Russia G20 Coal Subsidies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Energy Without Borders

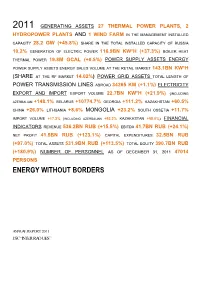

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

Notes on Moscow Exchange Index Review

Notes on Moscow Exchange index review Moscow Exchange approves the updated list of index components and free float ratios effective from 16 March 2018. X5 Retail Group N.V. (DRs) will be added to Moscow Exchange indices with the expected weight of 1.13 per cent. As these securities were offered initially, they were added without being in the waiting list under consideration. Thus, from 16 March the indices will comprise 46 (component stocks. The MOEX Russia and RTS Index moved to a floating number of component stocks in December 2017. En+ Group plc (DRs) will be in the waiting list to be added to Moscow Exchange indices, as their liquidity rose notably over recent three months. NCSP Group (ords) with low liquidity, ROSSETI (ords) and RosAgro PLC with their weights now below the minimum permissible level (0.2 per cent) will be under consideration to be excluded from the MOEX Russia Index and RTS Index. The Blue Chip Index constituents remain unaltered. X5 Retail Group (DRs), GAZ (ords), Obuvrus LLC (ords) and TNS energo (ords) will be added to the Broad Market Index, while Common of DIXY Group and Uralkali will be removed due to delisting expected. TransContainer (ords), as its free float sank below the minimum threshold of 5 per cent, and Southern Urals Nickel Plant (ords), as its liquidity ratio declined, will be also excluded. LSR Group (ords) will be incuded into SMID Index, while SOLLERS and DIXY Group (ords) will be excluded due to low liquidity ratio. X5 Retail Group (DRs) and Obuvrus LLC (ords) will be added to the Consumer & Retail Index, while DIXY Group (ords) will be removed from the Index. -

An Overview of Boards of Directors at Russia's Largest Public Companies

An Overview Of Boards Of Directors At Russia’s Largest Public Companies Andrei Rakitin Milena Barsukova Arina Mazunova Translated from Russian August 2020 Key Results According to information disclosed by 109 of Russia’s largest public companies: “Classic” board compositions of 11, nine, and seven seats prevail The total number of persons on Boards of the companies under study is not as low as it might seem: 89% of all Directors were elected to only one such Board Female Directors account for 12% and are more often elected to the audit, nomination, and remuneration committees than to the strategy committee Among Directors, there are more “humanitarians” than “techies,” while the share of “techies” among chairs is greater than across the whole sample The average age for Directors is 53, 56 for Chairmen, and 58 for Independent Directors Generation X is the most visible on Boards, and Generation Y Directors will likely quickly increase their presence if the impetuous development of digital technologies continues The share of Independent Directors barely reaches 30%, and there is an obvious lack of independence on key committees such as audit Senior Independent Directors were elected at 17% of the companies, while 89% of Chairs are not independent The average total remuneration paid to the Board of Directors is RUR 69 million, with the difference between the maximum and minimum being 18 times Twenty-four percent of the companies disclosed information on individual payments made to their Directors. According to this, the average total remuneration is approximately RUR 9 million per annum for a Director, RUR 17 million for a Chair, and RUR 11 million for an Independent Director The comparison of 2020 findings with results of a similar study published in 2012 paints an interesting dynamic picture. -

