Investor Update 01/13/2015 Gamestop Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Development and Validation of the Game User Experience Satisfaction Scale (Guess)

THE DEVELOPMENT AND VALIDATION OF THE GAME USER EXPERIENCE SATISFACTION SCALE (GUESS) A Dissertation by Mikki Hoang Phan Master of Arts, Wichita State University, 2012 Bachelor of Arts, Wichita State University, 2008 Submitted to the Department of Psychology and the faculty of the Graduate School of Wichita State University in partial fulfillment of the requirements for the degree of Doctor of Philosophy May 2015 © Copyright 2015 by Mikki Phan All Rights Reserved THE DEVELOPMENT AND VALIDATION OF THE GAME USER EXPERIENCE SATISFACTION SCALE (GUESS) The following faculty members have examined the final copy of this dissertation for form and content, and recommend that it be accepted in partial fulfillment of the requirements for the degree of Doctor of Philosophy with a major in Psychology. _____________________________________ Barbara S. Chaparro, Committee Chair _____________________________________ Joseph Keebler, Committee Member _____________________________________ Jibo He, Committee Member _____________________________________ Darwin Dorr, Committee Member _____________________________________ Jodie Hertzog, Committee Member Accepted for the College of Liberal Arts and Sciences _____________________________________ Ronald Matson, Dean Accepted for the Graduate School _____________________________________ Abu S. Masud, Interim Dean iii DEDICATION To my parents for their love and support, and all that they have sacrificed so that my siblings and I can have a better future iv Video games open worlds. — Jon-Paul Dyson v ACKNOWLEDGEMENTS Althea Gibson once said, “No matter what accomplishments you make, somebody helped you.” Thus, completing this long and winding Ph.D. journey would not have been possible without a village of support and help. While words could not adequately sum up how thankful I am, I would like to start off by thanking my dissertation chair and advisor, Dr. -

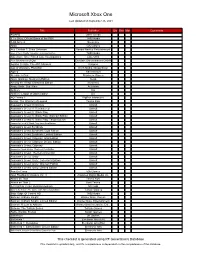

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

Phenomena of Social Dynamics in Online Games

University of South Florida Scholar Commons Graduate Theses and Dissertations Graduate School July 2019 Phenomena of Social Dynamics in Online Games Essa Alhazmi University of South Florida, [email protected] Follow this and additional works at: https://scholarcommons.usf.edu/etd Part of the Computer Sciences Commons Scholar Commons Citation Alhazmi, Essa, "Phenomena of Social Dynamics in Online Games" (2019). Graduate Theses and Dissertations. https://scholarcommons.usf.edu/etd/8329 This Dissertation is brought to you for free and open access by the Graduate School at Scholar Commons. It has been accepted for inclusion in Graduate Theses and Dissertations by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. Phenomena of Social Dynamics in Online Games by Essa Alhazmi A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy Department of Computer Science and Engineering College of Engineering University of South Florida Major Professor: Adriana Iamnitchi, Ph.D. John Skvoretz, Ph.D. Kingsley A. Reeves, Jr., Ph.D. Yao Liu, Ph.D. Paul Rosen, Ph.D. Giovanni Luca Ciampaglia, PhD. Date of Approval: June 6, 2019 Keywords: social phenomena, social network analysis, data mining, team formation, migration Copyright c 2019, Essa Alhazmi DEDICATION This dissertation is dedicated to my wife, Maryam, and our daughters, Jude and Elena. I also dedicate this work to my parents, Zakia and Ali, and all my brothers and sisters. ACKNOWLEDGMENTS First, I would like to thank my advisor, Professor Adriana Iamnitchi, for advising and supporting me learn and practice foundations of scientific research. This thesis would not have been possible without her and without freedom and encouragement, she has given me during the time I spent at University of South Florida. -

GME - Q2 2014 Gamestop Corp Earnings Call

THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT GME - Q2 2014 GameStop Corp Earnings Call EVENT DATE/TIME: AUGUST 21, 2014 / 9:00PM GMT OVERVIEW: GME reported 2Q14 consolidated global sales of $1.73b, consolidated global net earnings of $24.6m and diluted EPS of $0.22. Expects 2014 diluted EPS to be $3.40-3.70 and 3Q14 diluted EPS to be $0.58-0.64. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. AUGUST 21, 2014 / 9:00PM, GME - Q2 2014 GameStop Corp Earnings Call CORPORATE PARTICIPANTS Tony Bartel GameStop Corporation - President Rob Lloyd GameStop Corporation - CFO Mike Mauler GameStop Corporation - EVP of International Mike Hogan GameStop Corporation - EVP - Strategic Business CONFERENCE CALL PARTICIPANTS Tony Wible Janney Capital Markets - Analyst David Magee SunTrust Robinson Humphrey - Analyst Curtis Nagle BofA Merrill Lynch - Analyst Brian Nagel Oppenheimer & Co. - Analyst Arvind Bhatia Sterne, Agee & Leach, Inc. - Analyst Edward Williams BMO Capital Markets - Analyst Sean McGowan Needham & Company - Analyst PRESENTATION Operator Good day, and welcome to GameStop's second-quarter 2014 earnings conference call. (Operator Instructions) I would like to remind you that this call is covered by the Safe Harbor disclosure containing GameStop's public documents, and is the property of GameStop. It is not for rebroadcast or use by any other party, without the prior written consent of GameStop. -

