E.ON 2003 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Economics of the Nord Stream Pipeline System

The Economics of the Nord Stream Pipeline System Chi Kong Chyong, Pierre Noël and David M. Reiner September 2010 CWPE 1051 & EPRG 1026 The Economics of the Nord Stream Pipeline System EPRG Working Paper 1026 Cambridge Working Paper in Economics 1051 Chi Kong Chyong, Pierre Noёl and David M. Reiner Abstract We calculate the total cost of building Nord Stream and compare its levelised unit transportation cost with the existing options to transport Russian gas to western Europe. We find that the unit cost of shipping through Nord Stream is clearly lower than using the Ukrainian route and is only slightly above shipping through the Yamal-Europe pipeline. Using a large-scale gas simulation model we find a positive economic value for Nord Stream under various scenarios of demand for Russian gas in Europe. We disaggregate the value of Nord Stream into project economics (cost advantage), strategic value (impact on Ukraine’s transit fee) and security of supply value (insurance against disruption of the Ukrainian transit corridor). The economic fundamentals account for the bulk of Nord Stream’s positive value in all our scenarios. Keywords Nord Stream, Russia, Europe, Ukraine, Natural gas, Pipeline, Gazprom JEL Classification L95, H43, C63 Contact [email protected] Publication September 2010 EPRG WORKING PAPER Financial Support ESRC TSEC 3 www.eprg.group.cam.ac.uk The Economics of the Nord Stream Pipeline System1 Chi Kong Chyong* Electricity Policy Research Group (EPRG), Judge Business School, University of Cambridge (PhD Candidate) Pierre Noёl EPRG, Judge Business School, University of Cambridge David M. Reiner EPRG, Judge Business School, University of Cambridge 1. -

Germany - Regulatory Reform in Electricity, Gas, and Pharmacies 2004

Germany - Regulatory Reform in Electricity, Gas, and Pharmacies 2004 The Review is one of a series of country reports carried out under the OECD’s Regulatory Reform Programme, in response to the 1997 mandate by OECD Ministers. This report on regulatory reform in electricity, gas and pharmacies in Germany was principally prepared by Ms. Sally Van Siclen for the OECD. OECD REVIEWS OF REGULATORY REFORM REGULATORY REFORM IN GERMANY ELECTRICITY, GAS, AND PHARMACIES -- PART I -- ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT © OECD (2004). All rights reserved. 1 ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Pursuant to Article 1 of the Convention signed in Paris on 14th December 1960, and which came into force on 30th September 1961, the Organisation for Economic Co-operation and Development (OECD) shall promote policies designed: • to achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy; • to contribute to sound economic expansion in Member as well as non-member countries in the process of economic development; and • to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations. The original Member countries of the OECD are Austria, Belgium, Canada, Denmark, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The following countries became Members subsequently through accession at the dates indicated hereafter: Japan (28th April 1964), Finland (28th January 1969), Australia (7th June 1971), New Zealand (29th May 1973), Mexico (18th May 1994), the Czech Republic (21st December 1995), Hungary (7th May 1996), Poland (22nd November 1996), Korea (12th December 1996) and the Slovak Republic (14th December 2000). -

Annual Report 2007 Sales in € Million 14,430 14,125 EBITDA (Before Non-Operating Result) in € Million 2,221 2,157

The first annual report published under the Evonik brand. Overview Evonik Group: Key figures 2007 2006 Annual Report 2007 Sales in € million 14,430 14,125 EBITDA (before non-operating result) in € million 2,221 2,157 EBITDA margin in % 15.4 15.3 EBIT (before non-operating result) in € million 1,348 1,179 Return on capital employed (ROCE) in % 9.5 8.4 Net income in € million 876 1,046 The First. Total assets in € million 19,800 20,953 Equity ratio in % 25.7 20.6 Annual Report Annual 2007 Cash flow from operating activities in € million 1,215 1,142 Capital expenditures1) in € million 1,032 935 Depreciation and amortization1) in € million 862 943 The The First. Net financial debt in € million 4,645 5,434 Employees as of December 31 43,057 46,430 1) Intangible assets, property, plant, equipment and investment property. A clear structure Evonik Industries The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States of America, Canada, Japan or Australia. Chemicals Energy Real Estate Business areas Business units Industrial Consumer Coatings & Energy Real Estate Chemicals Specialties Additives Inorganic Health & Performance Materials Nutrition Polymers Technology Consumer Specialty Energy Real Estate Segments Evonik Industries AG Specialties Solutions Materials Rellinghauser Straße 1–11 45128 Essen Germany www.evonik.com The first annual report published under the Evonik brand. Overview Evonik Group: Key figures 2007 2006 Annual Report 2007 Sales in € million 14,430 14,125 EBITDA (before non-operating result) in € million 2,221 2,157 EBITDA margin in % 15.4 15.3 EBIT (before non-operating result) in € million 1,348 1,179 Return on capital employed (ROCE) in % 9.5 8.4 Net income in € million 876 1,046 The First. -

