Confidential Garvinm@Stlouis-Mo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Air Travel Consumer Report Is a Monthly Product of the Department of Transportation's Office of Aviation Enforcement and Proceedings

U.S. Department of Transportation Air Travel Consumer Report Issued: MARCH 2002 Includes data for the following periods: Flight Delays January 2002 12 Months Ending January 2002 Mishandled Baggage January 2002 Oversales 4th Quarter 2001 January-December 2001 Consumer Complaints January 2002 (Includes Disability Complaints) Office of Aviation Enforcement and Proceedings http://www.dot.gov/airconsumer/ TABLE OF CONTENTS Section Page Section Page INTRODUCTION ......................…2 Flight Delays Explanation ......................…3 Mishandled Baggage Table 1 ......................…4 Explanation ....................…..17 Overall Percentage of Reported Flight Ranking ....................…..18 Operations Arriving On Time, by Carrier Table 1A ......................…5 Oversales Overall Percentage of Reported Flight Explanation ....................…..19 Operations Arriving On Time and Carrier Rank, by Month, Quarter, and Data Base to Date Ranking--Quarter ....................…..20 Table 2 ......................…6 Ranking--YTD ....................…..21 Number of Reported Flight Arrivals and Per- centage Arriving On Time, by Carrier and Airport Consumer Complaints Table 3 ......................…8 Explanation ....................…..22 Percentage of All Carriers' Reported Flight Complaint Tables 1-5 ..............23 Operations Arriving On Time, by Airport and Summary, Complaint Categories, U.S. Airlines, Time of Day Incident Date, and Companies Other Than Table 4 .....................…9 U.S. Airlines Percentage of All Carriers' Reported Flight Rankings, -

ESTIMATING AIRLINE OPERATING COSTS Dal V. Maddalon NASA

-----------------_._---_.- ... _..... _... _.. _ ..... _- ...... - ...... -- ..... __ ... _- ESTIMATING AIRLINE OPERATING COSTS Dal V. Maddalon NASA Langley Research Center SUMMARY A review has been made of the factors affecting commercial aircraft operating and delay costs. From this work, an airline operating cost model was developed which includes a method for estimating the labor and material costs of individual airframe maintenance systems. The model, similar in some respects to the standard Air Transport Association of America (ATA) Direct Operating Cost model, permits estimates of aircraft-related costs not now included in the standard ATA model (e.g., aircraft service, landing fees, flight attendants, and control fees). A study of the cost of aircraft delay was also made and a method for estimating the cost of certain types of airline delay is described. All costs are in 1976 dollars. INTRODUCTION In 1976, Americans spent over $17 billion to obtain air transportation services (ref. 1). Of this amount, the airlines used roughly $8 billion to purchase and operate their aircraft fleet. The introduction of aircraft which incorporate new technology to reduce these costs is fundamental to the long term health of the U.S. civil aviation industry. The National Aeronautics and Space Administration (NASA) has the primary governmental role in developing new civil aircraft technology and is therefore concerned with the cost of applying this technology to future airline fleets. Examples of such NASA work include studies of supercritical aerodynamics, composite materials, active controls, terminal configured vehicles, very large cargo transports, supersonic airplanes, and hydrogen-fueled aircraft. A prime means of determining the payoff from specific examples of innova tive research is to incorporate the technological ~dvance into a specific airplane configuration study and economically compete the advanced design against a conventional aircraft (e.g., ref. -

1 SECURITIES and EXCHANGE COMMISSION Washington, D. C

1 SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 _____________ FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of earliest event reported: April 9, 2001 American Airlines, Inc. (Exact name of registrant as specified in its charter) Delaware 1-2691 13-1502798 (State of Incorporation) ( Commission File Number) (IRS Employer Identification No.) 4333 Amon Carter Blvd. Fort Worth, Texas 76155 (Address of principal executive offices) (Zip Code) (817) 963-1234 (Registrant's telephone number) 2 Item 5. Other Events American Airlines, Inc. ("American", a wholly owned subsidiary of AMR Corporation) is filing herewith a press release issued on April 9, 2001 as Exhibit 99.1 which is included herein. This press release was issued to announce the completion of American's acquisition of Trans World Airways, Inc. Item 7. Financial Statements and Exhibits The following exhibit is included herein: 99.1 Press Release 3 SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. American Airlines, Inc. /s/ Charles D. MarLett Charles D. MarLett Corporate Secretary Dated: April 10, 2001 4 EXHIBIT INDEX Exhibit Description 99.1 Press Release 5 Exhibit 99.1 Contact: Corporate Communications Fort Worth, Texas 817-967-1577 FOR RELEASE: Monday, April 9, 2001 AMERICAN AIRLINES COMPLETES ACQUISITION OF TRANS WORLD AIRLINES Combination Will Offer Greater Service to Customers And Create New Job Opportunities Business as Usual During Transition for TWA Employees, Passengers and Ticketholders FORT WORTH, Texas - A new era in aviation history began today as American Airlines successfully completed its acquisition of most of the assets of Trans World Airlines, Inc. -