Global Expansion of Russian Multinationals After the Crisis: Results of 2011

Global Expansion of Russian Multinationals after the Crisis: Results of 2011 Report dated April 16, 2013 Moscow and New York, April 16, 2013 The Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, Moscow, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint center of Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Russian multinationals today.1 The survey, conducted from November 2012 to February 2013, is part of a long-term study of the global expansion of emerging market non-financial multinational enterprises (MNEs).2 The present report covers the period 2009-2011. Highlights Russia is one of the leading emerging markets in terms of outward foreign direct investments (FDI). Such a position is supported not by several multinational giants but by dozens of Russian MNEs in various industries. Foreign assets of the top 20 Russian non-financial MNEs grew every year covered by this report and reached US$ 111 billion at the end of 2011 (Table 1). Large Russian exporters usually use FDI in support of their foreign activities. As a result, oil and gas and steel companies with considerable exports are among the leading Russian MNEs. However, representatives of other industries also have significant foreign assets. Many companies remained “regional” MNEs. As a result, more than 66% of the ranked companies’ foreign assets were in Europe and Central Asia, with 28% in former republics of the Soviet Union (Annex table 2). Due to the popularity of off-shore jurisdictions to Russian MNEs, some Caribbean islands and Cyprus attracted many Russian subsidiaries with low levels of foreign assets. -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

(31) December 2014

The Year An Interview with Chairman Electrification in Pictures: of Completed Ins of the State Duma’s Committee some facts from the history and Expected Outs for Energy Ivan GRACHEV of energy posters 14 20 32 Magazine about Russia’s Power Industry ENERGY WITHOUT BORDERS № 6 (31) December 2014 – January 2015 Happy Payments! The industry is anticipating tougher measures against non- payers in the retail electricity market IN RUSSIAN AND ENGLISH peretok.ru ENERGETICS IN RUSSIA AND IN THE WORLD peretok.ru NETWORKED! Dear readers, he end of the year is the time to sum up results. One of the un- solved problems of the year of 2014 is the outstanding debt for power supply. As of November 1, the amount owed to guaranteed supply companies in Russia reached 165 billion rubles. At the same time, the guaranteed supply companies have to pay on the wholesale market just in time and are forced to arrange loans to fulfill their obligations. Consumers’ poor payment discipline caus- es payment problems along the entire chain, undermining power companies’ financial stability, while the situation with non-pay- ments adversely affects the industry as a whole. Today, power supply companies do everything possible to get their money from consumers, including sending notices, cutting off electricity supply, filing lawsuits, and, jointly with court bai- liffs, prohibiting debtors from travelling abroad. It is clear that power supply companies will not be able to address this problem independently; this will require a systematic approach at the highest Tlevel. The State Duma is now developing a whole series of amendments to legislation aimed at tightening payment discipline on the retail market. -

Investment from Russia Stabilizes After the Global Crisis 1

Institute of World Economy and International Relations (IMEMO) of Russian Academy of Sciences Investment from Russia stabilizes after the global crisis 1 Report dated June 23, 2011 EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before June 23, 2011, 3:00 p.m. Moscow; 11 a.m. GMT; and 7 a.m. New York. Moscow and New York, June 23, 2011 : The Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, Moscow, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint undertaking of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their second joint survey of Russian outward investors today 2. The survey is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets. The present survey, conducted at the beginning of 2011, covers the period 2007-2009. Highlights Despite the global crisis of the last few years, Russia has remained one of the leading outward investors in the world. The foreign assets of Russian MNEs have grown rapidly and only China and Mexico are further ahead among emerging markets. As the results of our survey show, several non- financial 3 Russian MNEs are significant actors in the world economy. The foreign assets of the 20 leading non-financial MNEs were about USD 107 billion at the end of 2009 (table 1). Their foreign sales 4 were USD 198 billion and they had more than 200,000 employees abroad. -

