Coca-Cola Company 10-K

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 Annual Report Celebrations, Competitions & Community

2016 Annual Report Celebrations, Competitions & Community www.SpecialOlympicsGA.org Table of Mission Contents Special Olympics Georgia provides year-round sports training and athletic competition in a variety of Olympic-type sports for children and adults with intellectual disabilities, giving them continuing Letter from the Board opportunities to develop physical fitness, demonstrate courage, Chairman and CEO experience joy and participate in the sharing of gifts, skills and 3 friendships with their families, other Special Olympics athletes and the community. Sports Offered and State Competitions Special Olympics Georgia, a 501c3 nonprofit organization, is supported by donations 4 from individuals, events, community groups, corporations and foundations. Special Olympics Georgia does not charge athletes to participate. The state offices are located at 4000 Dekalb Technology Parkway, Building 400, Suite 400, Atlanta, GA Beyond Sports: Healthy 30340 and 1601 N. Ashley Street, Suite 88, Valdosta, GA 31602. 770-414-9390. Athletes & Unified Sports www.SpecialOlympicsGA.org. 5 Meet Our Athletes: Marcus & Elena 6 2016 Fundraising Highlights: Law Enforcement Torch Run & Special Events 7 2016 Financial Review 8 Meet Our Team 9-10 2016 Sponsors and Contributors Recognition “Let Me Win. But If I Cannot Win, 11-15 Let Me Be Brave In The Attempt.” Special Olympics Athlete Oath 2 A MESSAGE FROM OUR CHAIRMAN OF THE BOARD AND CEO Dear Friends and Fans, In 1970, 500 Special Olympics Georgia (SOGA) athletes trained and participated in the first-ever competition held within our organization. 46 years later, we are in amazement at the continued growth of activity and support our organization has seen. 2016 was a year filled with celebrations of friendships and accomplishments, competitions that showcased bravery and sportsmanship, and newly formed relationships within communities across Georgia. -

Leseprobe L 9783570501061 1.Pdf

Donald R. Keough Die 10 Gebote für geschäftlichen Misserfolg Vorwort von Warren Buffett Aus dem Englischen von Helmut Dierlamm Die amerikanische Originalausgabe erschien 2008 unter dem Titel »The Ten Commandments for Business Failure« bei Portfolio, einem Unternehmen der Penguin Group (USA) Inc., New York. Dieses Buch ist den Millionen Männern und Frauen auf der ganzen Welt gewidmet, die in Vergangenheit, Gegenwart und Zukunft der Coca-Cola-Familie angehören. Umwelthinweis Dieses Buch wurde auf 100 % Recycling-Papier gedruckt, das mit dem blauen Engel ausgezeichnet ist. Die Einschrumpffolie (zum Schutz vor Verschmutzung) ist aus umweltfreundlicher und recyclingfähiger PE-Folie. 1. Auflage © 2009 der deutschsprachigen Ausgabe Riemann Verlag, München in der Verlagsgruppe Random House GmbH © 2008 Donald R. Keough All rights reserved including the right of reproduction in whole or in part in any form. This edition published by arrangement with Portfolio, a member of Penguin Group (USA) Inc. Lektorat: Ralf Lay, Mönchengladbach Satz: Barbara Rabus Druck und Bindung: GGP Media GmbH, Pößneck ISBN 978-3-570-50106-1 www.riemann-verlag.de Inhalt Vorwort von Warren Buffett . 7 Einleitung . 11 Das erste Gebot – ganz oben auf der Liste – Gehen Sie keine Risiken ein . 21 Das zweite Gebot Seien Sie inflexibel . 34 Das dritte Gebot Isolieren Sie sich . 53 Das vierte Gebot Halten Sie sich für unfehlbar . 66 Das fünfte Gebot Operieren Sie stets am Rand der Legalität . 73 Das sechste Gebot Nehmen Sie sich keine Zeit zum Denken . 86 Das siebte Gebot Setzen Sie Ihr ganzes Vertrauen in Experten und externe Berater . 101 Das achte Gebot Lieben Sie Ihre Bürokratie . 117 Das neunte Gebot Vermitteln Sie unklare Botschaften . -

