Internal Custody News Company News SECURITIES MARKET

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Energy Without Borders

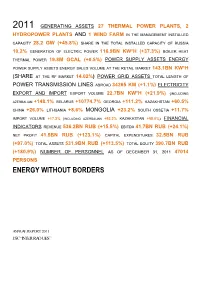

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

Notes on Moscow Exchange Index Review

Notes on Moscow Exchange index review Moscow Exchange approves the updated list of index components and free float ratios effective from 16 March 2018. X5 Retail Group N.V. (DRs) will be added to Moscow Exchange indices with the expected weight of 1.13 per cent. As these securities were offered initially, they were added without being in the waiting list under consideration. Thus, from 16 March the indices will comprise 46 (component stocks. The MOEX Russia and RTS Index moved to a floating number of component stocks in December 2017. En+ Group plc (DRs) will be in the waiting list to be added to Moscow Exchange indices, as their liquidity rose notably over recent three months. NCSP Group (ords) with low liquidity, ROSSETI (ords) and RosAgro PLC with their weights now below the minimum permissible level (0.2 per cent) will be under consideration to be excluded from the MOEX Russia Index and RTS Index. The Blue Chip Index constituents remain unaltered. X5 Retail Group (DRs), GAZ (ords), Obuvrus LLC (ords) and TNS energo (ords) will be added to the Broad Market Index, while Common of DIXY Group and Uralkali will be removed due to delisting expected. TransContainer (ords), as its free float sank below the minimum threshold of 5 per cent, and Southern Urals Nickel Plant (ords), as its liquidity ratio declined, will be also excluded. LSR Group (ords) will be incuded into SMID Index, while SOLLERS and DIXY Group (ords) will be excluded due to low liquidity ratio. X5 Retail Group (DRs) and Obuvrus LLC (ords) will be added to the Consumer & Retail Index, while DIXY Group (ords) will be removed from the Index. -

Annual Report

2014 ANNUAL REPORT TABLE OF CONTENTS Sistema today 2 Corporate governance system 91 History timeline 4 Corporate governance principles 92 Company structure 8 General Meeting of shareholders 94 President’s speech 10 Board of Directors 96 Strategic Review 11 Commitees of the Board of Directors 99 Strategy 12 President and the Management Board 101 Sistema’s financial results 20 Internal control and audit 103 Shareholder capital and securities 24 Development of the corporate 104 governance system in 2014 Our investments 27 Remuneration 105 MTS 28 Risks 106 Detsky Mir 34 Sustainable development 113 Medsi Group 38 Responsible investor 114 Lesinvest Group (Segezha) 44 Social investment 115 Bashkirian Power Grid Company 52 Education, science, innovation 115 RTI 56 Culture 117 SG-trans 60 Environment 119 MTS Bank 64 Society 121 RZ Agro Holding 68 Appendices 124 Targin 72 Binnopharm 76 Real estate 80 Sistema Shyam TeleServices 84 Sistema Mass Media 88 1 SISTEMA TODAY Established in 1993, today Sistema including telecommunications, companies. Sistema’s competencies is a large private investor operating utilities, retail, high tech, pulp and focus on improvement of the in the real sector of the Russian paper, pharmaceuticals, healthcare, operational efficiency of acquired economy. Sistema’s investment railway transportation, agriculture, assets through restructuring and portfolio comprises stakes in finance, mass media, tourism, attracting industry partners to predominantly Russian companies etc. Sistema is the controlling enhance expertise and reduce -