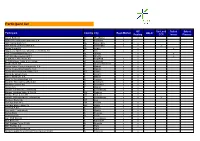

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Planning Supporting Statement

Branston Locks Employment Land Statement November 2012 Employment Land Statement Nurton Developments (Quintus) Limited Branston Locks, Burton upon Trent November 2012 Branston Locks – Employment Land Statement Contents 1 Introduction ............................................................................................................................................................ 2 2 Communications and Site Characteristics .......................................................................................................... 3 3 Relevant Planning Policy and Supporting Evidence Base................................................................................. 4 4 Market Overview for Burton ................................................................................................................................ 10 5 Assessment of Demand ...................................................................................................................................... 16 6 Conclusions ......................................................................................................................................................... 18 Appendix 1 – Schedule of Occupiers and Map of Centrum ........................................................................................ 19 Appendix 2 – Schedule of Available Industrial Floor Space in Burton Upon Trent .................................................. 20 Appendix 3 – Schedule of Available Office Floor Space in Burton Upon Trent ....................................................... -

International Passenger Survey, 2008

UK Data Archive Study Number 5993 - International Passenger Survey, 2008 Airline code Airline name Code 2L 2L Helvetic Airways 26099 2M 2M Moldavian Airlines (Dump 31999 2R 2R Star Airlines (Dump) 07099 2T 2T Canada 3000 Airln (Dump) 80099 3D 3D Denim Air (Dump) 11099 3M 3M Gulf Stream Interntnal (Dump) 81099 3W 3W Euro Manx 01699 4L 4L Air Astana 31599 4P 4P Polonia 30699 4R 4R Hamburg International 08099 4U 4U German Wings 08011 5A 5A Air Atlanta 01099 5D 5D Vbird 11099 5E 5E Base Airlines (Dump) 11099 5G 5G Skyservice Airlines 80099 5P 5P SkyEurope Airlines Hungary 30599 5Q 5Q EuroCeltic Airways 01099 5R 5R Karthago Airlines 35499 5W 5W Astraeus 01062 6B 6B Britannia Airways 20099 6H 6H Israir (Airlines and Tourism ltd) 57099 6N 6N Trans Travel Airlines (Dump) 11099 6Q 6Q Slovak Airlines 30499 6U 6U Air Ukraine 32201 7B 7B Kras Air (Dump) 30999 7G 7G MK Airlines (Dump) 01099 7L 7L Sun d'Or International 57099 7W 7W Air Sask 80099 7Y 7Y EAE European Air Express 08099 8A 8A Atlas Blue 35299 8F 8F Fischer Air 30399 8L 8L Newair (Dump) 12099 8Q 8Q Onur Air (Dump) 16099 8U 8U Afriqiyah Airways 35199 9C 9C Gill Aviation (Dump) 01099 9G 9G Galaxy Airways (Dump) 22099 9L 9L Colgan Air (Dump) 81099 9P 9P Pelangi Air (Dump) 60599 9R 9R Phuket Airlines 66499 9S 9S Blue Panorama Airlines 10099 9U 9U Air Moldova (Dump) 31999 9W 9W Jet Airways (Dump) 61099 9Y 9Y Air Kazakstan (Dump) 31599 A3 A3 Aegean Airlines 22099 A7 A7 Air Plus Comet 25099 AA AA American Airlines 81028 AAA1 AAA Ansett Air Australia (Dump) 50099 AAA2 AAA Ansett New Zealand (Dump) -

Willkommen Bei Ihrer Worksitebank!