December, 2005

CoverINT 11/21/05 3:05 PM Page 1 WWW.AIRCARGOWORLD.COM DECEMBER 2005 INTERNATIONAL EDITION Cargo’s New Directions the 2005-2006 Review & Outlook Saving Fuel • Latin America • Buying BAX 01TOCINT 11/21/05 11:56 AM Page 1 INTERNATIONAL EDITION December 2005 CONTENTS Volume 8, Number 10 REGIONS Review & 10 North America Outlook Air cargo traffic fell back Cargo carriers are looking at 2220 to earth in 2005 after 2004’s creative ways to reduce sky high strong growth. What’s on fuel costs • Delta Crisis tap for 2006? 12 Europe An integrated Air France/ KLM aims to be the word’s lead- ing international cargo airline 16 Pacific Asian carriers are fretting over a peak season that may be too little, too late Buying 20 Latin America Anti-trade sentiments and BAX restrictive regulations cool air 4 Deutsche Bahn’s pur- cargo growth in the region chase of the U.S. logistics operator adds to the speedy consolidation of global freight transport. 2006 DEPARTMENTS Corporate 2 Edit Note 29 Oulook 4 News Updates Special Advertising Sec- 35 Events tion provides companies’ pro- jections on the year ahead. 36 People 38 Bottom Line 40 Commentary WWW.aircargoworld.com Air Cargo World (ISSN 0745-5100) is published monthly by Commonwealth Business Media. Editorial and production offices are at 1270 National Press Building, Washington, DC, 20045. Telephone: (202) 355-1172. Air Cargo World is a registered trademark of Commonwealth Business Media. ©2005. Periodicals postage paid at Newark, NJ and at additional mailing offices. Subscription rates: 1 year, $58; 2 year $92; outside USA surface mail/1 year $78; 2 year $132; outside US air mail/1 year $118; 2 year $212. -

Bankruptcy Tilts Playing Field Frank Boroch, CFA 212 272-6335 [email protected]

Equity Research Airlines / Rated: Market Underweight September 15, 2005 Research Analyst(s): David Strine 212 272-7869 [email protected] Bankruptcy tilts playing field Frank Boroch, CFA 212 272-6335 [email protected] Key Points *** TWIN BANKRUPTCY FILINGS TILT PLAYING FIELD. NWAC and DAL filed for Chapter 11 protection yesterday, becoming the 20 and 21st airlines to do so since 2000. Now with 47% of industry capacity in bankruptcy, the playing field looks set to become even more lopsided pressuring non-bankrupt legacies to lower costs further and low cost carriers to reassess their shrinking CASM advantage. *** CAPACITY PULLBACK. Over the past 20 years, bankrupt carriers decreased capacity by 5-10% on avg in the year following their filing. If we assume DAL and NWAC shrink by 7.5% (the midpoint) in '06, our domestic industry ASM forecast goes from +2% y/y to flat, which could potentially be favorable for airline pricing (yields). *** NWAC AND DAL INTIMATE CAPACITY RESTRAINT. After their filing yesterday, NWAC's CEO indicated 4Q:05 capacity could decline 5-6% y/y, while Delta announced plans to accelerate its fleet simplification plan, removing four aircraft types by the end of 2006. *** BIGGEST BENEFICIARIES LIKELY TO BE LOW COST CARRIERS. NWAC and DAL account for roughly 26% of domestic capacity, which, if trimmed by 7.5% equates to a 2% pt reduction in industry capacity. We believe LCC-heavy routes are likely to see a disproportionate benefit from potential reductions at DAL and NWAC, with AAI, AWA, and JBLU in particular having an easier path for growth. -

