CARILLION/Mcalpine Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2007 Download PDF 504.15 KB

Delivering profitable growth Annual Report and Financial Statements 2007 CONTENTS PERFORMANCE “Galliford Try has had an excellent year. We have delivered significant profit growth across all our businesses, Highlights 01 our recent acquisitions are performing The Group 02 ahead of expectations, and we are Chairman’s Statement 03 confident that our strategy will continue Business Review 04 to deliver sustainable growth and Divisional Reviews 06 increased shareholder value.” Financial Results 11 Corporate Responsibility 14 Greg Fitzgerald Corporate and Social Responsibility Report 16 Chief Executive DIRECTORS AND GOVERNANCE Directors and Executive Board 20 Directors’ Report 22 Corporate Governance Report 24 Remuneration Report 28 FINANCIALS Independent Auditors’ Report – Group 34 Consolidated Income Statement 35 Consolidated Statement of Recognised Income and Expense 36 Consolidated Balance Sheet 37 Consolidated Cash Flow Statement 38 Notes to the Consolidated Financial Statements 39 Independent Auditors’ Report – Company 72 Company Balance Sheet 73 Notes to the Company Financial Statements 74 Five-Year Record 82 Contacts 83 Shareholder Information 84 HIGHLIGHTS For the year ended 30 June 2007 • Results ahead of expectations from Morrison Construction and REVENUE Chartdale Homes in the first full year following acquisition. +65% • Good performance from Linden Homes since acquisition; integration going well with synergies exceeding forecast. • Year end net debt of £99 million, representing gearing of 32 per cent, £1,410 m significantly better than expectations. • Current construction order book maintained at £2.1 billion. PROFIT BEFORE TAX • Record housebuilding completions of 1,526 units and landbank +75% of 11,200 plots. Encouraging sales during the summer period with current sales in hand of £323 million. -

Keep Calm and Carillion – the Company’S Pension Schemes Are More Secure Than They Look

Keep Calm and Carillion – The Company’s Pension Schemes Are More Secure than They Look Safeguarding the Carillion pension empire The company we came to know as Carillion was created in July 1999, following a demerger from Tarmac, through which it acquired a number of huge UK employers, including Mowlem and Alfred McAlpine. This gave the new company immediate responsibility for 13 defined benefit pension schemes. Almost two decades later, 27,500 people First Actuarial’s Catherine Lockyer continue to have benefits in schemes reliant on Carillion as sponsor, with close to half of sheds light on the doom and gloom these already receiving their pensions. surrounding Carillion’s pension schemes Commentators were not slow to point to The recent collapse of the construction and public problems with Carillion’s pension schemes. services contractor, Carillion plc, sent shockwaves The Guardian reported that MPs were through the British economy. accusing the company of trying to wriggle out of its pension obligations, for example. When the news broke in January, the future looked And The Economist asked whether pension uncertain for the company’s 20,000 UK employees. protection was still viable, referring to ‘a big And as industrialists took the measure of the hole’. All in all, the future of these schemes consequences for the country, other questions looked deeply uncertain, and this can only quickly emerged. have added to the anxieties of Carillion’s employees and pensioners. How would the Government deal with the huge infrastructure projects that Carillion had failed to The fantastic news, however, is that all of complete? Who would manage the maintenance Carillion’s pension scheme members have and service of hundreds of hospitals, schools and the security of the Pension Protection Fund homes? And as for the thousands of smaller (PPF). -

![J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]](https://docslib.b-cdn.net/cover/2296/j-jarvis-sons-ltd-v-blue-circle-dartford-estates-ltd-2007-322296.webp)

J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]

