One Belt One Road Infrastructure Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pin-Outs (PDF)

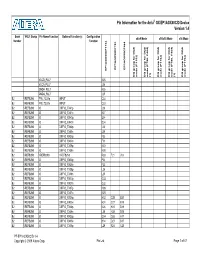

Pin Information for the Arria® GX EP1AGX50C/D Device Version 1.4 Bank VREF Group Pin Name/Function Optional Function(s) Configuration x8/x9 Mode x16/x18 Mode x36 Mode Number Function EP1AGX50DF780 EP1AGX50CF484 EP1AGX50DF1152 DQ group for DQS DQS for group DQ (F1152) mode DQS for group DQ (F780, F484) mode (1) DQS for group DQ (F1152) mode DQS for group DQ (F780, F484) mode (1) DQS for group DQ (F1152) mode VCCD_PLL7 K25 VCCA_PLL7 J26 GNDA_PLL7 K26 GNDA_PLL7 J25 B2 VREFB2N0 FPLL7CLKp INPUT C34 B2 VREFB2N0 FPLL7CLKn INPUT C33 B2 VREFB2N0 IO DIFFIO_TX41p J28 B2 VREFB2N0 IO DIFFIO_TX41n K27 B2 VREFB2N0 IO DIFFIO_RX40p E34 B2 VREFB2N0 IO DIFFIO_RX40n D34 B2 VREFB2N0 IO DIFFIO_TX40p J30 B2 VREFB2N0 IO DIFFIO_TX40n J29 B2 VREFB2N0 IO DIFFIO_RX39p F32 B2 VREFB2N0 IO DIFFIO_RX39n F31 B2 VREFB2N0 IO DIFFIO_TX39p K30 B2 VREFB2N0 IO DIFFIO_TX39n K29 B2 VREFB2N0 VREFB2N0 VREFB2N0 R30 T21 J18 B2 VREFB2N0 IO DIFFIO_RX38p F34 B2 VREFB2N0 IO DIFFIO_RX38n F33 B2 VREFB2N0 IO DIFFIO_TX38p L26 B2 VREFB2N0 IO DIFFIO_TX38n L25 B2 VREFB2N0 IO DIFFIO_RX37p G33 B2 VREFB2N0 IO DIFFIO_RX37n G32 B2 VREFB2N0 IO DIFFIO_TX37p M26 B2 VREFB2N0 IO DIFFIO_TX37n M25 B2 VREFB2N0 IO DIFFIO_RX36p H32 C28 B20 B2 VREFB2N0 IO DIFFIO_RX36n H31 C27 B19 B2 VREFB2N0 IO DIFFIO_TX36p K28 H23 D19 B2 VREFB2N0 IO DIFFIO_TX36n L28 H22 D18 B2 VREFB2N0 IO DIFFIO_RX35p G34 D28 A17 B2 VREFB2N0 IO DIFFIO_RX35n H34 D27 B17 B2 VREFB2N0 IO DIFFIO_TX35p L29 F24 C20 PT-EP1AGX50C/D-1.4 Copyright © 2009 Altera Corp. Pin List Page 1 of 47 Pin Information for the Arria® GX EP1AGX50C/D Device Version -

461114 1 En Bookbackmatter 209..247

Conclusion: Convergent Paths In November 1945, the President of the Republic of Vietnam, Hồ Chí Minh, sent a letter addressed to ‘the President of the Republic of Indonesia’, proposing that a joint declaration of solidarity to be made by Indonesia and Vietnam in the form of a ‘Preparatory Commission Struggling for a Federation of the Free Peoples of Southern Asia’. The letter, entrusted to an American journalist named Harold Isaacs, did not reach President Soekarno.1 It was handed to Vice-President Mohammad Hatta, who then passed it on to Prime Minister Sutan Sjahrir. Sjahrir discussed the offer with Soedjatmoko Koko, the interpreter to foreign correspon- dents of the Republican government, but told him that he would not reply and preferred just to ignore the letter. Sjahrir indifference sprang from his conviction that the situation in Indonesia and Vietnam were very different. The Indonesian nationalists were up against the Dutch, who were ‘a weak colonial power and could be defeated quickly.’ Hồ Chí Minh had to contend with the French, who could and would resist him for a long time. Furthermore, he looked askance at the fact that the DRV government depended on support from the communists, which was not the case in Indonesia. In conclusion, Sjahrir argued, ‘If we ally ourselves with Hồ Chí Minh, we shall weaken ourselves and delay Independence.’2 The story of the missed opportunity for cooperation between Vietnam and Indonesia3 as a result of Sjahrir’s ‘betrayal of the greater Asian revolution’,as 1Harold Robert Isaacs is the author of No Peace for Asia, which has been cited widely in this dissertation. -

