A Case Study of ICICI Bank in Jaipur City

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banking Awareness Question Bank V2

www.BankExamsToday.com www.BankExamsToday.com www.BankExamsToday.com Banking Awareness By Ramandeep Singh Question Bank v2 www.BankExamsToday.com S. NO. Banking AwarenessTOPICS Question Bank v2 PAGE NO. 1. 2. 3. History of Banking 2 - 4 4. Reserve Bank of India 4 - 7 5. NABARD 7 – 10 6. IRDAwww.BankExamsToday.com10 - 12 7. BIS 12 - 15 8. International Organizations 16 - 18 9. National Housing Bank 19 - 21 10. Credit/Debit Cards 21 - 24 11. Fiscal Policy 24 - 27 12. ATM 27 - 30 13. Banking OMBUDSMAN (Part 2) 30 - 33 14. Letter of Credit 33 - 36 15. WTO 36 - 39 16. World Bank 39 - 42 17. Allahabad Bank 42 - 45 18. Syndicate Bank 45 – 48 19. Oriental Bank of Commerce 48 - 51 20. Axis Bank 51 – 54 21. Punjab & Sind Bank 55 – 58 22. Bank of Baroda 58 – 60 23. ICICI Bank 60 – 63 24. PNB 63 – 66 25. United Bank of India 66 – 69 26. Vijaya Bank 69 - 72 27. ICICI Bank 72 – 75 28. Credit/Debit Cards (Part 2) 75 – 78 Canara Bank 78 – 81 Mixed Topics 81 - 121 By Ramandeep Singh Page 2 www.BankExamsToday.com HISTORY OF BANKINGBanking Awareness Question Bank v2 Q1. First Bank established in India was: a) Bank of India b) Bank of Hindustan c) General Bankwww.BankExamsToday.com of India d) None of The Above Q2. Bank of Hindustan was established in ____: a) 1700 b) 1770 c) 1780 d) None of The Above Q3. Which among the following is correct regarding Bank of Hindustan: a) The bank was established at calcutta under European management. -

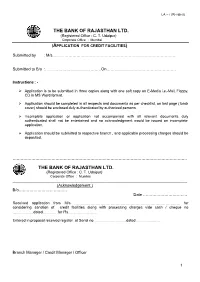

Credit Facility (LA-I Revised) Form

LA – I (REVISED) THE BANK OF RAJASTHAN LTD. (Registered Office : C. T. Udaipur) Corporate Office : Mumbai (APPLICATION FOR CREDIT FACILITIES) Submitted by : M/s………………………………………………………………………………… Submitted to B/o :……………………………………On……………………………………………. Instructions : - Ø Application is to be submitted in three copies along with one soft copy on E-Media i.e.-Mail, Floppy, CD in MS Word format. Ø Application should be completed in all respects and documents as per checklist, on last page ( back cover) should be enclosed duly authenticated by authorized persons. Ø Incomplete application or application not accompanied with all relevant documents duly authenticated shall not be entertained and no acknowledgment would be issued on incomplete application. Ø Application should be submitted to respective branch , and applicable processing charges should be deposited. …………………………………………………………………………………………………………………. THE BANK OF RAJASTHAN LTD. (Registered Office : C. T. Udaipur) Corporate Office : Mumbai _____________________________________________________________________________ (Acknowledgement ) B/o……………………………… Date …………………………… Received application from M/s …………………………………………………………………………. for considering sanction of credit facilities along with processing charges vide cash / cheque no ……..………dated…………for Rs…………………. Entered in proposal received register at Serial no ……………………..dated ………………. Branch Manager / Credit Manager / Officer 1 Please tick Check List of Enclosures to the application for credit facilities :- Ö (Yes / No) 1. Audited Financial Statements for last three Financial Years with Directors’ Report, Auditor’s Report, Schedules, and Notes to Accounts relating to Yes No applicant & group concerns. 2. CMA Report including Computation of Funded & Non Funded Limits, based on Last two years (actuals), current years estimates and projections of next year Yes No 3. Profile & Banking Arrangement of the Group Companies/Sister Concerns as per format Annexure-I Yes No 4. -

