Ilex Specifications

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pin-Outs (PDF)

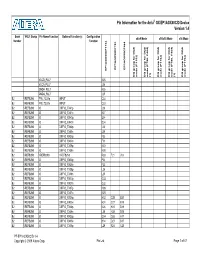

Pin Information for the Arria® GX EP1AGX50C/D Device Version 1.4 Bank VREF Group Pin Name/Function Optional Function(s) Configuration x8/x9 Mode x16/x18 Mode x36 Mode Number Function EP1AGX50DF780 EP1AGX50CF484 EP1AGX50DF1152 DQ group for DQS DQS for group DQ (F1152) mode DQS for group DQ (F780, F484) mode (1) DQS for group DQ (F1152) mode DQS for group DQ (F780, F484) mode (1) DQS for group DQ (F1152) mode VCCD_PLL7 K25 VCCA_PLL7 J26 GNDA_PLL7 K26 GNDA_PLL7 J25 B2 VREFB2N0 FPLL7CLKp INPUT C34 B2 VREFB2N0 FPLL7CLKn INPUT C33 B2 VREFB2N0 IO DIFFIO_TX41p J28 B2 VREFB2N0 IO DIFFIO_TX41n K27 B2 VREFB2N0 IO DIFFIO_RX40p E34 B2 VREFB2N0 IO DIFFIO_RX40n D34 B2 VREFB2N0 IO DIFFIO_TX40p J30 B2 VREFB2N0 IO DIFFIO_TX40n J29 B2 VREFB2N0 IO DIFFIO_RX39p F32 B2 VREFB2N0 IO DIFFIO_RX39n F31 B2 VREFB2N0 IO DIFFIO_TX39p K30 B2 VREFB2N0 IO DIFFIO_TX39n K29 B2 VREFB2N0 VREFB2N0 VREFB2N0 R30 T21 J18 B2 VREFB2N0 IO DIFFIO_RX38p F34 B2 VREFB2N0 IO DIFFIO_RX38n F33 B2 VREFB2N0 IO DIFFIO_TX38p L26 B2 VREFB2N0 IO DIFFIO_TX38n L25 B2 VREFB2N0 IO DIFFIO_RX37p G33 B2 VREFB2N0 IO DIFFIO_RX37n G32 B2 VREFB2N0 IO DIFFIO_TX37p M26 B2 VREFB2N0 IO DIFFIO_TX37n M25 B2 VREFB2N0 IO DIFFIO_RX36p H32 C28 B20 B2 VREFB2N0 IO DIFFIO_RX36n H31 C27 B19 B2 VREFB2N0 IO DIFFIO_TX36p K28 H23 D19 B2 VREFB2N0 IO DIFFIO_TX36n L28 H22 D18 B2 VREFB2N0 IO DIFFIO_RX35p G34 D28 A17 B2 VREFB2N0 IO DIFFIO_RX35n H34 D27 B17 B2 VREFB2N0 IO DIFFIO_TX35p L29 F24 C20 PT-EP1AGX50C/D-1.4 Copyright © 2009 Altera Corp. Pin List Page 1 of 47 Pin Information for the Arria® GX EP1AGX50C/D Device Version -

Enroll Today Easy Online Enrollment Cvtech.Edu Short-Term Classes

ADULT CAREER AND COMMUNITY DEVELOPMENT CANADIAN VALLEY TECHNOLOGY CENTER FALL 2021 JULY- DECEMBER ENROLL TODAY EASY ONLINE ENROLLMENT CVTECH.EDU SHORT-TERM CLASSES CHICKASHA COWAN EL RENO 405.224.7220 405.345.3333 405.262.2629 FALL 2021 CATALOG TABLE OF CONTENTS SHORT-TERM COURSES | JULY-DECEMBER ONLINE & BLENDED DANCING / MUSIC ....................................................4 FABRIC / YARN ...........................................................4 ALL ONLINE & BLENDED COURSES .................. 2 HEALTH / WELLNESS. ............................................. 5 BUSINESS HOME / AUTO MAINTENANCE. ........................... 5 & COMPUTERS LANGUAGE ................................................................ 5 MISCELLANEOUS .................................................... 5 ACCOUNTING / QUICKBOOKS ............................ 2 PERSONAL FINANCE. ............................................. 5 COMPUTER BASICS ................................................ 2 WRITING...................................................................... 5 COMPUTER CERTIFICATIONS .............................. 2 MICROSOFT OFFICE ............................................... 2 MODERN DESIGN / CADD ..................................2-3 TRADE, SAFETY & INDUSTRY HEALTH AUTOMOTIVE / DRIVING ....................................... 5 CPR / FIRST AID .........................................................3 ENERGY INDUSTRY ................................................. 5 DENTAL FIELD ............................................................3 -

