Payments Q4 Update Vf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

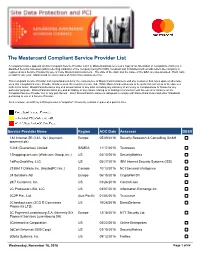

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

Payments Market Update SUMMER 2020 Payments Market Update–Summer 2020

Payments Market Update SUMMER 2020 Payments Market Update–Summer 2020 Dear Clients and Friends, Houlihan Lokey is pleased to present its Payments Market Update for the summer of 2020. We hope that you and your families remain safe and healthy. We have continued adapting to this fluid market and are busy helping our clients navigate financing, M&A, and other strategic alternatives. Please reach out to any of us if you would like to connect or brainstorm regarding any current needs or sector topics. We have included industry insights, select recent transaction announcements, and a public markets overview to help you stay ahead in our dynamic industry. We hope you find this update to be informative and that it serves as a valuable resource to you in staying abreast of the market. We look forward to staying in touch. Kind regards, Rob Freiman Director, Fintech [email protected] 212.497.7859 Additional Houlihan Lokey Fintech Contacts Corporate Finance Financial and Valuation Advisory Mark Fisher Tim Shortland David Sola Andrew Stull Oscar Aarts Managing Director Managing Director Managing Director Managing Director Director [email protected] [email protected] [email protected] [email protected] [email protected] Kegan Greene Chris Pedone Reggie Graham Director Director Senior Vice President [email protected] [email protected] [email protected] Payments Subsectors Covered: B2B PAYMENTS BLOCKCHAIN CREDIT CARDS DEBIT CARDS DISBURSEMENTS FOREIGN EXCHANGE FRAUD PROTECTION INTEGRATED PAYMENTS ISSUER PROCESSING LOAN PROCESSING LOYALTY/ REWARDS MERCHANT ACQUIRING MOBILE PAYMENTS MONEY TRANSFER NETWORKS P2P PAYMENTS PAYMENT FACILITATORS POS HARDWARE POS SOFTWARE / ISVs PREPAID UNATTENDED / KIOSKS / ATMS VERTICAL PAYMENTS 2 Market Insights and Observations While the COVID-19 pandemic reduced economic activity (and associated payments) across the globe, the crisis is likely to accelerate innovation across the sector. -

State of Delaware OFFICE of the STATE BANK COMMISSIONER

State of Delaware OFFICE OF THE STATE BANK COMMISSIONER Licensees and Existing Branches PDT: 4/25/2019 12:40PM Check Seller, Money Transmitter 010910 ADP Payroll Services, Inc. One ADP Boulevard M/S A437 Roseland, NJ 07068 Contact: Saundra T. Martin - (770) Filing Status: Current - Licensed Expires Date: 12/31/2019 360-3439 020637 Adyen, Inc. 274 Brannan Street San Francisco, CA 94107 Contact: Mr. Mike McGire - (415) 530-2025 Filing Status: Current - Licensed Expires Date: 12/31/2019 020927 Airbnb Payments, Inc. 650 7th Street San Francisco, CA 94103 Contact: Jed Davis - (415) 728-0105 Filing Status: Current - Licensed Expires Date: 12/31/2019 020556 Alipay US, Inc. 400 South El Camino Real Suite 6F San Mateo, CA 94402 Contact: Pengbo Liu - (408) Filing Status: Current - Licensed Expires Date: 12/31/2019 785-5580 8878 Amazon Payments, Inc. 410 Terry Avenue North Seattle, WA 98109 Contact: Anastasia (Tracy) Raissis - (206) Filing Status: Current - Licensed Expires Date: 12/31/2019 740-5684 011533 American Express Prepaid Card Managment Corporation 20022 North 31st Avenue Phoenix, AZ 85027 Contact: Freddy Escobar - (954) 503-7821 Filing Status: Current - Licensed Expires Date: 12/31/2019 1517 American Express Travel Related Services Company, Inc. 200 Versey Street Mail Code 01-49-05 New York, NY 10285-4902 Contact: Freddy Escobar Filing Status: Current - Licensed Expires Date: 12/31/2019 - (954) 503-7821 025589 Apple Payments Inc. 10101 N. De Anza Boulevard MS 42-3API Cupertino, CA 95014 Contact: Kenoy Kadakia - Filing Status: Current - Licensed Expires Date: 12/31/2019 (408) 614-6530 025144 AscendantFX Capital USA, Inc., D/B/A AscendantFX 3478 Buskirk Avenue Suite 1000 Pleasant Hill, CA 94523 Contact: Bernard Beck - (250) Filing Status: Current - Licensed Expires Date: 12/31/2019 412-5306 024539 Associated Foreign Exchange, Inc. -