An Overview of Boards of Directors at Russia's Largest Public Companies

An Overview Of Boards Of Directors At Russia’s Largest Public Companies Andrei Rakitin Milena Barsukova Arina Mazunova Translated from Russian August 2020 Key Results According to information disclosed by 109 of Russia’s largest public companies: “Classic” board compositions of 11, nine, and seven seats prevail The total number of persons on Boards of the companies under study is not as low as it might seem: 89% of all Directors were elected to only one such Board Female Directors account for 12% and are more often elected to the audit, nomination, and remuneration committees than to the strategy committee Among Directors, there are more “humanitarians” than “techies,” while the share of “techies” among chairs is greater than across the whole sample The average age for Directors is 53, 56 for Chairmen, and 58 for Independent Directors Generation X is the most visible on Boards, and Generation Y Directors will likely quickly increase their presence if the impetuous development of digital technologies continues The share of Independent Directors barely reaches 30%, and there is an obvious lack of independence on key committees such as audit Senior Independent Directors were elected at 17% of the companies, while 89% of Chairs are not independent The average total remuneration paid to the Board of Directors is RUR 69 million, with the difference between the maximum and minimum being 18 times Twenty-four percent of the companies disclosed information on individual payments made to their Directors. According to this, the average total remuneration is approximately RUR 9 million per annum for a Director, RUR 17 million for a Chair, and RUR 11 million for an Independent Director The comparison of 2020 findings with results of a similar study published in 2012 paints an interesting dynamic picture. -

Global Expansion of Russian Multinationals After the Crisis: Results of 2011

Global Expansion of Russian Multinationals after the Crisis: Results of 2011 Report dated April 16, 2013 Moscow and New York, April 16, 2013 The Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, Moscow, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint center of Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Russian multinationals today.1 The survey, conducted from November 2012 to February 2013, is part of a long-term study of the global expansion of emerging market non-financial multinational enterprises (MNEs).2 The present report covers the period 2009-2011. Highlights Russia is one of the leading emerging markets in terms of outward foreign direct investments (FDI). Such a position is supported not by several multinational giants but by dozens of Russian MNEs in various industries. Foreign assets of the top 20 Russian non-financial MNEs grew every year covered by this report and reached US$ 111 billion at the end of 2011 (Table 1). Large Russian exporters usually use FDI in support of their foreign activities. As a result, oil and gas and steel companies with considerable exports are among the leading Russian MNEs. However, representatives of other industries also have significant foreign assets. Many companies remained “regional” MNEs. As a result, more than 66% of the ranked companies’ foreign assets were in Europe and Central Asia, with 28% in former republics of the Soviet Union (Annex table 2). Due to the popularity of off-shore jurisdictions to Russian MNEs, some Caribbean islands and Cyprus attracted many Russian subsidiaries with low levels of foreign assets. -

Alfa Annual Report

ALFA GROUP CONSOLIDATED FINANCIAL STATEMENTS AND REPORT OF THE AUDITORS FOR THE YEAR ENDED 31 DECEMBER 2001 STATEMENT OF MANAGEMENT’S RESPONSIBILITIES TO THE SHAREHOLDERS OF ALFA GROUP . International convention requires that Management prepare consolidated financial statements which give a true and fair view of the state of affairs of Alfa Group (“the Group”) at the end of each financial period and of the results, cash flows and changes in shareholders’ equity for each period. Management are responsible for ensuring that the Group keeps accounting records which disclose, with reasonable accuracy, the financial position of each entity and which enable it to ensure that the consoli- dated financial statements comply with International Accounting Standards and that their statutory accounting reports comply with the applicable country’s laws and regulations. Furthermore, appropriate adjustments were made to such statutory accounts to present the accompanying consolidated financial statements in accordance with International Accounting Standards. Management also have a general responsibility for taking such steps as are reasonably possible to safeguard the assets of the Group and to prevent and detect fraud and other irregularities. Management considers that, in preparing the consolidated financial statements set out on pages to , the Group has used appropriate and consistently applied accounting policies, which are supported by reasonable and prudent judgments and estimates and that appropriate International Accounting Standards have been followed. For and on behalf of Management Nigel J. Robinson October ZAO PricewaterhouseCoopers Audit Kosmodamianskaya Nab. 52, Bld. 5 115054 Moscow Russia Telephone +7 (095) 967 6000 Facsimile +7 (095) 967 6001 REPORT OF THE AUDITORS TO THE SHAREHOLDERS OF ALFA GROUP . -

QUARTERLY REPORT Public Joint Stock Company

QUARTERLY REPORT Public Joint Stock Company ROSSETI Issuer Code: 55385-E Quarter 1 of 2018 Address of the issuer: Moscow, Russia The information contained in this Quarterly Report is subject to disclosure in accordance with the securities laws of the Russian Federation Director General ____________ P. A. Livinsky Date: May 15, 2018 signature Director of the Accounting and Reporting Department and Chief Accountant ____________ D. V. Nagovitsyn Date: May 15, 2018 signature Seal Contact person: Kseniya Valerievna Khokholkova, Deputy Head of the Securities and Disclosures Division of the Department for Corporate Governance and Shareholder and Investor Relations Telephone: (495) 995-5333 #3203 Fax: (495) 664-81-33 E-mail: [email protected] The information contained in this Quarterly Report is available on the Internet at www.rosseti.ru and http://www.e-disclosure.ru/portal/company.aspx?id=13806 1 Contents Contents ................................................................................................................................................................. 2 Introduction ............................................................................................................................................................ 5 Section I. Details of the Issuer’s Bank Accounts, Auditor (Audit Organization), Appraiser, and Financial Advisor and the Individuals Who Signed This Quarterly Report .......................................................................... 6 1.1. Bank Account Details of the Issuer ............................................................................................................ -

Transparency and Disclosure by Russian State-Owned Enterprises

Transparency And Disclosure By Russian State-Owned Enterprises Standard & Poor’s Governance Services Prepared for the Roundtable on Corporate Governance organized by the OECD in Moscow on June 3, 2005 Julia Kochetygova Nick Popivshchy Oleg Shvyrkov Vladimir Todres Christine Liadskaya June 2005 Transparency & Disclosure by Russian State-Owned Enterprises Transparency and Disclosure by Russian State-Owned Enterprises Executive Summary This survey of transparency and disclosure (T&D) by Russian state-owned companies by Standard & Poor’s Governance Services was prepared at the request of the OECD Roundtable on Corporate Governance. According to the OECD Guidelines on Corporate Governance of SOEs, “the state should act as an informed and active owner and establish a clear and consistent ownership policy, ensuring that the governance of state-owned enterprises is carried out in a transparent and accountable manner” (Chapter III). Further, “large or listed SOEs should disclose financial and non financial information according to international best practices” (Chapter V). In stark contrast with these principles, the study revealed consistent differences in disclosure standards between the state-controlled and similarly sized public Russian companies. This is in line with the notion that transparency of state-controlled enterprises is hampered by the tendency of the Russian government and individual officials to use their influence on such companies to promote political or individual goals that often diverge from commercial motives and investor interests. High standards of transparency and disclosure, on the other hand, are a cornerstone in the foundation of good governance. They provide legitimate stakeholders--whether creditors, minority shareholders, taxpayers, or the general public--with the information they need to be able to begin to hold government decision-makers accountable for their actions. -

