Financial Technology Sector Summary Week of July 24, 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 12945-20 Date: February 10, 2020 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. BNY Mellon | ADRs | Qualified Dividends for Tax Year 2019 Subject: Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2019. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of these events. Non-Confidential DTCC Public (White) 2019 DIVIDEND CERTIFICATION CUSIP DR Name Country Exchange Qualified 000304105 AAC TECHNOLOGIES HLDGS INC CAYMAN ISLANDS OTC N 000380105 ABCAM PLC UNITED KINGDOM OTC Y 001201102 AGL ENERGY LTD AUSTRALIA OTC Y 001317205 AIA GROUP LTD HONG KONG OTC N 002482107 A2A SPA ITALY OTC Y 003381100 ABERTIS INFRAESTRUCTURAS S A SPAIN OTC Y 003725306 ABOITIZ EQUITY VENTURES INC PHILIPPINES OTC Y 003730108 ABOITIZ PWR CORP PHILIPPINES OTC Y 004563102 ACKERMANS & VAN HAAREN BELGIUM OTC Y 004845202 ACOM CO. JAPAN OTC Y 006754204 ADECCO GROUP AG SWITZERLAND OTC Y 007192107 ADMIRAL GROUP UNITED KINGDOM OTC Y 007627102 AEON CO LTD JAPAN OTC Y 008712200 AIDA ENGR LTD JAPAN OTC Y 009126202 AIR LIQUIDE FRANCE OTC Y 009279100 AIRBUS SE NETHERLANDS OTC Y 009707100 AJINOMOTO INC JAPAN OTC Y 015096209 ALEXANDRIA MINERAL - REG. S EGYPT None N 015393101 ALFA LAVAL AB SWEDEN SWEDEN OTC Y 021090204 ALPS ELEC LTD JAPAN OTC Y 021244207 ALSTOM FRANCE OTC Y 022205108 ALUMINA LTD AUSTRALIA OTC Y 022631204 AMADA HLDGS CO LTD JAPAN OTC Y 023511207 AMER GROUP HOLDING - REG. -

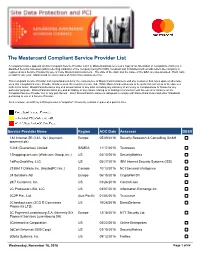

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

3I Group PLC 3M Co 58.Com Inc A2A Spa AAC Technologies Holdings

3i Group PLC 3M Co 58.com Inc A2A SpA AAC Technologies Holdings Inc ABB Ltd Abbott Laboratories AbbVie Inc Accenture PLC Accton Technology Corp ACS Actividades de Construccio Activision Blizzard Inc Acuity Brands Inc Adani Ports & Special Economic Adaro Energy Tbk PT Adecco Group AG Adelaide Brighton Ltd adidas AG Adient PLC Adobe Systems Inc Advance Auto Parts Inc Advanced Ceramic X Corp Advanced Micro Devices Inc Advanced Semiconductor Enginee Aegon NV AES Corp/VA Aetna Inc Affiliated Managers Group Inc Aflac Inc Aga Khan Fund for Economic Dev AGFA-Gevaert NV Agilent Technologies Inc AGL Energy Ltd Agnaten SE AIA Group Ltd Air Products & Chemicals Inc AirAsia Bhd Airtac International Group Akamai Technologies Inc Akbank Turk AS Akzo Nobel NV Alaska Air Group Inc Albemarle Corp Alcoa Corp Alexandria Real Estate Equitie Alexion Pharmaceuticals Inc Alibaba Group Holding Ltd Align Technology Inc ALK-Abello A/S Allegion PLC Allergan PLC Alliance Data Systems Corp Alliant Energy Corp Allianz SE Allstate Corp/The Ally Financial Inc Alphabet Inc ALS Ltd Altaba Inc/Fund Family Altice NV Altran Technologies SA Altria Group Inc Alumina Ltd Amadeus IT Group SA Amazon.com Inc Amcor Ltd/Australia Ameren Corp America Movil SAB de CV American Airlines Group Inc American Axle & Manufacturing American Electric Power Co Inc American Express Co American International Group I American Tower Corp American Water Works Co Inc Ameriprise Financial Inc AmerisourceBergen Corp AMETEK Inc Amgen Inc Amorepacific Corp AMOREPACIFIC Group AMP Ltd Amphenol Corp ams AG -

