Prefin-En.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fair Trade 1 Fair Trade

Fair trade 1 Fair trade For other uses, see Fair trade (disambiguation). Part of the Politics series on Progressivism Ideas • Idea of Progress • Scientific progress • Social progress • Economic development • Technological change • Linear history History • Enlightenment • Industrial revolution • Modernity • Politics portal • v • t [1] • e Fair trade is an organized social movement that aims to help producers in developing countries to make better trading conditions and promote sustainability. It advocates the payment of a higher price to exporters as well as higher social and environmental standards. It focuses in particular on exports from developing countries to developed countries, most notably handicrafts, coffee, cocoa, sugar, tea, bananas, honey, cotton, wine,[2] fresh fruit, chocolate, flowers, and gold.[3] Fair Trade is a trading partnership, based on dialogue, transparency and respect that seek greater equity in international trade. It contributes to sustainable development by offering better trading conditions to, and securing the rights of, marginalized producers and workers – especially in the South. Fair Trade Organizations, backed by consumers, are engaged actively in supporting producers, awareness raising and in campaigning for changes in the rules and practice of conventional international trade.[4] There are several recognized Fairtrade certifiers, including Fairtrade International (formerly called FLO/Fairtrade Labelling Organizations International), IMO and Eco-Social. Additionally, Fair Trade USA, formerly a licensing -

Fair Trade : Market-Driven Ethical Consumption

Fair Trade Market-Driven Ethical Consumption Alex Nicholls & Charlotte Opal eBook covers_pj orange.indd 86 21/4/08 15:34:02 Nicholls Prelims.qxd 5/9/2005 12:21 PM Page i FAIR TRADE Nicholls Prelims.qxd 5/9/2005 12:21 PM Page ii Nicholls Prelims.qxd 5/9/2005 12:21 PM Page iii FAIR TRADE MARKET-DRIVEN ETHICAL CONSUMPTION Alex Nicholls and Charlotte Opal SAGE Publications London ●●Thousand Oaks New Delhi Nicholls Prelims.qxd 5/9/2005 12:21 PM Page iv © Alex Nicholls and Charlotte Opal, 2005 Chapter 5 © Whitni Thomas, 2005 First published 2004 Apart from any fair dealing for the purposes of research or private study, or criticism or review, as permitted under the Copyright, Designs and Patents Act, 1988, this publication may be reproduced, stored or transmitted in any form, or by any means, only with the prior permission in writing of the publishers, or in the case of reprographic reproduction, in accordance with the terms of licences issued by the Copyright Licensing Agency. Enquiries concerning reproduction outside those terms should be sent to the publishers. SAGE Publications Ltd 1 Oliver’s Yard 55 City Road London EC1Y 1SP SAGE Publications Inc. 2455 Teller Road Thousand Oaks, California 91320 SAGE Publications India Pvt Ltd B-42, Panchsheel Enclave Post Box 4109 New Delhi 110 017 British Library Cataloguing in Publication data A catalogue record for this book is available from the British Library ISBN 1 4129 0104 9 ISBN 1 4129 0105 7 (pbk) Library of Congress Control Number: 20041012345 Typeset by C&M Digitals (P) Ltd., Chennai, India Printed in Great Britain by The Cromwell Press Ltd,Trowbridge,Wiltshire Printed on paper from sustainable resources Nicholls Prelims.qxd 5/9/2005 12:21 PM Page v Let us spread the fragrance of fairness across all aspects of life. -

Towards a Global Programme on Market Access: Opportunities and Options

Towards a Global Programme on Market Access: Opportunities and Options Report prepared for IFAD1 Sheila Page April 2003 ODI 111, Westminster Bridge Road London SE1 7JD Tel: +44 20 7922 0300 Fax: +44 20 7922 0399 Email: [email protected] Contents Summary 1 Market access as an instrument of development 3 What do we mean by market access? 5 Poverty and markets 7 The stages of ‘market access’ 7 Awareness of possibility of exporting 8 Familiarity with buyers 8 Familiarity with standards, including health and safety 9 Access to equipment and other inputs 10 Access to investment capital 10 Access to working capital 10 Access to appropriate labour 10 Technology 11 Organisation and orientation of firm 11 Legal regimes 11 Transport and communications, local 11 Transport and communications, international 12 Tariffs and non-tariff barriers 12 Other trading conditions 13 Which problems matter, for how long? 13 Different ways of providing market access: advantages and disadvantages 14 Direct foreign investment and ownership 14 Large direct private buyers 15 Initiatives by developing country producers 16 Alternative trading companies 17 Export promotion agencies (and other local government policy) 21 Import promotion agencies 22 Aid programmes 23 Targeted technical research 24 Agencies promoting small production 25 Complementarities and differences among market structures 26 Possible initiatives by IFAD 30 2 Table 1 How different initiatives affect the necessary conditions for market access 33 Table 2 Direct and Indirect Effects on Poverty 35 Table -

Investment Review

Volume 7, Issue 1, 2011 AU 10252 AU CA 94105 SAN FRANCISCO, 101 MARKET STREET F U N M I T M Y O ederal C D E V E C E L N O T E P R M F r E O N R eserve T IN VE S STMENT B ank o F s an F rancisco Community Develop Community Development INVESTMENT REVIEW www.frbsf.org/cdinvestments Articles Global Agricultural Value Chains: Sustainable Growth as a Means for Sustainable Development ment Investment Review Patricia Lee Devaney, Root Capital International Housing Partnership Exchange Thomas A. Bledsoe and Paul Weech, Housing Partnership Network Catalyzing American Retail Investment in Community Development Finance: What Can We Learn from Other SRI Success Stories? Caroline Bressan and Eliza M. Erikson, Calvert Foundation Unlocking Local Capital for Development: Shared Interest’s Guarantee Fund for South Africa Donna Katzin, Shared Interest and Robert Rosenbloom, Strategic Philanthropy Advisors, LLC Translating Plain English: Can the Peterborough Social Impact Bond Construct Apply Stateside? Drew von Glahn and Caroline Whistler, Third Sector Capital Partners Learning Social Metrics from International Development Paul Veldman, Columbia University Commentary The Latest Frontiers for Financial Inclusion: Using Mobile Phones to Reach the Unbanked Volume 7, Issue 1, 2011 Volume Tillman Bruett, UN Capital Development Fund CRA Goes Global: A Good Idea in the United States Could Use a Makeover and a Bigger Audience POSTAGE & FEES PAID POSTAGE SAN FRANCISCO, CA SAN FRANCISCO, David A. Smith, Affordable Housing Institute PERMIT NO. 752 PERMIT NO. PRSRT -

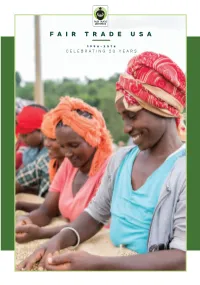

F a I R T R a D E U

FAIR TRADE USA FAIR AL AL REPORT CELEBRATING 20 YEARS CELEBRATING 2018 ANNU 1998-2018 I AIR TRADE USA F I 1 DEAR FRIENDS, More than twenty years ago, an idealistic, young do-gooder (that would be me) brought an idea from Nicaragua to a one room office in Oakland, California. What started with coffee and conviction has grown into a global movement. Fair Trade USA is now the leading certifier of Fair Trade products in North America. There wouldn’t have been a one room Everyone did their part to make Fair office without the Ford Foundation Trade work, grow, and thrive. Fair Trade betting on us with our first grant. That USA simply wouldn’t have survived grant enabled conviction to become over 20 years or reached over 1 million confidence. families around the world without the everyday heroes who joined us to For Fair Trade USA to become challenge the status quo and re-imagine sustainable we needed more than capitalism. grant dollars. Early partners like Equal AL REPORT Exchange and Green Mountain Coffee We established Fair Trade USA as a signed on to the “crazy” notion of different kind of organization—a mission- buying Fair Trade Certified™ coffee and driven nonprofit that generates earned putting our seal on their products. These revenue and is financially sustainable. 2018 ANNU partnerships primed us to become a One that helps mainstream companies viable organization generating impact for combine sustainability and profitability. farmers worldwide. One that serves farmers, workers, I companies, consumers, and the earth, Our model would have collapsed without based on mutual benefit and shared those first consumers willing to buy Fair value. -

3612 Annual Review 06

Finance for fair trade and support for disadvantaged producers Annual Review for the year ended 30 September 2006 Moderator’s statement Shared Interest is a part of a worldwide movement to promote fairer world trade. As we approach the 200th anniversary of the UK Parliament’s abolition of the slave trade it is sobering to reflect that slavery was for a long time regarded as an essential element of the economic process by which Britain prospered. We may have made slavery illegal, but tens of millions of people are still bound by the shackles of economic injustice. Shared Interest’s pioneering role in finance for fair trade is significant. The past year, our sixteenth trading year, has seen us pass some important milestones: members’ share capital topped £20 million for the first time; direct loans to producers doubled to £1.9 million (showing faster growth than our traditional lending to fair trade importers); we established a regional presence in Kenya and in Costa Rica; and the Shared Interest Foundation hosted its first producer training event. Growth in members’ capital is vital to support our aims to increase longer term loans to fair trade producers. Our regional presence helps us to identify potential borrowers, process loan applications more quickly and identify producers’ training requirements. Two years ago we began to invest in changes to make the Society more effective in supporting our investors and borrower customers. These new business developments are not yet complete and the trading results this year, a profit of £45,000 after share interest, fell slightly short of our plan. -

Assessing the Impact of Fairtrade Cocoa in Peru

08 Fall ASSESSING THE IMPACT OF FAIRTRADE FOR PERUVIAN COCOA FARMERS Karine Laroche, Roberto Jiménez, and Valerie Nelson June 2012 Natural Resources Institute, University of Greenwich 1 TABLE OF CONTENTS Page No. Abbreviations and Acknowledgements 4 List of boxes, tables and figures 5 1. Introduction 8 2. Methodology 8 Conceptual framework 8 Key steps in methodology 11 Sampling framework 12 Limitations 13 3. Context of cocoa trade 14 International market and trends 14 Organic cocoa market 20 Cocoa in Peru 20 Fairtrade market and trends 25 4. National and regional context 28 Economic context 28 Livelihood activities in San Martin 29 Socio-cultural characteristics of the area 29 Historical context 30 Structure and governance of the SPOs 31 Fairtrade and Fairtrade cocoa in Peru 33 5. Impact of Fairtrade on the social structure 33 Ability to participate in Fairtrade 33 Ability to benefit from Fairtrade 36 Gender issues 39 Farm labour 41 6. Impact of Fairtrade on the socio-economic situation of producers, workers and the 42 members of their households Producer prices 42 Profitability of production systems 46 Producer income stability and levels 49 Farmer livelihood assets and productive investments 52 Cash flow management 55 Stability of family farming 56 Household food security 58 7. Organization of producers 61 Structuring of the rural community 64 Use of the Fairtrade Premium 63 Influence on other producer organisations in the region 65 SPO capitalization and Fairtrade 66 SPO administrative and management capacities 68 Organizational business development 69 Quality 71 Diversification of products 72 Number and diversity of buyers 73 Negotiation, advocacy and networking capacity 77 Producer organization services 80 8. -

SHARED INTEREST SOCIAL ACCOUNTS for the Year Ended 30 September 2006

SHARED INTEREST SOCIAL ACCOUNTS for the year ended 30 September 2006 Shared Interest Society Limited 2 Cathedral Square, An Industrial and Provident Society Groat Market, Registered Number 27093R Newcastle upon Tyne And NE1 1EH Shared Interest Foundation, Tel 0191 233 9100 Registered Charity Number 1102375 www.shared‑interest.com Social Accounts for the year ended 30 September 2006 Acknowledgements Shared Interest is very grateful for the help and advice received during the preparation of these accounts. We would like to thank everyone who has been involved, especially John Pearce, Chris Pay, Jane Gibbon and Keith Stamp for taking part in the Social Audit Panel and David Parker from Alpha Communication for supporting the preparation of the report. The Social Audit Network and Co‑operatives UK have both been a useful source of guidance and training. We are grateful to the staff team involved in the process of preparing this second set of social accounts, particularly Amy McIntosh, Francesca Smith, John Grady, Lis Dales and Tracy Bonham as well as to other staff who contributed to specific areas particularly, Claire Brown, Kirsteen Bonar, Phoebe Richardson and Stuart Raistrick. Finance for fair trade and support for disadvantaged producers 2 Social Accounts for the year ended 30 September 2006 Contents Page 1 Welcome 4 2 History and Background 5 2.1 Shared Interest 5 2.2 Social accounts 7 3 Vision, Mission, Values, Objectives and Activities 8 3.1 Vision and values 8 3.2 Mission 8 3.3 Objectives and activities 9 3.4 Main issues, achievements, -

Beautiful Handcrafts That Don't Cost the Earth

QUARTERLY RETURN 102 WINTER 2016/17 BEAUTIFUL HANDCRAFTS THAT DON’T COST THE EARTH A HARMONIOUS RELATIONSHIP BETWEEN PEOPLE AND PLANET Sustaining a precious relationship in the Peruvian Amazon. A COMMITMENT WITH NATURE Leading the way in agricultural best practice and high quality production. WHAT’S UP WITH MAMBO COFFEE? Showcasing speciality coffee in Kenya. WELCOME Happy New Year to you all New customer, Allpa – which and I hope you had a great means ‘earth’ in Quechua Indian SPEAKING Christmas. We were delighted – is a fair trade handcraft producer OPPORTUNITIES to receive such a positive group in Peru. Read more about response to our Christmas their journey on pages 6 and 7. card, and thank you to Thank you to all who As part of our continued drive to responded to our call everyone who invested reduce our paper usage, instead for volunteers to speak further with us over the of sending you a full copy of the festive period. Annual Review, we have produced in your local area. a summary of both the Society ‘Your actions change lives’ is the and Foundation activities over We continue to receive enquiries and are working hard to deal with these message for this year’s Fairtrade the year, inside this issue of QR. requests. One invitation came from Fortnight and as Shared Interest If you would prefer to read the investors, you are changing lives member Geoffrey Lock, in Bristol, who full version, please contact invited ambassador Chris Fox to speak every single day. [email protected], at the Rotary Club of Clifton’s November or call 0191 233 9103. -