Master Plan on ASEAN Connectivity

Association of Southeast Asian Nations Master Plan on ASEAN Connectivity One Vision, One Identity, One Community i HA NOI DECLARATION ON THE ADOPTION OF THE MASTER PLAN ON ASEAN CONNECTIVITY WE, the Heads of State/Government of Brunei Darussalam, the Kingdom of Cambodia, the Republic of Indonesia, the Lao People’s Democratic Republic, Malaysia, the Union of Myanmar, the Republic of the Philippines, the Republic of Singapore, the Kingdom of Thailand and the Socialist Republic of Viet Nam, on the occasion of the 17th ASEAN Summit; Recalling the ASEAN Leaders’ Statement on ASEAN Connectivity issued in Cha-am Hua Hin, Thailand, on 24 October 2009; Reaffirming that enhancing intra-regional connectivity within ASEAN would benefit all ASEAN Member States through enhanced trade, investment, tourism, people-to-people exchanges, and development which would complement the ongoing regional efforts to realise a people-oriented ASEAN Community by 2015; Welcoming the work of the High Level Task Force on ASEAN Connectivity in developing the Master Plan on ASEAN Connectivity with the ASEAN Secretariat and relevant sectoral bodies, in cooperation with international organisations such as Asian Development Bank (ADB), Economic Research Institute for ASEAN and East Asia (ERIA), United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) and World Bank; Recognising that the Master Plan on ASEAN Connectivity will promote economic growth, narrow development gaps, ASEAN integration and Community building process, enhance competitiveness of ASEAN, promote deeper social and cultural understanding as well as greater people mobility and connect its Member States within the region and with the rest of the world; Expressing appreciation for the support shown by our Dialogue Partners towards the ASEAN Connectivity initiative and their readiness to partner with ASEAN in the implementation of the Master Plan. -

Oneida County Legislative District 1 Date: April 1, 2014

CARTER RD D D 5 R R 6 B T 3 L L I E P L P S A T K E U C E T 5 C 6 K R D D U W O 3 M R W O D E O R S E R A K T R L Y T N C E E A A S E U D H G R I C Y T O I E O E D E R ID R A R A T R N N R F D C R D E W E O R N S E G S N D R H R E T D T E E S E A L D H S E E R I R T O S T U R I 10 D R M S N W I S R A G E A C N L H R T Y Verona D R AC11 AC12 AC13 AC14 AC15 E AC16 AC17 AC18 H AC19 R C R W H T L D R E I IL D L D D R L S E VERONA 4 R E B R M U N L R D I E T A K C K H A C O O U R S 6 R TA R N D TE 2 D R T OU R LO TE W E 31 Y EL T L U D R D R D O E R R L L B N R O E S T G E N T W E D I B A R L T O D S R NS E D T A D S A M M R R R T H 4 WESTMORELAND 3 R E C E N R RO A E N R E U FR TE N D U G Y T H B R 31 D D R S I I L D E R Y 5 YD R L R 6 L BO R D 5 L R N 3 I I 6 E SPR R H A 3 ING RD M M G E D S 3 R M E L I E T O E W N U T R EL I F U L I O RD E S L R O PR I-90 R D R ING STAT D E RD I- E R T E 90 OU T T A D AD11 AD12 AD13 E AD14 T A AD15 AD16 AD17 AD18 AD19 31 S T R S I-90 I-90 H 0 T I-9 L I OW D E R M S LL S PR VERONA 3 L ING H RD IL 0 OUS H I-90 I-9 E RD FOSTE D R CORN N ERS RD A T S S N D I R A E I-90 R M O Y I-90 O IL DA 5 M D D R 36 I-90 I-90 R E S A T -90 MIT G I C HEL S E U L R WN L R D O I O D T NE N R I D R I-90 I R RD S K SK KINNE R N 0 E N T RD -9 T 5 E I I E 0 L A 6 R L 9 S A J I- P 3 D D T T S R WESTMORELAND 4 D S E Y R E A LL R E W T N E C NL D T H O O E U H C L T F I R O R I L L M E O I R O L L X M W U D IL HIL E L T R R O M 0 T I-9 A E D E O R IN AE11 AE12 AE1R 3 T AE14 D AE15 AE16 L AE17 AE18 AE19 R D S R 3 N C D 1 E EN OW TE -