Merchants Where Online Debit Card Transactions Can Be Done Using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata

Merchants where online Debit Card Transactions can be done using ATM/Debit Card PIN Amazon IRCTC Makemytrip Vodafone Airtel Tata Sky Bookmyshow Flipkart Snapdeal icicipruterm Odisha tax Vodafone Bharat Sanchar Nigam Air India Aircel Akbar online Cleartrip Cox and Kings Ezeego one Flipkart Idea cellular MSEDC Ltd M T N L Reliance Tata Docomo Spicejet Airlines Indigo Airlines Adler Tours And Safaris P twentyfourBySevenBooking Abercrombie n Kent India Adani Gas Ltd Aegon Religare Life Insur Apollo General Insurance Aviva Life Insurance Axis Mutual Fund Bajaj Allianz General Ins Bajaj Allianz Life Insura mobik wik Bangalore electricity sup Bharti axa general insura Bharti axa life insurance Bharti axa mutual fund Big tv realiance Croma Birla sunlife mutual fund BNP paribas mutural fund BSES rajdhani power ltd BSES yamuna power ltd Bharat matrimoni Freecharge Hathway private ltd Relinace Citrus payment services l Sistema shyam teleservice Uninor ltd Virgin mobile Chennai metro GSRTC Club mahindra holidays Jet Airways Reliance Mutual Fund India Transact Canara HSBC OBC Life Insu CIGNA TTK Health Insuranc DLF Pramerica Life Insura Edelweiss Tokio Life Insu HDFC General Insurance IDBI Federal Life Insuran IFFCO Tokio General Insur India first life insuranc ING Vysya Life Insurance Kotak Mahindra Old Mutual L and T General Insurance Max Bupa Health Insurance Max Life Insurance PNB Metlife Life Insuranc Reliance Life Insurance Royal Sundaram General In SBI Life Insurance Star Union Daiichi Life TATA AIG general insuranc Universal Sompo General I -

Payments in Poland 2017

Payments in Poland, 2017 Selected pages from the original report by Inteliace Research October 2017 Version: 17.c Table of contents Executive Summary 3. Retail landscape (merchants) and payment methods Slide 23: Brick&mortar (b&m) vs. online retail landscape, 2015-2017 1. Payments in Poland and in Europe Slide 24: Key payments methods available in B&M and in online retail, 2017 Slide 1: Consumer markets in Europe, 2016 Slide 25: Survey on payment methods in 72 large online stores, Oct. 2017 Slide 2: Total payments in Poland, structure by type, 2012-2016 Slide 26: Online merchants & payment methods– case (1/3): Allegro Slide 3: Total payments: Europe vs. Poland, structure by type, 2016 Slide 27: Online merchants & payment methods– case (2/3): RTVEuroAGD Slide 4: Card payment volumes in Europe & in Poland (1/2), 2014-2016 Slide 28: Online merchants & payment methods– case (3/3): empik.com Slide 5: Card payment volumes in Europe & in Poland (2/2), 2016 Slide 29: Key players in specialized mobile payments (parking, public /municipal transportation, regional railways), 2017 2. Payments and payment infrastructure in Poland Slide 30: Use of payment cards as tickets in public transport Slide 6: Card payments in Poland, 2012-2017F Slide 31: Block chain technology & bitcoin in Poland: Exchanges, bitcoin Slide 7: POS infrastructure evolution in Poland, 2012-2017F acquirers, merchants, 2017 2017 Poland, in Payments Slide 8: Cards/terminals in Poland by functionality, 2Q2015-2Q2017 Slide 9: ATM networks in Poland, 2012-2017H1 Slide 10: ATM cash withdrawals -