For Personal Use Only Use Personal for Scheme, Other Than As a Wameja Shareholder Or Wameja DI Holder

Wameja Limited ACN 052 947 743 SCHEME BOOKLET For a scheme of arrangement between Wameja Limited ABN 59 052 947 743 and the holders of shares in Wameja in relation to the proposed acquisition of Wameja by Burst Acquisition Co. Pty. Ltd ACN 644 142 834, a subsidiary of Mastercard. Your directors unanimously recommend that you vote in favour of the Scheme in the absence of a superior proposal. This is an important document and requires your immediate attention. You should read it in its entirety before voting on the Scheme. If you are in any doubt about how to deal with this document, please consult your financial, legal, taxation or other professional adviser. Financial Adviser * Please refer to Section 14.4 (c) of this Scheme Booklet for disclosure of the interests of Directors in the For personal use only Scheme, other than as a Wameja Shareholder or Wameja DI Holder. For personal use only WAMEJA LTD | SCHEME BOOKLET CONTENTS Overview of this Scheme Booklet 4 What should you do? 5 Important Notices 6 Important Dates 10 Letter from the Chairman 11 What you will receive under the Scheme 13 1. Reasons to vote in favour of the Scheme 14 2. Reasons why you may consider voting against the Scheme 16 3. Frequently asked questions 17 4. Scheme Meeting details and how to vote on the Scheme 24 5. Summary of the Scheme 26 6. Information about Wameja 33 7. Information about Mastercard 40 8. Information about HomeSend 46 9. Risks associated with the Scheme 50 10. Implementation of the Scheme 52 11. -

Report Arcane Crypto

Arcane Crypto Report The Institutionalisation of Bitcoin 10 years ago, Satoshi Nakamoto published a paper about a peer-to-peer electronic cash system on an obscure email list for cryptographers. A system that would make trusted third parties superfluous and remove the need for banks and financial institutions to facilitate economic transactions. Few could have predicted the magnitude that followed. Hype, bubble, price collapse and soon to be dead, was the conclusion by many during the crash in 2018. Still, as exemplified by the projects summarised in this report, bitcoin is anything but dead. Despite collapsing prices there has never been more people, bigger institutions or more money betting on bitcoin and cryptocurrencies than right now. Financial institutions, tech giants and regulators have joined the bitcoin ecosystem alongside the cypher punks, libertarians and start-ups. Like the lion and the impala, the different players might have a different vision. Still, they all have their role to play in this ever evolving and growing ecosystem. Bendik Norheim Schei Torbjørn Bull Jenssen Analyst Arcane Crypto CEO Arcane Crypto [email protected] Arcane Crypto Report Arcane Crypto Report Content The incumbents are waking up .............................................................................................. 1 Stock exchanges are embracing cryptocurrencies ................................................................. 2 Traditional banks and investment firms feel the demand ..................................................... 2 The -

Payments Insights. Opinions. Volume 21

Venture capital transaction overview Q3 2020 02 #payments VC tracker Venture capital Date Volume Funding Target Market Round Investor(s) Segment Description announced (US$m) (US$m) 1 01–07–20 Curv United States A 23.00 29.50 Commerz Ventures Alternative Develops a cloud-based wallet for payment storing and protecting digital assets. systems 2 01–07–20 Point Up Inc. United States A 10.5 12.70 Valar Ventures Issuing Provides card issuing and digital lending services for consumers. 3 01–07–20 Weifang Smart China B 2.84 2.84 Payment Designs and manufactures payment Yoke Network Mainland acceptance processing equipment for oil Technology Co., devices + stations. Ltd. Software 4 01–07–20 Creator Cash United Seed 4.00 4.00 Artis Capital Other Offers a suite of financial services, States Management, such as savings accounts, debit cards, L.P. and more to social media creators. 5 05–07–20 Spotii DMCC United Arab Seed – – Daman Alternative Develops a payment platform that Emirates Investments payment enables customers to make online PSC systems purchases and make payment in four equal installments. 6 06–07–20 Pair Finance Germany Venture 2.26 7.57 Other Provides digital debt collection services. 7 06–07–20 PAYFAZZ Indonesia B 53.00 127.10 B Capital Group, Alternative Owns and operates an online Insignia Ventures payment payment wallet. Partners systems 8 07–07–20 Thyngs United N/D 0.20 1.30 Payment Develops contactless payment Kingdom acceptance technology that connects buyers, devices + sellers, and brands. Software 9 07–07–20 Verestro Poland N/D – 1.00 Mastercard Alternative Offers payment solutions, which (formerly Upaid) payment includes digital wallet, NFC systems contactless payments, P2P transfers, QR payment, card management, and payment services. -