Broadcastingaor9 ? Ci5j DETR 4, Eqgzy C ^:Y Reach the 'Thp of the World with Fitness News

The Fifth Estate R A D I O T E L E V I S I O N C A B L E S A T E L L I T E BroadcastingAor9 ? ci5j DETR 4, EqGzY C ^:y Reach The 'Thp Of The World With fitness News. Nothing delivers Minnesota like Eyewitness News. Five stations of powerful news programming reaching 90% of the state. When you're looking for the top of the world, remember Eyewitness News. Represented nationally by Petry. Hubbard Broadcasting's Minnesota Network: KSTP-TV KSAX TV KRWF-TV WDIO -TV WIRT-TV APR. 1 1 1990 111 Lì,rJ_ ' -- . , ,. .n ..... -... ---_- -- -- ,--. Seattle KSTW Honolulu KGMB A BIGGER PAYOFF IS COMING This FALL! Anyone can say they have the "show of the '90s". But THE JOKER'S WILD is the one showing you clearances week after week. NOW 10 OF THE TOP 10! With a promotional package second to none, THE JOKER'S WILD is playing to win this Fall! PRODUCTION STARTS MAY 20th AT CBS TELEVISION CITY! JVummUNIUMI iun; Production A CAROLCO PICTURES COMPANY NEW YORK LOS ANGELES CHICAGO (212) 685 -6699 (213) 289 -7180 (312) 346-6333 Vol. 118 No. 15 Broadcasting ii Apr 9 Subcommittee Chairman 95/ PIONEER ENGINEER Daniel Inouye says that based Hilmer Swanson, senior staff 35/ NAB '90: highlights on views of committee members, telephone company scientist for Harris Corp.'s broadcast division, has from Atlanta entry "may be close call." NAB's annual convention in Atlanta provides forum for discussing competitive challenges facing 66/ TELCO BAN GOES broadcasters from cable, DBS and telcos; BACK TO GREENE "interference consequences" of TV Marti (page 43); U.S. -

Brian 73334 74470 Bank of America’S Brian Moynihan

IA.coverA1.REVISE2.qxd 7/10/09 1:15 PM Page 1 IRISHIRISHAugust/September 2009 AMERICA AMERICACanada $4.95 U.S.$3.95 THE GLORY DAYS OF IRISH IN BASEBALL JUSTICE ROBERTS’ IRISH FAMILY MEMORIES OF THE GREAT HUNGER THE WALL STREET 50 HONORING THE IRISH IN FINANCE The Life DISPLAY UNTIL SEPT. 30, 2009 08 of Brian 74470 73334 Bank of America’s Brian Moynihan on family, Ireland and 09 what the future holds > AIF-Left 7/9/09 12:08 PM Page 1 AIF-Left 7/9/09 12:08 PM Page 2 MutualofAmerica 7/6/09 11:15 AM Page 1 WaterfordAD 7/10/09 2:06 PM Page 1 IA.38-41.rev.qxd 7/10/09 7:36 PM Page 38 38 IRISH AMERICA AUGUST / SEPTEMBER 2008 IA.38-41.rev.qxd 7/10/09 7:36 PM Page 39 WAL L STREET50 KEYNOTE SPEAKER THE LIFE OF Brian Bank of America’s Brian Moynihan says “It doesn’t all break your way all the time, so you’ve got to just power through it.” e has the look of an athlete, com- “He has proved in difficult environments he is pact with broad shoulders. He also very capable,” said Anthony DiNovi, co-president of has something of a pre-game Boston private-equity firm Thomas H. Lee Partners focus, a quiet intensity, and gives LP, in a Wall Street Journal article by Dan the impression, even as he Fitzpatrick and Suzanne Craig. The article addressed answers questions, that he has his Moynihan’s emergence as a right-hand man and eye on the ball and he’s not forget- potential successor to Bank of America Corp. -