Is a 7 Digit Unique Number Issued by the Bank. What Are the Last Three

Mobile Money Identifier (MMID) is a 7 digit unique number issued by the bank. What are the last three digits represent? 1) to identify the account of the user 2) to identify the branch of the user 3) to identify the bank of the user 4) All of the above three 5) None of these Answer: to identify the account of the user What does the last character represent in PAN CARD? 1) type of holder 2) Surname of holder 3) Check digit 4) All of the above three 5) None of these Answer: Check digit What does I stands for, in PPI? 1) Instruments 2) Investment 3) Income 4) India 5) None of these Answer: Instruments Which of the below facility cannot be provided by Payment Banks? 1) ATM Card 2) Debit Card 3) Net banking 4) Mobile banking 5) Credit Card Answer: Credit Card Aapka Bank Aapke Dwar is a tagline of __________. 1) Airtel Payments Bank Limited 2) India Post Payments Bank Limited 3) Paytm Payments Bank Limited 4) Fino Payments Bank Limited 5) Vodafone M-Pesa Answer: India Post Payments Bank Limited Where is the headquarters of Paytm Payments Bank Limited? 1) Noida 2) New Delhi 3) Haryana 4) Lucknow 5) Varanasi Answer: Noida The headquarters of Equitas Small Finance Bank is _______________. 1) Guwahati 2) Thrissur 3) Coimbatore 4) Varanasi 5) Chennai Answer: Chennai Headquarters of Fino Payments Bank Limited is __________. 1) Kochi 2) New Delhi 3) Bangalore 4) Mangalore 5) Mumbai Answer: Mumbai Ho much % of FDI is allowed for Payment Banks in India? 1) 49% 2) 20% 3) 74% 4) 100% 5) 51% Answer: 74% Headquarters of FINCARE Small Finance Bank Limited is at? 1) Ahmedabad 2) Kochi 3) Mumbai 4) Bengaluru 5) Lucknow Answer: Bengaluru Loans to individuals up to ______ in metropolitan centres (with the population of ten lakh and above) under priority sector. -

A Study on Merger of ICICI Bank and Bank of Rajasthan

SUMEDHA Journal of Management A Study on Merger of ICICI Bank and Bank of Rajasthan – Achini Ambika* Abstract The purpose of the present paper is to explore various reasons of merger of ICICI and Bank of Rajasthan. This includes various aspects of bank mergers. It also compares pre and post merger financial performance of merged banks with the help of financial parameters like, Credit to Deposit, Capital Adequacy and Return on Assets, Net Profit margin, Net worth, Ratio. Through literature Review it comes know that most of the work done high lightened the impact of merger and Acquisition on different companies. The data of Merger and Acquisitions since economic liberalization are collected for a set of various financial parameters. Paired T-test used for testing the statistical significance and this test is applied not only for ratio analysis but also effect of merger on the performance of banks. This performance being tested on the basis of two grounds i.e., Pre-merger and Post- merger. Finally the study indicates that the banks have been positively affected by the event of merger. Keywords : Mergers & Acquisition, Banking, Financial Performance, Financial Parameters. Introduction The main roles of Banks are Economics growth, Expansion of the economy and provide funds for investment. The Indian banking sector can be divided into two eras, the liberalization era and the post liberalization era. In the pre liberalization era government of India nationalized 14 banks as 19th July 1965 and later on 6 more commercial Banks were nationalized as 15th April 1980. In the year 1993 government merged the new banks of India and Punjab National banks and this was the only merged between nationalized Banks after that the number of Nationalized Banks reduces from 20 to 19. -

Leadership in Banking Through Technology

Leadership in banking through technology 22ND ANNUAL REPORT AND ACCOUNTS ON THE MOVE 2015 - 2016 AT OUR PLACE AT YOUR PLACE CONTENTS 1 Leadership through Technology 2 ICICI Bank at a Glance 4 Financial Highlights 6 Message from the Chairman 8 Message from the Managing Director & CEO 10 Board and Management 11 Messages from Executive Directors 12 Banking on the Move 16 Banking at Your Place REGISTERED OFFICE 18 Banking at Our Place Landmark 20 Promoting Inclusive Growth Race Course Circle 24 Awards Vadodara 390 007 25 Directors’ Report Tel : +91-265-3263701 CIN : L65190GJ1994PLC021012 77 Auditor’s Certificate on Corporate Governance 78 Business Overview CORPORATE OFFICE 92 Management’s Discussion and Analysis ICICI Bank Towers 116 Key Financial Indicators: Last Ten Years Bandra-Kurla Complex Mumbai 400 051 FINANCIALS Tel : +91-22-33667777 Fax : +91-22-26531122 117 Independent Auditors’ Report – Financial Statements of ICICI Bank Limited STATUTORY AUDITORS B S R & CO. LLP 122 Financial Statements of ICICI Bank Limited 1st Floor, Lodha Excelus 193 Independent Auditors’ Report – Consolidated Apollo Mills Compound Financial Statements N. M. Joshi Marg 198 Consolidated Financial Statements of Mahalaxmi ICICI Bank Limited and its Subsidiaries Mumbai 400 011 243 Statement Pursuant to Section 129 of Companies Act, 2013 REGISTRAR AND 245 Basel Pillar 3 Disclosures TRANSFER AGENTS 246 Glossary of Terms 3i Infotech Limited International Infotech Park Tower 5, 3rd Floor ENCLOSURES Vashi Railway Station Complex Vashi, Navi Mumbai 400 703 Notice Attendance Slip and Form of Proxy LEADERSHIP THROUGH TECHNOLOGY... Digital technology is transforming the way we lead our lives today. The banking and financial services industry is a clear representation of this transformation. -