Willkommen bei Ihrer WorksiteBank! Stand: 16.09.2018 Agenda Über die Degussa Bank Unser Produkt- und Serviceangebot Depotführung für Mitarbeiter der M.M. Warburg & CO Anhang Depotführung für Mitarbeiter der M.M. Warburg & CO – Vermögensberatung 2 Über die Degussa Bank WorksiteBanking – Ein einzigartiges Geschäftsmodell Deutschlands einzige WorksiteBank – spezialisiert auf Bankdienstleistungen für Mitarbeiter in Unternehmen Seit mehr als 50 Jahren mit diesem Geschäftsmodell – mit unverwechselbarem Profil Marktführer Aktuell über 411.000 Kunden und 190 Bank-Shops an Standorten renommierter Partnerunternehmen Mitglied des Bankenverbands und des „Einlagensicherungsfonds des Bundesverbandes deutscher Banken e. V. (Einlagenschutz bis zu einer Höhe von rd. 45 Millionen Euro pro Kunde) Umfassendes Worksite Financial Service Angebot über die Tochtergesellschaften Industria (Immobilien), Prinas (Versicherungen) und mitarbeitervorteile.de (exklusive Einkaufsvorteile) Depotführung für Mitarbeiter der M.M. Warburg & CO – Vermögensberatung 4 Eine Bank mit „goldener“ Geschichte 1873: Gründung des Unternehmens Degussa (Deutsche Gold- und Silber- Scheideanstalt) als Bank, hervorgegangen aus der ehemaligen Münzmeisterei Frankfurt 1936: Anerkennung der Degussa als „Devisenbank“ 1947: Zulassung als „Außenhandelsbank“ 1979: Ausgründung der Degussa Bank GmbH als Universalbank aus der Degussa AG Depotführung für Mitarbeiter der M.M. Warburg & CO – Vermögensberatung 5 Dafür stehen wir: Nähe, Transparenz und Vertrauen! Nähe Kurze Wege, schnelle -

The Pfandbrief Roundtable 2019 in ASSOCIATION with the VDP

The Covered Bond Report www.coveredbondreport.com August 2019 The Pfandbrief Roundtable 2019 IN ASSOCIATION WITH THE VDP The Pfandbrief Roundtable 2019 The EU covered bond legislative package, sustainable finance developments, and a possible revival of APP were key topics in our annual Pfandbrief roundtable, produced in association with the vdp and hosted by pbb on 26 June, with leading players sharing their views ahead of the 250th anniversary of the Pfandbrief in August. Neil Day, The Covered Bond Report: are discussions about tightening the regu- Matthias Melms, NordLB: Indepen- What is it about the Pfandbrief that latory framework, it is important to ensure dently of the issuers and the assets that has resulted in it being such a long- that the Pfandbrief remains competitive are behind the Pfandbrief, when we talk lasting and successful product? versus other products. about 250 years of a success story we have to talk about the Pfandbrief law. A Jens Tolckmitt, Association of German Felix Rieger, Deutsche Bundesbank: foreign investor once told me: I want to Pfandbrief Banks (vdp): The stability I am here representing the Bundesbank as invest in Germany, in the German Pfand- and the high quality of the legal frame- an investor today — not for its role regard- brief, but I don’t care about the issuer, I work have been decisive in making the ing monetary policy — and in this respect, don’t care about the assets, I just want Pfandbrief such a long-lasting product. investing money on behalf of Federal gov- to have the Pfandbrief with the highest What is especially important today, is that ernment entities, the Bundesbank is a spread. -

(For Official Use Only) PUBLIC PETITION NO. PE1188 Should You Wish to Submit a Public Petition for Consideration by the Public P

(For official use only) PUBLIC PETITION NO. PE1188 Should you wish to submit a public petition for consideration by the Public Petitions Committee please refer to the guidance leaflet How to submit a public petition and the Guidance Notes at the back of this form. 1. NAME OF PRINCIPAL PETITIONER Nick Dekker 2. TEXT OF PETITION Nick Dekker calling on the Scottish Parliament to urge the Scottish Government to investigate the circumstances whereby it agreed that 60 hydro-power stations could be accredited for subsidy under the Renewables Obligation scheme and that generation capacity could be cut to below the 20megawatt qualification threshold at others to enable accreditation and whether, in the interests of electricity consumers, it will rescind these accreditations. 3. ACTION TAKEN TO RESOLVE ISSUES OF CONCERN BEFORE SUBMITTING THE PETITION I have contacted and have been in correspondence with AuditScotland, OFGEM, Scottish & Southern Energy PLC and ScottishPower PLC. Alex Neil MSP also corresponded with Scottish & Southern Energy. 4. ADDITIONAL INFORMATION See— “The war on climate change – A licence to print money?” “Subsidies and Subterfuge – Hydro-power and the Renewables Obligation” (also on www.swap.org.uk) “ROCs earned by Alcan, SSE and ScottishPower from 'old build' hydro, April 2002 to December 2007” (a report by the petitioners); “Renewable Energy Data for Scotland (Hydro), May 2008” Correspondence generally pertinent to the petition but esp to Question 3 OFGEM’s “Annual Reports on the Renewables Obligation” 2004 to 2008; Press releases and other material referred to in “The war on climate change – a licence to print money?” and elsewhere 5. -