Statement of Account

Page No .: 1 Account Branch : HINJAWADI Address : SURVEY NO 244/3 4 5, RAJIV GANDHI INFOTECH PARK, NR TATA JOHNSON CONTROLS, MR. VIKAS VILAS GUNDEWAR City : PUNE 411057 State : MAHARASHTRA IBM INDIA LTD Phone no. : 020-61606161 EMBASSY TECH ZONE BLOCK 1 3/CONGO OD Limit : 0.00 RAGIV GANDHI INFOTECH PARK HINJEWAD Currency : INR Email : [email protected] PUNE 411057 Cust ID : 57679401 MAHARASHTRA INDIA Account No : 50100064376582 POTENTIAL A/C Open Date : 07/03/2015 JOINT HOLDERS : Account Status : Regular RTGS/NEFT IFSC: HDFC0000794 MICR : 411240018 Branch Code : 794 Product Code : 113 Nomination : Not Registered From : 01/12/2018 To : 24/01/2019 Statement of account Date Narration Chq./Ref.No. Value Dt Withdrawal Amt. Deposit Amt. Closing Balance 01/12/18 UPI-00000033981657454-KADAMAKSHAY0609199 0000833511316354 01/12/18 700.00 80,198.91 4-2@OKSBI-833511732270-UPI 02/12/18 POS 436303XXXXXX5421 AMAZON PAY INDIA PO 0000833618562939 02/12/18 133.40 80,065.51 S DEBIT 02/12/18 UPI-19744201000007-ADD-MONEY@PAYTM-83364 0000833616221735 02/12/18 1,207.00 78,858.51 0061229-OID6674285046@PAYTM 02/12/18 UPI-7211944321-RAJPALREDDY222@OKHDFCBANK 0000833619577058 02/12/18 10,000.00 88,858.51 -PAY-833619000984-PAY BACK 04/12/18 UPI-19744201000007-ADD-MONEY@PAYTM-83383 0000833813198618 04/12/18 150.00 88,708.51 7221066-OID6690236203@PAYTM 05/12/18 UPI-19744201000007-ADD-MONEY@PAYTM-83393 0000833914697379 05/12/18 30.00 88,678.51 8487341-OID6699231984@PAYTM 05/12/18 UPI-19744201000007-ADD-MONEY@PAYTM-83393 0000833914700771 05/12/18 1,000.00 -

Crowdlending in Asia: Landscape and Investor Characteristics

Crowdlending in Asia: Landscape and Investor Characteristics November 2020 2 Table of Contents Overview 3 Methodology Overview 4 Methodology Statement 4 Crowdlending in Asia 5 Text Analytics and Insights 7 Crowdlending Investor Characteristics 15 Survey Analysis and Insights 16 Crowdlending in Asia: Landscape and Investor Characteristics | Findings and Insights | Findings and insights 3 Overview Multiple issues arise with the emergence of crowdlending; these pertain to regulation, risk management and investors’ behaviour. Compared to the non-investment crowdfunding model, crowdlending is the dominant model in the world. As of 2019, crowdlending accounted for more than 95% of the funds raised worldwide, with Asian countries – particularly China – in the lead. In early 2020, China had the largest volume of money-raising transactions from crowdfunding totalling more than 200 billion USD. However, given the industry’s potential growth in Asian countries, multiple issues with crowdfunding practices need to be resolved. Media coverage on crowdlending is increasingly widespread, as seen from how it has become a buzzword within the last few years. Media attention on crowdlending can help us understand media awareness, media framing, and public understanding of the topic. Further, there is a lack of information on distinct characteristics and decision making of crowdfunding investors in the field of investor behaviour. We analysed the news coverage on crowdlending in Asia spanning a ten-year period from 2009 to 2019. We also surveyed crowdlending investors to understand their behaviours when interacting with crowdlending platforms. Our analyses provide insights into the challenges and opportunities of the crowdlending industry in Asia. They also reveal crowdlending investors’ behaviour. -

India Fintech Sector a Guide to the Galaxy

India FinTech Sector A Guide to the Galaxy G77 Asia Pacific/India, Equity Research, 22 February 2021 Research Analysts Ashish Gupta 91 22 6777 3895 [email protected] Viral Shah 91 22 6777 3827 [email protected] DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Contents Payments leading FinTech scale-up in India .................................. 8 8 FinTechs: No longer just payments ..............................................14 Account Aggregator to accelerate growth of digital lending ...............................................................................22 Digital platforms and partnerships driving 50-75%of bank business ...28 Company section ..........................................................................32 PayTM (US$16 bn) ......................................................................33 14 Google Pay ..................................................................................35 PhonePe (US$5.5 bn) ..................................................................37 WhatsApp Pay .............................................................................39 -

Investigating the Application of Banking Regulation to Online Peer-To-Peer Lending Platforms in South Africa to Counter Systemic Risk