DMITRY GUBAREV PARTNER Moscow

DMITRY GUBAREV PARTNER Moscow Dmitry specialises in banking and finance transactions in Russia and other CIS countries. +7 495 36 36510 [email protected] BACKGROUND Dmitry Graduated from Moscow State University in 1998, Law Degree. Doctor of Law Degree, 2002, Diplomatic Academy of the Ministry of Foreign Affairs of the Russian Federation. KEY SERVICES KEY SECTORS Finance Banks and other Financial Institutions Restructuring, Turnaround and Insolvency Real Estate EXPERIENCE Dmitry has a focus on syndicated lending and debt restructurings in the Russian market. Dmitry represents international and Russian banks and corporations on all types of financing transactions in Russia and other CIS countries, including syndicated loans, real estate and infrastructure financings, pre-export financings and structured products. Consistently recognised as a leading Finance lawyer in the Russian market, clients describe Dmitry as "proactive and dynamic" and a “very strong negotiator," according to Chambers Global. Legal 500 sources comment that he “impresses with his helpfulness, knowledge and professionalism” and note his “excellent knowledge of English and Russian law and his ability to provide effective solutions during tough negotiations. Dmitry has advised: VEB.RF and VTB Bank on an up to RUB32 billion project financing of the construction of a specialised coal seaport "Sukhodol" (with capacity of 12 million tonnes per year) at the Russian Far East. The construction is initiated by SDS-Ugol in partnership with Russian Railways (financing is provided under the "Project Finance Factory" programme) Russian Crab Group in connection with a multibillion syndicated facility in relation to acquisition of crab fishing quotas, acquisition of crab fishing fleet and constructions of new crab fishing vessels in Russian shipyards VTB Group on providing an approximately EUR1.1 billion syndicated financing to Kazakhstan mining companies (Altynalmas group and Kazakhaltyn group) Sberbank of Russia on secured financing of over EUR900 million acquisition of a number of shopping malls in Moscow and St. -

Company News SECURITIES MARKET NEWS LETTER Weekly

SSEECCUURRIIITTIIIEESS MMAARRKKEETT NNEEWWSSLLEETTTTEERR weekly Presented by: VTB Bank, Custody March 5, 2020 Issue No. 2020/08 Company News Polyus to become Moscow Exchange’s blue chip instead of Severstal On February 28, 2020 it was reported that the Moscow Exchange planned to include the ordinary shares of Russian gold producer Polyus in its Blue Chip index instead of the shares of steelmaker Severstal on March 20. The depository receipts of multi-industry holding En+ Group will be replaced with its shares, and the shares together with the depository receipts of payment system operator Qiwi will be considered to be added to the MOEX Russia Index and the RTS Index. Other changes to the indices include addition of depository receipts of real estate developer Etalon Group and exclusion of Seligdar from the Broad Market Index, inclusion of ordinary shares of fertilizer producer Acron and Pharmacy Chain 36.6 in the SMID Index, and exclusion of ordinary shares of oil company RussNeft and oil and gas pipe producer TMK from the Oil and Gas Index. The committee also recommended that the Moscow Exchange launch a new sectorial index for the Russian real estate industry. Mail.ru’s board of directors approves listing on Moscow Exchange On March 2, 2020 the board of directors of Russian Internet company Mail.ru Group approved a listing of global depositary receipts (GDRs) on the Moscow Exchange. The plan is for Mail.ru Group’s GDRs to begin trading in Moscow by July. There will not be any secondary issuance accompanying the listing. Russian antitrust clears Fortum to buy stake in Uniper On March 2, 2020 it was announced that Russia’s Federal Antimonopoly Service cleared Finland’s Fortum to acquire a 20.5% stake in Germany’s Uniper. -