Download the 2014 Annual Report And

The Fairtrade Foundation Annual Report And Financial Statements For the year ended 31 December 2014 The Fairtrade Foundation 3rd Floor, Ibex House, 42-47 Minories, London, EC3N 1DY Tel: 020 7405 5942 Fax: 020 7977 0101 email: [email protected] website: www.fairtrade.org.uk Registered in England and Wales as a company limited by guarantee: No. 2733136 Registered Charity No. 1043886 Contents Page Trustees’ report 1 Objectives and activities 1 Strategic report: - Achievements and performance in 2014 3 - Plans for 2015 and beyond 11 - Financial review 12 - Principal risks and uncertainties 14 Structure, governance and management 14 Independent Auditor’s report 18 Financial statements Statement of Financial Activities 20 Balance sheet 21 Cashflow statement 22 Notes to the financial statements 23 Reference and administrative information 36 The Fairtrade Foundation Trustees’ Report (incorporating the Report of the Directors) For the year ended 31 December 2014 The trustees, who are also directors of the charity for the purposes of the Companies Act, present their annual report and financial statements of the Fairtrade Foundation (the “charity”) for the year ended 31 December 2014. The Reference and Administrative Information on pages 36 and 37 form part of this report. Objectives and activities The objects of the Fairtrade Foundation are formally set out in the Memorandum and Articles of Association as: Relieving poverty, suffering and distress in any part of the world; and Promoting research into and education concerning the causes and effects of poverty, particularly in relation to the conduct of trade and to the conditions of employment (including self-employment) of poor people in any part of the world, and publishing the useful results of that research. -

TX Capability Statement

Traidcraft Exchange Capability Statement Introduction Best known for pioneering fair trade in the UK, Traidcraft comprises both a trading company, with product sales of about £11.7 million in 2014/15, and a development charity. Unlike other charity/trading company models, Traidcraft plc does not exist to raise funds for the charity. It is a social enterprise, proving that it is possible to run a successful business on fair and ethical principles. Traidcraft Exchange – Traidcraft’s charity – is the UK’s leading international development charity focusing exclusively on trade. We manage programmes of development work that enable poor producers to grow businesses, find markets and engage in local and international trade. Working with a range of partner organisations, we help producers overcome the barriers that prevent them from selling their products and provide training and information services that develop their business skills. Traidcraft plc – Traidcraft’s trading company – buys products from poor producer groups on a fair trade basis and markets these in the UK. Traidcraft Exchange benefits from the plc’s practical knowledge and experience of the needs and constraints faced by producers in developing countries. This enables us to develop more practical, appropriate and effective projects. Similarly, the plc benefits from Traidcraft Exchange’s international development experience, which helps it to provide appropriate support to its suppliers. This unique structure gives us opportunities to influence opinion and behaviour in the charitable, business and public sectors. With a joint management team we combine our practical, commercial expertise with our deep-rooted developmental approach to trade. This makes us ideally placed to act as a catalyst and to influence opinion and behaviour across private, public and charitable sectors. -

Fairtrade Foundation Annual Review 2008/2009 Highlights in Numbers

Fairtrade Foundation Annual Review 2008/2009 Highlights in numbers High awareness 7 in 10 people recognise the FAIRTRADE Mark Higher sales Over £700m spent on Fairtrade goods in the UK in 2008 More people Producer groups in 56 developing countries from Rwanda to Vietnam now supply the UK market More products 1,514 new Fairtrade products on shelves for fi rst time in 2008 Leading the way Worldwide, Fairtrade in the UK still the most dynamic and innovative Citrus in South Africa Fairtrade in South Africa works within Black Economic Empowerment legislation. Workers on Zebediela, a farm growing Fairtrade certifi ed citrus fruit, have used their Fairtrade premiums to invest in a crèche for workers’ children, allowing parents to bring in extra money for their families. Welcome The Fairtrade Foundation is the independent charity based in the UK that licenses use of the FAIRTRADE Mark on products that meet internationally agreed Fairtrade standards. As Chair of the Fairtrade Foundation, I’m delighted Our vision to present the Annual Review for 2008/2009. In the Our vision is of a world in which justice and second year of our Tipping the Balance strategy, we sustainable development are at the heart of trade now face not only the goals we set ourselves, of structures and practices so that everyone, through scaling up the reach and impact of Fairtrade, but their work, can maintain a decent and dignifi ed also the challenges imposed upon us by the global livelihood and develop their full potential. To achieve economic downturn. My experience in building strong this vision, Fairtrade seeks to transform trading brands and consumer marketing allows me to be structures and practices in favour of the poor and confi dent that shoppers will continue to trust in and disadvantaged.