PJSC FGC UES | Appendices to the Annual Report 2016

Appene to te Annual Report 2016 Annual Report 2016 1 Appendix 1 ADDITIONAL INFORMATION ON THE SECTIONS OF THE ANNUAL REPORT Contents APPENDIX 1. Additional Information on the The following Appendices are available on the official Company’s website at http://www.fsk-ees.ru/eng/investors/company_reports/ or in the electronic version of the Annual Report of PJSC FGC UES for 2016: Sections of the Annual Report Appendix 1. Additional Information on the Sections of the Annual Report 1 About the Company Appendix 2. Audit Commission’s Report 54 International Activity Appendix 3. Report on Compliance with the Russian Corporate Governance Code and 59 Federal Grid Company (PJSC FGC UES) is the transmission across the border of the Russian Report on Compliance with Main Principles of the UK Corporate Governance organization managing the Unified National Electric Federation and is a technical contractor of the export/ Code Grid (UNEG) under the Federal Law on 26 March 2003 import commercial contracts of the Wholesale Appendix 4. Information on Major Transactions and on Transactions by PJSC FGC UES in 80 No. 35-FZ On Electric Power. Starting from Electricity and Capacity Market (WECM) participants. 2016, Classified Under the laws of the Russian Federation as Related Party 1 January 2004 PJSC FGC UES performs the electricity Transactions Subject To Approval by the Company’s Authorised Governing Bodies Appendix 5. Information on Material Transactions made by PJSC FGC UES and Entities 113 Fnlan Controlled Thereby Appendix 6. Information on the Actual Execution of Instructions of the President and the 116 Government of the Russian Federation Estonia China Appendix 7. -

Company News SECURITIES MARKET NEWS LETTER Weekly

SSEECCUURRIIITTIIIEESS MMAARRKKEETT NNEEWWSSLLEETTTTEERR weekly Presented by: VTB Bank, Custody December 5, 2019 Issue No. 2019/46 Company News Freight One converts shares in papers with higher face value On November 28, 2019 Russian railway cargo operator Freight One, part of Fletcher Group of tycoon Vladimir Lisin, converted 31.346 bln ordinary shares with a face value of RUB 1 into 208.976 mln ordinary shares with a face value of RUB 150. The shareholder equity remained unchanged at RUB 31.346 bln. The old shares were cancelled. Subsidiary says to sell RUB 15 bln new shares to Russian Railways On November 28, 2019 the board of directors of Federal Passenger Company, a long-distance passenger subsidiary of Russian Railways, approved the sale of RUB 15 bln of additional shares in favor of the parent company. The shareholder will consider the decision on December 6. Federal Passenger Company plans to use the money to buy rolling stock under a long-term contract. MGTS board appoints executive director Medvedev as general director On November 29, 2019 the board of directors of Moscow City Telephone Network (MGTS), a fixed line unit of mobile operator MTS, appointed Executive Director Vladislav Medvedev as general director. At the top position, Medvedev replaced Pavel Kuznetsov, who moved to MTS in mid-September as a vice president and combined the powers. The staff changes are explained by a functional merger of MGTS and MTS in the Moscow Region, which was triggered earlier in 2019. As a result, MTS will receive commercial aspects of the business and MGTS technical ones. -

RUSSIA WATCH No.2, August 2000 Graham T

RUSSIA WATCH No.2, August 2000 Graham T. Allison, Director Editor: Ben Dunlap Strengthening Democratic Institutions Project Production Director: Melissa C..Carr John F. Kennedy School of Government Researcher: Emily Van Buskirk Harvard University Production Assistant: Emily Goodhue SPOTLIGHT ON RUSSIA’S OLIGARCHS On July 28 Russian President Vladimir Putin met with 21 of Russia’s most influ- ential businessmen to “redefine the relationship between the state and big busi- ness.” At that meeting, Putin assured the tycoons that privatization results would remained unchallenged, but stopped far short of offering a general amnesty for crimes committed in that process. He opened the meeting by saying: “I only want to draw your attention straightaway to the fact that you have yourselves formed this very state, to a large extent through political and quasi-political structures under your control.” Putin assured the oligarchs that recent investi- The Kremlin roundtable comes at a crucial time for the oligarchs. In the last gations were not part of a policy of attacking big business, but said he would not try to restrict two months, many of them have found themselves subjects of investigations prosecutors who launch such cases. by the General Prosecutor’s Office, Tax Police, and Federal Security Serv- ice. After years of cozying up to the government, buying up the state’s most valuable resources in noncompetitive bidding, receiving state-guaranteed loans with little accountability, and flouting the country’s tax laws with imp u- nity, the heads of some of Russia’s leading financial-industrial groups have been thrust under the spotlight. -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L.