Coca-Cola 10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-02217 20FEB200902055832 (Exact name of Registrant as specified in its charter) DELAWARE 58-0628465 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) One Coca-Cola Plaza Atlanta, Georgia 30313 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (404) 676-2121 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered COMMON STOCK, $0.25 PAR VALUE NEW YORK STOCK EXCHANGE Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes ፤ No អ Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). -

Coca Cola Co

SECURITIES AND EXCHANGE COMMISSION FORM 10-K Annual report pursuant to section 13 and 15(d) Filing Date: 2007-02-21 | Period of Report: 2006-12-31 SEC Accession No. 0001047469-07-001328 (HTML Version on secdatabase.com) FILER COCA COLA CO Mailing Address Business Address ONE COCA COLA PLAZA ONE COCA COLA PLAZA CIK:21344| IRS No.: 580628465 | State of Incorp.:DE | Fiscal Year End: 1231 30313 ATLANTA GA 30313 Type: 10-K | Act: 34 | File No.: 001-02217 | Film No.: 07638901 4046762121 SIC: 2080 Beverages Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document QuickLinks -- Click here to rapidly navigate through this document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT ý OF 1934 For the fiscal year ended December 31, 2006 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE o ACT OF 1934 For the transition period from to Commission File No. 1-2217 (Exact name of Registrant as specified in its charter) DELAWARE 58-0628465 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) One Coca-Cola Plaza 30313 Atlanta, Georgia (Zip Code) (Address of principal executive offices) Registrant's telephone number, including area code: (404) 676-2121 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered COMMON STOCK, $0.25 PAR VALUE NEW YORK STOCK EXCHANGE Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

The Journey to Democracy: 1986-1996

The Journey to Democracy: 1986-1996 The Carter Center January 1996 TABLE OF CONTENTS 1. Foreword by Jimmy Carter 2. Introduction by Robert Pastor 3. Timeline 4. Chapter 1: One Journey To Democracy 5. Chapter 2: Defining a Mission 6. Chapter 3: Election Monitoring and Mediating 7. Chapter 4: The Hemispheric Agenda 8. Chapter 5: The Future Appendices I. Latin American and Caribbean Program Staff II. The Council of Freely Elected Heads of Government III. LACP, The Carter Center, and Emory University IV. Publications and Research V. Program Support VI. Some Participants in Conferences and Election-Monitoring Missions FOREWORD As president, I gave Latin America and the Caribbean high priority for several reasons. First, I believed that U.S. relations with our neighbors were among the most important we had for moral, economic, historical, and strategic reasons. Second, in the mid-1970s, the United States had a compelling interest in negotiating new Panama Canal Treaties and in working with democratic leaders and international organizations to end repression and assure respect for human rights. Third, I had a long-term personal interest in the region and had made several rewarding trips there. When I established The Carter Center, I was equally committed to the region. The Carter Center and Emory University recruited Robert Pastor to be director of our Latin American and Caribbean Program (LACP). He served as my national security advisor for Latin American and Caribbean Affairs when I was president and has been the principal advisor on the region to Rosalynn and me ever since. An Emory professor and author of 10 books and hundreds of articles on U.S. -

Coca-Cola Company (Herein Known As Coke) Possesses One of the Most Recognized Brands on the Planet

Table of Contents Introduction ....................................................................................................................... 1 Chapter One: Organizational Profile............................................................................... 3 1.1 Operations ................................................................................................................... 3 1.2 Brands.......................................................................................................................... 4 1.3 Bottling Process ......................................................................................................... 6 1.4 Production Facilities................................................................................................... 8 1.5 Coke Executives and their Salaries .......................................................................... 8 1.6 Board of Directors ...................................................................................................... 9 1.7 Public Relations ........................................................................................................ 10 1.8 University Links ........................................................................................................ 11 Chapter Two: Economic Profile..................................................................................... 14 2.1 Financial Data............................................................................................................ 14 2.2 Joint Ventures -