CADP 2.0) Infrastructure for Connectivity and Innovation

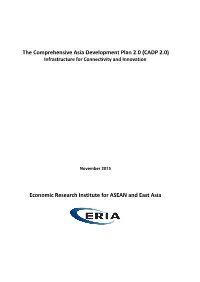

The Comprehensive Asia Development Plan 2.0 (CADP 2.0) Infrastructure for Connectivity and Innovation November 2015 Economic Research Institute for ASEAN and East Asia The findings, interpretations, and conclusions expressed herein do not necessarily reflect the views and policies of the Economic Research Institute for ASEAN and East Asia, its Governing Board, Academic Advisory Council, or the institutions and governments they represent. All rights reserved. Material in this publication may be freely quoted or reprinted with proper acknowledgement. Cover Art by Artmosphere ERIA Research Project Report 2014, No.4 National Library of Indonesia Cataloguing in Publication Data ISBN: 978-602-8660-88-4 Contents Acknowledgement iv List of Tables vi List of Figures and Graphics viii Executive Summary x Chapter 1 Development Strategies and CADP 2.0 1 Chapter 2 Infrastructure for Connectivity and Innovation: The 7 Conceptual Framework Chapter 3 The Quality of Infrastructure and Infrastructure 31 Projects Chapter 4 The Assessment of Industrialisation and Urbanisation 41 Chapter 5 Assessment of Soft and Hard Infrastructure 67 Development Chapter 6 Three Tiers of Soft and Hard Infrastructure 83 Development Chapter 7 Quantitative Assessment on Hard/Soft Infrastructure 117 Development: The Geographical Simulation Analysis for CADP 2.0 Appendix 1 List of Prospective Projects 151 Appendix 2 Non-Tariff Barriers in IDE/ERIA-GSM 183 References 185 iii Acknowledgements The original version of the Comprehensive Asia Development Plan (CADP) presents a grand spatial design of economic infrastructure and industrial placement in ASEAN and East Asia. Since the submission of such first version of the CADP to the East Asia Summit in 2010, ASEAN and East Asia have made significant achievements in developing hard infrastructure, enhancing connectivity, and participating in international production networks. -

