LATVIA – August 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ESS9 Appendix A3 Political Parties Ed

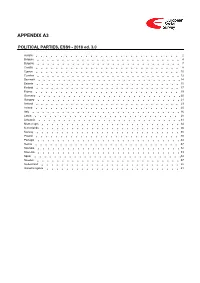

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

Internal Politics and Views on Brexit

BRIEFING PAPER Number 8362, 2 May 2019 The EU27: Internal Politics By Stefano Fella, Vaughne Miller, Nigel Walker and Views on Brexit Contents: 1. Austria 2. Belgium 3. Bulgaria 4. Croatia 5. Cyprus 6. Czech Republic 7. Denmark 8. Estonia 9. Finland 10. France 11. Germany 12. Greece 13. Hungary 14. Ireland 15. Italy 16. Latvia 17. Lithuania 18. Luxembourg 19. Malta 20. Netherlands 21. Poland 22. Portugal 23. Romania 24. Slovakia 25. Slovenia 26. Spain 27. Sweden www.parliament.uk/commons-library | intranet.parliament.uk/commons-library | [email protected] | @commonslibrary 2 The EU27: Internal Politics and Views on Brexit Contents Summary 6 1. Austria 13 1.1 Key Facts 13 1.2 Background 14 1.3 Current Government and Recent Political Developments 15 1.4 Views on Brexit 17 2. Belgium 25 2.1 Key Facts 25 2.2 Background 25 2.3 Current Government and recent political developments 26 2.4 Views on Brexit 28 3. Bulgaria 32 3.1 Key Facts 32 3.2 Background 32 3.3 Current Government and recent political developments 33 3.4 Views on Brexit 35 4. Croatia 37 4.1 Key Facts 37 4.2 Background 37 4.3 Current Government and recent political developments 38 4.4 Views on Brexit 39 5. Cyprus 42 5.1 Key Facts 42 5.2 Background 42 5.3 Current Government and recent political developments 43 5.4 Views on Brexit 45 6. Czech Republic 49 6.1 Key Facts 49 6.2 Background 49 6.3 Current Government and recent political developments 50 6.4 Views on Brexit 53 7. -

What Future for Federalism? About the CER

Gilles Andréani ★ What future for federalism? about the CER The Centre for European Reform is a think-tank devoted to improving the quality of the debate on the European Union. It is a forum for people with ideas from Britain and across the contintent to discuss the many social, political and economic challenges facing Europe. It seeks to work with similar bodies in other European countries, North America and elsewhere in the world. The CER is pro-European but not uncritical. It regards European integration What future as largely beneficial but recognises that in many respects the Union does not work well. The CER therefore aims to promote new ideas and policies for reforming the European Union. ★ for Director: CHARLES GRANT ADVISORY BOARD PERCY BARNEVIK................................................................................ Chairman, AstraZeneca CARL BILDT................................................................................ Former Swedish Prime Minister federalism? ANTONIO BORGES............................................................................... Former Dean of INSEAD NICK BUTLER (CHAIR)............................... Group Vice President for Policy Development, BP p.l.c. LORD DAHRENDORF ............ Former Warden of St Antony’s College, Oxford & EU Commissioner VERNON ELLIS..................................................................... International Chairman, Accenture JOHN GRAY........................................................................ Professor of European Thought, LSE LORD HANNAY......................................................... -

European Involvement in the Arab-Israeli Conflict

EUROPEAN INVOLVEMENT IN THE ARAB-ISRAELI CONFLICT Edited by Esra Bulut Aymat Chaillot Papers | December 2010 124 In January 2002 the Institute for Security Studies (EUISS) became an autonomous Paris-based agency of the European Union. Following an EU Council Joint Action of 20 July 2001, modified by the Joint Action of 21 December 2006, it is now an integral part of the new structures that will support the further development of the CFSP/CSDP. The Institute’s core mission is to provide analyses and recommendations that can be of use and relevance to the formulation of the European security and defence policy. In carrying out that mission, it also acts as an interface between European experts and decision-makers at all levels. Chaillot Papers are monographs on topical questions written either by a member of the EUISS research team or by outside authors chosen and commissioned by the Institute. Early drafts are normally discussed at a seminar or study group of experts convened by the Institute and publication indicates that the paper is considered by the EUISS as a useful and authoritative contribution to the debate on CFSP/CSDP. Responsibility for the views expressed in them lies exclusively with authors. Chaillot Papers are also accessible via the Institute’s website: www.iss.europa.eu EUROPEAN INVOLVEMENT IN THE ARAB-ISRAELI CONFLICT Muriel Asseburg, Michael Bauer, Agnès Bertrand-Sanz, Esra Bulut Aymat, Jeroen Gunning, Christian-Peter Hanelt, Rosemary Hollis, Daniel Möckli, Michelle Pace, Nathalie Tocci Edited by Esra Bulut Aymat CHAILLOT PAPERS December 2010 124 Acknowledgements The editor would like to thank all participants of two EU-MEPP Task Force Meetings held at the EUISS, Paris, on 30 March 2009 and 2 July 2010 and an authors’ meeting held in July 2010 for their feedback on papers and draft chapters that formed the basis of the volume. -

