For Personal Use Only Use Personal for Scheme, Other Than As a Wameja Shareholder Or Wameja DI Holder

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

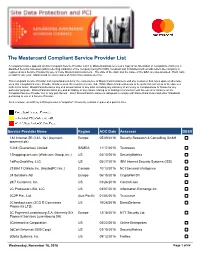

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Payments Market Update SUMMER 2020 Payments Market Update–Summer 2020

Payments Market Update SUMMER 2020 Payments Market Update–Summer 2020 Dear Clients and Friends, Houlihan Lokey is pleased to present its Payments Market Update for the summer of 2020. We hope that you and your families remain safe and healthy. We have continued adapting to this fluid market and are busy helping our clients navigate financing, M&A, and other strategic alternatives. Please reach out to any of us if you would like to connect or brainstorm regarding any current needs or sector topics. We have included industry insights, select recent transaction announcements, and a public markets overview to help you stay ahead in our dynamic industry. We hope you find this update to be informative and that it serves as a valuable resource to you in staying abreast of the market. We look forward to staying in touch. Kind regards, Rob Freiman Director, Fintech [email protected] 212.497.7859 Additional Houlihan Lokey Fintech Contacts Corporate Finance Financial and Valuation Advisory Mark Fisher Tim Shortland David Sola Andrew Stull Oscar Aarts Managing Director Managing Director Managing Director Managing Director Director [email protected] [email protected] [email protected] [email protected] [email protected] Kegan Greene Chris Pedone Reggie Graham Director Director Senior Vice President [email protected] [email protected] [email protected] Payments Subsectors Covered: B2B PAYMENTS BLOCKCHAIN CREDIT CARDS DEBIT CARDS DISBURSEMENTS FOREIGN EXCHANGE FRAUD PROTECTION INTEGRATED PAYMENTS ISSUER PROCESSING LOAN PROCESSING LOYALTY/ REWARDS MERCHANT ACQUIRING MOBILE PAYMENTS MONEY TRANSFER NETWORKS P2P PAYMENTS PAYMENT FACILITATORS POS HARDWARE POS SOFTWARE / ISVs PREPAID UNATTENDED / KIOSKS / ATMS VERTICAL PAYMENTS 2 Market Insights and Observations While the COVID-19 pandemic reduced economic activity (and associated payments) across the globe, the crisis is likely to accelerate innovation across the sector. -

Transactionwatch

TransactionWatch Week of: Weekly Newsletter For Payments Executives That Covers The Most Important March 30th – April 3rd And Relevant Merchant Acquiring Deals And Activity This report is based upon information considered reliable by The Strawhecker Group® (TSG), but the accuracy and completeness of such information is not guaranteed or warranted to be error-free. Information provided is as reasonably available, not to be deemed all inclusive. TSG assumes no obligation to update the content hereof. This report is subject to the terms and conditions of a separate license with recipient, is further protected by copyright under U.S. Copyright laws and is the property of TSG. Recipient may not copy, reproduce, distribute, publish, display, modify, create derivative works, transmit, exploit, or otherwise disseminate any part of this report except as expressly permitted under recipient’s license with TSG. The Strawhecker Group (TSG) is not endorsed, sponsored by, or in any other way affiliated with any companies identified in this presentation. The trademarks of third parties displayed herein are the property of such parties, and, are provided merely for identification purposes. TSG claims no rights therein. This document has not been prepared, approved or licensed by any entity identified in this report. © Copyright 2020. The Strawhecker Group ®. All Rights Reserved. Deal Activity Summary March 30th – April 3rd This Week’s M&A Overview Table of Contents In the wake of the COVID-19 pandemic, activity in the overall M&A space has Deal Activity Summary seen a slowdown across a wide range of industries, including merchant acquiring. As small-to-medium sized businesses (SMBs) take a hit due to lower COVID-19 Industry Impact consumer spending or temporary closures, many merchant acquirers and Historical M&A Tracker payment processors are largely affected. -