Transactionwatch

TransactionWatch Week of: Weekly Newsletter For Payments Executives That Covers The Most Important March 30th – April 3rd And Relevant Merchant Acquiring Deals And Activity This report is based upon information considered reliable by The Strawhecker Group® (TSG), but the accuracy and completeness of such information is not guaranteed or warranted to be error-free. Information provided is as reasonably available, not to be deemed all inclusive. TSG assumes no obligation to update the content hereof. This report is subject to the terms and conditions of a separate license with recipient, is further protected by copyright under U.S. Copyright laws and is the property of TSG. Recipient may not copy, reproduce, distribute, publish, display, modify, create derivative works, transmit, exploit, or otherwise disseminate any part of this report except as expressly permitted under recipient’s license with TSG. The Strawhecker Group (TSG) is not endorsed, sponsored by, or in any other way affiliated with any companies identified in this presentation. The trademarks of third parties displayed herein are the property of such parties, and, are provided merely for identification purposes. TSG claims no rights therein. This document has not been prepared, approved or licensed by any entity identified in this report. © Copyright 2020. The Strawhecker Group ®. All Rights Reserved. Deal Activity Summary March 30th – April 3rd This Week’s M&A Overview Table of Contents In the wake of the COVID-19 pandemic, activity in the overall M&A space has Deal Activity Summary seen a slowdown across a wide range of industries, including merchant acquiring. As small-to-medium sized businesses (SMBs) take a hit due to lower COVID-19 Industry Impact consumer spending or temporary closures, many merchant acquirers and Historical M&A Tracker payment processors are largely affected. -

The European Payments Industry Consolidates Around Its Two Largest Players

Rise of the champions: the European Payments industry consolidates around its two largest players Introduction From barters and coins to cash pooling to cashless exchanges, the payments industry has undergone a massive transformation since its inception. During the era of booming e-commerce, payment methods are evolving rapidly, with the scope of becoming faster, simpler, and more secure for all parties. The main segments of the payment ecosystem include acquirers/processors, issuers, card networks, gateways, ISOs/MSPs, and non card payments. 1. Acquirers/processors Acquiring (merchant) banks, also known as payment processors , (e.g., Worldpay, Worldline, Barclaycard, First Data, Nexi, Ingenico, Nets) process credit and debit card payments on behalf of a merchant, that is a business that wants to take card payments. Acquirers allow merchants to accept payments from the card-issuing banks (see point 3) through a point of sale terminal. They offer both the hardware and the software needed to “acquire” the payments, meaning to receive it and correctly linking it to a network on the likes of Mastercard. Oftentimes, these players also develop software that the banks use to handle the volume of payments and even perform analysis on the flows. This is a particularly interesting and value added area that is receiving a lot of attention lately, as for the commercial banks it is more and more cost effective to rely on external IT software rather than bear the costs of developing it in-house. In that regard, a particular solution is the ‘Payment as a Service’ (‘PaaS’) technology, which uses the Software-as-a-Service (‘SaaS’) model to connect a group of international payment systems, simplifying payments for the end customer. -