An Analysis of Kotak Mahindra Bank & ING VYSYA Bank

Interscience Management Review Volume 4 Issue 2 Article 5 July 2014 Merger and Acquisition Deal Brings Leveraging Synergy – An Analysis of Kotak Mahindra Bank & ING VYSYA Bank Rashmi Ranjan Panigrahi SOA Deemed to be University, Bhubaneswar, [email protected] S. K. Biswal SOA Deemed to be University, Bhubaneswar, [email protected] Ansuman Sahoo Utkal University, Vani Vihar, Bhubaneswar, [email protected] Follow this and additional works at: https://www.interscience.in/imr Part of the Business Administration, Management, and Operations Commons, and the Human Resources Management Commons Recommended Citation Panigrahi, Rashmi Ranjan; Biswal, S. K.; and Sahoo, Ansuman (2014) "Merger and Acquisition Deal Brings Leveraging Synergy – An Analysis of Kotak Mahindra Bank & ING VYSYA Bank," Interscience Management Review: Vol. 4 : Iss. 2 , Article 5. DOI: 10.47893/IMR.2011.1087 Available at: https://www.interscience.in/imr/vol4/iss2/5 This Article is brought to you for free and open access by the Interscience Journals at Interscience Research Network. It has been accepted for inclusion in Interscience Management Review by an authorized editor of Interscience Research Network. For more information, please contact [email protected]. Merger and Acquisition Deal Brings Leveraging Synergy – An Analysis of Kotak Mahindra Bank & ING VYSYA Bank Rashmi Ranjan Panigrahi1, Dr. S. K. Biswal2 & Dr. Ansuman Sahoo3 1Faculty of Management Studies, Institute Business Computer Studies, SOA Deemed to be University, Bhubaneswar 2Department of Finance & Control, Institute Business Computer Studies, SOA Deemed to be University, Bhubaneswar 3Department of Business Administration, Utkal University, Vani Vihar, Bhubaneswar Abstract - The quest for growth and changing market share. -

Initiating Coverage YES Bank…

Yes to ‘YES’ Bank Initiating Coverage YES Bank… Industry Banking Yes Bank, India’s new age private sector bank, is an outcome of the professional entrepreneurship of its Founder, Rana Stock Metrics Kapoor and his highly competent top management team, to BSE Group A establish a high quality, customer centric, service driven, private Indian Bank catering to the “Future Industries of BSE Code 532648 India”. It began operations in May 2004 and has the distinction Bloomberg Code YES IN of obtaining RBI’s only green-field banking license in the past Face Value 10 decade. CMP ` 347 Yes Bank has built a strong management team with experience Target Price ` 395 from foreign banks for each of its business units. It has Potential Upside 14% fructified into a “full service” commercial bank that has steadily built Corporate and Institutional Banking, Financial Markets, Market Data Investment Banking, Corporate Finance, Business and Market Cap (` Crs) 11785 Transaction Banking, Retail and Wealth Management business lines across the country, and is well equipped to offer a range 52 week High/Low 354.90/214.20 of products and services to corporate and retail customers. The Sensex 19983 bank has a network of 158 branches and 200+ ATMs. It aims Nifty 6027 to scale up its branch network to 400+ with a CASA ratio of ~25% by FY12 (currently at 10.5%). Average Volume 560839 Valuation Shareholding Pattern At the CMP of ` 347 the bank is trading at 2.6x FY12E ABV. The bank delivered RoE of over 20% and RoA of 1.6% for FY10. -

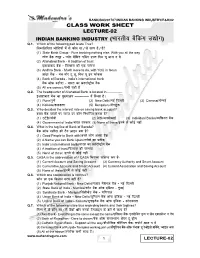

CLASS WORK SHEET LECTURE-02 INDIAN BANKING INDUSTRY ( Hkkjrh; Csfdax M|Ksx ) Q.1

BANK/GA/201707/INDIAN BANKING INDUSTRY/E&H/02 CLASS WORK SHEET LECTURE-02 INDIAN BANKING INDUSTRY ( Hkkjrh; cSfdax m|ksx ) Q.1. Which of the following pair is/are True? fuEufyf[kr tksfM+;ksa esa ls dkSu lk@ls lR; gS@gS\ (1) State Bank Group - Pure banking nothing else; With you all the way LVsV cSad lewg & I;ksj cSafdax ufFkax ,Yl foFk ;w vky n os (2) Allahabad Bank - A tradition of trust bykgkckn cSad & fo'okl dh ,d ijaijk (3) Andhra Bank - Much more to do, with YOU in focus vka/kzk cSad & ep eksj Vw Mw] foFk ;w bu Qksdl (4) Bank of Baroda - India’s international bank cSad vkWQ cM+kSnk & Hkkjr dk varjkZ"Vªh; cSad (5) All are correct / lHkh lgh gS Q.2. The headquarter of Allahabad Bank is located in--------------. bykgkckn cSad dk eq[;ky; &&&&&&&&&&& esa fLFkr gSA (1) Pune/ iq.ks (2) New Delhi/ ubZ fnYyh (3) Chennai/ psUubZ (4) Kolkata/ dydÙkk (5) Bengaluru/ csaxyq: Q.3. Who decided the interest rate on saving bank account? cpr cSad [kkrksa ij C;kt nj dkSu fu/kkZfjr djrk gS\ (1) SEBI/ lsch (2) RBI/ vkjchvkbZ (3) Individual Banks/ O;fäxr cSad (4) Government of India/ Hkkjr ljdkj (5) None of these/ bues ls dksbZ ugha Q.4. What is the tag line of Bank of Baroda? cSad vkWQ cM+kSnk dh VSx ykbu D;k gS\ (1) Good People to Bank with/ vPNs yksx vPNk cSad (2) A Name you can Bank Upon/ Hkjksls dk izrhd (3) India’s international bank/ Hkkjr dk varjkZ"Vªh; cSad (4) A tradition of trust/ fo'okl dh ijEijk (5) None of these / bues ls dksbZ ugha Q.5. -

Project Report of Research Study on Loan Default by Shgs

Project Report Of Research study on Loan default by SHGs Supported by Conducted by Supported by: Bankers Institute of Rural Development, Centre for microFinance, Lucknow Jaipur 1 Acknowledgements We like to take this opportunity to express our sincere thanks to Bankers Institute of Rural Development (BIRD), Lucknow for this collaborative research study on “Loan default by SHGs in Rajasthan”. Centre for microFinance (CmF) greatly acknowledges the cooperation and support of members of various Self Help Groups for sharing information, thoughts and their valuable time during study. We gratefully acknowledge the support of Bank of Baroda, SBI, SBBJ, UCO Bank, OBC, Baroda Rajasthan Gramin Bank, Rajasthan Gramin Bank, Bank of Rajasthan, Apex Bank, District central cooperative banks and all other banks for their valuable data and time. This project neither could have been completed without the active support of Self Help Promoting Intuitions like Department of Women & Child Development, Watershed department, People Education & Development Organization (PEDO), Ibtada, NYMS and other voluntary organizations. We would also like to thank Dr. Tara Nair for her insights on the concept and framework of the report. We sincerely hope that finding of report will be useful in making necessary decision for the future. Centre for microFinance 2 Content Abbreviation 6 Executive Summary 8 Chapter 1 Background of the Study 10 1.1 Background 10 1.2 The Context of the study 11 1.3 Purpose of the study 12 1.4 Objective of the study 12 1.5 Issues in focus 13 Chapter -

Mergers in Indian Banking Industry-A Case Study on ICICI Bank and Indian Overseas Bank

