REAL STRATEGY Realstrategy.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minto Commercial Properties Inc. Illustrative Purposes

Morgan’s Grant (Kanata) | Retail Plaza (73,000 sq. ft.) OTTAWA OVERVIEW MAP LOCATION MAP AERIAL MAP SITE MAP DUNROBIN ROAD FERRY ROAD 2001 Population and Households TORBOLTON RIDGE ROAD Zone Population Households GALETTA SIDE ROAD FITZROY PTA 6,909 2,165 HARBOUR CONSTANCE BAY STA1 14,544 5,015 QUEBEC STA2 12,790 4,470 CARP ROAD STA Total 27,334 9,485 WOODKILTON ROAD TA Total 34,243 11,650 VANCE SIDE ROAD 5 LINE ROAD Source: Statistics Canada 2001 Census Population Projections (TA Total) Year Population LOGGERS WAY JOHN SHAW ROAD DUNROBIN TORWOOD DRIVE 2005 41,200 MOHR ROAD 2010 50,500 DUNROBIN ROAD STA 2 2 LINE ROAD KERWIN ROAD KERWIN 2015 58,200 KINBURN SIDEROAD DIAMONDVIEW ROAD KINBURN PTA RIDDELL DRIVE MARCH VALLEY RD. DONALD B. MUNRO DRIVE 17 MARCHURST ROAD THOMAS A. DOLAN PARKWAY FARMVIEW ROAD MARCH ROAD OTTAWA RIVER 2 LINE ROAD UPPER DWYER HILL ROAD KLONDIKE ROAD CARP MARCH ROAD LEGGET DRIVESANDHILL ROAD THOMAS ARGUE ROAD TERRY FOX DRIVE SUBJECT SITE GOULBOURNFORCEDRD. SHANNA ROAD HINES ROAD CARLING AVENUEOTTAWA DIAMONDVIEW ROAD OLD CARPKANATA ROAD TERON ROAD CARP ROAD MARSHWOOD ROAD 417 417 HUNTMARSTA DRIVE 1 CONCESSION ROAD 12 OLD CREEK DRIVE TIMM ROAD CAMPEAU DRIVE ROBERTSON ROAD PANMURE ROAD MARCH ROAD PALLADIUM DRIVE HAZELDEAN ROAD RICHARDSON SIDE ROAD MAPLE GROVE ROAD 7 STITTSVILLE For discussion and/or Minto Commercial Properties Inc. illustrative purposes. Subject to change without notice 613-786-3000 minto.com Morgan’s Grant (Kanata) | Retail Plaza (73,000 sq. ft.) OTTAWA OVERVIEW MAP LOCATION MAP AERIAL MAP SITE MAP Future Residential Existing Future Residential Residential MARCH ROAD KLONDIKE ROAD FLAMBOROUGH WAY MERSEY DRIVE MORGAN’S GRANT For discussion and/or Minto Commercial Properties Inc. -

Project Synopsis

Final Draft Road Network Development Report Submitted to the City of Ottawa by IBI Group September 2013 Table of Contents 1. Introduction .......................................................................................... 1 1.1 Objectives ............................................................................................................ 1 1.2 Approach ............................................................................................................. 1 1.3 Report Structure .................................................................................................. 3 2. Background Information ...................................................................... 4 2.1 The TRANS Screenline System ......................................................................... 4 2.2 The TRANS Forecasting Model ......................................................................... 4 2.3 The 2008 Transportation Master Plan ............................................................... 7 2.4 Progress Since 2008 ........................................................................................... 9 Community Design Plans and Other Studies ................................................................. 9 Environmental Assessments ........................................................................................ 10 Approvals and Construction .......................................................................................... 10 3. Needs and Opportunities .................................................................. -

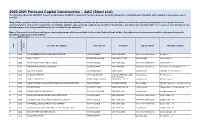

2021 Forecast Capital Construction - AAC (Short List) the List Below Shows the 2020/2021 Projects on Which Your Feedback Is Requested