1 Got Digital?: “Highly Digital” Defined

Got Digital?: Digital Matters Dig●it●tal [dij-i-tl] the translation of analog information (numbers, words, sounds, shapes, images, and more) into electronic data that can easily be stored and shared across networks and devices. Market Disruption. The digitization of information is upending traditional business models, changing the way people interact. Publishing: ebooks replacing paper (Borders run out of business) . Retail: online purchasing lowering brick-and-mortar sales . Music: artists selling directly through iTunes . Universal Impact. Every organization across every industry is impacted in some way. Marketing: “mass customization” of advertizing . Operations: supply-chain optimization . Customer Service: self-service . Growing Expectations of Corporate Leaders. Shareholders, employees and customers increasingly demanding that their leaders understand, leverage digital technologies effectively across the business. 1 Got Digital?: “Highly Digital” Defined “Highly Digital” companies satisfy …and are in short supply. four criteria… “Highly Digital” F500 Companies “Highly Digital” F100 Companies 2% 7% High % of Digital Revenue Sitting “Highly Digital” F100 Boards* CEO/Board Digital Leadership Channels 13% Experience Company Recognized as Transition Leader Highly Digital Board Examples: .Technology: Apple, Cisco, Dell, Google, H-P, Intel, Microsoft, Oracle Highly Digital Company Examples: Amazon, Apple, .Retail: Amazon, Walmart Cisco, Dell, eBay, Google, Microsoft, Oracle, Yahoo, .Financial Services: Berkshire Hathaway seven of which are in the F100. .Consumer: Procter & Gamble .Business Services: FedEx Source: Russell Reynolds Associates Analysis 2 Got Digital?: Key Findings . Disruption and digital status linked. For example, Technology and Retail well represented on the list. “Non-digital” companies boosting digital board status. For example, Berkshire Hathaway, Procter & Gamble and FedEx. Digital Boards Have 3 Common Themes: 1. -

Columbia Pictures: Portrait of a Studio

University of Kentucky UKnowledge Film and Media Studies Arts and Humanities 1992 Columbia Pictures: Portrait of a Studio Bernard F. Dick Click here to let us know how access to this document benefits ou.y Thanks to the University of Kentucky Libraries and the University Press of Kentucky, this book is freely available to current faculty, students, and staff at the University of Kentucky. Find other University of Kentucky Books at uknowledge.uky.edu/upk. For more information, please contact UKnowledge at [email protected]. Recommended Citation Dick, Bernard F., "Columbia Pictures: Portrait of a Studio" (1992). Film and Media Studies. 8. https://uknowledge.uky.edu/upk_film_and_media_studies/8 COLUMBIA PICTURES This page intentionally left blank COLUMBIA PICTURES Portrait of a Studio BERNARD F. DICK Editor THE UNIVERSITY PRESS OF KENTUCKY Copyright © 1992 by The University Press of Kentucky Paperback edition 2010 Scholarly publisher for the Commonwealth, serving Bellarmine University, Berea College, Centre College of Kentucky, Eastern Kentucky University, The Filson Historical Society, Georgetown College, Kentucky Historical Society, Kentucky State University, Morehead State University, Murray State University, Northern Kentucky University, Transylvania University, University of Kentucky, University of Louisville, and Western Kentucky University. All rights reserved. Editorial and Sales Offices: The University Press of Kentucky 663 South Limestone Street, Lexington, Kentucky 40508-4008 www.kentuckypress.com Cataloging-in-Publication Data for the hardcover edition is available from the Library of Congress ISBN 978-0-8131-3019-4 (pbk: alk. paper) This book is printed on acid-free recycled paper meeting the requirements of the American National Standard for Permanence in Paper for Printed Library Materials. -