Payments Insights. Opinions. Volume 21

#payments insights. opinions. Customer expectations, Three forces pushing banks to modernize payments technology and regulation infrastructure demand that financial organizations update payments Payments systems have always been complex and a critical part of the banking world. systems before the next wave But over the past decade, dynamic changes within payments have created even greater challenges for financial organizations and have driven the need for payments of disruption. transformation. In particular, more complex regulation, advancing technology and demands from customers to create a consistent, seamless experience across multiple channels are pushing banks, FinTechs and payment processors to invest heavily in payments modernization. Upgrading infrastructure to address these challenges, while keeping costs under control, requires financial organizations to first understand the drivers of change. Continued on page 3 Volume 26 03 Three forces pushing banks to modernize payments infrastructure Customer expectations, technology and regulation demand financial organizations update payments systems before the next wave of disruption. 05 How Africa’s growing mobile money market is evolving Africa’s fast-growing mobile money market offers opportunities to boost financial inclusion and tap the continent’s economic potential. Editorial 08 Welcome to the first issue of #payments for 2020. Can issuing capabilities strengthen acquirers’ competitive position? In this newsletter, we explore a diverse set of topics that we know are top of mind Since European Union (EU) regulators introduced a for many financial institutions this year. fee cap on credit card transactions, acquirers have been seeking new ways to boost margins. Some are • The ongoing challenge to modernize payments architecture is explored in an now issuing their own cards, to protect profitability and create competitive advantage. -

Payments Market Update FALL 2020 Payments Market Update—Fall 2020

Payments Market Update FALL 2020 Payments Market Update—Fall 2020 Houlihan Lokey is pleased to present its Payments Market Update for the fall of 2020. Dear Clients and Friends, We are pleased to present our Payments Market Update for the fall of 2020. We hope that you and your families remain safe and healthy. We have continued adapting to this fluid market and are busy helping our Rob Freiman clients navigate M&A, financing, and other strategic alternatives. Please reach out to any of us if you would Director, Fintech like to connect or brainstorm regarding any current needs or sector topics. [email protected] We have included industry insights, select recent transaction announcements, and a public markets 212.497.7859 overview (including some new additions, such as Nuvei and Shift4, with Billtrust coming soon) to help you stay ahead in our dynamic industry. We hope you find this update to be informative and that it serves as a valuable resource to you in staying abreast of the market. We look forward to staying in touch. Cheers, Additional Houlihan Lokey Fintech Contacts Corporate Finance Financial and Valuation Advisory Mark Fisher Tim Shortland David Sola Andrew Stull Oscar Aarts Managing Director Managing Director Managing Director Managing Director Director [email protected] [email protected] [email protected] [email protected] [email protected] Kegan Greene Chris Pedone Reggie Graham Director Director Senior Vice President [email protected] [email protected] [email protected] Payments Subsectors Covered: B2B PAYMENTS BLOCKCHAIN CREDIT CARDS DEBIT CARDS DISBURSEMENTS -

Hawaii-Licensed Money Transmitter Companies

Hawaii-Licensed Money Transmitter Companies Name Address 1 Address 2 City State Zipcode Telephone Email address One ADP ADP Payroll Services, Inc. M/S A437 Roseland New Jersey 07068 (973) 974-5000 [email protected] Boulevard 274 Brannan San Adyen, Inc. California 94107 (415) 957-1000 Street Francisco 400 S. El Camino Alipay US, Inc. 4th Floor San Mateo California 94402 (480) 235-8814 [email protected] Real Amazon Payments, Inc. 410 Terry Ave N Seattle Washington 98109 (866) 216-1075 [email protected] American Express Prepaid Card 20022 N. 31st Phoenix Arizona 85027 (212) 640-9787 [email protected] Management Avenue Corporation American Express Travel Related Services 200 Vesey Street New York New York 10285 (212) 640-3311 [email protected] Company, Inc. Anh Minh Money 9211 Bolsa #104 Westminster California 92683 (714) 893-4348 [email protected] Transfer, Inc. Avenue Associated Foreign 21045 Califa Woodland Exchange, Inc. California 91367 (818) 386-2702 [email protected] Street Hills (dba AFEX) BBVA Transfer Services, Inc. 16825 Suite 1525 Houston Texas 77060 (281) 765-1500 [email protected] (formerly Bancomer Northchase Drive Transfer Services, Inc.) BDO Remit (USA), Inc. 350 Gellert (formerly Express Padala Daly City California 94015 (800) 472-3252 [email protected] (USA), Inc. and BDO Boulevard Remittance (USA), Inc.) Bill.com, LLC 1810 (650) 621-7700 Embarcadero Palo Alto California 94303 [email protected] dba BDC Payment x7393 Services Road Blackhawk Network 6220 Stoneridge Pleasanton California 94588 (925) 226-9990 [email protected] California, Inc. Mall Road Cambridge Mercantile 1359 Broadway Suite 801 New York New York 10018 (212)594-2200 [email protected] Corp.