Share Capital

Company Strategic Production Financial Corporate Shareholder Appendix profile report results results governance and investor 181 ANNUAL REPORT – 2018 engagement SHARE CAPITAL PJSC Inter RAO has charter capital of RUB 293,339,674,800, which is split into STRUCTURE OF SHARE CAPITAL 104.44 billion ordinary shares with par value of RUB 2.809767 each. The shares % are included in the First Tier of the List of Securities that are permitted to trade AS OF DECEMBER 31, 2017 AS OF DECEMBER 31, 2018 on PJSC Moscow Exchange, the exchange’s highest tier. As of December 31, 2018, PJSC Inter RAO had no preferred shares. 4.9 9.2 18.6 The Russian Federation, as represented by the Federal Agency for State Property 29.4 Management, owns 493.69 ordinary shares (0.0000005% of charter capital). Shares in free-float The Russian Federation has no special right to manage the Company (“golden share”). Rosneftegaz Group JSC Inter RAO Capital PJSC FGC UES PJSC Inter RAO had a total of 354,745 shareholders as of December 31, 2018, 20.0 RusHydro Group including 351,968 individuals. 28.9 33.7 The proportion of quasi-treasury shares1 owned by JSC Inter RAO Capital is 29.39%. 27.6 The changes in the share ownership proportion of PJSC FGC UES from 18.57% 27.6 BUSINESS to 9.24% and the RusHydro Group from 4.92% to 0% resulted from transactions involving the purchase and sale of PJSC Inter RAO shares. The change in the proportion of share ownership of JSC Inter RAO – Capital INFORMATION ABOUT END BENEFICIARIES AS OF DECEMBER 31, 2018 from 19.98% to 29.39% resulted from transactions involving the purchase and sale Individual or company End Number of shares of PJSC Inter RAO shares and the implementation of a long-term incentive program name beneficiary Total % of charter for the management of the Inter RAO Group. -

The Russian State and Russian Energy Companies in the Post-Soviet Region, 1992–2012

Mutually supportive? The Russian State and Russian Energy Companies in the Post-Soviet Region, 1992–2012 By Ingerid Maria Opdahl A thesis submitted to The University of Birmingham For the degree of DOCTOR OF PHILOSOPHY Centre for Russian, European and Eurasian Studies Department of Political Science and International Studies School of Government and Society College of Social Sciences University of Birmingham May 2015 University of Birmingham Research Archive e-theses repository This unpublished thesis/dissertation is copyright of the author and/or third parties. The intellectual property rights of the author or third parties in respect of this work are as defined by The Copyright Designs and Patents Act 1988 or as modified by any successor legislation. Any use made of information contained in this thesis/dissertation must be in accordance with that legislation and must be properly acknowledged. Further distribution or reproduction in any format is prohibited without the permission of the copyright holder. Abstract This thesis investigates relations between five Russian energy companies – RAO UES/Inter RAO (electricity), Minatom/Rosatom (nuclear energy), Lukoil (oil), Transneft (oil pipelines) and Gazprom (gas) – and the Russian state from 1992 to 2012, with particular regard to state–company interaction over Russian foreign policy and companies’ activities in the post-Soviet region. The argument is that, due to the institutional legacies of the Soviet system, state–company interaction over foreign policy and energy operations abroad was part of their interaction over the Russian state’s institutional development. The study is based on the conceptual framework of social orders developed by North, Wallis and Weingast (NWW). -

INTER RAO Share Placement Price – 0.0535 RUB

Additional share issue Fundamentals Basic results of Private placement : INTER RAO share placement price – 0.0535 RUB Number of shares issued – 13,800,000,000,000 common shares Total number of shares placed with the participants of private placement – 6,822,972,629,771 shares. A total of 49.4% of newly issued shares were placed Number of shares placed with Inter RAO Capital – 2,917,890,939,501 (including shares for deal with Norilsk Nickel, stock option program and future deals) Final volume of Inter RAO’s authorized capital after private placement - 9,716,000,000,000 ordinary shares (increase by a factor of 3.36) Value of the share capital of the Company - 272.997 billion RUB* Total value of assets acquired by Inter RAO within the private placement: • Shares of utility companies - 283.2 bn RUB** • Cash – 81.8 bn RUB Share of government and state-owned companies in the authorized capital of Inter RAO amounts to 60%; Registration of additional share placement report by Federal Service for Financial Markets is planned for June 2011 Newly issued shares should start trading in June 2011 and merge into main symbol in October 2011 (MICEX) * Par value of 1 share - 0.02809767 RUB ** Value of assets based on independent appraisers. It does not include assets that might be received by INTER RAO’ s subsidiaries (closed subscription participants) after May, 17 2 Ownership structure Equity structure before Equity structure to May 17, 2011 Target equity structure after deals placement Minority finalization shareholders Federal Property Federal Property