Investigating the application of banking regulation to online peer-to-peer lending platforms in South Africa to counter systemic risk Tamarin Angela Floyd Student number 16391871 A research project submitted to the Gordon Institute of Business Science, University of Pretoria, in partial fulfilment of the requirements for the degree of Master of Business Administration. 6 November 2017 i © University of Pretoria ABSTRACT The behaviour and activities of online peer-to-peer lending platforms have evolved in different ways across jurisdictions, not fitting neatly within existing financial regulatory frameworks. Together with the growth momentum of the industry and the cases where losses were suffered, this culminated in a call to regulate peer-to-peer lending platforms adequately. The research presents an analysis of online peer-to-peer lending platforms through the lens of banking theory, questioning whether peer-to-peer platforms are behaving like banks and whether they pose systemic risk. These research questions feed into the ultimate research problem: whether online peer-to-peer lending platforms should be regulated like banks with respect to liquidity and capital requirements. Liquidity and capital requirements were designed to stem systemic risk in financial systems and have been praised as effective tools. Qualitative exploratory research was undertaken with 18 experts in the field. Key findings included that the presence of systemic risk is contingent on the operating structure and legal implications of the peer-to-peer platform. In certain cases, systemic risk could be present and as such liquidity and capital requirements should apply. The scope of the research was restricted to the South African financial system due to the unique nuances of its regulatory framework. -

Fintech Monthly Market Update | July 2021

Fintech Monthly Market Update JULY 2021 EDITION Leading Independent Advisory Firm Houlihan Lokey is the trusted advisor to more top decision-makers than any other independent global investment bank. Corporate Finance Financial Restructuring Financial and Valuation Advisory 2020 M&A Advisory Rankings 2020 Global Distressed Debt & Bankruptcy 2001 to 2020 Global M&A Fairness All U.S. Transactions Restructuring Rankings Advisory Rankings Advisor Deals Advisor Deals Advisor Deals 1,500+ 1 Houlihan Lokey 210 1 Houlihan Lokey 106 1 Houlihan Lokey 956 2 JP Morgan 876 Employees 2 Goldman Sachs & Co 172 2 PJT Partners Inc 63 3 JP Morgan 132 3 Lazard 50 3 Duff & Phelps 802 4 Evercore Partners 126 4 Rothschild & Co 46 4 Morgan Stanley 599 23 5 Morgan Stanley 123 5 Moelis & Co 39 5 BofA Securities Inc 542 Refinitiv (formerly known as Thomson Reuters). Announced Locations Source: Refinitiv (formerly known as Thomson Reuters) Source: Refinitiv (formerly known as Thomson Reuters) or completed transactions. No. 1 U.S. M&A Advisor No. 1 Global Restructuring Advisor No. 1 Global M&A Fairness Opinion Advisor Over the Past 20 Years ~25% Top 5 Global M&A Advisor 1,400+ Transactions Completed Valued Employee-Owned at More Than $3.0 Trillion Collectively 1,000+ Annual Valuation Engagements Leading Capital Markets Advisor >$6 Billion Market Cap North America Europe and Middle East Asia-Pacific Atlanta Miami Amsterdam Madrid Beijing Sydney >$1 Billion Boston Minneapolis Dubai Milan Hong Kong Tokyo Annual Revenue Chicago New York Frankfurt Paris Singapore Dallas -

REGULATION of CROWDLENDING in the EUROPEAN UNION Understanding the Suitableness of EU Legislation for Crowdlending

REGULATION OF CROWDLENDING IN THE EUROPEAN UNION Understanding the suitableness of EU legislation for crowdlending. Thesis – LL.M International Business Law Aleix Vidal Monés Tilburg University 2017/2018 Student name Aleix Vidal Monés Supervisor Gil-Lemstra, P. (LLM) SNR 233888 Date 2018 ABSTRACT This paper works about the added value of crowdlending as a source of funding, its characteristics opportunities, risks and regulatory implications for the European Union (EU). In concrete, the thesis’ research is mainly focused on discovering whether the European fragmented regulatory scenario it is an appropriate playground for the crowdlending sector development. The conclusions are clear. They point out that the current EU regulatory panorama does not fit the needs of the crowdlending sector. In this sense, legislative action from the EU institutions is required to turn the "state by state" based crowdlending sector into a common European industry. TABLE OF CONTENTS I.- INTRODUCTION ......................................................................................................................... 1 A) Presentation of the topic: ..................................................................................................... 1 B) Prior work on this subject: .................................................................................................... 4 C) Purpose and methodology research: .................................................................................... 5 D) Chapters overview: .............................................................................................................. -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD