SOFTWARE SECTOR REPORT Q4 2019 EXECUTIVE SUMMARY Software 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HW&Co. Landscape Industry Reader Template

TECHNOLOGY, MEDIA, & TELECOM QUARTERLY SOFTWARE SECTOR REVIEW │ 3Q 2016 www.harriswilliams.com Investment banking services are provided by Harris Williams LLC, a registered broker-dealer and member of FINRA and SIPC, and Harris Williams & Co. Ltd, which is authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. is a trade name under which Harris Williams LLC and Harris Williams & Co. Ltd conduct business. TECHNOLOGY, MEDIA, & TELECOM QUARTERLY SOFTWARE SECTOR REVIEW │ 3Q 2016 HARRIS WILLIAMS & CO. OVERVIEW HARRIS WILLIAMS & CO. (HW&CO.) GLOBAL ADVISORY PLATFORM CONTENTS . DEAL SPOTLIGHT . M&A TRANSACTIONS – 2Q 2016 KEY FACTS . SOFTWARE M&A ACTIVITY . 25 year history with over 120 . SOFTWARE SECTOR OVERVIEWS closed transactions in the . SOFTWARE PRIVATE PLACEMENTS last 24 months OVERVIEW . SOFTWARE PUBLIC COMPARABLES . Approximately 250 OVERVIEW professionals across seven . TECHNOLOGY IPO OVERVIEW offices in the U.S. and . DEBT MARKET OVERVIEW Europe . APPENDIX: PUBLIC COMPARABLES DETAIL . Strategic relationships in India and China HW&Co. Office TMT CONTACTS Network Office UNITED STATES . 10 industry groups Jeff Bistrong Managing Director HW&CO. TECHNOLOGY, MEDIA & TELECOM (TMT) GROUP FOCUS AREAS [email protected] Sam Hendler SOFTWARE / SAAS INTERNET & DIGITAL MEDIA Managing Director [email protected] . Enterprise Software . IT and Tech-enabled . AdTech and Marketing . Digital Media and Content Services Solutions Mike Wilkins . Data and Analytics . eCommerce Managing Director . Infrastructure and . Data Center and . Consumer Internet . Mobile [email protected] Managed Services Security Software EUROPE Thierry Monjauze TMT VERTICAL FOCUS AREAS Managing Director [email protected] . Education . Fintech . Manufacturing . Public Sector and Non-Profit . Energy, Power, and . Healthcare IT . Professional Services . Supply Chain, Transportation, TO SUBSCRIBE PLEASE EMAIL: Infrastructure and Logistics *[email protected] SELECT RECENT HW&CO. -

Education Technology & Services Market

Market Update Education Key Highlights The top subsector stock performer in Q4 2019 Technology was digital educational content & services, up 13.7% year-over-year & Services On average, EBITDA multiples for the subsectors decreased 0.5x from the prior quarter and were Q4 2019 down 0.8x on a year-over-year basis 2020 Forecast…Sustained Robust Deal Activity Focused on High Quality Assets and Strong Outcomes-Driven Business Models For several years now, we have been predicting continued consolidation within the education technology and services market. Merger and acquisition activity of all types within the sector has been robust, with overall transaction volumes repeatedly surpassing year-over-year levels by healthy margins. Even with ongoing strategic consolidation in the space, ever-increasing private equity interest in the education sector has been the primary driver of continued strong transaction levels and increasing valuations. A record amount of available capital, or “dry powder,” and elevated interest in software-as-a-service (“SaaS”) business models were the primary underlying factors driving private equity interest levels in ed tech businesses. Interest in high quality education providers has also been robust, underpinned by strong outcome-driven theses behind businesses built to solve the “achievement gap” and/or “skills gap” problem with a keen focus on value proposition to the consumer. In the early childhood segment, activity levels remain high, driven by continued professionalization and consolidation within an otherwise highly fragmented global market. And in the proprietary postsecondary sector, after a “decade of pain,” M&A has made a comeback with several new investments by private equity investors seeking premium operators in markets with strong supply/ demand imbalances. -

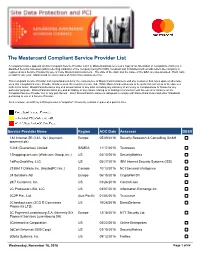

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Philadelphia Investment Trends Report

Venture impact Technology investment in the Greater Philadelphia region Trends and highlights, January 2008 to June 2013 Innovation, investment and opportunity On behalf of EY, Ben Franklin Technology Partners of Southeastern Pennsylvania and the Greater Philadelphia Alliance for Capital and Technologies (PACT), we are pleased to present this review 421 companies of technology investment trends and highlights in the Greater Philadelphia region. $4.1 billion The technology investment community in the Greater Philadelphia region includes a wide variety of funding sources supporting a diverse array of companies and industry sectors. In this report, Total investment since we’ve analyzed more than a thousand investment rounds and January 2008 exits that occurred in the Philadelphia region since 2008 – including investments from venture capital fi rms (VCs), angel investors (Angels), corporate/strategic investors, seed funds, accelerators and other sources of funding. As shown in this report, 2012 reversed a post-recession slowdown in venture funding in Greater Philadelphia, and to date, 2013 has brought a welcome increase in the amount of new funds available at regional investment fi rms. These are positive signs for our region’s technology companies, as are the increasing number of exits via IPO and acquisition, which serve as further validation of the investment opportunities created by our region’s growing technology sector. We encourage you to explore this report, and we hope that it will provide useful insights into the current state of -

Software Sector Summary Report

SOFTWARE SECTOR REPORT Q1 2019 GCA: A LEADING INDEPENDENT GLOBAL INVESTMENT BANK Global investment bank providing strategic M&A and capital markets advisory services to growth companies and market leaders LEEDS PARIS FRANKFURT MANCHESTER MUNICH ZURICH NAGOYA TOKYO LONDON SHANGHAI NEW YORK MILAN NEW DELHI OSAKA TEL AVIV FUKUOKA SAN FRANCISCO TAIPEI MUMBAI SINGAPORE HO CHI MINH CITY Global platform: Sector expertise: Exceptional cross- 21 offices in key Experienced team: Expansive coverage border capabilities: markets across Over 400 employees and deep Over a third of all America, Asia and across the globe specialization transactions Europe Broad spectrum Diversified Strong reputation of clients: business model: and track record: Leading Geographically High number of conglomerates, top balanced, synergistic repeat clients and private equity firms and complementary referrals and emerging high- focus areas growth companies 2 GCA operates as GCA in America and Asia, and GCA Altium in Europe GCA OVERVIEW The GCA Software Team US Team Paul DiNardo Daniel Avrutsky Rupert Sadler Josh Wepman Managing Director Managing Director Managing Director Managing Director Software HCM Software Software, Travel & Telematics Software & Digital Media [email protected] [email protected] [email protected] [email protected] James Orozco Clark Callander Chris Gough Kevin Walsh Managing Director Managing Director Managing Director Managing Director Financial Sponsors Technology Real Estate Tech Software & Digital Media [email protected] [email protected] -

A Microsoft Office for Software Development with a Growing Moat, Large TAM and High-Quality Management

Company: Atlassian (NasdaqGS: TEAM) Rainbow Chik Recommendation: Long [email protected] Price Target: $422 (79% upside/ 21% 3-yr IRR) A Microsoft Office for software development with a growing moat, large TAM and high-quality management KEY STATISTICS TRADING CHART EXECUTIVE SUMMARY Atlassian is a high-quality SaaS market leader that offers mission critical workplace collaboration and Application Development software. It is analogous to Microsoft Office for software development and is the oil that powers software development from planning, coding, deployment, support and collaboration. I believe TEAM is undervalued as the market (1) underappreciates TEAM’s moat expansion as a result of cloud migration, (2) underestimates TEAM’s strong network effect expanding in the large knowledge worker TAM, (3) overlooks management quality being long-term owner- operator and prudent capital allocator. The recently announced migration from perpetual licenses to cloud subscription presents a unique window to invest. Investors are concerned about the short-term revenue headwind and churn risk as a result of cloud migration, but my research suggests that it masked the better business potential given it leads to higher pricing power in a win-win situation and much stickier customers in the long-term. My base case valuation suggests a 79% upside from its current valuation at $236 ($423 target price). This is based upon sustained strong customer growth and subscription revenue per customer growth during and post-cloud-migration from my research. In addition, my bull/ bear case analysis suggests an attractive 3.5x upside/ downside ratio. COMPANY OVERVIEW Atlassian = Microsoft Office for software development Founded in 2002, Atlassian is an Australian SaaS market leader. -

