2008 Annual Report Air Transport Services Group 2008 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Abx Air Reaches Tentative Agreement with Pilot Union

Employee Portal Corporate Store ATSG ABX AIR REACHES TENTATIVE AGREEMENT WITH PILOT UNION WILMINGTON, Ohio--(BUSINESS WIRE)--Air Transport Services Group, Inc. (ATSG) said today that its ABX Air subsidiary has reached a tentative agreement to amend the collective bargaining agreement with its pilot group, currently numbering more than 230 flight crew members. ABX Air’s pilots are represented by the Airline Professionals Association of the International Brotherhood of Teamsters, Local 1224 (IBT). The tentative agreement would extend for six (6) years from the date of ratification by the ABX Air pilots. “We are optimistic that this tentative agreement, if ratified, will give ABX Air the opportunity to compete for new growth and provide all our employees with opportunities for career advancement and financial stability,” said ABX Air president David Soaper, “while ensuring that ABX Air continues to provide the excellent service its customers expect.” Terms of the tentative agreement were not disclosed but will be presented to the ABX Air pilot group prior to holding a ratification vote. The vote is expected to be completed prior to the end of the year. About Air Transport Services Group, Inc. (ATSG) ATSG is a leading provider of aircraft leasing and air cargo transportation and related services to domestic and foreign air carriers and other companies that outsource their air cargo lift requirements. ATSG, through its leasing and airline subsidiaries, is the world's largest owner and operator of converted Boeing 767 freighter aircraft. Through its principal subsidiaries, including three airlines with separate and distinct U.S. FAA Part 121 Air Carrier certificates, ATSG provides aircraft leasing, air cargo lift, passenger ACMI and charter services, aircraft maintenance services and airport ground services. -

December, 2005

CoverINT 11/21/05 3:05 PM Page 1 WWW.AIRCARGOWORLD.COM DECEMBER 2005 INTERNATIONAL EDITION Cargo’s New Directions the 2005-2006 Review & Outlook Saving Fuel • Latin America • Buying BAX 01TOCINT 11/21/05 11:56 AM Page 1 INTERNATIONAL EDITION December 2005 CONTENTS Volume 8, Number 10 REGIONS Review & 10 North America Outlook Air cargo traffic fell back Cargo carriers are looking at 2220 to earth in 2005 after 2004’s creative ways to reduce sky high strong growth. What’s on fuel costs • Delta Crisis tap for 2006? 12 Europe An integrated Air France/ KLM aims to be the word’s lead- ing international cargo airline 16 Pacific Asian carriers are fretting over a peak season that may be too little, too late Buying 20 Latin America Anti-trade sentiments and BAX restrictive regulations cool air 4 Deutsche Bahn’s pur- cargo growth in the region chase of the U.S. logistics operator adds to the speedy consolidation of global freight transport. 2006 DEPARTMENTS Corporate 2 Edit Note 29 Oulook 4 News Updates Special Advertising Sec- 35 Events tion provides companies’ pro- jections on the year ahead. 36 People 38 Bottom Line 40 Commentary WWW.aircargoworld.com Air Cargo World (ISSN 0745-5100) is published monthly by Commonwealth Business Media. Editorial and production offices are at 1270 National Press Building, Washington, DC, 20045. Telephone: (202) 355-1172. Air Cargo World is a registered trademark of Commonwealth Business Media. ©2005. Periodicals postage paid at Newark, NJ and at additional mailing offices. Subscription rates: 1 year, $58; 2 year $92; outside USA surface mail/1 year $78; 2 year $132; outside US air mail/1 year $118; 2 year $212. -

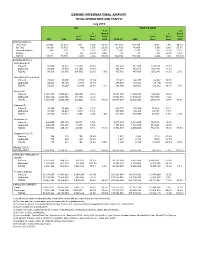

Automated Flight Statistics Report For

DENVER INTERNATIONAL AIRPORT TOTAL OPERATIONS AND TRAFFIC March 2014 March YEAR TO DATE % of % of % Grand % Grand Incr./ Incr./ Total Incr./ Incr./ Total 2014 2013 Decr. Decr. 2014 2014 2013 Decr. Decr. 2014 OPERATIONS (1) Air Carrier 36,129 35,883 246 0.7% 74.2% 99,808 101,345 (1,537) -1.5% 73.5% Air Taxi 12,187 13,754 (1,567) -11.4% 25.0% 34,884 38,400 (3,516) -9.2% 25.7% General Aviation 340 318 22 6.9% 0.7% 997 993 4 0.4% 0.7% Military 15 1 14 1400.0% 0.0% 18 23 (5) -21.7% 0.0% TOTAL 48,671 49,956 (1,285) -2.6% 100.0% 135,707 140,761 (5,054) -3.6% 100.0% PASSENGERS (2) International (3) Inbound 68,615 58,114 10,501 18.1% 176,572 144,140 32,432 22.5% Outbound 70,381 56,433 13,948 24.7% 174,705 137,789 36,916 26.8% TOTAL 138,996 114,547 24,449 21.3% 3.1% 351,277 281,929 69,348 24.6% 2.8% International/Pre-cleared Inbound 42,848 36,668 6,180 16.9% 121,892 102,711 19,181 18.7% Outbound 48,016 39,505 8,511 21.5% 132,548 108,136 24,412 22.6% TOTAL 90,864 76,173 14,691 19.3% 2.0% 254,440 210,847 43,593 20.7% 2.1% Majors (4) Inbound 1,698,200 1,685,003 13,197 0.8% 4,675,948 4,662,021 13,927 0.3% Outbound 1,743,844 1,713,061 30,783 1.8% 4,724,572 4,700,122 24,450 0.5% TOTAL 3,442,044 3,398,064 43,980 1.3% 75.7% 9,400,520 9,362,143 38,377 0.4% 75.9% National (5) Inbound 50,888 52,095 (1,207) -2.3% 139,237 127,899 11,338 8.9% Outbound 52,409 52,888 (479) -0.9% 139,959 127,940 12,019 9.4% TOTAL 103,297 104,983 (1,686) -1.6% 2.3% 279,196 255,839 23,357 9.1% 2.3% Regionals (6) Inbound 382,759 380,328 2,431 0.6% 1,046,306 1,028,865 17,441 1.7% Outbound -

Pilots Jump to Each Section Below Contents by Clicking on the Title Or Photo

November 2018 Aero Crew News Your Source for Pilot Hiring and More... ExpressJet is taking off with a new Pilot Contract Top-Tier Compensation and Work Rules $40/hour first-year pay $10,000 annual override for First Officers, $8,000 for Captains New-hire bonus 100% cancellation and deadhead pay $1.95/hour per-diem Generous 401(k) match Friendly commuter and reserve programs ARE YOU READY FOR EXPRESSJET? FLEET DOMICILES UNITED CPP 126 - Embraer ERJ145 Chicago • Cleveland Spend your ExpressJet career 20 - Bombardier CRJ200 Houston • Knoxville knowing United is in Newark your future with the United Pilot Career Path Program Apply today at expressjet.com/apply. Questions? [email protected] expressjet.com /ExpressJetPilotRecruiting @expressjetpilots Jump to each section Below contents by clicking on the title or photo. November 2018 20 36 24 50 32 Also Featuring: Letter from the Publisher 8 Aviator Bulletins 10 Self Defense for Flight Crews 16 Trans States Airlines 42 4 | Aero Crew News BACK TO CONTENTS the grid New Airline Updated Flight Attendant Legacy Regional Alaska Airlines Air Wisconsin The Mainline Grid 56 American Airlines Cape Air Delta Air Lines Compass Airlines Legacy, Major, Cargo & International Airlines Hawaiian Airlines Corvus Airways United Airlines CommutAir General Information Endeavor Air Work Rules Envoy Additional Compensation Details Major ExpressJet Airlines Allegiant Air GoJet Airlines Airline Base Map Frontier Airlines Horizon Air JetBlue Airways Island Air Southwest Airlines Mesa Airlines Spirit Airlines -

World Airline Cargo Report Currency and Fuel Swings Shift Dynamics

World Airline Cargo Report Currency and fuel swings shift dynamics Changing facilities Asia’s handlers adapt LCCs and cargo Handling rapid turnarounds Cool chain Security technology Maintaining pharma integrity Progress and harmonisation 635,1*WWW.CAASINT.COM www.airbridgecargo.com On Time Performance. Delivered 10 YEARS EXPERIENCE ON GLOBAL AIR CARGO MARKET Feeder and trucking delivery solutions within Russia High on-time performance Online Track&Trace System Internationally recognized Russian cargo market expert High-skilled staff in handling outsize and heavy cargo Modern fleet of new Boeing 747-8 Freighters Direct services to Russia from South East Asia, Europe, and USA Direct services to Russian Far East (KHV), Ural (SVX), and Siberian region (OVB, KJA) AirBridgeCargo Airlines is a member of IATA, IOSA Cool Chain Association, Cargo 2000 and TAPA Russia +7 495 7862613 USA +1 773 800 2361 Germany +49 6963 8097 100 China +86 21 52080011 IOSA Operator The Netherlands +31 20 654 9030 Japan +81 3 5777 4025 World Airline PARVEEN RAJA Cargo Report Currency and fuel swings shift dynamics Publisher Changing facilities [email protected] Asia’s handlers adapt LCCs and cargo Handling rapid turnarounds Cool chain Security technology Maintaining pharma integrity Progress and harmonisation 635,1*WWW.CAASINT.COM SIMON LANGSTON PROMISING SIGNS Business Development Manager here are some apparently very positive trends highlighted [email protected] and discussed in this issue of CAAS, which is refreshing for a sector that often goes round in -

November 2017 Newsletter

PilotsPROUDLY For C ELEBRATINGKids Organization 34 YEARS! Pilots For KidsSM ORGANIZATION Helping Hospitalized Children Since 1983 Want to join in this year’s holiday visits? Newsletter November 2017 See pages 8-9 to contact the coordinator in your area! PFK volunteers have been visiting youngsters at Texas Children’s Hospital for 23 years. Thirteen volunteers representing United, Delta and Jet Blue joined together and had another very successful visit on June 13th. Sign up for holiday visits in your area by contacting your coordinator! “100% of our donations go to the kids” visit us at: pilotsforkids.org (2) Pilots For Kids Organization CITY: LAX/Los Angeles, CA President’s Corner... COORDINATOR: Vasco Rodriques PARTICIPANTS: Alaska Airlines Dear Members, The volunteers from the LAX Alaska Airlines Pilots Progress is a word everyone likes. The definition for Kids Chapter visited with 400 kids at the Miller of progress can be described as growth, develop- Children’s Hospital in Long Beach. This was during ment, or some form of improvement. their 2-day “Beach Carnival Day”. During the last year we experienced continual growth in membership and also added more loca- The crews made and flew paper airplanes with the tions where our visits take place. Another sign kids. When the kids landed their creations on “Run- of our growth has been our need to add a second way 25L”, they got rewarded with some cool wings! “Captain Baldy” mascot due to his popularity. Along with growth comes workload. To solve this challenge we have continually looked for ways to reduce our workload and cost through increased automation. -

Automated Flight Statistics Report For

DENVER INTERNATIONAL AIRPORT TOTAL OPERATIONS AND TRAFFIC July 2010 July YEAR TO DATE % of % of % Grand % Grand Incr./ Incr./ Total Incr./ Incr./ Total 2010 2009 Decr. Decr. 2010 2010 (9) 2009 Decr. Decr. 2010 OPERATIONS (1) Air Carrier 42,054 41,412 642 1.6% 73.7% 271,866 269,130 2,736 1.0% 74.1% Air Taxi 14,569 13,761 808 5.9% 25.5% 92,769 86,804 5,965 6.9% 25.3% General Aviation 400 393 7 1.8% 0.7% 2,073 2,079 (6) -0.3% 0.6% Military 8 12 (4) -33.3% 0.0% 82 91 (9) -9.9% 0.0% TOTAL 57,031 55,578 1,453 2.6% 100.0% 366,790 358,104 8,686 2.4% 100.0% PASSENGERS (2) International (3) Inbound 50,854 62,421 (11,567) -18.5% 376,293 421,396 (45,103) -10.7% Outbound 47,469 60,635 (13,166) -21.7% 374,289 426,424 (52,135) -12.2% TOTAL 98,323 123,056 (24,733) -20.1% 1.9% 750,582 847,820 (97,238) -11.5% 2.5% International/Pre-cleared Inbound 37,682 30,097 7,585 25.2% 232,432 166,370 66,062 39.7% Outbound 34,523 29,170 5,353 18.4% 230,434 163,254 67,180 41.2% TOTAL 72,205 59,267 12,938 21.8% 1.4% 462,866 329,624 133,242 40.4% 1.5% Majors (4) Inbound 1,963,129 2,003,643 (40,514) -2.0% 11,491,709 11,586,595 (94,886) -0.8% Outbound 1,960,236 2,004,666 (44,430) -2.2% 11,526,782 11,639,633 (112,851) -1.0% TOTAL 3,923,365 4,008,309 (84,944) -2.1% 77.5% 23,018,491 23,226,228 (207,737) -0.9% 76.6% National (5) Inbound 38,190 36,695 1,495 4.1% 212,141 193,469 18,672 9.7% Outbound 38,140 36,227 1,913 5.3% 209,256 194,340 14,916 7.7% TOTAL 76,330 72,922 3,408 4.7% 1.5% 421,397 387,809 33,588 8.7% 1.5% Regionals (6) Inbound 443,456 420,139 23,317 5.5% 2,677,209 -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

PORTLAND INTERNATIONAL AIRPORT (PDX) Monthly Traffic Report January, 2012

PORTLAND INTERNATIONAL AIRPORT (PDX) Monthly Traffic Report January, 2012 This Month Calendar Year to Date 2012 2011 %Chg 2012 2011 %Chg Total PDX Flight Operations * 15,907 17,573 -9.5% 15,907 17,573 -9.5% Military 295 255 15.7% 295 255 15.7% General Aviation 1,372 1,408 -2.6% 1,372 1,408 -2.6% Hillsboro Airport Operations 12,834 11,335 13.2% 12,834 11,335 13.2% Troutdale Airport Operations 4,813 3,455 39.3% 4,813 3,455 39.3% Total System Operations 33,554 32,363 3.7% 33,554 32,363 3.7% PDX Commercial Flight Operations ** 13,642 15,144 -9.9% 13,642 15,144 -9.9% Cargo 1,698 2,042 -16.8% 1,698 2,042 -16.8% Charter 4 14 -71.4% 4 14 -71.4% Major 5,738 5,912 -2.9% 5,738 5,912 -2.9% National 440 362 21.5% 440 362 21.5% Regional 5,762 6,814 -15.4% 5,762 6,814 -15.4% Domestic 13,188 14,660 -10.0% 13,188 14,660 -10.0% International 454 484 -6.2% 454 484 -6.2% Total Enplaned & Deplaned Passengers 974,082 964,699 1.0% 974,082 964,699 1.0% Charter 301 1,059 -71.6% 301 1,059 -71.6% Major 653,855 626,343 4.4% 653,855 626,343 4.4% National 61,882 54,568 13.4% 61,882 54,568 13.4% Regional 258,044 282,729 -8.7% 258,044 282,729 -8.7% Total Enplaned Passengers 484,783 485,192 -0.1% 484,783 485,192 -0.1% Total Deplaned Passengers 489,299 479,507 2.0% 489,299 479,507 2.0% Total Domestic Passengers 947,137 935,041 1.3% 947,137 935,041 1.3% Total Enplaned Passengers 471,806 470,957 0.2% 471,806 470,957 0.2% Total Deplaned Passengers 475,331 464,084 2.4% 475,331 464,084 2.4% Total International Passengers 26,945 29,658 -9.1% 26,945 29,658 -9.1% Total Enplaned -

Student Investment Fund

STUDENT INVESTMENT FUND 2007-2008 ANNUAL REPORT May 9, 2008 http://org.business.utah.edu/investmentfund TABLE OF CONTENTS 2007-2008 STUDENT MANAGERS........................................................................................... 3 HISTORY ...................................................................................................................................... 4 STRATEGY................................................................................................................................... 5 Davidson & Milner Portfolios .................................................................................................... 5 School Portfolio .......................................................................................................................... 6 DAVIDSON AND MILNER PERFORMANCE........................................................................ 6 Overall ........................................................................................................................................ 6 Individual Stock Performance..................................................................................................... 7 SCHOOL PERFORMANCE....................................................................................................... 9 Overall ........................................................................................................................................ 9 Individual Stock Performance.................................................................................................... -

NACC Contact List July 2015 Update

ID POC Name POC Email Office Cell Filer Other Comments ABS Jets (Czech Republic) ABS Michal Pazourek (Chf Disp) [email protected] +420 220 111 388 + 420 602 205 (LKPRABPX & LKPRABY) [email protected] 852 ABX Air ABX Alain Terzakis [email protected] 937-366-2464 937-655-0703 (800) 736-3973 x62450 KILNABXD Ron Spanbauer [email protected] 937-366-2435 (937) 366-2450 24hr. AeroMexico AMX Raul Aguirre (FPF) [email protected] 011 (5255) 9132-5500 (281) 233-3406 Files thru HP/EDS Air Berlin BER Recep Bayindir [email protected] 49-30-3434-3705 EDDTBERA [email protected] AirBridgeCargo Airlines ABW Dmitry Levushkin [email protected] Chief Flight Dispatcher 7 8422 590370 Also see Volga-Dnepr Airlines Volga-Dnepr Airlines 7 8422 590067 (VDA) Air Canada ACA Richard Steele (Mgr Flt Supt) [email protected] 905 861 7572 647 328-3895 905 861 7528 CYYZACAW thru LIDO Rod Stone [email protected] 905 861 7570 Air China CCA Weston Li (Mgr. American Ops) [email protected] 604-233-1682 778-883-3315 Zhang Yuenian [email protected] Air Europa AEA Bernardo Salleras [email protected] Flight Ops [email protected] 34 971 178 281 (Ops Mgr) Air France AFR Thierry Vuillaume Thierry Vuillaume <[email protected]> +33 (0)1 41 56 78 65 LFPGAFRN Air India AIC Puneet Kataria [email protected] 718-632-0125 917-9811807 + 91-22-66858028 KJFKAICO [email protected] 718-632-0162direct Use SABRE for flights Files thru HP/EDS arriving/departing USA Air New Zealand -

Wisconsin-Madison and Texas A&M Transportation Institute

Air Cargo in the Mid-America Freight Coalition Region Teresa M. Adams, Ph.D. Scott Janowiak, Jason Bittner, Benjamin R. Sperry, Jeffery E. Warner, Jeffrey D. Borowiec, Ph.D. University of Wisconsin-Madison and Texas A&M Transportation Institute WisDOT ID no. 0092-11-09 CFIRE ID no. 04-11 August 2012 Research & Library Unit National Center for Freight & Infrastructure Research & Education University of Wisconsin-Madison WISCONSIN DOT PUTTING RESEARCH TO WORK Air Cargo in the Mid-America Freight Coalition Region CFIRE 04-11 CFIRE August 2012 National Center for Freight & Infrastructure Research & Education Department of Civil and Environmental Engineering College of Engineering University of Wisconsin–Madison Authors: Teresa M. Adams, Scott Janowiak, Jason Bittner University of Wisconsin–Madison Benjamin R. Sperry, Jeffery E. Warner, Jeffrey D. Borowiec Texas A&M Transportation Institute Principal Investigator: Teresa M. Adams National Center for Freight & Infrastructure Research & Education University of Wisconsin–Madison 2 Technical Report Documentation 1. Report No. CFIRE 04-11 2. Government Accession No. 3. Recipient’s Catalog No. CFDA 20.701 4. Title and Subtitle 5. Report Date August 2012 Air Cargo in the Mid-America Freight Coalition Region 6. Performing Organization Code 7. Author/s 8. Performing Organization Report No. Scott Janowiak, Teresa M. Adams, and Jason Bittner, CFIRE, University of CFIRE 04-11 Wisconsin–Madison Benjamin R. Sperry, Jeffery E. Warner, and Jeffrey D. Borowiec. Texas A&M Transportation Institute 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) National Center for Freight and Infrastructure Research and Education (CFIRE) University of Wisconsin-Madison 11. Contract or Grant No.