The Impact of Us Lng on Russian Natural Gas Export Policy

THE IMPACT OF US LNG ON RUSSIAN NATURAL GAS EXPORT POLICY BY TATIANA MITROVA AND TIM BOERSMA DECEMBER 2018 ABOUT THE CENTER ON GLOBAL ENERGY POLICY The Center on Global Energy Policy provides independent, balanced, data-driven analysis to help policymakers navigate the complex world of energy. We approach energy as an economic, security, and environmental concern. And we draw on the resources of a world- class institution, faculty with real-world experience, and a location in the world’s finance and media capital. Visit us at www.energypolicy.columbia.edu @ColumbiaUenergy ABOUT THE SCHOOL OF INTERNATIONAL AND PUBLIC AFFAIRS SIPA’s mission is to empower people to serve the global public interest. Our goal is to foster economic growth, sustainable development, social progress, and democratic governance by educating public policy professionals, producing policy-related research, and conveying the results to the world. Based in New York City, with a student body that is 50 percent international and educational partners in cities around the world, SIPA is the most global of public policy schools. For more information, please visit www.sipa.columbia.edu THE IMPACT OF US LNG ON RUSSIAN NATURAL GAS EXPORT POLICY BY TATIANA MITROVA AND TIM BOERSMA DECEMBER 2018 1255 Amsterdam Ave New York NY 10027 www.energypolicy.columbia.edu @ColumbiaUenergy THE IMPACT OF US LNG ON RUSSIAN NATURAL GAS EXPORT POLICY ACKNOWLEDGEMENTS For comments on earlier drafts of this paper and editorial guidance, the authors would like to thank Jason Bordoff, Jonathan Elkind, Anna Galkina, Matthew Robinson, Morena Skalamera, Rik Komduur, and Megan Burak. All remaining errors are the authors’ own. -

Report Template

Roger Tym & Partners t: 0116 249 3970 3 Museum Square e: 0116 249 3971 Leicester e: [email protected] LE1 6UF w: www.tymconsult.com Part of Peter Brett Associates LLP East Staffordshire Borough Council Infrastructure Delivery Study Part 1 Growth options assessment Final Report June 2012 PP26486 CONTENTS 1 INTRODUCTION ................................................................................................................. 1 Study approach ................................................................................................................... 3 The key study questions ...................................................................................................... 3 2 TRANSPORT ...................................................................................................................... 5 Context ................................................................................................................................ 5 Current and future transport capacity and impact for Burton ................................................ 6 Transport growth options assessment for Burton ................................................................. 7 Transport growth options review for Uttoxeter ................................................................... 12 Growth options RAG assessment ...................................................................................... 15 3 EDUCATION .................................................................................................................... -

The German Private Commercial Banks' Statutory Deposit Guarantee

The German private commercial banks’ statutory deposit guarantee and investor compensation scheme A brief guide and list of banks assigned to the scheme Berlin, October 2017 The German private commercial banks’ statutory deposit guarantee and investor compensation scheme A brief guide and list of banks assigned to the scheme Berlin, October 2017 * Please note: The present English translation is furnished for informa- tion purposes only. The original German text is binding in all respects. 4 Entschädigungseinrichtung Since the entry into force of the German Deposit Guarantee and Investor Compensation Act (Einlagensicherungs- und Anlegerentschädigungsgesetz [EAEG]) and, more recently, of the German Deposit Guarantee Act (Einlagensicherungsgesetz [EinSiG]), deposits and liabilities arising from securities transactions have been protected at the commercial banks operated in private legal form (the private commercial banks for short) by the Entschädigungseinrichtung deutscher Banken GmbH (EdB) Burgstraße 28 10178 Berlin www.edb-banken.de to the extent provided for by law. The legal basis for the private commercial banks’ deposit guarantee scheme was originally the Deposit Guarantee and Investor Compensation Act (Einlagensicherungs- und Anlegerentschädigungsgesetz [EAEG]). On 3 July 2015, the statutory deposit guarantee scheme was moved from this act to a separate Deposit Guarantee Act (Einlagensicherungsgesetz [EinSiG]), thereby transposing the provisions of the new European Deposit Guarantee Schemes Directive1 into German law. The aim of the Deposit Guarantee Schemes Directive is an even higher level of protection and maximum harmonisation of European deposit guarantee schemes. The Deposit Guarantee and Investor Compensation Act, which is now confined to dealing with investor compensation concerns, has been retained as the Investor Compensation Act (Anlegerentschädigungsgesetz [AnlEntG]).