I Innovation Adaptation in Urban Light-Rail Transport

i Innovation Adaptation in Urban Light-Rail Transport Innovation Adaptation in Urban Light-Rail Transport Adapting Pricing and Infrastructural Innovations using Frugal Approach in Ethiopia and Nigeria iii Innovation Adaptation in Urban Light-Rail Transport Innovation Adaptation in Urban Light-Rail Transport Adapting pricing and infrastructural innovations using frugal approach in Ethiopia and Nigeria Innovatie en aanpassing in stedelijk light-rail vervoer Aanpassing van beprijzing- en infrastructuurinnovaties met behulp van een sobere aanpak in Ethiopië en Nigeria Thesis to obtain the degree of Doctor from the Erasmus University Rotterdam by command of the rector magnificus Prof. dr. R.C.M.E. Engels and in accordance with the decision of the Doctorate Board. The public defence shall be held on Friday May 8, 2020 at 11.30 hrs by Taslim Adebowale Alade born in Kano, Nigeria Innovation Adaptation in Urban Light-Rail Transport iv Doctoral Committee: Promoter: Prof. dr. J. Edelenbos Other members: Prof. dr. H. Geerlings Prof. dr. ir. T. Tillema Prof. dr. P. Knorringa Copromoter: Dr. A. Gianoli v Innovation Adaptation in Urban Light-Rail Transport Dedication I dedicate this PhD dissertation to my late father and mother, Abdulrahman Babatunde Alade and Esther Eyinade Alade; for giving me a solid and deeply rooted foundation in education. Our parent made sure we had all we needed, especially when it comes to our education. They also encouraged us to push the limits and always aim high, no matter the challenges on the way. I love you both. Innovation Adaptation in Urban Light-Rail Transport vi Acknowledgments First, I would like to express my deepest gratitude to Jesus Christ, our Lord and saviour, for His love, sponsorship of the PhD studies, grace, empowerment, protection, provision, and mercy upon my life and family. -

Ilex Specifications

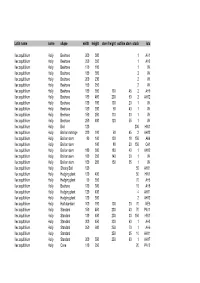

Latin name name shape width height stem height outline stem stock lots Ilex aquifolium Holly Beehave 200 300 1 AH1 Ilex aquifolium Holly Beehave 250 350 1 AH2 Ilex aquifolium Holly Beehave 170 180 1 VK Ilex aquifolium Holly Beehave 180 350 2 VK Ilex aquifolium Holly Beehave 200 230 2 VK Ilex aquifolium Holly Beehave 150 250 2 VK Ilex aquifolium Holly Beehave 180 350 130 45 2 AH9 Ilex aquifolium Holly Beehave 180 450 200 60 2 AH12 Ilex aquifolium Holly Beehave 130 180 100 20 1 VK Ilex aquifolium Holly Beehave 180 200 50 40 1 VK Ilex aquifolium Holly Beehave 150 250 110 30 1 VK Ilex aquifolium Holly Beehave 250 400 120 55 1 VK Ilex aquifolium Holly Ball 120 200 HW1 Ilex aquifolium Holly Ball on mini tige 220 180 60 45 2 AH12 Ilex aquifolium Holly Ball on stem 80 160 100 18 150 AK4 Ilex aquifolium Holly Ball on stem 160 80 20 150 CA1 Ilex aquifolium Holly Ball on stem 180 300 180 40 1 AH12 Ilex aquifolium Holly Ball on stem 180 250 140 30 1 VK Ilex aquifolium Holly Ball on stem 150 250 150 35 1 VK Ilex aquifolium Holly Shruby Ball 120 55 AH11 Ilex aquifolium Holly Hedging plant 120 400 50 HW1 Ilex aquifolium Holly Hedging plant 60 350 70 AH5 Ilex aquifolium Holly Beehave 130 300 15 AH6 Ilex aquifolium Holly Hedging plant 120 400 4 AH11 Ilex aquifolium Holly Hedging plant 120 350 2 AH12 Ilex aquifolium Holly Half standard 100 180 100 20 70 NE5 Ilex aquifolium Holly Standard 150 450 200 40 70 PA11 Ilex aquifolium Holly Standard 130 450 200 30 150 HW1 Ilex aquifolium Holly Standard 300 450 200 60 1 AH3 Ilex aquifolium Holly Standard 350 600 -