CONTINUITY in CHANGE? Latvia’S Local Governments After Regional Reform and Local Government Elections a REFORM to TACKLE REGIONAL DISPARITIES

PERSPECTIVE DEMOCRACY AND HUMAN RIGHTS Despite a substantial recent re- gional reform which was vigor- ously opposed by local leaders, the local government elections held in June 2021 did not alter CONTINUITY the balance of power in Latvia. As a political project, the re- form may have achieved its IN CHANGE? goal to implement effi ciency gains, yet the phenomenon of “strongmen” mayors continues Latvia’s Local Governments after Regional Reform to persist. and Local Government Elections A record-low voter turnout Daunis Auers and a general discontent with Riga, June 2021 parties and government per- formance may be an indication that a chance to fi nd a widely accepted and long-term re- gional reform solution was missed. DEMOCRACY AND HUMAN RIGHTS CONTINUITY IN CHANGE? Latvia’s Local Governments after Regional Reform and Local Government Elections A REFORM TO TACKLE REGIONAL DISPARITIES Latvia’s eighth regular local government elections since the the ages of 41 and 60 years although just 31 candidates were renewal of independence in 1991 were held on Saturday under 20 years of age, refl ecting the dire demographic trends 5 June 2021. Both citizens of Latvia and other European Un- affl icting Latvia’s regions over the last three decades. ion Member States resident in Latvia and registered in a mu- nicipality 90 days before the election were eligible to vote. In a sense, these elections were far more “local” than those While turnout fell dramatically from 50.4% in the previous in previous years. An early municipal election was held in 2017 vote to just 34% in 2021, those who did bother to vote Latvia’s capital city Rīga in August 2020 after a series of cor- tended to support political continuity, particularly in Latvia’s ruption scandals had engulfed the municipality. -

Download/Print the Study in PDF Format

GENERAL ELECTIONS IN LATVIA 06th October 2018 European Will 2018 be the year in which Elections monitor Harmony takes power in Latvia? Corinne Deloy On 24th January last we learned that the next general elections in Latvia will take place on 6th October, according to the tradition i.e. on the first Saturday in October. Early voting will be possible during three days preceding the vote. Analyse 16 political parties are officially running in these elections, i.e. the second highest number after the election on 7th October 2006. 1,470 candidates are running, 31.7% of whom are women. 121 polling stations have been opened for Latvians living abroad in 45 countries, 23 more than in the last elections on 4th October 2014. The votes of the latter are counted as part of the constituency of Riga. According to the most recent poll published at the end of August, Harmony (S) is due to come out ahead in the election with 23% of the vote. The Union of Greens and Farmers (ZZS), the party of outgoing Prime Minister Maris Kucinskis, is due to come second with 14% of the vote followed by its government partner, the National Alliance (AN), which is due to win 13% of the vote, just like “who does the country belong to?” (KPV), founded in May 2016 by Artuss Kaimins. Then there is the electoral alliance formed on 26th April by “For the Development of Latvia” (PAR), with 10% of the vote and the New Conservative Party (JKP), which is due to win 9% of the vote. -

Egils Levits, Candidate Supported by the Government Coalition Parties

PRESIDENTIAL ELECTION IN LATVIA 29th May 2019 European Egils Levits, candidate Elections monitor supported by the government coalition parties, should Corinne Deloy become the next President of the Republic of Latvia Analysis On 29th May the 100 members of the Saeima, the only house in the Latvian parliament, will elect the successor to Raimonds Vejonis, as President of the Republic of Latvia. The outgoing head of State decided not to ask for a second mandate. Raimonds Vejonis said he was pleased with several of the achievements completed during his term in office, amongst which are the strengthening of State security, the establishment of Latvian as the only language used in education and the adoption of several reforms of the civil service. On 14th May last, 34 people, members of Harmony opposition, the Green and Farmers Union (ZZS). The (Saskana, S) and the Union of Greens and Farmers (ZZS) candidate promotes his neutrality at a time when “many asked for a postponement of the presidential election in society do not trust politicians.” He hopes, if he is date from 29th May to 5th June to offer Latvians more elected head of State, to protect the weakest citizens and time to get to know the candidates – in the opinion of to reduce social inequality. the chair of the ZZS Armands Krauze, and to enable the organisation of more debate between the latter. The – Didzis Smits (KPV LV), MP, supported by a share of the presidential election must absolutely take place before members of his own party “To whom does the country 7th June. -