2020-2021 Forecast Capital Construction - AAC (Short List) The list below shows the 2020/2021 projects on which your feedback is requested. For these projects, the City of Ottawa Accessibility Design Standards will be applied to the greatest extent possible. Many of these projects contain exterior paths of travel for which the potention provision and placement of a rest area will be decided in the upcoming design phase of the project based on numerous factors, such as the results of the consultation, available space, property requirements, location of transit stops, and volume of pedestrian traffic. If a rest area is to be provided on an individual project, its design would follow the Accessibility Design Standards. Many of the projects listed have existing on-street parking areas which are available to Accessible Parking Permit holders. Any adjustments to those areas would be determined during the upcoming design phase of the project. May 07, 2020 Location Description From Street To Street Type of Work Ward Description Item Year Construction Construction 1 2020 OLD GREENBANK ROAD AND KILBIRNIE DRIVE NOT AVAILABLE NOT AVAILABLE Intersection Modifications Jan Harder - 3 2 2020 VARLEY DRIVE BEAVERBROOK LANE CARR CRESECENT New Sidewalks Jenna Sudds - 4 3 2020 MARCH ROAD AND STREET C AND E NOT AVAILABLE NOT AVAILABLE Intersection Modifications Eli El-Chantiry - 5 4 2020 FERNBANK ROAD AND COPE DRIVE NOT AVAILABLE NOT AVAILABLE Intersection Modifications Glen Gower - 6, Scott Moffatt - 21 5 2020 CEDARVIEW ROAD RICHMOND ROAD BRUIN ROAD Cycling -

Pathway Network for Canada's Capital Region 2006 Strategic Plan PLANI

Pathway Network for Canada’s Capital Region 2006 Strategic Plan PLANI-CITÉ i June 2006 Pathway Network for Canada’s Capital Region 2006 Strategic Plan THE VISION The National Capital Commission (NCC) and its partners propose the following as a framework for the planning and development of the Capital Pathway network for the next 10 years: Multi-purpose use The Capital Pathway network covers Canada’s Capital Region in its entirety. It is a multi-purpose recreational and tourist network, which also supports non-motorized commuting vocations. Accessibility and safety The network extends to and links natural and built areas. Through its layout and design standards, the network encourages a quality user experience and accessibility, emphasizing the recognition of the “Green Capital”, and highlighting symbolic points of interest within the Capital. The network provides access to waterways, green spaces, cultural and heritage features while supporting the protection of natural areas and offering a wide range of easily accessible services. User education and awareness programs targeting pathway sharing in a respectful and tolerant manner result in a safe and pleasant experience. Connectivity The network, through its linkage with local cycling routes and regional/national trails, is connected to other non-motorized transportation networks within the region to encourage sustainable transportation and forms a key component of Canada’s Capital recreational and cycling experience. Recognition The network, as a result of its multi use vocation, its extensive and far reaching system of pathways and connection with regional, provincial and national trails and pathways within and outside Canada’s Capital Region as well as the quality of the experience is regarded as one of North America’s best. -

Welcome to Kanata North Message from Councillor Wilkinson

WELCOME TO KANATA NORTH MESSAGE FROM COUNCILLOR WILKINSON anata North is the most fantastic ward in the City of Ottawa. As well as the Kanata North Business K Park, the largest employment area outside the City core, it contains natural environment lands, a provincially significant wetland, distinctive residential areas, the town centre that serves both Kanata North and Kanata South, schools, churches and retail areas. Just across Highway 417 is Canadian Tire Place, the home of the Ottawa Senators, and under construction is an outlet mall and Bass Pro Shop. I’ve had the great opportunity of representing this area on municipal councils for 25 years, with 9 of those years as Head of Council and 7 of those years as Mayor of Kanata, when Kanata was a separate municipality. My job is to serve all aspects of the community, from individual con- cerns to dealing with large developments and the services they need. Welcome to Kanata North. Feel free to contact me via phone 613-580-2474 or email Marianne.Wilkinson@ ottawa.ca if you have any concerns or suggestions to make Kanata North an even better place. MESSAGE FROM KANATA NORTH BIA anata North is a fantastic place to live, work and play. We have over 500 businesses doing incredible work K – and yet we have access to green space and many, many trails, right outside our door. Truthfully, we think there is no better place! The Kanata North BIA works hard every day to support our local businesses, and to promote the area as a center of expertise in technology and innovation. -

Phase One Environmental Site Assessment 950 Terry Fox Drive Ottawa, Ontario

Phase One Environmental Site Assessment 950 Terry Fox Drive Ottawa, Ontario Houle Chevrier Engineering Ltd. • 180 Wescar Lane • Ottawa, Ontario • K0A 1L0 • www.hceng.ca Submitted to: SPB Developments Inc. 114 Arbourbrook Blvd. Ottawa, Ontario K0A 1L0 Phase One Environmental Site Assessment 950 Terry Fox Drive Ottawa, Ontario September 11, 2014 Project: 14-346 Houle Chevrier Engineering Ltd. • 180 Wescar Lane • Ottawa, Ontario • K0A 1L0 • www.hceng.ca EXECUTIVE SUMMARY Houle Chevrier Engineering Ltd. (HCEL) was retained by SPB Developments Inc. to carry out a Phase One Environmental Site Assessment (ESA) for the properties located at 950 Terry Fox Drive and the southeast portion of the adjacent property located at 820 Terry Fox Drive in Ottawa, Ontario (hereafter collectively referred to as “the subject property”). The primary objective of this Phase One ESA was to identify any former or current potentially contaminating activities at the subject property and its vicinity to determine if they create any areas of potential environmental concern on the subject property. This Phase One ESA was carried out in accordance with Ontario Regulation 153/04 made under the Environmental Protection Act and meets the requirements of Part VII (Sections 23 to 31) and Schedule D of the regulation. Section 1.0 of this report provides a brief description of the site and Section 2.0 of this report provides the scope of investigation. Section 3.0 presents the findings of the records review. Section 4.0 presents the results of the interviews conducted. Section 5.0 presents the findings of the site reconnaissance. Section 6.0 provides a review and evaluation of information gathered. -

New Fernbank Elementary School Opening Grade Structure, Program and Attendance Boundary Study

New Fernbank Elementary School Opening Grade Structure, Program and Attendance Boundary Study Public Consultation Meeting Thursday May 23rd, 2019 7:00 PM – 9:00 PM Gymnasium John Young Elementary School 5 Morton Drive Ottawa Table of Contents Page 1. Introduction and Background 1 2. Planning Considerations 1-2 3. Working Group Meetings 2-3 4. Proposed New Fernbank ES Attendance Boundary, Program, 3-4 and Opening Grade Structure 5. Proposed Revisions to Middle French Immersion Program 4 Attendance Boundaries 6. Next Steps 5 7. Study Timeline 6 8. General Location Map 7 9. Proposed Attendance Boundary and Five Year Enrolment Projections 8-15 10. Impact Summary by School 16-18 11. Other Attendance Boundary Options Considered 19-23 12. Question and Answer Section 24-26 13. Supplementary Information 27 • Core Study Schools Attendance Boundaries 28-32 • 31 October 2018 Status Quo Enrolments 33 • 2019-2025 Enrolment Projections – Status Quo 34-40 14. Comment Sheet 41-42 Introduction and Background This study has been initiated in order to set the attendance boundary, opening grade structure, and program offering for a future new Ottawa-Carleton District School Board (OCDSB) elementary school to be opened in the Fernbank development area of Stittsville. The need for a new elementary school was first identified in 2008 as part of the City of Ottawa’s Fernbank Community Design Plan (CDP). In total the CDP process resulted in the identification of a requirement for four future elementary school sites and one secondary school site. In May 2018 the Board approved a list of updated capital priorities which included the opening of a new elementary school in the Fernbank development area as the highest ranked project. -