The European Payments Industry Consolidates Around Its Two Largest Players

Rise of the champions: the European Payments industry consolidates around its two largest players Introduction From barters and coins to cash pooling to cashless exchanges, the payments industry has undergone a massive transformation since its inception. During the era of booming e-commerce, payment methods are evolving rapidly, with the scope of becoming faster, simpler, and more secure for all parties. The main segments of the payment ecosystem include acquirers/processors, issuers, card networks, gateways, ISOs/MSPs, and non card payments. 1. Acquirers/processors Acquiring (merchant) banks, also known as payment processors , (e.g., Worldpay, Worldline, Barclaycard, First Data, Nexi, Ingenico, Nets) process credit and debit card payments on behalf of a merchant, that is a business that wants to take card payments. Acquirers allow merchants to accept payments from the card-issuing banks (see point 3) through a point of sale terminal. They offer both the hardware and the software needed to “acquire” the payments, meaning to receive it and correctly linking it to a network on the likes of Mastercard. Oftentimes, these players also develop software that the banks use to handle the volume of payments and even perform analysis on the flows. This is a particularly interesting and value added area that is receiving a lot of attention lately, as for the commercial banks it is more and more cost effective to rely on external IT software rather than bear the costs of developing it in-house. In that regard, a particular solution is the ‘Payment as a Service’ (‘PaaS’) technology, which uses the Software-as-a-Service (‘SaaS’) model to connect a group of international payment systems, simplifying payments for the end customer. -

Payments Insights. Opinions. Volume 21

#payments insights. opinions. Customer expectations, Three forces pushing banks to modernize payments technology and regulation infrastructure demand that financial organizations update payments Payments systems have always been complex and a critical part of the banking world. systems before the next wave But over the past decade, dynamic changes within payments have created even greater challenges for financial organizations and have driven the need for payments of disruption. transformation. In particular, more complex regulation, advancing technology and demands from customers to create a consistent, seamless experience across multiple channels are pushing banks, FinTechs and payment processors to invest heavily in payments modernization. Upgrading infrastructure to address these challenges, while keeping costs under control, requires financial organizations to first understand the drivers of change. Continued on page 3 Volume 26 03 Three forces pushing banks to modernize payments infrastructure Customer expectations, technology and regulation demand financial organizations update payments systems before the next wave of disruption. 05 How Africa’s growing mobile money market is evolving Africa’s fast-growing mobile money market offers opportunities to boost financial inclusion and tap the continent’s economic potential. Editorial 08 Welcome to the first issue of #payments for 2020. Can issuing capabilities strengthen acquirers’ competitive position? In this newsletter, we explore a diverse set of topics that we know are top of mind Since European Union (EU) regulators introduced a for many financial institutions this year. fee cap on credit card transactions, acquirers have been seeking new ways to boost margins. Some are • The ongoing challenge to modernize payments architecture is explored in an now issuing their own cards, to protect profitability and create competitive advantage. -

Payments Market Update FALL 2020 Payments Market Update—Fall 2020

Payments Market Update FALL 2020 Payments Market Update—Fall 2020 Houlihan Lokey is pleased to present its Payments Market Update for the fall of 2020. Dear Clients and Friends, We are pleased to present our Payments Market Update for the fall of 2020. We hope that you and your families remain safe and healthy. We have continued adapting to this fluid market and are busy helping our Rob Freiman clients navigate M&A, financing, and other strategic alternatives. Please reach out to any of us if you would Director, Fintech like to connect or brainstorm regarding any current needs or sector topics. [email protected] We have included industry insights, select recent transaction announcements, and a public markets 212.497.7859 overview (including some new additions, such as Nuvei and Shift4, with Billtrust coming soon) to help you stay ahead in our dynamic industry. We hope you find this update to be informative and that it serves as a valuable resource to you in staying abreast of the market. We look forward to staying in touch. Cheers, Additional Houlihan Lokey Fintech Contacts Corporate Finance Financial and Valuation Advisory Mark Fisher Tim Shortland David Sola Andrew Stull Oscar Aarts Managing Director Managing Director Managing Director Managing Director Director [email protected] [email protected] [email protected] [email protected] [email protected] Kegan Greene Chris Pedone Reggie Graham Director Director Senior Vice President [email protected] [email protected] [email protected] Payments Subsectors Covered: B2B PAYMENTS BLOCKCHAIN CREDIT CARDS DEBIT CARDS DISBURSEMENTS -

No Good Merchant Left Behind

VOLUME FIFTEEN, NUMBER EIGHT • DIGITAL TRANSACTIONS.NET • AUGUST 2018 20182018 AA handbookhandbook ofof vendorsvendors toto thethe NorthNorth AmericanAmerican paymentspayments marketmarket hello future. Tomorrow’s payment possibilities today. TSYS® has harnessed the power of payments so you can help businesses achieve their full potential in today’s ever-changing world. Through continuous innovation and our comprehensive suite of solutions, the possibilities are endless. UNIFIED COMMERCE • INTEGRATED POS • PAYMENTS • PREPAID CARDS Call 866.969.3350 ©2018 Total System Services, Inc. TSYS® is a federally registered service mark of Total System Services, Inc.® All rights reserved. TS8040 DIGITALTRANSACTIONS.NET CONTENTS August 2018 ■ Volume 15, Number 8 The Gimlet Eye 4 Steadiness in a Dizzying World BUYERS’ GUIDE 2018 ACH Information & Education . Gift Cards . Payment Management . ACH Processing . Global Acquirers . Payment Processing . Acquiring Banks . Healthcare Payments . Payment Software . Age Verification . High Risk Processing . Payments Education . Agent & ISO Programs . Identity Verification . Payments Research . Alternative Payments . Imaging Services . PCI Compliance . Associations. Imprinter Equipment & Supplies . PCI Security . ATM Equipment & Services . Incident Response & Forensics . Portfolio Assessment . Auto ID/RFID Technologies . Independent Sales Organizations Portfolio Purchases . Automated Sales Tax Solutions . (ISOs) . Portfolio Sales . Bar Code Technology . Independent Software Vendors (ISVs) . -