Including League Tables of Financial Advisors

An Acuris Company Finding the opportunities in mergers and acquisitions Global & Regional M&A Report 2019 Including League Tables of Financial Advisors mergermarket.com An Acuris Company Content Overview 03 Global 04 Global Private Equity 09 Europe 14 US 19 Latin America 24 Asia Pacific (excl. Japan) 29 Japan 34 Middle East & Africa 39 M&A and PE League Tables 44 Criteria & Contacts 81 mergermarket.com Mergermarket Global & Regional Global Overview 3 M&A Report 2019 Global Overview Regional M&A Comparison North America USD 1.69tn 1.5% vs. 2018 Inbound USD 295.8bn 24.4% Outbound USD 335.3bn -2.9% PMB USD 264.4bn 2.2x Latin America USD 85.9bn 12.5% vs. 2018 Inbound USD 56.9bn 61.5% Outbound USD 8.9bn 46.9% EMU USD 30.6bn 37.4% 23.1% Europe USD 770.5bn -21.9% vs. 2018 50.8% 2.3% Inbound USD 316.5bn -30.3% Outbound USD 272.1bn 28.3% PMB USD 163.6bn 8.9% MEA USD 141.2bn 102% vs. 2018 Inbound USD 49.2bn 29% Outbound USD 22.3bn -15.3% Ind. & Chem. USD 72.5bn 5.2x 4.2% 17% 2.6% APAC (ex. Japan) USD 565.3bn -22.5% vs. 2018 Inbound USD 105.7bn -14.8% Outbound USD 98.9bn -24.5% Ind. & Chem. USD 111.9bn -5.3% Japan USD 75.4bn 59.5% vs. 2018 Inbound USD 12.4bn 88.7% Global M&A USD 3.33tn -6.9% vs. 2018 Outbound USD 98.8bn -43.6% Technology USD 21.5bn 2.8x Cross-border USD 1.27tn -6.2% vs. -

Quarterly Holdings Report for Fidelity® Growth Strategies Fund

Quarterly Holdings Report for Fidelity® Growth Strategies Fund February 28, 2021 FEG-QTLY-0421 1.797938.117 Schedule of Investments February 28, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.1% Shares Value (000s) COMMUNICATION SERVICES – 4.4% Entertainment – 2.8% Electronic Arts, Inc. 210,000 $ 28,134 Take‑Two Interactive Software, Inc. (a) 340,000 62,716 90,850 Interactive Media & Services – 1.6% Bumble, Inc. 16,300 1,097 Match Group, Inc. (a) 324,300 49,569 50,666 TOTAL COMMUNICATION SERVICES 141,516 CONSUMER DISCRETIONARY – 7.3% Distributors – 1.1% Pool Corp. 105,000 35,151 Hotels, Restaurants & Leisure – 0.6% Domino’s Pizza, Inc. 55,900 19,370 Household Durables – 1.4% D.R. Horton, Inc. 114,500 8,802 Lennar Corp. Class A 66,100 5,484 NVR, Inc. (a) 1,650 7,426 Tempur Sealy International, Inc. 732,100 24,459 46,171 Internet & Direct Marketing Retail – 1.6% eBay, Inc. 207,100 11,685 Etsy, Inc. (a) 175,600 38,679 50,364 Multiline Retail – 0.8% Dollar General Corp. 143,000 27,026 Specialty Retail – 1.8% AutoZone, Inc. (a) 14,200 16,471 Best Buy Co., Inc. 257,200 25,810 Tractor Supply Co. 63,003 10,015 Williams‑Sonoma, Inc. 40,300 5,291 57,587 TOTAL CONSUMER DISCRETIONARY 235,669 CONSUMER STAPLES – 4.6% Beverages – 1.5% Boston Beer Co., Inc. Class A (a) 25,300 26,026 Brown‑Forman Corp. Class B (non‑vtg.) 303,099 21,696 47,722 Quarterly Report 2 Common Stocks – continued Shares Value (000s) CONSUMER STAPLES – continued Food Products – 1.5% Bunge Ltd. -

Private Equity & Venture Capital

VOLUME 14, ISSUE 6 ■ AUGUST 2018 PRIVATE EQUITY & VENTURE CAPITAL SPOTLIGHT THE RISE OF VENTURE AND IN THIS ISSUE GROWTH CAPITAL IN EUROPE €11bn in capital has already been secured by venture and growth capital funds focused on Europe that have closed this FEATURE 3 year; this is the highest figure seen at this stage in recent The Rise of Venture years. We put activity in the region under the microscope, examining the economic factors that have contributed to and Growth Capital in this. Europe Find out more on page 3 INDUSTRY NEWS 7 THE FACTS ■ Private Equity in the 9 PRIVATE EQUITY IN THE NORDIC Nordic Region REGION ■ Public Pension Funds 12 Investing in Private With the capital raised by managers based in the Nordic Equity region reaching record highs, we take a look at the growing private equity market in terms of fundraising activity, investor make-up and largest exits in the region. CONFERENCES 14 Find out more on page 9 RECENTLY RELEASED: THE 2018 PREQIN PRIVATE CAPITAL FUND TERMS THE 2018 PRIVATE CAPITAL All data in this newsletter ADVISOR can be downloaded to PREQIN FUND TERMS ADVISOR Excel for free Order Your Copy Download Sample Pages Sign up to Spotlight, our free monthly newsletter, providing insights into performance, investors, deals and fundraising, powered by Preqin data: Alt Credit Intelligence European and US Fund Services Awards: Best Data and Information Provider | Africa Global Funds Awards 2016: Best Research and Data Provider | The Queen’s SIGN UP Award for Enterprise: International Trade | HedgeWeek Global Awards: -

Software Sector Summary Report

Software COMPANYSector PRESENTATION Summary Week of October 2, 2017 1 DEAL DASHBOARD Software $35.9 Billion 470 $29.1 Billion 76 Financing Volume YTD (1)(2) Financing Transactions YTD (1)(2) M&A Volume YTD (3) M&A Transactions YTD (3) Select Financing Transactions Quarterly Financing Volume (1)(2) Quarterly M&A Volume (3) Select M&A Transactions (4) $Bn $Bn (61)% Company Amount ($MM) 43% Target Acquirer EV ($MM) $14 $50 $270 $12 $41 $3,903 $10 $11 $9 $6 $6 $24 $250 $6 $5 $1,125 $16 $15 $12 ( ) $12 $6 $5 $70 $834 ( ) Q3'15 Q4'15 Q1'16 Q2'16Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 $45 Quarterly Financing Deal Count (1)(2) Quarterly M&A Deal Count (3) $614 36% $35 9% $531 156 160 154 127 118 123 103 111 $35 94 29 29 29 29 $382 24 24 26 21 $32 14 $344 $26 $270 Q3'15 Q4'15 Q1'16 Q2'16Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Last 12 Months Software Price Performance vs. S&P 500 (5) M&A EV/ NTM Rev. Over Time (6) 35.0% SPX IGV All Buyers Strategic Buyers PE Buyers 30.0% 30% 6 ` 5.3x Financing Activity by Quarter 4.7x 4.9x 5 4.5x 4.6x 25.0% 4.2x 4.3x 4.0x 4.1x 3.9x 3.9x 3.7x 20.0% 4 3.6x 3.1x 16% 2.7x 2.9x 2.9x 15.0% 3 2.5x 2.5x 2.5x 2.2x 10.0% 2 5.0% 1 0.0% 0 Sep-16 Oct-16 Nov-16 Dec-16 Jan-17 Feb-17 Mar-17 Apr-17 May-17 Jun-17 Jul-17 Aug-17 2011 2012 2013 2014 2015 2016 2017 (5.0%) (10.0%) Notes: Source: Capital IQ, PitchBook, and Dow Jones VentureSource. -