World Airline Cargo Report Currency and Fuel Swings Shift Dynamics

World Airline Cargo Report Currency and fuel swings shift dynamics Changing facilities Asia’s handlers adapt LCCs and cargo Handling rapid turnarounds Cool chain Security technology Maintaining pharma integrity Progress and harmonisation 635,1*WWW.CAASINT.COM www.airbridgecargo.com On Time Performance. Delivered 10 YEARS EXPERIENCE ON GLOBAL AIR CARGO MARKET Feeder and trucking delivery solutions within Russia High on-time performance Online Track&Trace System Internationally recognized Russian cargo market expert High-skilled staff in handling outsize and heavy cargo Modern fleet of new Boeing 747-8 Freighters Direct services to Russia from South East Asia, Europe, and USA Direct services to Russian Far East (KHV), Ural (SVX), and Siberian region (OVB, KJA) AirBridgeCargo Airlines is a member of IATA, IOSA Cool Chain Association, Cargo 2000 and TAPA Russia +7 495 7862613 USA +1 773 800 2361 Germany +49 6963 8097 100 China +86 21 52080011 IOSA Operator The Netherlands +31 20 654 9030 Japan +81 3 5777 4025 World Airline PARVEEN RAJA Cargo Report Currency and fuel swings shift dynamics Publisher Changing facilities [email protected] Asia’s handlers adapt LCCs and cargo Handling rapid turnarounds Cool chain Security technology Maintaining pharma integrity Progress and harmonisation 635,1*WWW.CAASINT.COM SIMON LANGSTON PROMISING SIGNS Business Development Manager here are some apparently very positive trends highlighted [email protected] and discussed in this issue of CAAS, which is refreshing for a sector that often goes round in -

Automated Flight Statistics Report For

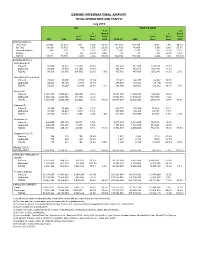

DENVER INTERNATIONAL AIRPORT TOTAL OPERATIONS AND TRAFFIC July 2010 July YEAR TO DATE % of % of % Grand % Grand Incr./ Incr./ Total Incr./ Incr./ Total 2010 2009 Decr. Decr. 2010 2010 (9) 2009 Decr. Decr. 2010 OPERATIONS (1) Air Carrier 42,054 41,412 642 1.6% 73.7% 271,866 269,130 2,736 1.0% 74.1% Air Taxi 14,569 13,761 808 5.9% 25.5% 92,769 86,804 5,965 6.9% 25.3% General Aviation 400 393 7 1.8% 0.7% 2,073 2,079 (6) -0.3% 0.6% Military 8 12 (4) -33.3% 0.0% 82 91 (9) -9.9% 0.0% TOTAL 57,031 55,578 1,453 2.6% 100.0% 366,790 358,104 8,686 2.4% 100.0% PASSENGERS (2) International (3) Inbound 50,854 62,421 (11,567) -18.5% 376,293 421,396 (45,103) -10.7% Outbound 47,469 60,635 (13,166) -21.7% 374,289 426,424 (52,135) -12.2% TOTAL 98,323 123,056 (24,733) -20.1% 1.9% 750,582 847,820 (97,238) -11.5% 2.5% International/Pre-cleared Inbound 37,682 30,097 7,585 25.2% 232,432 166,370 66,062 39.7% Outbound 34,523 29,170 5,353 18.4% 230,434 163,254 67,180 41.2% TOTAL 72,205 59,267 12,938 21.8% 1.4% 462,866 329,624 133,242 40.4% 1.5% Majors (4) Inbound 1,963,129 2,003,643 (40,514) -2.0% 11,491,709 11,586,595 (94,886) -0.8% Outbound 1,960,236 2,004,666 (44,430) -2.2% 11,526,782 11,639,633 (112,851) -1.0% TOTAL 3,923,365 4,008,309 (84,944) -2.1% 77.5% 23,018,491 23,226,228 (207,737) -0.9% 76.6% National (5) Inbound 38,190 36,695 1,495 4.1% 212,141 193,469 18,672 9.7% Outbound 38,140 36,227 1,913 5.3% 209,256 194,340 14,916 7.7% TOTAL 76,330 72,922 3,408 4.7% 1.5% 421,397 387,809 33,588 8.7% 1.5% Regionals (6) Inbound 443,456 420,139 23,317 5.5% 2,677,209 -