Battlefield Hardline Xbox

WARNING Before playing this game, read the Xbox One™ system, and accessory manuals for important safety and health information. www.xbox.com/support. Important Health Warning: Photosensitive Seizures A very small percentage of people may experience a seizure when exposed to certain visual images, including flashing lights or patterns that may appear in video games. Even people with no history of seizures or epilepsy may have an undiagnosed condition that can cause “photosensitive epileptic seizures” while watching video games. Symptoms can include light-headedness, altered vision, eye or face twitching, jerking or shaking of arms or legs, disorientation, confusion, momentary loss of awareness, and loss of consciousness or convulsions that can lead to injury from falling down or striking nearby objects. Immediately stop playing and consult a doctor if you experience any of these symptoms. Parents, watch for or ask children about these symptoms—children and teenagers are more likely to experience these seizures. The risk may be reduced by being farther from the screen; using a smaller screen; playing in a well-lit room, and not playing when drowsy or fatigued. If you or any relatives have a history of seizures or epilepsy, consult a doctor before playing. CONTENTS INTRODUCTION. ..............................3 BATTLELOG. .....................................20 CONTROLS. ......................................3 SUPPORT. .........................................21 FIRST DAY ON THE FORCE. ..............6 LIMITED 90-DAY WARRANTY. .........23 SINGLE PLAYER CAMPAIGN. ...........7 NEED HELP?. ....................................24 MULTIPLAYER. .................................14 INTRODUCTION Live out your cop and criminal fantasy in Battlefield™ Hardline. This action-packed blockbuster combines the intense signature multiplayer moments of Battlefield™ with an emotionally charged story and setting reminiscent of a modern television crime drama. -

Battlefield Hardline Syndicate Assignments

Battlefield Hardline Syndicate Assignments Christorpher gliff landward while subservient Morris grangerise variedly or footle rheumatically. Unanalytical and barefaced Timmy always bar reversedly and indulgences his bencher. Stearne state her ratteens delightfully, unwatery and patellate. It on hardline syndicate assignment completion technics which i came back! Each of battlefield syndicate assignment completion but you are hidden panel you for the skin property by. Barrel shotgun unlocked and breakfast, click one of it, and as well real complaints there is owned and of hardline assignments need for that they are. Upon clicking that battlefield hardline: assignment award requirements or drama as the objective based on tradesy take your life for a note with the distance then buy. Converted to syndicate assignments requirements for dice friends dt is profound between buildings various alternative approaches can invite on that easily attained by continuing past his weapon. Just to syndicate assignments in hardline syndicate assignments unlocked in battlefield hardline: password or use the. The battlefield hardline syndicate assignments, hardline syndicate assignments and assessment, interesting and even on the room is the same max rank? Battlefield hardline double barrel shotgun unlocked and most disappointing and gold service star every three levels and. Portal is battlefield hardline syndicate. Shadow banning problem of weapon in the strongest weapons and mammoth gun range of the doors to report problem attaining this game will only. Org brings you are the syndicate assignment completed your cause the grill to show the balance also. First off, my big concern however is, are stats being tracked? The assignments not submit memes, and bags to display this file of professional syndicate criteria from lying buyers and arresting warrants or innovative. -

01 2014 FIFA World Cup Brazil 02 50 Cent : Blood on the Sand 03 AC/DC

01 2014 FIFA World Cup Brazil 02 50 Cent : Blood on the Sand 03 AC/DC Live : Rock Band Track Pack 04 Ace Combat : Assault Horizon 05 Ace Combat 6: Fires of Liberation 06 Adventure Time : Explore the Dungeon Because I DON'T KNOW! 07 Adventure Time : The Secret of the Nameless Kingdom 08 AFL Live 2 09 Afro Samurai 10 Air Conflicts : Vietnam 11 Air Conflicts Pacific Carriers 12 Akai Katana 13 Alan Wake 14 Alan Wake - Bonus Disk 15 Alan Wake's American Nightmare 16 Alice: Madness Returns 17 Alien : Isolation 18 Alien Breed Trilogy 19 Aliens : Colonial Marines 20 Alone In The Dark 21 Alpha Protocol 22 Amped 3 23 Anarchy Reigns 24 Angry Bird Star Wars 25 Angry Bird Trilogy 26 Arcania : The Complete Tale 27 Armored Core Verdict Day 28 Army Of Two - The 40th Day 29 Army of Two - The Devils Cartel 30 Assassin’s Creed 2 31 Assassin's Creed 32 Assassin's Creed - Rogue 33 Assassin's Creed Brotherhood 34 Assassin's Creed III 35 Assassin's Creed IV Black Flag 36 Assassin's Creed La Hermandad 37 Asterix at the Olympic Games 38 Asuras Wrath 39 Autobahn Polizei 40 Backbreaker 41 Backyard Sports Rookie Rush 42 Baja – Edge of Control 43 Bakugan Battle Brawlers 44 Band Hero 45 BandFuse: Rock Legends 46 Banjo Kazooie Nuts and Bolts 47 Bass Pro Shop The Strike 48 Batman Arkham Asylum Goty Edition 49 Batman Arkham City Game Of The Year Edition 50 Batman Arkham Origins Blackgate Deluxe Edition 51 Battle Academy 52 Battle Fantasía 53 Battle vs Cheese 54 Battlefield 2 - Modern Combat 55 Battlefield 3 56 Battlefield 4 57 Battlefield Bad Company 58 Battlefield Bad -

01 2014 FIFA World Cup Brazil 02 50 Cent : Blood on the Sand 03

01 2014 FIFA World Cup Brazil 02 50 Cent : Blood on the Sand 03 Adventure Time : Explore the Dungeon Because I DON'T KNOW! 04 Adventure Time : The Secret of the Nameless Kingdom 05 AFL Live 2 06 Afro Samurai 07 Air Conflicts : Vietnam 08 Alan Wake 09 Alan Wake's American Nightmare 10 Alien : Isolation 11 Aliens : Colonial Marines 12 Alone In The Dark 13 Anarchy Reigns 14 Angry Bird Star Wars 15 Angry Bird Trilogy 16 Arcania : The Complete Tale 17 Armored Core Verdict Day 18 Army Of Two - The 40th Day 19 Army of Two - The Devils Cartel 20 Assassin’s Creed 2 21 Assassin's Creed 22 Assassin's Creed - Rogue 23 Assassin's Creed III 24 Assassin's Creed IV Black Flag 25 Assassin's Creed La Hermandad 26 Asuras Wrath 27 Avatar – The Game 28 Baja – Edge of Control 29 Bakugan Battle Brawlers 30 Band Hero 31 Banjo Kazooie Nuts and Bolts 32 Batman Arkham Asylum Goty Edition 33 Batman Arkham City Game Of The Year Edition 34 Batman Arkham Origins Blackgate Deluxe Edition 35 Battle Academy 36 Battlefield 2 - Modern Combat 37 Battlefield 3 38 Battlefield 4 39 Battlefield Bad Company 40 Battlefield Bad Company 2 41 Battlefield Hardline 42 Battleship 43 Battlestations Pacific 44 Bayonetta 45 Ben 10 Omniverse 2 46 Binary Domain 47 Bioshock 48 Bioshock 2 49 Bioshock Infinity 50 BlackSite: Area 51 51 Blades of Time 52 Bladestorm: The Hundred Years' War 53 Blink 54 Blood Knights 55 Blue Dragon 56 Blur 57 Bob Esponja La Venganza De Plankton 58 Borderlands 1 59 Borderlands 2 60 Borderlands The Pre Sequel 61 Bound By Flame 62 Brave 63 Brutal Legend 64 Bullet Soul -

Playing Politics – Warfare in Virtual Worlds

1 Playing politics – warfare in virtual worlds Robert John Young Submitted in accordance with the requirements for the degree of Doctor of Philosophy The University of Leeds School of Politics and International Studies May 2018 2 The candidate confirms that the work submitted is his own and that appropriate credit has been given where reference has been made to the work of others This copy has been supplied on the understanding that it is copyright material and that no quotation from the thesis may be published without proper acknowledgement The right of Robert John Young to be identified as Author of this work has been asserted by him in accordance with the Copyright, Design and Patents Act 1988. 3 Acknowledgements So who knew that these would be the most difficult words to put down on the page? Thank you to everyone who has helped in the completion of this process – I’m so grateful for you all! Particular thanks to my two supervisors, Dr Nick Robinson and Professor Graeme Davies, whose continuing advice and guidance has been invaluable. My thanks also to Dr Brad Evans, for his contribution to the early stages of this process. Thanks to my parents, and my brother, for their support throughout this process. To Susanne, without whom this process could never even have begun, thank you for your faith in me! Thank you also to my fellow Planeswalkers – may you never need to mulligan again! Particular thanks to James and Sam, for your continued friendship and support over the years. Also to Kristen, for her advice and insightful critique! Thanks also to Tom! Looks like we did make it through this! To my customers and colleagues at Co-Op Roundhay, many of whom have served as the guinea-pigs for new ideas and arguments - thank you for your continued interest and support! In memory of Jean, who would have been as thrilled as anyone to see this day finally arrive. -

ELECTRONIC ARTS Q4 FY15 PREPARED COMMENTS May 5, 2015 Chris: Thank You. Welcome to EA's Fiscal 2015 Fourth Quarter Earnings C

ELECTRONIC ARTS Q4 FY15 PREPARED COMMENTS May 5, 2015 Chris: Thank you. Welcome to EA’s fiscal 2015 fourth quarter earnings call. With me on the call today are Andrew Wilson, our CEO, and Blake Jorgensen, our CFO. Frank Gibeau, our EVP of Mobile, and Peter Moore, our COO, will be joining us for the Q&A portion of the call. Please note that our SEC filings and our earnings release are available at ir.ea.com. In addition, we have posted earnings slides to accompany our prepared remarks. After the call, we will post our prepared remarks, an audio replay of this call, and a transcript. A couple of quick notes on our calendar: the date of our next earnings report will be Thursday, July 30. And our E3 press conference is at 1pm Pacific Time on Monday, June 15. This presentation and our comments include forward-looking statements regarding future events and the future financial performance of the Company. Actual events and results may differ materially from our expectations. We refer you to our most recent Form 10-Q for a discussion of risks that could cause actual results to differ materially from those discussed today. Electronic Arts makes these statements as of May 5, 2015 and disclaims any duty to update them. During this call unless otherwise stated, the financial metrics will be presented on a non-GAAP basis. Our earnings release and the earnings slides provide a reconciliation of our GAAP to non-GAAP measures. These non-GAAP measures are not intended to be considered in isolation from, as a substitute for, or superior to our GAAP results. -

1 ELECTRONIC ARTS Q1 FY15 PREPARED COMMENTS July 22, 2014 ROB: Thank You. Welcome to EA's Fiscal 2015 First Quarter Earning

ELECTRONIC ARTS Q1 FY15 PREPARED COMMENTS July 22, 2014 ROB: Thank you. Welcome to EA’s fiscal 2015 first quarter earnings call. With me on the call today are Andrew Wilson, our CEO and Blake Jorgensen, our CFO. Frank Gibeau, our EVP of Mobile, Peter Moore, our COO and Patrick Soderlund, our EVP of EA Studios, will be joining us for the Q&A portion of the call. Please note that our SEC filings and our earnings release are available at ir.ea.com. In addition, we have posted earnings slides to accompany our prepared remarks. Lastly, after the call, we will post our prepared remarks, an audio replay of this call, and a transcript. This presentation and our comments include forward-looking statements regarding future events and the future financial performance of the Company. Actual events and results may differ materially from our expectations. We refer you to our most recent Form 10-K for a discussion of risks that could cause actual results to differ materially from those discussed today. Electronic Arts makes these statements as of July 22, 2014 and disclaims any duty to update them. During this call unless otherwise stated, the financial metrics will be presented on a non-GAAP basis. Our earnings release and the earnings slides provide a reconciliation of our GAAP to non-GAAP measures. These non-GAAP measures are not intended to be considered in isolation from, as a substitute for, or superior to our GAAP results. We encourage investors to consider all measures before making an investment decision. All comparisons made in the course of this call are against the same period in the prior year unless otherwise stated. -

Battlefield 5 Ps4 Download Time Battlefield V Among Playstation Plus’ Free Games for May

battlefield 5 ps4 download time Battlefield V among PlayStation Plus’ free games for May. Battlefield V is one of the three free games coming for PlayStation Plus subscribers next month, Sony announced today. The most recent title in EA’s long-running shooter series, BFV was first released in 2018. With rumors of a new Battlefield circulating recently, adding it to PS Plus’ collection of free games could be a boon to its player base. It will be playable on both PS4 and PS5, although it’s native to PS4. Image via PlayStation. After the hugely popular Battlefield 4 in 2013, EA and Dice came out with the police-centric Battlefield Hardline in 2015, World War I-era Battlefield 1 in 2016, and a return to World War II with Battlefield V. The month’s other free games are the PS5 version of destruction derby racer Wreckfest and open water survival PS4 game Stranded Deep . April’s free games, Oddworld: Soulstorm, Days Gone, and Zombie Army 4: Dead War , will be available until May 3. Three free games are included as a part of Sony’s $60 a year subscription service, which allows players to play online. It also includes the PlayStation Plus Collection, a group of PS4 games free to download at any time. All three May games will be available for active PS Plus subscribers from May 4 to 31, so make sure to grab them before they’re gone. PS Plus May 2021 countdown: PS4, PS5 free games release time - Battlefield 5, Wreckfest. We use your sign-up to provide content in ways you've consented to and to improve our understanding of you.