668 Bus Time Schedule & Line Route

668 bus time schedule & line map 668 Bridlewood View In Website Mode The 668 bus line (Bridlewood) has 2 routes. For regular weekdays, their operation hours are: (1) Bridlewood: 2:15 PM - 2:25 PM (2) Holy Trinity H.S: 7:12 AM - 7:17 AM Use the Moovit App to ƒnd the closest 668 bus station near you and ƒnd out when is the next 668 bus arriving. Direction: Bridlewood 668 bus Time Schedule 48 stops Bridlewood Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday Not Operational Holy Trinity H.S 17 Liston Cres, Ottawa Tuesday 2:15 PM - 2:25 PM Katimavik / Mcgibbon Wednesday 2:15 PM - 2:25 PM 13 Liston Cres, Ottawa Thursday Not Operational Katimavik / Mcgibbon Friday Not Operational 5 Robarts Cres, Ottawa Saturday Not Operational Katimavik / Davis 28 Dorey Crt, Ottawa Katimavik / Ad. 200 118 Rowe Dr, Ottawa 668 bus Info Direction: Bridlewood Katimavik / Terry Fox Stops: 48 90 Rowe Dr, Ottawa Trip Duration: 35 min Line Summary: Holy Trinity H.S, Katimavik / Terry Fox / Palladium Mcgibbon, Katimavik / Mcgibbon, Katimavik / Davis, Terry Fox Drive, Ottawa Katimavik / Ad. 200, Katimavik / Terry Fox, Terry Fox / Palladium, Terry Fox / Maple Grove, Terry Fox / Terry Fox / Maple Grove Edgewater, Hazeldean / Terry Fox, Hazeldean / 8 Gesner Crt, Ottawa Young, Hazeldean / Castlefrank, Hazeldean / Castlefrank, 436 Hazeldean, Hazeldean / Carbrooke, Terry Fox / Edgewater Hazeldean / Carbrook, Eagleson / Hazeldean, 651 Terry Fox Drive, Ottawa Eagleson / Abbeyhill, Eagleson / Palomino, Eagleson / Rothesay, Eagleson / Ad. 500, Eagleson Ad. 630, -

KANATA Thesenovember 26, 2020 [email protected] 613-45-VOICE [email protected] Vol

CommunityWRAP Voice - November 26, 2020 1 Your CommunityVoice KANATA TheseNovember 26, 2020 [email protected] 613-45-VOICE www.ottawavoice.ca [email protected] Vol. 3 No. 23 UNTIL DECEMBER 4TH Blackwork. People Friday tell us that our starts now! Blundstone CSA work boot is the lightest work boot they’ve ever offALL WINTER worn. Pretty incredible when BOOTS you consider that these rugged $ boots are more durable than most heavy clunkers. All-day comfort even on concrete. Pull-on, kick-off 20 laceless convenience. These work overtime. #164 CSA Greenpatch Crazy Horse Brown $219.95 BLUNDSTONE.CA Excludes Blundstones. Discounts cannot be combined with other offers. Only applicable to in stock merchandise. Some restrictions. See in store for details. KANATA - 499 Terry Fox Drive - (613) 799-6101 BARRHAVEN - 3777 Strandherd Drive - (613) 825-6100 KEMPTVILLE - 2727 County Road 43 - (613) 258- 6100 BARRHAVEN -Follow 3777 Strandherd us on Instagram Drive - (613) 825 -www.tandashoes.com 6100 Like us on Facebook KEMPTVILLE - 2727 County Road 43 - (613) 258 - 6100 2 November 26, 2020 - Community Voice 2 November 26, 2020 - WRAP Black Friday startsUNTIL DECEMBER now! 4TH % 50ALL EARTH BOOTSoff & SHOES Community Voice - November 26, 2020 1 Free consultations. No fees until we settle. Disability insurance denials, car crashes, wrongful dismissal, slip and fall accidents and medical malpractice. Call today 613-599-3535 or www.gironeslawyers.com You have nothing to lose and so much to gain. Your CommunityVoice KANATA November 26, 2020 [email protected] 613-45-VOICE www.ottawavoice.ca [email protected] Vol. 3 No. 23 City planners reject ClubLink development proposal BY PATRICK UGUCCIONI The so-called 40-per- is not expected until cent Agreement is cur- January 2022 because of a City planning staff op- rently the subject of a backlog due to COVID-19. -