PORTLAND INTERNATIONAL AIRPORT (PDX) Monthly Traffic Report January, 2012

PORTLAND INTERNATIONAL AIRPORT (PDX) Monthly Traffic Report January, 2012 This Month Calendar Year to Date 2012 2011 %Chg 2012 2011 %Chg Total PDX Flight Operations * 15,907 17,573 -9.5% 15,907 17,573 -9.5% Military 295 255 15.7% 295 255 15.7% General Aviation 1,372 1,408 -2.6% 1,372 1,408 -2.6% Hillsboro Airport Operations 12,834 11,335 13.2% 12,834 11,335 13.2% Troutdale Airport Operations 4,813 3,455 39.3% 4,813 3,455 39.3% Total System Operations 33,554 32,363 3.7% 33,554 32,363 3.7% PDX Commercial Flight Operations ** 13,642 15,144 -9.9% 13,642 15,144 -9.9% Cargo 1,698 2,042 -16.8% 1,698 2,042 -16.8% Charter 4 14 -71.4% 4 14 -71.4% Major 5,738 5,912 -2.9% 5,738 5,912 -2.9% National 440 362 21.5% 440 362 21.5% Regional 5,762 6,814 -15.4% 5,762 6,814 -15.4% Domestic 13,188 14,660 -10.0% 13,188 14,660 -10.0% International 454 484 -6.2% 454 484 -6.2% Total Enplaned & Deplaned Passengers 974,082 964,699 1.0% 974,082 964,699 1.0% Charter 301 1,059 -71.6% 301 1,059 -71.6% Major 653,855 626,343 4.4% 653,855 626,343 4.4% National 61,882 54,568 13.4% 61,882 54,568 13.4% Regional 258,044 282,729 -8.7% 258,044 282,729 -8.7% Total Enplaned Passengers 484,783 485,192 -0.1% 484,783 485,192 -0.1% Total Deplaned Passengers 489,299 479,507 2.0% 489,299 479,507 2.0% Total Domestic Passengers 947,137 935,041 1.3% 947,137 935,041 1.3% Total Enplaned Passengers 471,806 470,957 0.2% 471,806 470,957 0.2% Total Deplaned Passengers 475,331 464,084 2.4% 475,331 464,084 2.4% Total International Passengers 26,945 29,658 -9.1% 26,945 29,658 -9.1% Total Enplaned -

Trans World Airlines, Inc. V. Independent Federation of Flight Attendants: a Fundamental Blow to Collective Bargaining

Missouri Law Review Volume 54 Issue 4 Fall 1989 Article 4 Fall 1989 Trans World Airlines, Inc. v. Independent Federation of Flight Attendants: A Fundamental Blow to Collective Bargaining David Allen Larson Follow this and additional works at: https://scholarship.law.missouri.edu/mlr Part of the Law Commons Recommended Citation David Allen Larson, Trans World Airlines, Inc. v. Independent Federation of Flight Attendants: A Fundamental Blow to Collective Bargaining, 54 MO. L. REV. (1989) Available at: https://scholarship.law.missouri.edu/mlr/vol54/iss4/4 This Article is brought to you for free and open access by the Law Journals at University of Missouri School of Law Scholarship Repository. It has been accepted for inclusion in Missouri Law Review by an authorized editor of University of Missouri School of Law Scholarship Repository. For more information, please contact [email protected]. Larson: Larson: Trans World Airlines TRANS WORLD AIRLINES, INC. v. INDEPENDENT FEDERATION OF FLIGHT ATTENDANTS: A FUNDAMENTAL BLOW TO COLLECTIVE BARGAINING By: David Allen Larson* The United States Supreme Court recently allowed Trans World Airlines, Inc. (TWA) to make a promise to striking employees that significantly affects unions' ability to engage in collective action. In Trans World Airlines Inc. v. Independent Federation of Flight Attendants,' a case arising under the Railway Labor Act (RLA),2 TWA was permitted to encourage junior strikers to immediately return to work by promising them that they would not be displaced at the end of the strike by more senior full-time strikers. The Supreme Court rejected the argument that this would result in a loss of seniority for the full-time strikers because those strikers retain seniority for purposes of future reductions of force, future vacancies in desirable assignments, and job scheduling. -

