Notes on Moscow Exchange Index Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Expiry Notice

Expiry Notice 19 January 2018 London Stock Exchange Derivatives Expiration prices for IOB Derivatives Please find below expiration prices for IOB products expiring in January 2018: Underlying Code Underlying Name Expiration Price AFID AFI DEVELOPMENT PLC 0.1800 ATAD PJSC TATNEFT 58.2800 FIVE X5 RETAIL GROUP NV 39.2400 GAZ GAZPROM NEFT 23.4000 GLTR GLOBALTRANS INVESTMENT PLC 9.9500 HSBK JSC HALYK SAVINGS BANK OF KAZAKHSTAN 12.4000 HYDR PJSC RUSHYDRO 1.3440 KMG JSC KAZMUNAIGAS EXPLORATION PROD 12.9000 LKOD PJSC LUKOIL 67.2000 LSRG LSR GROUP 2.9000 MAIL MAIL.RU GROUP LIMITED 32.0000 MFON MEGAFON 9.2000 MGNT PJSC MAGNIT 26.4000 MHPC MHP SA 12.8000 MDMG MD MEDICAL GROUP INVESTMENTS PLC 10.5000 MMK OJSC MAGNITOGORSK IRON AND STEEL WORKS 10.3000 MNOD MMC NORILSK NICKEL 20.2300 NCSP PJSC NOVOROSSIYSK COMM. SEA PORT 12.9000 NLMK NOVOLIPETSK STEEL 27.4000 NVTK OAO NOVATEK 128.1000 OGZD GAZPROM 5.2300 PLZL POLYUS PJSC 38.7000 RIGD RELIANCE INDUSTRIES 28.7000 RKMD ROSTELEKOM 6.9800 ROSN ROSNEFT OJSC 5.7920 SBER SBERBANK 18.6900 SGGD SURGUTNEFTEGAZ 5.2450 SMSN SAMSUNG ELECTRONICS CO 1148.0000 SSA SISTEMA JSFC 4.4200 SVST PAO SEVERSTAL 16.8200 TCS TCS GROUP HOLDING 19.3000 TMKS OAO TMK 5.4400 TRCN PJSC TRANSCONTAINER 8.0100 VTBR JSC VTB BANK 1.9370 Underlying code Underlying Name Expiration Price D7LKOD YEAR 17 DIVIDEND LUKOIL FUTURE 3.2643 YEAR 17 DIVIDEND MMC NORILSK NICKEL D7MNOD 1.8622 FUTURE D7OGZD YEAR 17 DIVIDEND GAZPROM FUTURE 0.2679 D7ROSN YEAR 17 DIVIDEND ROSNEFT FUTURE 0.1672 D7SBER YEAR 17 DIVIDEND SBERBANK FUTURE 0.3980 D7SGGD YEAR 17 DIVIDEND SURGUTNEFTEGAZ FUTURE 0.1000 D7VTBR YEAR 17 DIVIDEND VTB BANK FUTURE 0.0414 Members are asked to note that reports showing exercise/assignments should be available by approx. -

NOVATEK RS Presentation

“Harnessing the Energy of the Far North” Mark Gyetvay, Deputy Chairman of the Management Board Alexander Palivoda, Head of Investor Relations Goldman Sachs Global Natural Resources Conference London 11-12 November 2015 Forward-Looking Statements Certain statements in this presentation are not historical facts and are “forward-looking”. Examples of such forward-looking statements include, but are not limited to: – projections or expectations of revenues, income (or loss), earnings (or loss) per share, dividends, capital structure or other financial items or ratios; – statements of our plans, objectives or goals, including those related to products or services; – statements of future economic performance; and – statements of assumptions underlying such statements Words such as “believes”, “anticipates”, “expects”, “estimates”, “intends”, “plans”, “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that the predictions, forecasts, projections and other forward-looking statements will not be achieved. You should be aware that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements When relying on forward-looking statements, you should carefully consider the foregoing factors and other uncertainties and events, especially in light of the political, economic, social and legal environment in which we operate. Such forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. -

FY2020 Financial Results

Norilsk Nickel 2020 Financial Results Presentation February 2021 Disclaimer The information contained herein has been prepared using information available to PJSC MMC Norilsk Nickel (“Norilsk Nickel” or “Nornickel” or “NN”) at the time of preparation of the presentation. External or other factors may have impacted on the business of Norilsk Nickel and the content of this presentation, since its preparation. In addition all relevant information about Norilsk Nickel may not be included in this presentation. No representation or warranty, expressed or implied, is made as to the accuracy, completeness or reliability of the information. Any forward looking information herein has been prepared on the basis of a number of assumptions which may prove to be incorrect. Forward looking statements, by the nature, involve risk and uncertainty and Norilsk Nickel cautions that actual results may differ materially from those expressed or implied in such statements. Reference should be made to the most recent Annual Report for a description of major risk factors. There may be other factors, both known and unknown to Norilsk Nickel, which may have an impact on its performance. This presentation should not be relied upon as a recommendation or forecast by Norilsk Nickel. Norilsk Nickel does not undertake an obligation to release any revision to the statements contained in this presentation. The information contained in this presentation shall not be deemed to be any form of commitment on the part of Norilsk Nickel in relation to any matters contained, or referred to, in this presentation. Norilsk Nickel expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the contents of this presentation. -

The Russia You Never Met

The Russia You Never Met MATT BIVENS AND JONAS BERNSTEIN fter staggering to reelection in summer 1996, President Boris Yeltsin A announced what had long been obvious: that he had a bad heart and needed surgery. Then he disappeared from view, leaving his prime minister, Viktor Cher- nomyrdin, and his chief of staff, Anatoly Chubais, to mind the Kremlin. For the next few months, Russians would tune in the morning news to learn if the presi- dent was still alive. Evenings they would tune in Chubais and Chernomyrdin to hear about a national emergency—no one was paying their taxes. Summer turned to autumn, but as Yeltsin’s by-pass operation approached, strange things began to happen. Chubais and Chernomyrdin suddenly announced the creation of a new body, the Cheka, to help the government collect taxes. In Lenin’s day, the Cheka was the secret police force—the forerunner of the KGB— that, among other things, forcibly wrested food and money from the peasantry and drove some of them into collective farms or concentration camps. Chubais made no apologies, saying that he had chosen such a historically weighted name to communicate the seriousness of the tax emergency.1 Western governments nod- ded their collective heads in solemn agreement. The International Monetary Fund and the World Bank both confirmed that Russia was experiencing a tax collec- tion emergency and insisted that serious steps be taken.2 Never mind that the Russian government had been granting enormous tax breaks to the politically connected, including billions to Chernomyrdin’s favorite, Gazprom, the natural gas monopoly,3 and around $1 billion to Chubais’s favorite, Uneximbank,4 never mind the horrendous corruption that had been bleeding the treasury dry for years, or the nihilistic and pointless (and expensive) destruction of Chechnya. -

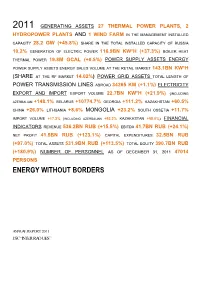

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

Information on IRC – R.O.S.T., the Registrar of the Company and the Acting Ballot Committee of MMC Norilsk Nickel

Information on IRC – R.O.S.T., the registrar of the Company and the acting Ballot Committee of MMC Norilsk Nickel IRC – R.O.S.T. (former R.O.S.T. Registrar merged with Independent Registrar Company in February 2019) was established in 1996. In 2003–2015, Independent Registrar Company was a member of Computershare Group, a global leader in registrar and transfer agency services. In July 2015, IRC changed its ownership to pass into the control of a group of independent Russian investors. In December 2016, R.O.S.T. Registrar and Independent Registrar Company, both owned by the same group of independent investors, formed IRC – R.O.S.T. Group of Companies. In 2018, Saint Petersburg Central Registrar joined the Group. In February 2019, Independent Registrar Company merged with IRC – R.O.S.T. Ultimate beneficiaries of IRC – R.O.S.T. Group are individuals with a strong background in business management and stock markets. No beneficiary holds a blocking stake in the Group. In accordance with indefinite License No. 045-13976-000001, IRC – R.O.S.T. keeps records of holders of registered securities. Services offered by IRC – R.O.S.T. to its clients include: › Records of shareholders, interestholders, bondholders, holders of mortgage participation certificates, lenders, and joint property owners › Meetings of shareholders, joint owners, lenders, company members, etc. › Electronic voting › Postal and electronic mailing › Corporate consulting › Buyback of securities, including payments for securities repurchased › Proxy solicitation › Call centre services › Depositary and brokerage, including escrow agent services IRC – R.O.S.T. Group invests a lot in development of proprietary high-tech solutions, e.g. -

Annual Report

2014 ANNUAL REPORT TABLE OF CONTENTS Sistema today 2 Corporate governance system 91 History timeline 4 Corporate governance principles 92 Company structure 8 General Meeting of shareholders 94 President’s speech 10 Board of Directors 96 Strategic Review 11 Commitees of the Board of Directors 99 Strategy 12 President and the Management Board 101 Sistema’s financial results 20 Internal control and audit 103 Shareholder capital and securities 24 Development of the corporate 104 governance system in 2014 Our investments 27 Remuneration 105 MTS 28 Risks 106 Detsky Mir 34 Sustainable development 113 Medsi Group 38 Responsible investor 114 Lesinvest Group (Segezha) 44 Social investment 115 Bashkirian Power Grid Company 52 Education, science, innovation 115 RTI 56 Culture 117 SG-trans 60 Environment 119 MTS Bank 64 Society 121 RZ Agro Holding 68 Appendices 124 Targin 72 Binnopharm 76 Real estate 80 Sistema Shyam TeleServices 84 Sistema Mass Media 88 1 SISTEMA TODAY Established in 1993, today Sistema including telecommunications, companies. Sistema’s competencies is a large private investor operating utilities, retail, high tech, pulp and focus on improvement of the in the real sector of the Russian paper, pharmaceuticals, healthcare, operational efficiency of acquired economy. Sistema’s investment railway transportation, agriculture, assets through restructuring and portfolio comprises stakes in finance, mass media, tourism, attracting industry partners to predominantly Russian companies etc. Sistema is the controlling enhance expertise and reduce -

Tatneft Group IFRS CONSOLIDATED INTERIM CONDENSED

Tatneft Group IFRS CONSOLIDATED INTERIM CONDENSED FINANCIAL STATEMENTS (UNAUDITED) AS OF AND FOR THE THREE AND SIX MONTHS ENDED 30 JUNE 2019 Contents Report on Review of Consolidated Interim Condensed Financial Statements Consolidated Interim Condensed Financial Statements Consolidated Interim Condensed Statement of Financial Position (unaudited) ........................................ 1 Consolidated Interim Condensed Statement of Profit or Loss and Other Comprehensive Income (unaudited) ..................................................................................................................................... 2 Consolidated Interim Condensed Statement of Changes in Equity (unaudited) ........................................ 4 Consolidated Interim Condensed Statement of Cash Flows (unaudited) .................................................. 5 Notes to the Consolidated Interim Condensed Financial Statements (unaudited) Note 1: Organisation ................................................................................................................................. 7 Note 2: Basis of preparation ...................................................................................................................... 7 Note 3: Adoption of new or revised standards and interpretations .......................................................... 10 Note 4: Cash and cash equivalents .......................................................................................................... 12 Note 5: Accounts receivable ................................................................................................................... -

An Overview of Boards of Directors at Russia's Largest Public Companies

An Overview Of Boards Of Directors At Russia’s Largest Public Companies Andrei Rakitin Milena Barsukova Arina Mazunova Translated from Russian August 2020 Key Results According to information disclosed by 109 of Russia’s largest public companies: “Classic” board compositions of 11, nine, and seven seats prevail The total number of persons on Boards of the companies under study is not as low as it might seem: 89% of all Directors were elected to only one such Board Female Directors account for 12% and are more often elected to the audit, nomination, and remuneration committees than to the strategy committee Among Directors, there are more “humanitarians” than “techies,” while the share of “techies” among chairs is greater than across the whole sample The average age for Directors is 53, 56 for Chairmen, and 58 for Independent Directors Generation X is the most visible on Boards, and Generation Y Directors will likely quickly increase their presence if the impetuous development of digital technologies continues The share of Independent Directors barely reaches 30%, and there is an obvious lack of independence on key committees such as audit Senior Independent Directors were elected at 17% of the companies, while 89% of Chairs are not independent The average total remuneration paid to the Board of Directors is RUR 69 million, with the difference between the maximum and minimum being 18 times Twenty-four percent of the companies disclosed information on individual payments made to their Directors. According to this, the average total remuneration is approximately RUR 9 million per annum for a Director, RUR 17 million for a Chair, and RUR 11 million for an Independent Director The comparison of 2020 findings with results of a similar study published in 2012 paints an interesting dynamic picture. -