1 Report to Rapport Au: Planning Committee Comité De L

1 Report to Rapport au: Planning Committee Comité de l'urbanisme and Council et au Conseil June 23, 2014 23 juin 2014 Submitted by Soumis par: Nancy Schepers, Deputy City Manager / Directrice municipale adjointe, Planning and Infrastructure / Urbanisme et Infrastructure Contact Person Personne ressource: Lee Ann Snedden, Manager / Gestionnaire, Policy Development and Urban Design / Élaboration de la politique et conception urbaine, Planning and Growth Management / Urbanisme et Gestion de la croissance (613) 580-2424, 25779, [email protected] Ward: KANATA NORTH (4) / KANATA File Number: ACS2014-PAI-PGM-0142 NORD (4) and KANTA SOUTH (23) / KANATA-SUD (23) SUBJECT: City-initiated Official Plan and Zoning By-law amendment regarding building heights in Kanata OBJET: Modification du Plan officiel et du Règlement de zonage demandé par la Ville relative à la hauteur des bâtiments à Kanata 2 REPORT RECOMMENDATIONS That Planning Committee recommend Council approve an amendment to: 1. Zoning By-law 2008-250 for multiple properties throughout Kanata North and Kanata South, as shown in Document 1 and detailed in Document 2; and 2. The Official Plan, Volume 2b, Former City of Kanata, 5.7 Town Centre, as detailed in Document 3. RECOMMANDATIONS DU RAPPORT Que le Comité de l’urbanisme recommande au Conseil d’approuver une modification au : 1. Règlement de zonage 2008-250 pour plusieurs propriétés à Kanata Nord et à Kanata Sud, comme le montre le document 1 et l’explique en détail le document 2; 2. Plan officiel, volume 2B, ancienne Ville de Kanata, 5.7 Centre de ville, comme l’explique en détail le document 3. -

2011 Q4 Retail

MA RKET BEAT RETAIL SNAPSHOT OTTAWA , ON Q4 201 1 A Cushman & Wakefield Alliance Research Publication ECONOMIC OVERVIEW In contrast to the national employment loss of almost anywhere else in Canada; spending an average of $16,000 a 18,600, the Ottawa-Gatineau region added year on commercial goods and services. This translates into 1,900 jobs in November. However, due to a approximately $472 for every square foot of retail in the city. Most larger labour force, the local unemployment other Canadian cities come in between $250 and $350 per square rate rose 0.4 percentage points to 6.3%. This foot (psf) of retail space annually. This spending, combined with the marks the highest unemployment rate since this past April. This rate average Ottawa income being in the top three in the country, makes still compares favourably to the national unemployment rate, which the city an attractive place for retailers to establish a presence. increased to 7.4%. Improving local sectors included professional, ECONOMIC INDICATORS scientific, technical, and educational services, while job losses NATIONAL 2010 2011 2012F occurred within the public administration and construction sectors. GDP Growth 2.8 % 1.4 % 1.8 % Sales of existing homes in the Ottawa area set an all-time record in November with sales of 1,020 properties, an increase of 8.5% from CPI Growth 2.5 % 3.1 % 2.0 % one year ago. The number of properties on the market is higher Retail Sales Growth 5.4 % 3.6 % 3.7 % compared to last year, indicating current homeowners are confident that it is a good time to sell, and when, combined with the strong REGION 2010 2011 2012F sales numbers, this demonstrates that buyers feel this is the time to Household Income $43,235 $43, 811 $44, 490 buy. -

Ads Canadian Bank 343 Amex Bank of Canada 303 Bank Of

SECTION I NUMERIC LIST / LISTE NUMÉRIQUE 1 ADS CANADIAN BANK 343 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 034300012 00012-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 034300092 00092-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 AMEX BANK OF CANADA 303 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030300012 00012-303 101 McNabb Street, Markham, ON L3R 4H8 030300022 00022-303 101 McNabb Street, Markham, ON L3R 4H8 030300032 00032-303 101 McNabb Street, 101 McNabb Street, Markham, ON L3R 4H8 BANK OF AMERICA NATIONAL ASSOCIATION 241 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 024101312 01312-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 024156792 56792-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 BANK OF CANADA 177 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 017700000 00000-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 017700006 00006-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 BANK OF CHINA (CANADA) 308 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030800012 00012-308 50 Minthorn BLVD-Suite 600, Markham, ON L3T 7X8 030800022 00022-308 Toronto Downtown