Development of Safety Control Structure of Addis Ababa Light Rail Transit, Using System – Theoretic Approach

ADDIS ABABA UNIVERSITY ADDIS ABABA INSTITUTE OF TECHNOLOGY SCHOOL OF MECHANICAL AND INDUSTRIAL ENGINEERING UNDER RAILWAY MECHANICAL ENGINEERING STREAM DEVELOPMENT OF SAFETY CONTROL STRUCTURE OF ADDIS ABABA LIGHT RAIL TRANSIT, USING SYSTEM – THEORETIC APPROACH A Thesis Submitted to the Graduate School of Addis Ababa University in Partial Fulfillment of the Requirements for the Degree of Masters of Science In Railway Mechanical Engineering By: Gemta Kedjela ID NO. GSR/3806/05 Advisor: DR.Gulelat Gatew March, 2015 Addis Ababa University Addis Ababa Institute of Technology School Of Mechanical and Industrial Engineering Under Railway Mechanical Engineering Stream DEVELOPMENT OF SAFETY CONTROL STRUCTURE OF ADDIS ABABA LIGHT RAIL TRANSIT, USING SYSTEM –THEORETIC APPROACH By: Gemta Kedjela Approved by: Board of Examiners Chairman of Department Signature Date Graduate Committee (DGC) Dr. Gulelat Gatew. Advisor Signature Date Internal examiner Signature Date External examiner Signature Date Associate Dean, Research and graduate program Signature Date DECLARATION I hereby declare that the work which is being presented in this thesis entitled, “DEVELOPMENT OF SAFETY CONTROL STRUCTURE OF ADDIS ABABA LIGHT RAIL TRANSIT, USING SYSTEM –THEORETIC APPROACH ” is original work of my own, has not been presented for a degree of any other university and all the resource of materials uses for this thesis have been duly acknowledged. Gemta Kedjela Date This is to certify that the above declaration made by the candidate is correct to the best of my knowledge. Dr.Gulelat Gatew Date Development of Safety Control Structure of Addis Ababa Light Rail Transit, using System –Theoretic Approach ACKNOWLEDGEMENT First of all, I would like to thank my almighty God, for what he has done to me, during those hard times. -

Bibliography

Bibliography Many books were read and researched in the compilation of Binford, L. R, 1983, Working at Archaeology. Academic Press, The Encyclopedic Dictionary of Archaeology: New York. Binford, L. R, and Binford, S. R (eds.), 1968, New Perspectives in American Museum of Natural History, 1993, The First Humans. Archaeology. Aldine, Chicago. HarperSanFrancisco, San Francisco. Braidwood, R 1.,1960, Archaeologists and What They Do. Franklin American Museum of Natural History, 1993, People of the Stone Watts, New York. Age. HarperSanFrancisco, San Francisco. Branigan, Keith (ed.), 1982, The Atlas ofArchaeology. St. Martin's, American Museum of Natural History, 1994, New World and Pacific New York. Civilizations. HarperSanFrancisco, San Francisco. Bray, w., and Tump, D., 1972, Penguin Dictionary ofArchaeology. American Museum of Natural History, 1994, Old World Civiliza Penguin, New York. tions. HarperSanFrancisco, San Francisco. Brennan, L., 1973, Beginner's Guide to Archaeology. Stackpole Ashmore, w., and Sharer, R. J., 1988, Discovering Our Past: A Brief Books, Harrisburg, PA. Introduction to Archaeology. Mayfield, Mountain View, CA. Broderick, M., and Morton, A. A., 1924, A Concise Dictionary of Atkinson, R J. C., 1985, Field Archaeology, 2d ed. Hyperion, New Egyptian Archaeology. Ares Publishers, Chicago. York. Brothwell, D., 1963, Digging Up Bones: The Excavation, Treatment Bacon, E. (ed.), 1976, The Great Archaeologists. Bobbs-Merrill, and Study ofHuman Skeletal Remains. British Museum, London. New York. Brothwell, D., and Higgs, E. (eds.), 1969, Science in Archaeology, Bahn, P., 1993, Collins Dictionary of Archaeology. ABC-CLIO, 2d ed. Thames and Hudson, London. Santa Barbara, CA. Budge, E. A. Wallis, 1929, The Rosetta Stone. Dover, New York. Bahn, P. -

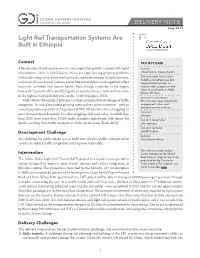

Light Rail Transportation Systems Are Built in Ethiopia

DELIVERY NOTE June 2017 Light Rail Transportation Systems Are Built in Ethiopia Context PROJECT DATA After decades of sustained economic and population growth coupled with rapid SECTOR: Infrastructure, transportation urbanization, cities in Sub-Saharan Africa are experiencing growing problems DEVELOPMENT CHALLENGE: with traffic congestion. Poor road networks, underinvestment in infrastructure, Building cost-effective public and a lack of mass transit systems exacerbate the problems and negatively affect transportation systems to economic activities and human health. Even though countries in the region reduce traffic congestion and improve road safety in Addis have only 2 percent of the world’s registered vehicles, these countries have some Ababa, Ethiopia of the highest road mortality rates in the world (Marquez 2012). DELIVERY CHALLENGES: Addis Ababa, the capital of Ethiopia, is a clear example of the challenges of traffic Skills transfer, weak stakeholder congestion. As one of the fastest-growing metropolises on the continent—with an engagement, inter- and intragovernment relations annual population growth of 3.8 percent (UITP 2014)—the city is struggling to COUNTRY: meet transportation demands. It is also struggling with road safety. Available data Ethiopia from 2015 show more than 10,000 traffic accidents nationwide, with about 418 PROJECT DURATION: deaths resulting from traffic accidents in Addis Ababa alone (Kassa 2015). 2007–present PROJECT AMOUNT: Development Challenge US$475 million REGION: The challenge for Addis Ababa was to build cost-effective public transportation Sub-Saharan Africa systems to reduce traffic congestion and improve road safety. This note was produced by Intervention Carlos Sabatino at the World Bank from an original case study The Addis Ababa Light Rail Transit (LRT) project is a modern transportation published by the Centre for system designed to improve mass transit options and reduce congestion in Public Impact. -

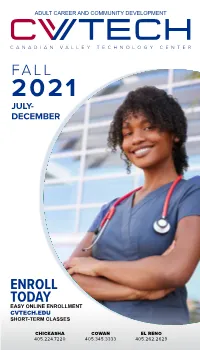

Enroll Today Easy Online Enrollment Cvtech.Edu Short-Term Classes

ADULT CAREER AND COMMUNITY DEVELOPMENT CANADIAN VALLEY TECHNOLOGY CENTER FALL 2021 JULY- DECEMBER ENROLL TODAY EASY ONLINE ENROLLMENT CVTECH.EDU SHORT-TERM CLASSES CHICKASHA COWAN EL RENO 405.224.7220 405.345.3333 405.262.2629 FALL 2021 CATALOG TABLE OF CONTENTS SHORT-TERM COURSES | JULY-DECEMBER ONLINE & BLENDED DANCING / MUSIC ....................................................4 FABRIC / YARN ...........................................................4 ALL ONLINE & BLENDED COURSES .................. 2 HEALTH / WELLNESS. ............................................. 5 BUSINESS HOME / AUTO MAINTENANCE. ........................... 5 & COMPUTERS LANGUAGE ................................................................ 5 MISCELLANEOUS .................................................... 5 ACCOUNTING / QUICKBOOKS ............................ 2 PERSONAL FINANCE. ............................................. 5 COMPUTER BASICS ................................................ 2 WRITING...................................................................... 5 COMPUTER CERTIFICATIONS .............................. 2 MICROSOFT OFFICE ............................................... 2 MODERN DESIGN / CADD ..................................2-3 TRADE, SAFETY & INDUSTRY HEALTH AUTOMOTIVE / DRIVING ....................................... 5 CPR / FIRST AID .........................................................3 ENERGY INDUSTRY ................................................. 5 DENTAL FIELD ............................................................3 -

Master Plan on ASEAN Connectivity

Association of Southeast Asian Nations Master Plan on ASEAN Connectivity One Vision, One Identity, One Community i HA NOI DECLARATION ON THE ADOPTION OF THE MASTER PLAN ON ASEAN CONNECTIVITY WE, the Heads of State/Government of Brunei Darussalam, the Kingdom of Cambodia, the Republic of Indonesia, the Lao People’s Democratic Republic, Malaysia, the Union of Myanmar, the Republic of the Philippines, the Republic of Singapore, the Kingdom of Thailand and the Socialist Republic of Viet Nam, on the occasion of the 17th ASEAN Summit; Recalling the ASEAN Leaders’ Statement on ASEAN Connectivity issued in Cha-am Hua Hin, Thailand, on 24 October 2009; Reaffirming that enhancing intra-regional connectivity within ASEAN would benefit all ASEAN Member States through enhanced trade, investment, tourism, people-to-people exchanges, and development which would complement the ongoing regional efforts to realise a people-oriented ASEAN Community by 2015; Welcoming the work of the High Level Task Force on ASEAN Connectivity in developing the Master Plan on ASEAN Connectivity with the ASEAN Secretariat and relevant sectoral bodies, in cooperation with international organisations such as Asian Development Bank (ADB), Economic Research Institute for ASEAN and East Asia (ERIA), United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) and World Bank; Recognising that the Master Plan on ASEAN Connectivity will promote economic growth, narrow development gaps, ASEAN integration and Community building process, enhance competitiveness of ASEAN, promote deeper social and cultural understanding as well as greater people mobility and connect its Member States within the region and with the rest of the world; Expressing appreciation for the support shown by our Dialogue Partners towards the ASEAN Connectivity initiative and their readiness to partner with ASEAN in the implementation of the Master Plan. -

Oneida County Legislative District 1 Date: April 1, 2014

CARTER RD D D 5 R R 6 B T 3 L L I E P L P S A T K E U C E T 5 C 6 K R D D U W O 3 M R W O D E O R S E R A K T R L Y T N C E E A A S E U D H G R I C Y T O I E O E D E R ID R A R A T R N N R F D C R D E W E O R N S E G S N D R H R E T D T E E S E A L D H S E E R I R T O S T U R I 10 D R M S N W I S R A G E A C N L H R T Y Verona D R AC11 AC12 AC13 AC14 AC15 E AC16 AC17 AC18 H AC19 R C R W H T L D R E I IL D L D D R L S E VERONA 4 R E B R M U N L R D I E T A K C K H A C O O U R S 6 R TA R N D TE 2 D R T OU R LO TE W E 31 Y EL T L U D R D R D O E R R L L B N R O E S T G E N T W E D I B A R L T O D S R NS E D T A D S A M M R R R T H 4 WESTMORELAND 3 R E C E N R RO A E N R E U FR TE N D U G Y T H B R 31 D D R S I I L D E R Y 5 YD R L R 6 L BO R D 5 L R N 3 I I 6 E SPR R H A 3 ING RD M M G E D S 3 R M E L I E T O E W N U T R EL I F U L I O RD E S L R O PR I-90 R D R ING STAT D E RD I- E R T E 90 OU T T A D AD11 AD12 AD13 E AD14 T A AD15 AD16 AD17 AD18 AD19 31 S T R S I-90 I-90 H 0 T I-9 L I OW D E R M S LL S PR VERONA 3 L ING H RD IL 0 OUS H I-90 I-9 E RD FOSTE D R CORN N ERS RD A T S S N D I R A E I-90 R M O Y I-90 O IL DA 5 M D D R 36 I-90 I-90 R E S A T -90 MIT G I C HEL S E U L R WN L R D O I O D T NE N R I D R I-90 I R RD S K SK KINNE R N 0 E N T RD -9 T 5 E I I E 0 L A 6 R L 9 S A J I- P 3 D D T T S R WESTMORELAND 4 D S E Y R E A LL R E W T N E C NL D T H O O E U H C L T F I R O R I L L M E O I R O L L X M W U D IL HIL E L T R R O M 0 T I-9 A E D E O R IN AE11 AE12 AE1R 3 T AE14 D AE15 AE16 L AE17 AE18 AE19 R D S R 3 N C D 1 E EN OW TE -

CADP 2.0) Infrastructure for Connectivity and Innovation

The Comprehensive Asia Development Plan 2.0 (CADP 2.0) Infrastructure for Connectivity and Innovation November 2015 Economic Research Institute for ASEAN and East Asia The findings, interpretations, and conclusions expressed herein do not necessarily reflect the views and policies of the Economic Research Institute for ASEAN and East Asia, its Governing Board, Academic Advisory Council, or the institutions and governments they represent. All rights reserved. Material in this publication may be freely quoted or reprinted with proper acknowledgement. Cover Art by Artmosphere ERIA Research Project Report 2014, No.4 National Library of Indonesia Cataloguing in Publication Data ISBN: 978-602-8660-88-4 Contents Acknowledgement iv List of Tables vi List of Figures and Graphics viii Executive Summary x Chapter 1 Development Strategies and CADP 2.0 1 Chapter 2 Infrastructure for Connectivity and Innovation: The 7 Conceptual Framework Chapter 3 The Quality of Infrastructure and Infrastructure 31 Projects Chapter 4 The Assessment of Industrialisation and Urbanisation 41 Chapter 5 Assessment of Soft and Hard Infrastructure 67 Development Chapter 6 Three Tiers of Soft and Hard Infrastructure 83 Development Chapter 7 Quantitative Assessment on Hard/Soft Infrastructure 117 Development: The Geographical Simulation Analysis for CADP 2.0 Appendix 1 List of Prospective Projects 151 Appendix 2 Non-Tariff Barriers in IDE/ERIA-GSM 183 References 185 iii Acknowledgements The original version of the Comprehensive Asia Development Plan (CADP) presents a grand spatial design of economic infrastructure and industrial placement in ASEAN and East Asia. Since the submission of such first version of the CADP to the East Asia Summit in 2010, ASEAN and East Asia have made significant achievements in developing hard infrastructure, enhancing connectivity, and participating in international production networks. -

(Presentation): Improving Railway Technologies and Efficiency

RegionalConfidential EST Training CourseCustomizedat for UnitedLorem Ipsum Nations LLC University-Urban Railways Shanshan Li, Vice Country Director, ITDP China FebVersion 27, 2018 1.0 Improving Railway Technologies and Efficiency -Case of China China has been ramping up investment in inner-city mass transit project to alleviate congestion. Since the mid 2000s, the growth of rapid transit systems in Chinese cities has rapidly accelerated, with most of the world's new subway mileage in the past decade opening in China. The length of light rail and metro will be extended by 40 percent in the next two years, and Rapid Growth tripled by 2020 From 2009 to 2015, China built 87 mass transit rail lines, totaling 3100 km, in 25 cities at the cost of ¥988.6 billion. In 2017, some 43 smaller third-tier cities in China, have received approval to develop subway lines. By 2018, China will carry out 103 projects and build 2,000 km of new urban rail lines. Source: US funds Policy Support Policy 1 2 3 State Council’s 13th Five The Ministry of NRDC’s Subway Year Plan Transport’s 3-year Plan Development Plan Pilot In the plan, a transport white This plan for major The approval processes for paper titled "Development of transportation infrastructure cities to apply for building China's Transport" envisions a construction projects (2016- urban rail transit projects more sustainable transport 18) was launched in May 2016. were relaxed twice in 2013 system with priority focused The plan included a investment and in 2015, respectively. In on high-capacity public transit of 1.6 trillion yuan for urban 2016, the minimum particularly urban rail rail transit projects.