151 Appendix 1. List of Prospective Projects

Appendix 1. List of Prospective Projects Country Sector Project Name Region Tier Brunei Road/Bridge Construction of Temburong Bridge BIMP+ Tier 2 Darussalam Brunei Road/Bridge Pulau Muara Besar Project BIMP+ Tier 2 Darussalam Brunei Road/Bridge Construction of Telisai Lumut Highway BIMP+ Tier 2 Darussalam Brunei Port/Maritime Muara container terminal extension BIMP+ Tier 2 Darussalam Cambodia Road/Bridge Phnom Penh–Ho Chi Minh City Mekong Tier 1 Expressway (E-1) Cambodia Road/Bridge Phnom Penh–Sihanoukville Expressway Mekong Tier 2 (E-4) Cambodia Road/Bridge National Road No. 1 (Phase 4: 4 km from Mekong Tier 2 Phnom Penh) Cambodia Road/Bridge National Road No. 2 and No. 22 Mekong Tier 2 Cambodia Road/Bridge National Road No. 3 Upgrading to AC Mekong Tier 2 Cambodia Road/Bridge National Road No. 5 (from Chroy Chang Mekong Tier 2 Var–Prek Kdam) Cambodia Road/Bridge Rehabilitation of National Road No. 5 Mekong Tier 2 from Prek Kdam Bridge to Poipet Cambodia Road/Bridge National Road No. 5 Improvement Mekong Tier 2 Project (Battambang–Sri Sophorn Section) (North: 81.2 km) Cambodia Road/Bridge National Road No. 5 Improvement Mekong Tier 2 Project (Thlea Ma'Am–Battangbang + Sri Sophorn–Poipet Sections) (Center: 148.3 km) Cambodia Road/Bridge National Road No. 5 Improvement Mekong Tier 2 Project (Prek Kdam–Thlea Ma'Am Section) (I) (South: 135.4 km) Cambodia Road/Bridge National Road No. 6A (PK44 to PK290) Mekong Tier 2 Cambodia Road/Bridge National Road No. 11 (Neak Leoung– Mekong Tier 2 Thnal Toteoung) Cambodia Road/Bridge National Road No. -

Europe Price List

2019 Europe Price List EUROPE PRICE LIST 2019 Terms and Conditions of Sale Conditions générales de vente Condizioni generali di vendita Allgemeine Verkaufsbedingungen By placing an order, the customer Toutes les commandes passées Tutti gli ordini effettuati com- Mit Aufgabe einer Bestellung er- fully accepts the following Terms impliquent que l’acheteur accep- portano la piena accettazione, kennt der Kunde die folgenden and Conditions of Sale: te intégralement les Conditions da parte dell’acquirente, delle Allgemeinen Verkaufsbedingun- générales de vente suivantes : seguenti Condizioni Generali di gen in vollem Umfang an: 0. Validity Vendita: Price list valid from 18/02/2019. 0. Validité 0. Gültigkeit Tarif valable à partir de 18/02/2019. 0. Validità Die Preisliste gilt ab dem 1. Prices Listino valido dal 18/02/2019. 18/02/2019. The prices applied will be those 1. Prix valid on the date of reception of Les tarifs en vigueur s’appliquent 1. Prezzi 1. Preise the order (RRP, VAT not included). à la date de réception de la com- Verranno applicate le tariffe Es werden die Preise berechnet, All prices featured in the price list mande (prix PVPR, TVA non com- vigenti alla data di ricezione die am Tag des Auftrageingangs include the WEEE eco-fee. prise). Tous les prix indiqués dans dell’ordine (prezzi di vendita al gelten (UVP ohne Mehrwerts- la liste des tarifs comprennent pubblico consigliati, IVA esclusa). teuer). Alle angegebenen Preise 2. Delivery times l’éco-participation DEEE. Tutti i prezzi indicati nel listino sind einschließlich WEEE Gebühr. Delivery times will be confirmed at prezzi sono con contributo ECO- the moment of placing the order 2. -

Affordable Housing 7

549 Main Street, Chatham, MA 02633 ph: 5089455100 Chatham Town Office fx: 5089453550 Affordable Housing 7. Affordable Housing Overview When one compares the maximum affordable home purchase prices for an average, locallyemployed Chatham couple or family to the average listing price for Chatham residential properties, it is clear that there is a remarkable affordability gap for locallyemployed Chatham workers and residents who wish to acquire their own home. Affordable Housing Strategies for Chatham, June 1988 After World War II, Chatham experienced both a residential building boom and an unprecedented influx of new residents, primarily of retirement age. The number of housing units has nearly quadrupled since 1945, while the population has more than tripled. The percentage of houses used only seasonally has steadily increased, though figures are elusive. From 1980 to 2000, the percentage of houses used yearround has declined from 53% to 47%, with the result that presently half of Chatham’s housing units are used seasonally and the number of houses now exceeds the yearround census population 6,743 units versus 6,625 people. As land costs increased, inexpensive homes, primarily smaller yearround affordable houses, were sold, enlarged or totally replaced for retirement and/or second homes, depleting the affordable housing stock drastically. A substantial gap exists between mortgage costs and the price which typical area residents can pay. As of 1999, the maximum mortgage affordable by a household with the area’s median income ($44,700) was $117,220 and for a moderate income household (one earning 80% of the median income), the maximum affordable mortgage was $89,400. -

One Belt One Road Infrastructure Sector

Asian Insights SparX One Belt One Road Infrastructure Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 24 Jul 2017 OBOR: moving faster than expected HSI: 26,706 ANALYST • Our analysis shows that market has yet to price in the potential investment spending from OBOR initiative; total Rachel MIU +852 2863 8843 [email protected] OBOR surged sharply in 2016 and China has a large share Chong Tjen-San, CFA +60 3 26043972 • One of the key growth drivers will be from ASEAN as Chinese contractors expand their presence in the region [email protected] • CCCC (1800 HK) best for OBOR exposure; CRCC (1186 HK) Chris Leung +852 3668 5694 ** still see mid-term upside potential [email protected] ** contributed to macro inputs only Implementation of OBOR projects is accelerating; Chinese companies are securing more projects. China is stepping up its project-driven growth model to countries interested in the One Recommendation & valuation Belt, One Road (OBOR) initiative. The OBOR strategy could pave Company Price Target Recom Mkt FY18F the way for much higher investments in the future, and provide Price Cap PE enormous opportunity for the Chinese contractors. They are Local$ Local$ US$m x participating in several large-scale infrastructure projects in six major regions, with huge interests in the China-Pakistan Economic Infrastructure construction Corridor (CPEC) development. The Chinese contractors are now CCC-H (1800 HK) HK$ 10.88 12.90 BUY 36,292 7.1 targeting at ASEAN, the next up and coming region. We estimate CCC-A (601800 CH) RMB 17.31 18.10 HOLD 36,292 13.0 the transport related investment could be much higher than the CRCC-H (1186 HK) HK$ 10.80 12.90 BUY 25,587 7.3 initial phase, exceeding US$200 billion over a 5-year period in CRCC-A (601186 CH) RMB 13.33 12.50 HOLD 25,587 10.5 ASEAN. -

ASEAN Connectivity, Project Information Sheet

ASEAN Connectivity Project Information Sheets one vision one identity one community The Association of Southeast Asian Nations (ASEAN) was established on 8 August 1967. The Member States of the Association are Brunei Darussalam, Cambodia, Indonesia, Lao PDR, Malaysia, Myanmar, Philippines, Singapore, Thailand and Viet Nam. The ASEAN Secretariat is based in Jakarta, Indonesia. The ASEAN Secretariat Public Outreach and Civil Society Division 70A Jalan Sisingamangaraja Jakarta 12110, Indonesia Phone : (62 21) 724-3372, 726-2991 Fax : (62 21) 739-8234, 724-3504 E-mail : [email protected] General information on ASEAN appears online at the ASEAN Website: www.asean.org Catalogue-in-Publication Data ASEAN Connectivity Jakarta: ASEAN Secretariat, August 2012 The text of this publication may be freely quoted or reprinted with proper acknowledgement. Copyright Association of Southeast Asian Nations (ASEAN) 2012 All rights reserved PHYSICAL CONNECTIVITY PrOjECT INfOrmATION SHEET mPAC PP/A1/01 CONSTRUCTION OF THE ASEAN HIGHWAY NETWORK (AHN) MISSING LINKS AND UPGRADE OF TRANSIT TRANSPORT ROUTES IN LAO PDR AND MYANMAR PrOjECT DESCrIPTION PrOjECT STATuS ASEAN HIGHWAY Given the growing regional integration and cooperation Seeking technical in ASEAN, the development of high quality transport assistance and funding NETWORK infrastructure is a crucial element to building a competitive ASEAN Community with equitable economic TArgET COmPLETION development. However, ASEAN with total land area DATE of around 4.4 million sq. km faces challenges with poor December 2015 quality of roads and incomplete road networks. The ASEAN Highway Network (AHN) project is a flagship ImPLEmENTINg bODIES infrastructure project that seeks to bring connectivity Ministry of Public across borders and confer many benefits, such as Works and Transport improved competitiveness of regional production of Lao PDR, Ministry networks, better trade and investment flows, and of Construction of reductions in development gaps. -