Outstanding Shares

PJSC RusHydro | Annual Report 2018 Share of securities in free float1 Shareholder agreements Date Free-float factor RusHydro’s shareholders can enter into Last trading day of 2016 0.23 shareholder agreements, including Last trading day of 2017 0.25 those that afford them an extent of Last trading day of 2018 0.19 control disproportionate to their contribution to the authorized capital2. Notifications on concluded shareholder agreements received by RusHydro Parties to the shareholder agreement Date of the shareholder agreement ↗ The Russian Federation as represented by the Federal Agency for State Property Management March 7, 2017 ↗ VTB Bank (PJSC) ↗ The Russian Federation as represented by the Federal Agency for State Property Management June 23, 2016 ↗ RusHydro’s subsidiaries: Hydroinvest3, EZOP, Energy Index – HydroOGK Outstanding shares Moscow Exchange listing Index inclusion: ↗ FTSE All-World Index AWORLDS; ↗ MOEX Russia Index (previous name – ↗ FTSE4Good Emerging; The Company’s shares have been MICEX Index) IMOEX; ↗ NASDAQ Russia NQRU; traded on the Moscow Exchange ↗ Electric Utilities Index MOEXEU; ↗ Nasdaq AlphaDEX Emerging Markets (formerly MICEX Stock Exchange). ↗ Broad Market Index MOEXBMI; NQDXEM; since February 4, 2008 (ticker: HYDR). ↗ State-Owned Companies Index ↗ STOXX Russia Total Market TCRUP; The securities are listed in Level 1, MOEXSCI; ↗ STOXX Optimized Russia EEORGT. the Exchange’s top quotation list. ↗ FTSE Emerging Index AWALLE; Moscow Exchange trading information Item 2016 2017 2018 Trading mode T+: stocks and DRs T+: stocks and DRs T+: stocks and DRs Currency RUB RUB RUB Maximum trade price 0.994 1.100 0.810 Minimum trade price 0.575 0.717 0.476 Year-end trade price 0.926 0.729 0.486 Trading volume, bn pcs 134 173 136 1 In accordance with the Moscow Exchange’s methodology for calculating the free-float factor published at http://www.moex.com/ru/index/MICEXINDEXCF/constituents/. -

PRESS RELEASE JSC ALROSA Announces Purchase of a 25

PRESS RELEASE JSC ALROSA Announces Purchase of a 25 Percent Interest in OJSC Polyus Gold August, 2007, Moscow. Joint-Stock Company ALROSA signed an agreement with ONEXIM Group to buy a 25 percent stake in the Open Joint-Stock Company Polyus Gold (RTS, MICEX, and LSE – PLZL), Russia’s largest gold producer. “This deal was implemented as part of the development strategy approved by the Supervisory Board of JSC ALROSA. Among other things, ALROSA focuses on diversifying into other sectors. The purchase of a significant stake in Polyus Gold, which pursues an effective production strategy, will enable ALROSA to access a market with considerable long-term prospects and will further boost the development and economic growth of regions in Central and Eastern Siberia,” said President of ALROSA Sergei Vybornov. Open Joint-Stock Company Polyus Gold (RTS, MICEX, and LSE – PLZL) – is the leading gold producer in Russia and one of the biggest players in gold mining in the world in terms of deposits and production. The asset portfolio of Polyus Gold includes ore and alluvial gold deposits in the Krasnoyarsk Territory, the Irkutsk, Magadan, and Amur regions, and in the Republic of Sakha (Yakutia), where the company operates gold exploration and mining projects. As of January 1, 2007, the mineral resource base of OJSC Polyus Gold comprises 3,000.7 tons of gold in B+C1+C2 reserves, including 2,149 tons of B+C1 reserves. Joint-Stock Company ALROSA – is a global leader in diamond exploration, mining and sales of rough diamonds, and in cut diamond manufacture. ALROSA accounts for 97 percent of Russia’s rough diamond production and for 25 percent of the global output of rough diamonds. -

Global Expansion of Russian Multinationals After the Crisis: Results of 2011

Global Expansion of Russian Multinationals after the Crisis: Results of 2011 Report dated April 16, 2013 Moscow and New York, April 16, 2013 The Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, Moscow, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint center of Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Russian multinationals today.1 The survey, conducted from November 2012 to February 2013, is part of a long-term study of the global expansion of emerging market non-financial multinational enterprises (MNEs).2 The present report covers the period 2009-2011. Highlights Russia is one of the leading emerging markets in terms of outward foreign direct investments (FDI). Such a position is supported not by several multinational giants but by dozens of Russian MNEs in various industries. Foreign assets of the top 20 Russian non-financial MNEs grew every year covered by this report and reached US$ 111 billion at the end of 2011 (Table 1). Large Russian exporters usually use FDI in support of their foreign activities. As a result, oil and gas and steel companies with considerable exports are among the leading Russian MNEs. However, representatives of other industries also have significant foreign assets. Many companies remained “regional” MNEs. As a result, more than 66% of the ranked companies’ foreign assets were in Europe and Central Asia, with 28% in former republics of the Soviet Union (Annex table 2). Due to the popularity of off-shore jurisdictions to Russian MNEs, some Caribbean islands and Cyprus attracted many Russian subsidiaries with low levels of foreign assets.