPORT 143 Electronic Communications Committee (ECC) within the European Conference of Postal and Telecommunications Administrations (CEPT) PRACTICAL IMPROVEMENTS IN HANDLING 112 EMERGENCY CALLS: CALLER LOCATION INFORMATION Lisbon, April 2010 ECC REPORT 143 Page 2 0 EXECUTIVE SUMMARY Each year in the European Union several millions of citizens dial the emergency call number to access emergency services. Due to increasing penetration of mobile telephony in the society, the share of emergency calls emanating from mobile networks is rapidly outgrowing emergency calls for fixed networks; this causes that an emergency situation mobile callers are increasingly not able to indicate the precise location for an optimum response. Similarly, VoIP services are substituting voice calls over traditional networks, customers increasingly use VoIP for emergency calls and expecting the same reliability and completeness of the emergency calls service. Location information is normally represented by data indicating the geographic position of the terminal equipment of a user. These data vary in range, indicating in a general way where the user is or very precise, pinpointing the user’s whereabouts to within a few meters. Some location data are effectively a subset of signalling data as they are necessary for setting up a telephone connection. In the framework of Enhanced emergency call services, the availability of location information must serve three main goals: Route the calls to the right emergency call centre; Locate the caller and/or the incident site. Dispatch the most appropriate emergency response team(s); The Report identify the most relevant regulatory principles applicable to caller location requirements in the context of emergency calls and analyses the location information standards produced by ETSI as a Standard Development Organization for fixed, mobile and IP communications networks. -

Monthly Industry Overview

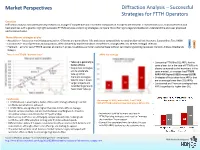

Market Perspectives Diffraction Analysis – Successful Strategies for FTTH Operators Overview Diffraction Analysis conducted primary research on a range of competitive and incumbent companies in Europe to benchmark FTTH/B services so as to analyse trends and best practices with a goal to: highlight successful FTTH/B services and pricing strategies; compare fibre offerings to legacy broadband; understand the end-user proposed and perceived value. Three different strategies at play ARPU • Acquisition – focuses on maximising penetration. Offerings are generally no frills and priced competitively to existing alternatives: Networx; Superonline; Teo; HKBN TAKE • Constrained – mix of premium and acquisition, often dictated by market condition: Rostelecom; Orange; KPN; Izzi; M-Net; Portugal Telecom - UP • Premium – aims for sexy FTTH/B services at premium prices, to address a smaller customer base without cannibalising existing revenues: Verizon; Altibox; Bredbands Bolaget There is no FTTH/B “demand issue” ARPU by strategy • Take-up is generally a • Comparing FTTH/B to DSL ARPU for the factor of time same player (or in the case of FTTH/B only • Acquisition strategies players compared to the incumbent in the aim to accelerate same market), on average has FTTH/B take-up while ARPU 46% higher (US$55 versus US$38) Premium strategies • Strategies of Acquisition have ARPUs that tend to slow it down are on average lower than DSL ARPUs • Larger projects and • Constrained and Premium strategies have incumbents generally ARPUs significantly higher than DSL