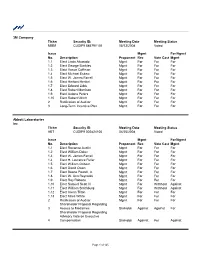

3M Company Ticker Security ID: MMM CUSIP9 88579Y101 Issue No

3M Company Ticker Security ID: Meeting Date Meeting Status MMM CUSIP9 88579Y101 05/13/2008 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Linda Alvarado Mgmt For For For 1.2 Elect George Buckley Mgmt For For For 1.3 Elect Vance Coffman Mgmt For For For 1.4 Elect Michael Eskew Mgmt For For For 1.5 Elect W. James Farrell Mgmt For For For 1.6 Elect Herbert Henkel Mgmt For For For 1.7 Elect Edward Liddy Mgmt For For For 1.8 Elect Robert Morrison Mgmt For For For 1.9 Elect Aulana Peters Mgmt For For For 1.10 Elect Robert Ulrich Mgmt For For For 2 Ratification of Auditor Mgmt For For For 3 Long-Term Incentive Plan Mgmt For For For Abbott Laboratories Inc Ticker Security ID: Meeting Date Meeting Status ABT CUSIP9 002824100 04/25/2008 Voted Issue Mgmt For/Agnst No. Description Proponent Rec Vote Cast Mgmt 1.1 Elect Roxanne Austin Mgmt For For For 1.2 Elect William Daley Mgmt For For For 1.3 Elect W. James Farrell Mgmt For For For 1.4 Elect H. Laurance Fuller Mgmt For For For 1.5 Elect William Osborn Mgmt For For For 1.6 Elect David Owen Mgmt For For For 1.7 Elect Boone Powell, Jr. Mgmt For For For 1.8 Elect W. Ann Reynolds Mgmt For For For 1.9 Elect Roy Roberts Mgmt For For For 1.10 Elect Samuel Scott III Mgmt For Withhold Against 1.11 Elect William Smithburg Mgmt For Withhold Against 1.12 Elect Glenn Tilton Mgmt For For For 1.13 Elect Miles White Mgmt For For For 2 Ratification of Auditor Mgmt For For For Shareholder Proposal Regarding 3 Access to Medicines ShrHoldr Against Against For Shareholder Proposal Regarding Advisory Vote on Executive 4 Compensation ShrHoldr Against For Against Page 1 of 125 Accenture Limited Ticker Security ID: Meeting Date Meeting Status ACN CUSIP9 G1150G111 02/07/2008 Voted Issue Mgmt For/Agnst No. -

A History of Comparative Advertising in the United States

JMO15310.1177/1522637913486092<italic>Journalism & Communication Monographs</italic>Beard 486092research-article2013 Monograph Journalism & Communication Monographs 15(3) 114 –216 A History of Comparative © 2013 AEJMC Reprints and permissions: Advertising in the sagepub.com/journalsPermissions.nav DOI: 10.1177/1522637913486092 United States jcmo.sagepub.com Fred K. Beard1 Abstract This historical monograph addresses a gap in the extensive scholarly research literature devoted to comparative advertising—especially that which contrasts the advertised product, service, or brand with an identifiable competitor—by exploring advertisers’ explanations for its appeal as a tactic throughout the previous century. Prior historical research confirms advertisers have long been aware of and greatly concerned about the unintended consequences of what they often called excessively competitive and combative advertising. Moreover, despite some thirty-five years of systematic scholarly research, two research teams recently concluded that the state of empirical knowledge regarding its effectiveness remains “equivocal.” By synthesizing the extensive theoretical and empirical research literature on comparative advertising and interpreting those findings from a historical perspective, this monograph offers uniquely significant insights into modern advertising’s history, theory, and practice. Keywords comparative advertising, advertising history, advertising message strategy Comparative advertising—especially that which contrasts the advertised product or service