International Journal of Applied Research 2017; 3(1): 01-05 ISSN Print: 2394-7500 ISSN Online: 2394-5869 Impact Factor: 5.2 Mergers in Indian banking industry-A case study on IJAR 2017; 3(1): 01-05 ICICI bank and Indian Overseas bank www.allresearchjournal.com Received: 01-11-2016 Accepted: 02-12-2016 K Abirami K Abirami Assistant Professor, Abstract Department of Commerce, Mergers and acquisitions are the revolution strategies to restructure a business where the competitions Avinashilingam University, are reduced and existing markets are protected. In the recent years Indian Banking industry had also Institute for Home Science and Higher Education for Women, adopted the strategies to increase the market share of the business and to control the competition. The Coimbatore, Tamil Nadu, study is an effort to analyse the financial performance and shareholder value of the select banks. The India share holder value of the select banks are calculated through economic value added (EVA) tool. The performances of the banks are measured with profitability and productivity ratios. Paired t-test is used for testing the statistical significance of the ratios of the select banks. Mergers help banks to strengthen their financial base to expand their operation and reduce their cost of operation. The study covers a public sector bank and a private sector bank which were involved in merger during 2006-07 and 2010- 11 respectively. The results suggest that banks had improved efficiency and increased the shareholders value through strategic mergers. Required data were collected from the Capitaline Plus Database. It was found that the in post merger period there is increase in the economic value added of the banks under the study. -

SCHEDULE 18 Significant Accounting Policies and Notes to Accounts

SCHEDULE 18 Significant Accounting Policies and Notes to Accounts OVERVIEW ICICI Bank Limited (“ICICI Bank” or “the Bank”), incorporated in Vadodara, India is a publicly held bank engaged in providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank is a banking company governed by the Banking Regulation Act, 1949. Basis of preparation In fiscal 2001, ICICI Bank acquired and merged Bank of Madura into itself in an all-stock deal. Effective March 30, 2002, ICICI Bank acquired ICICI Limited (“ICICI”) and two of its retail finance subsidiaries, ICICI Personal Financial Services Limited (“I PFS”) and ICICI Capital Services Limited (“I CAPS”) along with ICICI’s interest in its subsidiaries in an all-stock deal. The amalgamation was accounted for as per the approved Scheme of Amalgamation and the purchase method of accounting. The accounting and reporting policies of ICICI Bank used in the preparation of these financial statements conform with Generally Accepted Accounting Principles (“GAAP”) in India, the guidelines issued by the Reserve Bank of India (“RBI”) from time to time and practices generally prevailing within the banking industry in India. The Bank follows the accrual method of accounting and historical cost convention. The preparation of financial statements requires the management to make estimates and assumptions considered in the reported amounts of assets and liabilities (including contingent liabilities) as of the date of the financial statements and the reported income and expenses during the reporting period. Management believes that the estimates used in the preparation of the financial statements are prudent and reasonable. -

Corporation Bank a Premier Government of India Enterprise SANSCO SERVICES - Annual Reports Library Services

SANSCO SERVICES - A 'Crvices - www.sansco.net Quality Banking ANNUAL REPORT 2003 - 2004 STf/sR % Trfrt 'fe Customer Care Loan Hi-tech Banking Products Products Deposit Bancassurance Products Products fl 5!TP? Team Work Corporation Bank www.reportjunction.com A Premier Government of India Enterprise SANSCO SERVICES - Annual Reports Library Services - www.sansco.net THE BOARD OF DIRECTORS Shri K. Cherian Varghese Shri P.K. Gupta S\ if Shri G. R. Summan Smt Uma Shankar Shri Ch. Hanumantha Rao Shri D.N. Prakash Shri Ramesh Chander Chandiwala Shri V.K. Chanana Shri K.K.G. Pillai Shri Dushyant Tyagi Shri S. Ravi Shri Ramakant Vashishtha GENERAL MANAGERS ?ft TJTT.^t. Shri K. Achutha Pai Shri M.V. Nair .. Shri M.D. Mallya Shri M. Narendra Shri A. Mohan Rao Shri K.R. Kamath Shri V.A. Mendonsa Shri R.K. Nair www.reportjunction.com SANSCO SERVICES - Annual Reports Library Services - www.sansco.net dte Annual Report 2003-2004 CONTENTS Chairman's Statement 2 Notice 6 Directors' Report 12 cfi[ Management Discussion & Analysis 24 Report on Corporate Governance 40 t3> 3)1 Ten Years' Performance of the Bank 69 Balance Sheet and Profit & Loss Account 70 Performance Highlights 2003-04 106 Consolidated Balance Sheet and Profit & Loss Account 107 ^ Accounts of Corpbank Homes Ltd. 131 . % ^f Accounts of Corpbank Securities Ltd. 154 -3Tft)Piqi) ^ "l Extracts of Relevant Acts and Regulations 190 ^ Attendance Slip 203 3rf?}59T ECS Mandate 205 5l4 Proxy Form 207 WT Nomination Form 209 g Declaration Form 211 Auditors Registrar & Share Transfer Agent Sudit K. Parekh & Co.