The Direct Listing As a Competitor of the Traditional Ipo

The Direct Listing As a Competitor of the Traditional Ipo Research Paper – Law & Economics Course (IUS/05) Degree: Economics & Business, Dipartimento di Economia e Finanza Academic Year: 2019-2020 Name: Ludovico Morera Student Number: 216721 Supervisor: Prof. Pierluigi Matera The Direct Listing as a Competitor of the Traditional Ipo 2 Abstract In 2018, Spotify SA broke into the NYSE through an unusual direct listing, allowing it to become a publicly traded company without the high underwriting costs of a traditional Initial Public Offering that often deter companies from requesting to list. In order for such procedure to be possible, Spotify had to work closely with NYSE and SEC staff, which allowed for some amendments to their implementations of the Securities Act and the Securities Exchange Act. In this way, Spotify’s listing was done within the limits imposed by the U.S. market authorities. Several rumours concerning the direct listing arose, speculating that it may disrupt the American going public market and get past the standard firm-commitment underwriting procedures. This paper argues that these beliefs are largely wrong given the current regulatory limitations and tries to clarify for what firms direct listing is actually suitable. Furthermore, unlike the United Kingdom whose public exchanges have some experience, the NYSE faced such event for the first time; it follows that liability provisions under § 11 of the securities Act of 1933 may be attributed in different ways, especially due to the absence of an underwriter that may be held liable in case of material misstatements and omissions upon the registered documents. I find out that the direct listing can substitute the traditional IPO partially and only a restricted group of firms with some specific features could successfully do without an underwriter. -

Including League Tables of Financial Advisors

An Acuris Company Finding the opportunities in mergers and acquisitions Global & Regional M&A Report 2019 Including League Tables of Financial Advisors mergermarket.com An Acuris Company Content Overview 03 Global 04 Global Private Equity 09 Europe 14 US 19 Latin America 24 Asia Pacific (excl. Japan) 29 Japan 34 Middle East & Africa 39 M&A and PE League Tables 44 Criteria & Contacts 81 mergermarket.com Mergermarket Global & Regional Global Overview 3 M&A Report 2019 Global Overview Regional M&A Comparison North America USD 1.69tn 1.5% vs. 2018 Inbound USD 295.8bn 24.4% Outbound USD 335.3bn -2.9% PMB USD 264.4bn 2.2x Latin America USD 85.9bn 12.5% vs. 2018 Inbound USD 56.9bn 61.5% Outbound USD 8.9bn 46.9% EMU USD 30.6bn 37.4% 23.1% Europe USD 770.5bn -21.9% vs. 2018 50.8% 2.3% Inbound USD 316.5bn -30.3% Outbound USD 272.1bn 28.3% PMB USD 163.6bn 8.9% MEA USD 141.2bn 102% vs. 2018 Inbound USD 49.2bn 29% Outbound USD 22.3bn -15.3% Ind. & Chem. USD 72.5bn 5.2x 4.2% 17% 2.6% APAC (ex. Japan) USD 565.3bn -22.5% vs. 2018 Inbound USD 105.7bn -14.8% Outbound USD 98.9bn -24.5% Ind. & Chem. USD 111.9bn -5.3% Japan USD 75.4bn 59.5% vs. 2018 Inbound USD 12.4bn 88.7% Global M&A USD 3.33tn -6.9% vs. 2018 Outbound USD 98.8bn -43.6% Technology USD 21.5bn 2.8x Cross-border USD 1.27tn -6.2% vs.