Master Plan on ASEAN Connectivity

Association of Southeast Asian Nations Master Plan on ASEAN Connectivity One Vision, One Identity, One Community i HA NOI DECLARATION ON THE ADOPTION OF THE MASTER PLAN ON ASEAN CONNECTIVITY WE, the Heads of State/Government of Brunei Darussalam, the Kingdom of Cambodia, the Republic of Indonesia, the Lao People’s Democratic Republic, Malaysia, the Union of Myanmar, the Republic of the Philippines, the Republic of Singapore, the Kingdom of Thailand and the Socialist Republic of Viet Nam, on the occasion of the 17th ASEAN Summit; Recalling the ASEAN Leaders’ Statement on ASEAN Connectivity issued in Cha-am Hua Hin, Thailand, on 24 October 2009; Reaffirming that enhancing intra-regional connectivity within ASEAN would benefit all ASEAN Member States through enhanced trade, investment, tourism, people-to-people exchanges, and development which would complement the ongoing regional efforts to realise a people-oriented ASEAN Community by 2015; Welcoming the work of the High Level Task Force on ASEAN Connectivity in developing the Master Plan on ASEAN Connectivity with the ASEAN Secretariat and relevant sectoral bodies, in cooperation with international organisations such as Asian Development Bank (ADB), Economic Research Institute for ASEAN and East Asia (ERIA), United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) and World Bank; Recognising that the Master Plan on ASEAN Connectivity will promote economic growth, narrow development gaps, ASEAN integration and Community building process, enhance competitiveness of ASEAN, promote deeper social and cultural understanding as well as greater people mobility and connect its Member States within the region and with the rest of the world; Expressing appreciation for the support shown by our Dialogue Partners towards the ASEAN Connectivity initiative and their readiness to partner with ASEAN in the implementation of the Master Plan. -

The Effect of Road Upgrading to Overland Trade in Asian Highway Network Ziyodullo PARPIEV ∗ Jamshid SODIKOV **

Eurasian Journal of Business and Economics 2008, 1 (2), 85-101. The Effect of Road Upgrading to Overland Trade in Asian Highway Network Ziyodullo PARPIEV ∗ Jamshid SODIKOV ** Abstract This paper investigates an impact of road upgrading and improvement on overland trade in 18 out of 32 Asian Highway Network member countries. A regression based cost model was developed. The results indicate that approximately 6.5 billion US dollars is required to upgrade and improve surface condition of the selected roads with total length of 15,842 km. The gravity model approach was adopted to quantitatively evaluate overland trade expansion assuming pessimistic and optimistic scenarios: improvements in road quality indices up to 50 and up to 75, respectively. The results suggests that in the first scenario total intra-regional trade will increase by about 20 percent or 48.7 billion US dollars annually, while second scenario predicts that trade will increase by about 35 percent or 89.5 billion US dollars annually. Keywords: Asian Highway Network, road transport, gravity model. Jel Classification: F12, F15, F17. ∗ Advisor-Economist, UNDP Uzbekistan Country Office, Email: [email protected] ** Chief Engineer, Road Research Institute, Tashkent, Uzbekistan The views expressed in this paper are those of the author(s) and do not necessarily represent those of organizations the authors are associated with. Ziyodullo PARPIEV & Jamshid SODIKOV 1. Introduction In 1992, the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) endorsed the Asian Land Transport Infrastructure Development (ALTID) project comprising of the Asian Highway and the Trans-Asian Railway network. The formalization of the Asian Highway, through the Intergovernmental Agreement on Asian Highway Network (AHN), was adopted in November 2003.