J Jarvis & Sons Ltd v Blue Circle Dartford Estates Ltd [2007] APP.L.R. 05/14 JUDGMENT : MR JUSTICE JACKSON: TCC. 14th May 2007 1. This judgment is in seven parts, namely, Part 1 "Introduction"; Part 2 "The Facts"; Part 3 "The Present Proceedings"; Part 4 "The Law"; Part 5 "The Application for an Injunction"; Part 6 "Jarvis's Challenges to the Interim Award"; and Part 7 "Conclusion". Part 1: Introduction 2. This is an action brought by a main contractor in order to prevent the continuance of an arbitration. The contractor seeks to achieve that result either by means of an injunction or, alternatively, by challenging an Interim Award of the Arbitrator. This litigation has been infused with some urgency because it was launched just fifteen days before the date fixed for the start of arbitration hearing. 3. J Jarvis & Sons Limited is claimant in these proceedings and defendant in the arbitration. Prior to 18th February 1997, the name of this company was J Jarvis & Sons plc. I shall refer to the company as "Jarvis". Jarvis is the subsidiary company of Jarvis plc. Blue Circle Dartford Estates Limited is defendant in these proceedings and claimant in the arbitration. I shall refer to this party as "Blue Circle". Blue Circle is a subsidiary company of Blue Circle Industries plc. The solicitors for the parties will feature occasionally in the narrative. Squire & Co are solicitors for Jarvis. Howrey LLP are solicitors for Blue Circle. 4. I turn now to other companies which will feature in the narrative of events. GEFCO (UK) Limited are forwarding agents. -

Completed Acquisition by Interserve Plc of the Facilities Management Business of Rentokil Initial Plc (Initial Facilities)

Completed acquisition by Interserve plc of the facilities management business of Rentokil Initial plc (Initial Facilities) ME/6432-14 The CMA’s decision on clearance under section 33(1) given on 29 May 2014. Full text of the decision published on 11 June 2014. Please note that the square brackets indicate figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. Summary 1. On 18 March 2014, Interserve plc (Interserve) acquired the facilities management (FM) business (Initial Facilities) of Rentokil Initial plc (Rentokil) through the purchase of a combination of shares and assets. The Competition and Markets Authority (CMA) considers that the parties have ceased to be distinct and that the turnover test in section 23(1)(b) of the Enterprise Act 2002 (the Act) is met. The CMA therefore believes that it is or may be the case that a relevant merger situation has been created. 2. The parties notified the completed merger to the Office of Fair Trading (OFT)1 on 31 March 2014. The administrative deadline for the CMA to make a decision on whether or not to refer the merger to a phase II investigation is 29 May 2014. 3. The parties overlapped in the provision of FM services in the UK. The CMA analysed the effects of the merger on the provision of FM services in the UK as a whole, and also taking into account the information received by it on how competition varies across certain segments and geographies. 1 The Competition and Markets Authority (CMA) was established on 1 October 2013. -

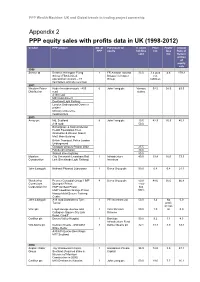

Appendix 2 PPP Equity Sales with Profits Data in UK (1998-2012)

PPP Wealth Machine: UK and Global trends in trading project ownership Appendix 2 PPP equity sales with profits data in UK (1998-2012) Vendor PPP project No. of Purchaser of % share Price Profit/ Annual PPP equity holding £m loss Rate of sold £m Return at time of equity sale 1998 Serco Ltd Defence Helicopter Flying 1 FR Aviation Ltd and 33.0 3.4 plus 4.6 179.3 School (FBS Limited, Bristow Helicopter net operational contract – 47 Group liabilities helicopters and site services) 2001 Western Power Hyder Investments plc - A55 6 John Laing plc Various 92.5 58.5 63.3 Distribution road stakes A130 road M40 road project Dockland Light Railway London Underground Connect project Ministry of Defence headquarters 2003 Amey plc M6, Scotland 8 John Laing plc 19.5 42.9 25.9 45.2 A19 road 50.0 Birmingham & Solihull Mental Health Foundation Trust (Erdington & Winson Green) MoD Main Building British Transport Police London Underground Glasgow schools-Project 2002 25.5 Edinburgh schools 30.0 Walsall street lighting 50.0 Mowlem City Greenwich Lewisham Rail 1 Infrastructure 40.0 19.4 16.0 73.3 Construction Link (Docklands Light Railway) Investors John Laing plc National Physical Laboratory 1 Serco Group plc 50.0 0.8 0.4 21.1 Wackenhut Premier Custodial Group: HMP 4 Serco Group plc 50.0 48.6 35.0 66.8 Corrections Dovegate Prison - now Corporation Inc HMP Ashfield Prison has HMP Lowdham Grange Prison 100% Hassockfield Secure Training Centre John Laing plc A19 road Dishforth to Tyne 1 PFI Investors Ltd 50.0 3.4 No 0.0 Tunnel profit or loss Vinci plc Lloyd George -