The Saeima of the Latvian Republic

THE SAEIMA OF THE LATVIAN REPUBLIC Last updated on 02/07/2019 http://www.europarl.europa.eu/relnatparl [email protected] Photo credits: Saeima of the Latvian Republic 1. AT A GLANCE Latvia is a Republic and a parliamentary democracy. Its Parliament, the Saeima, is a unicameral Parliament composed of 100 Members, elected for a maximum term of 4 years. All citizens of Latvia who enjoy full rights of citizenship and who on Election Day have attained 18 years of age are entitled to vote. The main function of the Saeima is law-making and adopting the state budget, but it also elects the President of the Republic, the State Auditor, and the Central Election Commission, and ratifies international agreements. The work of the Saeima is supervised by its Presidium, which consists of five MPs: the Speaker, two Deputy Speakers, the Secretary and the Deputy Secretary. The Saeima may give a vote of confidence or no confidence in the government. On the motion of not less than one-half of the Members of the Saeima, the Saeima may decide in close session by a two-thirds majority to dismiss the President. Draft laws may be presented to the Saeima by the President of State, the Cabinet, and the Committees of the Saeima, no less than five individual Members of the Saeima or, in cases and in a manner provided for in the Constitution, by one-tenth of the electorate. On 23 January 2019, the Saeima elected Mr Krišjānis Kariņš (New Unity/EPP) prime minister of the Republic. He is leading a five-party coalition consisting of his own New Unity party, the New Conservative Party, the Development/For! Alliance, the National Alliance plus most of the Who Owns the State? Party. -

Latvia's 15 Years in the European Union

THE DILIGENT TEENAGER: LATVIA’S 15 YEARS IN THE LATVIA IN THE EUROPEAN UNION 15 YEARS EUROPEAN UNION Photo 1 Fifteen years ago, on 1 May 2004, Latvia The day of the EU enlargement. On 1 May joined the European Union (EU), thus closing 2004, ten countries became the new EU almost ten-year long process of accession. Member States: Cyprus, the Czech Republic, Given the sensitive geo-political situation, the Estonia, Hungary, Latvia, Lithuania, choice in favour of Europe was self-evident, Malta, Poland, Slovakia and Slovenia. even though, the ideas of neutrality or closer Romano Prodi, President of the European Commission, Pat Cox, President of the cooperation with the Commonwealth of European Parliament and many EU Heads of Independent States originally emerged in the State and Government, including President political environment. However, the history Vaira-Vīķe Freiberga, attended the official was still alive in people’s memories, and it enlargement ceremony in Dublin. also determined the fate of Latvia in favour of Photo: The European Community, Maxwell’s, integration into the EU, by choosing the so- Irish Presidency called ‘return to Europe’. When regaining independence, Latvia based its statehood on the values of the republic proclaimed in 1918, providing that Latvia is an independent, democratic and parliamentary state. Accession to the EU provided for the strengthening of these values, by incorporating in the family of western democratic states, as well as the economic prosperity, well-being and security of Latvia by cooperating with like-minded countries. It would be difficult to challenge this choice now: the EU is the largest trading Photo 1 bloc in the world, the euro is the second largest currency in the world, the EU is a global leader in combating climate change the most developed countries by the Human and providing development aid; its population Development Index of the United Nations has almost the highest life expectancy in Organization. -