Open Honors Thesis Lap Chi Adriano Chao.Pdf

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF SUPPLY CHAIN AND INFORMATION SYSTEMS AIRLINE MERGER WAVES IN THE UNITED STATES IS A MERGER BETWEEN AMERICAN AIRLINES AND US AIRWAYS POSSIBLE? LAP CHI ADRIANO CHAO Spring 2011 A thesis submitted in partial fulfillment of the requirements for baccalaureate degrees in Management and Economics with honors in Supply Chain and Information Systems Reviewed and approved* by the following: Robert Novack Associate Professor of Supply Chain and Information Systems Thesis Supervisor John Spychalski Professor Emeritus of Supply Chain and Information Systems Honors Adviser * Signatures are on file in the Schreyer Honors College. i ABSTRACT Commercial airlines are an important part of the transportation industry in the United States. A better understanding of the reasons for a series of airline merger waves in the United States can help airline professionals realize the criteria and requirements of a merger. This study examined three recent U.S. airline mergers (i.e., Delta-Northwest, United-Continental and Southwest-AirTran) and deduced eight major dimensions of merger motivations, including network synergies, antitrust immunity, fleet commonality, alliance coordination, market positioning, financial benefits and shareholders’ approval, union support and organizational learning. The feasibility of a hypothetical merger between American Airlines and US Airways was determined using the eight dimensions derived. Results suggested that the merger was unlikely to increase the competitiveness -

Engineering by D E S I

20400_ch00_fm1.qxd 11/25/03 12:42 PM Page i ENGINEERING BY DESIGN Second Edition GERARD VOLAND I n d i a n a U n i v e r s i t y – P u r d u e U n i v e r s i t y F o r t W a y n e Upper Saddle River, New Jersey 07458 Frontmatter1 7/12/04 9:07 AM Page ii Library of Congress Cataloging-in-Publication Data on File Vice President and Editorial Director, Production Editor: Rebecca Homiski ECS: Marcia J. Horton Director of Creative Services: Executive Editor: Eric Svendsen Paul Belfanti Associate Editor: Dee Bernhard Art Director: Jayne Conte Vice President and Director of Cover Designer: Bruce Kenselaar Production and Manufacturing, Art Editor: Greg Dulles ESM: David W. Riccardi Manufacturing Manager: Executive Managing Editor: Trudy Pisciotti Vince O’Brien Manufacturing Buyer: Lynda Castillo Managing Editor: David A. George Marketing Manager: Holly Stark © 2004 Pearson Education, Inc. Pearson Prentice Hall Pearson Education, Inc. Upper Saddle River, NJ 07458 All rights reserved. No part of this book may be reproduced in any form or by any means, without permission in writing from the publisher. Pearson Prentice Hall® is a trademark of Pearson Education, Inc. The author and publisher of this book have used their best efforts in preparing this book. These efforts include the development, research, and testing of the theories and programs to determine their effectiveness. The author and publisher make no warranty of any kind, expressed or implied, with regard to these programs or the documentation contained in this book. -

2008 Annual Report Air Transport Services Group 2008 Annual Report

SM 2008 Annual Report Air Transport Services Group 2008 Annual Report To Our Shareholders 2008 was bound to be a year of dramatic the $91.2 million in impairment charges, full-year change for us. Shortly after our acquisition of Cargo pre-tax earnings increased 36 percent to $45.4 Holdings International (CHI) at the end of 2007, we million, versus $33.3 million for 2007. For the full were informed that our principal customer, DHL, year, our revenues were up 37 percent to $1.6 intended to dramatically restructure its U.S. operations. billion. This growth can be attributed primarily to DHL’s decision in May 2008 to pursue an air transport our CHI businesses, which contributed revenue of and sorting agreement for domestic freight with its $352.7 million for the year. Likewise, cash fl ows competitor UPS came as a tremendous shock. generated from operations increased to $161.7 million in 2008, up from $95.5 million in 2007. Just as disappointing, however, was DHL’s decision last November to suspend its domestic services in favor of handling only inbound and Operating Cash Flow 2004-2008 outbound international shipments for its global customers. Those decisions, together with the U.S. economic recession, have substantially $162M reduced the scale of our operations for DHL. $119M They also have cost us the valued contributions of thousands of men and women who had served us, and DHL, very well over the years. Wilmington, the southwest Ohio community where we are $96M based, has experienced severe economic distress. We are doing our best to remain a supportive $55M $65M corporate citizen in Wilmington, and have funded and taken an active role in many groups seeking long-term solutions to the region’s diffi culties.