Building on Strong Foundations 2001 December 1 WP066 AR 2001 COVER V3 Tp 6/3/02 2:33 Pm Page FC2

1 WP066 AR_2001 COVER_v3 tp 6/3/02 2:37 pm Page FC1 january february march Annual Report & Accounts 2001 april may june july august september october november Annual Report & Accounts 2001 building on strong foundations 2001 december 1 WP066 AR_2001 COVER_v3 tp 6/3/02 2:33 pm Page FC2 Our commitment to create and deliver value for our customers and shareholders has determined the ways in which we have brought changes to George Wimpey. By continuing to create real value we will achieve our goal of becoming a truly successful housebuilder measured by customers and shareholders alike. Contents Financial Highlights 02 Chairman’s Statement 03 Chief Executive’s Review 04 2001 – The Year That Changed George Wimpey 06 Operating and Financial Review 14 Environmental, Health and Safety Report 20 Board of Directors 21 Corporate Governance 22 Remuneration Report 24 Directors’ Report 27 Group Profit and Loss Account 30 Balance Sheet 31 Group Cash Flow Statement 32 Accounting Policies 33 Notes on the Accounts 34 Auditors’ Report 48 Five Year Review 49 Notice of Meeting 50 George Wimpey PLC Business Directory UK and US 53 Shareholder Information IBC George Wimpey Annual Report & Accounts 2001 During 2001 we have changed to create a new and rejuvenated business. We are rebuilding our Company to ensure that George Wimpey offers a long term secure and rewarding investment for our shareholders. George Wimpey Annual Report & Accounts 2001 02 Financial Highlights Year ended 31 December 2001 2000 Turnover £1895.9m £1702.0m Operating profit* £213.1m £170.2m -

View Annual Report

Annual report and accounts for the year ended 31 March 2015 Stock code: SFR www.severfield.com Building a solid platform for growth 23925-04 24-06-2015 Proof 5 Severfield plc Stock code: SFR Welcome to our 2015 annual report Sever eld plc is the largest specialist structural steelwork group in the UK, with a growing presence in India and a reputation for performance and value. Our vision is to be recognised as world- class leaders in structural steel, known for our ability to deliver any project, to the highest possible standards. Five reasons to invest 1 2 3 Market leading UK position — Strong balance sheet provides Unrivalled experience and well positioned to benefit from operational and financial flexibility. capability in design, fabrication and the recovery in the wider UK construction of steel structures. construction market. 4 5 Operational improvement Established foothold in the programme — generating steady developing Indian market — margin improvement. building value through the joint venture business. Investor website We maintain a corporate website at www.severfield.com containing a wide range of information of interest to institutional and private investors including: • Latest news and press releases • Annual reports and investor presentations Getting around the report This icon signposts the reader to other sections in this report Find out more information on our website www.severfield.com Front cover image: Project: South Bank Tower Sector: Commercial offices Location: London Tonnage: 1,700 Client: CIT Main contractor: -

Report of the Directors 21

735427 pp21-pp22 6/4/04 12:58 pm Page 21 Alfred McAlpine plc | Annual Report & Accounts 2003 Report of the Directors 21 Report of the Directors The Directors present their Annual Report and the audited accounts for the year ended 31st December, 2003. Principal Activities The Group provides infrastructure, construction and business services, principally in the UK. The operations of the Group are reviewed on pages 6 to 17 of this report. Profits and Dividends The Group profit for the year attributable to shareholders amounted to £22.8m (2002: £14.4m) after tax and goodwill. The Directors recommend the payment of a final dividend of 6.5p per ordinary share which, together with the interim dividend of 4.5p already paid, makes a total of 11p per ordinary share for the financial year. If approved at the Annual General Meeting (‘AGM’) to be held on 20th May, 2004, the final dividend will be paid on 28th May, 2004 to those shareholders on the register at close of business on 7th May, 2004. After provision for these ordinary dividends and dividends of £0.4m paid to preference shareholders, the retained profit of £11.5m (2002: £3.6m) has been transferred to reserves. Post Balance Sheet Event On 6th February, 2004, the Group acquired the entire issued share capital of UK Power Construction Limited for a total cash consideration of £5.2m. Substantial Interests At 22nd March, 2004, the following interests in 3% or more of the Company’s ordinary share capital had been notified to the Company: Number of shares Percentage held % Fidelity International Limited 5,262,986 5.13 Zurich Financial Services 5,105,000 4.98 Aviva plc 4,185,713 4.08 Legal & General Group Plc 3,538,268 3.45 Standard Life Investments 3,159,675 3.08 Directors Present members of the Board are shown on pages 18 and 19. -

Top 150 Tablesdr&!!!.Qxd

Top 150 tablesdr&!!!.qxd 20/07/2007 14:37 Page 12 12 industry rankings CONTRACTORS AND HOUSEBUILDERS TOP150 BY TURNOVER Company Total turnover Year end Contracting Housing Property Services Other £000 £000 £000 £000 £000 £000 2007 2006 1 n/a Taylor Wimpey1 6,826,400 Dec-06 550,600 6,275,800 2 2 Balfour Beatty* 5,852,000 Dec-06 5,297,000 555,000 3 n/a Barratt2 3,762,800 Dec-06 3,577,200 185,600 4 8 Carillion 3,593,400 Dec-06 1,905,700 1,539,700 148,000 5 1 Amec 3,229,200 Dec-06 1,150,800 2,078,400 6 7 Persimmon 3,141,900 Dec-06 3,141,900 7 9 Laing O’Rourke* 2,271,646 Mar-06 2,172,582 99,064 8 10 Kier 1,838,300 Jun-06 1,218,100 277,900 47,500 281,300 13,500 9 11 Morgan Sindall 1,496,844 Dec-06 667,051 404,164 425,629 10 13 Interserve 1,408,500 Dec-06 556,000 744,200 108,300 11 16 Newarthill 1,317,581 Oct-06 948,940 40,555 328,086 12 14 Amey UK 1,309,644 Dec-06 1,264,666 44,978 13 15 Bellway 1,240,193 Jul-06 1,240,193 14 19 Miller 1,207,800 Dec-06 342,600 706,900 158,300 15 28 Galliford Try3 1,142,901 Jun-06 628,847 512,583 1,471 16 4 Bovis Lend Lease4 1,134,991 Jun-06 1,134,991 17 17 Alfred McAlpine 1,123,200 Dec-06 402,100 746,000 19,700 18 22 Mitie 935,600 Mar-06 935,600 19 27 Keller 920,200 Dec-06920,200 20 18 Berkeley Group 917,926 Apr-06 890,539 27,387 21 21 Skanska Construction5 907,200 Dec-06 907,200 22 25 Costain 886,300 Dec-06786,100 13,200 87,000 23 30 Wates Group 885,592 Dec-06 837,579 21,444 26,569 24 24 HBG UK 882,300 Dec-06 810,000 84,700 13,800 25 26 Babcock 836,700 Mar-06 562,000 274,700 26 23 Redrow Group 770,100 Jun-06 -

Carillion Plc: Fake It ‘Til You Break It

Nova School of Business and Economics & Louvain School of Management A Work Project, presented as part of the requirements for the Award of a Master’s degree in Finance from the Nova School of Business and Economics and the Master 120 credits in Management, professional focus, from the Louvain School of Management. CARILLION PLC: FAKE IT ‘TIL YOU BREAK IT PATRÍCIA MARIA MARTINS SANTOS 26161 Work Project carried out under the supervision of: Professor Paulo Soares de Pinho 01-05-2020 Carillion PLC: Fake It ‘Til You Break It Abstract The case “Carillion PLC: Fake It ‘Til You Break It” explores the recent collapse of Carillion, the second largest constructor in the United Kingdom, marking the largest trading liquidation known to date in the country. By exposing the company’s history from its start to its demise, the case looks into the specificities of operating the construction industry, as well as Carillion’s M&A activity, international expansion, bidding approach and financial policy. Emphasis is further given to the Corporate Governance issues that guided the company’s downfall. The supporting teaching note guides the analysis of the case, touching on several aspects related to Corporate Finance and Corporate Governance including: (i) the risk of overvaluation of companies and synergies in the context of M&A; (ii) pros and cons of debt issuance and the effects of operating under high leverage; and (iii) effectiveness of Corporate Governance entities, namely the Board of Directors, External Advisor and Investors. Keywords: Construction, Acquisitions, Debt, Corporate Governance This work used infrastructure and resources funded by Fundação para a Ciência e a Tecnologia (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, Project 22209), POR Lisboa (LISBOA-01-0145-FEDER-007722 and Social Sciences DataLab, Project 22209) and POR Norte (Social Sciences DataLab, Project 22209). -

