Worksite Banking It’S the Right Combination That Counts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2007 Sales in € Million 14,430 14,125 EBITDA (Before Non-Operating Result) in € Million 2,221 2,157

The first annual report published under the Evonik brand. Overview Evonik Group: Key figures 2007 2006 Annual Report 2007 Sales in € million 14,430 14,125 EBITDA (before non-operating result) in € million 2,221 2,157 EBITDA margin in % 15.4 15.3 EBIT (before non-operating result) in € million 1,348 1,179 Return on capital employed (ROCE) in % 9.5 8.4 Net income in € million 876 1,046 The First. Total assets in € million 19,800 20,953 Equity ratio in % 25.7 20.6 Annual Report Annual 2007 Cash flow from operating activities in € million 1,215 1,142 Capital expenditures1) in € million 1,032 935 Depreciation and amortization1) in € million 862 943 The The First. Net financial debt in € million 4,645 5,434 Employees as of December 31 43,057 46,430 1) Intangible assets, property, plant, equipment and investment property. A clear structure Evonik Industries The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States of America, Canada, Japan or Australia. Chemicals Energy Real Estate Business areas Business units Industrial Consumer Coatings & Energy Real Estate Chemicals Specialties Additives Inorganic Health & Performance Materials Nutrition Polymers Technology Consumer Specialty Energy Real Estate Segments Evonik Industries AG Specialties Solutions Materials Rellinghauser Straße 1–11 45128 Essen Germany www.evonik.com The first annual report published under the Evonik brand. Overview Evonik Group: Key figures 2007 2006 Annual Report 2007 Sales in € million 14,430 14,125 EBITDA (before non-operating result) in € million 2,221 2,157 EBITDA margin in % 15.4 15.3 EBIT (before non-operating result) in € million 1,348 1,179 Return on capital employed (ROCE) in % 9.5 8.4 Net income in € million 876 1,046 The First. -

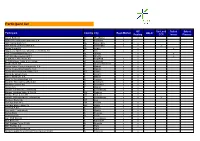

Participant List

Participant list GC SecLend Select Select Participant Country City Repo Market HQLAx Pooling CCP Invest Finance Aareal Bank AG D Wiesbaden x x ABANCA Corporaction Bancaria S.A E Betanzos x ABN AMRO Bank N.V. NL Amsterdam x x ABN AMRO Clearing Bank N.V. NL Amsterdam x x x Airbus Group SE NL Leiden x x Allgemeine Sparkasse Oberösterreich Bank AG A Linz x x ASR Levensverzekering N.V. NL Utrecht x x ASR Schadeverzekering N.V. NL Utrecht x x Augsburger Aktienbank AG D Augsburg x x B. Metzler seel. Sohn & Co. KGaA D Frankfurt x x Baader Bank AG D Unterschleissheim x x Banco Bilbao Vizcaya Argentaria, S.A. E Madrid x x Banco Cooperativo Español, S.A. E Madrid x x Banco de Investimento Global, S.A. PT Lisbon x x Banco de Sabadell S.A. E Alicante x x Banco Santander S.A. E Madrid x x Bank für Sozialwirtschaft AG D Cologne x x Bank für Tirol und Vorarlberg AG A Innsbruck x x Bankhaus Lampe KG D Dusseldorf x x Bankia S.A. E Madrid x x Banque Centrale du Luxembourg L Luxembourg x x Banque Lombard Odier & Cie SA CH Geneva x x Banque Pictet & Cie AG CH Geneva x x Banque Internationale à Luxembourg L Luxembourg x x x Bantleon Bank AG CH Zug x Barclays Bank PLC GB London x x Barclays Bank Ireland Plc IRL Dublin x x BAWAG P.S.K. A Vienna x x Bayerische Landesbank D Munich x x Belfius Bank B Brussels x x Berlin Hyp AG D Berlin x x BGL BNP Paribas L Luxembourg x x BKS Bank AG A Klagenfurt x x BNP Paribas Fortis SA/NV B Brussels x x BNP Paribas S.A. -

Willkommen Bei Ihrer Worksitebank!

Willkommen bei Ihrer WorksiteBank! Stand: 16.09.2018 Agenda Über die Degussa Bank Unser Produkt- und Serviceangebot Depotführung für Mitarbeiter der M.M. Warburg & CO Anhang Depotführung für Mitarbeiter der M.M. Warburg & CO – Vermögensberatung 2 Über die Degussa Bank WorksiteBanking – Ein einzigartiges Geschäftsmodell Deutschlands einzige WorksiteBank – spezialisiert auf Bankdienstleistungen für Mitarbeiter in Unternehmen Seit mehr als 50 Jahren mit diesem Geschäftsmodell – mit unverwechselbarem Profil Marktführer Aktuell über 411.000 Kunden und 190 Bank-Shops an Standorten renommierter Partnerunternehmen Mitglied des Bankenverbands und des „Einlagensicherungsfonds des Bundesverbandes deutscher Banken e. V. (Einlagenschutz bis zu einer Höhe von rd. 45 Millionen Euro pro Kunde) Umfassendes Worksite Financial Service Angebot über die Tochtergesellschaften Industria (Immobilien), Prinas (Versicherungen) und mitarbeitervorteile.de (exklusive Einkaufsvorteile) Depotführung für Mitarbeiter der M.M. Warburg & CO – Vermögensberatung 4 Eine Bank mit „goldener“ Geschichte 1873: Gründung des Unternehmens Degussa (Deutsche Gold- und Silber- Scheideanstalt) als Bank, hervorgegangen aus der ehemaligen Münzmeisterei Frankfurt 1936: Anerkennung der Degussa als „Devisenbank“ 1947: Zulassung als „Außenhandelsbank“ 1979: Ausgründung der Degussa Bank GmbH als Universalbank aus der Degussa AG Depotführung für Mitarbeiter der M.M. Warburg & CO – Vermögensberatung 5 Dafür stehen wir: Nähe, Transparenz und Vertrauen! Nähe Kurze Wege, schnelle -

The Pfandbrief Roundtable 2019 in ASSOCIATION with the VDP

The Covered Bond Report www.coveredbondreport.com August 2019 The Pfandbrief Roundtable 2019 IN ASSOCIATION WITH THE VDP The Pfandbrief Roundtable 2019 The EU covered bond legislative package, sustainable finance developments, and a possible revival of APP were key topics in our annual Pfandbrief roundtable, produced in association with the vdp and hosted by pbb on 26 June, with leading players sharing their views ahead of the 250th anniversary of the Pfandbrief in August. Neil Day, The Covered Bond Report: are discussions about tightening the regu- Matthias Melms, NordLB: Indepen- What is it about the Pfandbrief that latory framework, it is important to ensure dently of the issuers and the assets that has resulted in it being such a long- that the Pfandbrief remains competitive are behind the Pfandbrief, when we talk lasting and successful product? versus other products. about 250 years of a success story we have to talk about the Pfandbrief law. A Jens Tolckmitt, Association of German Felix Rieger, Deutsche Bundesbank: foreign investor once told me: I want to Pfandbrief Banks (vdp): The stability I am here representing the Bundesbank as invest in Germany, in the German Pfand- and the high quality of the legal frame- an investor today — not for its role regard- brief, but I don’t care about the issuer, I work have been decisive in making the ing monetary policy — and in this respect, don’t care about the assets, I just want Pfandbrief such a long-lasting product. investing money on behalf of Federal gov- to have the Pfandbrief with the highest What is especially important today, is that ernment entities, the Bundesbank is a spread. -

The German Private Commercial Banks' Statutory Deposit Guarantee

The German private commercial banks’ statutory deposit guarantee and investor compensation scheme A brief guide and list of banks assigned to the scheme Berlin, October 2017 The German private commercial banks’ statutory deposit guarantee and investor compensation scheme A brief guide and list of banks assigned to the scheme Berlin, October 2017 * Please note: The present English translation is furnished for informa- tion purposes only. The original German text is binding in all respects. 4 Entschädigungseinrichtung Since the entry into force of the German Deposit Guarantee and Investor Compensation Act (Einlagensicherungs- und Anlegerentschädigungsgesetz [EAEG]) and, more recently, of the German Deposit Guarantee Act (Einlagensicherungsgesetz [EinSiG]), deposits and liabilities arising from securities transactions have been protected at the commercial banks operated in private legal form (the private commercial banks for short) by the Entschädigungseinrichtung deutscher Banken GmbH (EdB) Burgstraße 28 10178 Berlin www.edb-banken.de to the extent provided for by law. The legal basis for the private commercial banks’ deposit guarantee scheme was originally the Deposit Guarantee and Investor Compensation Act (Einlagensicherungs- und Anlegerentschädigungsgesetz [EAEG]). On 3 July 2015, the statutory deposit guarantee scheme was moved from this act to a separate Deposit Guarantee Act (Einlagensicherungsgesetz [EinSiG]), thereby transposing the provisions of the new European Deposit Guarantee Schemes Directive1 into German law. The aim of the Deposit Guarantee Schemes Directive is an even higher level of protection and maximum harmonisation of European deposit guarantee schemes. The Deposit Guarantee and Investor Compensation Act, which is now confined to dealing with investor compensation concerns, has been retained as the Investor Compensation Act (Anlegerentschädigungsgesetz [AnlEntG]). -

E.ON 2003 Annual Report

Financial Calendar 2003 Annual Report E.ON Group Financial Highlights in millions 2003 20021 +/– % Electricity sales volume (in billion kWh)2 387.6 333.6 +16 Gas sales volume (in billion kWh)2 803.7 721.3 +11 April 28, 2004 2004 Annual Shareholders Meeting Sales 46,364 36,624 +27 April 29, 2004 Dividend Payment EBITDA3 9,458 7,558 +25 EBIT3 6,228 4,649 +34 May 13, 2004 Interim Report: January–March 2004 Internal operating profit4 4,565 3,817 +20 Income/(loss) from continuing operations August 12, 2004 Interim Report: January–June 2004 before income taxes and minority interests 5,538 –759 – November 11, 2004 Interim Report: January–September 2004 Income/(loss) from continuing operations 3,950 –720 – Income/(loss) from discontinued operations 1,137 3,306 –66 March 10, 2005 Annual Press Conference, Net income 4,647 2,777 +67 Release of 2004 Annual Report Investments 9,196 24,159 –62 Cash provided by operating activities 5,538 3,614 +53 March 10, 2005 Annual Analysts Conference Stockholders’ equity 29,774 25,653 +16 Total assets 111,850 113,503 –1 April 27, 2005 2005 Annual Shareholders Meeting ROCE6 (in %) 9.9 9.2 +0.75 Cost of capital (in %) 9.5 9.5 – Return on equity after taxes7 (in %) 16.8 11.1 5.75 Employees at year end 66,549 101,336 –34 Earnings per share from (in ) on•top continuing operations 6.04 –1.10 – discontinued operations 1.74 5.07 –66 cumulative effect of changes in accounting principles, net –0.67 0.29 – net income 7.11 4.26 +67 2003 Annual Report Per share (in ) Dividend 2.00 1.75 +14 Stockholders’ equity8 45.39 39.33 +15 1Adjusted for discontinued operations (see commentary on pages 133–141). -

Where Does the Cash in Your Wallet Come From?

Where does the cash in your wallet come from? An empirical study of the cash withdrawal behaviour of the German population at ATMs and bank counters in Germany Deutsche Bundesbank 2010 Deutsche Bundesbank Wilhelm-Epstein-Strasse 14 60431 Frankfurt am Main Germany Postal address Postfach 10 06 02 60006 Frankfurt am Main Germany Tel +49 69 95 66-1 Fax +49 69 5 60 10 71 Internet http://www.bundesbank.de Authors Dr Heike Wörlen and Markus Altmann Completed: 31 October 2010 Reproduction permitted only if source is stated. - II - Contents 0 Management summary.................................................................................................1 1 Issues and study design ..............................................................................................3 2 Amount held for transaction purposes in Germany...................................................5 2.1 Frequency and amount of withdrawals................................................................... 5 2.2 Amount of cash remaining before next withdrawal ................................................. 8 2.3 Calculating the amount of cash held for transaction purposes in Germany ............ 8 3 Withdrawal behaviour in Germany ............................................................................13 3.1 Identification of user types ....................................................................................13 3.2 Categorising respondents by means of a cluster analysis .....................................15 3.3 Cluster solutions within the context -

Basisprospekt IHS 2020

Degussa Bank AG Frankfurt am Main, Deutschland Basisprospekt für Schuldverschreibungen vom 27. August 2020 Der Basisprospekt ist ab dem 28. August 2021 nicht mehr gültig. Eine Pflicht zur Erstellung eines Prospekt- nachtrags im Fall wichtiger neuer Umstände, wesentlicher Unrichtigkeiten oder wesentlicher Ungenauigkeiten besteht nicht, wenn der Prospekt ungültig ist. Inhaltsverzeichnis 2 Inhaltsverzeichnis I. Allgemeine Beschreibung des Angebotsprogramms ........................................................ 7 II. Risikofaktoren ........................................................................................................................ 9 1. Risikofaktoren hinsichtlich der Wertpapiere ......................................................................................... 9 1.1 Risiken, die sich aus der Verzinsungsstruktur und den Bedingungen der Schuldverschreibungen ergeben ................................................................................................... 9 1.2 Besondere Risiken bei nachrangingen Schuldverschreibungen, die sich aus der Nachrangigkeit und den Bedingungen der Schuldverschreibungen ergeben ............................. 11 1.3 Risiken, die sich aus dem Erwerb, dem Halten und der Veräußerung der Schuldverschreibungen ergeben ................................................................................................. 12 1.4 Spezielle Risiken im Zusammenhang mit einem Referenzzinssatz ............................................ 16 2. Risikofaktoren hinsichtlich der Emittentin ......................................................................................... -

From Cooperation to Complicity

From Cooperation to Complicity From Cooperation to Complicity is a study of the Degussa corporation, a firm that played a pivotal role in the processing of plundered precious metals in Nazi- occupied Europe and controlled the production and distribution of Zyklon B, the infamous pesticide used to gas the inmates of Auschwitz and Majdanek concentration camps, during the Third Reich. The author traces the extent of the corporation’s involvement in these and other Nazi war crimes, including the Aryanization of Jewish-owned property and the exploitation of forced labor, and delineates the motivations for such conduct. Peter Hayes is Professor of History and German and Theodore Z. Weiss Professor of Holocaust Studies at Northwestern University. He is the author of Industry and Ideology: IG Farben in the Nazi Era (new edition, Cambridge, 2001), which won the Conference Group on Central European History’s biannual book award in 1988. He is also editor of Lessons and Legacies: The Meaning of the Holocaust in a Changing World (1991) and four other collections. He has written more than fifty articles published in German French, and Italian, as well as English. In 1997–98, he was the Shapiro Senior Scholar in Residence at the U.S. Holocaust Memorial Museum. Advance praise for From Cooperation to Complicity ... “Bringing to bear a knowledge of business rare among historians, Peter Hayes has, on the basis of previously inaccessible company records, meticulously documented the moral corruption under Nazism of a ven- erable German firm whose executives allowed it to be drawn into ever- deeper implication in the crimes of Hitler’s regime.” – Henry Ashby Turner, Jr., Stille Professor of History Emeritus, Yale University “This outstanding study reaffirms Peter Hayes’ claim to be the world’s leading authority on business and the Third Reich. -

E.ON 2000 Annual Report

Financial Calendar Provisional 2000 Annual Report E.ON 2000 May 18, 2001 Interim Report: January–March 2001 E.ON Group financial highlights May 18, 2001 2001 Annual Shareholders’ Meeting in millions (pro forma)1 1999 2000 +/– % Sales 69,754 93,240 +34 May 21, 2001 Dividend Payment Income August 16, 2001 Interim Report: January–June 2001 Pretax income 5,048 6,802 +35 Net income 3,095 4,184 +35 November 15, 2001 Interim Report: January–September 2001 After minority interests 2,839 3,678 +30 Internal operating profit 2,748 2,762 +1 March 21, 2002 Annual Press Conference, Annual Analyst Conference Return on equity after taxes2 in percent 11.2 13.5 +2.33 May 28, 2002 Annual Shareholders’ Meeting Investments 11,045 14,961 +35 Cash flow from operations 4,866 3,889 –20 Stockholders’ equity 26,293 28,033 +7 Total assets 94,628 106,215 +12 Employees at year-end 203,733 186,788 –8 Per share in (pro forma) Earnings 3.90 5.07 +30 Cash dividend 1.25 1.35 +8 Dividend including tax credit 1.79 1.93 +8 Stockholders’ equity4 36.09 38.61 +7 Cash flow from operations 6.68 5.36 –20 1Pro-forma figures for 1999 and 2000 are shown in accordance with U.S. GAAP and depict the E.ON Group as if the VEBA-VIAG merger had been consummated as of January 1, 1999. 2Net income (excluding minority interests) ÷ annual average stockholders’ equity (excluding minority interests). 3Change in percentage points. 2000 Annual Report 4Excluding minority interests. -

Geschäftsbericht 2007 Umsatz in Millionen € 14.430 14.125 EBITDA Vor Sondereinflüssen in Millionen € 2.221 2.157

Der Erste. Bericht über das erste Geschäftsjahr mit der Marke Evonik. Auf einen Blick Kennzahlen Evonik-Konzern 2007 2006 Geschäftsbericht 2007 Umsatz in Millionen € 14.430 14.125 EBITDA vor Sondereinflüssen in Millionen € 2.221 2.157 EBITDA-Marge in % 15,4 15,3 EBIT vor Sondereinflüssen in Millionen € 1.348 1.179 ROCE (Verzinsung des eingesetzten Kapitals) in % 9,5 8,4 Konzernergebnis in Millionen € 876 1.046 Der Erste. Bilanzsumme in Millionen € 19.800 20.953 Eigenkapitalquote in % 25,7 20,6 Cashflow aus laufender Geschäftstätigkeit in Millionen € 1.215 1.142 Geschäftsbericht 2007 Geschäftsbericht Sachinvestitionen in Millionen € 1.032 935 Abschreibungen in Millionen € 862 943 Nettofinanzschulden in Millionen € 4.645 5.434 Der Der Erste. Mitarbeiter zum 31.12. 43.057 46.430 Eine klare Struktur Evonik Industries Chemie Energie Immobilien Geschäftsfelder Geschäftsbereiche Industrial Consumer Coatings & Energie Immobilien Chemicals Specialties Additives Inorganic Health & Performance Materials Nutrition Polymers Technology Consumer Specialty Energy Real Estate Berichtssegmente Evonik Industries AG Specialties Solutions Materials Rellinghauser Straße 1–11 45128 Essen www.evonik.de Der Erste. Bericht über das erste Geschäftsjahr mit der Marke Evonik. Auf einen Blick Kennzahlen Evonik-Konzern 2007 2006 Geschäftsbericht 2007 Umsatz in Millionen € 14.430 14.125 EBITDA vor Sondereinflüssen in Millionen € 2.221 2.157 EBITDA-Marge in % 15,4 15,3 EBIT vor Sondereinflüssen in Millionen € 1.348 1.179 ROCE (Verzinsung des eingesetzten Kapitals) in % 9,5 8,4 Konzernergebnis in Millionen € 876 1.046 Der Erste. Bilanzsumme in Millionen € 19.800 20.953 Eigenkapitalquote in % 25,7 20,6 Cashflow aus laufender Geschäftstätigkeit in Millionen € 1.215 1.142 Geschäftsbericht 2007 Geschäftsbericht Sachinvestitionen in Millionen € 1.032 935 Abschreibungen in Millionen € 862 943 Nettofinanzschulden in Millionen € 4.645 5.434 Der Der Erste. -

List of Correspondent Banks Europe

LIST OF CORRESPONDENT BANKS EUROPE GERMANY 1 ABC International Bank, Plc, Frankfurt ABCA DE FF 2 ABN Amro Bank, Frankfurt ABNA DE FF 3 Bank of Tokyo Mitsubishi UFJ, Ltd., Dusseldorf BOTK DE DX 4 Barclays Bank Plc, Frankfurt BARC DE FF 5 Bayerische Hypo-Und Vereinsbank AG - Hypovereinsbank, Muenchen HYVE DE MM 6 Bayerische Landesbank, Muenchen BYLA DE MM 7 Berliner Bank and Co. KG, Berlin BEBE DE BB 8 BHF Bank Aktiengesellschaft, Frankfurt BHFB DE FF 9 Bremer Landesbank, Bremen BRLA DE 22 10 Citigroup Global Markets Deutschland, Frankfurt CITI DE FF 11 Commerzbank AG, Frankfurt AM Main DRES DE FF / (acquired Dresdner Bank AG – effective January 12, 2009) COBA DE FF 12 Degussa Bank, Frankfurt DEGU DE FF 13 Deutsche Bank AG, Frankfurt DEUT DE FF Branches Essen DEUT DE DE Freiburg IM Breisgau DEUT DE 6F Berlin DEUT DE BB Bielefeld DEUT DE 3B Bremen DEUT DE HB Chemnitz DEUT DE 8C Dusseldorf DEUT DE DD Erfurt DEUT DE 8E Hamburg DEUT DE HH Hannover DEUT DE 2H Koeln DEUT DE DK Leipzig DEUT DE 8L Mainz DEUT DE 5M Mannheim DEUT DE SM Muenchen DEUT DE MM Rostock DEUT DE BR Stuttgart DEUT DE SS Wuppertal DEUT DE DW 14 Deutsche Bank Privat-Und Geschaeftskuden AG, Frankfurt AM Main DEUT DE DB 15 DZ Bank AG (Deutsche Zentral Genossenschaftsbank), Frankfurt GENO DE 55 Branches Karlsruhe GENO DE 6K Frankfurt GENO DE FF Stuttgart GENO DE SG 16 Hamburger Sparkasse AG, Hamburg HASP DE HH 17 HSBC Trinkhaus und Burkhardt AG, Duesseldorf TUBD DE DD Branch Hamburg TUBD DE HH 18 HSH Nordbank AG, Hamburg HSHN DE HH 19 J.