Finance & Technology Market Update

Finance & Technology Market Update Q3:2017 Issue Financial Technology ISVs / VARs | Wealth Management Tech 2.0 | Risk Analytics SPECIALIZED INVESTMENT BANKERS AT THE INTERSECTION OF FINANCE & TECHNOLOGY Table of Contents 1. Executive Summary 3 2. Firm Qualifications 6 3. Industry Landscape 12 4. Deal Activity 34 5. Company Interviews (“Industry Insight”) 36 6. Transaction Themes 54 7. Public Comparables 63 Executive Summary Executive Summary Summary of Newsletter SUMMARY KEY OBSERVATIONS This newsletter provides insight into Expected size of the Supply Chain Efficiencies that banks can generate Opportunity for integrated the financial technology capital $5 Analytics market in 2019 compared through analytics-based automation payments in North America 2x 50% markets. We seek to provide a billion to 2014 of the risk assessment process snapshot of market activity and detailed analysis of trends. Bank acquirers claim about 50% of the Merchant Acquiring market. However, non-bank entities are growing ISVs, VARs, and faster, because they take a more proactive approach. Merchant acquirers are increasingly relying upon This issue focuses on ISVs, VARs Integrated Payments technology as a differentiator to wrap around card processing services (integrated payments), recognizing that and, Integrated Payments; Wealth Players Disrupting traditional feet-on-the-street sales are facing secular pressure. Traditional distribution channels such as Management Tech (version 2.0); Merchant Acquisition ISO/field sales are now being supplemented with dealer/developers who are being utilized to acquire and Risk Analytics. We are new merchants through ISVs and VARs, which are growing much faster than the traditional channels. continuing over coverage of the Wealth Tech sector, building on top of With increasing service expectations of investors and a growing population of wealth techs striving to exceed our Q2:2017 issue; hence version 2.0. -

Payments Q4 Update Vf

Payments – Are Cross Border Payments A Benefactor In The Pandemic Affected World Dear Clients and Friends, Marlin & Associates (M&A) is pleased to share our latest report on m&a values and trends in the Payments Technology sector. As you will see in the report, after a few slow months, m&a activity and values in this sector have come back strong - driven in part by (i) significant shifts to online spending during a never-ending pandemic that has accelerated trends across the B2B, B2C and P2P spaces that were already in place well before the coronavirus upended daily life; (ii) customer demand for ever more speed and transparency for these transactions; (iii) regulations that are driving more banks to partner with payment tech companies to facilitate transactions; and (iv) small and medium sized businesses (“SMEs”) increasingly seeking cross border opportunities due to access to more efficient (and less expensive) cross border payment solutions. Our own client pipeline largely mimics these trends. As you also will see in this report, market values for publicly traded firms have continued to remain robust. Several notable deals have been announced including Stripe acquiring Nigeria’s Paystack for $200mm to expand to the African continent, Italy’s Nexi SpA agreed to buy SIA SpA to in an all-share deal that values closely-held SIA at EUR 4.56 billion ($5.3 billion), and U.K. based online money transfer company, World Remit, is buying Africa-focused, app- based remittance firm Sendwave in a cash and stock deal worth more than $500mm. Marlin & Associates is one of the most active investment banking and strategic advisory firms, providing trusted counsel to middle market companies worldwide that offer enterprise and vertical application software, services, data and analytics including firms across the FinTech ecosystem (Payments, Real Estate Tech, Payments, BankTech, WealthTech, InsurTech, LegalTech, GRC, Capital Markets Tech, Digital Tech, Business Intelligence, and Market Intelligence). -

Bi-Weekly Financial Technology Sector Report

Financial Technology Sector Summary Week of June 19, 2017 1 DEAL DASHBOARD Financial Technology (3) (1) (3) $11.7 Bn | 1,179 Deals Industry Stock Market Performance $77.6 Bn | 683 Deals LTM Financing Volume Last Twelve Months LTM M&A Volume 160 Select Recent Financing Transactions Select Recent M&A Transactions Company Amount ($MM) 150 Target Acquirer EV ($MM) 140 $300.0 $1,381.0 130 $145.5 $304.0 120 $140.0 110 $89.0 100 $65.0 $33.0 90 $28.0 NA 80 6/16/16 8/1/16 9/14/16 10/28/16 12/13/16 1/26/17 3/13/17 4/26/17 6/9/17 $22.5 NA Payments Exchanges Financial Data, Content, Information Processors / $12.0 & Analytics Credit Bureaus NA Banking & Lending Online Broker Dealers Technology $12.0 NA Investment Services, Healthcare / Insurance Software, & Technology Technology S&P 500 (3) (3) Quarterly Financing Volume Quarterly M&A Volume $10 500 $30 219 250 205 196 188 $8 $8.9 400 $25 200 $24.9 299 298 316 $24.5 276 $20 $6 300 $20.8 $20.4 150 $15 $4 200 100 $10 $3.0 $2 $2.6 $2.6 100 $5 50 $0 0 $0 0 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Financing Volume ($Bn) Financing Deal Count M&A Volume ($Bn) M&A Deal Count Notes: Source: Capital IQ, CB Insights and GCA FinTech Database. Market Data as of 6/16/17. 1) Refer to footnotes on page 5 for index composition. -

Chase $132.21

FOR 47 YEARS, THE LEADING PUBLICATION COVERING PAYMENT SYSTEMS WORLDWIDE JUNE 2018 / ISSUE 1134 Middle East–Africa’s Largest Acquirers The top 32 Visa/Mastercard merchant acquirers in the Middle Top Issuers of Commercial East–Africa region are ranked on page 7 based on Visa and Cards in the U.S. 2017 Mastercard card transactions processed in 2017. Collectively this > see p. 6 Ranked by Purchase Volume Bl. PayPal Buys Mass Payouts & Anti-Fraud Platforms This month, PayPal announced it will buy Hyperwallet Systems for $400 million in cash and Simility for $120 million in cash. Chase This follows two acquisitions in May, when PayPal announced > see p. 12 $132.21 Giift.com Loyalty Program Support More than 40% of loyalty program reward points are never used. In part, because many points are earned for products or services Comdata rarely used. It is also true that many issuers of reward points have Bank of America $31.53 > see p. 6 $127.21 Supreme Court Victory for American Express Citibank $60.96 In a 5 to 4 opinion, the U.S. Supreme Court ruled June 25 in favor of American Express in litigation concerning Amex’s prohibition against any merchant in its U.S. network requesting a cardholder U.S. Bank Wells Fargo > see p. 5 Bancorp $68.17 $89.66 Linked2pay Instant Merchant Settlement Bank $28.14 Risk management and payment technology provider linked2pay, Capital One Wex in partnership with Push Payments, offers acquirers instant $52.09 merchant settlement. Merchants that accept credit and debit card $26.68 > see p. -

SOFTWARE SECTOR REPORT Q4 2019 EXECUTIVE SUMMARY Software 2019

SOFTWARE SECTOR REPORT Q4 2019 EXECUTIVE SUMMARY Software 2019 » The global software sector remains one of the most active sectors, with ~$63Bn in financing deal value and ~$110Bn in M&A deal value during 2019 - 848 financings, 16% higher than 2018 - 1,453 M&A transactions, 5% higher than 2018 » Significant M&A activity in Q4 includes major acquisitions in the cybersecurity sector: Thoma Bravo’s $3.8Bn acquisition of Sophos and F5 Network’s $1.0Bn acquisition of Shape Security » Financial Software had some of the largest financing deals in Q4 ‘19 led by the $1.7Bn financing of Paytm and $500MM financing of Chime; the Business Intelligence & Analytics sector saw high financing volume » Software sector trading performance remained healthy, as the IGV tech-software index outperformed the S&P 500 by 7.2% in 2019 – Sales & Marketing software index grew 49.7% LTM, outperforming all other software sub segments » Technical Application software companies traded at 9.7x and 28.7x for 2019 Revenue and EBITDA, respectively, among the highest in software » Momentum and growth rates remain healthy with the Business Intelligence & Analytics subsector leading 2019E/2018A revenue growth at 31.0% Select Q4 Active Investors Select Q4 Active Buyers Notes: Sources: Pitchbook, 451 Research, Capital IQ. 2 GCA OVERVIEW The GCA Software team KEY GCA STATS SECTOR COVERAGE GCA US TEAM AI / Machine Learning Josh Wepman Rupert Sadler Managing Director Managing Director 23 Offices Globally [email protected] [email protected] BI / Analytics Collaboration Software