Cala Homes Plc V. Alfred Mcalpine Homes East

CH 1993 C NO. 5508 Neutral Citation Number: [1995] EWHC 7 (Ch) IN THE HIGH COURT OF JUSTICE CHANCERY DIVISION Royal Courts of Justice Strand, London, WC2A 2LL Date: 6 July 1995 Before: THE HON. MR. JUSTICE LADDIE - - - - - - - - - - - - - - - - - - - - - B E T W E E N (1) CALA HOMES (SOUTH) LTD (2) CALA HOMES (SOUTHERN) LTD (3) CALA PLC (4) CALA MANAGEMENT LTD (5) ROGER DATE Plaintiffs - and - ALFRED McALPINE HOMES EAST LTD Defendant - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Mr. Howe instructed by Frere Cholmeley Bischoff for the Plaintiffs Mr. G. Hobbs QC and Miss D. McFarland instructed by Edward Lewis for the Defendant Hearing dates: 13 - 26 June, 1995 - - - - - - - - - - - - - - - - - - - - - JUDGMENT Mr. JUSTICE LADDIE: Introduction This is an action for copyright infringement and inducement of breach of contract. There are five plaintiffs. The first four are companies engaged in the business of designing and building houses. The third plaintiff, Cala Plc, is the parent company. Nothing turns on the separate identities of these companies for the purpose of this judgment. They will be referred to as Cala. The corporate plaintiffs are part of a group of associated companies which are referred to in this judgment as the Cala group. The fifth plaintiff, Roger Gareth Date, has been employed by Cala for about 12 years. He is currently Cala’s Design Director. The plaintiffs claim to own the copyright in a number of drawings for houses which Cala has erected on various sites round the United Kingdom. Once again, for the purpose of this judgment, if relevant copyright is owned by one or more of the five plaintiffs, no issue arises at this stage as to which one that is. -

Sustainable Geosystems in Civil Engineering Applications

Geosystems Report, February 2010 Sustainable geosystems in civil engineering applications Geosystems provide alternatives to some standard materials and designs used by civil engineers. This guidance document explains what geosystems are, and how they can be used to provide sustainable and cost effective solutions. Project code: MRF116-001 Research date: 2008-2009 Date: February 2010 WRAP’s vision is a world without waste, where resources are used sustainably. We work with businesses and individuals to help them reap the benefits of reducing waste, develop sustainable products and use resources in an efficient way. Find out more at www.wrap.org.uk Prepared by: Capita Symonds on behalf of John Barritt, Banbury, WRAP Document reference: WRAP, 2009, Sustainable Geosystems in Civil Engineering Authors: Niall Corney, Patrick Cox, Sophie Norgate, Andrew Thrower Front cover photography: A30 Bodmin Bypass, Holywell Embankment; Formed of a geogrid wraparound face Geosystem using site won fills Photo courtesy of Alfred McAlpine / Huesker Ltd. WRAP and Capita Symonds believe the content of this report to be correct as at the date of writing. However, factors such as prices, levels of recycled content and regulatory requirements are subject to change and users of the report should check with their suppliers to confirm the current situation. In addition, care should be taken in using any of the cost information provided as it is based upon numerous project-specific assumptions (such as scale, location, tender context, etc.). The report does not claim to be exhaustive, nor does it claim to cover all relevant products and specifications available on the market. While steps have been taken to ensure accuracy, WRAP cannot accept responsibility or be held liable to any person for any loss or damage arising out of or in connection with this information being inaccurate, incomplete or misleading.