Latvia Covering the Period of January to December 2019

ANNUAL REVIEW OF THE HUMAN RIGHTS SITUATION OF LESBIAN, GAY, BISEXUAL, TRANS, AND INTERSEX PEOPLE IN LATVIA COVERING THE PERIOD OF JANUARY TO DECEMBER 2019 LATVIA BIAS-MOTIVATED SPEECH PUBLIC OPINION Over 500 anti-LGBT posts were removed by a social media The Eurobarometer 2019 survey found that even though social platform this year. 20 of these were reported to the police, but acceptance of LGBTI people in Latvia has slightly increased in criminal proceedings were only initiated in two cases. the past four years, it continues to lag far behind the EU average. 72 per cent of those in the EU say there is nothing wrong with BIAS-MOTIVATED VIOLENCE same-sex relationships, compared to only 25 per cent in Latvia. A total of 29 anti-LGBT hate crimes were reported to Mozaika this The support for same-sex marriage is 69 per cent in the EU, year, of which most (17) targeted gay men. The crimes included compared to 24 per cent in Latvia. Latvia scored a little better on sexual and physical assault, blackmail, and arson. The victims did attitudes towards legal gender recognition, 41 per cent in support not report the cases to the police. The number of crimes signal versus the EU average of 59 per cent. an increase - in 2018, 22 cases were reported. SOCIAL SECURITY AND SOCIAL PROTECTION DIVERSITY The first LGBT House was opened on 27 November in Riga. The On 12 February, the Open Centre association launched the House will provide services to the LGBT community and their Latvian Diversity Charter, joining a number of other EU Member friends, including legal and healthcare services. -

Valdis Dombrovskis Latvia (EPP)

Contacts: [email protected] Valdis Dombrovskis Latvia (EPP) Background Born on August 5, 1971. Valdis Dombrovkis has a master’s degree in physics from the University of Latvia and professional master’s degree in tax and customs administration from the Riga Technical University. He has finished doctoral studies at the University of Maryland, Faculty of Electrical Engineering. Valdis is a former Member of the Latvian parliament as well as the European Parliament. Prior he has served three consecutive terms as Prime Minister of Latvia, becoming the longest serving elected head of government in Latvia's history. He stepped down as the Prime Minister in late 2013, after the tragic incident when due to poor supervision of the construction industry, a shopping center collapsed and 54 people died. Valdis Dombrovskis has had a long career in politics, with experience mainly in financial policy. He worked at the Bank of Latvia, has served as the Minister for Finance for two years until 2004, when Latvia joined the EU. In 2004 he was elected as a Member of the European Parliament and in 2009 he became the Prime Minister straight after the financial crisis. He oversaw various measures including IMF program and austerity measures to stabilize the economic situation in the country. Since 2014 Dombrovskis has been the EC VP for the Euro and Social Dialogue. In 2016, when Jonathan Hill stepped down following the Brexit referendum, Dombrovskis took over his responsibilities since then being also in charge of financial stability, financial services and capital markets union. In 2019 he stood for the EP elections for the New Unity party. -

Baltic Journal of Law & Politics

BALTIC JOURNAL OF LAW & POLITICS A Journal of Vytautas Magnus University VOLUME 13, NUMBER 2 (2020) ISSN 2029-0454 Cit.: Baltic Journal of Law & Politics 13:2 (2020): 76-108 https://content.sciendo.com/view/journals/bjlp/bjlp- overview.xml DOI: 10.2478/bjlp-2020-0012 EUROPEANIZATION BY EUROPEAN PARLIAMENT POLITICAL GROUPS: THE CASE OF LATVIA 2004-2019 Māris Andžāns Assistant Professor; Dr. Rīga Stradiņš University, Faculty of European Studies (Latvia) Contact information Address: Dzirciema Street 16, Rīga, Latvia, LV-1007 Telephone: +371 67 409 161 E-mail address: [email protected] Kārlis Bukovskis Assistant Professor; Dr. Rīga Stradiņš University, Faculty of European Studies (Latvia) Contact information Address: Dzirciema Street 16, Rīga, Latvia, LV-1007 Telephone: +371 67 409 161 E-mail address: [email protected] Andris Sprūds Professor; Dr. Rīga Stradiņš University, Faculty of European Studies (Latvia) Contact information Address: Dzirciema Street 16, Rīga, Latvia, LV-1007 Telephone: +371 67 409 161 E-mail address: [email protected] Received: July 6, 2020; reviews: 2; accepted: December 30, 2020. BALTIC JOURNAL OF LAW & POLITICS ISSN 2029-0454 VOLUME 13, NUMBER 2 2020 ABSTRACT This article assesses the top-down Europeanization of national political parties by the political groups of the European Parliament. Based on the premise that the national political parties alter their agendas and argumentation because of ties to their respective European Parliament political groups, the paper presents a case study of Latvia in the period from 2004 to 2019. The analysis focuses on the agendas of three political parties whose continuity can be clearly traced during the fifteen years – the “New Unity”, the “National Alliance” and the “Latvian Russian Union”.